North America Fishery And Aquaculture Market

市场规模(十亿美元)

CAGR :

%

USD

7.29 Billion

USD

12.15 Billion

2024

2032

USD

7.29 Billion

USD

12.15 Billion

2024

2032

| 2025 –2032 | |

| USD 7.29 Billion | |

| USD 12.15 Billion | |

|

|

|

|

北美漁業和水產養殖市場細分,按產品類型(設備和水產飼料)、水產養殖生產系統(陸基系統、水基系統、回收系統、綜合農業系統等)、環境(海水、淡水和鹹水)、應用(幼蟲、幼魚和成魚)、生產規模(小規模、中規模和大規模)、類別(有機和常規)、來源(植物基和動物基)、形式(乾、濕形式和濕潤形式)、功能(漁業和水產養殖合理價值、能量助推器、提高消化率、飼料保存、細胞毒性管理等)、技術(智能漁業和水產養殖、常規漁業和水產養殖)、香料(魚類、甲殼類動物和軟體動物) - 產業趨勢和預測到 2032 年

北美漁業和水產養殖市場規模

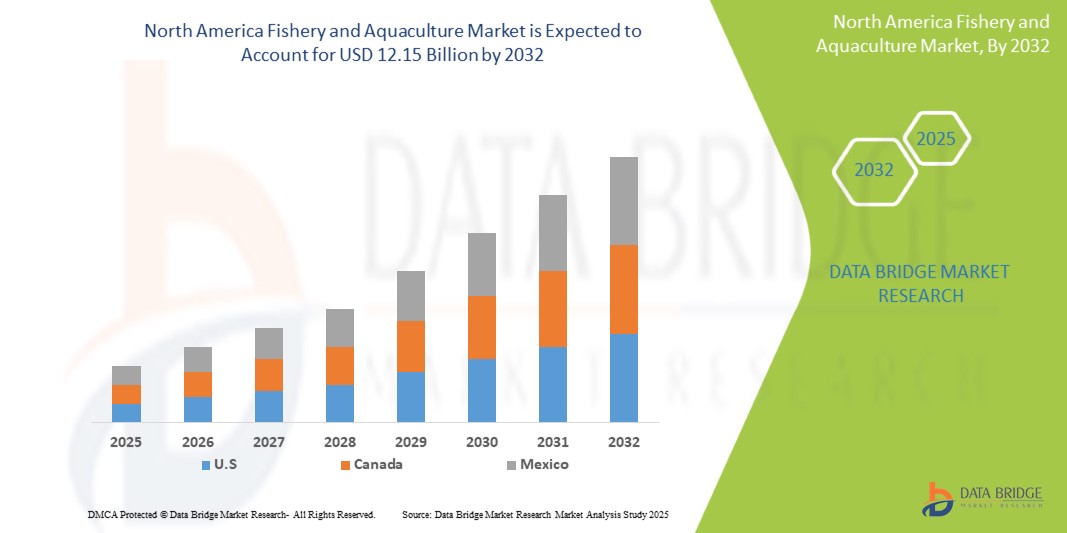

- 2024 年北美漁業和水產養殖市場規模為72.9 億美元 ,預計 到 2032 年將達到 121.5 億美元,預測期內 複合年增長率為 6.8%。

- 北美漁業和水產養殖市場受到北美海鮮需求成長、人口成長、水產養殖技術進步和健康意識增強的推動

- 可持續的實踐、政府的支持和不斷擴大的出口機會進一步促進了市場成長,並吸引了大量該領域的投資

北美漁業和水產養殖市場分析

- 北美漁業和水產養殖市場是北美食品和農業產業的重要組成部分,涵蓋魚類、貝類和海藻等水生生物的養殖、收穫和加工。水產養殖是重要的蛋白質來源和生計來源,尤其是在沿海和發展中地區。該市場包括野生捕撈漁業和水產養殖(魚類養殖),其中,由於過度捕撈的擔憂和永續需求,後者日益受到重視。

- 市場參與者正專注於循環水養殖系統 (RAS)、選擇性育種和疾病管理等技術創新,以提高生產力和環境效率。這些進步對於滿足北美日益增長的海鮮需求至關重要,而這種需求是由人口增長、城市化以及飲食偏好轉變為高蛋白、低脂肪食物所驅動的。

- 預計到 2025 年,美國將以 64.68% 的市場份額主導北美漁業和水產養殖市場,預計在預測期內,美國將以最高的複合年增長率增長,這得益於其漫長的海岸線、良好的氣候條件、政府支持和高國內消費

- 預計到2025年,水產飼料細分市場將引領北美漁業和水產養殖市場,佔據最大份額(60.03%),這得益於其可擴展性、永續性潛力以及持續滿足需求的能力。消費者對可追溯、生態標章和人工養殖海鮮的偏好日益增長,這進一步鞏固了其在北美食品安全中的作用。

報告範圍和北美漁業和水產養殖市場細分

|

屬性 |

北美漁業與水產養殖市場關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、按地理位置表示的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和更新的價格趨勢分析以及供應鏈和需求的缺口分析。 |

北美漁業和水產養殖市場趨勢

功能性水產養殖產品和個人化營養的創新

- 隨著對功能性海鮮和針對個人健康需求、飲食生活方式和永續性偏好的個人化營養的需求不斷增長,北美漁業和水產養殖市場正在經歷顯著的轉型

- 這一趨勢促使生產者超越傳統產品,開發富含 Omega-3 脂肪酸、益生菌、膠原蛋白和其他生物活性成分的強化水產養殖產品,以促進心臟健康、大腦功能、免疫力和整體健康

