North America Corrugated Packaging Market

市场规模(十亿美元)

CAGR :

%

USD

66.68 Million

USD

98.34 Million

2024

2032

USD

66.68 Million

USD

98.34 Million

2024

2032

| 2025 –2032 | |

| USD 66.68 Million | |

| USD 98.34 Million | |

|

|

|

北美瓦楞包裝市場細分,按產品(常規開槽容器(RSC)、半開槽容器(HSC)、重疊開槽容器(OSC)、全重疊開槽容器(FOL)、中心特殊開槽容器(CSSC)、1-2-3 底或自動鎖底容器(ALB)、伸縮盒(設計風格B、內折托盤、外折類型)楞、F 楞和 D 楞)、紙板類型(單壁、雙壁、三壁、單面和襯紙板)、容量(高達 100 磅、100-300 磅和 300 磅以上)、尺寸(0-10 英寸、10-20 英寸、20-30 英寸和 30英寸以上)、印刷類型(印刷和非印刷)、應用(電子商務和零售、食品、電子產品、家用電器、汽車、醫療保健和製藥、飲料、玻璃器皿和陶瓷、個人護理、家庭護理、農業和園藝、石油和天然氣、玩具產品、嬰兒用品等)- 行業趨勢和預測至 2032 年

瓦楞包裝市場規模

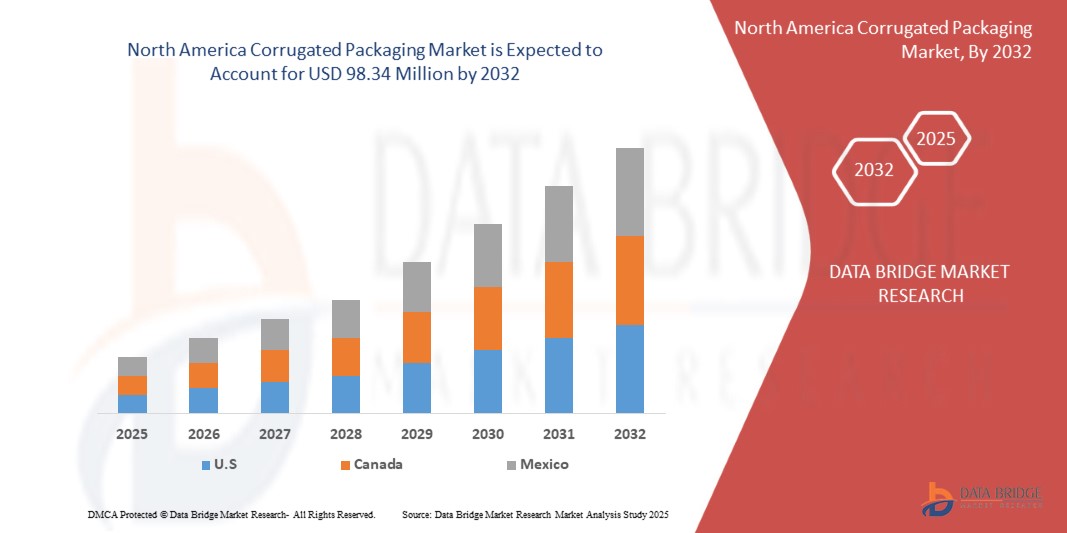

- 2024 年北美瓦楞包裝市場價值為6,668 萬美元,預計到 2032 年將達到 9,834 萬美元

- 在 2025 年至 2032 年的預測期內,市場可能以5.1% 的複合年增長率成長,主要受技術進步的推動

- 這種成長是由產品客製化、可持續包裝、採用可回收和可再生材料、瓦楞包裝電子商務等因素推動的

瓦楞包裝市場分析

- 瓦楞包裝因其耐用性、可回收性和成本效益而成為電子商務、食品飲料、製藥和消費品等行業廣泛使用的材料。它在運輸和儲存過程中提供卓越的保護,使其成為北美供應鏈的必需品。

