North America Optical Fiber Components Market

市场规模(十亿美元)

CAGR :

%

USD

2.72 Billion

USD

4.10 Billion

2024

2032

USD

2.72 Billion

USD

4.10 Billion

2024

2032

| 2025 –2032 | |

| USD 2.72 Billion | |

| USD 4.10 Billion | |

|

|

|

|

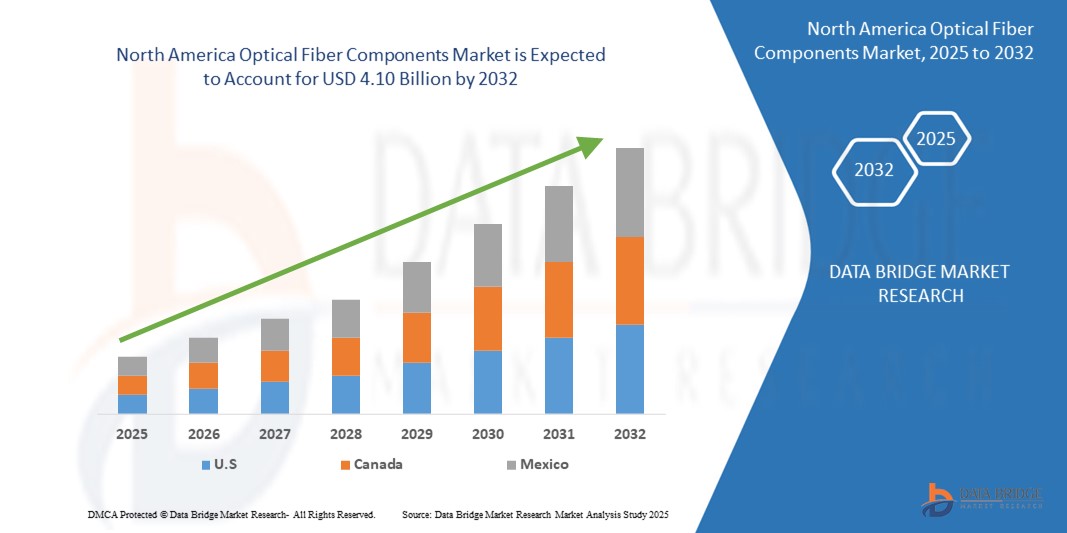

北美光纖組件市場按類型(收發器、放大器、電纜、連接器、波分復用 (WDM) 組件)、數據速率(高達 10 Gbps、10-40 Gbps、40-100 Gbps、100 Gbps 以上)、應用(電信、數據通訊、工業、國防)和最終服務工業、國防管理)。該市場橫跨美國、加拿大和墨西哥,其中美國憑藉 5G 的強勁部署、數據中心的成長以及聯邦數位基礎設施計劃而處於領先地位。

北美光纖組件市場規模

- 2025 年北美光纖組件市場價值為 27.2 億美元,預計到 2032 年將達到約 41 億美元,預測期內複合年增長率為 6.03%......

- 這一增長得益於高速寬頻網路投資的不斷增加、5G 的快速部署以及美國和加拿大超大規模資料中心的擴張。此外,對低延遲連接、雲端服務和人工智慧驅動的數位基礎設施的需求日益增長,促使電信營運商和企業升級到先進的光纖組件,包括收發器、WDM 模組和光放大器。

北美光纖組件市場分析

- 隨著北美地區電信、企業和政府部門的數位轉型,該地區光纖組件市場正呈現強勁成長動能。隨著5G部署、雲端運算和資料中心擴張推動對更快、更可靠的互聯網的需求激增,收發器、光纖、連接器和WDM系統等光纖組件正成為必不可少的基礎設施。

- 美國在寬頻普及方面處於領先地位,聯邦政府在BEAD(寬頻公平、接入和部署)等項目的支持下,對寬頻擴展和農村連接進行了大規模投資。同時,加拿大也在加速光纖部署,以滿足各行各業和社區日益增長的數位服務需求。

- 隨著企業不斷升級其網路以支援人工智慧、物聯網和邊緣運算,對高頻寬、低延遲光纖基礎設施的需求也日益增長。同時,從傳統銅纜網路向光纖網路的過渡也推動了對耐用且可擴展組件的需求。