- 例如,企業正在創新強化魚飼料和控制養殖方法,以提高鮭魚、羅非魚和蝦等養殖物種的營養成分,使它們對注重健康的消費者更具吸引力

- 人們對植物基水產飼料、藻類衍生成分和無抗生素水產養殖的興趣日益濃厚,這進一步強化了這一趨勢,符合清潔標籤和環保意識的消費者需求

- 人工智慧和基因組學的進步也推動了海鮮產業個人化營養的興起,使得能夠根據個人健康目標,結合特定海鮮類型或營養素的客製化飲食解決方案成為可能

- 這反映了消費者越來越重視預防性醫療保健、清潔標籤透明度和營養豐富的食物來源,將功能性水產養殖定位為現代健康飲食的重要貢獻者

北美漁業和水產養殖市場動態

司機

北美對可持續和富含蛋白質的食物來源的需求不斷增長

- 隨著北美人口成長和收入增加,尤其是在新興市場,海鮮消費量正在加速成長,因為海鮮蛋白質含量高、脂肪含量低,並且富含 omega-3 等必需營養素

- 水產養殖已成為成長最快的動物性蛋白質來源,得益於技術進步,水產養殖能夠高效、大規模地養殖魚類,同時最大程度地減少對環境的影響

- 消費者越來越尋求可持續來源和認證的海鮮產品,促使主要零售商和品牌投資可追溯、帶有生態標籤的水產養殖供應鏈

- 2025 年 1 月,根據北美水產養殖聯盟的報告,目前消費的海鮮中超過 55% 來自水產養殖,反映出與野生捕撈漁業相比,水產養殖的主導地位和可靠性不斷上升

- 此外,企業正在採用循環水產養殖系統 (RAS)、離岸水產養殖和基於人工智慧的監控來提高產量,同時減少生態足跡——這是市場擴張的關鍵因素

- 水產養殖還能提供穩定的產量,避免影響野生魚類族群的季節性和過度捕撈問題,使其成為未來更可靠、更可擴展的蛋白質來源

克制/挑戰

小規模水產養殖生產者的營運和合規成本高昂

- 雖然對優質和永續水產養殖產品的需求不斷增長,但滿足品質、安全和永續性標準的成本構成了重大挑戰,尤其是對於中小型生產商而言

- 費用包括專用飼料、水過濾系統、疾病預防措施、環境監測、勞動力和認證(例如 ASC、BAP、有機)

- 2024 年 9 月,世界銀行的一項研究指出,建立中型循環水養殖系統的成本可能超過 100 萬美元,對於沒有資金支持的小型業者來說,這是無法實現的

- 此外,有關環境影響、抗生素使用和動物福利的監管頻繁變化增加了生產者的負擔,特別是在機構支持有限的地區

- 技術障礙和數位基礎設施的缺乏也阻礙了人工智慧監控、自動餵食和精準水質控制等智慧農業工具的採用。

- 這些挑戰限制了創新、生產可擴展性以及小型企業參與高價值出口市場的能力,導致市場集中在規模較大、資本雄厚的公司手中

- 如果無法獲得更好的融資、培訓和政府激勵,許多小型水產養殖企業可能會在產業現代化過程中落後

北美漁業和水產養殖市場範圍

市場根據產品類型、水產養殖生產系統、環境、應用、生產銷售、類別、來源、形式、功能、技術和物種進行細分

•依產品類型

根據產品類型,北美漁業和水產養殖市場分為水產飼料和設備。預計到 2025 年,水產飼料將佔據 59.37% 的市場份額,並預計在預測期內成長最快。全球對高品質、營養豐富的魚飼料的需求不斷增長,推動了這一增長。植物蛋白、益生菌和功能性添加劑的創新正在增強魚類健康、提高生長率並促進永續水產養殖實踐。這些進步滿足了集約化養殖系統的需求,同時也符合注重環保的消費者偏好,推動了商業營運中的廣泛採用。減少過度捕撈和對野生魚類作為飼料成分的依賴的監管壓力加速了替代配方的轉變。水產飼料製造商正在大力投資研發,以提高消化率並最大限度地減少造成水污染的營養物質徑流。飼料配方和劑量控制的數位工具的整合進一步優化了效率。設備雖然所佔份額較小,但支持餵食、曝氣和監控的自動化,特別是在智慧水產養殖裝置中。

•按水產養殖生產系統

根據水產養殖生產系統,北美漁業和水產養殖市場分為水基系統、陸基系統、回收系統、綜合養殖系統和其他系統。水基系統在 2025 年佔據最大份額,為 68.84%,預計在預測期內將成長最快。這部分包括利用天然水體養魚的池塘、水箱和離岸網箱。這些系統因其成本效益高、可擴展性強以及能夠提供自然飼養環境而受到青睞。由於易於控制的水質和較低的基礎設施成本,它們吸引了商業營運商的大量投資。它們對不同物種和地區的適應性支持了高產量,使其成為永續和大規模水產養殖擴張的首選。由於進入門檻低且利用現有水資源,池塘仍然是發展中國家最常使用的方法。沿海國家正在增加對離岸網箱系統的投資,以減少對環境的影響並提高生產能力。政府補貼和公私合作夥伴關係正在支持傳統水基農場的現代化。這些系統受益於自然水交換,減少了人工過濾的需求。

