North America Domestic Booster Pump Market

市场规模(十亿美元)

CAGR :

%

USD

1.07 Billion

USD

2.08 Billion

2025

2033

USD

1.07 Billion

USD

2.08 Billion

2025

2033

| 2026 –2033 | |

| USD 1.07 Billion | |

| USD 2.08 Billion | |

|

|

|

|

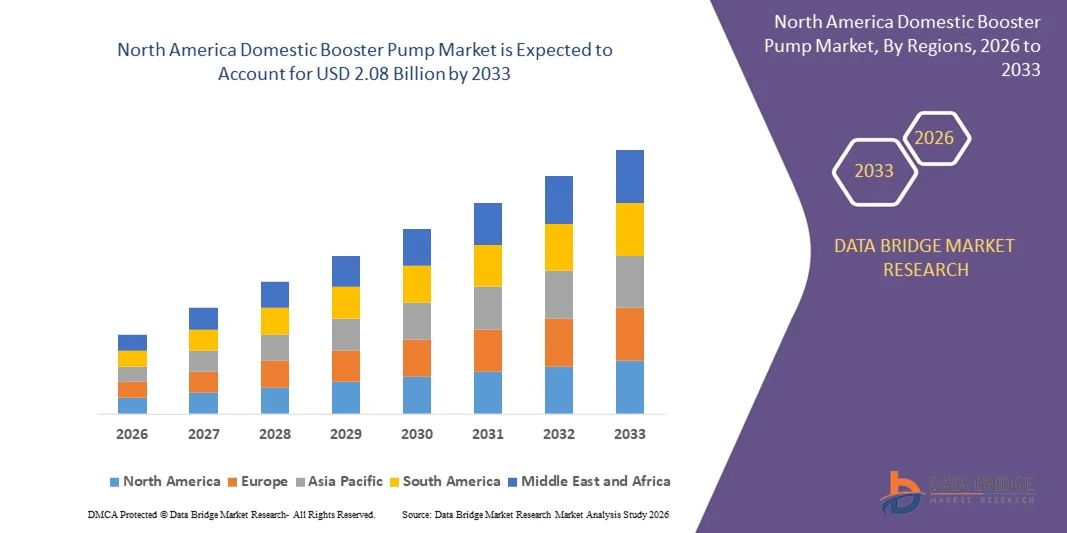

North America Domestic Booster Pump Market Segmentation, By Product (Single Stage and Multiple Stage), Material (Cast Iron, Stainless Steel, Gunmetal, Aluminium, Copper, Titanium, and Others), Distribution Channel (B2B/Direct Sales, Third Party Distributors, Brand Websites, E-Commerce, and Others), End User (Residential Homes/Flats, Sea Farm Houses/Cottages/Guest Houses, and Others) - Industry Trends and Forecast to 2033

What is the North America Domestic Booster Pump Market Size and Growth Rate?

- The North America domestic booster pump market size was valued at USD 1.07 billion in 2025 and is expected to reach USD 2.08 billion by 2033, at a CAGR of 8.6% during the forecast period

- Increase in the world population is leading to the rise in requirement of water due to which the demand for domestic booster pump market is increasing with significant CAGR. High cost of installation of booster pumps is acting as major restraint for the domestic booster pump market growth

What are the Major Takeaways of Domestic Booster Pump Market?

- Increasing technological advancements in domestic booster pumps is acting as major window of opportunity for the domestic booster pump market

- Technical complexities involved with domestic booster pumps acts as a major challenge for the growth of domestic booster pump market

- The U.S. dominated the North America domestic booster pump market with a revenue share of 54.67% in 2025, driven by strong residential construction, rapid expansion of urban housing infrastructure, and rising installation of domestic pressure-boosting systems across apartments, villas, and multi-storey homes

- Mexico is projected to register fastest growth of 12.69% from 2026 to 2033, driven by rising urbanization, expanding residential construction, and increased installation of pressure-boosting systems in multi-family apartments and gated communities

- The Single Stage segment dominated the market with an estimated 68.4% share in 2025, supported by widespread residential usage, compact design, cost-effectiveness, and ease of installation

Report Scope and Domestic Booster Pump Market Segmentation

|

Attributes |

Domestic Booster Pump Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Domestic Booster Pump Market?

