North America Intumescent Coatings For Fireproofing And Spray

市场规模(十亿美元)

CAGR :

%

USD

454.95 Million

USD

667.07 Million

2025

2033

USD

454.95 Million

USD

667.07 Million

2025

2033

| 2026 –2033 | |

| USD 454.95 Million | |

| USD 667.07 Million | |

|

|

|

|

North America Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Segmentation, By Product Type (Intumescent Coatings for Fire Proofing and Spray Applied Fire Resistive Materials), Type (Thick-Film and Thin-Film), Resin (Epoxy, Acrylic, Alkyd, Polyurethane, and Others), Substrate (Structural Cast Iron and Cast Iron, Wood, Composite Elements, and Others), Technology (Epoxy Based, Water Based, Solvent Based, and Powder Based), Application (Hydrocarbon and Cellulosic), End-User (Building and Constructions, Oil and Gas, Industrial, Automotive, Aerospace, and Others) - Industry Trends and Forecast to 2033

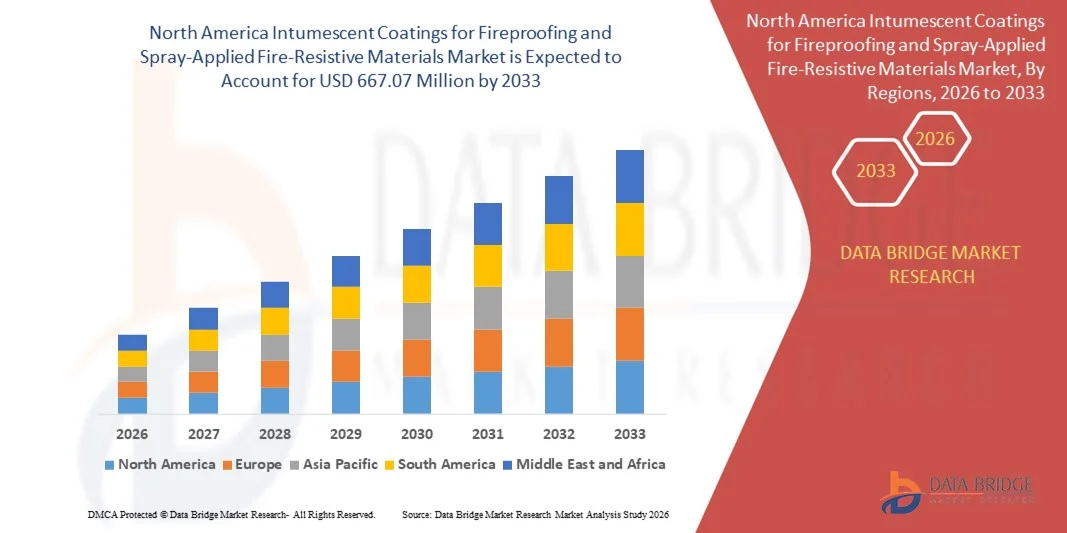

What is the North America Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Size and Growth Rate?

- The North America intumescent coatings for fireproofing and spray-applied fire-resistive materials market size was valued at USD 454.95 million in 2025 and is expected to reach USD 667.07 million by 2033, at a CAGR of 4.90% during the forecast period

- The market growth is largely fueled by rising infrastructure development and stringent fire safety regulations across residential, commercial, and industrial sectors, driving the demand for passive fire protection solutions such as intumescent coatings and spray-applied fire-resistive materials

- Furthermore, increasing awareness of structural fire safety, combined with advancements in water-based and eco-friendly coating technologies, is accelerating the adoption of these materials in construction and manufacturing, thereby significantly boosting the market’s expansion

What are the Major Takeaways of Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market?

- Intumescent coatings and spray-applied fire-resistive materials are passive fire protection solutions applied to structural elements to enhance fire resistance by forming an insulating char layer when exposed to high temperatures, helping maintain structural integrity during fire events

- Growing implementation of fire safety codes, especially in high-rise buildings, oil & gas facilities, and public infrastructure, coupled with increasing use of steel and composite materials in construction, is propelling the demand for these coatings globally

- U.S. dominated the North America intumescent coatings for fireproofing and spray-applied fire-resistive materials market with an estimated 58.2% revenue share in 2025, driven by strong demand across commercial construction, industrial facilities, oil & gas infrastructure, power generation, and transportation projects

- Canada is projected to register the fastest CAGR of 11.02% during the forecast period, driven by increasing infrastructure development, rising commercial construction, and strict enforcement of fire safety regulations across public and private buildings

- The intumescent coatings for fireproofing segment accounted for the largest market share in 2024 due to its superior aesthetics, ease of application, and ability to provide passive fire protection without compromising the visual appearance of structures

Report Scope and Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Segmentation

|

Attributes |

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market?

