North America Polyurethane Foam Market

市场规模(十亿美元)

CAGR :

%

USD

6.13 Billion

USD

8.87 Billion

2024

2032

USD

6.13 Billion

USD

8.87 Billion

2024

2032

| 2025 –2032 | |

| USD 6.13 Billion | |

| USD 8.87 Billion | |

|

|

|

北美聚氨酯泡棉市場細分,按產品(軟質泡棉、硬質泡棉和噴塗泡棉)、類別(開孔和閉孔)、密度組成(低密度組成、中密度組成和高密度組成)、製程(模製泡棉、塊狀泡棉、噴塗和層壓)、最終用戶(床上用品和家具、建築和施工、汽車、電子包裝、鞋類到電子、包裝、鞋類。

聚氨酯泡棉市場分析

聚氨酯泡棉市場正穩步成長,這得益於其優異的絕緣和緩衝性能,建築、汽車和家具等行業的需求不斷增長。市場大致分為硬質泡沫和軟質泡沫,其中硬質泡沫在絕緣應用中廣泛應用,而軟質泡沫則廣泛用於床上用品和家具。日益增長的永續性問題和環境法規正在推動生物基和低排放替代品的開發。在快速城市化、基礎設施擴張和工業成長的推動下,亞太地區引領市場。此外,輕質節能泡沫解決方案的創新將繼續塑造該產業的未來。

聚氨酯泡棉市場規模

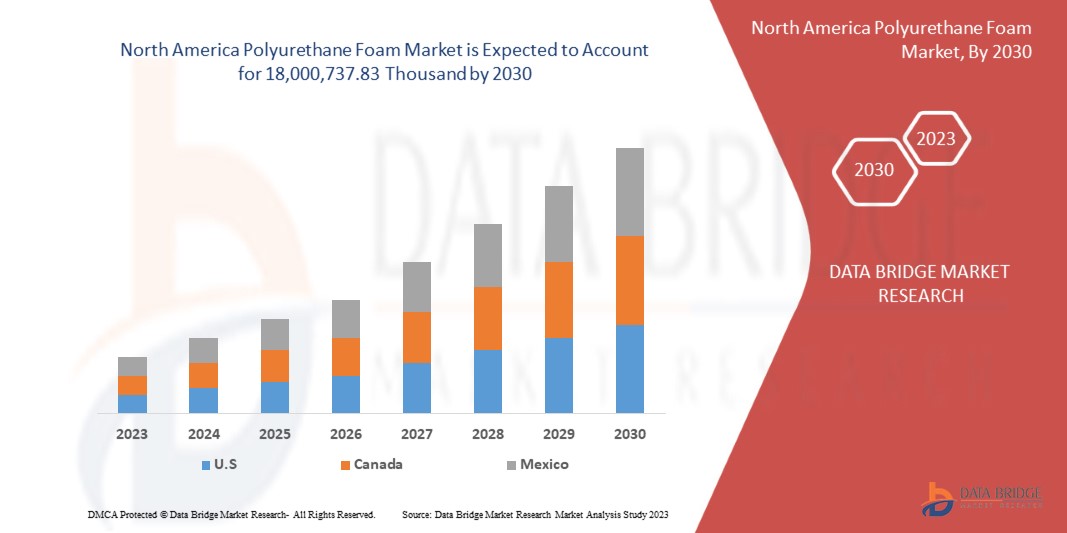

北美聚氨酯泡棉市場預計將從 2024 年的 61.3 億美元增至 2032 年的 88.7 億美元,在 2025 年至 2032 年的預測期內,複合年增長率將大幅成長 4.9%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

聚氨酯泡棉市場趨勢

“建築業前景樂觀”

建築業可以成為擴大聚氨酯泡沫市場的主要動力。由於新興經濟體的外國直接投資,建築相關活動正在增加。水泥、木材、玻璃、金屬和黏土是建築業最常使用的材料。聚氨酯用於建築領域,製造出強度高、重量輕、功能良好、經久耐用且適應性強的高性能產品。聚氨酯泡棉是一種柔性化學產品,可用於許多典型的建築應用,例如黏合、填充、密封和絕緣。它具有很高的隔熱和隔音性能,是水管隔熱、屋頂和牆壁粘合和密封,以及最重要的安裝窗戶和門框的完美產品。建築相關活動的成長以及聚氨酯泡沫在建築業的廣泛應用促進了聚氨酯泡沫市場的成長。