- 對永續包裝解決方案的需求不斷增長以及電子商務活動的激增極大地推動了瓦楞包裝市場的擴張。隨著企業注重減少塑膠垃圾,瓦楞紙材質作為環保替代品而備受青睞

- 美國地區是瓦楞包裝的主要市場之一,這得益於其日益增長的工業化、城市化和蓬勃發展的線上零售業

- 北美瓦楞包裝位列永續包裝的首選,在減少碳足跡、確保高效產品運輸以及支持循環經濟措施方面發揮著至關重要的作用

報告範圍和瓦楞包裝市場細分

|

屬性 |

瓦楞包裝關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

瓦楞包裝市場趨勢

“對永續和智慧包裝解決方案的需求不斷增長”

- 北美瓦楞包裝市場的一個突出趨勢是,受環境法規和消費者偏好的推動,越來越多地轉向永續和智慧包裝解決方案

- 企業正在投資環保、可回收和可生物降解的瓦楞包裝,以減少碳足跡並符合循環經濟目標

- 例如,Smurfit Kappa 與 Mindful Chef 合作開發 100% 可回收瓦楞紙板隔熱包,減少 30% 的碳足跡。在測試期間,可持續包裝可維持所需溫度超過 30 小時。這項創新取代了不可回收的保溫袋,支持環保食品配送

- RFID 標籤、二維碼和數位印刷等智慧包裝技術正在整合到瓦楞紙箱中,以增強供應鏈可視性、產品追蹤和消費者參與度

- 這一趨勢正在改變瓦楞包裝產業,促進創新、提高成本效益並符合北美永續發展標準,最終推動長期市場成長

瓦楞包裝市場動態

司機

“零售和快速消費品行業的成長加速了瓦楞包裝的採用”

- 隨著網上購物的激增,品牌優先考慮耐用且環保的包裝,以提高產品安全性並滿足不斷變化的消費者期望

- 此外,政府推廣可回收材料的法規也進一步促進了人們對瓦楞包裝的青睞

- 尤其是白內障,它是全世界最常見的失明原因之一,需要高精準度的手術

- 隨著快速消費品公司擴大其產品線並探索創新的包裝形式,瓦楞紙板提供了多功能性和客製化選項。從食品飲料到個人護理產品,這些片材具有出色的結構強度和品牌機會

例如,

- 2020 年 2 月,根據 Business Wire 報道,SpendEdge 幫助一家快速消費品公司製定了戰略包裝採購方法,實現了每年 1500 萬美元的節省。透過優化供應商選擇、支出匯總和成本因素,該公司提高了供應鏈效率並鞏固了市場地位。隨著快速消費品公司優先考慮成本優化和營運效率,對可持續且具有成本效益的瓦楞紙包裝的需求正在上升。對策略採購、供應商評估和總成本優化的關注進一步推動了瓦楞包裝在零售和快速消費品領域的應用

- Fresh Plaza 在 2025 年 3 月的文章中強調,Klabin 已引入內陸海運,以加強巴西的瓦楞紙板運輸,從而降低成本、縮短交貨時間並減少對環境的影響。該公司還投資防潮紙板,支持電子商務、新鮮農產品出口和永續發展需求推動的不斷增長的零售和快速消費品行業

- 零售和快速消費品行業的快速擴張是推動瓦楞包裝採用率不斷提高的主要因素。隨著消費者對電子商務、永續包裝和經濟高效物流的需求不斷增長,企業正在轉向輕質、耐用和可回收的瓦楞紙解決方案。向環保包裝的轉變和對高效供應鏈管理的需求進一步強化了這一趨勢。隨著零售商和快速消費品品牌優先考慮永續性和產品保護,瓦楞包裝市場將持續成長和創新

機會

“北美電子商務的擴張推動了對輕質耐用瓦楞紙包裝的需求”

