North America Long Chain Polyamide Market

市场规模(十亿美元)

CAGR :

%

USD

798.55 Million

USD

1,107.78 Million

2024

2032

USD

798.55 Million

USD

1,107.78 Million

2024

2032

| 2025 –2032 | |

| USD 798.55 Million | |

| USD 1,107.78 Million | |

|

|

|

北美長鏈聚醯胺市場細分,按類型(PA 11、PA 12、PA 610、PA 612、PA 410、PA 1010、PA 1012等)、來源(人造和天然存在)、形式(碎片、粉末等)、應用(工程塑料、聚酰胺纖維和織物、聚酰胺薄膜、聚酰胺粘合劑、塗料等)、最終用途(電氣和電子、醫療保健、工業、汽車、消費品、包裝、航空航天和國防、石油和天然氣、能源等)- 行業趨勢和預測到 2032 年

北美長鏈聚醯胺市場分析

長鏈聚醯胺 (LCPA) 市場因其在汽車、電氣、電子和工業應用中的廣泛應用而正在穩步增長。這些高性能材料具有優異的熱穩定性、耐化學性和機械性能,逐漸取代傳統的金屬和聚合物。汽車產業推動了需求,LCPA 被用於燃油系統、連接器和引擎蓋下應用。此外,電動車產量的成長和零件輕量化的趨勢進一步提升了市場前景。在工業擴張的推動下,亞太地區在市場份額方面處於領先地位,而北美和歐洲也因技術進步和永續材料創新做出了巨大貢獻。

長鏈聚醯胺市場規模

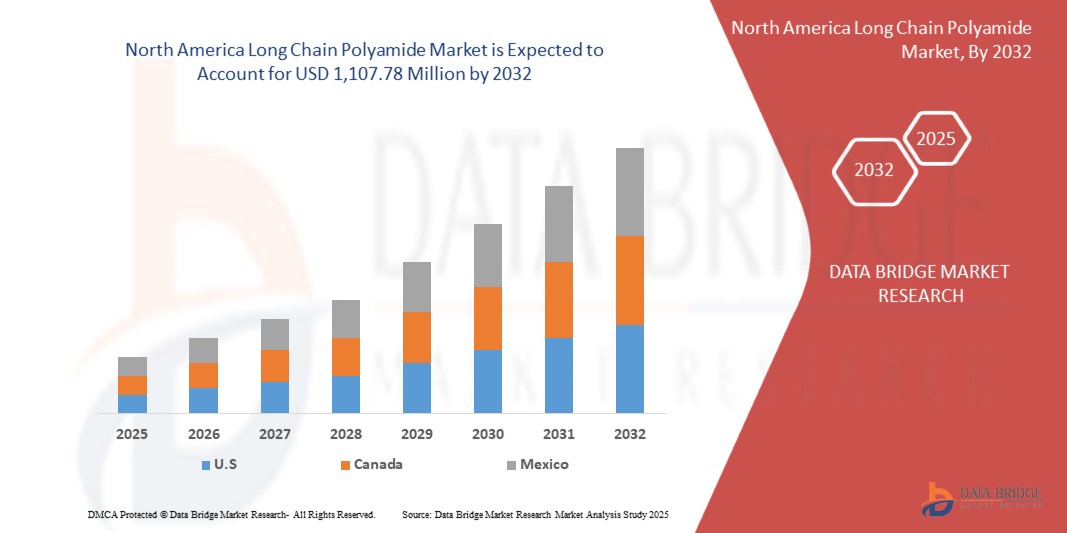

2024 年北美長鏈聚醯胺市場規模為 7.9855 億美元,預計到 2032 年將達到 11.0778 億美元,2024 年至 2032 年預測期內的複合年增長率為 4.28%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

長鏈聚醯胺市場

“廣泛應用於汽車、電氣、電子和工業領域”

長鏈聚醯胺 (LCPA) 因其出色的熱穩定性、機械強度和耐化學性,在汽車、電氣、電子和工業應用中越來越受歡迎。在汽車產業,LCPA 用於輕量化零件、燃油系統、連接器和引擎蓋下零件,有助於提高燃油效率和車輛性能。在電氣和電子領域,LCPA 的絕緣性能使其成為連接器、電線和電路板的理想選擇。它的耐用性也有利於工業應用,其中 LCPA 可用於齒輪、軸承和機械零件。這些屬性使 LCPA 能夠取代傳統材料,從而提高各領域的效率和永續性。