•依環境

根據環境,北美漁業和水產養殖市場分為淡水、海水和鹹水。 2025年,淡水佔比最大,為55.49%,預計在預測期內成長最快。這種增長得益於豐富的內陸水資源,例如河流、湖泊和水庫,尤其是在發展中地區。與海洋或鹹水環境相比,淡水系統面臨的技術挑戰更少,因此更容易獲得且更具成本效益。羅非魚、鯉魚和鯰魚等魚類在這些條件下茁壯成長,並在當地廣泛消費。低營運成本,加上強勁的國內需求和政府支持,使淡水水產養殖成為糧食安全和農村生計的關鍵貢獻者。中國、印度和埃及是主要的淡水生產國,利用廣大的江河流域和灌溉網絡。小農戶通常將養魚與水稻種植結合起來,以提高單位面積的產量。淡水農場正在採用循環系統來節約用水並提高生物安全性。

•按應用

根據應用,北美漁業和水產養殖市場分為成魚、幼魚和幼體。成魚在 2025 年佔最大份額,為 73.29%,預計在預測期內成長最快。這種主導地位是由於消費者對適合直接消費和出口的成熟、可上市魚類的需求很高。成魚通常整條出售或加工出售,這使其成為水產養殖的主要收入來源。高效的飼養策略、優化的健康管理和改進的養殖技術可確保高存活率和最佳體重增加。大型生產者專注於此階段以最大化獲利能力,使其成為水產養殖價值鏈中最具經濟意義的階段。養成階段(成魚階段)佔總生產成本的 70% 以上,因此強調了對效率的需求。自動餵料系統和氧氣監測被廣泛用於支持快速生長。此階段的疾病爆發可能導致巨大損失,促使對疫苗和生物安全的投資。

•依生產規模

根據生產規模,北美漁業和水產養殖市場分為大型、中型和小型。大型養殖在 2025 年佔據最高份額,為 49.49%,預計在預測期內增長最快。這些營運受益於工業自動化、先進的監控系統和整合供應鏈,可確保一致的生產和品質控制。大型農場實現了規模經濟,降低了單位成本並提高了獲利能力。他們越來越多地採用智慧農業技術進行飼養、水管理和疾病預防。隨著中東和非洲海鮮需求的不斷增長,大型生產商能夠有效率且可持續地滿足市場需求,從而吸引大量私人和公共投資。跨國公司和農業企業正在進入該行業,帶來資本和專業知識。

•依類別

根據類別,北美漁業和水產養殖市場分為傳統和有機。傳統養殖在 2025 年佔據最高 86.83%,預計在預測期內將成長最快。由於初始投資較低、耕作方式成熟以及飼料和種子等投入品廣泛可用,它仍然是首選方法。雖然對環境影響的擔憂仍然存在,但傳統系統生產力高且易於獲取,尤其是在農村和發展中地區。由於獲得有機認證或先進技術的管道有限,大多數生產商依賴這種模式。它的熟悉度和可擴展性使其成為區域水產養殖業的支柱,支持糧食供應和經濟發展。傳統養殖通常使用化學處理和抗生素,引發了對殘留物和抗生素抗藥性的擔憂。

•依來源

根據來源,北美漁業和水產養殖市場分為植物基和動物基。植物基在 2025 年佔據最高份額 60.11%,預計在預測期內增長最快。這種增長是由對魚粉和魚油可持續替代品的需求推動的,魚粉和魚油是資源密集型產品,對環境造成負擔。大豆、藻類、玉米和豆類等成分提供必需的蛋白質和營養素,同時減少對野生捕撈魚類的依賴。植物性飼料也符合環保和道德的水產養殖實踐,吸引環保意識的消費者和監管機構。對替代蛋白質的持續研究繼續提高飼料效率和魚類健康,促進整個產業的採用。微藻和昆蟲粉正在與植物蛋白混合以改善氨基酸組成。基因改造和發酵技術正被用來開發專門用於水產飼料的高蛋白作物。透過優化植物基配方,飼料轉換率 (FCR) 已顯著提高。

•依形式

根據飼料形態,北美漁業和水產養殖市場可細分為乾飼料、濕飼料和濕飼料。乾飼料在2025年佔最高份額,為55.79%,預計在預測期內成長最快。乾飼料因其保質期長、易於儲存和抗腐敗性而受到青睞,是大規模養殖的理想選擇。乾飼料提供精準的營養配方,確保持續餵食和魚類最佳生長。它們可與自動餵食系統相容,從而降低人工成本和飼料浪費。乾飼料在運輸和處理過程中的耐用性使其適用於偏遠地區和商業養殖場。隨著現代水產養殖機械化程度的提高,乾飼料仍然是最實用、最有效的飼料解決方案。擠壓技術可以根據魚種習性生產漂浮、下沉或緩沉顆粒飼料。這種飼料形態透過減少顆粒崩解來最大限度地減少水污染。相較之下,濕飼料和濕飼料更容易腐爛,需要冷藏,這限制了它們的使用。乾飼料在蝦、羅非魚和鯰魚等高產量養殖領域占主導地位。

•按功能

根據功能,北美漁業和水產養殖市場細分為漁業和水產養殖合理價值、能量增強劑、提高消化率、飼料保鮮、細胞毒性管理等。國家價值強調成本效益、資源優化和水產養殖營運的投資回報。生產者優先考慮能夠最大化產量同時最小化投入成本和環境影響的方法。這包括高效飼養、疾病預防和產量優化策略。透過平衡經濟目標和生態目標,合理價值支持長期獲利能力和永續性。它吸引了在競爭激烈的市場中尋求有韌性、可擴展且經濟可行的水產養殖模式的小農戶和商業農場。該概念將生命週期成本分析、飼料轉換率和死亡率整合到決策中。

