North America Left Ventricular Assist Device (LVAD) Market, By Product Type (Heart Pump, Controller, Batteries, and Wires), Therapy (Bridge-To-Transplant (BTT) Therapy, Destination Therapy, Bridge-To-Candidacy (BTC) Therapy, and Bridge-To-Recovery (BTR) Therapy), Age Group (Adult and Pediatric), Indication (Congestive Heart Failure, Congenital Heart Disease, Myocarditis, Cardiac Arrest, Familial Arrhythmias and Arrhythmic, Cardiomyopathies, Advanced Heart Failure, and Others), Generation (Second Generation Devices, Third Generation Devices, and First Generation Devices), Durability (Long-Term, Intermediate-Term, and Short-Term), Design (Axial and Centrifugal), Pulse Type (Nonpulsatile and Pulsatile), End User (Hospitals, Cardiac Cath Laboratories, Specialty Clinics, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others) - Industry Trends and Forecast to 2029.

North America Left Ventricular Assist Device (LVAD) Market Analysis and Size

A left ventricular assist device (LVAD) is a mechanical pump implanted in patients with heart failure. It helps the left bottom chamber of the heart (left ventricle) pump blood out of the ventricle to the aorta and the rest of the body. It is used for patients who have reached end-stage heart failure. The LVAD is surgically implanted, a battery-operated mechanical pump, which helps the left ventricle (main pumping chamber of the heart) pump blood to the rest of the body.

The occurrence of cardiovascular illnesses is growing at a rapid pace. It is estimated that advanced cardiovascular breakdown affects around 2.3% of North America's total population and is a severe socioeconomic burden. Further strong emphasis on R&D exercises aimed at the development of progressively enticing devices, as well as optimum government efforts, drive the left ventricular assist device (LVAD) market. Furthermore, the Canadian market is likely to benefit from low-intensity competition in the vendor landscape, making the country an attractive investment ground for firms looking to enter the sector of ventricular assist devices. The enormous pool of patients awaiting donor hearts for transplant gives commercial opportunities. However, there are dangers associated with the LVAD implant, and these hazards have an influence on market growth by acting as a restraining factor. Furthermore, the sector is currently confronted with a number of challenges, including barriers to DT adoption and safety concerns.