報告範圍和聚氨酯泡沫市場細分

|

屬性 |

聚氨酯泡沫市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

美國、加拿大和墨西哥 |

|

主要市場參與者 |

漢高股份公司(德國)、聖哥班(法國)、亨斯邁國際有限責任公司(美國)、巴斯夫(德國)、井上株式會社(日本)、陶氏(美國)、積水化學工業株式會社(日本)、Sunpreeth Engineers(印度)、Recticel NV/SA(比利時)、Esid Corporation(比利時)、Esid Corporation(義大利)、Ela 這是(義大利)、J看到印度) Inc.(美國)、General Plastics Manufacturing Company, Inc.(美國)、Meenakshi Polymers Pvt. Ltd.(印度)、Foamcraft Inc.(美國)、ALSTONE INDUSTRIES PVT.有限公司(印度)、Wisconsin Foam Products(美國)、Tirupati Foam Ltd(印度) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

聚氨酯泡棉市場定義

聚氨酯泡沫是由二異氰酸酯和多元醇反應得到的聚合物。聚氨酯泡沫通常稱為PU泡沫或PUR泡沫。聚氨酯泡棉為材料提供絕緣並保護其免受外部腐蝕源的影響。聚氨酯泡沫生產中與異氰酸酯一起使用的試劑或催化劑的類型取決於聚氨酯泡沫的用途。聚氨酯泡沫有三種:硬質泡沫、軟質泡沫和噴塗泡沫。

聚氨酯泡棉市場動態

驅動程式

- 汽車和航空領域的接受度不斷提高

聚氨酯泡棉是一種聚合物材料,具有高抗拉強度、低重量、耐化學性、可加工性和機械特性,已用於各種應用。由於其獨特的性能,航空航天和汽車工業對輕質高性能材料的需求日益增長。在汽車行業中,汽車泡棉發揮著重要作用,因為它對從汽車座椅到地毯襯墊的乘客安全和舒適度起著重要作用。聚氨酯泡棉在汽車工業中用於製造裝飾件、座椅、頭枕、隔音材料和空調過濾器。這是因為泡沫是一種具有多種特性的材料,例如隔振、吸音和絕緣。開孔泡棉和閉孔泡棉均可用於現代汽車的汽車緩衝墊和座椅。目前汽車中使用的聚氨酯泡沫由於其耐用和極輕的特性,可以為車輛提供更長的行駛里程,從而進一步降低汽車的整體重量。因此,燃油效率得到提高並減少了對環境的影響。汽車領域的此類高端應用將推動聚氨酯泡沫市場的成長。

聚氨酯泡沫在航空航太工業的應用非常多樣化。它用於客艙壁、行李艙、天花板、盥洗室、駕駛艙墊以及艙室和艙段分隔器等結構件。這種泡沫可以保護飛機和機內乘客免受過度溫度波動的影響。航空航太泡沫密度也有助於防止空氣洩漏進出飛機,從而保持機艙壓力。它還可以作為隔音屏障,保護乘客免受飛機引擎高分貝噪音的影響。例如,根據 Linden Industries, LLC 發表的一篇文章,2022 年 6 月。聚氨酯泡棉因其緩衝、耐用性和降噪性能而被廣泛用於汽車內裝。它增強了汽車座椅和頭枕的舒適度和支撐性,同時也提供避震功能。儀表板和車門面板使用它來隔離和減少道路噪音。儘管頻繁使用,其耐用性仍可確保長久使用壽命。它對於提高安全性和乘客體驗至關重要,仍然是車輛製造的關鍵材料

- 各種家居應用的需求不斷增長

家居裝飾是放置在房間內的物品,以使房間更加舒適和宜人。它們包括任何可移動的物品,例如家具、窗簾、地毯和與房間設計相配的裝飾物品。聚氨酯泡棉因其獨特的特性,如低密度、高機械性能和低導熱性,被廣泛應用於家居裝飾。聚氨酯泡沫是一種輕質多孔材料,具有良好的性能特徵。這些材料進一步應用於沙發和椅子等家具的墊子等最終應用,從而推動了聚氨酯泡沫市場的成長。

人口增長、城市化進程加快、對優質床墊的傾向以及機構基礎設施的改善等因素推動了房地產和酒店領域的床墊銷售。柔性聚氨酯泡棉具有蜂巢結構,具有一定的壓縮性和彈性,從而起到緩衝作用。此功能廣泛應用於家具、床墊、枕頭和地毯應用。住房、旅館和鐵路等行業的成長也是聚氨酯泡沫床墊市場成長的因素。例如, 據 ISPF 稱,這項研究是由印度睡眠產品聯合會所進行的。在印度,整體床墊市場約為 1,860 萬張,預計每年對床墊的新增需求為 700 萬張。此外,床墊平均更換週期為12年,床墊更換需求為1,160萬張。研究也顯示,家具通路對於新需求至關重要,佔床墊整體銷售額的 50%。此外,泡棉床墊佔總銷售額的 52.6%,彈簧床墊佔 13.5%,椰棕床墊佔 34%。

