North America Flexible Printed Circuit Fpc Market

市场规模(十亿美元)

CAGR :

%

USD

6.01 Billion

USD

1,498.00 Billion

2024

2032

USD

6.01 Billion

USD

1,498.00 Billion

2024

2032

| 2025 –2032 | |

| USD 6.01 Billion | |

| USD 1,498.00 Billion | |

|

|

|

|

北美柔性印刷電路 (FPC) 市場細分,按類型(多層、雙面、單面、剛柔結合電路、雙向接入、異形 FPC 及其他)、製造製程(減材製程、增材製程、膠黏層壓和柔性無膠層壓)、材料(基材和導體材料)、柔性(靜態尺寸(柔性安裝)、動態柔性(可安裝)、動態柔性(可貼片/移動尺寸) µm)、厚(200 µm))、最終用戶(消費性電子、汽車、工業與機器人、物聯網與智慧型裝置、醫療設備、電信、航空航太與國防及其他)、通路(直銷和間接銷售)劃分-產業趨勢及至 2032 年的預測

北美柔性印刷電路(FPC)市場規模

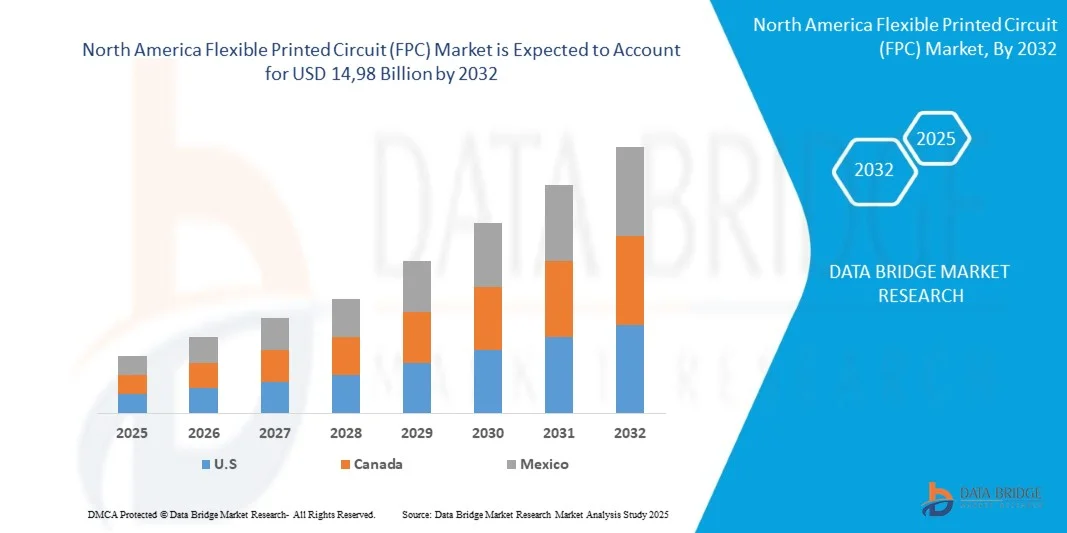

- 預計北美柔性印刷電路(FPC)市場規模將從2024年的60.1億美元成長至2032年的149.8億美元,在2025年至2032年的預測期內,複合年增長率將達到12.2%。

- 北美柔性印刷電路 (FPC) 市場的成長受到各行業對緊湊輕巧電子設備的需求不斷增長的顯著影響,這需要高性能和節省空間的互連解決方案。

- 區域消費電子和汽車產業(包括穿戴式裝置和電動車)投資的不斷增長進一步推動了這一擴張,這些投資也帶動了對可靠且靈活的FPC技術的需求。此外,用於FPC的先進材料和製造流程的日益普及和應用,透過提高靈活性、耐用性和訊號完整性,促進了市場准入和持續成長。

北美柔性印刷電路(FPC)市場分析

- 北美數位化、物聯網整合以及小型化趨勢推動了對緊湊型高性能電子設備的日益增長的需求,這是該地區柔性印刷電路板 (FPC) 需求的主要驅動力。隨著電子功能的不斷擴展,傳統的剛性印刷電路板在柔性和空間利用率方面面臨許多限制。

- 北美柔性印刷電路市場的主要驅動力是消費性電子、汽車和醫療設備領域對先進互連性和小型化技術的迫切需求,以及智慧型手機、穿戴式裝置和先進顯示技術等產業對柔性元件的高利用率。材料科學領域的技術創新速度和電子設備設計監管環境(包括北美標準和產品開發週期)也會影響市場,進而影響柔性元件的整體應用。

