North America Functional Gummies And Jellies Market

市场规模(十亿美元)

CAGR :

%

USD

8.14 Billion

USD

13.55 Billion

2024

2032

USD

8.14 Billion

USD

13.55 Billion

2024

2032

| 2025 –2032 | |

| USD 8.14 Billion | |

| USD 13.55 Billion | |

|

|

|

北美功能性軟糖和果凍市場,按類型(軟糖和果凍)、性質(傳統和有機)、價格類別(標準、高級和超高級)、品牌類別(品牌和自有品牌)、包裝類型(小袋、保鮮膜、小袋、盒子和其他)、年齡組(兒童(0-18 歲)、青年(18-35 歲)、中年(35 歲)歲以上))、分銷管道(商店零售和非商店零售)劃分 - 行業趨勢和預測(至 2032 年)

北美功能性軟糖和果凍市場分析

北美功能性軟糖和果凍市場主要受到消費者健康意識增強以及對方便、營養豐富的產品的需求的推動,這些產品具有增強免疫力、支持消化和提高能量等功效。此外,它們的便攜性非常適合忙碌的生活方式。然而,市場面臨對糖含量和人工添加劑更嚴格監管的限制,這會影響產品配方。新興經濟體不斷提高的健康意識和可支配收入提供了巨大的成長機會,鼓勵企業擴大在這些地區的產品供應。然而,製造商面臨的挑戰是重新配製產品以滿足這些新的健康標準而不犧牲口味,特別是在對甜味有高需求的市場中。

北美功能性軟糖和果凍市場規模

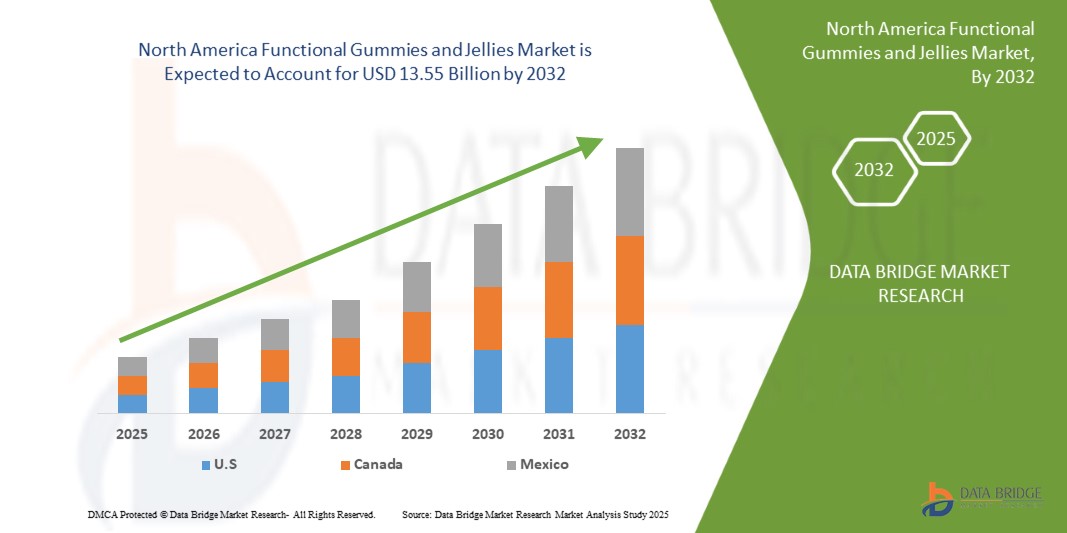

2024 年北美功能性軟糖和果凍市場規模價值 81.4 億美元,預計到 2032 年將達到 135.5 億美元,預測期內(2025 年至 2032 年)的複合年增長率為 6.6%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

北美功能性軟糖和果凍市場趨勢

“將重點轉向預防性健康和保健”

消費者對預防性健康和保健的關注度不斷轉變,推動了對具有增強免疫力、改善消化和緩解壓力等額外益處的功能性食品的需求。功能性軟糖和果凍以美味、方便的形式提供必需的營養素(如維生素、礦物質和益生菌)來滿足這些需求。它們的吸引力涵蓋了從兒童到成人和老年人的各個年齡段,使其成為傳統補充劑的一種令人愉悅且受歡迎的替代品。

北美功能性軟糖和果凍市場細分

|

屬性 |

北美功能性軟糖和果凍市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋區域 |

美國、加拿大和墨西哥 |

|

主要市場參與者 |

HARIBO GmbH & Co. KG(德國)、Ferrara Candy Company(美國)、好時公司(美國)、不凡帝範梅勒公司(荷蘭)、雀巢(瑞士)、億滋國際公司(美國)、瑪氏食品服務公司(英國)、明治控股有限公司(日本)、樂天健康食品株式會。 (韓國)、Hero Nutritionals, Inc.(瑞士)、深圳市金多多食品有限公司(中國)、The Candy Plus Sweet Factory sro(捷克共和國)、Nature's Way Brands, LLC(美國)、Damel Group SL(西班牙)、Vitabiotics Ltd.(英國)、STARPOWA UK(英國)和 Sambucol(英國) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