- 隨著技術先進的城市、超大規模資料中心的成長以及成熟的電信生態系統,北美預計將繼續成為下一代光纖組件創新和部署的關鍵成長中心

北美光纖組件市場細分

|

屬性 |

北美光纖組件市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

5G 網路的快速部署以及美國和加拿大對超大規模資料中心日益增長的需求,正在推動對高效能光纖元件的投資,以確保超低延遲和高速資料傳輸。

各行業的企業都在升級到基於光纖的網絡,以支援雲端運算、遠端工作和即時資料交換,從而增加了對收發器、電纜和 WDM 組件的需求。

智慧城市、製造業和醫療保健領域向邊緣運算的轉變正在為網路邊緣的緊湊型高容量光纖組件創造新的用例——提高速度並減少擁塞。

政府支持的寬頻擴展計畫(如美國的BEAD)和電信業者的私人投資正在加速最後一英里的光纖部署,尤其是在服務不足的農村地區。

相干光學、矽光子學和整合式光放大器等創新正在突破光纖組件的性能界限,為供應商提供滿足不斷發展的企業和電信需求的機會。 |

|

加值資料資訊集 |

|

北美光纖組件市場趨勢

“人工智慧和自動化在光纖網路監控和優化中的作用日益增強”

- 重塑北美光纖組件市場的關鍵趨勢是人工智慧與自動化在光纖網路營運中的融合。傳統的光纖網路需要手動診斷和定期維護,這常常導致故障檢測延遲和更長的停機時間。然而,借助人工智慧驅動的網路監控工具,電信營運商和資料中心現在可以主動偵測訊號衰減,預測元件故障,並即時優化流量路由。

- 在美國和加拿大,光纖網路構成了 5G、雲端運算和高頻金融服務的骨幹,對近乎零延遲和不間斷正常運作的需求正推動智慧光纖監控系統的普及。這些系統利用機器學習來分析數 TB 的光訊號數據,識別使用異常並建議預防措施,從而最大限度地減少服務中斷並提升客戶體驗。

- 此外,自動化配置和軟體定義網路 (SDN) 功能使電信業者能夠重新配置光路、調整頻寬並管理交叉連接,而無需人工幹預。這種轉變不僅降低了營運成本,而且還支援可擴展性,以應對智慧城市、自動駕駛交通和邊緣運算應用需求的激增。

- 隨著北美數位基礎設施的持續擴張,人工智慧和自動化對於確保光纖網路的效率、靈活性和彈性至關重要。光纖硬體與智慧軟體的融合不再是奢侈的,而是競爭的必需品。

北美光纖組件市場動態

司機

“高速連接和雲端基礎設施需求飆升”

- 受快速雲端遷移、視訊串流、遠端辦公以及人工智慧、邊緣運算和自主系統等新一代技術的推動,北美地區的頻寬需求正呈現前所未有的激增。從城域網路到超大規模資料中心,對更快、可擴展且低延遲連接的需求正推動企業和電信營運商對其光纖網路進行現代化升級。

- 光纖組件(例如收發器、放大器和WDM模組)是此轉變的核心,它們能夠實現長距離高容量傳輸,同時最大程度地降低訊號損耗。隨著雲端服務供應商在美國和加拿大各地擴展資料中心,對堅固耐用且模組化的光纖基礎設施的需求急劇增長。

- 此外,5G 的日益普及進一步放大了這項需求。光纖對於跨分散式天線系統和小型蜂窩網路的高頻 5G 訊號回傳和前傳至關重要。雲端運算和行動生態系統的整合正在推動對光纖技術的持續投資,北美在全球部署計畫中處於領先地位。

- With government incentives, private-public partnerships, and broadband expansion programs like the U.S. BEAD (Broadband Equity, Access, and Deployment) initiative, the fiber optics ecosystem is well-positioned for long-term, transformative growth across both urban and underserved areas.

Restraint/Challenge

“High Capital Investment and Complex Installation Processes

- Despite the robust outlook, one of the most significant challenges facing the North America optical fiber components market is the steep capital expenditure required for full-scale deployment. Laying fiber networks—especially in rural or underground environments—requires expensive trenching, permits, labor, and materials. Additionally, core components like DWDM systems, high-speed transceivers, and optical switches come with a high price tag

- Installation is also highly labor-intensive and often involves navigating legacy infrastructure, coordinating with multiple stakeholders, and overcoming zoning or regulatory hurdles. This slows down rollout timelines and adds logistical complexity for telecom operators and ISPs.

