North America Copper Market

市场规模(十亿美元)

CAGR :

%

USD

64.76 Billion

USD

98.58 Billion

2024

2032

USD

64.76 Billion

USD

98.58 Billion

2024

2032

| 2025 –2032 | |

| USD 64.76 Billion | |

| USD 98.58 Billion | |

|

|

|

|

北美铜市场细分,按产品形式(线材、板材、薄板、带材、棒材、型材、管材、管材、阴极等)、回火(软、半硬、硬弹、超弹)、铜等级(纯铜、无氧铜、电解铜、易加工铜)、铜加工(采矿、提取、电解精炼、净化、合金化等)、应用(电线、输电线、电缆、母线、热交换器、电动汽车、汽车零件、工业机械、管道、屋顶、太阳能电池板、管道、建筑应用、制冷管、高导电性电线、电极、炊具、水冷铜坩埚、火花塞、光纤等)、最终用途(建造、电气与电子、电力与能源、基础设施、汽车、工业设备、设备制造、消费品、电信、运输、医疗、航空航天、国防、其他)、国家(美国、加拿大、墨西哥)- 行业趋势和预测(至 2032 年)

铜市场规模

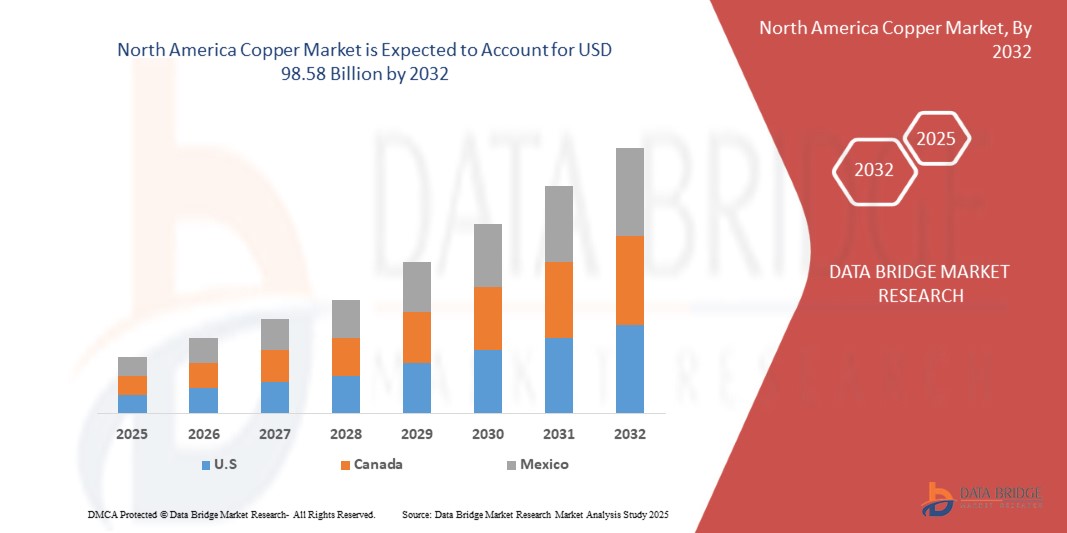

- 北美铜市场规模估值为2024年为647.6亿美元预计将达到到2032年将达到985.8亿美元, 在复合年增长率为5.5%在预测期内

- 这一增长受到可再生能源和电动汽车需求不断增长、基础设施和城市化扩张以及技术进步等因素的推动

铜市场分析

- 铜是各种电气和电子应用中的关键材料,具有优异的导电性和导热性。它对于发电、输电和配电以及各种电子设备至关重要。

- 全球对电气化和能源转型的日益关注,以及高度依赖铜导电性能的技术进步,极大地推动了铜的需求

- 由于工业化进程强劲、建筑和电子行业需求旺盛,亚太地区预计将主导铜市场

- 由于中国和印度等国家电动汽车和可再生能源基础设施的快速增长,预计亚太地区将成为预测期内铜市场增长最快的地区

- 电线行业预计将占据市场主导地位,市场份额达到29.63%,这得益于可再生能源项目的扩张以及交通系统的电气化,这进一步扩大了对高效铜线的需求。此外,新兴经济体快速的城市化和基础设施建设也促进了该行业的增长。

报告范围和铜市场细分

|

属性 |

铜关键市场洞察 |

|

涵盖的领域 |

|

|

覆盖国家 |

北美

|

|

主要市场参与者 |

|

|

市场机会 |

|

|

增值数据信息集 |

除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的洞察之外,Data Bridge Market Research 策划的市场报告还包括进出口分析、生产能力概览、生产消费分析、价格趋势分析、气候变化情景、供应链分析、价值链分析、原材料/消耗品概览、供应商选择标准、PESTLE 分析、波特分析和监管框架。 |

铜市场趋势

“铜合金的创新提升了航空航天和国防应用的性能”

- 铜应用发展的一个突出趋势是先进合金和复合材料的日益融合

- 这些创新通过提供卓越的强度、导电性和耐用性来增强材料性能,提高苛刻应用中的效率和可靠性

- 例如,现代 3D 可视化系统提供卓越的深度感知,使外科医生能够更清晰地导航复杂的眼内解剖结构,这对于玻璃体视网膜手术和微创青光眼手术特别有益。

- 这些进步正在改变材料科学和工程,提高产品性能,并推动对具有尖端性能组合的下一代铜合金和复合材料的需求

铜市场动态

司机

“全球可再生能源项目激增,铜消费量增加”