北美功能性軟糖和果凍市場定義

功能性軟糖和果凍是添加了額外成分的糖果產品,除了味道之外還具有健康益處。這些軟糖旨在以方便和愉快的形式提供維生素、礦物質、草藥和其他膳食補充劑。例如富含維生素(如維生素 C、D 或 B12)、礦物質(如鈣)或益生菌、纖維和omega-3 脂肪酸等功能性成分的軟糖。

北美功能性軟糖與果凍市場動態

驅動程式

- 將重點轉向預防性健康和保健

消費者對預防性健康和保健的關注度不斷轉變,推動了對具有增強免疫力、改善消化和緩解壓力等額外益處的功能性食品的需求。功能性軟糖和果凍以美味、方便的形式提供必需的營養素(如維生素、礦物質和益生菌)來滿足這些需求。它們的吸引力涵蓋了從兒童到成人和老年人的各個年齡段,使其成為傳統補充劑的一種令人愉悅且受歡迎的替代品。

例如,

- 2024 年 11 月,根據 SHAFAA 發表的一篇文章,軟糖,尤其是加拿大透過 Shafaa 等藥房提供的緩解壓力的軟糖,因其一致的劑量和誘人的口味而變得受歡迎。這一趨勢凸顯了消費者健康意識的不斷增強,人們越來越多地尋求方便、愉快的方式來管理壓力和改善健康。隨著消費者優先考慮健康和保健解決方案,對此類功能性軟糖的需求預計將推動全球市場的成長

- 2024年3月,根據《印度時報》發表的一篇文章稱,70%的印度城市女性營養不良,許多女性現在開始選擇功能性軟糖,作為一種方便且有吸引力的方式來滿足她們日常的維生素和礦物質需求。與傳統補充劑不同,軟糖吸引了初次使用者,並為疲勞、脫髮和虛弱等健康問題提供了簡單的解決方案。消費者(尤其是女性)的健康意識不斷增強,推動了對功能性軟糖和果凍的需求,尤其是在二線和三線城市,為市場持續成長奠定了基礎

人們對健康和保健的日益重視使得消費者意識成為全球功能性軟糖和果凍市場的關鍵驅動力,隨著人們尋求方便有效的營養解決方案來滿足不斷變化的健康優先事項,推動了市場的穩步增長。

- 植物性功能性G CS 開發創新不斷湧現

隨著消費者越來越多地尋求更健康、更永續的替代品,不含動物成分的植物軟糖越來越受歡迎。這些產品滿足了人們對純素、無麩質和無過敏原日益增長的需求,擴大了對各個消費者群體的吸引力。此外,富含維生素、礦物質和超級食物的功能性軟糖正在吸引註重健康的消費者,他們注重便利性,同時又不損害營養。植物成分和功能配方的創新符合現代消費者不斷變化的偏好,為市場持續成長奠定了基礎。

例如,

- 2024年4月,根據《國際食品科學期刊》發表的一篇文章,印度的一項研究使用瓊脂和瓜爾膠等植物膠凝劑開發了含有薑黃和黑胡椒的純素軟糖。透過優化薑黃和黑胡椒濃度,該配方實現了理想的質地和感官特性。這些經濟實惠的軟糖可與商業產品相媲美,展示了植物基和功能性軟糖的不斷創新,以滿足注重健康的消費者的需求

這些創新不僅滿足了消費者對更健康、植物性選擇的需求,也增強了功能優勢,推動了全球功能性軟糖和果凍市場的擴張

機會

- 增加個人化營養支出

個人化營養和補充劑的趨勢為全球功能性軟糖和果凍市場提供了重大機會。隨著消費者越來越意識到與其個人生活方式、健康狀況和遺傳因素相關的獨特營養需求,對客製化解決方案的需求也日益增長。這種轉變正在推動可客製化軟糖配方的發展,以解決免疫、睡眠、認知功能和消化等特定的健康問題。個人化補充劑讓消費者能夠選擇最適合自己需求的成分和劑量,從而提供更有針對性的健康和保健方法。隨著個人化持續受到關注,它成為功能性軟糖和果凍市場的一個重要成長機會。

例如,

- 2024年10月,根據負責任營養委員會發表的《2024年CRN消費者調查》文章發現,74%的美國成年人使用膳食補充劑,其中55%為常規使用者。消費者對客製化營養解決方案的需求不斷增長,推動了功能性軟糖和果凍的普及,推動了市場成長和創新