- 北美電子商務的快速擴張顯著增加了對運輸過程中保護產品的輕質、耐用包裝的需求

- 線上零售的激增帶來了對可靠、經濟高效的解決方案的需求,例如以強度和可回收性著稱的瓦楞紙包裝

- 製造商越來越多地採用先進的設計來優化供應鏈物流並降低損壞率。隨著數位商務的不斷發展,這一趨勢有望帶來穩定的收入成長和巨大的市場潛力

例如,

- 2024年5月,根據Baywater Packaging & Supply發表的文章,2024年電子商務的快速成長顯著增加了對瓦楞紙箱的需求,因為線上購物激增。企業需要更耐用、更輕、更永續的包裝來滿足不斷增長的運輸量。環保材料和智慧包裝解決方案的創新對於滿足消費者偏好和監管標準至關重要。物流網絡的擴張和供應鏈的進步進一步刺激了需求。專注於優化生產、回收和高效包裝設計以滿足不斷變化的市場需求的公司

- 2024 年 3 月,Mondi 發布了一份關於電子商務包裝趨勢的報告,該報告基於對歐洲和土耳其 6,000 名消費者的調查。該研究探討了購物習慣、包裝偏好、回收行為和未來趨勢。它強調電子商務品牌和包裝供應商之間的合作,以滿足消費者的期望和永續發展目標。隨著對永續包裝的需求不斷增長,電子商務為瓦楞包裝提供了支持環保高效解決方案的強大機會

- 北美電子商務的快速擴張推動了對輕質、耐用瓦楞包裝的巨大需求。隨著網路零售額持續成長,企業正在採用創新、永續的包裝解決方案來滿足運輸需求。物流、材料科學和智慧包裝的進步將進一步加強瓦楞包裝市場,確保效率和環境永續性

克制/挑戰

“原材料價格波動推高生產成本,壓縮利潤率”

- 原料價格波動,尤其是牛皮紙和再生纖維價格,大幅增加了瓦楞包裝產業的生產成本,壓縮了利潤率

- 紙漿和紙張價格的波動造成財務不穩定,使製造商難以規劃預算和保持獲利

- 為了應對成本上升,企業經常採取削減成本的措施,這可能會影響產品品質和營運效率。許多公司透過簽訂長期供應合約和投資先進製造技術來提高效率和減少浪費,從而緩解這些挑戰

例如,

- 2024年7月,根據JohnsByrne發表的文章,由於原物料價格上漲、勞動力短缺以及運輸費用增加,電子商務包裝成本上升。隨著需求激增和永續性預期不斷增長,瓦楞包裝市場面臨挑戰。為了解決這些問題,企業採用了合適尺寸的包裝、使用了具有成本效益的永續材料、實現了自動化配送並優化了產品組合。這些策略有助於降低開支,同時保持效率和客戶滿意度

- 2024 年 10 月,根據 THG PUBLISHING PVT LTD 發表的文章。由於牛皮紙成本上漲,喀拉拉邦瓦楞紙箱製造協會(KeCBMA)將瓦楞紙箱價格上調了15%。原料成本飆升,製造商面臨維持獲利能力的挑戰,影響了瓦楞包裝市場

- 由於原物料價格波動,尤其是牛皮紙成本上漲,瓦楞包裝產業持續面臨重大挑戰。價格飆升增加了生產費用,降低了利潤率,並迫使製造商實施自動化和優化包裝等節省成本的策略。為了保持盈利能力,公司正在採用長期供應協議並探索替代材料。解決這些成本壓力對於維持市場穩定和競爭力仍然至關重要

瓦楞包裝市場範圍

市場根據產品、瓦楞類型、紙板樣式、容量、尺寸、印刷類型和應用進行細分。

|

分割 |

細分 |

|

按產品 |

|

|

按槽型 |

|

|

按板型 |

|

|

按容量 |

|

|

按尺寸 |

|

|

按印刷類型

|

|

|

按應用 |

|

瓦楞包裝市場區域分析

“美國是瓦楞包裝市場的主導國家”

