North America Palm Fiber Packaging Market, By Source (Wood, Non-Wood), Process (Thermoforming, Thick Wall, Transfer, Others), Product (Plates, Trays, Cups, Clamshell, Bowls, Others), Application (Food & Beverages, Industrial, Cosmetics, Logistics, Electrical & Electronics, Pharmaceuticals, Others), Country (U.S., Canada, and Mexico), Industry Trends and Forecast to 2029.

Market Analysis and Insights: North America Palm Fiber Packaging Market

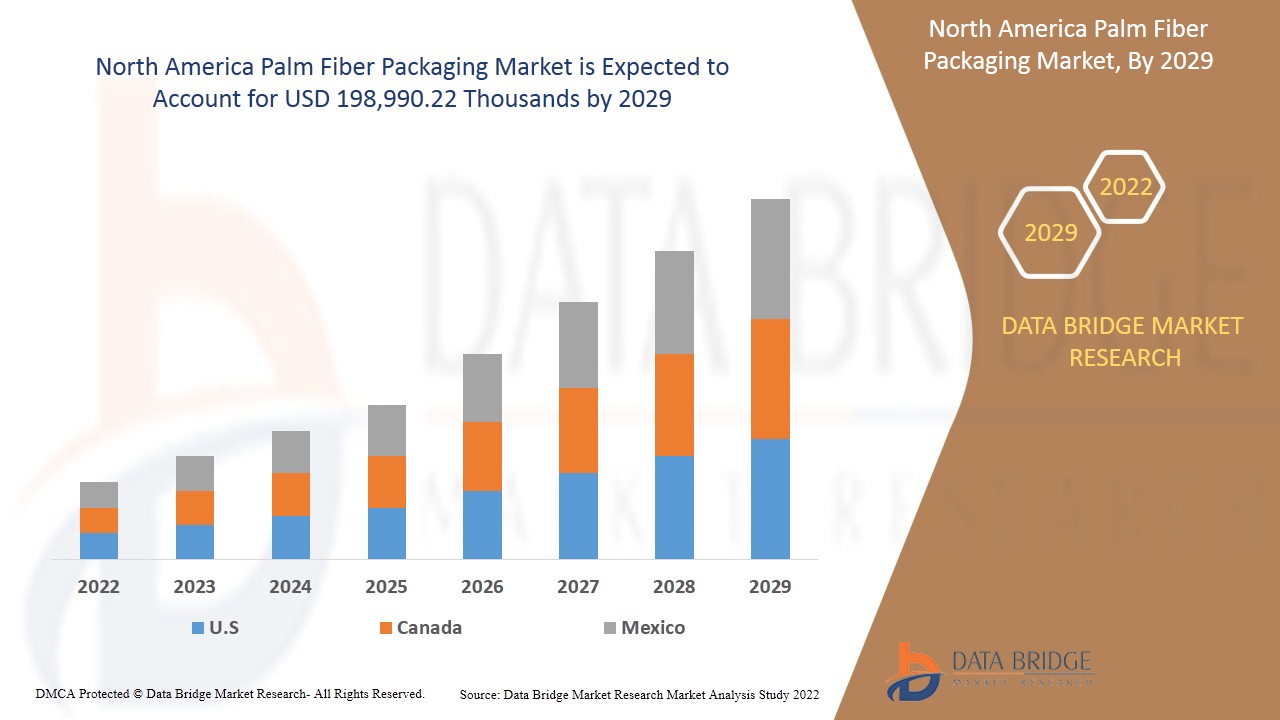

North America palm fiber packaging market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.9% in the forecast period of 2022 to 2029 and is expected to reach USD 198,990.22 thousand by 2029.

Palm fiber is a biodegradable fiber that is obtained from palm tree products such as leaves, fruits. Palm fiber has gained immense popularity in the packaging sector, as these by-products are eco-friendly and have the potential to replace plastic usage in the packaging industry. Palm fibers are extracted using two methods; one of the methods of extracting is via palm fruits. Palm oils are extracted using fruits, and the waste generated after oil extraction can be used for palm fiber. Another method of extraction is via chemical processes where palm leaf sheath is used to extract fiber by treating chemical degumming process at 100°C for 2 hours and 30 min. Palm fiber has various benefits, such as it is inexpensive, naturally available, and have less carbon footprint than others.

Some of the factors which are expected to drive the market is increasing preference for eco-friendly and biodegradable products for packaging and rise in the e-commerce delivery services across the globe. On the other hand, threats from stringent regulations and norms imposed by the government may be a restraining factor for the market's growth.

Significant demand from organized retail stores for innovative packing products is expected to create a new window of opportunity for the market. However, the impact on palm fiber packaging due to environmental factors may act as a major challenge for the market.

This palm fiber packaging market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

North America Palm Fiber Packaging Market Scope and Market Size

North America palm fiber packaging market is segmented based on source, process, product and application. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of source, the Asia-Pacific palm fiber packaging market is segmented into wood and non-wood. In 2022, the non-wood segment is expected to hold a larger share in the palm fiber packaging market due to factors such as growing demand for bio-degradable packaging in FMCG globally, as non-wood are easily available, which can be molded into different shapes and size. Moreover, these by-products are biodegradable; hence it is widely adopted.

