North America Insulin Market For Type 1 And Type 2 Diabetes Market

市场规模(十亿美元)

CAGR :

%

USD

8.38 Billion

USD

10.58 Billion

2024

2032

USD

8.38 Billion

USD

10.58 Billion

2024

2032

| 2025 –2032 | |

| USD 8.38 Billion | |

| USD 10.58 Billion | |

|

|

|

|

北美 1 型和 2 型糖尿病胰島素市場細分、類型(2 型糖尿病和 1型糖尿病)、產品類型(長效胰島素、速效胰島素、短效胰島素等)、吸收部位(基礎、快速注射等)、年齡組(成人患者、老年患者和兒童患者)、來源(胰島素類似物、人類胰島素等)、給藥方式(胰島素筆、胰島素瓶和注射器、胰島素泵、吸入式胰島素和植入式胰島素輸送系統)、性別(男性和女性商店)、零售藥局和藥店(零售藥局和藥局商店2032 年)

1 型和第 2 型糖尿病胰島素市場規模

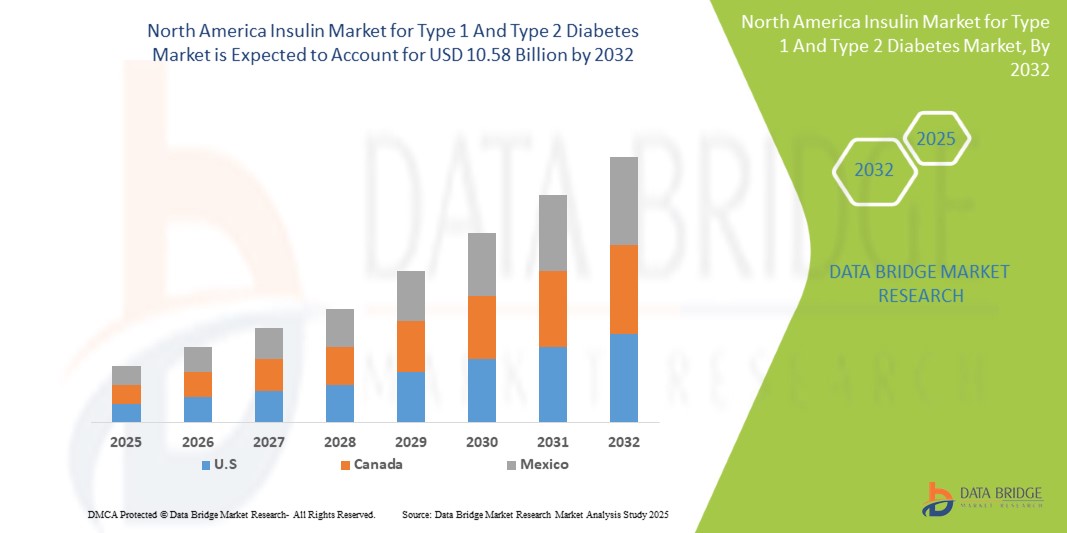

- 2024 年,北美 1 型和 2 型糖尿病胰島素市值為83.8 億美元 ,預計到 2032 年將達到105.8億美元

- 在 2025 年至 2032 年的預測期內,市場可能以3.0% 的複合年增長率成長,主要受預期推出的療法的推動

- 這一增長受到許多因素的推動,例如糖尿病(尤其是第1型和第2型糖尿病)的盛行率不斷上升,從而推動了胰島素的需求。此外,胰島素輸送系統的進步以及個人化糖尿病照護的日益普及

1 型和第 2 型糖尿病胰島素市場分析

- 第1型糖尿病是一種自體免疫疾病,人體免疫系統會攻擊並破壞胰臟中產生胰島素的β細胞,導致胰島素缺乏。 2型糖尿病是指人體對胰島素產生抗性或無法產生足夠的胰島素。胰島素治療可用於調節這兩種疾病的血糖水平,改善血糖控制,並預防心血管疾病、腎衰竭和神經損傷等併發症。