- 由於消費性電子製造業投資不斷增加以及先進汽車系統的應用日益普及,美國預計將成為北美柔性印刷電路 (FPC) 市場的主導且成長最快的地區。該地區市場的主要特點是對可靠且節省空間的互連解決方案的迫切需求,以增強設備功能並縮小尺寸,這在許多智慧型設備計劃不斷擴展的已開發經濟體中都是普遍趨勢。

- 多層電路板是北美柔性印刷電路板市場的主導類型,到 2025 年市場份額將達到 34.28%,這反映出緊湊型和經濟型電子設備的強勁增長需要繼續戰略性地部署多層電路板,以簡化互連並降低製造複雜性,從而使這些材料成為北美電子產品和便攜式設備未來發展的重要組成部分。

報告範圍及北美 柔性印刷電路(FPC)市場細分

|

屬性 |

北美柔性印刷電路 (FPC) 市場關鍵洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、按地域劃分的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和最新的價格趨勢分析以及供應鏈和需求的缺口分析。 |

北美柔性印刷電路板(FPC)市場趨勢

“電動和混合動力汽車對柔性電路的需求日益增長”

- 電動和混合動力車生產的加速轉型是北美柔性印刷電路 (FPC) 市場的重要驅動力。隨著原始設備製造商 (OEM) 和一級供應商重新設計車輛架構以適應電池系統、高級駕駛輔助系統、增強型資訊娛樂系統以及輕量化等要求,對高度整合、更薄、更易於彎曲的佈線和互連解決方案的需求日益增長。

- 柔性印刷電路 (FPC) 兼具輕量化、緊湊尺寸和高佈線密度等優勢,完美契合電動化出行生態系統的需求。各國政府和業界透過專案計畫和投資,日益認識到這些需求,進一步推動了 FPC 在汽車應用領域的普及。

- 例如,2024 年 4 月,Ennovi 推出了一種用於電動汽車電池單元接觸系統的低壓連接的新型柔性電路生產工藝,並明確將該技術定位為傳統柔性印刷電路的可持續、尺寸優化替代方案。

- 向電動和混合動力汽車的快速轉型是北美柔性印刷電路 (FPC) 市場發展的關鍵催化劑。隨著汽車製造商整合先進的電池系統、駕駛輔助技術和軟體定義的車輛架構,對輕量化、高密度和可彎曲互連解決方案的需求大幅增長。

- 柔性印刷電路具有獨特的優勢,能夠滿足這些需求,例如重量更輕、尺寸更緊湊以及佈線能力更強。這得歸功於政府措施、研究計畫和產業投資的支持。

北美柔性印刷電路板(FPC)市場動態

司機

“擴大FPC在汽車和醫療電子領域的應用”

- 柔性印刷電路 (FPC) 在汽車和醫療電子領域的廣泛應用,是北美 FPC 市場的重要驅動力。在汽車領域,車輛電氣化、高級駕駛輔助系統以及日益增強的車內功能,促使原始設備製造商 (OEM) 和一級供應商指定使用更薄、更輕、更舒適的互連技術,以降低線束複雜性並實現更高的集成密度,而 FPC 技術恰好滿足這些要求。

- 在醫療電子領域,穿戴式監視器、植入式感測器和微創診斷平台的快速發展,正在加速對可彎曲、生物相容性互連線和嵌入式感測器陣列的需求。監管機構和資助機構正透過有針對性的指導和創新計劃,強化這一發展趨勢。

- 公共部門和產業創新計畫為柔性混合電子產品提供資金,並支援供應鏈韌性,進一步降低了規模化的技術和商業壁壘,從而將應用層面的需求轉化為柔性印刷電路板 (FPC) 供應商可採購的數量。

- 例如,2024年4月,歐盟委員會發布新聞稿,重點介紹了BAYFLEX計畫(透過歐盟委員會的CORDIS資料庫),該計畫報告了在可彎曲基底上設計的柔性有機電子感測器貼片的開發,用於電生理訊號的檢測和分類。

- 柔性印刷電路 (FPC) 在汽車和醫療電子領域的加速集成,正成為塑造北美 FPC 市場格局的關鍵力量。在汽車應用領域,向電氣化、智慧駕駛輔助系統和車內數位化程度提升的轉型,持續推動著對輕量化、可彎曲、節省空間的互連解決方案的需求,這些方案能夠在優化性能的同時,降低佈線複雜性。

- 例如,2024年3月,美國國防部宣布根據《國防生產法投資計畫》(DPAI)授予一項合同,旨在擴大高超音速武器系統印刷電路板組件的國內生產,這凸顯了提升先進國防平台電子產品製造能力的戰略舉措。

克制/挑戰

“FPC製造對昂貴的聚醯亞胺和銅材料的依賴”