Growing Adoption of Energy-Efficient, Smart, and Sustainable Water Pumping Solutions

- The domestic booster pump market is experiencing a strong shift toward energy-efficient designs, low-noise performance, and intelligent water-pressure management technologies, driven by rising urbanization, smart-home adoption, and stricter energy-saving regulations

- Manufacturers are integrating variable frequency drives (VFDs), smart sensors, and IoT-enabled monitoring systems to optimize pressure control, reduce power consumption, and extend pump lifespan

- Digitalization is accelerating the use of remote diagnostics, predictive maintenance, and automated pressure optimization, improving operational efficiency in residential water supply systems

- For instance, leading brands such as Grundfos, WILO SE, Xylem, Pentair, and KSB are introducing AI-enabled booster pumps with real-time monitoring, cloud connectivity, and self-adjusting pressure capabilities

- Growing emphasis on water conservation, green-building standards, and eco-friendly home infrastructure is strengthening demand across the U.S., Europe, and North America

- As households increasingly prioritize efficient water pressure, reduced energy bills, and digital convenience, domestic booster pumps will remain essential to modern residential water management systems worldwide

What are the Key Drivers of Domestic Booster Pump Market?

- Rising demand for consistent household water pressure, especially in multi-storey buildings, gated communities, and urban housing, is accelerating adoption of domestic booster pumps across residential applications

- For instance, in 2025, companies such as Grundfos, Franklin Electric, and Pentair expanded production of energy-efficient VFD-based booster systems to meet increasing demand from high-density housing clusters

- Growing enforcement of energy-efficiency standards, water-usage regulations, and green-building norms across the U.S., Europe, and North America is fueling upgrades from conventional pumps to smart, efficient booster systems

- Advancements in brushless DC motors, automated pressure control, compact pump designs, and durable corrosion-resistant materials have enhanced performance, reliability, and operational efficiency

- Rising focus on water scarcity management, low-energy residential infrastructure, and improved home comfort is further strengthening market adoption

- Supported by rapid urban development, expansion of smart-home ecosystems, and increasing renovation of aging water supply systems, the domestic booster pump market is expected to witness strong and sustained growth

Which Factor is Challenging the Growth of the Domestic Booster Pump Market?

- High certification costs, extensive testing procedures, and complex compliance requirements often burden small manufacturers and emerging construction firms

- For instance, between 2024–2025, rising costs of raw materials, testing equipment, and specialized labor resulted in longer certification timelines for many companies

- Strict regulatory standards related to fire resistance, chemical emissions, structural integrity, and environmental performance add challenges for global market entrants

- Limited technical expertise and low awareness in developing economies restrict certification adoption among small and mid-sized construction material producers

- Competition from uncertified, low-cost, and counterfeit construction products creates pricing pressure and affects market differentiation

- To overcome these challenges, companies are focusing on digital certification tools, standardized global testing frameworks, cost-efficient processes, and awareness programs to expand certification accessibility worldwide

How is the Domestic Booster Pump Market Segmented?

The market is segmented on the basis of product, material, distribution channel, and end-user.

- By Product

The domestic booster pump market is segmented into Single Stage and Multiple Stage pumps. The Single Stage segment dominated the market with an estimated 68.4% share in 2025, supported by widespread residential usage, compact design, cost-effectiveness, and ease of installation. These pumps are highly preferred in apartments, villas, and small commercial buildings due to their simple operating mechanism and reliable performance in maintaining consistent household water pressure. Their lower maintenance needs and compatibility with standard plumbing systems further strengthen adoption across both developing and mature markets.

The Multiple Stage segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for high-pressure systems in multi-storey buildings, luxury homes, and water-intensive applications. Increasing adoption of smart multi-stage pumps featuring VFDs, energy-efficient motors, and IoT-based pressure monitoring enables precise pressure control and enhanced pumping efficiency. Growing urbanization and expansion of high-rise residential infrastructure will continue to accelerate segment growth.

- By Material

The domestic booster pump market is segmented into Cast Iron, Stainless Steel, Gunmetal, Aluminium, Copper, Titanium, and Others. The Cast Iron segment dominated the market with approximately 42.1% share in 2025, owing to its durability, corrosion resistance, high structural strength, and competitive pricing. Cast-iron booster pumps are widely used in residential buildings due to their long life, ability to handle moderate impurities, and suitability for medium-pressure applications. Their affordability makes them the preferred choice in price-sensitive markets across North America, the Middle East, and Latin America.

The Stainless Steel segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by consumer preference for hygienic, corrosion-free, and premium-grade materials suitable for drinking-water applications. Increasing adoption of stainless-steel pumps in modern homes, villas, coastal regions, and smart water systems—combined with demand for lightweight and energy-efficient materials—continues to enhance market penetration.

- By Distribution Channel

The domestic booster pump market is segmented into B2B/Direct Sales, Third-Party Distributors, Brand Websites, E-Commerce, and Others. The B2B/Direct Sales segment dominated the market with an estimated 49.6% share in 2025, driven by strong partnerships with builders, plumbing contractors, commercial installers, and facility managers. Direct sales channels ensure faster product delivery, bulk purchasing advantages, customized solutions, and reliable after-sales support, making them the preferred route for large residential projects and institutional buyers.