- 1 型糖尿病 (T1D) 通常在兒童或青少年時期診斷出來,由於胰臟幾乎不分泌胰島素,需要終生胰島素治療。它是一種自體免疫疾病,免疫系統會錯誤地攻擊產生胰島素的 β 細胞。 2 型糖尿病 (T2D) 更為常見,主要發生在成年人中,但由於肥胖率上升,兒童中也越來越多地出現這種疾病。 2 型糖尿病的特徵是胰島素阻抗,即身體無法有效利用胰島素。隨著時間的推移,胰臟無法產生足夠的胰島素來維持正常的血糖水平。這兩種類型的糖尿病都需要定期監測和胰島素治療,以有效控制血糖值。胰島素治療有助於預防視網膜病變、神經病變和心血管疾病等長期併發症,進而改善患者的整體生活品質。

- 美國憑藉其先進的醫療基礎設施和創新胰島素輸送技術的高度採用,成為 1 型和 2 型糖尿病胰島素市場的主導地區之一

- 例如,美國繼續在胰島素幫浦和持續血糖監測系統的使用方面處於領先地位,從而能夠更好地管理糖尿病

- 隨著對糖尿病治療和以患者為中心的解決方案的日益關注,該地區推動了胰島素治療的重大進步,為北美市場的成長做出了巨大貢獻。

報告範圍和1 型和 2 型糖尿病胰島素市場 細分

|

屬性 |

1 型與第 2 型糖尿病胰島素市場 關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

1 型和第 2 型糖尿病胰島素市場趨勢

“智慧胰島素輸送系統的普及率不斷提高”

- 北美 1 型和 2 型糖尿病胰島素市場的一個突出趨勢是智慧胰島素輸送系統的採用率不斷提高

- 這些先進的設備透過提供即時監測和根據血糖水平調整胰島素劑量來增強糖尿病管理,從而提高治療的精確度和整體治療效果

- 例如,與連續血糖監測(CGM) 系統整合的胰島素幫浦可以自動輸送胰島素,並根據即時數據調整劑量,這有助於在最少的人工幹預下保持最佳血糖控制

- 數位平台還促進了無縫數據跟踪,使患者和醫療保健提供者能夠監測趨勢、改進治療計劃並預防併發症

- 這一趨勢正在改變糖尿病護理,促進更好的患者依從性和治療結果,並推動市場對先進胰島素輸送技術的需求

1 型與第 2 型糖尿病胰島素市場市場動態

司機

“糖尿病盛行率上升”

- 糖尿病患者數量的不斷增長,帶來了對有效胰島素療法的巨大需求,進而推動了北美胰島素市場的成長。久坐的生活方式、不健康的飲食和人口老化等因素加劇了這一趨勢,導致需要糖尿病管理解決方案的患者群體不斷擴大。

- 胰島素產品需求的不斷增長刺激了製藥公司之間的創新和競爭,從而推動了新劑型和給藥方式的開發。這種充滿活力的環境支持現有療法,並鼓勵引入價格合理的生物相似藥和改進技術,進一步擴大了市場機會。

例如,

- 根據世界衛生組織的數據,到2024年,糖尿病患者人數將從1990年的2億增加到2022年的8.3億。低收入和中等收入國家的增幅大於高收入國家。 2021年,糖尿病導致超過200萬人死亡,並伴隨腎衰竭和心臟病等嚴重併發症。

- 2024年3月,NCBI數據顯示,糖尿病盛行率顯著上升,2021年全球成年人口達5.37億,佔總人口的10.5%。預計到2030年,這一數字將上升至6.43億(佔總人口的11.3%)。 2021年,與糖尿病相關的醫療保健費用為9,660億美元,預計到2045年將超過10,540億美元。

- 北美糖尿病盛行率的上升,推動了對創新便捷療法的需求,這些療法可以顯著改善患者的生活品質並提高治療依從性。儘管生物利用度和生產成本的挑戰依然存在,但市場潛力巨大,為1型和2型糖尿病的管理提供了一個有前景的解決方案。

機會

“胰島素製劑和傳輸技術的進步”