- 北美柔性印刷電路(FPC)市場嚴重依賴高成本材料,例如聚醯亞胺薄膜和銅箔。這些材料在實現現代FPC所需的彎曲耐久性、高熱性能和電氣性能以及小型化能力方面發揮著至關重要的作用。

- 原料成本高且波動劇烈,加上聚醯亞胺基材和銅的供應鏈瓶頸,推高了製造成本,降低了利潤空間,並提高了小型企業和對銷售敏感的買家的准入門檻。

- 因此,材料成本負擔可能會減緩成本敏感型細分市場的採用速度,並限制FPC相對於傳統剛性或半剛性互連解決方案的價格競爭力。

- 例如,2023年5月,《EC Electronics》雜誌的一篇文章指出,電子製造業評論指出,PCB生產商正面臨銅箔、樹脂和玻璃纖維織物等原材料供應鏈中斷和成本波動的問題,而這些原材料是柔性互連和剛柔結合互連解決方案的重要組成部分。

- 北美柔性印刷電路 (FPC) 市場的發展受到其對高成本材料(尤其是聚醯亞胺薄膜和銅箔)的嚴重限制。這些材料對於確保熱穩定性、電氣性能和機械柔韌性至關重要,但其高昂且波動的價格給製造商帶來了巨大的成本壓力。

北美柔性印刷電路(FPC)市場範圍

北美柔性印刷電路 (FPC) 市場分為七個主要部分,分別是類型、製造流程、材料、柔性、外形尺寸、最終用戶和分銷管道。

- 按類型

根據類型,北美柔性印刷電路 (FPC) 市場可細分為多層、雙面、單面、剛柔結合電路、雙向存取、異形 FPC 和其他類型。預計到 2025 年,多層電路將以 34.28% 的市場份額佔據主導地位,因為這類電路在緊湊的結構中提供了更高的設計靈活性和電路密度。此外,它們還能在保持卓越性能和可靠性的同時,實現複雜電子元件的高效互連。

預計單面互連領域將實現最快成長,複合年增長率達 13.1%,這主要得益於智慧型手機、穿戴式裝置和醫療植入物等小型電子設備對高密度互連和增強功能的需求不斷增長。

- 透過製造工藝

根據製造工藝,北美柔性印刷電路 (FPC) 市場可分為減材製造工藝、增材製造工藝、黏合層壓和無膠層壓。預計到 2025 年,減材製造流程將佔據市場主導地位,市佔率高達 79.75%。這主要得益於其廣泛的應用和與其他製造流程相比更具成本效益,使其成為大規模柔性電路生產的首選。

由於積層製造流程能夠製造更精細的線條和空間,減少材料浪費,並實現更複雜和客製化的FPC設計,因此預計該製程領域將成為成長最快的領域,複合年增長率將達到12.4%,這對於醫療設備和高頻通訊等先進應用至關重要。

- 按材料

根據材料的不同,北美柔性印刷電路 (FPC) 市場可分為基材和導體材料。預計到 2025 年,基材將佔據市場主導地位,市場份額高達 61.80%,這主要得益於其卓越的熱穩定性、柔韌性和可靠性,這些特性使其能夠在各種環境條件下實現高效的電路性能和耐久性。

由於對增強訊號完整性、更高載流能力和改進的散熱管理的需求不斷增長,FPC 的基礎材料細分市場預計將以 12.6% 的複合年增長率快速增長,這對於高速資料傳輸和電源應用至關重要。

- 透過靈活性

根據柔性程度,北美柔性印刷電路 (FPC) 市場可分為靜態柔性(即裝即用)、動態柔性(即貼合/移動)和可捲曲/可折疊三種類型。預計到 2025 年,靜態柔性(即裝即用)將佔據市場主導地位,市場份額高達 60.80%,這主要得益於其在 FPC 只需在組裝過程中彎曲或成型一次並保持固定位置的應用中的廣泛應用。靜態柔性具有成本效益和可靠性,尤其適用於消費性電子產品和汽車模組等應用,使其成為在狹小空間內整合組件的首選。

由於對能夠在使用壽命期間承受反覆彎曲和移動的柔性印刷電路板 (FPC) 的需求不斷增長,可捲曲/可折疊電路板細分市場預計將以 13.7% 的複合年增長率快速增長,這對於翻蓋手機、可穿戴設備和機械臂等應用至關重要。