- 美國在瓦楞包裝市場中佔據主導地位,並且是成長最快的國家,這得益於蓬勃發展的電子商務行業、快速的工業化以及對經濟高效、可持續包裝解決方案的高需求

- 該地區受益於低製造成本、強大的供應鏈以及中國和印度等大型消費市場,推動了更高的生產和消費

- 此外,該地區零售和食品配送服務的日益增長也刺激了對經濟高效且耐用的瓦楞包裝解決方案的需求

瓦楞包裝市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、區域影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

市場中主要的市場領導者有:

- Smurfit Kappa(愛爾蘭)

- 王子控股株式會社(日本)

- 國際紙業(美國)

- 世界錦標賽(英國)

- 斯道拉恩索(芬蘭)

- Sonoco Products Company(美國)

- 喬治亞太平洋公司(美國)

- WestRock公司(美國)

- 美國包裝公司(美國)

- VPK Group NV(比利時)

- Elsons International(美國)

- 連合株式會社(日本)

- 普拉特工業公司(美國)

- 美國工業公司(Ameripac Industries)

- SCG包裝(泰國)

北美瓦楞包裝市場的最新發展

- 2025 年 1 月,國際紙業收購 DS Smith,打造北美永續包裝解決方案的領導者。此舉旨在提供卓越的客戶體驗並增強包裝行業的創新。透過整合兩家公司的能力,他們計劃提供更具永續性、更有效率、更具創新性的包裝解決方案,滿足日益增長的環保產品需求,並加強其在行業中的領導地位

- 2023 年 5 月,斯道拉恩索推出用於冷凍和冷藏食品包裝的新型易回收包裝紙板。 Tambrite Aqua+ 是一種用於冷凍和冷藏食品包裝的新型圓形包裝材料,可減少對化石基塑膠的需求,並提高使用後的可回收性

- 2024 年 6 月,Smurfit Kappa 收購了保加利亞的 Bag-in-Box 工廠。此次收購將擴大 Smurfit Kappa 的產品供應,增強其向客戶提供可持續、高品質解決方案的能力,從而鞏固其在北美包裝市場的地位

- 2019年8月,Elsons International在執行長Andrew Jackson的帶領下,積極與社區合作,提升製造業的就業機會。該公司繼續努力改善該行業的就業市場。這意味著瓦楞紙業將因此次合作和更多的就業而受益。這可能會導致瓦楞產品生產對勞動力和資源的需求增加,從而在該領域創造更多的就業機會

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CORRUGATED PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL:

4.2.2 ECONOMIC:

4.2.3 SOCIAL:

4.2.4 TECHNOLOGICAL:

4.2.5 LEGAL:

4.2.6 ENVIRONMENTAL:

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4.1 SMART PACKAGING INTEGRATION

4.4.2 MAX LAMINATION TECHNOLOGY

4.4.3 HIGH-PRECISION DIGITAL PRINTING

4.4.4 3 D & AI-DRIVEN PACKAGING DESIGN

4.4.5 AUTOMATED PRODUCTION & ROBOTICS

4.4.6 FLEXO PRINTING AND DIGITAL TECHNOLOGY

4.4.7 FIT-TO-PRODUCT (FTP)

4.5 RAW MATERIAL COVERAGE

4.5.1 CELLULOSE FIBERS

4.5.2 STARCH-BASED ADHESIVES

4.5.3 SPECIALTY COATINGS & ADDITIVES

4.5.4 REINFORCEMENT MATERIALS

4.5.5 RECYCLED MATERIALS & SUSTAINABILITY INNOVATIONS

4.6 IMPORT EXPORT SCENARIO

4.7 SUPPLY CHAIN ANALYSIS

4.8 LOGISTICS COST SCENARIO

4.9 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT’S ROLE

4.11 VENDOR SELECTION CRITERIA

4.11.1 PRODUCT QUALITY & COMPLIANCE

4.11.2 COST & PRICING STRUCTURE

4.11.3 SUSTAINABILITY PRACTICES

4.11.4 PRODUCTION CAPACITY & LEAD TIME

4.11.5 CUSTOMIZATION & DESIGN CAPABILITIES

4.11.6 SUPPLY CHAIN RELIABILITY & LOGISTICS

4.11.7 TECHNOLOGICAL CAPABILITIES & INNOVATION

4.11.8 CUSTOMER SUPPORT & AFTER-SALES SERVICE

4.12 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN RETAIL AND FMCG SECTORS ACCELERATES CORRUGATED PACKAGING ADOPTION