Increasing Fire Safety Regulations

- Rising fire safety regulations worldwide are a principal driver for growth in intumescent coatings and spray-applied fire-resistive materials (SFRMs). New building codes for high-rises, industrial structures, and public infrastructure increasingly mandate the use of advanced passive fire protection, spurring demand in both new construction and refurbishment projects

- For instance, regulatory regimes in Asia-Pacific, such as recent high-rise fire codes in China and India, now require thin-film intumescent coatings for towers above 24m, making third-party certification and compliance a prerequisite for market access. The push for low-VOC formulations and sustainability in the EU has further accelerated the shift from traditional materials to modern, environment-friendly intumescent coatings

- Fire safety authorities, such as the National Fire Protection Association (NFPA) in the U.S., have documented a persistent rise in fire incidents, adding urgency to the implementation of stricter fire safety standards and inspection regimes for commercial, industrial, and residential buildings

- The advancement of intumescent coatings—such as nano-enhanced, graphene-infused, and water-based formulations—enables higher fire resistance with thinner layers, supporting modern architectural designs and compliance with evolving codes

- Sustainability goals, including the use of bio-based resins and recyclable fireproofing systems, are shaping product innovation as environmental impact becomes a factor in regulatory frameworks and developer decisions

- Hybrid solutions that blend passive coatings with active monitoring (IoT sensors, smart coatings) are emerging, ensuring maintenance and performance tracking throughout the building lifecycle

What are the Key Drivers of Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market?

- The increasing frequency and severity of wildfires worldwide are visibly accelerating investments in fireproofing solutions. Wildland-urban interface (WUI) areas, critical infrastructure, and industrial facilities in at-risk regions are prioritizing advanced fire-resistive materials to protect assets and meet insurance and regulatory mandates

- For instance, after record-breaking wildfires in the western U.S. and Australia, both government and private sector operators have increased fireproofing budgets, specifying intumescent coatings and SFRMs for perimeter structures, emergency response facilities, and transportation infrastructure to minimize loss and damage

- Technological innovations—such as AI-powered risk modeling, drone-based inspections, and real-time detection—play a key role in targeting and optimizing fireproofing investments in high-risk zones

- Fireproofing is now recognized as a necessary requirement for new construction and also for retrofitting existing buildings, especially where fire events have created pressure for more robust disaster resilience and preparedness strategies

- Policy incentives, stricter insurance coverage requirements, and funding for disaster mitigation are further fueling the market's expansion beyond traditional industrial sectors

Which Factor is Challenging the Growth of the Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market?

- Despite the advantages of intumescent coatings and SFRMs—including lighter weight, aesthetic flexibility, and superior performance for complex steel structures—traditional fireproofing materials such as cementitious sprays and mineral-fiber boards continue to pose significant competition, especially in price-sensitive and industrial-scale applications

- For instance, cementitious fireproofing is often preferred for large structural steel projects due to its lower upfront cost, ease of bulk application, and well-established regulatory acceptance—even though it can be bulky and may compromise space or design elegance

- Intumescent coatings typically require more specialized application techniques and can carry higher initial costs, which can deter adoption among budget-constrained projects or regions with less rigorous fire safety codes

- The established supply chains, contractor familiarity, and legacy specifications tied to traditional products make it challenging for newer formulations to gain rapid acceptance in conservative construction markets

- In some industrial and commercial settings, maintenance and environmental exposure concerns (such as humidity or impact damage) may tip the scales in favor of older, more robust—if less elegant—fireproofing solutions, despite innovation in intumescent technology. Addressing price sensitivity and improving awareness of lifecycle benefits remain key for advancing intumescent and spray-applied material adoption over legacy alternatives

How is the Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Segmented?

The market is segmented on the basis of product type, type, resin, substrate, technology, application, and end-user.