- For smaller enterprises and local network providers, these upfront costs can be prohibitive, limiting their ability to scale infrastructure quickly—even if demand is present. Moreover, the specialized skill sets required for fiber splicing, testing, and network optimization are still in short supply, adding further constraints to fast-track deployments.

- Without cost-effective, plug-and-play fiber solutions and broader workforce training, the pace of optical network modernization may face delays, especially in semi-urban and rural areas where ROI is less immediate.

The North America Optical Fiber Components Market is segmented based on component, system type, application, and end-user industry.

-

- By component

The market includes key components such as optical transceivers, optical amplifiers, optical cables, connectors, splitters, circulators, and WDM (Wavelength Division Multiplexing) components. Optical transceivers and cables hold the largest share due to their widespread use in high-speed data transmission across telecom and data center infrastructures.

-

- By Data Rate:

Segments include Up to 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, and Above 100 Gbps. Demand for components supporting 100 Gbps and above is growing rapidly with the expansion of hyperscale data centers and 5G backhaul requirements across the U.S. and Canada.

- By Application

The primary applications are data communication, telecommunication, enterprise networking, industrial automation, and military & aerospace. Data communication and telecom are the dominant segments, driven by digital transformation initiatives and the growth of cloud infrastructure.

- By end-user industry

End users include telecom operators, data centers, government & defense, IT & ITeS, healthcare, BFSI, and education sectors. Telecom and hyperscale data centers are the largest consumers, while sectors like healthcare and BFSI are growing rapidly due to increased digitalization and data traffic.

North America Optical Fiber Components Market Regional Analysis

North America surface vision and inspection market insight.

The North America optical fiber components market is witnessing strong growth due to increasing demand for high-speed internet, 5G infrastructure, and data center expansion. The region’s digital transformation across telecom, IT, and enterprise sectors is creating a robust foundation for sustained fiber component deployment.

United States

The U.S. leads the North American market, supported by large-scale 5G rollouts, rising cloud consumption, and government-backed broadband initiatives like the BEAD program. Telecom providers are heavily investing in optical transceivers, WDM modules, and high-bandwidth cables to enable faster connectivity in metro, long-haul, and edge networks. Additionally, the growing adoption of fiber in healthcare and smart city projects is enhancing market traction.

Canada

Canada is focusing on modernizing its network backbone to support remote work, e-learning, and digital services across provinces. Investments are being channeled into rural broadband and urban fiber deployments. Canadian service providers are leveraging optical amplifiers and splitters to boost network efficiency, especially in enterprise and education sectors.

Mexico

Mexico's market is emerging with increased investments in optical cable infrastructure driven by expanding mobile connectivity and rising internet penetration. The growth of online streaming, fintech, and smart infrastructure initiatives is accelerating fiber component usage. While challenges such as cost and urban-rural disparity remain, government-private collaborations are expected to improve accessibility and network coverage.

The following companies are recognized as major players in the Global Surface Vision and Inspection market:

- Corning Incorporated (New York, USA)

- CommScope Inc. – (North Carolina, USA)

- Ciena Corporation – (Maryland, USA)

- Cisco Systems, Inc. – (California, USA)

- Lumentum Holdings Inc. – (California, USA)

- II-VI Incorporated (Coherent Corp.) – (Pennsylvania, USA)

- Viavi Solutions Inc. –( Arizona, USA)

- Belden Inc. – (Missouri, USA)

- Finisar Corporation – (California, USA)

- Prysmian Group – (Milan, Italy)

Latest Developments in North America Optical Fiber Components Market

- In January 2025, Corning announced stronger-than-expected revenue forecasts, driven by robust demand for its optical fiber products across AI-powered data centers and 5G backhaul infrastructure in North America.

- 2024年10月,AT&T與康寧簽署了價值超過10億美元的多年期光纖供應協議,旨在加速其光纖到戶的部署,到2025年覆蓋超過3000萬個地點。

- 2025年4月,康寧在OFC大會上推出了其新一代高密度光纖電纜,專為滿足人工智慧驅動和超大規模資料中心的頻寬和延遲要求而設計。

- 2025年初,美國領先的電信業者開始加大400G光模組的部署,以滿足城域網路和邊緣網路對更高頻寬和超低延遲日益增長的需求。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。