6.1.2 SURGE IN DEMAND FOR PROTECTIVE PACKAGING ENHANCES INNOVATION IN CORRUGATED BOX DESIGNS

6.1.3 GROWING HEALTHCARE & PHARMACEUTICAL SECTOR DRIVES DEMAND FOR STERILE AND SECURE PACKAGING

6.1.4 INNOVATIONS IN DIGITAL PRINTING ENHANCE BRANDING AND CUSTOMIZATION IN CORRUGATED PACKAGING

6.2 RESTRAINTS

6.2.1 LIMITED RECYCLABILITY OF MULTI-LAYERED CORRUGATED PACKAGING HAMPERS SUSTAINABLE ADOPTION AND RAISING ENVIRONMENTAL CONCERNS

6.2.2 LIMITED DURABILITY COMPARED TO RIGID PACKAGING MATERIALS RESTRICTS ADOPTION FOR HEAVY-DUTY APPLICATIONS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR SUSTAINABLE PACKAGING CREATES OPPORTUNITIES FOR CORRUGATED SOLUTIONS

6.3.2 EXPANDING NORTH AMERICA E-COMMERCE BOOSTS DEMAND FOR LIGHTWEIGHT, DURABLE CORRUGATED PACKAGING

6.3.3 ADVANCEMENT IN TECHNOLOGY VIA RFID AND QR CODES BOOSTS SMART PACKAGING TRACEABILITY

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES ELEVATE PRODUCTION COSTS AND COMPRESS PROFIT MARGINS

6.4.2 INTENSE COMPETITION FROM ALTERNATIVE PACKAGING MATERIALS REDUCES MARKET SHARE AND COMPRESSES PRICING

7 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REGULAR SLOTTED CONTAINER (RSC)

7.2.1 REGULAR SLOTTED CONTAINER (RSC), BY FLUTE TYPE

7.2.2 REGULAR SLOTTED CONTAINER (RSC), BY BOARD TYPE

7.3 HALF SLOTTED CONTAINER (HSC)

7.3.1 HALF SLOTTED CONTAINER (HSC), BY FLUTE TYPE

7.3.2 HALF SLOTTED CONTAINER (HSC), BY BOARD TYPE

7.4 OVERLAP SLOTTED CONTAINER (OSC)

7.4.1 OVERLAP SLOTTED CONTAINER (OSC), BY FLUTE TYPE

7.4.2 OVERLAP SLOTTED CONTAINER (OSC), BY BOARD TYPE

7.5 FULL OVERLAP SLOTTED CONTAINER (FOL)

7.5.1 FULL OVERLAP SLOTTED CONTAINER (FOL), BY FLUTE TYPE

7.5.2 FULL OVERLAP SLOTTED CONTAINER (FOL), BY BOARD TYPE

7.6 CENTER SPECIAL SLOTTED CONTAINER (CSSC)

7.6.1 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY FLUTE TYPE

7.6.2 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY BOARD TYPE

7.7 CENTER SPECIAL SLOTTED CONTAINER (CSSC)

7.7.1 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY FLUTE TYPE

7.7.2 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY BOARD TYPE

7.8 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB)

7.8.1 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY FLUTE TYPE

7.8.2 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY BOARD TYPE

7.9 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB)

7.9.1 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY FLUTE TYPE

7.9.2 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY BOARD TYPE

7.1 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS)