- By Product Type

On the basis of product type, the market is segmented into intumescent coatings for fireproofing and spray-applied fire-resistive materials. The intumescent coatings for fireproofing segment accounted for the largest market share in 2024 due to its superior aesthetics, ease of application, and ability to provide passive fire protection without compromising the visual appearance of structures. Widely preferred in commercial and high-rise buildings, these coatings expand under heat to form a char layer that insulates the underlying material, thereby delaying structural collapse during a fire. Their growing use in steel-framed constructions and increasing regulatory compliance regarding fire safety standards are driving segment dominance.

The spray-applied fire-resistive materials (SFRM) segment is projected to witness the fastest growth from 2025 to 2032, spurred by its cost-effectiveness and extensive application in industrial and large-scale infrastructure projects. SFRMs are preferred for their quick installation and strong thermal insulation properties, especially in settings where fire protection must cover complex geometries or wide surface areas. Their growing use in retrofitting older buildings and in oil & gas facilities enhances their growth outlook.

- By Type

On the basis of type, the market is segmented into thick-film and thin-film coatings. The thick-film segment led the market with the highest revenue share in 2024, driven by its widespread application in hydrocarbon fire protection, particularly in high-risk environments such as petrochemical and energy plants. Thick-film coatings offer higher durability, superior thermal insulation, and longer fire-resistance duration, making them a critical choice for heavy-duty infrastructure.

The thin-film segment is expected to exhibit the fastest growth from 2025 to 2032, primarily due to its rising adoption in architectural applications where aesthetics are paramount. Thin-film coatings are favored in commercial buildings and offices for their smooth finish, low weight, and reliable performance under cellulosic fire conditions. Their compatibility with decorative topcoats and lower application thickness contribute to their growing preference among architects and contractors.

- By Resin

On the basis of resin type, the market is segmented into epoxy, acrylic, alkyd, polyurethane, and others. The epoxy segment held the largest market share of 59% in 2024 owing to its exceptional adhesion, corrosion resistance, and mechanical strength. Epoxy-based fireproof coatings are extensively used in oil & gas, marine, and industrial sectors where durability and chemical resistance are crucial. Their ability to perform under extreme environmental conditions supports their leadership in high-risk installations.

The acrylic segment is anticipated to grow at the highest CAGR from 2025 to 2032, fueled by demand for water-based, low-VOC coatings in green building projects. Acrylic resins offer rapid drying, cost-effectiveness, and environmental compliance, making them ideal for residential and light-commercial fireproofing applications. Their increasing use in thin-film systems and decorative coatings further boosts segment growth.

- By Substrate

On the basis of substrate, the market is segmented into structural cast iron and cast iron, wood, composite elements, and others. Structural cast iron and cast iron dominated the market in 2024, supported by their widespread use in large-scale steel frameworks and the urgent need for fire protection in such load-bearing components. The strong thermal conductivity of metal substrates necessitates advanced fire-resistive coatings to maintain structural integrity in fire scenarios.

The wood segment is expected to register the fastest growth rate from 2025 to 2032, driven by increasing applications in modular construction, residential buildings, and interior design. As wooden structures become more prominent in sustainable architecture, the need for fire retardant solutions that preserve aesthetics while ensuring safety is driving demand for specialized intumescent coatings compatible with wood.

- By Technology

On the basis of technology, the market is divided into epoxy-based, water-based, solvent-based, and powder-based. Epoxy-based coatings dominated the market in 2024 due to their exceptional performance in offshore and oil & gas applications. These coatings resist moisture, chemicals, and mechanical stress, making them ideal for harsh environments where fire hazards are combined with corrosive exposure.

Water-based coatings are projected to witness the highest growth from 2025 to 2032, supported by environmental regulations and the push for low-VOC and non-toxic fireproofing materials. Their user-friendly application, fast drying times, and minimal odor make them increasingly suitable for occupied buildings, schools, and healthcare settings.

- By Application

On the basis of application, the market is segmented into hydrocarbon and cellulosic fire protection. Hydrocarbon fire protection led the market in 2024 due to stringent safety norms in oil & gas, chemical processing, and offshore industries where high-temperature fires caused by fuel combustion pose severe structural risks. Coatings used in these applications are designed to withstand rapid temperature rise and maintain integrity under explosive conditions.

Cellulosic fire protection is anticipated to grow fastest over the forecast period as it finds rising usage in commercial and residential buildings. These fires, driven by wood, paper, and furniture, require effective and visually acceptable fireproofing solutions, making intumescent coatings a favorable choice for architects and developers.