報告範圍和市場細分

|

屬性 |

長鏈聚醯胺成分關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

美國、加拿大和墨西哥 |

|

主要市場參與者 |

LG化學(韓國)、巴斯夫(德國)、阿科瑪(法國)、贏創工業股份公司(德國)、杜邦(美國)、旭化成株式會社(日本)、東麗工業株式會社(日本)、三井化學美國公司(日本)、可樂麗株式會社(日本)、亨斯邁斯國際責任公司。 (美國)、Ascend Performance Materials(美國)、Envalior(德國)、Domo Chemicals(比利時)、NYCOA(紐約化學公司)(美國)和Radici Partecipazioni SpA(義大利) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

長鏈聚醯胺市場定義

The Long Chain Polyamide (LCPA) market refers to the North America industry focused on the production, distribution, and consumption of polyamide polymers with longer molecular chains, typically containing 12 or more carbon atoms. These high-performance materials are known for their superior thermal stability, chemical resistance, mechanical strength, and durability. LCPAs are used in a wide range of applications, including automotive, electrical, electronics, industrial, and consumer goods, where their strength and resilience in harsh environments are essential. The market is driven by demand for lightweight, durable, and sustainable materials that offer better performance compared to conventional polymers and metals.

Biochar Market Dynamics

Drivers

- Surging Demand For Lightweight And High-Performance Materials From Automotive Industry

The surging demand for lightweight and high-performance materials from the automotive industry is a significant driver of the North America long-chain polyamide market. As automotive manufacturers increasingly focus on improving fuel efficiency, reducing emissions, and enhancing vehicle performance, the need for materials that are both lightweight and durable has escalated. Long-chain polyamides, with their exceptional strength-to-weight ratio, are ideal for these purposes, making them a preferred choice in various automotive applications.

Long-chain polyamides are used in the production of components such as engine parts, fuel lines, connectors, and electrical components. These materials not only reduce the overall weight of the vehicle but also provide the required strength and resistance to heat, chemicals, and wear, making them essential for modern automotive manufacturing. For example, in engine compartments, where components must withstand high temperatures and stress, long-chain polyamides offer superior thermal stability and mechanical strength compared to traditional materials.

Furthermore, the automotive industry’s shift toward electric vehicles (EVs) has also boosted the demand for high-performance polymers. EVs require lightweight materials to enhance battery efficiency and range, and long-chain polyamides, with their electrical insulating properties and robustness, are increasingly being integrated into the design of battery housings, connectors, and other crucial components.

- Fast Expanding Electrical And Electronics Sector

The fast-expanding electrical and electronics sector is a key driver for the North America long-chain polyamide market. As technology advances and the demand for electronic devices and systems grows, there is an increasing need for materials that offer excellent thermal stability, electrical insulation, and mechanical strength. Long-chain polyamides, known for their high-performance characteristics, meet these requirements and are widely used in electrical and electronic applications.

長鏈聚醯胺在連接器、開關、電路板、絕緣體和電纜等零件的生產上特別有價值。這些材料具有優異的電氣絕緣性能,這對於確保電子設備安全高效運作至關重要。它們具有耐熱和耐化學腐蝕的特性,非常適合用於高性能電子產品,因為這些電子產品的組件通常在高溫下運作或暴露在惡劣的條件下。

智慧型手機、穿戴式裝置和智慧家居設備等消費性電子產品的興起正在推動對長鏈聚醯胺的需求。此外,醫療保健、汽車和電信等行業的物聯網 (IoT) 和智慧技術的發展進一步推動了對先進材料的需求。長鏈聚醯胺越來越多地用於製造微型電子元件,因為空間限制和性能要求至關重要。