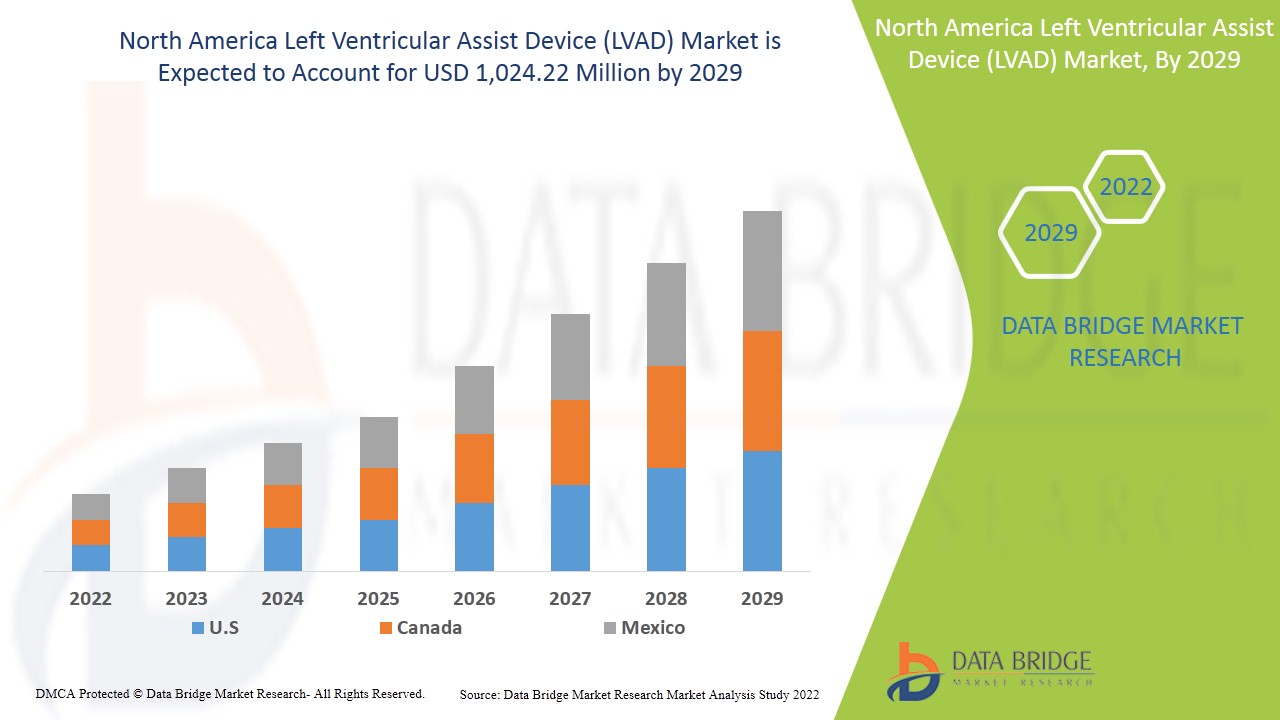

北美左心室辅助装置 (LVAD) 市场预计将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析,在 2022 年至 2029 年的预测期内,该市场以 9.5% 的复合年增长率增长,预计到 2029 年将达到 10.2422 亿美元。左心室辅助装置的技术进步日益成为左心室辅助装置 (LVAD) 市场增长的驱动力。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制为2015-2020) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

按产品类型(心脏泵、控制器、电池和电线)、疗法(移植桥接 (BTT) 疗法、目的疗法、候选桥接 (BTC) 疗法和康复桥接 (BTR) 疗法)、年龄组(成人和儿童)、适应症(充血性心力衰竭、先天性心脏病、心肌炎、心脏骤停、家族性心律失常和心律失常、心肌病、晚期心力衰竭等)、代数(第二代设备、第三代设备和第一代设备)、耐用性(长期、中期和短期)、设计(轴向和离心)、脉冲类型(非脉动和脉动)、最终用户(医院、心导管实验室、专科诊所等)、分销渠道(直接招标、零售等) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

在市场上交易的主要公司包括 ABIOMED、Abbott、Berlin Heart、Saft、Jarvik Heart, Inc.、CorWave SA 和 Evaheart, Inc. 等 |

市场定义

左心室辅助装置 (LVAD) 是一种植入心力衰竭患者的机械泵。它帮助心脏左下腔(左心室)将血液从心室泵送到主动脉和身体的其他部位。

它用于已达到终末期心力衰竭的患者。LVAD 是通过手术植入的,是一种电池供电的机械泵,可帮助左心室(心脏的主要泵腔)将血液泵送到身体的其他部位。LVAD 可用作:

心血管疾病的高发性、技术的不断进步以及医疗保健支出的不断增加也推动了北美左心室辅助装置(LVAD)市场的增长。

北美左心室辅助装置 (LVAD) 市场动态

本节旨在了解市场驱动因素、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

- 老年人口不断增加,心脏病发病率不断上升

随着北美老年人口的不断增长,心脏病的患病率也在不断上升。据估计,北美有 4000 万盲人,其中大多数属于老年人口。然而,所有研究都表明老年人口中心脏病的患病率很高。随着年龄的增长和老年人口中心力衰竭等心脏病的患病率不断上升,适当的治疗和药物也在增加。此外,人口的增长也增加了医疗保健系统的压力,因此对护理、服务和技术的需求正在迅速增加。因此,老年人口的增加预计将推动北美左心室辅助装置 (LVAD) 市场的发展。

- 存在优惠的报销政策

医疗保险和医疗补助服务中心 (CMS) 发布了一份决策备忘录,放宽了心室辅助装置的覆盖标准 (CMS, 2010)。CMS 政策取消了体型标准,并放宽了对失败药物治疗所需时间和峰值氧耗的限制。从今以后,有利的报销政策预计将在预测年推动北美左心室辅助装置 (LVAD) 市场的发展。

机会

- 医疗支出增加

随着北美各国的可支配收入不断增加,医疗支出也随之增加。此外,为了满足人口需求,政府机构和医疗机构正在采取措施,加快医疗支出。医疗支出的增加同时有助于医疗机构改善各种心血管疾病的治疗设施,并提供外科治疗,因为这种疾病近年来非常普遍。

