North America Japanese Restaurant Market

市场规模(十亿美元)

CAGR :

%

USD

5.11 Billion

USD

6.59 Billion

2024

2032

USD

5.11 Billion

USD

6.59 Billion

2024

2032

| 2025 –2032 | |

| USD 5.11 Billion | |

| USD 6.59 Billion | |

|

|

|

北美日本餐廳市場細分,按菜系(傳統日本料理、特色日本料理、現代日本料理)、服務類型(快餐店 (QSR)、全方位服務餐廳、外賣櫃檯/門店)、餐廳類別(獨立餐廳、連鎖/特許經營模式)、餐廳模式(外賣、送餐上門、廚房

日本餐廳市場規模

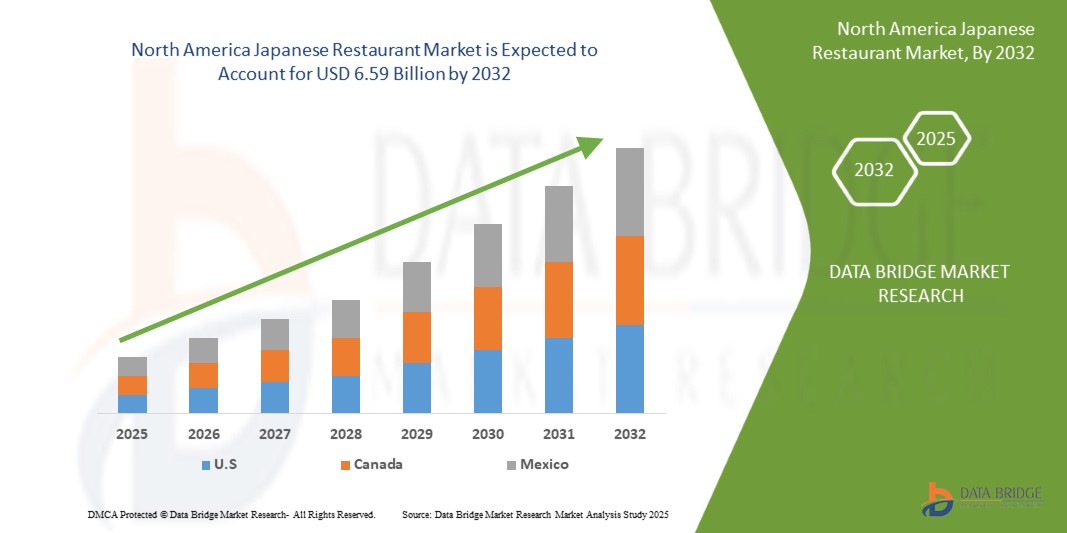

- 2024 年北美日本餐廳市場價值為51.1 億美元,預計到 2032 年將達到 65.9 億美元

- 在 2025 年至 2032 年的預測期內,市場可能會以3.28% 的複合年增長率增長,這主要得益於壽司菜餚的受歡迎程度的提高。

- 這一增長受到北美日本料理日益普及、消費者健康意識增強、壽司需求增加、文化影響、城市化、便利性、創新和旅遊業等因素的推動。

日本餐廳市場分析

- 由於對壽司和傳統美食的需求不斷增長,日本餐飲市場在全球範圍內不斷增長。注重健康的消費者青睞日本食品,因為其食材新鮮、蛋白質瘦肉豐富、海鮮富含歐米伽 3。城市化和快節奏的生活方式推動了對便利、營養餐飲的需求

- 媒體曝光和融合菜餚創新進一步擴大了市場吸引力。然而,挑戰包括原料成本高、市場飽和以及平衡真實性與在地化

- 未來依然充滿希望,數位化食品配送、永續發展努力和不斷變化的消費者偏好將推動成長。日本餐廳繼續蓬勃發展,提供從快餐壽司店到高端 omakase 等多樣化的用餐體驗

- 人們對日本料理的健康益處的認識不斷提高,極大地推動了對這些餐廳的需求。全球超過一半的需求是由日本料理驅動的,日本料理被認定為聯合國教科文組織非物質文化遺產

- 例如,World Metrics 報告稱,2024 年全球壽司市場經歷了大幅增長,該行業價值超過 270 億美元。這一激增凸顯了壽司日益流行的趨勢,推動了日本餐廳數量的大幅增加,並促進了日本餐飲體驗在世界各地的擴展