•依技術

根據技術,北美漁業和水產養殖市場分為傳統漁業和水產養殖以及智慧漁業和水產養殖。傳統漁業和水產養殖在 2025 年佔有 72.90% 的最高份額,預計在預測期內將成長最快。這些方法包括傳統的野生捕撈、池塘養殖和網箱養殖,由於技術門檻低和廣泛採用,它們仍然占主導地位。它們支持中東和非洲的農村就業和當地糧食安全。儘管面臨環境挑戰,傳統系統仍受到生產者的信任和充分理解。雖然智慧水產養殖正在興起,但數位工具的高成本和複雜性限制了它們的普及,使得傳統做法在短期內保持領先地位。手工漁民和小規模農民依靠世代知識和低成本投入。非洲和南亞超過 90% 的水產養殖採用傳統方法進行。

•依物種

根據種類,北美漁業和水產養殖市場分為魚類、甲殼類動物和軟體動物。魚類在 2025 年佔據最高份額,為 60.47%,預計在預測期內增長最快。羅非魚、鮭魚、鯰魚和鯉魚等魚類因其生長迅速、消費者接受度高且適應各種養殖系統而成為養殖最多的魚類。它們是廉價動物性蛋白質的主要來源,尤其是在發展中地區。對海鮮的需求不斷增長,加上對野生族群的過度捕撈,加速了水產養殖的生產。魚類養殖支持糧食安全、出口收入和經濟發展,使其成為全球水產養殖業的基石。羅非魚因其耐寒性和低成本的飼料要求而在非洲和美洲很受歡迎。挪威和智利的鮭魚養殖推動了對北美的高價值出口。

北美漁業和水產養殖市場區域分析

- 美國憑藉先進的捕撈技術、強大的監管框架和完善的海鮮加工基礎設施,在北美漁業和水產養殖市場佔據主導地位,2025年其收入份額高達64.68%。美國國內對永續和本地採購海鮮的高需求進一步支撐了市場成長。

- 該國也投入大量資金進行研發,以提高水產養殖效率和環境永續性

- 戰略性沿海通道、政府措施以及私營部門的參與提升了生產能力。此外,消費者健康意識的增強也刺激了全國對富含蛋白質的魚類和海鮮產品的需求。

加拿大北美漁業與水產養殖市場洞察

2025年,加拿大北美漁業和水產養殖市場在北美地區的收入份額超過25.20%。加拿大的發展得益於豐富的淡水資源、政府補貼以及強勁的國內海鮮市場。技術進步、大規模的養魚場以及不斷增長的出口產業使其成為北美水產養殖供應的中心樞紐。

北美漁業和水產養殖市場份額

北美漁業和水產養殖市場主要由知名公司主導,包括:

- 濱特爾(美國)

- CPI Equipment Inc.(加拿大)

- 奧特奇(美國)

- 建明水產科學(美國)

- Syndel(加拿大)

- Dura-Tech 工業和海洋有限公司(加拿大)

- Fluval(加拿大)

- Innovasea Systems, Inc.(美國)

- Deep Trekker Inc.(加拿大)

- Lifegard Aquatics(美國)

- In-Situ Inc(美國)

- Integrated Aqua Systems, Inc.(美國)

北美漁業和水產養殖市場的最新發展

- 2025年5月,Wildtype獲得美國食品藥物管理局(FDA)的監管批准,允許其在美國銷售人工養殖的銀鮭。它成為美國首家獲準銷售細胞培養海鮮的新創公司,目前已在部分餐廳推出。

- 2025年7月,挪威Grieg Seafood宣布將其在加拿大的鮭魚養殖業務出售給Cermaq。此舉標誌著該公司的策略重組,將繼續專注於其在挪威、不列顛哥倫比亞省和設得蘭群島的核心業務。

- 2024 年 6 月,Huon Aquaculture 宣布計劃在塔斯馬尼亞州鯨魚角建造一座價值 1.1 億澳元的循環水產養殖系統 (RAS) 設施,該設施將於 2025 年初開始建設。一旦投入運營,它將成為南半球最大的 RAS 設施之一,到 2027 年,陸地鮭魚養殖將覆蓋魚類生命週期的 60%。

- 2023 年 4 月,日本日水公司 (Nippon Suisan Kaisha) 在鹿兒島縣榮市啟動了其首個商業陸基蝦養殖場,並計劃於 2026 年開始運營陸基鯖魚養殖場,這標誌著其向更永續的水產養殖的轉變

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.1.1 COMPETITIVE RIVALRY – HIGH

4.1.2 THREAT OF NEW ENTRANTS – MODERATE TO HIGH

4.1.3 BARGAINING POWER OF BUYERS – HIGH

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.5 THREAT OF SUBSTITUTES – MODERATE

4.2 PATENT ANALYSIS

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 REGION PATENT LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 VALUE CHAIN

4.3.1 NORTH AMERICA FISHERY AND AQUACULTURE MARKET VALUE CHAIN

4.3.2 PRODUCTION:

4.3.3 PROCESSING:

4.3.4 MARKETING/DISTRIBUTION:

4.3.5 BUYERS:

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 HATCHERIES AND FISH SEED SUPPLIERS

