North America Flame Retardant For Electronic Electrical And Appliances Market

市场规模(十亿美元)

CAGR :

%

3,657,521.84 Thousand

854,440.69 Thousand

2024

2032

3,657,521.84 Thousand

854,440.69 Thousand

2024

2032

| 2025 –2032 | |

| USD 3,657,521.84 Thousand | |

| USD 854,440.69 Thousand | |

|

|

|

|

北美電子、電氣和家電阻燃劑市場,按類型(非鹵化和鹵化)、塑膠(PC、ABS、PP、PE、PS 等)、最終用途(電氣和電子、家用電器和專業電器)劃分 - 行業趨勢及預測(至 2032 年)

北美電子、電氣和家電阻燃劑市場規模

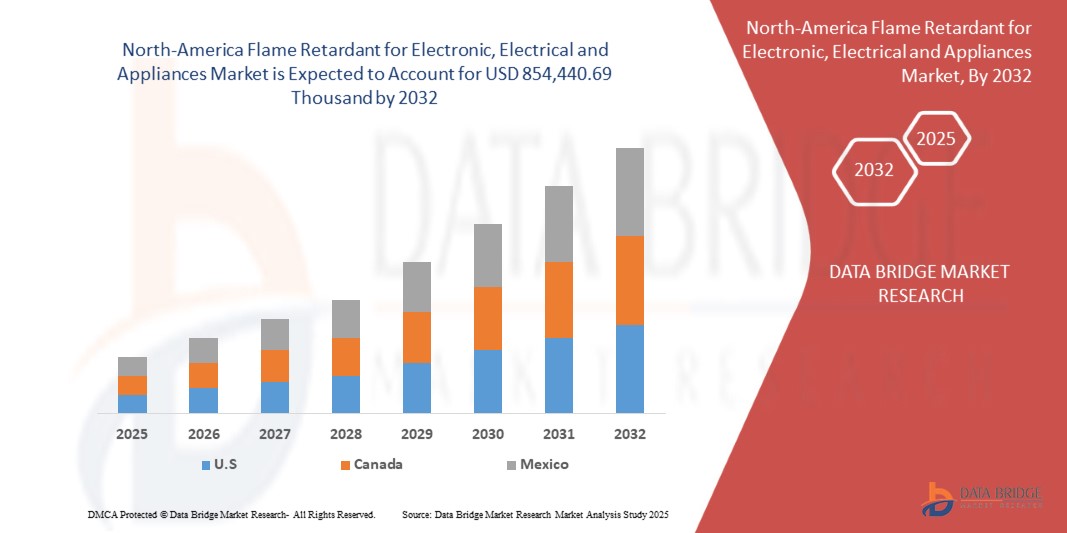

- 2024 年,北美電子、電氣和家電阻燃劑市場規模為3657,521.84 千美元,預計到 2032 年將達到 854,440.69 千美元,預測期內 複合年增長率為 3.40%。

- 這種成長是由消費性電子產品需求的增加以及工業和商業應用的使用增加等因素所推動的

北美電子、電氣和家電阻燃劑市場分析

- 電子、電氣、電器用阻燃劑用於降低或防止電子、電氣、電器元件的火災風險。這些物質對於提高電路板、電纜、連接器和電器外殼等產品的防火安全性至關重要

- 這些顯微鏡的需求很大程度上是由於工業和商業應用的增加以及電力基礎設施的擴張

- 由於美國擁有強大的技術基礎,並且在電子和電器領域不斷創新,預計它將在電子、電氣和家電阻燃劑市場中佔據主導地位。該國有嚴格的消防安全標準和法規,要求在各種應用中使用阻燃劑,包括電子和電氣產品

- 由於消費性電子產品、智慧家庭設備和電器的需求不斷增長,預計美國將成為預測期內電子、電氣和家電阻燃劑市場成長最快的國家

- 由於環境問題日益嚴重、鹵化化學品使用法規日益嚴格,以及對更安全、更永續替代品的需求不斷增長,預計非鹵化部分將佔據市場主導地位,市場份額達到 61.14%。

報告範圍和電子、電氣和家電阻燃劑市場細分

|

屬性 |

電子、電氣和家用電器的阻燃劑關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

北美電子、電氣和家電阻燃劑市場趨勢

“手術顯微鏡和眼內手術3D可視化的進步”