7.10.1 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS), BY FLUTE TYPE

7.10.2 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS), BY BOARD TYPE

7.11 FOLDERS

7.11.1 FOLDERS, BY FLUTE TYPE

7.11.2 FOLDERS, BY BOARD TYPE

7.12 WRAPAROUND BLANK

7.12.1 WRAPAROUND BLANK, BY FLUTE TYPE

7.12.2 WRAPAROUND BLANK, BY BOARD TYPE

8 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE

8.1 OVERVIEW

8.2 C FLUTE

8.3 B FLUTE

8.4 E FLUTE

8.5 A FLUTE

8.6 F FLUTE

8.7 D FLUTE

9 NORTH AMERICA CORRUGATED PACKAGING MARKET, BOARD STYLE

9.1 OVERVIEW

9.2 SINGLE WALL

9.3 DOUBLE WALL

9.4 TRIPLE WALL

9.5 SINGLE FACE

9.6 LINER BOARD

10 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 UPTO 100 LBS

10.3 100-300 LBS

10.4 ABOVE 300 LBS

11 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY SIZE

11.1 OVERVIEW

11.2 0-10 INCHES

11.3 10-20 INCHES

11.4 20-30 INCHES

11.5 ABOVE 30 INCHES

12 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE

12.1 OVERVIEW

12.2 PRINTED

12.3 NON-PRINTED

13 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 E-COMMERCE & RETAIL

13.3 FOOD

13.3.1 FOOD, BY APPLICATION

13.4 ELECTRONICS GOODS

13.4.1 ELECTRIC GOODS, BY APPLICATION

13.4.1.1 CONSUMER ELECTRONICS, BY TYPE

13.4.1.2 COMPUTER AND IT HARDWARE, BY TYPE

13.5 HOME APPLIANCES

13.5.1 HOME APPLIANCES, BY APPLICATION

13.5.1.1 MAJOR HOME APPLIANCES, BY TYPE

13.5.1.2 HEATING AND COOLING DEVICES, BY TYPE

13.5.1.3 SMALL KITCHEN, BY TYPE

13.6 AUTOMOTIVE

13.6.1 AUTOMOTIVE, BY APPLICATION

13.7 HEALTHCARE & PHARMACEUTICALS

13.7.1 HEALTHCARE, BY APPLICATION

13.7.1.1 PHARMACEUTICALS, BY TYPE

13.7.1.2 HEALTHCARE, BY TYPE

13.8 BEVERAGE

13.8.1 BEVERAGE, BY APPLICATION

13.9 GLASSWARE AND CERAMICS

13.9.1 GLASSWARE AND CERAMICS, BY APPLICATION

13.9.1.1 GLASSWARE, BY TYPE

13.9.1.2 CERAMICS, BY TYPE

13.1 PERSONAL CARE

13.10.1 PERSONAL CARE, BY APPLICATION

13.11 HOME CARE

13.11.1 HOME CARE, BY APPLICATION

13.12 AGRICULTURE & HORTICULTURE

13.12.1 AGRICULTURE & HORTICULTURE, BY APPLICATION

13.13 OIL AND GAS

13.13.1 OIL AND GAS, BY APPLICATION

13.14 TOYS

13.14.1 TOYS, BY APPLICATION

13.15 BABY PRODUCTS

13.15.1 BABY PRODUCTS, BY APPLICATION

13.16 OTHERS

14 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA CORRUGATED PACKAGING MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 WESTROCK COMPANY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT/NEWS

17.2 INTERNATIONAL PAPER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT/NEWS

17.3 STORA ENSO

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT/NEWS

17.4 SMURFIT KAPPA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT/NEWS

17.5 PACKAGING CORPORATION OF AMERICA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT NEWS

17.6 AMERIPAC INDUSTRIES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ELSONS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT/NEWS

17.8 GEORGIA-PACIFIC

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT/NEWS

17.9 MONDI

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT/NEWS

17.1 OJI HOLDINGS CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT/NEWS

17.11 PRATT INDUSTRIES, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 RENGO CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT/NEWS