- 在全球範圍內,日本料理是繼義大利料理之後第二受歡迎的料理。從餐廳數量來看,中餐佔首位,其次是義大利菜和印度菜。然而,日本擁有最多頂級餐廳,東京擁有全球最多的米其林三星餐廳

報告範圍和日本餐廳市場細分

|

屬性 |

日本餐廳關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

日本餐廳市場趨勢

“提高對健康益處的認識”

- 全球日本餐廳市場的一個突出趨勢是人們越來越意識到健康益處

- 隨著人們越來越意識到日本料理的健康益處,該行業正在經歷顯著增長。日本料理以注重新新鮮、高品質的食材和均衡的營養而聞名,這與全球日益重視健康和保健的趨勢相一致

- 例如,2019 年 2 月,神戶牛排館強調,日本飲食的健康益處(包括降低癌症風險、降低心臟病發病率和高蛋白質含量)越來越受到認可。這種日益增長的認識正在推動全球對日本料理的興趣,強調其在促進長壽和整體健康方面的作用,並有助於市場擴張

- 傳統菜如壽司、生魚片和味噌湯品不僅味道鮮美,而且脂肪含量低,富含必需營養素

- 人們越來越意識到日本料理對健康的益處,這推動了全球日本餐飲市場的發展,以滿足消費者對營養均衡餐飲選擇日益增長的需求。這一趨勢正在激發國際社會對日本食品的興趣,擴大全球市場,並增強全球日本餐廳的整體吸引力

日本餐廳市場動態

司機

“壽司的受歡迎程度正在上升”

- 壽司的日益普及極大地促進了日本餐飲市場的發展。它的健康益處(包括新鮮成分和高蛋白質含量)吸引了注重健康的消費者尋求營養替代品

- 壽司的多樣性,包括素食和無麩質等選擇,增強了它的全球吸引力

- 創新的捲餅和融合菜餚吸引了不同的受眾,擴大了市場範圍。此外,透過媒體曝光和全球城市的廣泛普及,壽司逐漸被主流接受,成為現代飲食文化中不可或缺的一部分,推動了全球對日本餐廳的需求

例如,

- 2024 年,World Metrics 報告稱,全球壽司市場經歷了大幅成長,產業價值超過 270 億美元。這一激增凸顯了壽司日益流行的趨勢,推動了日本餐廳數量的大幅增加,並促進了日本餐飲體驗在世界各地的擴展

- 2024年,Elle India 雜誌發表的一篇部落格報道稱,壽司在印度的受歡迎程度激增,各大城市的日本餐廳的投資都在增加。這一增長趨勢反映了印度地區對壽司的接受度和熱情

- 2024 年 4 月,《印度零售商》雜誌發表的一篇文章報導,隨著消費者口味的變化和健康飲食趨勢的興起,壽司在印度越來越受歡迎。壽司在印度的日益普及推動了日本餐廳的成長,在孟買、德里、班加羅爾等主要城市,新餐廳和壽司產品變得越來越普遍。這種轉變反映了一種更廣泛的全球趨勢,即壽司作為一種新鮮、營養的選擇的吸引力與不斷變化的飲食偏好相一致

- 壽司受歡迎程度的飆升是全球日本餐飲市場的主要動力。它符合健康趨勢,適應多樣化的飲食需求,並被主流接受,因此吸引力越來越大。隨著消費者越來越追求營養豐富、種類繁多、時尚的餐飲選擇,壽司在擴大日本餐飲在全球的影響力和成功方面繼續發揮關鍵作用

機會

“菜單創新”

- 菜單創新為日本餐廳提供了一個重要的成長機會,使他們能夠吸引新顧客並適應不斷變化的餐飲趨勢。透過對傳統菜餚進行現代化改造,例如提供素食壽司、融合捲和壽司捲餅,餐廳可以滿足不同的飲食偏好

- 此外,融合全球烹飪影響可增強創造力,融合風味和技術以創造出獨特的美食。這種適應性有助於日本餐廳脫穎而出,擴大市場吸引力,並滿足當代消費者尋求創新用餐體驗的需求