- 眼內手術顯微鏡和 3D 視覺化系統發展的一個突出趨勢是先進光學技術和數位增強技術的日益融合

- 這些創新透過提供高清、即時的眼內結構視覺化來提高手術精度,從而提高精細手術的準確性。

- 例如,現代 3D 視覺化系統提供卓越的深度感知,使外科醫生能夠更清晰地導航複雜的眼內解剖結構,這對於玻璃體視網膜手術和微創青光眼手術特別有益。

- 這些進步正在改變眼內手術,改善患者的治療效果,並推動對具有尖端可視化功能的下一代手術顯微鏡的需求

北美電子、電氣和家電阻燃劑市場動態

司機

“消費性電子產品需求不斷增長”

- 智慧型手機、平板電腦、筆記型電腦、電視和智慧家電等電子設備的需求急劇增長

- 這些設備需要複雜的組件組裝,包括印刷電路板 (PCB)、連接器、外殼和電線,所有這些都必須符合嚴格的消防安全標準,以防止電氣火災並提高最終用戶的安全

- 在美國和加拿大等新興市場,可支配收入的增加和互聯網普及率的提高正在推動個人電子產品的普及率提高

例如,

- 2023年7月,根據生態部門的規定,製造商在電視和電腦等電子設備的塑膠外殼中添加了阻燃劑,以滿足可燃性標準並降低火災風險。這種做法有助於防止內部故障時火焰蔓延

- 消費性電子產業的蓬勃發展大大加速了全球對阻燃劑的需求。隨著設備變得更加整合、緊湊化和普及,對先進、安全且永續的防火材料的需求只會增長——這使得阻燃劑市場成為電子產品安全和創新的重要推動因素

機會

“數據中心和5G基礎設施的技術創新”

- 5G 技術的推出和資料中心的擴張正在推動電氣和電子 (E&E) 領域對高性能阻燃材料的需求

- 資料中心的數量不斷增加,容納了大容量伺服器和電氣設備,這增加了對阻燃材料的需求。

- 隨著現代資料中心組件密度的增加,電氣火災的風險也隨之增加,因此阻燃電纜和電路板對於消防安全和法規合規性至關重要

例如,

- 2024年8月,國際電信聯盟(ITU)強調在5G基地台和設備建設中需要使用阻燃材料。由於 5G 技術需要更密集的基礎設施和更強大的電氣元件,因此使用阻燃電纜和電路板對於防止高密度環境中的火災危險至關重要。安全標準的推動正在推動 5G 基礎設施對阻燃材料的需求增加

- 為了滿足 5G 網路和資料中心的需求,製造商正在轉向先進的阻燃材料,包括無鹵化和低毒性解決方案。這些創新提高了消防安全性,同時最大限度地減少了對環境的影響。隨著5G和資料中心基礎設施的不斷發展,對阻燃組件的需求將會增加,這為阻燃市場帶來了巨大的機會。

克制/挑戰

“由於污染和加工限製而導致的回收挑戰”

- 阻燃材料在各行各業的使用日益增多,導致這些材料的回收面臨巨大挑戰,特別是由於污染和加工能力的限制

- 阻燃化學品(例如溴化和氯化化合物)通常被添加到塑膠、紡織品和電子元件中以降低可燃性。然而,由於這些物質的化學特性,回收過程變得複雜

- 阻燃劑的存在會污染回收材料,使其不適合在新產品中重複使用。回收過程通常涉及粉碎、熔化和重塑材料,但當存在阻燃化學物質時,它們可能會釋放有毒煙霧或在這些階段引起不良化學反應,導致消費品材料不安全