- 2020年1月,根據Healthline發表的一篇文章,改良和強化的功能性食品可以透過增加維生素、礦物質、纖維和益生菌等必需營養素的攝取來幫助填補飲食缺口、預防營養缺乏並透過增加維生素、礦物質、纖維和益生菌等必需營養素的攝取來增強整體健康。隨著消費者越來越多地尋求個人化營養解決方案,對功能性軟糖和果凍等方便、營養豐富的食品的需求持續增長,成為市場成長的關鍵驅動力

個人化營養需求的不斷增長為全球功能性軟糖和果凍市場帶來了重要機會。隨著消費者越來越意識到基於生活方式、遺傳和具體情況的獨特健康需求,對客製化軟糖補充劑的需求也在增加。針對免疫力、睡眠、認知和消化的可定製配方讓消費者能夠選擇適合個人需求的成分和劑量。這種個人化健康趨勢推動了功能性軟糖和果凍市場的顯著成長,為健康提供了有針對性的方法。

- 隨時隨地享用零食的勢頭強勁

軟糖將便利性、口味和功能性完美地結合在一起,使其成為希望將補充劑納入日常生活而又無需服用藥丸或粉末的人們的理想選擇。其便攜、易於食用的形式吸引了廣泛的消費者,從忙碌的專業人士到為孩子尋找更健康替代品的父母。隨著生活節奏越來越快,消費者越來越重視能夠以快速、愉快的方式滿足其營養需求的產品。功能性軟糖和果凍具有廣泛的吸引力和多功能性,代表著市場成長的重要機會,滿足了人們對便利、健康解決方案日益增長的需求。這種需求推動了口味、配方和目標健康益處的創新,創造了充滿活力的市場機會。

例如,

- 2023年8月,根據Agro FOOD Industry Hi Tech發表的一篇文章稱,軟糖不僅外觀賞心悅目,而且還提供無窮無盡的口味可能性,成為消費者令人愉悅的選擇。它們易於咀嚼且吞嚥順暢,比傳統補充劑更具吸引力。這種口味、便利性和多樣性的結合創造了強大的市場機會,隨著人們對美味、有效營養的需求不斷增加,推動了全球功能性軟糖和果凍行業的成長

- 2023年11月,根據Science Direct發表的一篇文章,軟糖果凍產品是傳遞功能性成分的理想方式,具有食用方便、質地宜人、口味和顏色多樣等特點。它們的多功能性使其成為尋求美味、營養豐富的解決方案的消費者的理想選擇。這種便利性和吸引力的結合帶來了巨大的市場機遇,推動了全球功能性軟糖和果凍行業的需求和創新

- 功能性軟糖和果凍提供了一種方便、美味的補充劑攝取方式,吸引了那些喜歡簡單、隨時隨地攝取補充劑的忙碌消費者。它們的便攜性和令人愉悅的口味使其受到那些尋求輕鬆的方式來增加營養的人們的歡迎。隨著對快速、以健康為中心的解決方案的需求不斷增長,這些產品創造了強大的市場機會,推動了創新和擴張。

限制/挑戰

- 來自其他補充劑形式的競爭

功能性軟糖市場面臨來自各種其他補充劑形式日益激烈的競爭,包括藥丸、膠囊、粉末和液體,每種形式都有其自身的優勢。例如,膠囊和藥片通常提供更高濃度的活性成分,並且被認為能夠更有效地提供精確的劑量。粉末和液體在食用份量上具有靈活性,並且吸收速度更快。此外,注重特定健康益處的消費者可能會轉向有針對性的補充劑,這進一步挑戰了軟糖在擁擠的市場中脫穎而出。儘管功能性軟糖因其便利性和口味而具有吸引力,但它們必須克服這些競爭壓力才能保持其市場份額並吸引註重健康的消費者。來自其他補充劑形式的激烈競爭對功能性軟糖市場提出了重大挑戰。

例如,

- 2024 年 9 月,根據《國際科學與研究期刊》(IJSR)發表的文章,與其他補充劑如片劑、粉末和軟糖相比,膠囊被發現具有明顯更好的生物利用度,可能以較小的劑量產生相同的治療效果。這種更高的效率使膠囊成為強大的競爭對手,因為它們提供更快的吸收和更濃縮的劑量。這些優勢對功能性軟糖市場在消費者偏好和市場份額方面提出了挑戰

- 2020年5月,根據NCBI發表的文章,在生物利用度比較中,產前多種軟糖的平均血清葉酸AUC0-8小時為239.67±24.50h×ng/mL,而葉酸片的值更高,為255.23±30.17h×ng/mL。這種性能差異凸顯了功能性軟糖在與其他可能提供更有效營養吸收的補充劑形式競爭時面臨的挑戰,從而影響其市場成長