- 全球向风能、太阳能和水力发电等可再生能源的转变极大地推动了铜的需求,因为这些系统需要大量的铜线和组件来实现高效的发电和输电。

- 铜的优异导电性使其成为太阳能电池板布线、风力发电机、逆变器和储能系统的关键材料。例如,一台风力涡轮机可能包含多达数吨的铜,而光伏太阳能系统则高度依赖铜缆进行集电和接地。

- 随着各国加快努力减少碳排放并实现净零目标,可再生能源基础设施的部署预计将激增,进一步推动铜消费

例如,

- 据CrossBoundary Energy称,2025年4月,与卡莫阿铜业公司(Kamoa Copper SA)签署的新购电协议标志着可持续采矿领域迈出了重要一步,为刚果民主共和国的卡莫阿-卡库拉铜矿综合体提供了非洲首个太阳能光伏和基于电池的基载可再生能源系统。222兆瓦的太阳能电池阵列和526兆瓦时的电池储能系统将提供30兆瓦的清洁电力,大幅减少对柴油的依赖和排放。这一举措凸显了全球日益增长的趋势,即在能源密集型行业整合大规模可再生能源系统——这将推高太阳能电池板、电线和储能组件对铜的需求,并强化铜在清洁能源转型中的关键作用。

- 因此,日益增长的依赖不仅凸显了铜在清洁能源技术中不可或缺的作用,也使铜成为实现更绿色、更电气化未来的关键推动因素

机会

“5G基础设施扩张推动电信行业对高导电性铜的需求”

- 5G 基础设施的全球部署为铜市场带来了巨大的增长机会,因为该技术需要高性能、高导电性的材料来支持更快的数据传输和更高的带宽

- 铜的优异导电性使其成为 5G 网络中使用的同轴电缆、天线和连接器等组件不可或缺的材料

- 此外,5G 网络的推出——需要密集的小型基站基础设施和扩展的基站——推动了对铜的需求增加,铜对于接地、电力传输和信号完整性至关重要

例如,

- 2024年8月,CIVEN Metal将抓住5G全球扩张的机遇,供应基站、天线和高速PCB等关键基础设施所需的高性能铜箔。凭借先进的技术和定制化的解决方案,该公司正在满足5G网络快速可靠数据传输对高导电性铜日益增长的需求。随着5G的推出推动整个电信行业的铜使用量增加,这一趋势凸显了铜市场的巨大机遇。

- 在持续创新、基础设施建设和专注于构建安全可持续供应链的战略投资的推动下,铜市场将保持长期持续增长的轨迹

克制/挑战

“铜价波动阻碍长期投资规划”

- 铜价波动持续对铜市场构成重大制约,尤其是在长期投资规划方面。地缘政治紧张局势引发的突然波动

- 这种不稳定性使得生产商和投资者难以预测回报并获得长期项目的融资,这可能会减缓满足电动汽车、可再生能源和数据中心等行业日益增长的需求所需的扩张。

- 更稳定的定价环境对于增强铜行业持续增长和供应链弹性所需的信心至关重要

例如,

- 据New Wave Media Int报道,2025年2月,美国总统唐纳德·特朗普推迟关税计划后,铜价近期飙升至三个月来的最高水平。受潜在关税不确定性驱动,铜价飙升导致铜市场波动,尤其是在美国和全球交易所之间。这种波动带来了不稳定性,使投资者难以规划长期投资。价格走势的不可预测性削弱了信心,导致投资者在投资大型矿业和基础设施项目时犹豫不决,因为他们难以预测回报并管理相关风险。

- 因此,确保铜的未来不仅是为了满足工业需求,也是为了实现未来清洁、互联和有韧性的世界

铜市场范围

北美铜市场根据产品形式、回火、铜等级、铜加工、应用和最终用途分为六个显著的部分。

|

分割 |

细分 |

|

按产品形态 |

|

|

按脾气 |

|

|

按铜等级 |

|

|

按铜加工 |

|

|

按应用 |

|

|

按最终用途 |

|

预计到 2025 年,电线将占据市场主导地位,在产品形态领域占有最大份额

预计到 2025 年,电线行业将占据铜市场的主导地位,占据 30.14% 的最大份额 受配电、电信和建筑行业需求不断增长的驱动,市场需求也随之增长。可再生能源项目的扩张和交通系统的电气化进一步扩大了对高效铜线的需求。此外,新兴经济体快速的城市化和基础设施建设也促进了该领域的增长。

预计在预测期内,软质部分将占据铜市场的最大份额

预计到2025年,软电缆将占据市场主导地位,市场份额达到43.19%,这得益于其灵活性、易于安装和成本效益,使其成为建筑、电线和消费电子产品等广泛应用的理想选择。其对各种环境条件的适应性进一步支持了其在多个行业中日益增长的受欢迎程度。

铜市场区域分析

“美国占据铜市场最大份额”

- 在快速工业化、不断增加的基础设施建设和强劲的制造业活动的推动下,美国在铜市场占据主导地位

- 美国在建筑、电力基础设施以及蓬勃发展的电动汽车和可再生能源领域有着巨大的消费,因此占据了相当大的份额。

- 政府支持基础设施项目和扩大制造能力的举措进一步加强了市场。

- 此外,电子行业日益增长的需求以及电动汽车和可再生能源技术的日益普及正在推动整个地区的市场扩张。

“预计美国将实现铜市场最高复合年增长率”