機會

- 生物基聚醯胺的進展

生物基聚醯胺的進步為北美長鏈聚醯胺 (LCPA) 市場的成長提供了重大機會。隨著永續性成為各行業越來越重要的關注點,對傳統石油基聚合物的環保替代品的需求也日益增長。生物基聚醯胺源自再生資源,如植物糖、油和其他生物質來源,它提供了一種有吸引力的解決方案,可以減少對化石燃料的依賴,同時保持 LCPA 所具有的高性能特性。

生物基聚醯胺的主要優勢之一是其能夠減少生產過程中的碳排放和能源消耗。透過利用可再生原料,生物基聚醯胺可以幫助降低汽車、電子和紡織等產業對環境的影響,這些產業是長鏈聚醯胺的主要消費者。這與北美向循環經濟轉型和滿足更嚴格的環境法規的努力一致,特別是在歐洲和北美等地區。

此外,生物基聚醯胺可以滿足消費者對永續產品日益增長的偏好。隨著越來越多的消費者和企業優先考慮環保解決方案,對傳統塑膠的生物基替代品的需求正在上升。例如,生物基聚醯胺在汽車應用領域越來越受到關注,汽車產業正在尋求更輕、更永續的材料來提高燃油效率並減少排放。此外,生物基聚醯胺正在被探索用於電子產品,其高熱穩定性和電絕緣性能有利於綠色技術。

- 高性能紡織品需求不斷成長

對高性能紡織品的需求不斷增長,為北美長鏈聚醯胺 (LCPA) 市場的成長提供了重大機會。高性能紡織品以其耐用性、強度和多功能性而聞名,在汽車、運動服、醫療和工業應用等各個行業中越來越受到追捧。長鏈聚醯胺由於其獨特的機械強度、耐磨性和熱穩定性組合,是這些高性能織物的理想材料。

例如,在汽車領域,LCPA 用於生產汽車內飾的輕質耐用紡織品,包括座椅套、內飾和安全氣囊。這些材料具有所需的韌性和抵抗高溫、紫外線照射等惡劣條件的能力,提高了汽車零件的安全性和使用壽命。隨著汽車製造商繼續專注於生產具有先進功能的更省油的汽車,對長鏈聚酰胺製成的高性能紡織品的需求預計會增加。

運動服和運動服市場是高性能紡織品需求不斷增長的另一個領域。 LCPA 具有出色的強度和彈性,適合生產需要耐用性和舒適性的服裝和裝備,例如運動服、鞋子和防護裝備。隨著消費者越來越關注高品質、高性能的產品,長鏈聚醯胺基紡織品為運動服產業的製造商提供了競爭優勢。

限制/挑戰

- 生產流程複雜,己內醯胺和特種添加劑等原料成本高昂

複雜的製造流程和己內醯胺、特種添加劑等原料的高成本嚴重限制了北美長鏈聚醯胺(LCPA)市場的成長。 LCPA 的生產涉及複雜的工藝,需要專門的設備和技術。這些過程包括聚合、縮合和擠壓,需要大量的能源投入和技術專長,這會增加生產成本。製造的複雜性也使得擴大生產變得困難,可能會限制供應並進一步推高成本。

生產長鏈聚醯胺的主要原料之一是己內醯胺,它是尼龍合成的關鍵前驅物。己內醯胺來自石油基原料,原油價格的波動直接影響其成本。隨著北美油價上漲,己內醯胺的價格也隨之上漲,增加了 LCPA 生產的整體成本。這種價格波動對製造商來說是一個挑戰,他們必須平衡生產成本和市場價格才能保持競爭力。

此外,也經常使用增塑劑、穩定劑和阻燃劑等特殊添加劑來增強長鏈聚醯胺的性能。這些添加劑也很昂貴,可能會導致 LCPA 生產的總體成本過高。對這些昂貴材料的依賴進一步給製造業的經濟帶來了壓力,特別是對於那些尋求降低成本同時保持高性能標準的行業。

- 原物料價格波動

原料價格波動對北美長鏈聚醯胺 (LCPA) 市場來說是一項重大挑戰。 LCPA 的生產很大程度上依賴關鍵原材料,例如己內酰胺(一種源自石油基來源的主要前體)和特種添加劑。這些原材料的價格會因各種因素而波動,包括北美油價變化、供應鏈中斷和地緣政治不穩定。因此,製造商面臨不確定性和成本壓力,這可能會影響獲利能力和市場穩定性。