4.4.2 FISH FARMERS / AQUACULTURE PRODUCERS

4.4.3 CAPTURE FISHERIES (WILD CATCH)

4.4.4 FEED PRODUCERS

4.4.5 PROCESSORS

4.4.6 PACKAGERS

4.4.7 DISTRIBUTORS / WHOLESALERS

4.4.8 EXPORTERS

4.4.9 RETAIL CHANNELS

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5.1 VERTICAL INTEGRATION FOR SUPPLY CHAIN EFFICIENCY

4.5.2 SUSTAINABLE AQUACULTURE CERTIFICATIONS AND ECO-LABELING

4.5.3 STRATEGIC MERGERS AND ACQUISITIONS

4.5.4 INVESTMENT IN R&D AND BIOTECHNOLOGICAL ADVANCEMENTS

4.5.5 EXPANSION INTO NUTRITION

4.5.6 INNOVATION AND SMART AQUACULTURE

4.5.7 PUBLIC-PRIVATE PARTNERSHIPS AND GOVERNMENT COLLABORATIONS

4.6 RAW MATERIAL SOURCING IN THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET

4.6.1 OVERVIEW OF RAW MATERIALS IN AQUACULTURE

4.6.2 SOURCING OF AQUAFEED RAW MATERIALS

4.6.2.1 Protein and Amino Acid Sources

4.6.2.2 Lipid Sources

4.6.2.3 Functional Additives and Micronutrients

4.6.3 RAW MATERIALS IN AQUACULTURE EQUIPMENT MANUFACTURING

4.6.3.1 Polymer Materials

4.6.3.2 Metal Components

4.6.3.3 Sensor and Electronic Inputs

4.6.4 RAW MATERIAL INPUTS FOR PHARMACEUTICALS AND HEALTH MANAGEMENT

4.6.4.1 Active Pharmaceutical Ingredients (APIs)

4.6.4.2 Excipients and Carriers

4.6.4.3 Diagnostic Reagents

4.6.5 SOURCING OF WATER TREATMENT AND BIOSECURITY INPUTS

4.6.5.1 Disinfectants and Oxidizing Agents

4.6.5.2 Mineral and pH Modifiers

4.6.5.3 Biological Agents

4.6.6 SUPPLY CHAIN CONSIDERATIONS AND CHALLENGES

4.6.6.1 Globalization and Regional Dependencies

4.6.6.2 Sustainability and Ethical Sourcing

4.6.6.3 Quality Assurance and Traceability

4.6.7 CONCLUSION

4.7 BRAND OUTLOOK

4.8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 JOINT VENTURES

4.8.2 MERGERS AND ACQUISITIONS

4.8.3 LICENSING AND PARTNERSHIP

4.8.4 TECHNOLOGY COLLABORATIONS

4.8.5 STRATEGIC DIVESTMENTS

4.8.6 NUMBER OF PRODUCTS IN DEVELOPMENT

4.8.7 STAGE OF DEVELOPMENT

4.8.8 TIMELINES AND MILESTONES

4.8.9 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.10 RISK ASSESSMENT AND MITIGATION

4.8.11 FUTURE OUTLOOK

4.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.9.1 PRODUCT QUALITY AND FRESHNESS

4.9.2 PRICE COMPETITIVENESS AND VALUE

4.9.3 SUSTAINABILITY AND CERTIFICATIONS

4.9.4 AVAILABILITY AND SUPPLY RELIABILITY

4.9.5 TECHNOLOGICAL INTEGRATION AND TRANSPARENCY

4.9.6 BRAND REPUTATION AND CONSUMER PREFERENCES

4.1 IMPACT OF ECONOMIC SLOWDOWN ON MARKET NORTH AMERICA FISHERY AND AQUACULTURE MARKET

4.10.1 IMPACT OF PRICE

4.10.2 IMPACT ON SUPPLY CHAIN

4.10.3 IMPACT ON SHIPMENT

4.10.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.10.5 CONCLUSION

4.11 OVERVIEW OF TECHNOLOGICAL ANALYSIS.

4.11.1 DATA ANALYTICS AND ARTIFICIAL INTELLIGENCE (AI)

4.11.2 THE INTERNET OF THINGS (IOT) AND SENSOR TECHNOLOGY

4.11.3 AUTOMATION AND ROBOTICS

4.11.4 BLOCKCHAIN FOR TRACEABILITY AND SUPPLY CHAIN MANAGEMENT

4.11.5 CONCLUSION:

4.12 IMPORT EXPORT SCENARIO

4.13 PRODUCTION CONSUMPTION ANALYSIS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.3.1 COMPLIANCE AND COST EFFICIENCY

5.3.2 SUSTAINABILITY PRACTICES

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.5.3 IMPACT ON PRICES

5.6 REGULATORY INCLINATION

5.6.1 GEOPOLITICAL SITUATION

5.6.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.6.2.1 FREE TRADE AGREEMENTS

5.6.2.2 ALLIANCES ESTABLISHMENTS

5.6.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.6.4 DOMESTIC COURSE OF CORRECTION

5.6.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.6.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5.7 CONCLUSION