- 胰島素藥物製劑的進步,包括奈米顆粒載體、黏膜黏附劑和pH敏感塗層,顯著提高了口服胰島素的生物利用度,使其成為傳統注射劑的可行替代方案。胰島素類似物和智慧給藥系統等創新技術增強了吸收,並實現了即時血糖監測。這些突破性進展解決了患者依從性問題,尤其是在糖尿病盛行率不斷上升的新興市場,為口服胰島素市場創造了巨大的成長機會。

例如,

- NCBI 2020 年 7 月的一篇文章強調,迫切需要創新療法來應對日益加重的糖尿病負擔。關鍵需求包括提高患者對治療方案的依從性、降低醫療成本,以及提供有效的非侵入性糖尿病管理解決方案。口服胰島素和智慧給藥系統等技術進步為應對這些挑戰並改善患者預後提供了充滿希望的機會。

- 2024年8月,MDPI報告稱,奈米顆粒和脂質體等藥物傳遞系統的進展可提高口服胰島素的生物利用度。這些創新透過提供非侵入性、有效的治療方法,為改善糖尿病管理提供了重要機會。隨著北美糖尿病發病率的上升,這些進展滿足了人們對以患者為中心的解決方案日益增長的需求,而藥物輸送系統的進展則滿足了人們對更便捷、更以患者為中心的治療的需求。

- 藥物配方和技術的不斷進步正在改變口服胰島素的格局,為更好地管理糖尿病提供了重大機會。生物利用度提升、新型藥物輸送系統以及數位健康工具的整合,為口服胰島素成為注射療法的可靠、非侵入性替代方案奠定了基礎。隨著北美糖尿病疫情持續蔓延,這些技術創新不僅提高了患者的依從性,也實現了更有效率、更個人化的糖尿病管理,最終改善了生活品質。

克制/挑戰

“高劑量胰島素的不良反應”

- 高劑量的胰島素會導致嚴重的副作用,如低血糖、體重增加和潛在的心血管問題,這可能會阻止患者和醫療保健提供者接受胰島素治療

- 因此,對這些併發症的擔憂可能會導致處方實踐中更加謹慎,最終阻礙北美 1 型和 2 型糖尿病胰島素市場的擴張,因為患者越來越多地轉向替代治療或管理策略

例如,

- 2023年7月,NCBI指出低血糖是胰島素治療最常見的不良反應。胰島素治療的其他不良反應包括體重增加和罕見的電解質紊亂,例如低血鉀,尤其是與其他導致低血鉀的藥物合併使用時。此外,注射部位疼痛和注射部位脂肪營養障礙是每日皮下注射最常見的不良反應。

- 此外,對高劑量不良反應的擔憂可能會導致住院治療或需要額外藥物來控制副作用,從而增加醫療費用。這種經濟負擔可能會限制胰島素治療的可近性,尤其是在醫療資源有限的發展中地區,這進一步加劇了北美胰島素市場的低迷。提高對這些風險的認識和教育至關重要,但這也凸顯了市場在鼓勵廣泛遵循胰島素治療方案方面所面臨的挑戰。

北美第 1 型和第 2 型糖尿病胰島素市場市場範圍

市場根據基礎類型、產品類型、吸收部位、年齡層、來源、交付方式、性別和分銷管道進行細分。

|

分割 |

細分 |

|

按類型 |

|

|

依產品類型 |

|

|

按吸收部位 |

|

|

按年齡組

|

|

|

按來源 |

|

|

按交付方式 |

|

|

按性別

|

|

|

按分銷管道

|

|

1 型和第 2 型糖尿病胰島素市場區域分析

“北美是1型和2型糖尿病胰島素市場的主導國家”

- 美國在第 1 型和第 2 型糖尿病的胰島素市場佔據主導地位,這得益於先進的醫療基礎設施、創新胰島素療法的廣泛採用以及領先製藥公司的強大影響力

- 由於糖尿病盛行率不斷上升、對先進胰島素輸送系統的需求增加以及糖尿病管理技術的不斷創新,美國佔據了相當大的份額

- 完善的醫療保健政策和強大的報銷結構,以及頂級胰島素製造商對研發的大量投資,進一步增強了市場。

- 此外,對個人化糖尿病護理的日益關注,以及胰島素幫浦和連續血糖監測 (CGM) 系統的採用率的提高,正在推動整個地區的市場擴張

“美國預計將實現最高成長率”