- On the basis of process, the Asia-Pacific palm fiber packaging market is segmented into thermoforming, thick wall, transfer, others. In 2022, the thermoforming segment is expected to hold a larger share in the palm fiber packaging market. Factors such as growing demand for bio-degradable thermoformed palm fiber among consumers, as it is easy to and production and fabrication of easy.

- On the basis of product, the Asia-Pacific palm fiber packaging market is segmented into plates, trays, cups, clamshell, bowls, and others. In 2022, the trays segment is expected to hold a larger share in the palm fiber packaging market due to growing awareness among consumers in using eco-friendly products. Trays are the most used products in the market by consumers; hence, proper packaging of these products is crucial.

- On the basis of application, the Asia-Pacific palm fiber packaging market is segmented into food & beverages, industrial, cosmetics, logistics, electrical & electronics, pharmaceuticals, others. In 2022, the food & beverages segment is expected to hold a larger share in the palm fiber packaging market owing to factors such as the growing e-commerce scenario across the globe. Eco-friendly packaging is essential as packaging industries produce a huge quantity of plastic waste.

North America Palm Fiber Packaging Market Country Level Analysis

North America palm fiber packaging market is analysed, and market size information is provided by country, source, process, product, and application.

The countries covered in the North America palm fiber packaging market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the palm fiber packaging market due to factors such as the strong presence of providers and the growing adoption of innovations in palm fiber packaging. Moreover, increasing awareness benefits of fiber-based packaging acts as a market driver.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand for Palm Fiber packaging

The North America palm fiber packaging market also provides you with detailed market analysis for every country's growth in the industry with sales, components sales, the impact of technological development in palm fiber packaging, and changes in regulatory scenarios with their support for the market. The data is available for the historical period 2011 to 2019.

Competitive Landscape and North America Palm Fiber Packaging Market Share Analysis

The North America palm fiber packaging market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the North America palm fiber packaging market.

Some of the major players covered in the North America palm fiber packaging market are ADVANCED PAPER FORMING, Atlantic Pulp, CKF Inc., among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide, which are also accelerating the growth of the North America palm fiber packaging market.

For instances,

- In October 2021, CKF Inc. announced its investment in recyclable and renewable packaging solutions. The key objective of this solution was to reduce the wastage and environmental damages caused by non-renewable packaging products. Through this investment, the company is focusing on sustainable development methods to grow its market

- In July 2017, ADVANCED PAPER FORMING launched end caps for the scanner. The objective of this product launch was to protect the scanner from external mechanical influence. This product was made up of biodegradable fiber material. This helped the company to offer quality products to its consumer.

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. It also benefits the organization to improve its offering for palm fiber packaging through an expanded range of sizes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PALM FIBER PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOURCE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATION COVERAGE

4.2 PRODUCT CODES

4.3 CERTIFIED STANDARDS

4.3.1 SAFETY STANDARDS

4.3.1.1 MATERIAL HANDLING AND STORAGE

4.3.1.2 TRANSPORT AND PRECAUTIONS

4.3.1.3 HAZARD IDENTIFICATION

4.4 PORTERS FIVE FORCES

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREFERENCE FOR ECO-FRIENDLY AND BIODEGRADABLE PRODUCTS FOR PACKAGING

6.1.2 RISE IN E-COMMERCE DELIVERY SERVICES NORTH AMERICALY

6.1.3 UPSURGE IN NEED TO LOWER CARBON FOOTPRINT MATERIALS

6.1.4 INCREASE IN IMPLEMENTATION OF PALM FIBER FOR VARIOUS PACKAGING

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS AND NORMS IMPOSED BY GOVERNMENT

6.2.2 LIMITED AVAILABILITY OF RAW PRODUCTS AND FLUCTUATION IN PRICE OF WOOD PULP

6.3 OPPORTUNITIES

6.3.1 GROWING INVESTMENT IN R&D IN EMERGING ECONOMIES

6.3.2 SIGNIFICANT DEMAND FROM ORGANIZED RETAIL STORES FOR INNOVATIVE PACKING PRODUCTS

6.3.3 INCREASE IN DEMAND FOR ENVIRONMENTAL FRIENDLY PRODUCTS

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO STRENGTH AND DURABILITY OF PALM FIBER

6.4.2 IMPACT ON PALM FIBER PACKAGING DUE TO ENVIRONMENTAL FACTORS

7 IMPACT OF COVID-19 ON NORTH AMERICA PALM FIBER PACKAGING MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON PALM FIBER PACKAGING MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND AND SUPPLY CHAIN