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 POPULATION GROWTH IS ACCELERATING SEAFOOD DEMAND

7.1.2 TECHNOLOGICAL ADVANCES IN AQUACULTURE SYSTEMS ADOPTION

7.1.3 CONSUMER PREFERENCE SHIFTING TOWARD HEALTHFUL PROTEINS

7.1.4 TECHNOLOGICAL IMPROVEMENTS IN COLD CHAIN LOGISTICS AND DISTRIBUTION

7.2 RESTRAINTS

7.2.1 COST VOLATILITY FOR FEED AND PRODUCTION OPERATIONS

7.2.2 INCREASING REGULATORY REQUIREMENTS FOR MARKET COMPLIANCE

7.3 OPPORTUNITIES

7.3.1 EXPANSION OF SUSTAINABLE AND ECO-FRIENDLY PRACTICES

7.3.2 INNOVATION IN VALUE-ADDED SEAFOOD PRODUCT OFFERINGS

7.3.3 GROWING MARKET ACCESS IN EMERGING ECONOMIES

7.4 CHALLENGES

7.4.1 CLIMATE CHANGE IS DISRUPTING MARINE ECOSYSTEMS STABILITY

7.4.2 DISEASE OUTBREAKS HEAVILY IMPACTING FARMED SPECIES

8 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 AQUAFEED

8.3 EQUIPMENT

9 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM

9.1 OVERVIEW

9.2 WATER-BASED SYSTEMS

9.3 LAND-BASED SYSTEMS

9.4 RECYCLING SYSTEMS

9.5 INTEGRATED FARMING SYSTEM

9.6 OTHERS

10 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT

10.1 OVERVIEW

10.2 FRESH WATER

10.3 MARINE WATER

10.4 BRACKISH WATER

11 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ADULT

11.3 JUVENILE

11.4 LARVA

12 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE

12.1 OVERVIEW

12.2 LARGE-SCALE

12.3 MEDIUM-SCALE

12.4 SMALL-SCALE

13 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 ORGANIC

14 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SOURCE

14.1 OVERVIEW

14.2 PLANT-BASED

14.3 ANIMAL-BASED

15 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FORM

15.1 OVERVIEW

15.2 DRY

15.3 WET FORM

15.4 MOIST FORM

16 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION

16.1 OVERVIEW

16.2 FISHERY AND AQUACULTURE RATIONAL VALUE

16.3 ENERGY BOOSTER

16.4 IMPROVE DIGESTIBILITY

16.5 FEED PRESERVATION

16.6 CYTOTOXIC MANAGEMENT

16.7 OTHERS

17 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 CONVENTIONAL FISHERY & AQUACULTURE