- 在快速工业化、大规模基础设施建设和蓬勃发展的制造业活动的推动下,美国预计将成为北美铜市场中增长率最高的国家。

- 美国和加拿大等国家由于其在基础设施方面的大量投资、制造业(包括电子和汽车)的快速增长以及绿色技术的日益普及,正在成为主要市场。

- 美国凭借其先进的技术能力和对高效系统的重视,仍然是专业化高性能铜应用的关键市场。美国对技术创新的重视推动了对先进铜合金的需求。

铜市场份额

市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投入、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司在市场中的重点相关。

市场中的主要市场领导者有:

- 江西铜业集团公司(中国)

- Aurubis AG(德国)

- Codelco(智利)

- 嘉能可(瑞士)

- 必和必拓(澳大利亚)

- 英美资源集团(英国)

- 泰克资源有限公司(加拿大)

- 安托法加斯塔股份有限公司(英国)

- KGHM(波兰)

- 力拓(英国)

- 自由港麦克莫兰公司(美国)

- 墨西哥集团(墨西哥)

- 三菱综合材料株式会社(日本)

- 第一量子矿产有限公司(加拿大)

- Southwire公司,LLC(美国)

- 诺里尔斯克镍业公司(俄罗斯)

- 中铝(中国)

- 西门子(德国)

- 住友金属矿业株式会社(东京)

- Sarkuysan 信息系统(土耳其)

- 伊顿(爱尔兰)

- 蒂森克虏伯材料北美公司(美国)

- ABB(瑞士)

- 丰山株式会社(韩国)

- 施耐德电气(法国)

- 三井金属矿业株式会社(日本)

- 纳科布雷(墨西哥)

- KME Germany GmbH(德国)

- 维兰德(德国)

- 承诺(芬兰)

- 淡水河谷(巴西)

- 赫西·科珀(Libertas)(美国)

- 热力学 - Sao Paulo SA(巴西)

- Revere Copper Products Inc.(纽约)

- Cecil S/A(巴西)

- 三同株式会社(韩国)

- 巴拉那帕内马机构。 (巴西)

- Gindre(美国)

- JX Advanced Metals Corporation(日本)

- Aviva Metals(美国)

- 东方铜业有限公司(泰国)

- 索菲亚医学中心(保加利亚)

- Univertical(美国)

- IUSA WIRE, Inc.(美国)

- IMC(美国)

- Cunext(西班牙)

- Tecnofil(秘鲁)

- 金龙精密铜管集团(中国)

北美铜市场最新动态

- 2023年8月,IMC Metals America LLC与Southwire达成协议,将在其位于北卡罗来纳州谢尔比的工厂安装一套SCR®-4500铜杆生产系统。新系统设计每小时可生产35吨8毫米铜杆,将显著提升IMC的生产效率和产能。这项战略投资将使IMC能够更好地满足全球对高质量铜产品日益增长的需求,从而增强其在铜市场的竞争优势。

- 2020年12月,总部位于宾夕法尼亚州的铜加工和制造公司Hussey Copper经美国破产法院批准后,被KPS Capital Partners LP的一家关联公司通过Libertas Copper LLC收购。此次收购将为Hussey Copper带来KPS的战略、运营和财务支持,增强其制造能力,并为公司未来增长奠定基础。此次合作将使Hussey能够继续生产高质量的铜产品,同时追求有机增长和潜在的收购,从而增强其在铜市场的竞争地位。

- 2020年11月,西门子与加拿大公司Copperleaf合作,通过西门子Xcelerator平台加强投资和技术电网规划,支持能源行业向更可持续、更数字化的转型。此次合作巩固了西门子在智能电网基础设施领域的地位,并间接刺激了铜的需求,因为现代化和电气化电网需要大量使用耗铜部件。

- 2025年3月,蒂森克虏伯材料北美公司(thyssenkrupp Materials NA)将业务扩展至新墨西哥州圣特雷莎,开设了一家新的金属服务中心,旨在提升美国和墨西哥配电行业的加工能力和配送能力。这一战略发展将提升公司在铜市场的地位,增强其铜基零部件加工能力,优化供应链运营,并提供即时服务,以满足能源行业日益增长的需求。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 MARKET TIMELINE PRODUCT FORM

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 PORTERS FIVE FORCES

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 IMPORT-EXPORT SCENARIO

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.7 COMPETITOR KEY PRICING ANALYSIS

4.8 DIVE INTO DISTRIBUTORS AND OEMS TO UNDERSTAND POTENTIAL OR EXISTING CUSTOMERS NEEDS TO UNDERSTAND POTENTIAL OR EXISTING CUSTOMERS NEEDS & SUPPLY CHAIN ANALYSIS

4.8.1 LOGISTICS COST SCENARIO

4.8.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 CLIMATE CHANGE SCENARIO