- By End-User

On the basis of end-user, the market is segmented into building and constructions, oil and gas, industrial, automotive, aerospace, and others. The building and construction segment dominated the market in 2024, underpinned by expanding urban infrastructure, increasing focus on occupant safety, and rising adoption of fire safety codes across developed and developing regions. Fireproofing of steel and wooden structures in high-rise residential and commercial projects continues to propel demand.

The oil and gas segment is forecasted to experience the highest growth from 2025 to 2032, driven by heightened safety regulations, ongoing investments in refining and exploration, and the critical need to prevent catastrophic damage during fire incidents. Fire-resistive coatings in these settings protect lives and also ensure the continuity of operations in high-risk environments.

Which Region Holds the Largest Share of the Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market?

- U.S. dominated the North America intumescent coatings for fireproofing and spray-applied fire-resistive materials market with an estimated 58.2% revenue share in 2025, driven by strong demand across commercial construction, industrial facilities, oil & gas infrastructure, power generation, and transportation projects. Stringent fire safety regulations, widespread adoption of fire-resistant materials in high-rise buildings, and growing refurbishment of aging infrastructure are significantly supporting market growth

- Increasing focus on fire protection compliance, asset safety, structural integrity, and risk mitigation has accelerated the adoption of advanced intumescent coatings across industrial and commercial applications. Presence of leading coating manufacturers, strong R&D capabilities, and continuous investments in fire-resistive material technologies further strengthen regional market leadership

Canada Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Insight

Canada is projected to register the fastest CAGR of 11.02% during the forecast period, driven by increasing infrastructure development, rising commercial construction, and strict enforcement of fire safety regulations across public and private buildings. Growing adoption in oil & gas facilities, industrial plants, and transportation infrastructure further supports market expansion.

Mexico Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Insight

Mexico is witnessing steady growth, supported by expanding manufacturing activities, infrastructure modernization, and rising investments in industrial and commercial construction. Increasing awareness of fire safety standards and adoption of protective coatings in factories and public infrastructure are driving consistent market growth across the country.

Which are the Top Companies in Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market?

The Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials industry is primarily led by well-established companies, including:

- P2i Ltd. (U.K.)

- NEI Corporation (U.S.)

- UltraTech International Inc. (U.S.)

- Aculon Inc. (U.S.)

- Lotus Leaf Coatings, Inc. (U.S.)

- Rust-Oleum (U.S.)

- Cytonix (U.S.)

- NASIOL NANO COATINGS (Turkey)

- The President and Fellows of Harvard College (U.S.)

- LiquiGlide Inc. (U.S.)

- Surfactis Technologies (France)

- PearlNano (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Keronite (U.K.)

- Nanoshel LLC (U.S.)

- Nanorh (U.S.)

What are the Recent Developments in North America Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials market?

- In June 2025, Huntsman introduced the POLYRESYST EV5005 polyurethane-based intumescent coating system, designed specifically for automotive applications. This innovation addresses a critical fire safety challenge in electric vehicles by enhancing passive fire protection for metal and composite battery components without compromising design flexibility. The launch is expected to expand the application of intumescent coatings in the automotive sector, particularly in EV battery safety, reinforcing market growth in transportation-related fireproofing solutions

- In June 2023, Jotun expanded its Global Intumescent R&D Laboratory to boost product innovation and technology advancement. This expansion aims to enhance product development and fire testing capacity, accelerating the creation of innovations and advanced products. In addition, it provides certification support for Jotun's existing product range, strengthening its position in the intumescent coatings market

- In January 2022, PPG Industries unveiled the PPG AMERCOAT range of passive fire protection coatings tailored for steel structures. As water-based intumescent solutions, these coatings contribute to enhanced safety standards while aligning with growing environmental and regulatory expectations. The launch reinforced PPG’s role in supporting industrial and infrastructure fire safety, further advancing market adoption of sustainable fire-resistive materials

- In May 2020, Sherwin-Williams introduced Firetex M90/03, an intumescent coating capable of providing up to 90 minutes of fire resistance for both onsite and offsite applications. The product's adaptability to different construction environments supports the growing trend of modular and prefabricated building practices. This innovation helped broaden the use of fire-resistive coatings in versatile construction settings, supporting market expansion across both traditional and modern construction methods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。