- 美國預計將見證1 型和 2 型糖尿病胰島素市場的最高增長率,這得益於醫療保健基礎設施的快速改善、糖尿病管理意識的提高以及先進胰島素療法的採用率的提高

- 由於人口老化加劇,美國和加拿大等國家更容易罹患糖尿病相關併發症,因此正成為主要市場

- 美國擁有先進的醫療保健體系和日益壯大的糖尿病專家隊伍,仍是胰島素治療的重要市場。該國在胰島素幫浦和持續血糖監測 (CGM) 系統等創新型胰島素輸送設備的採用方面繼續保持領先地位。

- 美國和加拿大糖尿病患者數量龐大,糖尿病相關併發症的發生率也不斷上升,政府和私營部門對現代糖尿病護理解決方案的投資正在增加。北美胰島素製造商的擴張以及先進糖尿病治療方案的可及性不斷提高,進一步促進了市場的成長。

1 型和第 2 型糖尿病胰島素市場份額

市場競爭格局按競爭對手提供詳細資料。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、區域佈局、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據點僅與公司在市場中的重點相關。

市場中主要的市場領導者有:

- 諾和諾德公司(丹麥)

- 禮來公司(美國)

- 賽諾菲(法國)

- Biocon(印度)

- 魯冰花(印度)

- 上海復星萬邦(江蘇)醫藥集團有限公司 (中國)

- Diasome Pharmaceuticals, Inc.(美國)

- SciGen Pte. Ltd.(新加坡)

- 沃克哈特(印度)

- MJ Biopharma Pvt. Ltd.(印度)

- Oramed Pharmaceuticals(美國)

- Adocia(法國)

- Nektar Therapeutics(美國)

北美1型和第2型糖尿病胰島素市場的最新發展

- 2024年9月,諾和諾德宣佈建立新的合作關係,在南非建立人體胰島素生產基地,進一步加強對非洲糖尿病照護的承諾。目前,該計畫已涵蓋撒哈拉以南非洲地區的50萬人,旨在擴大胰島素的可及性,目標是到2026年為整個非洲大陸410萬1型和2型糖尿病患者提供胰島素。

- 今年8月,禮來公司公佈了SURMOUNT-1研究的正面結果,結果顯示每週服用tirzepatide(Zepbound/Mounjaro)可將患有糖尿病前期和肥胖或超重的成年人患2型糖尿病的風險降低94%。 15毫克劑量組在176週內平均體重減輕了22.9%,證明了其持續療效。

- 2022年12月,賽諾菲擴大了與Innate Pharma的合作,專注於腫瘤學領域的自然殺手(NK)細胞銜接劑。賽諾菲從Innate的ANKET平台獲得了靶向B7H3的NK細胞銜接劑計畫的許可,並可選擇添加兩個靶點。此次合作旨在開發新的癌症療法,包括實體瘤療法,從而增強賽諾菲的免疫腫瘤學產品線。預計此次合作將提供具有高安全性的創新癌症治療方案,並透過為多種癌症類型提供潛在療法,使患者受益。賽諾菲將負責進一步的開發、生產和商業化。

- 2024年12月,魯賓公司從禮來公司收購了Huminsulin,以增強糖尿病產品組合。此次收購旨在擴大糖尿病產品組合,並為患者提供高品質、負擔得起的醫療保健服務。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 COMPETITIVE INTELLIGENCE

4.4 NORTH AMERICA AND REGIONAL PREVALENCE:

4.5 INDUSTRY INSIGHTS

4.6 KEY MARKETING STRATEGIES FOR THE NORTH AMERICA INSULIN MARKET TYPE 1 & TYPE 2 DIABETES

4.7 MARKETED DRUG ANALYSIS

5 PIPELINE ANALYSIS

6 REGULATORY FRAMEWORK

6.1 REGULATORY FRAMEWORK FOR THE ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.1.1 REGULATORY APPROVAL PROCESS

6.1.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.1.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.1.4 LICENSING AND REGISTRATION