己內醯胺是生產聚醯胺的關鍵原料,對原油價格的變化非常敏感。由於己內酰胺來自石油,因此石油市場的任何波動都可能導致己內酰胺成本大幅上漲,進而提高 LCPA 的整體生產成本。此外,主要產油區的地緣政治事件或自然災害可能會擾亂供應鏈,導致石油短缺和價格進一步上漲。

用於增強 LCPA 性能的特殊添加劑(如阻燃劑、穩定劑和增塑劑)的價格也容易波動。這些添加劑通常來自特定的化學過程或來自有限的供應商,因此容易受到供應鏈中斷的影響。這些材料成本的增加可能會增加製造商的財務負擔,特別是在對價格敏感或已經面臨激烈競爭的行業。

原材料短缺和運輸延誤的影響和當前市場情勢

Data Bridge Market Research 提供高水準的市場分析,並透過考慮原材料短缺和運輸延遲的影響和當前市場環境來提供資訊。這意味著評估策略可能性、制定有效的行動計劃並協助企業做出重要決策。

除了標準報告外,我們還提供對採購層面的深入分析,包括預測運輸延遲、按地區劃分的經銷商映射、商品分析、生產分析、價格映射趨勢、採購、類別績效分析、供應鏈風險管理解決方案、高級基準測試以及其他採購和戰略支援服務。

經濟放緩對產品定價和供應的預期影響

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

North America Long Chain Polyamide Market Scope

The North America long-chain polyamide market is segmented into five notable segments based on type, source, form, application, and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- PA 12

- PA 11

- PA 610

- PA 612

- PA 1010

- PA 1012

- PA 410

- Others

Source

- Artificially Made

- Naturally Occurring

Form

- Chips

- Powder

- Others

Application

- Engineering Plastics

- Polyamide Fibers & Fabrics

- Polyamide Films

- Polyamide Adhesives

- Coatings

- Others

End Use

- Electrical & Electronics

- Healthcare, Industrial

- Automotive, Consumer Goods

- Packaging

- Aerospace & Defense

- Oil & Gas

- Energy

- Others

North America Long Chain Polyamide Market Regional Analysis

The market is analyzed and market size insights and trends are provided on the basis of country, type, source, form, application, and end-use as referenced above

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate the long chain polyamide market due to advanced technological innovation, strong automotive and electronics industries, a focus on sustainability, and high demand for high-performance materials in various applications.

Canada is expected to be fastest growing region in the long chain polyamide market due to its focus on automotive innovation, sustainable manufacturing practices, increasing demand for high-performance materials, and strong presence in industrial and electronic sectors.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Long Chain Polyamide Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Long Chain Polyamide Market Leaders Operating in the Market Are:

- LG Chem (South Korea)

- BASF (Germany)

- Arkema (France)

- Evonik Industries AG (Germany)

- DuPont (U.S.)

- Asahi Kasei Corporation (Japan)

- TORAY INDUSTRIES INC. (Japan)

- MITSUI CHEMICALS AMERICA INC. (Japan)

- KURARAY CO. LTD (Japan)

- Huntsman International LLC. (U.S.)

- Ascend Performance Materials (U.S.)

- Envalior (Germany)

- Domo Chemicals (Belgium)

- NYCOA (New York Chemicals) (U.S.)

- Radici Partecipazioni SpA (Italy)

Latest Developments in North America Long Chain Polyamide Market

- In November 2024, BASF’s Polyamide 6 (PA6) plant in Shanghai received the ISCC PLUS certification, enabling it to produce biomass-balanced and Ccycled PA6. This certification supports BASF’s commitment to sustainability, offering lower carbon footprint and circular product alternatives in the PA6 value chain

- In December 2024, Arkema completed the acquisition of Dow’s flexible packaging laminating adhesives business, a leading global producer. This move expanded Arkema's portfolio in flexible packaging, positioning the company as a key player in the market

- In November 2024, Asahi Kasei has announced its decision to absorb its wholly owned subsidiary, Asahi Kasei NS Energy, through a simplified absorption-type merger, effective April 1, 2025. This move aims to streamline operations after Asahi Kasei NS Energy became a fully owned subsidiary in April 2023

- In April 2024, Domo Chemicals has inaugurated a new factory in China with a USD 15.12 million investment, enhancing production capacity. The facility, located south of Shanghai, will double output in the short term and potentially triple it in the future.