例如,

- 2024 年 5 月,瑞典環保署發布的一份報告探討了人們對紡織品和塑膠製品中存在阻燃化學物質日益增長的擔憂。該機構強調,這些化學物質在消費品中的使用為消費後廢物的回收帶來了障礙,尤其是服裝和塑膠包裝。這項挑戰在紡織業尤為突出,因為該行業的回收率較低,而且阻燃劑的存在使回收過程更加複雜

- 因此,為了確保永續性,更安全、可回收的阻燃劑的創新和改進的回收技術對於減輕環境和健康風險至關重要

北美電子、電氣和家電阻燃劑市場範圍

市場根據應用、產品類型、技術、放大類型、最終用戶和分銷管道進行細分。

|

分割 |

細分 |

|

按類型 |

|

|

塑膠 |

|

|

按最終用途 |

|

預計到 2025 年,非鹵化物將佔據市場主導地位,在類型細分市場中佔有最大份額

非鹵化阻燃劑預計將在 2025 年佔據電子、電氣和家電阻燃劑市場的主導地位,佔據 61.14% 的最大份額,這 得益於其出色的熱穩定性、高抗衝擊性和光學清晰度,使其成為電子、電氣和家電應用的理想選擇。

預計在預測期內,PC 將在塑膠領域佔據最大份額

到 2025 年,PC 預計將佔據市場主導地位,市場份額達到 36.92%,這得益於其出色的熱穩定性、高抗衝擊性和光學清晰度,使其成為電子、電氣和家電應用的理想選擇。

北美電子、電氣和家電阻燃劑市場區域分析

“美國在電子、電氣和家電阻燃劑市場中佔有最大份額”

- 美國在電子、電氣和家電阻燃劑市場佔據主導地位,這得益於快速的工業化、電子和電氣製造業的高度集中以及對消費性電子產品的強勁需求

- 由於其強大的電子和家電製造基礎、優惠的政府政策以及不斷增長的國內消費,美國佔據了相當大的份額。

- 該國受益於完善的供應鏈、原材料供應以及北美領先製造商的存在

- 此外,人們對消防安全法規的認識不斷提高,以及家用和工業電子產品對阻燃材料的需求進一步推動了市場擴張

“預計美國將在電子、電氣和家電阻燃劑市場實現最高複合年增長率”

- 美國預計將在電子、電氣和家電阻燃劑市場中實現最高成長率,這得益於消費性電子產品的持續成長、電動和智慧家電的普及以及城市化進程的加快

- 美國一直在電子和電氣製造業吸引大量的外國直接投資,投資重點是擴大生產能力和推進技術創新,從而推動對阻燃劑的需求。

- 人們對消防安全法規的認識不斷提高,以及家用和工業電子產品對防火材料的需求進一步推動了市場需求

北美電子、電氣和家電阻燃劑市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、北美業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

市場中主要的市場領導者有:

- 巴斯夫(德國)

- 科萊恩(德國)

- DIC株式會社(日本)

- 朗盛(德國)

- Plastibends(印度)

- 雅寶公司(美國)

- Ampacet Corporation(美國)

- Cromex S/A(巴西)

- 都佛化學公司(美國)

- 努里約(荷蘭)

- Gabriel-Chemie GmbH(奧地利)

- 濰坊明潤化工有限公司 (中國)

- Americhem(美國)

- 東莞市傑富阻燃材料有限公司 (中國)

- Kandui Industries Private Limited(印度)

北美電子、電氣和家電阻燃劑市場最新動態

- 2025年1月,巴斯夫先進阻燃級Ultramid T6000聚鄰苯二甲醯胺(PPA)被應用於接線端子,取代非阻燃材料,以提高電動車(EV)逆變器和馬達系統的安全性。它支援電動車的電氣安全性增強,使其成為汽車電氣系統的熱保護、可靠性和合規性具有直接影響的功能升級。

- 2022 年 7 月,巴斯夫和 THOR GmbH 結合各自在非鹵化阻燃添加劑方面的專業知識,推出了一套全面的解決方案,在滿足嚴格的消防安全標準的同時,提高了部分塑膠化合物的可持續性和性能。

