North America Orthobiologics Market Segmentation, By Products (Demineralized Bone Matrix (DBM), Allograft, Bone Morphogenetic Protein (BMP), Viscosupplementation, Synthetic Bone Substitutes, Stem Cell Therapy, Bone Marrow Aspirate Protein, Plasma-Rich Protein, Other Products), Application (Spinal Fusion, Trauma Repair, Reconstructive Surgery, Tendon And Ligament, Osteoarthritis and Degenerative Arthritis, Soft-Tissue Injuries, Fracture Recovery, Maxillofacial and Dental Applications, Others), By Type (Knee, Ankle, Hip, Wrist and Shoulder, Spine, Others), By End-User (Hospitals, Orthopedic Clinics and Ambulatory Care Centres, Research and Academic Institutes, Dental Clinics and Facilities)- Industry Trends and Forecast to 2032

Orthobiologics Market Size

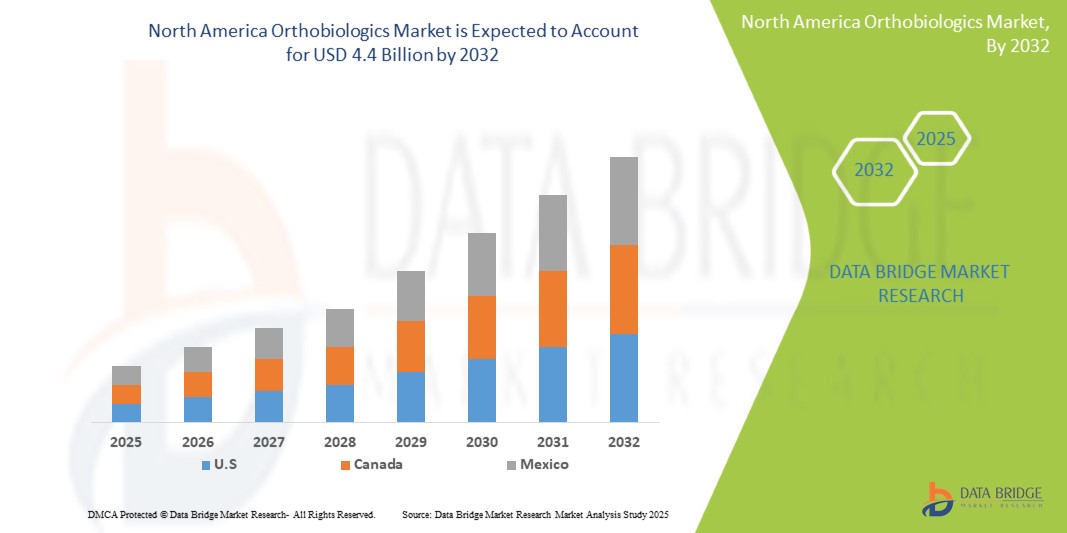

- The North America Orthobiologics Market was valued atUSD2.8 Billionin 2024and is expected to reachUSD4.4 Billionby 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 4.8%primarily driven by the anticipated launch of therapies

- The drivers of the Orthobiologics Market include the Continuous innovation in the development of biologically-based anesthesia delivery systems, biologic implants, and regenerative biologic treatments.

North America Orthobiologics Market Analysis

- Orthobiologics are an essential subset of biologics that play a pivotal role in modern healthcare, particularly in enhancing the safety and efficacy of anesthesia delivery across a wide range of surgical procedures. These biologically derived products are crucial for improving patient outcomes by reducing surgical risks, enhancing tissue healing, and promoting faster recovery. Orthobiologics are commonly utilized in specialties such as orthopedics, cardiology, neurology, trauma care, and regenerative medicine, offering significant benefits in minimally invasive surgeries and biologic therapies.

- The demand for Orthobiologics in North America is driven by factors such as technological advancements, increasing surgical procedures, and a growing aging population. Additionally, the high levels of healthcare expenditure, along with a robust healthcare infrastructure, support the widespread adoption of advanced anesthesia technologies across hospitals and surgical centers.

- North America stands as a dominant region in the global Orthobiologics market, with the United States leading in market share due to its well-established healthcare system, continuous medical innovation, and significant investments in healthcare infrastructure. The presence of major industry players and increasing governmental focus on improving healthcare access further bolsters market growth.