4.9.1 ENVIRONMENTAL CONCERNS

4.9.2 INDUSTRY RESPONSE

4.9.3 GOVERNMENT’S ROLE

4.1 BUYERS INSIGHTS, BY APPLICATION

4.11 PRODUCTION CAPACITY FOR TOP COMPANIES

4.12 IMPORT-EXPORT SCENARIO

4.13 TARIFFS & IMPACT ON THE MARKET

4.13.1 CURRENT COPPER TARIFF RATE (S) IN TOP-5 FIVE MAJOR MARKETS

4.13.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.13.3 VENDOR SELECTION CRITERIA DYNAMICS

4.13.4 IMPACT ON SUPPLY CHAIN

4.13.4.1 RAW MATERIAL PROCUREMENT

4.13.4.2 MANUFACTURING AND PRODUCTION

4.13.5 IMPACT ON PRICES

4.13.6 REGULATORY INCLINATION

4.13.6.1 GEOPOLITICAL SITUATION

4.14 RAW MATERIAL COVERAGE

4.15 MAIN COMPETITORS

4.15.1 JIANGXI COPPER CORPORATION

4.15.2 SWOT ANALYSIS

4.15.3 SWOT ANALYSIS

4.15.4 SWOT ANALYSIS

5 REGULATION COVERAGE

5.1 PRODUCT CODES FOR NORTH AMERICA COPPER INDUSTRY

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HARAD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SURGE IN NORTH AMERICA RENEWABLE ENERGY PROJECTS INCREASING COPPER CONSUMPTION

6.1.2 RISING INTEGRATION OF COPPER IN EMERGING RENEWABLE INDUSTRIES

6.1.3 RAPID ADOPTION OF ELECTRIC VEHICLES (EVS) BOOSTING DEMAND FOR COPPER-INTENSIVE COMPONENTS

6.1.4 PROLIFERATION OF CONSUMER ELECTRONICS AND DATA CENTERS INCREASING COPPER DEMAND

6.2 RESTRAINTS

6.2.1 VOLATILITY IN COPPER PRICES HAMPERS LONG-TERM INVESTMENT PLANNING

6.2.2 ENVIRONMENTAL CONCERNS AND REGULATORY RESTRICTIONS DELAY MINING OPERATIONS

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF 5G INFRASTRUCTURE FUELS DEMAND FOR HIGH-CONDUCTIVITY COPPER IN TELECOMMUNICATIONS INDUSTRIES

6.3.2 STRATEGIC PARTNERSHIPS BETWEEN MINING FIRMS AND TECH COMPANIES ENSURE SUSTAINABLE COPPER SOURCING

6.3.3 INNOVATIONS IN COPPER ALLOYS ENHANCE PERFORMANCE IN AEROSPACE AND DEFENSE APPLICATIONS

6.3.4 RISING INVESTMENTS IN INFRASTRUCTURE AND SMART GRID DEVELOPMENT ACROSS EMERGING ECONOMIES

6.4 CHALLENGES

6.4.1 LABOR SHORTAGES AND SKILL GAPS IN MINING SECTORS HINDER OPERATIONAL PRODUCTIVITY

6.4.2 GEOPOLITICAL INSTABILITY IN COPPER-PRODUCING NATIONS DISRUPTS SUPPLY CHAIN RELIABILITY

7 NORTH AMERICA COPPER MARKET, BY PRODUCT FORM

7.1 OVERVIEW

7.2 WIRES

7.3 PLATES

7.4 SHEETS

7.5 STRIPS

7.6 RODS

7.7 BARS AND SECTIONS

7.8 TUBES

7.9 PIPES

7.1 CATHODES

7.11 OTHERS

8 NORTH AMERICA COPPER MARKET, BY TEMPER

8.1 OVERVIEW

8.2 SOFT

8.3 HALF-HARD

8.4 HARD-SPRING

8.5 EXTRA-SPRING

9 NORTH AMERICA COPPER MARKET, BY COPPER GRADE

9.1 OVERVIEW

9.2 PURE COPPERS

9.3 OXYGEN FREE COPPERS

9.4 ELECTROLYTIC COPPERS

9.5 FREE-MACHINING COPPERS

10 NORTH AMERICA COPPER MARKET, BY COPPER PROCESSING

10.1 OVERVIEW

10.2 MINING

10.3 EXTRACTION

10.4 ELECTROREFINING

10.5 PURIFICATION

10.6 ALLOYING

10.7 OTHERS

11 NORTH AMERICA COPPER MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ELECTRICAL WIRING

11.3 POWER TRANSMISSION LINES

11.4 CABLES AND BUSBARS

11.5 HEAT EXCHANGERS

11.6 ELECTRIC VEHICLES

11.7 MOTOR PARTS

11.8 INDUSTRIAL MACHINERY

11.9 PLUMBING

11.1 ROOFING

11.11 SOLAR PANELS

11.12 PIPES

11.13 ARCHITECTURAL APPLICATIONS

11.14 REFRIGERATION TUBING

11.15 HIGH CONDUCTIVITY WIRES

11.16 ELECTRODES

11.17 COOKING UTENSILS

11.18 WATER-COOLED COPPER CRUCIBLES

11.19 SPARK PLUGS

11.2 OPTICAL FIBERS

11.21 OTHERS

12 NORTH AMERICA COPPER MARKET, BY END-USE

12.1 OVERVIEW

12.2 CONSTRUCTION

12.3 ELECTRICALS AND ELECTRONICS

12.4 POWER AND ENERGY

12.5 INFRASTRUCTURE

12.6 AUTOMOTIVE

12.7 INDUSTRIAL EQUIPMENT

12.8 EQUIPMENT MANUFACTURE

12.9 CONSUMER PRODUCTS

12.1 TELECOMMUNICATIONS

12.11 TRANSPORT

12.12 MEDICAL

12.13 AEROSPACE

12.14 DEFENSE

12.15 OTHERS

13 NORTH AMERICA COPPER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA COPPER MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 JIANGXI COPPER GROUP CO., LTD.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 AURUBIS AG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS/NEWS