例如,

- 《經濟時報》報道稱,隨著壽司甜甜圈和壽司捲餅的推出,日本餐飲市場迎來了重大創新。這些新穎的菜餚將傳統壽司食材與新形式(例如甜甜圈形壽司或墨西哥捲餅式捲餅)融合在一起,反映了菜單創意日益增長的趨勢

- 據日本旅遊局稱,東京的 Narisawa 餐廳是日本餐飲市場菜單創新的典範。 Narisawa 以其獨特的日本料理而聞名,融合了尖端烹飪技術和當地時令食材,創造出突破傳統日本料理界限的用餐體驗

- 菜單創新透過調整傳統菜餚、融合全球趨勢、迎合注重健康的消費者、利用科技和擁抱永續性提供了大量機會。日本餐廳可以增強其吸引力,在競爭激烈的市場中脫穎而出,並推動持續成長。

克制/挑戰

“日本料理的食材成本很高”

- 日本料理依賴壽司級魚類和稀有蔬菜等優質食材,這些食材價格昂貴且容易波動

- 這些高成本影響了餐廳的定價,可能會減少消費者的需求,特別是那些難以負擔費用的小型餐廳

- 價格波動可能導致菜單定價和供應情況不一致,從而影響顧客對可負擔性的看法。成本上升也可能限制菜單的多樣性,降低對更廣泛受眾的吸引力

- 因此,在控製食材成本的同時保持品質是日本餐廳面臨的關鍵挑戰,它影響營運的可持續性和消費者行為

例如,

- 2024 年 1 月,SeafoodSource 上發表的一篇文章報道稱,今年首條藍鰭金槍魚的拍賣價格高達 310 萬美元,創下了歷史新高,凸顯了日本料理中優質食材成本的不斷上升。由於藍鰭鮪魚是高級壽司和生魚片的關鍵原料,成本上漲凸顯了依賴此類優質食材來吸引和留住顧客的餐廳所面臨的財務挑戰

- 2023 年 8 月,Hanaya FM 上發表的一篇部落格報道稱,採購新鮮海鮮和優質大米等優質食材的高成本嚴重影響了壽司和其他日本料理的定價。為了確保日本料理的正宗性和品質,需要一流的食材,這導致成本上升,這通常反映在菜單價格上。這一因素影響了日本餐廳的整體用餐費用,影響了全球消費市場和日本餐廳的營運策略

- 原料成本高昂,增加了營運費用並影響了定價策略,造成了很大的限制。管理優質原料成本的挑戰尤其會對小型企業產生影響,導致菜單價格波動,並影響消費者的看法

日本餐廳市場範圍

市場根據菜系類型、服務類型、餐廳類別、餐廳模式和銷售管道進行細分。

|

分割 |

細分 |

|

按應用 |

|

|

|

|

按餐廳類別 |

|

|

依餐廳模式

|

|

|

按銷售管道 |

|

日本餐廳市場區域分析

“美國是日本餐飲市場的主導國家”

- 美國在日本餐飲市場佔據主導地位,這得益於人們對日本食品健康益處的認識不斷提高,以及主要市場參與者的強大影響力

- 美國憑藉其烹飪的地道性、高品質的原料、強勁的國內需求、旅遊業以及北美文化的影響而佔據了相當大的份額。

- 高品質的食材、強勁的需求、旅遊業、技術嫻熟的廚師、創新、海鮮供應、米其林餐廳和北美的影響。

- 此外,烹飪真實性的提高、優質的食材、強勁的國內需求、旅遊業、技術嫻熟的廚師、創新、米其林星級餐廳、海鮮供應、政府支持、食品技術、北美的影響、豐富的文化遺產、高效的物流和餐飲文化正在推動市場成長。

“美國預計將實現最高成長率”

- 預計美國將見證日本餐飲市場的最高成長率,這得益於壽司菜餚的受歡迎程度的提高

- 美國憑藉其烹飪的正宗性、優質的原料、強勁的國內需求、旅遊業、米其林星級餐廳、技藝精湛的廚師、創新、海鮮供應、政府支持、先進的食品技術、豐富的文化遺產、高效的物流、高雅的餐飲文化以及北美的影響而佔據主導地位。

日本餐廳市佔率

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、北美業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

市場中主要的市場領導者有:

- KATSU-YA GROUP, INC.(美國)

- Wokcano 亞洲餐廳和酒吧。 (我們)

- 893 Ryōtei柏林(德國)