17.3 SMART FISHERY & AQUACULTURE

18 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SPECIES

18.1 OVERVIEW

18.2 FISH

18.3 CRUSTACEANS

18.4 MOLLUSKS

19 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY REGION

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

20 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 SKRETTING

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENT

22.2 ALLTECH

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENT

22.3 PENTAIRAES

22.3.1 COMPANY SNAPSHOT

22.3.2 COMPANY SHARE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT DEVELOPMENT

22.4 KEMIN INDUSTRIES, INC.

22.4.1 COMPANY SNAPSHOT

22.4.2 COMPANY SHARE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENT

22.5 CORBION

22.5.1 COMPANY SNAPSHOT

22.5.2 RECENT FINANCIALS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 AKVA GROUP ASA

22.6.1 COMPANY SNAPSHOT

22.6.2 REVENUE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 REC.ENT DEVELOPMENTS/NEWS

22.7 AQ1 SYSTEMS PTY LTD

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT UPDATES

22.8 AQUABYTE

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 AQUACULTURE EQUIPMENT LTD

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS/NEWS

22.1 ASAKUA

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS/NEWS

22.11 BAADER

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 BHUVAN BIOLOGICALS

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS/NEWS

22.13 CAGE EYE

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 CPI EQUIPMENT INC

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS/NEWS

22.15 DEEP TREKKER INC.

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENT

22.16 DURA TECH INDUSTRIAL & MARINE LIMITED

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENTS/NEWS

22.17 ERUVAKA TECHNOLOGIES

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENT

22.18 FAIVRE SASU

22.18.1 COMPANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENTS/NEWS

22.19 FISHFARMFEEDER

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 FISH TREATMENT

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENT

22.21 FLUVAL

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 GAEL FORCE GROUP LIMITED

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS/NEWS

22.23 GAMAKATSU CO., LTD.

22.23.1 COMPANY SNAPSHOT

22.23.2 PRODUCT PORTFOLIO

22.23.3 RECENT DEVELOPMENT

22.24 GILIOCEAN TECHNOLOGY

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS/NEWS

22.25 GROWEL

22.25.1 COMPANY SNAPSHOT

22.25.2 PRODUCT PORTFOLIO

22.25.3 RECENT DEVELOPMENT

22.26 HESY AQUACULTURE B.V.

22.26.1 COMPANY SNAPSHOT

22.26.2 PRODUCT PORTFOLIO

22.26.3 RECENT DEVELOPMENTS/NEWS

22.27 HIPRA, S.A.

22.27.1 COMPANY SNAPSHOT

22.27.2 PRODUCT PORTFOLIO

22.27.3 RECENT DEVELOPMENT

22.28 HUNG STAR ENTERPRISE CORP.

22.28.1 COMPANY SNAPSHOT

22.28.2 PRODUCT PORTFOLIO

22.28.3 RECENT DEVELOPMENTS/NEWS

22.29 IMENCO AQUA AS

22.29.1 COMPANY SNAPSHOT

22.29.2 PRODUCT PORTFOLIO

22.29.3 RECENT DEVELOPMENT

22.3 INNOVASEA SYSTEMS INC.

22.30.1 COMPANY SNAPSHOT

22.30.2 PRODUCT PORTFOLIO

22.30.3 RECENT DEVELOPMENT

22.31 IN- SITU INC.

22.31.1 COMPANY SNAPSHOT

22.31.2 PRODUCT PORTFOLIO

22.31.3 RECENT DEVELOPMENT

22.32 INTEGRATED AQUA SYSTEMS, INC

22.32.1 COMPANY SNAPSHOT

22.32.2 PRODUCT PORTFOLIO

22.32.3 RECENT DEVELOPMENTS/NEWS

22.33 INTERNATIONAL HEALTHCARE

22.33.1 COMPANY SNAPSHOT

22.33.2 PRODUCT PORTFOLIO

22.33.3 RECENT DEVELOPMENTS/NEWS

22.34 INVE AQUACULTURE

22.34.1 COMPANY SNAPSHOT

22.34.2 PRODUCT PORTFOLIO

22.34.3 RECENT DEVELOPMENT

22.35 KAI CHUANG MARINE INTERNATIONAL

22.35.1 COMPANY SNAPSHOT

22.35.2 PRODUCT PORTFOLIO

22.35.3 RECENT DEVELOPMENT

22.36 LIFEGARD AQUATICS

22.36.1 COMPANY SNAPSHOT

22.36.2 PRODUCT PORTFOLIO

22.36.3 RECENT DEVELOPMENT

22.37 LINN GERATEBAU

22.37.1 COMPANY SNAPSHOT

22.37.2 PRODUCT PORTFOLIO

22.37.3 RECENT DEVELOPMENTS/NEWS

22.38 MUSTAD FISHING

22.38.1 COMPANY SNAPSHOT

22.38.2 PRODUCT PORTFOLIO

22.38.3 RECENT DEVELOPMENT

22.39 NANRONG SHANGHAI CO., LTD.

22.39.1 COMPANY SNAPSHOT

22.39.2 PRODUCT PORTFOLIO

22.39.3 RECENT DEVELOPMENT

22.4 NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED

22.40.1 COMPANY SNAPSHOT

22.40.2 PRODUCT PORTFOLIO

22.40.3 RECENT DEVELOPMENTS/NEWS

22.41 NIREUS

22.41.1 COMPANY SNAPSHOT

22.41.2 PRODUCT PORTFOLIO

22.41.3 RECENT DEVELOPMENT

22.42 PHARMAQ AS (SUBSIDIARY OF ZOETIS INC.)

22.42.1 COMPANY SNAPSHOT

22.42.2 PRODUCT PORTFOLIO

22.42.3 RECENT DEVELOPMENT

22.43 PIONEER GROUP

22.43.1 COMPANY SNAPSHOT

22.43.2 PRODUCT PORTFOLIO

22.43.3 RECENT DEVELOPMENT

22.44 PROTEON PHARMACEUTICALS S.A.

22.44.1 COMPANY SNAPSHOT

22.44.2 PRODUCT PORTFOLIO

22.44.3 RECENT DEVELOPMENT

22.45 PT JALA AKUAKULTUR LESTARI ALAMKU

22.45.1 COMPANY SNAPSHOT

22.45.2 PRODUCT PORTFOLIO

22.45.3 RECENT DEVELOPMENT

22.46 SAGAR AQUACULTURE PVT LTD

22.46.1 COMPANY SNAPSHOT

22.46.2 PRODUCT PORTFOLIO

22.46.3 RECENT DEVELOPMENT

22.47 SINO-AQUA CORPORATION

22.47.1 COMPANY SNAPSHOT

22.47.2 PRODUCT PORTFOLIO

22.47.3 RECENT DEVELOPMENTS/NEWS

22.48 SREEMA’S FEEDS

22.48.1 COMPANY SNAPSHOT

22.48.2 PRODUCT PORTFOLIO

22.48.3 RECENT DEVELOPMENT

22.49 SRR AQUA SUPPLIERS LLP

22.49.1 COMPANY SNAPSHOT

22.49.2 PRODUCT PORTFOLIO

22.49.3 RECENT DEVELOPMENTS/NEWS

22.5 SYNDEL

22.50.1 COMPANY SNAPSHOT

22.50.2 PRODUCT PORTFOLIO

22.50.3 RECENT DEVELOPMENTS/NEWS

22.51 THAI UNION FEEDMILL PUBLIC COMPANY LIMITED.

22.51.1 COMPANY SNAPSHOT

22.51.2 REVENUE ANALYSIS

22.51.3 PRODUCT PORTFOLIO

22.51.4 RECENT DEVELOPMENT

22.52 VAKI AQUACULTURE SYSTEMS LTD. (SUBSIDIARY OF MERCK & CO., INC. )

22.52.1 COMPANY SNAPSHOT

22.52.2 PRODUCT PORTFOLIO

22.52.3 RECENT DEVELOPMENT

22.53 VAXXINOVA INTERNATIONAL BV

22.53.1 COMPANY SNAPSHOT

22.53.2 PRODUCT PORTFOLIO

22.53.3 RECENT DEVELOPMENTS/NEWS

22.54 VERAMARIS

22.54.1 COMPANY SNAPSHOT

22.54.2 PRODUCT PORTFOLIO

22.54.3 RECENT DEVELOPMENT

22.55 VIJAYA SARADHI FEEDS

22.55.1 COMPANY SNAPSHOT

22.55.2 PRODUCT PORTFOLIO

22.55.3 RECENT DEVELOPMENT

22.56 IAERATOR (ZHEJIANG FORDY IMP. & EXP. CO.,LTD.)

22.56.1 COMPANY SNAPSHOT

22.56.2 PRODUCT PORTFOLIO

22.56.3 RECENT DEVELOPMENT

23 QUESTIONNAIRE

24 RELATED REPORTS

表格列表

TABLE 1 PATENT BY COUNTRY

TABLE 2 APPLICANTS OF PATENTS

TABLE 3 INVENTORS OF PATENTS

TABLE 4 IPC CODES OF PATENTS

TABLE 5 PUBLICATION OF PATENTS YEARLY

TABLE 6 BRAND OUTLOOK: KEY COMPANIES IN THE NORTH AMERICA FISHERY AND AQUACULTURE EQUIPMENT MARKET

TABLE 7 REGULATORY COVERAGE

TABLE 8 COST OF FEED AND PRODUCTION OPERATIONS

TABLE 9 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 11 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 12 NORTH AMERICA AQUAFEED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA AQUAFEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA INTEGRATED FARMING SYSTEM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA OTHERS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA FRESH WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA MARINE WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA BRACKISH WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA ADULT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA JUVENILE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA LARVA IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA LARGE-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA MEDIUM-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA SMALL-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA CONVENTIONAL IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA ORGANIC IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA PLANT-BASED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA ANIMAL-BASED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA DRY IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA WET FORM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA MOIST FORM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA FISHERY AND AQUACULTURE RATIONAL VALUE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA ENERGY BOOSTER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA IMPROVE DIGESTIBILITY IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA FEED PRESERVATION IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA CYTOTOXIC MANAGEMENT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA OTHERS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA CONVENTIONAL FISHERY & AQUACULTURE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA SMART FISHERY & AQUACULTURE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA FISH IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND METRIC TONS)