- 按外形尺寸

根據外形尺寸,北美柔性印刷電路 (FPC) 市場可分為標準厚度、超薄(<50 µm)和厚(>200 µm)三種。預計到 2025 年,標準厚度 FPC 將佔據市場主導地位,市佔率高達 66.19%,這主要得益於其廣泛的應用以及在各種電子設備中兼具的柔韌性、耐用性和成本效益。此外,標準厚度 FPC 適用於傳統製造工藝,因此成為消費性電子和汽車行業通用 FPC 應用的首選。

由於對極緻小型化和高度緊湊的電子設備的需求不斷增長,尤其是在穿戴式裝置、醫療植入物和先進顯示技術領域,預計超薄(<50 µM)細分市場將以 12.8% 的複合年增長率快速增長。

- 由最終用戶

根據最終用戶,北美柔性印刷電路 (FPC) 市場可細分為消費性電子、汽車、工業與機器人、物聯網與智慧設備、醫療設備、電信、航空航天與國防以及其他領域。預計到 2025 年,消費性電子領域將佔據市場主導地位,市場份額達 35.41%,這主要得益於智慧型手機、平板電腦、筆記型電腦和其他個人電子設備的大規模生產,這些設備廣泛採用 FPC 以實現緊湊的設計和先進的功能。

由於連網設備、智慧家庭產品和各種感測器的爆炸性成長,汽車領域預計將成為成長最快的產業,年複合成長率將達到13.8%,這些設備都需要靈活、微型化和高可靠性的互連技術。此外,穿戴式裝置、智慧感測器和遠端監控系統對柔性電路板(FPC)的需求也推動了這一成長,這些應用需要在小型化尺寸下實現高度整合。另外,5G技術的日益普及和智慧城市計畫的擴展可能會加速該領域的應用。

- 按分銷管道

根據分銷管道,北美柔性印刷電路 (FPC) 市場可分為直銷和間接銷售兩大類。預計到 2025 年,直銷通路將佔據市場主導地位,市場份額高達 69.59%,這主要得益於其強大的成熟分銷網絡以及終端用戶行業對高效、直接的供應渠道日益增長的需求,這些渠道能夠確保產品供應充足並加快交付速度。

預計直銷領域將實現最快成長,複合年增長率預計達到12.3%,這主要得益於消費者對個人化和便利購物體驗日益增長的需求。品牌能夠直接與客戶互動、提供客製化促銷活動,並在無需中間商的情況下維持更牢固的客戶關係,從而推動了這一成長。

北美柔性印刷電路(FPC)市場區域分析

- 北美地區被公認為柔性印刷電路 (FPC) 的重要市場,這得益於先進消費電子產品的普及和不斷增長、電動汽車產量的大幅增長以及醫療器械製造業的擴張,使得柔性印刷電路成為該地區創新和高性能連接戰略的重要組成部分。

- 電子設備普及率和技術進步的不斷提高,以及不同區域經濟體對更緊湊的設計和更完善的訊號完整性的需求,是該地區 FPC 得到必要且日益普及的主要催化劑。

- 電子製造和通訊基礎設施的穩定擴張和現代化,尤其是在主要技術中心和已開發市場,以及確保無縫資料傳輸和高效設備運作的沉重負擔,進一步加速了北美對功能強大、高密度FPC產品的需求。

北美柔性印刷電路(FPC)市場洞察

北美柔性印刷電路板(FPC)市場正蓬勃發展,預計在2025年至2032年的預測期內將以12.2%的複合年增長率增長,這主要得益於消費電子、汽車、航空航天/國防、醫療保健和電信等行業需求的不斷增長。對小型化、輕量化電子設備(包括穿戴式裝置、電動車儀錶板、醫療感測器和物聯網產品)的需求日益增長,推動了柔性印刷電路板相對於傳統剛性電路板的普及。先進的多層和高密度FPC技術正被越來越多地用於滿足性能、空間和可靠性方面的要求。隨著汽車電氣化、5G基礎設施、醫療設備和航空航天電子領域的持續投資,預計該地區的FPC市場將在未來幾年保持持續成長。

美國柔性印刷電路(FPC)市場洞察

受消費性電子、汽車、醫療器材和穿戴式科技等產業需求成長的推動,美國柔性印刷電路 (FPC) 市場正經歷強勁成長,預計 2025 年至 2032 年的複合年增長率將達到 12.3%。小型化和對輕量化、柔性電子解決方案的需求正在推動 FPC 的應用,因為 FPC 能夠實現緊湊的設計和高密度互連。汽車產業,尤其是電動車和高級駕駛輔助系統,正越來越多地將 FPC 整合到資訊娛樂、感測器和控制模組中。同時,多層 FPC、高密度互連設計以及製造流程的進步正在提升 FPC 的性能和可靠性。隨著技術應用和電子創新持續加速,該市場預計將保持持續擴張。