- 千葉日本餐廳(美國)

- 辻田手工麵條。 (日本)

- 選集(日本)

- KAITEN ZUSHI (US)

- Kura Sushi USA(美國)

- My Concierge Japan(日本)

- 成澤(日本)

- RE&S(新加坡)

- SAZENKA(日本)

- SEZANNE(日本)

- Sushi A Go Go(美國)

- Sushi Den(美國)

- 壽司源企業。 (我們)

- Sushi Nozawa Group(美國)

- 壽司店(印度)

- Takami Sushi & Robata 餐廳(美國)

- Tatsu Ramen 有限責任公司(我們)

- 山城好萊塢(美國)

北美日本餐廳市場最新動態

- 2024 年 5 月,Sushi Den 宣布重新推出備受期待的午餐服務。此外,Sushi Den and Izakaya Den 的最新成員 OTOTO 還推出了美味的周日早午餐,供應時間為上午 11:00 至下午 2:00。公司期待與顧客分享這一新篇章,共同享受本季的新鮮產品

- 2024 年 6 月,東京丸之內四季酒店的 Sézanne 在 2024 年全球 50 佳餐廳中排名第 15 位,並被評為亞洲最佳餐廳。餐廳由主廚 Daniel Calvert 主理,以日本食材展現法國烹飪的精髓,在精緻的環境中提供優雅、季節性的用餐體驗

- 2024年5月,南方資本集團與RE&S Holdings Limited聯合宣布透過協議安排收購該公司。這項策略性舉措是重組計畫的一部分,南方資本集團將收購 RE&S Holdings 的所有權。此次收購已獲得雙方同意,協議安排將促進平穩過渡,確保公司在新所有權下繼續高效運作。這一發展標誌著 RE&S Holdings 在 Southern Capital Group 的領導下開啟了新篇章,標誌著該公司的一個重要里程碑

- 2024 年 8 月,Kura Sushi USA 與東映動畫合作,從 2024 年 8 月 2 日至 9 月 30 日推出特別 Bikkura Pon 促銷活動來慶祝「海賊王」。此次合作包括獨家海盜王獎品,包括小雕像和罐頭徽章,以及限時菜單,如 Gum-Gum 水果冰淇淋 Monaka 和 Jumbo 辣烤牛肉捲。客人還可以以 16.00 美元的價格購買主題瓶,並免費補充軟性飲料。 Kura Sushi Rewards 會員在 8 月 2 日至 8 日期間消費 80 美元或以上即可獲得一條冷卻毛巾。所有獎品均採用環保、可生物降解的膠囊包裝

- 2024 年 5 月,Kura Sushi USA 推出了七龍珠超主題 Bikkura Pon 促銷活動,活動時間為 2024 年 5 月 1 日至 6 月 30 日。此次合作推出了獨家龍珠超獎品,包括限量版壓克力立式鑰匙圈和琺瑯別針。罕見的夜光悟空鑰匙圈數量有限。 6 月 5 日至 9 日,獎勵會員在餐廳消費滿 70 美元即可獲得一件七龍珠超圖案 T 卹。自 6 月 1 日起,配備吸管和掛繩的龍珠超瓶裝套裝售價 16.00 美元。 Bikkura Pon 獎勵系統為每享用 15 盤龍珠超主題獎品的食客提供獎勵

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL SOURCING

4.1.2 PROCESSING & PACKAGING

4.1.3 LOGISTICS & DISTRIBUTION

4.1.4 RESTAURANT OPERATIONS

4.1.5 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS FOR THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.2 VENDOR SELECTION CRITERIA

4.2.1 INGREDIENT QUALITY AND AUTHENTICITY

4.2.2 RELIABILITY AND SUPPLY CHAIN EFFICIENCY

4.2.3 COMPLIANCE WITH FOOD SAFETY AND REGULATORY STANDARDS

4.2.4 COST COMPETITIVENESS AND PRICING STABILITY

4.2.5 SUSTAINABILITY AND ETHICAL SOURCING PRACTICES

4.2.6 TECHNOLOGICAL INTEGRATION AND ORDERING EFFICIENCY

4.3 FACTORS INFLUENCING PURCHASING DECISION OF END USERS IN THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.3.1 AUTHENTICITY AND CULTURAL EXPERIENCE