6.1.5 POST-MARKETING SURVEILLANCE

6.1.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.2 REGULATORY FRAMEWORK FOR THE NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.2.1 REGULATORY APPROVAL PROCESS

6.2.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.2.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.2.4 LICENSING AND REGISTRATION

6.2.5 POST-MARKETING SURVEILLANCE

6.2.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.3 REGULATORY FRAMEWORK FOR THE SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.3.1 REGULATORY APPROVAL PROCESS

6.3.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.3.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.3.4 LICENSING AND REGISTRATION

6.3.5 POST-MARKETING SURVEILLANCE

6.3.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.4 REGULATORY FRAMEWORK FOR THE EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.4.1 REGULATORY APPROVAL PROCESS

6.4.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.4.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.4.4 LICENSING AND REGISTRATION

6.4.5 POST-MARKETING SURVEILLANCE

6.4.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.5 REGULATORY FRAMEWORK FOR THE MIDDLE EAST & AFRICA (MEA) INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.5.1 REGULATORY APPROVAL PROCESS

6.5.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.5.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.5.4 LICENSING AND REGISTRATION

6.5.5 POST-MARKETING SURVEILLANCE

6.5.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF DIABETES

7.1.2 GROWING ADOPTION OF INSULIN THERAPIES FOR TYPE 1 AND TYPE 2 DIABETES

7.1.3 INTEGRATION OF AUTOMATED INSULIN DELIVERY (AID)

7.1.4 INCREASING TECHNOLOGICAL INNOVATIONS FOR INSULIN

7.2 RESTRAINTS

7.2.1 ADVERSE EFFECTS OF HIGH DOSAGE OF INSULIN

7.2.2 HIGH PRODUCTION AND DEVELOPMENT COSTS ASSOCIATED WITH INSULIN

7.3 OPPORTUNITIES

7.3.1 ADVANCEMENTS IN INSULIN FORMULATION AND DELIVERY TECHNOLOGIES

7.3.2 REVOLUTIONIZING DIABETES MANAGEMENT WITH NEEDLE-FREE INSULIN

7.3.3 INCREASING PHARMACEUTICAL INVESTMENTS AND STRATEGIC COLLABORATIONS

7.4 CHALLENGES

7.4.1 INSULIN ACCESSIBILITY CHALLENGES IN RURAL AND UNDERSERVED REGIONS

7.4.2 LIMITED SHELF LIFE ASSOCIATED WITH ORAL INSULIN

8 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE

8.1 OVERVIEW

8.2 TYPE 2 DIABETES

8.3 TYPE 1 DIABETES

9 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE

9.1 OVERVIEW

9.2 ANALOG INSULIN

9.3 HUMAN INSULIN

9.4 OTHERS

10 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 LONG ACTING INSULIN

10.3 RAPID-ACTING INSULIN

10.4 SHORT ACTING INSULIN

10.5 OTHERS

11 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER

11.1 OVERVIEW

11.2 MALE

11.3 FEMALE

12 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD

12.1 OVERVIEW

12.2 INSULIN PENS

12.3 VIAL & SYRINGE

12.4 INSULIN PUMPS

12.5 INHALABLE INSULIN

12.6 IMPLANTABLE INSULIN DELIVERY SYSTEMS

13 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULT PATIENTS

13.3 GERIATRIC PATIENTS

13.4 PEDIATRIC PATIENTS

14 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE

14.1 OVERVIEW

14.2 BASAL

14.3 BOLUS

14.4 OTHERS

15 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL PHARMACIES

15.3 HOSPITAL PHARMACIES

15.4 ONLINE PHARMACIES

15.5 DIABETES CLINICS & SPECIALTY PHARMACIES

16 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 NOVO NORDISK A/S

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 SWOT ANALYSIS

19.1.5 PIPELINE PORTFOLIO

19.1.6 RECENT DEVELOPMENT/ NEWS

19.2 LILLY

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 SWOT ANALYSIS

19.2.5 PRODUCT PORTFOLIO

19.2.6 RECENT DEVELOPMENT

19.3 SANOFI

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 SWOT ANALYSIS

19.3.5 PRODUCT PORTFOLIO

19.3.6 RECENT DEVELOPMENT

19.4 BIOCON

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 SWOT ANALYSIS

19.4.5 PIPELINE PRODUCT PORTFOLIO

19.4.6 RECENT DEVELOPMENT

19.5 LUPIN

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 SWOT ANALYSIS

19.5.5 PRODUCT PORTFOLIO

19.5.6 RECENT DEVELOPMENT

19.6 ADOCIA

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 SWOT ANALYSIS

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENT

19.7 DIASOME PHARMACEUTICALS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 SWOT ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 MJ BIOPHARM PVT LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 SWOT ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 NEKTAR