加拿大柔性印刷電路(FPC)市場洞察

隨著消費性電子、汽車、醫療保健和工業等產業對更輕薄、更柔性電子元件的需求不斷增長,加拿大柔性印刷電路板(FPC)市場正蓬勃發展。小型化、穿戴式裝置、電動車電子產品、智慧家庭設備和醫療感測器的發展趨勢,推動了柔性電路相對於傳統剛性電路板的需求。隨著加拿大對柔性電子製造和研發的日益重視,在節能設計、物聯網擴展以及對適用於現代設備和系統的緊湊型高密度電路的需求等趨勢的推動下,柔性印刷電路板的應用預計將顯著增長。

北美柔性印刷電路(FPC)市場份額

柔性印刷電路(FPC)產業主要由一些成熟企業引領,其中包括:

- NOK株式會社(日本)

- 振鼎科技集團控股有限公司(中國)

- 日東電工公司(日本)

- 藤倉印刷電路有限公司(藤倉株式會社子公司)(日本)

- 住友電工株式會社(日本)

- Flexium Interconnect (中國台灣地區)

- 安費諾公司(美國)

- 易比登(日本)

- MFLEX(美國)

- Würth Elektronik eiSos GmbH & Co. KG(德國)

- TTM Technologies Inc.(美國)

- Interflex有限公司(韓國)

- Cicor集團(瑞士)

- MFS Technology(新加坡)

- Cirexx International(美國)

- AS&R Circuits India Pvt. Ltd.(印度)

- PCB電源(美國)

- AdvancedPCB(美國)

- QDOS(馬來西亞)

- MEKTEC製造公司(台灣)

- FPCWAY(中國)

- 泰特電路工業有限公司(英國)

- 千禧電路有限公司(美國)

- 柔性電路(美國)

- Shah Circuittech(印度)

北美柔性印刷電路(FPC)市場最新發展動態

- 2025年10月,在TPCA Show 2025上,振鼎科技發布了「One ZDT」策略藍圖,將半導體、先進封裝和PCB技術整合到一個統一的成長模式中。該公司透過展示新一代IC基板和高階PCB,強調了其在人工智慧和高效能運算應用領域的重要地位。此舉鞏固了振鼎科技在不斷發展的人工智慧生態系統中的地位,透過異質整合提升運算性能,並在先進電子封裝市場佔據更有利的地位。

- 2025 年 3 月,日東電工株式會社入選“科睿唯安 2025 年北美百強創新企業”,以表彰其在研發能力和強大的知識產權戰略方面的卓越表現。

- 2025年9月,振鼎科技在台灣國際半導體展(SEMICON Taiwan)高科技智慧製造論壇上展示了其在積體電路異構整合和先進封裝領域的最新進展。該公司強調了其在推動人工智慧驅動的數位轉型、使PCB技術與半導體整合趨勢相契合方面所發揮的作用。透過利用先進封裝和異質整合技術,振鼎科技旨在突破摩爾定律的限制,並在人工智慧和高效能運算領域拓展其生態系統。

- 2025 年 3 月,藤倉印刷電路有限公司宣布與早稻田大學聯合研究開發出具有剪紙/摺紙結構的 FPC,該 FPC 能夠在保持安裝平面的同時實現膨脹/收縮和曲面適應性。

- 2025年8月,安費諾宣布達成最終協議,將以105億美元現金收購康普連接與電纜解決方案公司(CCS),此舉將顯著增強安費諾在IT/數據通訊和通訊網路市場的光纖互連和連接能力。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS: NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.1.1 INTRODUCTION:

4.1.2 INTENSITY OF COMPETITIVE RIVALRY (MODERATE TO HIGH)

4.1.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.1.4 THREAT OF SUBSTITUTES (LOW)

4.1.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.1.6 BARGAINING POWER OF BUYERS (HIGH)

4.1.7 CONCLUSION

4.2 VALUE CHAIN ANALYSIS — NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.2.1 INTRODUCTION

4.2.2 RAW MATERIAL AND COMPONENT SUPPLY

4.2.3 MATERIAL INPUTS

4.2.4 SUPPLIER ROLES AND COLLABORATION

4.2.5 CHALLENGES AND RISKS

4.2.6 MANUFACTURING AND ASSEMBLY

4.2.7 DISTRIBUTION AND LOGISTICS

4.2.8 INTEGRATION AND SYSTEM ASSEMBLY

4.2.9 END-USE APPLICATIONS AND AFTERMARKET

4.2.10 CROSS-STAGE STRATEGIC CONSIDERATIONS

4.3 REGULATORY STANDARDS GOVERNING THE NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.3.1 MATERIAL AND DESIGN STANDARDS