功能性軟糖面臨來自藥丸、粉末和液體等其他補充劑形式的激烈競爭,每種補充劑形式都具有獨特的功效。膠囊和藥片通常含有更高的成分濃度,而粉末和液體則吸收更快,劑量也更靈活。隨著消費者尋求有針對性的解決方案,軟糖必須在競爭格局中脫穎而出,這使得這種競爭成為市場面臨的重大挑戰。

- 與糖和添加劑含量有關的健康問題

隨著健康意識的增強和對卡路里攝取量的擔憂,一些消費者因為傳統軟糖含糖量高而避免食用。雖然有無糖和低糖替代品,但它們可能無法完全滿足消費者的口味偏好,從而限制其在市場上的吸引力。

例如,

- 2023年12月,根據NCBI發表的一篇文章,傳統軟糖通常含有高水平的可吸收碳水化合物和低含量的有益化合物,這引起了消費者的健康擔憂。這導致全球功能性軟糖和果凍市場受到限制,因為消費者對糖和添加劑含量變得更加謹慎,限制了傳統產品的吸引力

- 2021 年 7 月,根據 Walter de Gruyter GmbH 發表的一篇文章,過量食用含糖量高、添加劑高、以及羥甲基糠醛和丙烯酰胺等有害化合物的軟糖和果凍與肥胖、蛀牙和高血糖有關。對糖和添加劑的健康擔憂限制了這些產品的吸引力,從而限制了全球功能性軟糖和果凍市場的發展

對糖含量及其相關健康影響的擔憂限制了全球功能性軟糖和果凍市場的發展,因為它限制了傳統產品的吸引力,並增加了更健康替代品的成本負擔。

北美功能性軟糖和果凍市場範圍

市場根據類型、性質、價格類別、品牌類別、包裝類型、年齡層和分銷管道進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

類型

- 軟糖

- 形式

- 熊

- 蠕蟲

- 戒指

- 其他的

- 味道

- 草莓

- 覆盆子

- 蘋果

- 西瓜

- 桃

- 橘子

- 芒果

- 藍莓

- 黑莓

- 柚子

- 櫻桃

- 桃

- 香蕉

- 黑加侖

- 蔓越莓

- 柑橘

- 其他的

- 強化軟糖

- 維他命

- 維生素和礦物質混合軟糖

- 礦物

- 蛋白質(包括益生菌)

- Omega 3 和 Omega 6

- 大麻

- 10毫克

- 20毫克

- 25毫克

- 其他的

- 褪黑激素

- 其他的

- 功能

- 免疫

- 整體幸福感

- 體重管理

- 消化健康

- 釋放壓力

- 骨骼和關節健康

- 皮膚健康

- 頭髮健康

- 心臟健康

- 指甲健康

- 其他的

- 形式

- 果凍

- 形式

- 小吃

- 豆子

- 棍棒

- 夾心果凍

- 其他的

- 味道

- 草莓

- 覆盆子

- 蘋果

- 西瓜

- 桃

- 橘子

- 芒果

- 藍莓

- 黑莓

- 柚子

- 櫻桃

- 桃

- 香蕉

- 黑加侖

- 蔓越莓

- 柑橘

- 其他

- 形式

自然

- 傳統的

- 有機的

價格類別

- 標準

- 優質的

- 超高端

品牌類別

- 品牌

- 自有品牌

包裝類型

- 袋裝

- 保鮮膜

- 小袋

- 盒子

- 其他的

年齡組

- 兒童(0-18歲)

- 青年(18-35歲)

- 中年(36-45歲)

- 老年人(45歲以上)

分銷管道

- 實體店面零售

- 超市/大賣場

- 便利商店

- 專賣店

- 其他的

- 無店零售

- 電子商務

- 公司所有

北美功能性軟糖和果凍市場區域分析

對市場進行分析,並提供市場規模洞察和趨勢,包括上述國家、類型、性質、價格類別、品牌類別、包裝類型、年齡層和分銷管道。

市場涵蓋的國家包括美國、加拿大和墨西哥。

由於重點轉向預防性健康和保健、植物性和功能性軟糖開發創新不斷增加、大麻食品增長以及在線購物平台偏好增加,推動了對功能性軟糖和果凍的需求,美國預計將成為市場主導和增長最快的國家。

報告的國家部分還提供了影響個別市場因素以及影響市場當前和未來趨勢的國內市場監管變化。下游和上游價值鏈分析、技術趨勢和波特五力分析、案例研究等數據點是用於預測各國市場情景的一些指標。此外,在對國家數據進行預測分析時,還考慮了全球品牌的存在和可用性及其因來自本地和國內品牌的大量或稀缺的競爭而面臨的挑戰、國內關稅和貿易路線的影響。

北美功能性軟糖和果凍市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

北美功能性軟糖和果凍市場領導者有:

- HARIBO GmbH & Co. KG(德國)

- 費拉拉糖果公司(美國)