- For instance, North America accounted for 40.8% of the global Orthobiologics market, with the U.S. contributing significantly to this share. In 2025, the market is expected to reach USD 6.04 billion and grow to USD 8.51 billion by 2030, driven by increased surgical procedures and advanced anesthesia technologies.

- Globally, Orthobiologics with an increasing emphasis on biologic solutions to improve surgical precision, enhance recovery, and reduce complications. Technological innovations in biologics, particularly in stem cell therapies, tissue engineering, and regenerative medicine, are central to the market's expansion, especially in the U.S., which is leading the adoption of advanced biologic treatments in clinical settings

Report Scope Orthobiologics Market Segmentation

|

Attributes |

Orthobiologics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orthobiologics Market Trends

“Integration of AI and Advanced Monitoring Technologies”

- Adoption of AI-Enhanced Monitoring: The North American market is witnessing a surge in the integration of artificial intelligence (AI) into anesthesia monitoring devices. These advancements enable real-time data analysis, enhancing patient safety and optimizing anesthesia delivery during surgical procedures.

- Shift Towards Minimally Invasive Procedures: There's a growing preference for minimally invasive surgeries, which require sophisticated Orthobiologics capable of precise control and monitoring, thereby driving demand for advanced equipment in the region.

Orthobiologics Market Dynamics

Driver

“Rising Surgical Procedures and Technological Advancements”

- The escalating number of surgical procedures, particularly among the aging population and patients with chronic diseases, is propelling the demand for Orthobiologics in North America. As Orthobiologics are integral in facilitating healing and recovery during orthopedic surgeries, this increasing volume of procedures further boosts the market for these biologics.

- Continuous advancements in Orthobiologics technology, including the development of user-friendly workstations and integration with electronic health records, are enhancing operational efficiency and patient outcomes. Orthobiologics now benefit from more efficient and precise delivery mechanisms, allowing for better clinical results.

For instance,

- In October 2024, according to a report published by the Orthobiologics Research Society, the increasing adoption of regenerative medicine is driving the growth of the orthobiologics market. With advancements in stem cell therapy, platelet-rich plasma (PRP), and bone marrow aspirates, patients are experiencing faster recovery times and improved healing for musculoskeletal injuries.

- As a result, the growing shift towards regenerative and minimally invasive treatments is encouraging healthcare providers to invest in orthobiologics products, further propelling the expansion of the orthobiologics market.

Opportunity

“Expansion of Ambulatory Surgical Centers and Telehealth Services”

- The proliferation of ambulatory surgical centers (ASCs) is creating new avenues for Orthobiologics device manufacturers, as these centers require compact, efficient, and cost-effective Orthobiologics equipment. With a shift towards outpatient surgeries, there is rising demand for Orthobiologics that can support minimally invasive treatments, which are prevalent in ASCs.

- The expansion of telehealth services is facilitating remote monitoring and management of anesthesia care, opening opportunities for Orthobiologics devices that can seamlessly integrate with telemedicine platforms. This trend helps extend the reach of Orthobiologics treatments to patients in remote or underserved areas.

For instance,

- In November 2024, according to a study published by the American Academy of Orthopaedic Surgeons, the growing demand for non-invasive and minimally invasive procedures presents a significant opportunity for the orthobiologics market. As patients increasingly seek alternatives to traditional surgery, treatments like stem cell therapy, PRP, and growth factors are gaining popularity for their potential to accelerate healing and reduce recovery times.

- This shift towards regenerative medicine offers a promising avenue for market expansion, as healthcare providers invest in orthobiologics solutions to meet the rising demand for more effective, minimally invasive treatments.

Restraint/Challenge

“High Costs and Regulatory Hurdles”

- The substantial costs associated with advanced Orthobiologics can be a barrier for smaller healthcare facilities and ASCs, potentially limiting market penetration. The high costs of specialized Orthobiologics products require substantial investment, which could constrain growth in budget-conscious healthcare settings.

- Navigating the complex regulatory landscape, including obtaining necessary approvals and adhering to stringent standards, poses challenges for manufacturers aiming to introduce new Orthobiologics products in the North American market. Regulatory hurdles can delay product availability and impact time-to-market for emerging Orthobiologics innovations.

For instance,

- In December 2024, according to a report published by the Global Orthobiologics Consortium, one of the key restraints in the orthobiologics market is the high cost of treatments and procedures. The expensive nature of regenerative therapies, such as stem cell treatments and platelet-rich plasma (PRP), can limit accessibility for many patients and healthcare facilities.