- 2022 年 5 月,巴斯夫擴大了其聚鄰苯二甲醯胺 (PPA) 產品組合,增加了各種阻燃等級,具有高熱穩定性、優異的電絕緣性和低吸水率。這些無鹵材的 RTI 值高於 140°C,顏色穩定性更高,並且能夠在電動車、電子產品、家用電器和電源連接器中實現更安全、更可靠的應用。

- 2023年10月,科萊恩在中國大亞灣啟用了一座價值6,678萬美元的新的Exolit OP阻燃劑工廠。該設施旨在滿足亞洲對永續防火的需求,並增強當地的供應能力。第二條生產線正在建設中,預計 2024 年投入使用

- 2022 年 9 月,Gabriel-Chemie 為電氣導管和管道市場推出了一系列新型無鹵化阻燃母粒,強調了公司對永續發展的承諾。這些母粒符合阻燃標準 EN 61386、無鹵標準 EN 50642 和低菸標準 IEC 61304-2。其優點包括減少火災期間的有毒氣體排放、提高可回收性以及最大限度地減少電子設備和機械的腐蝕

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF BUYERS

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.4.1 OVERVIEW OF FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES PRICES

4.4.2 FACTORS INFLUENCING PRICING TRENDS

4.4.3 PRICE VOLATILITY AND MARKET OUTLOOK

4.4.4 CONCLUSION

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 RAW MATERIAL COVERAGE

4.8.1 SUPPLY CHAIN CONSIDERATIONS:

4.8.2 ENVIRONMENTAL AND REGULATORY TRENDS:

4.8.3 CONCLUSION:

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TARIFFS AND THEIR IMPACT ON MARKET

4.10.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.10.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.10.3 VENDOR SELECTION CRITERIA DYNAMICS

4.10.4 IMPACT ON SUPPLY CHAIN

4.10.4.1 RAW MATERIAL PROCUREMENT

4.10.4.2 MANUFACTURING AND PRODUCTION

4.10.4.3 LOGISTICS AND DISTRIBUTION

4.10.4.4 PRICE PITCHING AND POSITION OF MARKET

4.10.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.10.5.1 SUPPLY CHAIN OPTIMIZATION

4.10.5.2 JOINT VENTURE ESTABLISHMENTS

4.10.6 IMPACT ON PRICES

4.10.7 REGULATORY INCLINATION

4.10.7.1 GEOPOLITICAL SITUATION

4.10.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.10.7.2.1 FREE TRADE AGREEMENTS

4.10.7.2.2 ALLIANCE ESTABLISHMENTS

4.10.7.3 STATUS ACCREDITATION (INCLUDING MFN)

4.10.7.4 DOMESTIC COURSE OF CORRECTION

4.10.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.10.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.11.1 DEVELOPMENT OF HALOGEN-FREE FLAME RETARDANTS

4.11.2 ECO-FRIENDLY AND SUSTAINABLE FORMULATIONS

4.11.3 NANO-TECHNOLOGY INTEGRATION

4.11.4 SYNERGISTIC ADDITIVE SYSTEMS

4.11.5 SMART AND REACTIVE FLAME RETARDANTS

4.12 WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE) REGULATIONS

4.12.1 RESTRICTION OF HAZARDOUS FLAME RETARDANTS

4.12.2 DESIGN FOR RECYCLING AND ECO-FRIENDLY MATERIALS

4.12.3 EXTENDED PRODUCER RESPONSIBILITY (EPR)

4.12.4 TRANSPARENCY AND MATERIAL DOCUMENTATION

4.12.5 CONCLUSION

4.13 FLAME RETARDANT DATA TABLE

4.14 REQUIREMENT

4.15 DATA SOURCING ANALYSIS

4.15.1 PRIMARY SOURCING

4.15.2 SECONDARY SOURCING

4.15.2.1 CHEMICAL INDUSTRIES

4.15.2.2 SCIENTIFIC RESEARCH

4.15.2.3 ARTICLES & LITERATURE REVIEW

4.15.2.4 AMONG OTHERS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CONSUMER ELECTRONICS

6.1.2 EXPANSION OF ELECTRICAL INFRASTRUCTURE

6.1.3 RISING USE IN INDUSTRIAL AND COMMERCIAL APPLICATIONS

6.2 RESTRAINTS

6.2.1 COMPLEXITY OF MANUFACTURING PROCESS

6.2.2 DEPENDENCY ON RAW MATERIALS FROM SPECIFIC REGIONS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL INNOVATION IN DATA CENTERS AND 5G INFRASTRUCTURE