- 好時公司(美國)

- 不凡蒂範梅勒(荷蘭)

- 雀巢(瑞士)

- 億滋國際(美國)

- 瑪氏食品服務公司(英國)

- 明治控股株式會社(日本)

- 樂天WELLFOOD株式會社(韓國)

- Hero Nutritionals, Inc.(瑞士)

- Shenzhen Jinduoduo Food Co., Ltd. (China)

- Candy Plus Sweet Factory sro(捷克共和國)

- Nature's Way Brands, LLC(美國)

- Damel Group SL(西班牙)

- Vitabiotics Ltd.(英國)

- STARPOWA UK(英國)

- Sambucol(英國)

北美功能性軟糖和果凍市場的最新發展

- 2024 年 9 月,HARIBO GmbH & Co. KG 宣布 Goldbears Wild Berry 即將回歸,並將成為美國 Goldbears 系列的永久成員。此舉將為忠實粉絲提供全新、清爽的口味,從而提高消費者參與度並擴大品牌吸引力,在競爭激烈的軟糖市場中推動銷售和品牌忠誠度的成長

- 2024 年 7 月,Jelly Belly 糖果公司與富有想像的遊戲創作者 Wilder 合作,為其標誌性的 BeanBoozled 軟糖帶來新的樂趣。透過將這種獨特的糖果體驗遊戲化,此次合作增強了品牌的吸引力,吸引了糖果愛好者和遊戲愛好者。此舉可能會提高品牌知名度,吸引更廣泛的受眾,並透過引入互動、共享的體驗來推動銷售

- 2024年2月,費拉拉糖果公司生產的Nerds Gummy Clusters榮獲糖果類享有盛譽的「2024年度產品」獎,這是全球最大的消費者投票產品創新獎項。這項認可凸顯了產品的受歡迎程度和創造力,提升了品牌的聲譽。它還使費拉拉糖果公司能夠利用該獎項在營銷和促銷中提高消費者的興趣、品牌忠誠度和潛在的銷售成長

- 2023 年 10 月,不凡帝範梅勒集團宣布收購億滋國際在美國、加拿大和歐洲的口香糖部門,將 Trident、Dentyne 和 Chiclets 等知名品牌納入其產品組合。此舉鞏固了不凡帝範梅勒在糖果和口香糖領域的全球領先地位,增強了其生產能力、分銷網絡和市場佔有率。該交易還包括位於美國羅克福德和波蘭斯卡比米日的生產設施,使該公司的全球業務範圍擴大至 33 個生產基地

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INDUSTRY RIVALRY

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL SOURCING

4.2.2 MANUFACTURING & PRODUCTION

4.2.3 PACKAGING

4.2.4 DISTRIBUTION

4.2.5 RETAIL & E-COMMERCE

4.2.6 CONSUMER PURCHASE & FEEDBACK

4.2.7 CONCLUSION

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL SOURCING

4.3.2 MANUFACTURING & PRODUCTION

4.3.3 PACKAGING

4.3.4 DISTRIBUTION

4.3.5 RETAIL & E-COMMERCE

4.3.6 CONSUMER PURCHASE & FEEDBACK

4.3.7 CONCLUSION

4.4 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS ON THE NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET

4.4.1 HEALTH BENEFITS AND FUNCTIONALITY

4.4.2 TASTE AND TEXTURE

4.4.3 BRAND REPUTATION AND TRUST

4.4.4 PRICE SENSITIVITY

4.4.5 INGREDIENT QUALITY AND SOURCING

4.4.6 PACKAGING AND SUSTAINABILITY

4.4.7 CONVENIENCE AND PORTABILITY

4.4.8 RECOMMENDATIONS AND REVIEWS

4.4.9 PRODUCT AVAILABILITY AND DISTRIBUTION CHANNELS

4.4.10 REGULATORY APPROVALS AND CERTIFICATIONS

4.4.11 LIFESTYLE AND DIETARY PREFERENCES

4.4.12 CONCLUSION

4.5 IMPACT OF ECONOMIC SLOWDOWN ON THE NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET

4.5.1 REDUCED CONSUMER SPENDING

4.5.2 SHIFT TOWARD PRIVATE LABELS AND BUDGET OPTIONS

4.5.3 SUPPLY CHAIN DISRUPTIONS AND INCREASED COSTS

4.5.4 SLOWDOWN IN INNOVATION AND R&D INVESTMENTS

4.5.5 DECREASE IN MARKETING AND BRAND PROMOTION

4.5.6 REGIONAL VARIATIONS IN IMPACT

4.5.7 INCREASED FOCUS ON ESSENTIAL HEALTH BENEFITS

4.5.8 OPPORTUNITIES FOR E-COMMERCE GROWTH

4.5.9 CONCLUSION

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET

4.6.1 RISE IN PLANT-BASED AND VEGAN OPTIONS

4.6.2 FOCUS ON CLEAN LABEL AND NATURAL INGREDIENTS

4.6.3 EXPANSION OF CUSTOMIZED AND TARGETED HEALTH BENEFITS

4.7 GROWTH IN ONLINE SALES AND DIRECT-TO-CONSUMER (DTC) CHANNELS

4.7.1 SUSTAINABLE AND ECO-FRIENDLY PACKAGING

4.7.2 INTEGRATION OF TECHNOLOGY AND INNOVATION IN MANUFACTURING

4.7.3 CONCLUSION

4.8 OVERVIEW OF PRODUCTION CAPACITY

4.8.1 NORTH AMERICA

4.8.2 EUROPE

4.8.3 ASIA-PACIFIC

4.8.4 LATIN AMERICA

4.8.5 MIDDLE EAST AND AFRICA

4.8.6 CONCLUSION

4.9 OVERVIEW OF TECHNOLOGICAL INNOVATIONS IN THE NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET

4.9.1 ENHANCED PRODUCTION TECHNIQUES FOR TEXTURE AND TASTE

4.9.2 BIOAVAILABILITY AND CONTROLLED RELEASE TECHNOLOGIES

4.9.3 CLEAN-LABEL AND PLANT-BASED INGREDIENTS

4.9.4 SUGAR-FREE AND LOW-CALORIE FORMULATIONS

4.9.5 PERSONALIZED AND FUNCTIONAL INGREDIENTS

4.9.6 SUSTAINABLE PACKAGING INNOVATIONS

4.9.7 INNOVATIVE MANUFACTURING PROCESSES

4.9.8 DIGITALIZATION AND DIRECT-TO-CONSUMER (DTC) ENGAGEMENT

4.9.9 CONCLUSION

4.1 RAW MATERIAL SOURCING ANALYSIS

4.10.1 GELATIN AND GELLING AGENTS

4.10.2 VITAMINS, MINERALS, AND ACTIVE INGREDIENTS

4.10.3 SWEETENERS AND SUGAR ALTERNATIVES

4.10.4 NATURAL COLORS AND FLAVORS

4.10.5 PACKAGING MATERIALS

4.10.6 SUPPLY CHAIN AND GEOPOLITICAL FACTORS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SHIFTING FOCUS TOWARDS PREVENTIVE HEALTH AND WELLNESS