16.3 CODELCO

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 GLENCORE

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS/NEWS

16.5 BHP

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ABB

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ALUMINIUM CORP

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS/NEWS

16.8 ANGLO AMERICAN PLC

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT/NEWS

16.9 ANTOFAGASTA PLC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 AVIVA METALS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CECIL

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS/NEWS

16.12 CUNEXT GROUP INDUSTRIES

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS/NEWS

16.13 EATON

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT/NEWS

16.14 FIRST QUANTUM MINERALS LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT/NEWS

16.15 FREEPORT-MCMORAN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS/NEWS

16.16 GINDRE

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 GOLDEN DRAGON PRECISE COPPER TUBE INC,

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 GRUPO MÉXICO

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 HUSSEY COPPER

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS/NEWS

16.2 IMC

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS/NEWS

16.21 IUSA WIRE, INC

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS/NEWS

16.22 JX ADVANCED METALS CORPORATION (SUBSIDIARY OF ENEOS HOLDINGS)

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 KGHM

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 KME GERMANY GMBH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 LUVATA

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 MITSUBISHI MATERIALS CORPORATION

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT/NEWS

16.27 MITSUI MINING & SMELTING CO.,LTD

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 NACOBRE USA

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENTS/NEWS

16.29 NORILSK NICKEL

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENTS/NEWS

16.3 ORIENTAL COPPER CO., LTD.

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENTS/NEWS

16.31 PARANAPANEMA INSTITUCIONAL

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT DEVELOPMENT

16.32 POONGSAN CORPORATION

16.32.1 COMPANY SNAPSHOT

16.32.2 REVENUE ANALYSIS

16.32.3 PRODUCT PORTFOLIO

16.32.4 RECENT DEVELOPMENT

16.33 REVERE COPPER PRODUCTS INC.

16.33.1 COMPANY SNAPSHOT

16.33.2 PRODUCT PORTFOLIO

16.33.3 RECENT DEVELOPMENTS/NEWS

16.34 RIO TINTO

16.34.1 COMPANY SNAPSHOT

16.34.2 REVENUE ANALYSIS

16.34.3 PRODUCT PORTFOLIO

16.34.4 RECENT DEVELOPMENTS/NEWS

16.35 SAM DONG CO, LTD.

16.35.1 COMPANY SNAPSHOT

16.35.2 PRODUCT PORTFOLIO

16.35.3 RECENT DEVELOPMENTS/NEWS

16.36 SARKUYSAN BILGI SISTEMLERI

16.36.1 COMPANY SNAPSHOT

16.36.2 REVENUE ANALYSIS

16.36.3 PRODUCT PORTFOLIO

16.36.4 RECENT DEVELOPMENTS/NEWS

16.37 SCHNEIDER ELECTRIC

16.37.1 COMPANY SNAPSHOT

16.37.2 REVENUE ANALYSIS

16.37.3 PRODUCT PORTFOLIO

16.37.4 RECENT DEVELOPMENT/NEWS

16.38 SIEMENS

16.38.1 COMPANY SNAPSHOT

16.38.2 REVENUE ANALYSIS

16.38.3 PRODUCT PORTFOLIO

16.38.4 RECENT DEVELOPMENTS

16.39 SOFIA MED

16.39.1 COMPANY SNAPSHOT

16.39.2 PRODUCT PORTFOLIO

16.39.3 RECENT DEVELOPMENT/NEWS

16.4 SOUTHWIRE COMPANY, LLC

16.40.1 COMPANY SNAPSHOT

16.40.2 PRODUCT PORTFOLIO

16.40.3 RECENT DEVELOPMENT

16.41 SUMITOMO METAL MINING CO., LTD.

16.41.1 COMPANY SNAPSHOT

16.41.2 REVENUE ANALYSIS

16.41.3 PRODUCT PORTFOLIO

16.41.4 RECENT DEVELOPMENTS/NEWS

16.42 TECK RESOURCES LIMITED

16.42.1 COMPANY SNAPSHOT

16.42.2 REVENUE ANALYSIS

16.42.3 PRODUCT PORTFOLIO

16.42.4 RECENT DEVELOPMENTS/NEWS

16.43 TECNOFIL

16.43.1 COMPANY SNAPSHOT

16.43.2 PRODUCT PORTFOLIO

16.43.3 RECENT DEVELOPMENTS/NEWS

16.44 TERMOMECANICA - SÃO PAULO S.A.

16.44.1 COMPANY SNAPSHOT

16.44.2 PRODUCT PORTFOLIO

16.44.3 RECENT DEVELOPMENTS/NEWS

16.45 THYSSENKRUPP MATERIALS NA, INC.

16.45.1 COMPANY SNAPSHOT

16.45.2 PRODUCT PORTFOLIO

16.45.3 RECENT DEVELOPMENTS

16.46 UNIVERTICAL

16.46.1 COMPANY SNAPSHOT

16.46.2 PRODUCT PORTFOLIO

16.46.3 RECENT DEVELOPMENTS/NEWS

16.47 VALE

16.47.1 COMPANY SNAPSHOT

16.47.2 REVENUE ANALYSIS

16.47.3 PRODUCT PORTFOLIO

16.47.4 RECENT DEVELOPMENTS/NEWS

16.48 WIELAND

16.48.1 COMPANY SNAPSHOT

16.48.2 PRODUCT PORTFOLIO

16.48.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 PRODUCTION CAPACITY FOR TOP COMPANIES