4.3.2 QUALITY AND FRESHNESS OF INGREDIENTS

4.3.3 MENU VARIETY AND DIETARY PREFERENCES

4.3.4 PRICING AND VALUE FOR MONEY

4.3.5 AMBIENCE AND RESTAURANT DESIGN

4.3.6 BRAND REPUTATION AND REVIEWS

4.3.7 CONVENIENCE AND ACCESSIBILITY

4.3.8 CUSTOMER SERVICE AND HOSPITALITY

4.3.9 HEALTH AND SAFETY CONCERNS

4.3.10 CULTURAL TRENDS AND POPULARITY

4.3.11 CONCLUSION

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS IN THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.4.1 EXPANSION THROUGH FRANCHISING

4.4.2 MENU INNOVATION AND DIVERSIFICATION

4.4.3 DIGITAL TRANSFORMATION AND ONLINE PRESENCE

4.4.4 STRATEGIC PARTNERSHIPS AND COLLABORATIONS

4.4.5 SUSTAINABLE PRACTICES AND ETHICAL SOURCING

4.4.6 PREMIUMIZATION AND FINE DINING CONCEPTS

4.4.7 GEOGRAPHIC EXPANSION INTO EMERGING MARKETS

4.4.8 LOYALTY PROGRAMS AND CUSTOMER ENGAGEMENT

4.4.9 TECHNOLOGY-DRIVEN EFFICIENCY

4.4.10 HEALTH AND WELLNESS-FOCUSED OFFERINGS

4.4.11 CONCLUSION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.5.1 RISING POPULARITY OF AUTHENTIC AND REGIONAL JAPANESE CUISINE

4.5.2 GROWTH OF FAST-CASUAL AND TAKEAWAY CONCEPTS

4.5.3 INCREASED FOCUS ON SUSTAINABILITY AND ETHICAL SOURCING

4.5.4 DIGITAL TRANSFORMATION AND SMART RESTAURANT TECHNOLOGY

4.5.5 EXPANSION INTO EMERGING MARKETS

4.5.6 HEALTH AND WELLNESS-DRIVEN MENUS

4.5.7 INFLUENCE OF JAPANESE POP CULTURE ON FOOD TRENDS

4.5.8 PERSONALIZATION AND CUSTOMIZATION

4.5.9 ALCOHOL PAIRING AND SAKE CULTURE EXPANSION

4.5.10 FUTURE OUTLOOK: THE EVOLUTION OF THE JAPANESE RESTAURANT MARKET

4.5.11 CONCLUSION

4.6 TECHNOLOGICAL ADVANCEMENT OF THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.6.1 AUTOMATION AND ROBOTICS

4.6.2 AI AND SMART ORDERING SYSTEMS

4.6.3 DIGITAL PAYMENT AND CONTACTLESS SOLUTIONS

4.6.4 SMART KITCHENS AND IOT INTEGRATION

4.6.5 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.6.6 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING AWARENESS OF HEALTH BENEFITS

6.1.2 THE INCREASE IN POPULARITY OF THE DISH SUSHI

6.1.3 JAPANESE CUISINE, RECOGNIZED AS A UNESCO INTANGIBLE CULTURAL HERITAGE, INCREASES THE NORTH AMERICA CONSUMER INTEREST FOR JAPANESE CUISINE