17.13 SCG PACKAGING

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT/NEWS

17.14 SONOCO PRODUCTS COMPANY

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 TGIPACKAGING.IN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 VPK GROUP NV

17.16.1 COMPANY SNAPSHOT

17.16.2 1.1.4 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT/NEWS

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 GREENHOUSE GAS EMISSIONS FOR COMMON BOX SIZES

TABLE 3 FIBERBOARD PERFORMANCE STANDARDS

TABLE 4 TIME TAKEN FOR GARBAGE TO DECOMPOSE IN THE ENVIRONMENT

TABLE 5 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 7 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA C FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA B FLUTE IN CORRUGATED PACKAGING MARKETMARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA E FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA A FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA F FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA D FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA SINGLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA DOUBLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA TRIPLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA SINGLE FACE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA LINER BOARD IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA UPTO 100 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA 100-300 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA ABOVE 300 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA 0-10 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA 10-20 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA 20-30 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA ABOVE 30 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA PRINTED IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA NON-PRINTED IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA E-COMMERCE & RETAIL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA FOOD IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA ELECTRONICS GOODS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 98 NORTH AMERICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 99 NORTH AMERICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 100 NORTH AMERICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 101 NORTH AMERICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 102 NORTH AMERICA OTHERS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 103 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 104 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 105 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 106 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 107 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 108 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 109 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 110 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 111 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 112 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 113 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 114 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 115 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 116 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 117 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 118 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 119 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 120 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 121 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 122 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 123 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 124 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 125 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 126 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 127 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 128 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 129 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 130 NORTH AMERICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 131 NORTH AMERICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 132 NORTH AMERICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 NORTH AMERICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 134 NORTH AMERICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 135 NORTH AMERICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 NORTH AMERICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 NORTH AMERICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 138 NORTH AMERICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 139 NORTH AMERICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 140 NORTH AMERICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 NORTH AMERICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 142 NORTH AMERICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 143 NORTH AMERICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 144 NORTH AMERICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 NORTH AMERICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 NORTH AMERICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 147 NORTH AMERICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 148 NORTH AMERICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 149 NORTH AMERICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 150 NORTH AMERICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 151 NORTH AMERICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 152 U.S. CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 153 U.S. CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 154 U.S. REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 155 U.S. REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 156 U.S. HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 157 U.S. HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 158 U.S. OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 159 U.S. OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 160 U.S. FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 161 U.S. FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 162 U.S. CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 163 U.S. CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 164 U.S. 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 165 U.S. 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 166 U.S. TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 167 U.S. TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 168 U.S. FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 169 U.S. FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 170 U.S. WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 171 U.S. WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 172 U.S. CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 173 U.S. CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 174 U.S. CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 175 U.S. CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 176 U.S. CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 177 U.S. CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 178 U.S. FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 179 U.S. ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 180 U.S. CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 U.S. COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 182 U.S. HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 183 U.S. MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 184 U.S. HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 185 U.S. SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 U.S. AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 187 U.S. HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 188 U.S. PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 U.S. HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 U.S. BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 191 U.S. GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 192 U.S. GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 U.S. CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 U.S. PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 195 U.S. HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 196 U.S. AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 197 U.S. OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 U.S. TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 U.S. BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 200 CANADA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 201 CANADA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 202 CANADA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 203 CANADA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 204 CANADA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 205 CANADA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 206 CANADA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 207 CANADA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 208 CANADA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 209 CANADA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 210 CANADA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 211 CANADA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 212 CANADA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 213 CANADA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 214 CANADA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 215 CANADA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 216 CANADA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 217 CANADA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 218 CANADA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 219 CANADA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 220 CANADA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 221 CANADA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 222 CANADA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 223 CANADA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 224 CANADA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 225 CANADA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 226 CANADA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 227 CANADA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 228 CANADA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 229 CANADA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 230 CANADA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 231 CANADA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 232 CANADA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 CANADA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 CANADA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 235 CANADA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 236 CANADA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 237 CANADA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 CANADA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 239 CANADA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 240 CANADA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 241 CANADA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 CANADA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 243 CANADA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 244 CANADA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 245 CANADA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 246 CANADA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 247 CANADA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 248 MEXICO CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 249 MEXICO CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 250 MEXICO REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 251 MEXICO REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 252 MEXICO HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 253 MEXICO HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 254 MEXICO OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 255 MEXICO OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 256 MEXICO FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 257 MEXICO FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 258 MEXICO CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 259 MEXICO CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 260 MEXICO 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 261 MEXICO 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 262 MEXICO TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 263 MEXICO TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 264 MEXICO FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 265 MEXICO FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 266 MEXICO WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 267 MEXICO WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 268 MEXICO CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 269 MEXICO CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 270 MEXICO CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 271 MEXICO CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 272 MEXICO CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 273 MEXICO CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 274 MEXICO FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 275 MEXICO ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 276 MEXICO CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 MEXICO COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 MEXICO HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 279 MEXICO MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 MEXICO HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 MEXICO SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 282 MEXICO AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 283 MEXICO HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 284 MEXICO PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 MEXICO HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 MEXICO BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 287 MEXICO GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 288 MEXICO GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 289 MEXICO CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 290 MEXICO PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 291 MEXICO HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 292 MEXICO AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 293 MEXICO OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 294 MEXICO TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 295 MEXICO BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA CORRUGATED PACKAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CORRUGATED PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CORRUGATED PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CORRUGATED PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CORRUGATED PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CORRUGATED PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CORRUGATED PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CORRUGATED PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CORRUGATED PACKAGING MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA CORRUGATED PACKAGING MARKET: PRODUCT TIMELINE CURVE