7.6 CONCLUSION

8 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY SOURCE

8.1 OVERVIEW

8.2 NON-WOOD

8.3 WOOD

9 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY PROCESS

9.1 OVERVIEW

9.2 THERMOFORMING

9.3 THICK WALL

9.4 TRANSFER

9.5 OTHERS

10 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 TRAYS

10.3 PLATES

10.4 CLAMSHELL

10.5 CUPS

10.6 BOWLS

10.7 OTHERS

11 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 BY PRODUCT

11.2.1.1 TRAYS

11.2.1.2 PLATES

11.2.1.3 CLAMSHELL

11.2.1.4 CUPS

11.2.1.5 BOWLS

11.2.1.6 OTHERS

11.3 INDUSTRIAL

11.3.1 BY PRODUCT

11.3.1.1 TRAYS

11.3.1.2 PLATES

11.3.1.3 CLAMSHELL

11.3.1.4 CUPS

11.3.1.5 BOWLS

11.3.1.6 OTHERS

11.4 COSMETICS

11.4.1 BY PRODUCT

11.4.1.1 TRAYS

11.4.1.2 CLAMSHELL

11.4.1.3 PLATES

11.4.1.4 OTHERS

11.5 LOGISTICS

11.5.1 BY PRODUCT

11.5.1.1 BOWLS

11.5.1.2 OTHERS

11.6 ELECTRICAL & ELECTRONICS

11.6.1 BY PRODUCT

11.6.1.1 BOWLS

11.6.1.2 OTHERS

11.7 PHARMACEUTICALS

11.7.1 BY PRODUCT

11.7.1.1 TRAYS

11.7.1.2 BOWLS

11.7.1.3 OTHERS

11.8 OTHERS

12 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA PALM FIBER PACKAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CKF INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCTS PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.2 DENTAS

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCTS PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 BUHL-PAPERFORM GMBH

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCTS PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 NEXTGREEN NORTH AMERICA BERHAD

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCTS PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 NORTH AMERICA GREEN SYNERGY SDN. BHD.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCTS PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ADVANCED PAPER FORMING

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCTS PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ATLANTIC PULP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCTS PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 HENG HUAT RESOURCES GROUP BERHAD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCTS AND SERVICES PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 PALM CO.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCTS PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 PALMFIL

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCTS PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 UPC-A

TABLE 2 UPC- E BAR

TABLE 3 VARIOUS CERTIFIED STANDARDS

TABLE 4 MATERIAL HANDLING AND STORAGE STANDARDS

TABLE 5 TRANSPORTATION AND PRECAUTIONS STANDARDS

TABLE 6 NON-DEGRADABLE PRODUCTS AND THEIR LIFE SPAN

TABLE 7 CO2 FOOTPRINT LEFT BY CITIZENS OF THE RESPECTIVE COUNTRY PER YEAR

TABLE 8 NORTH AMERICA RETAIL DEVELOPMENT INDEX 2021 (DEVELOPING COUNTRIES)

TABLE 9 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA NON-WOOD IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA WOOD IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA THERMOFORMING IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA THICK WALL IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA TRANSFER IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA TRAYS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA PLATES IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA CLAMSHELL IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA CUPS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA BOWLS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA OTHERS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA COSMETICS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA OTHERS IN PALM FIBER PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 CANADA PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 MEXICO PALM FIBER PACKAGING MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO PALM FIBER PACKAGING MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO PALM FIBER PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO FOOD & BEVERAGES IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO INDUSTRIAL IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO COSMETICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 76 MEXICO LOGISTICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO ELECTRICAL & ELECTRONICS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO PHARMACEUTICALS IN PALM FIBER PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA PALM FIBER PACKAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PALM FIBER PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PALM FIBER PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PALM FIBER PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PALM FIBER PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PALM FIBER PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PALM FIBER PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PALM FIBER PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PALM FIBER PACKAGING MARKET: SEGMENTATION

FIGURE 10 INCREASING PREFERENCE FOR ECO-FRIENDLY AND BIO-DEGRADABLE PRODUCTS FOR PACKING IS EXPECTED TO DRIVE THE NORTH AMERICA PALM FIBER PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 NON-WOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PALM FIBER PACKAGING MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE, AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA PALM FIBER PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA PALM FIBER PACKAGING MARKET

FIGURE 14 PERCENTAGE (%) OF SALARY SPENT BY PEOPLE ON E-COMMERCE COUNTRY WISE

FIGURE 15 PLASTIC UASGE (%) & PLASTIC WASTE GENERATION BY SECTOR (%) FOR 2017 & 2018

FIGURE 16 COUNTRIES WITH LARGEST SHARE OF PALM TREE

FIGURE 17 ALTERNATIVE PACKAGING METHODS

FIGURE 18 NORTH AMERICA PALM FIBER PACKAGING MARKET: BY SOURCE, 2021

FIGURE 19 NORTH AMERICA PALM FIBER PACKAGING MARKET: BY PROCESS, 2021

FIGURE 20 NORTH AMERICA PALM FIBER PACKAGING MARKET: BY PRODUCT, 2021

FIGURE 21 NORTH AMERICA PALM FIBER PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA PALM FIBER PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA PALM FIBER PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA PALM FIBER PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA PALM FIBER PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA PALM FIBER PACKAGING MARKET: BY SOURCE (2022-2029)

FIGURE 27 North America palm fiber packaging Market: company share 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。