6.1.2 RISING INNOVATION IN THE DEVELOPMENT OF PLANT-BASED AND FUNCTIONAL GCS

6.1.3 GROWTH IN THE CANNABIS-INFUSED EDIBLES

6.1.4 INCREASING PREFERENCES OF ONLINE PLATFORM FOR SHOPPING MEDIUM

6.2 RESTRAINTS

6.2.1 HEALTH CONCERNS RELATED TO SUGAR AND ADDITIVE CONTENT

6.2.2 CREDIBLE THREATS OF ALTERNATIVE NUTRACEUTICAL FORMATS

6.3 OPPORTUNITIES

6.3.1 INCREASING SPENDING ON PERSONALIZED NUTRITION

6.3.2 GAINING MOMENTUM TOWARDS ON-THE GO SNACKING OPTIONS

6.3.3 HIGH SHELF LIFE ASSOCIATED WITH FUNCTIONAL GUMMIES

6.4 CHALLENGES

6.4.1 COMPETITION FROM OTHER SUPPLEMENT FORMS

6.4.2 INTAKE AMONG THE CONSUMER

7 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE

7.1 OVERVIEW

7.2 GUMMIES

7.2.1 CANDY GUMMIES

7.2.1.1 Bears

7.2.1.2 Worms

7.2.1.3 Rings

7.2.1.4 Others

7.2.1.5 Strawberry

7.2.1.6 Raspberry

7.2.1.7 Apple

7.2.1.8 Watermelon

7.2.1.9 Peach

7.2.1.10 Orange

7.2.1.11 Mango

7.2.1.12 Blueberry

7.2.1.13 Blackberry

7.2.1.14 Grapefruit

7.2.1.15 Cherry

7.2.1.16 Peach

7.2.1.17 Banana

7.2.1.18 Blackcurrant

7.2.1.19 Cranberry

7.2.1.20 Tangerine

7.2.1.21 Others

7.2.2 FORTIFIED GUMMIES

7.2.2.1 Vitamin

7.2.2.2 Vitamins & Mineral Mix Gummies

7.2.2.3 Mineral

7.2.2.4 Protein (Including probiotics)

7.2.2.5 Omega 3 and Omega 6

7.2.2.6 Cannabis

7.2.2.7 Melatonin

7.2.2.8 Others

7.2.2.9 Immunity

7.2.2.10 General Well-Being

7.2.2.11 Weight Management

7.2.2.12 Digestive Health

7.2.2.13 Stress Release

7.2.2.14 Bone And Joint Health

7.2.2.15 Skin Health

7.2.2.16 Hair Health

7.2.2.17 Heart Health

7.2.2.18 Nail Health

7.2.2.19 Others

7.3 JELLIES

7.3.1 STRAWBERRY

7.3.2 RASPBERRY

7.3.3 APPLE

7.3.4 WATERMELON

7.3.5 PEACH

7.3.6 ORANGE

7.3.7 MANGO

7.3.8 BLUEBERRY

7.3.9 BLACKBERRY

7.3.10 GRAPEFRUIT

7.3.11 CHERRY

7.3.12 PEACH

7.3.13 BANANA

7.3.14 BLACKCURRANT

7.3.15 CRANBERRY

7.3.16 TANGERINE

7.3.17 OTHERS

8 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET, BY PRICE CATEGORY

8.1 OVERVIEW

8.2 STANDARD

8.3 PREMIUM

8.4 SUPER PREMIUM

9 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET, BY BRAND CATEGORY

9.1 OVERVIEW

9.2 BRANDED

9.3 PRIVATE LABEL

10 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET, BY PACKAGING TYPE

11.1 OVERVIEW

11.2 POUCHES

11.3 PLASTIC WRAP

11.4 SACHETS

11.5 BOX

11.6 OTHERS

12 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 CHILDREN (0-18)

12.3 YOUTH (18-35)

12.4 MIDDLE AGE (36-45)

12.5 SENIOR (45+ YEARS)

13 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE-BASED RETAILING

13.2.1 SUPERMARKETS/HYPERMARKETS

13.2.2 CONVENIENCE STORES

13.2.3 SPECIALTY STORES

13.2.4 OTHERS

13.3 NON-STORE BASED RETAILING

13.3.1 E-COMMERCE

13.3.2 COMPANY-OWNED

14 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET, BY REGION

14.1 NORTH AMERICA

15 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 HARIBO GMBH & CO. KG

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 FERRARA CANDY COMPANY

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 THE HERSHEY COMPANY

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 PERFETTI VAN MELLE

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 NESTLÉ

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AMOS SWEETS INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 BIOGLAN

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 CHEWWIES

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 DAMEL GROUP SL

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATES

17.1 HERO NUTRITIONALS, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 JELLY BELLY CANDY COMPANY

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATES

17.12 LOTTE WELLFOOD CO.,LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

17.13 MARS INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 MONDELĒZ INTERNATIONAL.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 NATURE’S WAY BRANDS, LLC.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATES

17.16 NUTRIBURSTINDIA

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 NATURE'S BOUNTY

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 SAMBUCOL

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 STARPOWA

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 THE CANDY PLUS SWEET FACTORY S.R.O

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 TRACE

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 VITABIOTICS LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT UPDATES

17.23 VITAWEST NUTRACEUTICALS

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 ITAWELL

17.24.1 COMPANY SNAPSHOT

17.24.2 24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 WEIDER

17.25.1 COMPANY SNAPSHOT

17.25.2 25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 YUMI NUTRITION

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 3 NORTH AMERICA GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 4 NORTH AMERICA GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA CANNABIS IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY CBD CONTENT PER GUMMY, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET, BY PRICE CATEGORY, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA STANDARD IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA PREMIUM IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA SUPER-PREMIUM IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION

TABLE 17 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY BRAND CATEGORY, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA BRANDED IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA PRIVATE LABEL IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA CONVENTIONAL IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA ORGANIC IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA POUCHES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA PLASTIC WRAP IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA SACHETS IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA BOX IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA CHILDREN (0-18) IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA YOUTH (18-35) IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA MIDDLE AGE (36-45) IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA SENIOR (45+ YEARS) IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA STORE-BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA STORE-BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA NON-STORE BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA NON-STORE BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA CANNABIS IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY CBD CONTENT PER GUMMY, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY PRICE CATEGORY, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY BRAND CATEGORY, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA STORE-BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA NON-STORE BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 U.S. FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 U.S. GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 U.S. CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 60 U.S. CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 61 U.S. FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 U.S. CANNABIS IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY CBD CONTENT PER GUMMY, 2018-2032 (USD MILLION)

TABLE 63 U.S. FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 64 U.S. JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 65 U.S. JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 66 U.S. FUNCTIONAL GUMMIES & JELLIES MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 67 U.S. FUNCTIONAL GUMMIES & JELLIES MARKET, BY PRICE CATEGORY, 2018-2032 (USD MILLION)

TABLE 68 U.S. FUNCTIONAL GUMMIES & JELLIES MARKET, BY BRAND CATEGORY, 2018-2032 (USD MILLION)