4.3.2 ELECTRICAL AND MECHANICAL RELIABILITY TESTING

4.3.3 ENVIRONMENTAL AND SUSTAINABILITY COMPLIANCE

4.3.4 QUALITY MANAGEMENT AND MANUFACTURING PROCESS STANDARDS

4.3.5 SECTOR-SPECIFIC REGULATORY FRAMEWORKS

4.3.6 EMERGING STANDARDS AND INDUSTRY ADAPTATION

4.3.7 CONCLUSION

4.4 PENETRATION AND GROWTH PROSPECT MAPPING — NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.4.1 INTRODUCTION

4.4.2 FRAMEWORK AND METHODOLOGY (SUMMARY)

4.4.3 CURRENT PENETRATION ANALYSIS

4.4.3.1 GEOGRAPHIC PENETRATION

4.4.3.2 VERTICAL / APPLICATION PENETRATION

4.4.3.3 TECHNOLOGY & PRODUCT PENETRATION

4.4.4 GROWTH-PROSPECT MAPPING: DRIVERS AND ENABLERS

4.4.4.1 TECHNOLOGY AND PRODUCT DRIVERS

4.4.4.2 COMMERCIAL AND SUPPLY-CHAIN ENABLERS

4.4.4.3 POLICY & ECOSYSTEM ENABLERS

4.4.5 GROWTH LIMITATIONS AND CONSTRAINTS

4.4.5.1 TECHNICAL CONSTRAINTS

4.4.5.2 SUPPLY AND COST CONSTRAINTS

4.4.5.3 MARKET & COMMERCIAL CONSTRAINTS

4.4.6 MAPPING GROWTH PROSPECTS BY SCENARIO

4.4.7 STRATEGIC IMPLICATIONS AND PRIORITIZED ACTIONS

4.4.7.1 FOR FABRICATORS AND EQUIPMENT SUPPLIERS

4.4.7.2 FOR OEMS AND INTEGRATORS

4.4.7.3 FOR INVESTORS AND POLICYMAKERS

4.4.8 MEASURABLE KPIS FOR TRACKING PENETRATION AND GROWTH

4.5 NEW BUSINESS & EMERGING REVENUE OPPORTUNITIES — FUTURE OUTLOOK NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.5.1 INTRODUCTION

4.5.2 DEMAND PULL: APPLICATION-LED REVENUE POOLS

4.5.2.1 AUTOMOTIVE & EV ARCHITECTURES

4.5.2.2 WEARABLES, TEXTILE ELECTRONICS & CONSUMER IOT

4.5.2.3 MEDICAL & BIO-INTEGRATED DEVICES

4.5.2.4 AEROSPACE, SPACE & INDUSTRIAL ROBOTICS

4.5.3 ECHNOLOGY-DRIVEN BUSINESS MODELS & SERVICES

4.5.3.1 DESIGN-AS-A-SERVICE AND RAPID PROTOTYPING

4.5.3.2 MANUFACTURING-AS-A-SERVICE (MAAS) / FLEXIBLE CAPACITY LEASING

4.5.3.3 ADDITIVE & PRINTED ELECTRONICS LICENSING

4.5.3.4 SYSTEM INTEGRATION & MODULE SUPPLY

4.5.3.5 SUBSCRIPTION & DATA-DRIVEN SERVICES

4.5.4 MANUFACTURING & PROCESS INNOVATION — REVENUE LEVERS

4.5.4.1 ROLL-TO-ROLL AND HIGH-THROUGHPUT FABRICATION

4.5.4.2 ADVANCED SUBSTRATES & HIGH-RELIABILITY MATERIALS

4.5.4.3 HYBRID PRODUCTION (ADDITIVE + SUBTRACTIVE)

4.5.4.4 IN-PROCESS INSPECTION & DIGITAL TRACEABILITY

4.5.5 SUPPLY-CHAIN & LOCALIZATION OPPORTUNITIES

4.5.5.1 ON-SHORING AND REGIONAL HUBS

4.5.5.2 TIERED SUPPLIER ECOSYSTEMS

4.5.5.3 LOGISTICS AND VALUE-ADDED DISTRIBUTION

4.5.6 AFTERMARKET, RECYCLING & CIRCULAR ECONOMY REVENUE STREAMS

4.5.6.1 COMPONENT RECOVERY & MATERIAL REUSE

4.5.6.2 SERVICE & REPAIR PROGRAMS

4.5.7 BARRIERS, RISKS & MITIGATIONS (BUSINESS-LEVEL CONSIDERATIONS)

4.5.8 STRATEGIC RECOMMENDATIONS FOR NEW & EMERGING BUSINESSES

4.5.9 FUTURE OUTLOOK (5–10 YEAR HORIZON)

4.5.10 CONCLUSION

4.6 TECHNOLOGY MATRIX ANALYSIS–NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.7 COMPANY COMPARATIVE ANALYSIS – NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.8 COMPANY SERVICE PLATFORM MATRIX – NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