FIGURE 11 NORTH AMERICA CORRUGATED PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA CORRUGATED PACKAGING MARKET: SEGMENTATION

FIGURE 13 NINE SEGMENTS COMPRISE THE NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT (2024)

FIGURE 14 NORTH AMERICA CORRUGATED PACKAGING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWTH IN RETAIL AND FMCG SECTORS ACCELERATES CORRUGATED PACKAGING ADOPTION IS EXPECTED TO DRIVE THE NORTH AMERICA CORRUGATED PACKAGING MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 REGULAR SLOTTED CONTAINER (RSC) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CORRUGATED PACKAGING MARKET IN 2025 & 2032

FIGURE 18 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 19 HIGHEST RECEIVERS OF PACKAGING EXPORTS (DOLLAR)

FIGURE 20 SUPPLY CHAIN ANALYSIS FOR THE NORTH AMERICA CORRUGATED PACKAGING MARKET

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 MARKET OVERVIEW

FIGURE 23 OVERALL RETAIL MARKET GROWTH IN INDIA (FY 18-FY 24)

FIGURE 24 DEMAND FOR CORRUGATED BOXES

FIGURE 25 SHARE OF ONLINE RETAIL TRANSACTIONS OVER THE YEARS

FIGURE 26 GROWTH IN RETAIL E-COMMERCE SALES GLOBALLY OVER THE YEARS

FIGURE 27 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY PRODUCT, 2024

FIGURE 28 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY FLUTE TYPE, 2024

FIGURE 29 NORTH AMERICA CORRUGATED PACKAGING MARKET: BOARD STYLE, 2024

FIGURE 30 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY CAPACITY, 2024

FIGURE 31 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY SIZE, 2024

FIGURE 32 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY PRINT TYPE, 2024

FIGURE 33 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY APPLICATION, 2024

FIGURE 34 NORTH AMERICA CORRUGATED PACKAGING MARKET SNAPSHOT

FIGURE 35 NORTH AMERICA CORRUGATED PACKAGING MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。