6.3.2 ADVANCEMENTS IN ECO-FRIENDLY FLAME RETARDANTS

6.4 CHALLENGES

6.4.1 RECYCLING CHALLENGES DUE TO CONTAMINATION AND PROCESSING LIMITATIONS

6.4.2 HEALTH HAZARDS AND ENVIRONMENTAL TOXICITY

7 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-HALOGENATED

7.3 HALOGENATED

8 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC

8.1 OVERVIEW

8.2 PC

8.3 ABS

8.4 PP

8.5 PE

8.6 PS

8.7 OTHERS

9 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE

9.1 OVERVIEW

9.2 ELECTRICAL AND ELECTRONICS

9.3 HOUSEHOLD APPLIANCES

9.4 PROFESSIONAL APPLIANCES

10 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ALBEMARLE CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 BASF

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 WEIFANG MINGRUN CHEMICAL CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 DIC CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 RECENT FINANCIALS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 CLARIANT

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 INDUSTRIES PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 AMERICHEM

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMPACET CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 BLENDCOLOURS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 CROMEX S/A

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DONGGUAN JIEFU FLAME RETARDANT MATERIAL CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 DOVER CHEMICAL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 GABRIEL-CHEMIE GESELLSCHAFT M.B.H.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 GREEN VIEW TECHNOLOGY AND DEVELOPMENT CO., LTD

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 KANDUI INDUSTRIES PRIVATE LIMITED

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LANXESS

13.15.1 COMPANY SNAPSHOT

13.15.2 RECENT FINANCIALS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 NOURYON

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 PLASTIBLENDS

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 SHANDONG HAIWANG CHEMICAL CO., LTD

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 TOSAF COMPOUNDS LTD.

13.19.1 COMPANY SNAPSHOT

13.19.2 SOLUTION PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 XINOMER AG

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA -HALOGENATED

TABLE 2 NORTH AMERICA -NON_HALOGENATED

TABLE 3 EUROPE-HALOGENATED

TABLE 4 EUROPE-NON_HALOGENATED

TABLE 5 FRANCE-HALOGENATED

TABLE 6 FRANCE-NON_HALOGENATED

TABLE 7 REGULATORY COVERAGE

TABLE 8 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 10 NORTH AMERICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (TONS)

TABLE 12 NORTH AMERICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (TONS)

TABLE 17 NORTH AMERICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA PC IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA ABS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA PP IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA PE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA PS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 40 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 42 NORTH AMERICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 59 U.S. NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 CANADA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CANADA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 CANADA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CANADA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 CANADA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CANADA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 90 CANADA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 93 MEXICO NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MEXICO ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MEXICO ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MEXICO HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 MEXICO HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MEXICO PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 MEXICO PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 2 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET END USE COVERAGE GRID

FIGURE 11 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASING DEMAND FOR CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 THE NON-HALOGENATED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 24 TOTAL NUMBER OF MOBILE PHONES SOLD WORLDWIDE EACH YEAR

FIGURE 25 TOP STATES FOR UTILITY- AND SMALL-SCALE SOLAR (COMBINED) CAPACITY AND GENERATION IN 2023

FIGURE 26 NORTH AMERICA MOTOR VEHICLE SALES BY COUNTRY IN 2021

FIGURE 27 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY TYPE, 2024

FIGURE 28 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY PLASTIC, 2024

FIGURE 29 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY END USE, 2024

FIGURE 30 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: SNAPSHOT (2024)

FIGURE 31 NORTH AMERICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。