4.9 EMERGING PRODUCTION PROCESSES SHAPING THE FPC AND FHE INDUSTRIES

4.1 KEY INSIGHTS ON TECHNOLOGICAL ADVANCEMENTS

4.10.1 KEY TECHNOLOGICAL BREAKTHROUGHS IN FPC MANUFACTURING

4.10.1.1 ADHESIVELESS LAMINATION TECHNOLOGY

4.10.1.2 SEMI-ADDITIVE PROCESS (SAP) & MODIFIED SAP (MSAP)

4.10.1.3 LASER DIRECT IMAGING (LDI) & UV LASER MICROVIA DRILLING

4.10.2 MARKET IMPACT & STRATEGIC IMPLICATIONS

4.10.3 MATERIAL INNOVATION IN COPPER FOILS & POLYIMIDE FILMS — STRATEGIC DRIVER FOR FPC MARKET LEADERSHIP

4.10.4 SUPPLY CHAIN & STRATEGIC IMPLICATIONS OF FPC MATERIAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 EXPANDING FPC ADOPTION IN AUTOMOTIVE AND MEDICAL ELECTRONICS.

5.1.2 RISING DEMAND FOR COMPACT AND LIGHTWEIGHT ELECTRONIC DEVICES

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN FPC DESIGN AND MATERIALS

5.1.4 GROWING DEMAND FOR FLEXIBLE CIRCUITS IN ELECTRIC AND HYBRID VEHICLES

5.2 RESTRAINTS

5.2.1 DEPENDENCE OF FPC MANUFACTURING ON COSTLY POLYIMIDE AND COPPER MATERIALS

5.2.2 HIGH DEFECT RATES DURING PRECISION BENDING OPERATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF FPC CIRCUIT IN AEROSPACE AND DEFENSE SYSTEMS.

5.3.2 EXPANDING FPC APPLICATIONS IN NEXT-GENERATION FOLDABLE PHONES

5.3.3 STRATEGIC PARTNERSHIPS FOR ADVANCED RIGID-FLEX PRODUCT DEVELOPMENT

5.4 CHALLENGES

5.4.1 CONTINUOUS PRESSURE TO REDUCE COSTS WHILE SUSTAINING QUALITY STANDARDS

5.4.2 RAPID TECHNOLOGICAL CHANGES DEMANDING CONTINUOUS INNOVATION INVESTMENT

6 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE

6.1 OVERVIEW

6.2 MULTI-LAYER

6.3 DOUBLE SIDED

6.4 SINGLE SIDED

6.5 RIGID FLEXIBLE CIRCUIT

6.6 DUAL ACCESS

6.7 SCULPTURED FPC

6.8 OTHERS

7 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 SUBTRACTIVE PROCESS

7.3 ADDITIVE PROCESS

7.4 ADHESIVE AND ADHESIVELESS LAMINATION

8 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 BASE MATERIAL

8.3 CONDUCTOR MATERIAL

9 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY

9.1 OVERVIEW

9.2 STATIC FLEX (FLEX-TO-INSTALL)

9.3 DYNAMIC FLEX (FLEX-TO-FIT/MOVE)

9.4 ROLLABLE / FOLDABLE

10 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR

10.1 OVERVIEW

10.2 STANDARD THICKNESS

10.3 ULTRA-THIN (<50 µM)

10.4 THICK (>200 µM)

11 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.3 AUTOMOTIVE

11.4 INDUSTRIAL & ROBOTICS

11.5 IOT & SMART DEVICES

11.6 MEDICAL DEVICES

11.7 TELECOMMUNICATION

11.8 AEROSPACE & DEFENSE

11.9 OTHERS

12 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 IN-DIRECT SALES

13 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 NOK CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZHEN DING TECH. GROUP TECHNOLOGY HOLDING LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 NITTO DENKO CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 FUJIKURA PRINTED CIRCUITS LTD. (SUBSIDIARY OF FUJIKURA LTD.)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 SUMITOMO ELECTRIC INDUSTRIES, LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADVANCED PCB

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AMPHENOL CORPORATION..