6.2 RESTRAINTS

6.2.1 FOOD CONTAMINATION, RISKING THE SAFETY, AND QUALITY OF THE PRODUCT

6.2.2 HIGH COSTS OF INGREDIENTS FOR JAPANESE CUISINE

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN MENU OFFERINGS

6.3.2 COLLABORATION WITH LOCAL CULTURAL EVENTS AND FESTIVALS

6.4 CHALLENGES

6.4.1 INTENSE COMPETITION FROM ITALIAN AND CHINESE CUISINES

6.4.2 MAINTAINING AUTHENTICITY AND LABOR SHORTAGES

7 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE

7.1 OVERVIEW

7.2 TRADITIONAL JAPANESE CUISINE

7.2.1 SUSHI

7.2.2 RAMEN

7.2.3 TEMPURA

7.2.4 SASHIMI

7.2.5 KAISEKI

7.2.6 UDON/SOBA

7.2.7 OTHERS

7.3 SPECIALTY JAPANESE CUISINE

7.4 MODERN JAPANESE CUISINE

8 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE

8.1 OVERVIEW

8.2 QUICK SERVICE RESTAURANTS (QSR)

8.3 FULL SERVICE RESTAURANTS

8.4 TAKE-OUT COUNTERS/OUTLETS

9 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY

9.1 OVERVIEW

9.2 STANDALONE RESTAURANT

9.3 CHAIN/FRANCHISE MODEL

10 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL

10.1 OVERVIEW

10.2 TAKEAWAY

10.3 HOME DELIVERY

10.4 DINE-IN

11 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 PHYSICAL OUTLETS

11.3 DELIVERY ONLINE RESTAURANTS/GHOST KITCHEN

12 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA JAPANESE RESTAURANT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 KATSU-YA GROUP, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 WOKCANO ASIAN RESTAURANT & BAR.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 893 RYŌTEI BERLIN

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 CHIBA JAPANESE RESTAURANT

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 TSUJITA ARTISAN NOODLE.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FLORILÈGE

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 KAITEN ZUSHI

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 KURA SUSHI USA

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 MY CONCIERGE JAPAN

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 NARISAWA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 RE&S

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 BRAND PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 SAZENKA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 SEZZANE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT NEWS

15.14 SUSHI A GO GO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SUSHI DEN

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SUSHI GEN ENTERPRISES

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SUSHI NOZAWA GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SUSHIYA

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 TAKAMI SUSHI & ROBATA RESTAURANT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TATSU RAMEN LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 YAMASHIRO HOLLYWOOD

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MODERN JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA QUICK SERVICE RESTAURANTS (QSR) IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA FULL SERVICE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA TAKE-OUT COUNTERS/OUTLETS IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA STANDALONE RESTAURANT IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA CHAIN/FRANCHISE MODEL IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA TAKEAWAY IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA HOME DELIVERY IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA DINE-IN IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA PHYSICAL OUTLETS IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA DELIVERY ONLINE RESTAURANTS/GHOST KITCHEN IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 112 CANADA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 113 CANADA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 114 CANADA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 115 CANADA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 116 CANADA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 132 MEXICO SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 133 MEXICO SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 134 MEXICO RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 135 MEXICO RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 136 MEXICO TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 137 MEXICO TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 138 MEXICO SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 139 MEXICO SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 140 MEXICO KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 141 MEXICO KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 142 MEXICO UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 143 MEXICO UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 144 MEXICO OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 145 MEXICO OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 146 MEXICO SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MEXICO SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 148 MEXICO SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 149 MEXICO MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MEXICO MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 151 MEXICO MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 152 MEXICO JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MEXICO JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 154 MEXICO JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 155 MEXICO JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA JAPANESE RESTAURANT MARKET

FIGURE 2 NORTH AMERICA JAPANESE RESTAURANT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA JAPANESE RESTAURANT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA JAPANESE RESTAURANT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA JAPANESE RESTAURANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA JAPANESE RESTAURANT MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA JAPANESE RESTAURANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA JAPANESE RESTAURANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA JAPANESE RESTAURANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA JAPANESE RESTAURANT MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA JAPANESE RESTAURANT MARKET: BY CUISINE TYPE, 2024

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING AWARENESS OF HEALTH BENEFITS IS EXPECTED TO DRIVE THE NORTH AMERICA JAPANESE RESTAURANT MARKET IN THE FORECAST PERIOD

FIGURE 15 TRADITIONAL JAPANESE CUISINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA JAPANESE RESTAURANT MARKET IN 2025 AND 2032

FIGURE 16 SUPPLY CHAIN ANALYSIS- NORTH AMERICA JAPANESE RESTAURANT MARKET

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA JAPANESE RESTAURANT MARKET

FIGURE 19 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY CUISINE TYPE, 2024

FIGURE 20 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY SERVICE TYPE, 2024

FIGURE 21 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY RESTAURANT CATEGORY, 2024

FIGURE 22 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY RESTAURANT MODEL, 2024

FIGURE 23 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY SALES CHANNEL, 2024

FIGURE 24 NORTH AMERICA JAPANESE RESTAURANT MARKET: SNAPSHOT, 2024

FIGURE 25 NORTH AMERICA JAPANESE RESTAURANT MARKET: COMPANY SHARE, 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。