- In September 2022, NYCOA announced the launch of NXTamid-L, a new family of specialty performance nylons designed as alternatives to Nylon 12 and 11. NXTamid-L offers comparable or superior properties, including flexibility, lower moisture absorption, higher glass transition temperatures, and enhanced chemical resistance. This innovative nylon family can also be customized to meet specific performance requirements, reinforcing NYCOA’s position as a leader in the nylon industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OVERVIEW: NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

4.6 PRODUCTION CONSUMPTION ANALYSIS- NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

4.7 VALUE CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT (MONOMERS & CHEMICALS)

4.7.2 POLYMERIZATION PROCESS (SYNTHESIS OF POLYAMIDE)

4.7.3 COMPOUNDING AND ADDITIVES

4.7.4 FABRICATION (PROCESSING INTO FINAL SHAPES)

4.7.5 DISTRIBUTION AND LOGISTICS

4.7.6 END-USE APPLICATIONS (FINAL PRODUCTS)

4.7.7 CONCLUSION

4.8 VENDOR SELECTION CRITERIA

4.9 CLIMATE CHANGE SCENARIO

4.9.1 ENVIRONMENTAL CONCERNS

4.9.2 INDUSTRY RESPONSE

4.9.3 GOVERNMENT’S ROLE

4.9.4 ANALYST RECOMMENDATIONS

4.1 MARKET SITUATION

4.10.1 PA 1010

4.10.2 PA 1012

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12.1 DEVELOPMENT OF BIO-BASED POLYAMIDES

4.12.2 ADVANCED POLYMERIZATION TECHNIQUES

4.12.3 INTEGRATION OF RECYCLING TECHNOLOGIES

4.12.4 ADOPTION OF SMART MANUFACTURING

4.13 RAW MATERIAL COVERAGE

4.13.1 DICARBOXYLIC ACIDS

4.13.2 DIAMINES

4.13.3 LONG-CHAIN FATTY ACIDS

4.13.4 PETROCHEMICAL FEEDSTOCKS

4.13.5 EMERGING BIO-BASED ALTERNATIVES

4.13.6 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SURGING DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS FROM AUTOMOTIVE INDUSTRY

6.1.2 FAST EXPANDING ELECTRICAL AND ELECTRONICS SECTOR

6.1.3 ADVANCEMENTS AND INNOVATIONS IN SUSTAINABLE PRODUCTION TECHNOLOGIES FOR LONG CHAIN POLYAMIDE

6.2 RESTRAINTS

6.2.1 COMPLEX MANUFACTURING PROCESS AND HIGH COSTS OF RAW MATERIALS

6.2.2 COMPETITION FROM OTHER HIGH-PERFORMANCE POLYMERS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN BIO-BASED POLYAMIDES

6.3.2 RISING DEMAND FOR HIGH-PERFORMANCE TEXTILES

6.3.3 GROWING APPLICATIONS OF LONG CHAIN POLYAMIDE IN MEDICAL DEVICES

6.4 CHALLENGES

6.4.1 VOLATILITY IN RAW MATERIAL PRICES

6.4.2 STRINGENT REGULATIONS ON PLASTIC USE, RECYCLING AND DISPOSAL

7 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE

7.1 OVERVIEW

7.2 PA 11

7.3 PA 12

7.4 PA 610

7.5 PA 612

7.6 PA 410

7.7 PA 1010

7.8 PA 1012

7.9 OTHERS

8 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ARTIFICIALLY MADE

8.3 NATURALLY OCCURRING

9 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM

9.1 OVERVIEW

9.2 CHIPS

9.3 POWDER

9.4 OTHERS

10 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ENGINEERING PLASTICS

10.3 POLYAMIDE FIBERS & FABRICS

10.4 POLYAMIDE FILMS

10.5 POLYAMIDE ADHESIVES

10.6 COATINGS

10.7 OTHERS

11 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE

11.1 OVERVIEW

11.2 ELECTRICAL & ELECTRONICS

11.3 HEALTHCARE

11.4 INDUSTRIAL

11.5 AUTOMOTIVE

11.6 CONSUMER GOODS

11.7 PACKAGING

11.8 AEROSPACE & DEFENSE

11.9 OIL & GAS

11.1 ENERGY

11.11 OTHERS

12 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EVONIK INDUSTRIES AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ARKEMA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASAHI KASEI CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ASCEND PERFORMANCE MATERIALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DOMO CHEMICALS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ENVALIOR