TABLE 2 U.S. COPPER DEMAND, PRODUCTION, AND IMPORTS

TABLE 3 COMPANY WISE MARKET ANALYSIS

TABLE 4 COMPANY WISE REVENUE BY PRODUCT

TABLE 5 NORTH AMERICA COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA COPPER MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 7 NORTH AMERICA WIRE IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA PLATES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA SHEET IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA STRIPS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA RODS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA BARS AND SECTIONS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA TUBES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA PIPES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA CATHODES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA COPPER MARKET, BY TEMPER, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA COPPER MARKET, BY TEMPER, 2018-2032 (TONS)

TABLE 19 NORTH AMERICA SOFT IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA HALF-HARD IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA HARD-SPRING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA EXTRA-SPRING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA COPPER MARKET, BY COPPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA COPPER MARKET, BY COPPER GRADE, 2018-2032 (TONS)

TABLE 25 NORTH AMERICA PURE COPPERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA OXYGEN FREE COPPERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA ELECTROLYTIC COPPERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA FREE-MACHINING COPPERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (TONS)

TABLE 31 NORTH AMERICA MINING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA MINING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA EXTRACTION IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA ELECTROREFINING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA PURIFICATION IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA ALLOYING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA OTHERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA COPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA COPPER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 40 NORTH AMERICA ELECTRICAL WIRING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA POWER TRANSMISSION LINES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA CABLES AND BUSBARS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA HEAT EXCHANGERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA MOTOR PARTS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA INDUSTRIAL MACHINERY IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA PLUMBING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA ROOFING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA SOLAR PANELS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA PIPES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA ARCHITECTURAL APPLICATIONS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA REFRIGERATION TUBING IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA HIGH CONDUCTIVITY WIRES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA ELECTRODES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA COOKING UTENSILS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA WATER-COOLED COPPER CRUCIBLES IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA SPARK PLUGS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA OPTICAL FIBERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA OTHERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA COPPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA COPPER MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 62 NORTH AMERICA CONSTRUCTION IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA CONSTRUCTION IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA CONSTRUCTION IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA ELECTRICAL POWER IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA PLUMBING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA BUILDING PLANT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA ARCHITECTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA COMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA ELECTRICALS AND ELECTRONICS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA ELECTRICALS AND ELECTRONICS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA POWER AND ENERGY IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA POWER AND ENERGY IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA INFRASTRUCTURE IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA INFRASTRUCTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA INFRASTRUCTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA POWER UTILITY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA RENEWABLE ENERGY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA TELECOMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA AUTOMOTIVE IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA AUTOMOTIVE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA NON-ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA EQUIPMENT MANUFACTURE IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA EQUIPMENT MANUFACTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA EQUIPMENT MANUFACTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA CONSUMER AND GENERAL PRODUCTS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA COOLING EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA ELECTRONIC EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA CONSUMER PRODUCTS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA CONSUMER PRODUCTS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA TELECOMMUNICATIONS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA TELECOMMUNICATIONS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA TRANSPORT IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA TELECOMMUNICATIONS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA TRANSPORT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA AUTOMOTIVE ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA AUTOMOTIVE NON-ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA OTHER VEHICLES IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA MEDICAL IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA MEDICAL IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA AEROSPACE IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA AEROSPACE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA DEFENSE IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA DEFENSE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA DEFENSE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA OTHERS IN COPPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA COPPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA COPPER MARKET, BY COUNTRY, 2018-2032 (THOUSAND TONS)

TABLE 113 NORTH AMERICA COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA COPPER MARKET, BY PRODUCT FORM, 2018-2032 (THOUSAND TONS)

TABLE 115 NORTH AMERICA COPPER MARKET, BY TEMPER, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA COPPER MARKET, BY TEMPER, 2018-2032 (THOUSAND TONS)

TABLE 117 NORTH AMERICA COPPER MARKET, BY COPPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA COPPER MARKET, BY COPPER GRADE, 2018-2032 (THOUSAND TONS)

TABLE 119 NORTH AMERICA COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (THOUSAND TONS)

TABLE 121 NORTH AMERICA MINING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA COPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA COPPER MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 124 NORTH AMERICA COPPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 125 NORTH AMERICA COPPER MARKET, BY END-USE, 2018-2032 (THOUSAND TONS)