- As a result, these high treatment costs may hinder broader adoption of orthobiologics, particularly in regions with limited healthcare budgets, thereby slowing market growth and creating disparities in access to advanced musculoskeletal treatment

Orthobiologics Market Scope

The market is segmented on the basis, product, Application, type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Application |

|

|

By Distribution Channel

|

|

In 2025, the demineralized bone matrix (DBM) is projected to dominate the market with a largest share in product segment

The demineralized bone matrix (DBM) segment is expected to dominate the orthobiologics market with the largest share of 38.14% in 2025 due to its significant role in bone regeneration and repair. DBM is widely used in spinal surgeries, bone defects, and orthopedic procedures due to its ability to promote osteoinduction and accelerate healing. Advancements in processing technologies, along with the growing preference for minimally invasive treatments, are driving the demand for DBM. Additionally, the increasing incidence of musculoskeletal disorders and the aging population further contribute to the market dominance of DBM in the orthobiologics space..

The o Spinal Fusion is expected to account for the largest share during the forecast period in application market

In 2025, the spinal fusion segment is expected to dominate the orthobiologics market with the largest market share of 45.22% due to its widespread use in treating degenerative disc diseases and spinal injuries. As a leading procedure for restoring spinal stability, advancements in biologic materials, including bone grafts and growth factors, are improving patient outcomes and reducing recovery times. The rising incidence of spinal disorders, along with the growing aging population and increasing demand for minimally invasive treatments, further contribute to the market dominance of spinal fusion procedures in orthobiologics.

Orthobiologics Market Regional Analysis

“U.S. is the Dominant Country in the Orthobiologics Market”

- North America leads the global Orthobiologics market, driven by its advanced healthcare infrastructure, high surgical procedure volumes, and the presence of leading medical device manufacturers such as GE Healthcare, Medtronic, and Baxter International.

- The United States holds the largest market share, fueled by the rising prevalence of chronic diseases requiring surgical interventions, strong hospital networks, and a high adoption rate of technologically advanced anesthesia systems.

- Policies such as the Affordable Care Act (ACA), which mandate broader healthcare coverage, indirectly support the market by ensuring access to elective and emergency surgeries that require anesthesia support.

- Robust investments in R&D, along with the integration of digital technologies like artificial intelligence (AI) and electronic health records (EHR) into anesthesia management systems, are further boosting the country’s leadership in the market

“Canada is Projected to Register the Highest Growth Rate”

- Canada is expected to witness the fastest growth in the North American Orthobiologics market, supported by its publicly funded universal healthcare system and growing number of surgical procedures across provinces.

- The country’s proactive healthcare strategies, including increased funding for hospitals and surgical centers, are driving the demand for anesthesia workstations, ventilators, and monitoring equipment.

- Urban regions such as Toronto, Vancouver, and Montreal are seeing significant installations of high-end anesthesia systems due to the rise in outpatient surgeries and specialized surgical care facilities.

- Canada’s healthcare sector is increasingly adopting remote patient monitoring and smart anesthesia technologies, spurred by government incentives and a push toward digital health transformation, further expanding market potential

Orthobiologics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Stryker Corporation (U.S.)

- Zimmer Biomet (U.S.)

- Johnson & Johnson (U.S.)

- NuVasive, Inc. (U.S.)

- MediFocus, Inc. (U.S.)

- Orthofix Medical, Inc. (U.S.)

- DePuy Synthes (U.S.)

- Bioventus (U.S.)

- Xtant Medical (U.S.))

Latest Developments in Orthobiologics Market

- In September 2024, Knack Global announced the acquisition of Merrick Management, Inc., a provider of revenue cycle management solutions for anesthesia practices, marking a significant expansion of Knack’s offerings into the anesthesia market as Merrick’s experienced management team is expected to continue to play a pivotal role in leading Knack’s newly formed Anesthesia Services division.

- In June 2024, GHR Healthcare acquired United Anesthesia, a CRNA and Anesthesiologist staffing firm based in North Carolina, U.S. This strategic merger is expected to allow GHR Healthcare to expand its service offerings and providing comprehensive healthcare staffing solutions to clients nationwide.

- In January 2024, GlaxoSmithKline (GSK) strategically acquired Aiolos Bio, a biopharmaceutical company focused on innovative asthma treatments. Aiolos Bio's advanced pipeline of therapies for respiratory and inflammatory conditions offered GSK promising opportunities for growth and enhanced patient care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。