医疗支出的增加为市场提供了机会,提供了更多的治疗选择、免费诊断和促进早期诊断的不同计划。此外,政府的医疗支出侧重于将资源分配给改善管理和患者治疗效果的策略,以减轻日益增加的经济负担。

医疗支出的增长也有利于进一步的经济增长和医疗行业的增长,而且它的主要成果是它显著影响了更好、更先进的心脏病治疗设备的开发。因此,医疗支出的激增为北美左心室辅助装置 (LVAD) 市场带来了更大的机会。

限制/挑战

- LVAD 植入和治疗费用高昂

非强心剂依赖型心力衰竭患者使用 LVAD 可改善生活质量,但由于频繁再入院和昂贵的后续护理,会大幅增加终生成本。左心室辅助装置还会增加就业和职业,影响财务状况。

LVAD 植入和治疗的高昂费用给患者带来了经济负担和挑战。此外,高昂的后续护理费用进一步增加了患者的经济负担,从而限制了市场的增长。

北美左心室辅助装置 (LVAD) 市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地化市场参与者的影响,分析了新兴收入领域的机会、市场法规变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地理扩展、市场技术创新。

近期发展

- 2020 年 12 月 21 日,美国食品药品监督管理局 (FDA) 于 12 月 17 日批准了雅培 HeartMate 3 左心室辅助装置 (LVAD) 的更新标签,用于治疗晚期难治性左心室心力衰竭的儿科患者

北美左心室辅助装置 (LVAD) 市场范围

北美左心室辅助装置 (LVAD) 市场根据产品类型、治疗、年龄组、适应症、代数、耐用性、设计、脉搏类型、最终用户和分销渠道分为十个值得关注的细分市场。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和见解,帮助他们做出战略决策,确定核心市场应用。

按产品类型

- 心脏泵

- 控制器

- 电池

- 电线

根据产品类型,北美左心室辅助装置 (LVAD) 市场分为心脏泵、控制器、电池和电线。电池进一步分为可充电电池和不可充电电池。

通过治疗

- 移植前桥接 (BTT) 治疗

- 目的地治疗

- 候选人资格过渡期(BTC)治疗

- 康复桥 (BTR) 治疗

根据治疗方式,北美左心室辅助装置 (LVAD) 市场分为移植桥接 (BTT) 治疗、目的地治疗、候选桥接 (BTC) 治疗和康复桥接 (BTR) 治疗。

按年龄组

- 成人

- 儿科

根据年龄组,北美左心室辅助装置 (LVAD) 市场分为成人和儿童。

根据指征

- 充血性心力衰竭

- 先天性心脏病

- 心肌炎

- 心脏停搏

- 家族性心律失常和心律失常

- 心肌病

- 晚期心力衰竭

- 其他的

根据适应症,北美左心室辅助装置 (LVAD) 市场分为充血性心力衰竭、先天性心脏病、心肌炎、心脏骤停、家族性心律失常和心律失常性心肌病、晚期心力衰竭等。

按代际划分

- 第二代设备

- 第三代设备

- 第一代设备

根据代数,北美左心室辅助装置 (LVAD) 市场分为第二代装置、第三代装置和第一代装置。

耐用性

- 长期

- 中期

- 短期

根据耐用性,北美左心室辅助装置 (LVAD) 市场分为长期、中期和短期。

设计

- 轴向

- 离心式

根据设计,北美左心室辅助装置 (LVAD) 市场分为轴向和离心式。

按脉冲类型

- 非搏动性

- 脉动

根据脉搏类型,北美左心室辅助装置 (LVAD) 市场分为非脉搏性和脉搏性。

由最终用户

- 医院

- 心导管实验室

- 专科诊所

- 其他的

根据最终用户,北美左心室辅助装置 (LVAD) 市场分为医院、专科诊所、心导管实验室和其他。

按分销渠道

- 直接招标

- 零售销售

- 其他的

根据分销渠道,北美左心室辅助装置 (LVAD) 市场分为直接招标、零售和其他。

北美左心室辅助装置 (LVAD) 市场区域分析/见解

对北美左心室辅助装置 (LVAD) 市场进行了分析,并按国家、产品类型、疗法、年龄组、适应症、代数、耐用性、设计、脉冲类型、最终用户和分销渠道提供了市场规模洞察和趋势。