TABLE 126 NORTH AMERICA CONSTRUCTION IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 127 NORTH AMERICA CONSTRUCTION IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 NORTH AMERICA ELECTRICAL POWER IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 NORTH AMERICA PLUMBING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 NORTH AMERICA BUILDING PLANT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 NORTH AMERICA ARCHITECTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 NORTH AMERICA COMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 NORTH AMERICA ELECTRICALS AND ELECTRONICS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 134 NORTH AMERICA POWER AND ENERGY IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 135 NORTH AMERICA INFRASTRUCTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 136 NORTH AMERICA INFRASTRUCTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 NORTH AMERICA POWER UTILITY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 NORTH AMERICA RENEWABLE ENERGY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 NORTH AMERICA TELECOMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 NORTH AMERICA AUTOMOTIVE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 141 NORTH AMERICA INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 142 NORTH AMERICA INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NORTH AMERICA NON ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 NORTH AMERICA ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 NORTH AMERICA EQUIPMENT MANUFACTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 146 NORTH AMERICA EQUIPMENT MANUFACTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 NORTH AMERICA CONSUMER AND GENERAL PRODUCTS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 NORTH AMERICA COOLING EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 NORTH AMERICA ELECTRONIC EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NORTH AMERICA CONSUMER PRODUCTS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 151 NORTH AMERICA TELECOMMUNICATIONS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 152 NORTH AMERICA TRANSPORT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 153 NORTH AMERICA TRANSPORT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 NORTH AMERICA AUTOMOTIVE ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 NORTH AMERICA AUTOMOTIVE NON-ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 NORTH AMERICA OTHER VEHICLES IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 NORTH AMERICA MEDICAL IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 158 NORTH AMERICA AEROSPACE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 159 NORTH AMERICA DEFENSE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 160 NORTH AMERICA DEFENSE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. COPPER MARKET, BY PRODUCT FORM, 2018-2032 (THOUSAND TONS)

TABLE 163 U.S. COPPER MARKET, BY TEMPER, 2018-2032 (USD THOUSAND)

TABLE 164 U.S. COPPER MARKET, BY TEMPER, 2018-2032 (THOUSAND TONS)

TABLE 165 U.S. COPPER MARKET, BY COPPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 166 U.S. COPPER MARKET, BY COPPER GRADE, 2018-2032 (THOUSAND TONS)

TABLE 167 U.S. COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (USD THOUSAND)

TABLE 168 U.S. COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (THOUSAND TONS)

TABLE 169 U.S. MINING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.S. COPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 171 U.S. COPPER MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 172 U.S. COPPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 173 U.S. COPPER MARKET, BY END-USE, 2018-2032 (THOUSAND TONS)

TABLE 174 U.S. CONSTRUCTION IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 175 U.S. CONSTRUCTION IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.S. ELECTRICAL POWER IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 U.S. PLUMBING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 U.S. BUILDING PLANT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 U.S. ARCHITECTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 U.S. COMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.S. ELECTRICALS AND ELECTRONICS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 182 U.S. POWER AND ENERGY IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 183 U.S. INFRASTRUCTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 184 U.S. INFRASTRUCTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 U.S. POWER UTILITY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 U.S. RENEWABLE ENERGY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 U.S. TELECOMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 U.S. AUTOMOTIVE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 189 U.S. INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 190 U.S. INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 U.S. NON ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 U.S. ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 U.S. EQUIPMENT MANUFACTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 194 U.S. EQUIPMENT MANUFACTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 U.S. CONSUMER AND GENERAL PRODUCTS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 U.S. COOLING EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 U.S. ELECTRONIC EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 U.S. CONSUMER PRODUCTS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 199 U.S. TELECOMMUNICATIONS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 200 U.S. TRANSPORT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 201 U.S. TRANSPORT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 U.S. AUTOMOTIVE ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 U.S. AUTOMOTIVE NON-ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 U.S. OTHER VEHICLES IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 U.S. MEDICAL IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 206 U.S. AEROSPACE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 207 U.S. DEFENSE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 208 U.S. DEFENSE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA COPPER MARKET, BY PRODUCT FORM, 2018-2032 (THOUSAND TONS)

TABLE 211 CANADA COPPER MARKET, BY TEMPER, 2018-2032 (USD THOUSAND)

TABLE 212 CANADA COPPER MARKET, BY TEMPER, 2018-2032 (THOUSAND TONS)

TABLE 213 CANADA COPPER MARKET, BY COPPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 214 CANADA COPPER MARKET, BY COPPER GRADE, 2018-2032 (THOUSAND TONS)

TABLE 215 CANADA COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (USD THOUSAND)

TABLE 216 CANADA COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (THOUSAND TONS)

TABLE 217 CANADA MINING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 CANADA COPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 219 CANADA COPPER MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 220 CANADA COPPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 221 CANADA COPPER MARKET, BY END-USE, 2018-2032 (THOUSAND TONS)

TABLE 222 CANADA CONSTRUCTION IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 223 CANADA CONSTRUCTION IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 CANADA ELECTRICAL POWER IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 CANADA PLUMBING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 CANADA BUILDING PLANT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 CANADA ARCHITECTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 CANADA COMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 CANADA ELECTRICALS AND ELECTRONICS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 230 CANADA POWER AND ENERGY IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 231 CANADA INFRASTRUCTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 232 CANADA INFRASTRUCTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 CANADA POWER UTILITY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 CANADA RENEWABLE ENERGY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 CANADA TELECOMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 CANADA AUTOMOTIVE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 237 CANADA INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 238 CANADA INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 CANADA NON ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 CANADA ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 CANADA EQUIPMENT MANUFACTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 242 CANADA EQUIPMENT MANUFACTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 CANADA CONSUMER AND GENERAL PRODUCTS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 CANADA COOLING EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 CANADA ELECTRONIC EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 CANADA CONSUMER PRODUCTS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 247 CANADA TELECOMMUNICATIONS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 248 CANADA TRANSPORT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 249 CANADA TRANSPORT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 CANADA AUTOMOTIVE ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 CANADA AUTOMOTIVE NON-ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 CANADA OTHER VEHICLES IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 CANADA MEDICAL IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 254 CANADA AEROSPACE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 255 CANADA DEFENSE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 256 CANADA DEFENSE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 MEXICO COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 258 MEXICO COPPER MARKET, BY PRODUCT FORM, 2018-2032 (THOUSAND TONS)