TABLE 95 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 96 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 98 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 99 NORTH AMERICA AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 NORTH AMERICA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 NORTH AMERICA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 NORTH AMERICA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 NORTH AMERICA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 130 NORTH AMERICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 NORTH AMERICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 NORTH AMERICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 134 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 135 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 136 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 137 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 138 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 139 NORTH AMERICA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 141 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 142 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 143 NORTH AMERICA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 NORTH AMERICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 NORTH AMERICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.S. FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 148 U.S. FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 149 U.S. AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 U.S. MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.S. PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 U.S. EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 U.S. CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.S. WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.S. WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.S. FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 U.S. MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.S. SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.S. SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 U.S. FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 U.S. OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.S. CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 U.S. UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 U.S. AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 U.S. FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 180 U.S. WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.S. LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 U.S. RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 U.S. FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 184 U.S. FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 U.S. FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 186 U.S. FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 187 U.S. FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 188 U.S. FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 189 U.S. DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 U.S. FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 191 U.S. FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 192 U.S. FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 193 U.S. FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 U.S. CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 U.S. MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 CANADA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 198 CANADA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 199 CANADA AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 CANADA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 CANADA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 CANADA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 CANADA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 CANADA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CANADA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CANADA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 CANADA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 CANADA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 CANADA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CANADA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 CANADA EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 CANADA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 CANADA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 CANADA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 CANADA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 CANADA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 CANADA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 CANADA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 CANADA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 CANADA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 CANADA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 CANADA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 CANADA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 CANADA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 230 CANADA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 CANADA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 CANADA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 CANADA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 234 CANADA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 235 CANADA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 236 CANADA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 237 CANADA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 238 CANADA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 239 CANADA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 CANADA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 241 CANADA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 242 CANADA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 243 CANADA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 CANADA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 CANADA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 MEXICO FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 MEXICO FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 248 MEXICO FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 249 MEXICO AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 MEXICO FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 MEXICO LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 MEXICO BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 MEXICO AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 MEXICO AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 MEXICO VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 MEXICO TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 MEXICO PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 MEXICO ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 MEXICO ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 MEXICO FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 MEXICO CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 MEXICO PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 MEXICO ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 MEXICO MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 MEXICO PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 MEXICO EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 MEXICO CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 MEXICO WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 MEXICO WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 MEXICO FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 MEXICO MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 MEXICO SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 MEXICO SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 MEXICO FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 MEXICO OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 MEXICO CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 MEXICO UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 MEXICO AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 MEXICO FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 280 MEXICO WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 MEXICO LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 MEXICO RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 MEXICO FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 284 MEXICO FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 285 MEXICO FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 286 MEXICO FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 287 MEXICO FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 288 MEXICO FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 289 MEXICO DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 MEXICO FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 291 MEXICO FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 292 MEXICO FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 293 MEXICO FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 MEXICO CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 MEXICO MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA FISHERY AND AQUACULTURE MARKET

FIGURE 2 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 TWO SEGMENTS COMPRISE THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE (2024)

FIGURE 13 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: STRATEGIC DECISIONS

FIGURE 14 POPULATION GROWTH ACCELERATING SEAFOOD DEMAND IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET FROM 2025 TO 2032

FIGURE 15 THE AQUAFEED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET IN 2025 & 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 PATENT BY COUNTRIES

FIGURE 18 FISHERY AND AQUACULTURE MARKET VALUE CHAIN ANALYSIS

FIGURE 19 FISHERY AND AQUACULTURE MARKET SUPPLY CHAIN ANALYSIS

FIGURE 20 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: NORTH AMERICA FISHERY AND AQUACULTURE MARKET

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET

FIGURE 23 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2024

FIGURE 24 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY AQUACULTURE PRODUCTION SYSTEM, 2024

FIGURE 25 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY ENVIRONMENT, 2024

FIGURE 26 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2024

FIGURE 27 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY PRODUCTION SCALE, 2024

FIGURE 28 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY CATEGORY, 2024

FIGURE 29 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY SOURCE, 2024

FIGURE 30 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2024

FIGURE 31 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY FUNCTION, 2024

FIGURE 32 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY TECHNOLOGY, 2024

FIGURE 33 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY SPECIES, 2024

FIGURE 34 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: SNAPSHOT 2024

FIGURE 35 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。