北美左心室辅助装置 (LVAD) 市场包括美国、加拿大和墨西哥等国家,预计由于心脏病病例增加和老年人口增加而增长。心室疾病风险的增加也推动了市场增长。

由于拥有先进的技术、心脏病患病率高以及完善的医疗保健体系,美国预计将主导北美左心室辅助装置 (LVAD) 市场。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和国内市场法规的变化。新销售、替代销售、国家人口统计、疾病流行病学和进出口关税等数据点是用于预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了其他品牌的存在和可用性以及由于来自本地和国内品牌的激烈或稀缺竞争而面临的挑战以及销售渠道的影响。

竞争格局和左心室辅助装置 (LVAD) 市场份额分析

北美左心室辅助装置 (LVAD) 市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、国家/地区分布、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对骨质疏松症药物市场的关注有关。

北美左心室辅助装置 (LVAD) 市场的一些主要参与者包括 ABIOMED、Abbott、Berlin Heart、Saft、Jarvik Heart, Inc.、CorWave SA 和 Evaheart, Inc. 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S

4.3 INDUSTRIAL INSIGHTS:

5 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: REGULATIONS

5.1 REGULATION IN U.S.

5.1.1 GUIDELINES-

5.2 REGULATION IN CANADA

5.2.1 GUIDELINES FOR THE MANUFACTURERS:

5.3 REGULATION IN MEXICO

5.3.1 GUIDELINES FOR THE MANUFACTURERS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING GERIATRIC POPULATION ALONG WITH RISING PREVALENCE OF CARDIAC DISEASES