TABLE 259 MEXICO COPPER MARKET, BY TEMPER, 2018-2032 (USD THOUSAND)

TABLE 260 MEXICO COPPER MARKET, BY TEMPER, 2018-2032 (THOUSAND TONS)

TABLE 261 MEXICO COPPER MARKET, BY COPPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 262 MEXICO COPPER MARKET, BY COPPER GRADE, 2018-2032 (THOUSAND TONS)

TABLE 263 MEXICO COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (USD THOUSAND)

TABLE 264 MEXICO COPPER MARKET, BY COPPER PROCESSING, 2018-2032 (THOUSAND TONS)

TABLE 265 MEXICO MINING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 MEXICO COPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 267 MEXICO COPPER MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 268 MEXICO COPPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 269 MEXICO COPPER MARKET, BY END-USE, 2018-2032 (THOUSAND TONS)

TABLE 270 MEXICO CONSTRUCTION IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 271 MEXICO CONSTRUCTION IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 MEXICO ELECTRICAL POWER IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 MEXICO PLUMBING IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 MEXICO BUILDING PLANT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 MEXICO ARCHITECTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 MEXICO COMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 MEXICO ELECTRICALS AND ELECTRONICS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 278 MEXICO POWER AND ENERGY IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 279 MEXICO INFRASTRUCTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 280 MEXICO INFRASTRUCTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 MEXICO POWER UTILITY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 MEXICO RENEWABLE ENERGY IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 MEXICO TELECOMMUNICATIONS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 MEXICO AUTOMOTIVE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 285 MEXICO INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 286 MEXICO INDUSTRIAL EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 MEXICO NON ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 MEXICO ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 MEXICO EQUIPMENT MANUFACTURE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 290 MEXICO EQUIPMENT MANUFACTURE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 MEXICO CONSUMER AND GENERAL PRODUCTS IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 MEXICO COOLING EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 MEXICO ELECTRONIC EQUIPMENT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 MEXICO CONSUMER PRODUCTS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 295 MEXICO TELECOMMUNICATIONS IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 296 MEXICO TRANSPORT IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 297 MEXICO TRANSPORT IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 MEXICO AUTOMOTIVE ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 MEXICO AUTOMOTIVE NON-ELECTRICAL IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 MEXICO OTHER VEHICLES IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 MEXICO MEDICAL IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 302 MEXICO AEROSPACE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 303 MEXICO DEFENSE IN COPPER MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 304 MEXICO DEFENSE IN COPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA COPPER MARKET

FIGURE 2 NORTH AMERICA COPPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COPPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COPPER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COPPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COPPER MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA COPPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA COPPER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET APPLICATION COVERAGE GRID: NORTH AMERICA COPPER MARKET

FIGURE 10 NORTH AMERICA COPPER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA COPPER MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TEN SEGMENTS COMPRISE THE NORTH AMERICA COPPER MARKET, BY PRODUCT FORM (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 SURGE IN NORTH AMERICA RENEWABLE ENERGY PROJECTS INCREASING COPPER CONSUMPTION IS EXPECTED TO DRIVE THE NORTH AMERICA COPPER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE WIRES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COPPER MARKET IN 2025 AND 2032

FIGURE 17 PESTLE ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS FOR THE COPPER MARKET

FIGURE 19 DROC ANALYSIS

FIGURE 20 FIGURE: WORLD REFINED COPPER CONSUMPTION (IN COPPER METAL TERMS) – MILLION TONS

FIGURE 21 2023 COPPER DEMAND IN WIDE RANGE OF APPLICATION

FIGURE 22 COPPER INTENSITIES

FIGURE 23 COPPER DEMAND FROM POWER ELECTRONICS DEVICES (KT)

FIGURE 24 COPPER PRICES - HISTORICAL ANNUAL DATA

FIGURE 25 ANNUAL GRID INVESTMENTS FOR NETZERO

FIGURE 26 NORTH AMERICA COPPER MARKET: BY PRODUCT FORM, 2024

FIGURE 27 NORTH AMERICA COPPER MARKET: BY TEMPER, 2024

FIGURE 28 NORTH AMERICA COPPER MARKET: BY COPPER GRADE, 2024

FIGURE 29 NORTH AMERICA COPPER MARKET: BY COPPER PROCESSING, 2024

FIGURE 30 NORTH AMERICA COPPER MARKET: BY APPLICATION, 2024

FIGURE 31 NORTH AMERICA COPPER MARKET: BY END-USE, 2024

FIGURE 32 NORTH AMERICA COPPER MARKET: SNAPSHOT (2024)

FIGURE 33 NORTH AMERICA COPPER MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。