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 HUNTSMAN INTERNATIONAL LLC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 KURARAY CO., LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 LG CHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MITSUI CHEMICALS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 NYCOA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 RADICI PARTECIPAZIONI SPA

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 TORAY INDUSTRIES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF TOP COMPANIES: NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

TABLE 2 REGULATORY COVERAGE

TABLE 3 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 5 NORTH AMERICA PA 11 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA PA 11 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 7 NORTH AMERICA PA 12 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA PA 12 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 9 NORTH AMERICA PA 610 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA PA 610 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 11 NORTH AMERICA PA 612 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA PA 612 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 13 NORTH AMERICA PA 410 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA PA 410 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 15 NORTH AMERICA PA 1010 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA PA 1010 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 17 NORTH AMERICA PA 1012 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PA 1012 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 19 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 21 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2018-2032 (TONS)

TABLE 23 NORTH AMERICA ARTIFICIALLY MADE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA ARTIFICIALLY MADE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 25 NORTH AMERICA NATURALLY OCCURRING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA NATURALLY OCCURRING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 27 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 29 NORTH AMERICA CHIPS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA CHIPS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 NORTH AMERICA POWDER IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA POWDER IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 33 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 37 NORTH AMERICA ENGINEERING PLASTICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA ENGINEERING PLASTICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 NORTH AMERICA POLYAMIDE FIBERS & FABRICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA POLYAMIDE FIBERS & FABRICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 41 NORTH AMERICA POLYAMIDE FILMS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA POLYAMIDE FILMS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 NORTH AMERICA POLYAMIDE ADHESIVES IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA POLYAMIDE ADHESIVES IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 45 NORTH AMERICA COATINGS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COATINGS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 47 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 49 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 51 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 53 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 57 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 61 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 65 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 69 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 73 NORTH AMERICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 76 NORTH AMERICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 79 NORTH AMERICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 82 NORTH AMERICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 85 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 88 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 90 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 92 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 94 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 96 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 98 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 115 U.S. LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 117 U.S. LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 118 U.S. LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 119 U.S. LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 121 U.S. LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 122 U.S. LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 123 U.S. ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 U.S. ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 U.S. INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 CANADA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 CANADA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 140 CANADA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 141 CANADA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 142 CANADA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 143 CANADA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 144 CANADA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 146 CANADA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 148 CANADA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 CANADA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 CANADA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 CANADA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MEXICO LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MEXICO LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 165 MEXICO LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 166 MEXICO LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 167 MEXICO LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 168 MEXICO LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 169 MEXICO LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 MEXICO LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 171 MEXICO LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 172 MEXICO LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 173 MEXICO ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 174 MEXICO ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MEXICO HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 MEXICO HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 MEXICO INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 178 MEXICO INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MEXICO AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 180 MEXICO AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 MEXICO CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 MEXICO CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 MEXICO PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MEXICO AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MEXICO OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MEXICO ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

FIGURE 2 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 EIGHT SEGMENTS COMPRISE THE NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 SURGING DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS FROM AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA LONG CHAIN POLYAMIDE MARKET IN THE FORECAST PERIOD

FIGURE 16 THE PA 11 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LONG CHAIN POLYAMIDE MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 VALUE CHAIN ANALYSIS FOR NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

FIGURE 24 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: BY TYPE, 2024

FIGURE 25 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2024

FIGURE 26 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2024

FIGURE 27 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2024

FIGURE 28 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2024

FIGURE 29 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: SNAPSHOT (2024)

FIGURE 30 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。