6.1.2 PRESENCE OF FAVOURABLE REIMBURSEMENT POLICIES

6.1.3 CHANGING LIFESTYLE TRIGGERS THE DEVELOPMENT OF CARDIOVASCULAR DISEASES

6.2 RESTRAINTS

6.2.1 HIGH COST OF LVAD IMPLANTATION AND TREATMENT

6.2.2 COMPLICATIONS AND RISKS ASSOCIATED WITH LVAD

6.3 OPPORTUNITIES

6.3.1 INCREASE IN HEALTHCARE EXPENDITURE

6.3.2 INCREASE IN MINIMALLY INVASIVE PROCEDURE

6.3.3 INCREASING SHORTAGE OF ORGAN DONORS

6.3.4 TECHNOLOGICAL ADVANCEMENTS IN LEFT VENTRICULAR ASSIST DEVICES

6.4 CHALLENGES

6.4.1 ONGOING COVID-19

6.4.2 INCREASE IN PRODUCT RECALL

7 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 HEART PUMP

7.3 CONTROLLER

7.4 BATTERIES

7.4.1 RECHARGEABLE

7.4.2 NON-RECHARGEABLE

7.5 WIRES

8 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY

8.1 OVERVIEW

8.2 BRIDGE-TO-TRANSPLANT (BTT) THERAPY

8.2.1 HEART PUMP

8.2.2 CONTROLLER

8.2.3 BATTERIES

8.2.4 WIRES

8.3 DESTINATION THERAPY

8.3.1 HEART PUMP

8.3.2 CONTROLLER

8.3.3 BATTERIES

8.3.4 WIRES

8.4 BRIDGE-TO-CANDIDACY (BTC) THERAPY

8.4.1 HEART PUMP

8.4.2 CONTROLLER

8.4.3 BATTERIES

8.4.4 WIRES

8.5 BRIDGE-TO-RECOVERY (BTR) THERAPY

8.5.1 HEART PUMP

8.5.2 CONTROLLER

8.5.3 BATTERIES

8.5.4 WIRES

9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP

9.1 OVERVIEW

9.2 ADULT

9.2.1 19-39 YEARS

9.2.2 40-59 YEARS

9.2.3 60-79 YEARS

9.2.4 ABOVE 80 YEARS

9.3 PEDIATRIC

10 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION

10.1 OVERVIEW

10.2 SECOND GENERATION DEVICES

10.3 THIRD GENERATION DEVICES

10.4 FIRST GENERATION DEVICES

11 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN

11.1 OVERVIEW

11.2 AXIAL

11.3 CENTRIFUGAL

12 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION

12.1 OVERVIEW

12.2 CONGESTIVE HEART FAILURE

12.2.1 HEART PUMP

12.2.2 CONTROLLER

12.2.3 BATTERIES

12.2.4 WIRES

12.3 CONGENITAL HEART DISEASE

12.3.1 HEART PUMP

12.3.2 CONTROLLER

12.3.3 BATTERIES

12.3.4 WIRES

12.4 MYOCARDITIS

12.4.1 HEART PUMP

12.4.2 CONTROLLER

12.4.3 BATTERIES

12.4.4 WIRES

12.5 CARDIAC ARREST

12.5.1 HEART PUMP

12.5.2 CONTROLLER

12.5.3 BATTERIES

12.5.4 WIRES

12.6 FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES

12.6.1 HEART PUMP

12.6.2 CONTROLLER

12.6.3 BATTERIES

12.6.4 WIRES

12.7 ADVANCED HEART FAILURE

12.7.1 HEART PUMP

12.7.2 CONTROLLER

12.7.3 BATTERIES

12.7.4 WIRES

12.8 OTHERS

13 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY DURABILITY

13.1 OVERVIEW

13.2 LONG-TERM

13.3 INTERMEDIATE-TERM

13.4 SHORT-TERM

14 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY PULSE TYPE

14.1 OVERVIEW

14.2 NONPULSATILE

14.3 PULSATILE

15 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITAL

15.3 CARDIAC CATH LABORATORIES

15.4 SPECIALTY CLINICS

15.5 OTHERS

16 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY NORTH AMERICA

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 ABIOMED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.1.5.1 FDA APPROVAL

20.1.5.2 FDA APPROVAL

20.2 ABBOTT

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.2.5.1 SUPPLY INCREMENT

20.2.5.2 BREAK THROUGH DEVICE DESIGNATION

20.3 BERLIN HEART

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.3.4.1 PRODUCT APPROVAL

20.4 SAFT (A SUBSIDIARY OF TOTALENERGIES)

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENT

20.4.5.1 PARTNERSHIP

20.5 JARVIK HEART, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.5.4.1 FDA APPROVAL

20.6 CORWAVE SA

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.6.3.1 EXPANSION

20.7 EVAHEART, INC

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.7.3.1 PRODUCT TRIAL

21 QUESTIONNAIRE

22 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 26 U.S. BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 28 U.S. BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 29 U.S. DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 30 U.S. BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 31 U.S. BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 32 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 33 U.S. ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 34 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 35 U.S. CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 36 U.S. CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 37 U.S. MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 38 U.S. CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 U.S. ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 41 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 42 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 43 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 44 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 49 CANADA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 51 CANADA BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 52 CANADA DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 53 CANADA BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 54 CANADA BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 55 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 56 CANADA ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 57 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 CANADA CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 59 CANADA CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 63 CANADA ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 66 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 67 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 72 MEXICO BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 74 MEXICO BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 75 MEXICO DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 76 MEXICO BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 77 MEXICO BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 78 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 84 MEXICO CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 86 MEXICO ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 87 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 88 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 89 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 90 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET:VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASE AND RISING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HEART PUMP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET

FIGURE 14 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, 2021

FIGURE 19 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, 2020-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, 2021

FIGURE 23 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, 2020-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 26 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, 2021

FIGURE 27 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, 2020-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, 2021

FIGURE 31 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, 2020-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 34 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, 2021

FIGURE 35 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 38 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, 2021

FIGURE 39 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, 2020-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, LIFELINE CURVE

FIGURE 42 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, 2021

FIGURE 43 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, 2020-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, LIFELINE CURVE

FIGURE 46 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, 2021

FIGURE 47 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 48 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 49 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 50 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 51 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 52 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 53 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 54 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SNAPSHOT (2021)

FIGURE 55 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2021)

FIGURE 56 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 57 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 58 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 59 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。