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 AS&R CIRCUITS INDIA PVT. LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CIREXX INTERNATIONAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CICOR GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 FLEXIBLE CIRCUIT

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FPCWAY

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FLEXIUM INTERCONNECT.INC

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 INTERFLEX CO.,LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 IBIDEN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 MILLENNIUM CIRCUITS LIMITED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MFS TECHNOLOGY

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MEKTEC MANUFACTURING CO.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MFLEX

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PCB POWER

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 QDOS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SHAH CRICUITECH

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 TATE CIRCUIT INDUSTRIES LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 TTM TECHNOLOGIES INC

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENT

16.25 WÜRTH ELEKTRONIK EISOS GMBH & CO. KG

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 COMPANY COMPARATIVE ANALYSIS

TABLE 4 COMPANY SERVICE PLATFORM MATRIX

TABLE 5 STRATEGIC IMPLICATIONS FOR OEMS, FPC MANUFACTURERS & INVESTORS

TABLE 6 TECHNOLOGY MAP

TABLE 7 SEMI-ADDITIVE PROCESS (SAP) & MODIFIED SAP (MSAP) PARAMETERS

TABLE 8 COPPER FOIL ADVANCEMENTS — ROLLED ANNEALED (RA) VS. ELECTRODEPOSITED (ED) VS. NEXT-GENERATION HIGH-FREQUENCY COPPER

TABLE 9 POLYIMIDE FILM EVOLUTION — FROM STANDARD PI TO TRANSPARENT & LOW-DK FLEX SUBSTRATES

TABLE 10 WHO IS INVESTING AND WHY IT MATTERS?

TABLE 11 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 13 NORTH AMERICA MULTI-LAYER IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA MULTI-LAYER IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA SINGLE SIDED IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA RIGID FLEXIBLE CIRCUIT IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA DUAL ACCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA SCULPTURED FPC IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 22 NORTH AMERICA SUBTRACTIVE PROCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA ADDITIVE PROCESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA ADHESIVE AND ADHESIVELESS LAMINATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA STATIC FLEX (FLEX-TO-INSTALL) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA DYNAMIC FLEX (FLEX-TO-FIT/MOVE) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA ROLLABLE / FOLDABLE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA STANDARD THICKNESS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA ULTRA-THIN (<50 µM) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA THICK (>200 µM) IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA AEROSPACE & DEFENCE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA OTHERS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 67 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 69 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 71 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 95 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 97 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 101 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 102 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 103 U.S. CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 U.S. CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 U.S. INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 U.S. IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 U.S. MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 U.S. FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 118 U.S. IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 121 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 123 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 128 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 129 CANADA CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 CANADA CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 CANADA AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 CANADA AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 CANADA INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 CANADA INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 CANADA IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 CANADA IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 CANADA MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 CANADA MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 CANADA TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 CANADA TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 CANADA AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 CANADA AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 CANADA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 144 CANADA IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 147 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 148 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 149 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 150 MEXICO BASE MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 MEXICO CONDUCTOR MATERIAL IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FLEXIBILITY, 2018-2032 (USD THOUSAND)

TABLE 153 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 154 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 155 MEXICO CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 MEXICO CONSUMER ELECTRONICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 MEXICO AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 MEXICO AUTOMOTIVE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 MEXICO INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 MEXICO INDUSTRIAL & ROBOTICS IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 MEXICO IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MEXICO IOT & SMART DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MEXICO MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MEXICO MEDICAL DEVICES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MEXICO TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MEXICO TELECOMMUNICATION IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MEXICO AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 MEXICO AEROSPACE & DEFENSE IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY FPC TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MEXICO FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 170 MEXICO IN-DIRECT SALES IN FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: END USER GRID SLIDE

FIGURE 9 EXECUTIVE SUMMARY

FIGURE 10 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: SEGMENTATION

FIGURE 11 SEVEN SEGMENTS COMPRISE THE NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET, BY TYPE

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 EXPANDING FPC ADOPTION IN AUTOMOTIVE AND MEDICAL ELECTRONICS IS LEADING THE GROWTH OF THE NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET IN 2025 & 2032

FIGURE 15 VALUE CHAIN ANALYSIS

FIGURE 16 TECHNOLOGY TRAJECTORY DRIVING NEXT-GENERATION FPC AND FHE MANUFACTURING

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET

FIGURE 18 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: BY TYPE, 2024

FIGURE 19 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: BY MANUFACTURING PROCESS, 2024

FIGURE 20 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: BY MATERIAL, 2024

FIGURE 21 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: BY FLEXIBILITY, 2024

FIGURE 22 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: BY FORM FACTOR, 2024

FIGURE 23 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC): BY END-USER, 2024

FIGURE 24 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 25 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: SNAPSHOT (2024)

FIGURE 26 NORTH AMERICA FLEXIBLE PRINTED CIRCUIT (FPC) MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。