TABLE 69 U.S. FUNCTIONAL GUMMIES & JELLIES MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 70 U.S. FUNCTIONAL GUMMIES & JELLIES MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 71 U.S. FUNCTIONAL GUMMIES & JELLIES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 72 U.S. STORE-BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 73 U.S. NON-STORE BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 74 CANADA FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 CANADA GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 CANADA CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 77 CANADA CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 78 CANADA FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 CANADA CANNABIS IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY CBD CONTENT PER GUMMY, 2018-2032 (USD MILLION)

TABLE 80 CANADA FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 81 CANADA JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 82 CANADA JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 83 CANADA FUNCTIONAL GUMMIES & JELLIES MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 84 CANADA FUNCTIONAL GUMMIES & JELLIES MARKET, BY PRICE CATEGORY, 2018-2032 (USD MILLION)

TABLE 85 CANADA FUNCTIONAL GUMMIES & JELLIES MARKET, BY BRAND CATEGORY, 2018-2032 (USD MILLION)

TABLE 86 CANADA FUNCTIONAL GUMMIES & JELLIES MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 87 CANADA FUNCTIONAL GUMMIES & JELLIES MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 88 CANADA FUNCTIONAL GUMMIES & JELLIES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 89 CANADA STORE-BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 CANADA NON-STORE BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 91 MEXICO FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 92 MEXICO GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 93 MEXICO CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 94 MEXICO CANDY GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 95 MEXICO FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 96 MEXICO CANNABIS IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY CBD CONTENT PER GUMMY, 2018-2032 (USD MILLION)

TABLE 97 MEXICO FORTIFIED GUMMIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 98 MEXICO JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 99 MEXICO JELLIES IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 100 MEXICO FUNCTIONAL GUMMIES & JELLIES MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 101 MEXICO FUNCTIONAL GUMMIES & JELLIES MARKET, BY PRICE CATEGORY, 2018-2032 (USD MILLION)

TABLE 102 MEXICO FUNCTIONAL GUMMIES & JELLIES MARKET, BY BRAND CATEGORY, 2018-2032 (USD MILLION)

TABLE 103 MEXICO FUNCTIONAL GUMMIES & JELLIES MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 104 MEXICO FUNCTIONAL GUMMIES & JELLIES MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 105 MEXICO FUNCTIONAL GUMMIES & JELLIES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 106 MEXICO STORE-BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 107 MEXICO NON-STORE BASED RETAILING IN FUNCTIONAL GUMMIES & JELLIES MARKET, BY TYPE, 2018-2032 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 TWO SEGMENTS COMPRISE THE NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET, BY TYPE

FIGURE 13 SHIFTING FOCUS TOWARDS PREVENTIVE HEALTH AND WELLNESS THE GROWTH OF THE NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET FROM 2025 TO 2032

FIGURE 14 THE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET IN 2025 AND 2032

FIGURE 15 PORTER’S FIVE FORCES

FIGURE 16 SUPPLY CHAIN ANALYSIS- NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET

FIGURE 17 VALUE CHAIN ANALYSIS FOR FUNCTIONAL GUMMIES AND JELLIES MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET

FIGURE 19 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY TYPE, 2024

FIGURE 20 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY TYPE, 2025-2032 (USD MILLION)

FIGURE 21 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 22 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PRICE CATEGORY, 2024

FIGURE 24 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PRICE CATEGORY, 2025-2032 (USD MILLION)

FIGURE 25 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PRICE CATEGORY, CAGR (2025-2032)

FIGURE 26 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PRICE CATEGORY, LIFELINE CURVE

FIGURE 27 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PRICE CATEGORY, 2024

FIGURE 28 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PRICE CATEGORY, 2025-2032 (USD MILLION)

FIGURE 29 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PRICE CATEGORY, CAGR (2025-2032)

FIGURE 30 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PRICE CATEGORY, LIFELINE CURVE

FIGURE 31 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY NATURE, 2024

FIGURE 32 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY NATURE, 2025-2032 (USD MILLION)

FIGURE 33 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY NATURE, CAGR (2025-2032)

FIGURE 34 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY NATURE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PACKAGING TYPE, 2024

FIGURE 36 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PACKAGING TYPE, 2025-2032 (USD MILLION)

FIGURE 37 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PACKAGING TYPE, CAGR (2025-2032)

FIGURE 38 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: BY PACKAGING TYPE, LIFELINE CURVE

FIGURE 39 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY AGE GROUP, 2024

FIGURE 40 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY AGE GROUP, 2025-2032 (USD MILLION)

FIGURE 41 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 42 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 43 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 44 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 45 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 46 NORTH AMERICA FUNCTIONAL GUMMIES & JELLIES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 47 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: SNAPSHOT (2024)

FIGURE 48 NORTH AMERICA FUNCTIONAL GUMMIES AND JELLIES MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。