The E-Commerce channel is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising digital adoption, transparent pricing, doorstep delivery, easy comparison of pump specifications, and growing trust in online platforms. Increasing sales from marketplaces such as Amazon, Flipkart, and brand-owned online stores are driving rapid penetration among homeowners seeking convenient, self-service purchasing options. Improved online product information, reviews, and installation support videos further strengthen e-commerce growth.

- By End User

The domestic booster pump market is segmented into Residential Homes/Flats, Sea Farm Houses/Cottages/Guest Houses, and Others. The Residential Homes/Flats segment dominated the market with an estimated 67.8% share in 2025, supported by rising urbanization, growing multi-storey housing construction, and increasing consumer demand for consistent water pressure in bathrooms, kitchens, and household appliances. Booster pumps are widely used in apartments, gated societies, and standalone homes to ensure reliable water flow from overhead tanks, municipal supply lines, and storage units.

The Sea Farm Houses/Cottages/Guest Houses segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing development of vacation properties, farm stays, and premium hospitality units in coastal and semi-urban regions. Higher water-pressure requirements, use of multiple fixtures, and demand for efficient pumps resistant to corrosion and saline water exposure are supporting rapid adoption. Growth in tourism, holiday rentals, and remote living trends further accelerates segment expansion.

Which Region Holds the Largest Share of the Domestic Booster Pump Market?

- The U.S. dominated the North America domestic booster pump market with a revenue share of 54.67% in 2025, driven by strong residential construction, rapid expansion of urban housing infrastructure, and rising installation of domestic pressure-boosting systems across apartments, villas, and multi-storey homes. Increasing demand for stable water pressure—especially in densely populated metropolitan areas—combined with growing adoption of energy-efficient and smart water management technologies, continues to support large-scale deployment across major U.S. states. Ongoing investments in high-rise housing, renovation activities, and modernization of municipal water distribution networks further accelerate the demand for domestic booster pumps across the country

- Domestic pump manufacturers in the U.S. are increasingly focusing on smart booster pumps, corrosion-resistant materials, variable-speed motors, and IoT-enabled pressure monitoring systems to cater to modern residential water supply needs. Strong emphasis on sustainable plumbing systems, energy efficiency, and water conservation measures further reinforces the U.S. leadership in the regional market

- Rising adoption of automated water supply systems, growing residential construction, and continuous product innovation by domestic and global brands further strengthen the U.S. dominance across the North America region

Canada Domestic Booster Pump Market Insight

Canada demonstrates steady market growth supported by strict residential plumbing standards, increasing development of multi-storey housing units, and a high preference for premium-quality, low-noise domestic booster pumps. Demand continues to rise for durable, energy-efficient, and weather-resistant pump systems—especially across urban apartments and modern homes requiring stable water pressure. Growing adoption of smart water management solutions and government initiatives promoting sustainable housing further contribute to market expansion.

Mexico Domestic Booster Pump Market Insight

Mexico is projected to register fastest growth of 12.69% from 2026 to 2033, driven by rising urbanization, expanding residential construction, and increased installation of pressure-boosting systems in multi-family apartments and gated communities. Growing awareness of consistent water pressure needs—particularly in regions with fluctuating municipal supply—continues to drive household adoption. Rising preference for energy-efficient pumps, automated pressure control technologies, and affordable residential water management systems further accelerates market penetration across the country.

Which are the Top Companies in Domestic Booster Pump Market?

The domestic booster pump industry is primarily led by well-established companies, including:

- Grundfos Holding A/S (Denmark)

- Xylem Inc. (U.S.)

- KSB SE & Co. KGaA (Germany)

- Pentair plc (U.S.)

- ABB Ltd. (Sweden)

- DAB Pumps Spa (Italy)

- Franklin Electric (U.S.)

- Alfred Kärcher SE & Co. KG (Germany)

- WILO SE (Germany)

- Davey Water Products (Australia)

- EDDY Pump (U.S.)

- Eaton (U.S.)

- CNP India Private Limited (India)

- Torontech Inc. (Canada)

- Injung Tech Co., Ltd (South Korea)

What are the Recent Developments in Global Domestic Booster Pump Market?

- In January 2025, Grundfos introduced a new solar-enabled booster pump series that lowers energy consumption by 35% and is designed for off-grid households in emerging economies, aligning with the rising global focus on sustainability. This development is expected to strengthen the company’s position in renewable-compatible pumping solutions

- In October 2024, Xylem Inc. broadened its domestic pump portfolio with AI-powered pressure optimization features to improve reliability for multi-family residences after successful trials in the U.S., supporting the growing adoption of intelligent home water systems. This advancement is such asly to accelerate Xylem’s footprint in smart, automated pumping technologies

- In March 2024, Pentair Plc. acquired a strategic supplier to enhance its variable speed pump capabilities, aiming to secure an additional 10% market share in energy-efficient residential water applications, driven by rising consumer preference for sustainable technologies. This move is set to reinforce Pentair’s competitiveness in the high-efficiency pump segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。