19.9.1 COMPANY SNAPSHOT

19.9.2 SWOT ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT NEWS

19.1 ORAMED

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 SWOT ANALYSIS

19.10.4 PIPELINE PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENT

19.11 SCIGEN PTE. LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 SWOT ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 SHANGHAI FOSUN PHARMACEUTICAL(GROUP)CO., LTD.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 SWOT ANALYSIS

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENT

19.13 WOCKHARDT

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 SWOT ANALYSIS

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENT

20 QUESTIONNAIRE

表格列表

TABLE 1 THE TOP 10 COUNTRIES BY THE NUMBER OF ADULTS WITH DIABETES IN 2021

TABLE 2 DISTRIBUTION OF EXPENDITURE ACROSS REGIONS:

TABLE 3 NUMBER OF ADULTS WITH DIABETES IS EXPECTED TO INCREASE SIGNIFICANTLY IN SEVERAL COUNTRIES:

TABLE 4 REGIONAL DIABETES STATISTICS: PREVALENCE, TREATMENT, AND OUTCOMES

TABLE 5 NORTH AMERICA CLINICAL TRIAL MARKET FOR ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 6 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE NORTH AMERICA ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 7 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE NORTH AMERICA ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 8 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA TYPE 2 DIABETES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA TYPE 1 DIABETES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA ANALOG INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA HUMAN INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA LONG ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA RAPID-ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA SHORT ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA MALE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA FEMALE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA INSULIN PENS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA VIAL & SYRINGE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA INSULIN PUMPS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA INHALABLE INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA IMPLANTABLE INSULIN DELIVERY SYSTEMS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA ADULT PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA GERIATRIC PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA PEDIATRIC PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA BASAL IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA BOLUS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA RETAIL PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA HOSPITAL PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA ONLINE PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA DIABETES CLINICS & SPECIALTY PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 70 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SEGMENTATION

FIGURE 2 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SEGMENTATION

FIGURE 10 TWO SEGMENTS COMPRISE THE NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE

FIGURE 11 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING PREVALENCE OF DIABETES IS EXPECTED TO DRIVE THE NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 TYPE 2 DIABETES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 15 TOP 10 COUNTRIES BY THE NUMBER OF ADULTS WITH DIABETES IN 2021

FIGURE 16 NORTH AMERICA HEALTHCARE EXPENDITURE FOR DIABETES

FIGURE 17 NUMBER OF PEOPLE WITH DIABETES IN 2045 (MILLIONS)

FIGURE 18 DROC ANALYSIS

FIGURE 19 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, 2024

FIGURE 20 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 21 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, CAGR (2025-2032)

FIGURE 22 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, 2024

FIGURE 24 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, CAGR (2025-2032)

FIGURE 26 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, 2024

FIGURE 28 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 30 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, 2024

FIGURE 32 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 33 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, CAGR (2025-2032)

FIGURE 34 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, 2024

FIGURE 36 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, CAGR (2025-2032)

FIGURE 38 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, LIFELINE CURVE

FIGURE 39 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, 2024

FIGURE 40 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, 2025 TO 2032 (USD THOUSAND)

FIGURE 41 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, CAGR (2025-2032)

FIGURE 42 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, LIFELINE CURVE

FIGURE 43 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, 2024

FIGURE 44 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, 2025 TO 2032 (USD THOUSAND)

FIGURE 45 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, CAGR (2025-2032)

FIGURE 46 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, LIFELINE CURVE

FIGURE 47 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, 2024

FIGURE 48 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 49 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 50 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 51 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SNAPSHOT (2024)

FIGURE 52 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。