機會

- 環保泡沫的利潤前景

聚氨酯泡棉已成為該行業最重要的材料之一,因為它們是適應性最強的聚合物之一。它們在汽車行業中用於製造座椅、內飾和保險桿;在家具中用作座墊、沙發和床墊的填充材料;包裝領域;在建築中用於隔熱和隔音;以及其他應用。除了低密度、低導熱性和出色的機械特性外,聚氨酯泡棉的主要優點之一是能夠根據市場應用要求調整其密度和剛度。

然而,這種聚合物主要以石油為基礎。對環境的擔憂要求聚氨酯的生產更加永續,例如使用可再生原料或回收聚氨酯泡沫。消費者行為轉向使用永續材料、政府的嚴格規章制度以及製造商在生產泡沫時減少使用石油基原材料的措施是導致人們對環保泡沫持積極態度的幾個因素。這些措施將促進可生物降解且環保的聚氨酯泡沫的開發。製造商也與其他公司合作開發聚氨酯泡沫回收設施。例如,2023 年 9 月,根據 Crain Communications, Inc. 發表的一篇文章,科思創與 Selena Group 合作開髮用於建築隔熱的可持續聚氨酯 (PU) 泡棉。該公司在升級版 Ultra-Fast 70 泡棉中使用了科思創的生物屬性 MDI,減少了 60% 的碳足跡。泡沫在 90 分鐘內固化,每個容器的產量為 70 公升。它與化石基泡沫的品質相匹配並支援無縫整合。 Selena 在其泡沫系列中加入了生物基多元醇和再生 PET 材料

- 政府對國內市場投資的支持政策

可支配收入的增加、城市化的快速發展、工業應用的多樣化、高消費、外國直接投資的增加以及良好的出口潛力是推動印度和中國等發展中經濟體化學工業增長的一些因素。各種即將到來的製造特種化學品和聚合物產品的機會將創造巨大的國內需求。發展中國家將能夠自給自足地生產原料和最終產品。此外,已開發國家的投資或在新興經濟體建立化工廠可以為北美聚氨酯泡沫市場的成長提供廣泛的機會。

聚氨酯泡棉可應用於汽車、家具、建築、包裝、紡織、鞋類等各行業。這些產業的市場成長將進一步促進發展中國家的經濟。研發活動、技術進步、終端用戶產業需求的成長以及有利的政策和框架影響了這些國家化學工業的發展。例如,2022年9月,根據《阿拉伯新聞》報道,自2016年沙烏地阿拉伯宣布「2030願景」以來,沙烏地阿拉伯已在基礎建設和房地產項目上共投入1.1兆美元,有望成為世界上最大的建築工地。沙烏地阿拉伯將輕鬆成為世界上最大的建築工地,該國計劃建造超過 555,000 個住宅單元、超過 275,000 間酒店房間、超過 430 萬平方米的零售空間以及超過 610 萬平方米的辦公空間。如此龐大的基礎設施建設將在未來幾年推動聚氨酯泡沫在建築領域的廣泛應用

限制/挑戰

- 聚氨酯泡沫生產中的有害化學物質使用

聚氨酯泡沫用於從家具到絕緣材料的各種應用。然而,在生產聚氨酯泡沫的過程中使用各種化學物質會為參與生產的工人帶來環境和健康問題。聚氨酯是從原油中提取的各種多元醇和二異氰酸酯聚合的產物。該過程涉及各種發泡劑、固化劑、阻燃劑、表面活性劑和催化劑。常用的多元醇有聚乙二醇、聚丙二醇、聚四亞甲基二醇等。同時,甲苯二異氰酸酯(TDI)和二苯基甲烷二異氰酸酯(MDI)也是常用的二異氰酸酯材料。例如,2023 年 3 月,據美國環保署 (EPA) 稱,MDI 和 TDI 等二異氰酸酯會導致工人氣喘、肺損傷,甚至在某些情況下導致死亡。環保署已製定了在工作單位內對其進行保護性控制的行動計劃。據稱,生產過程中釋放的揮發性有機化合物會引發環境問題

- 原物料價格波動

任何行業的製造過程都取決於原材料的價格。原物料價格波動越大,產品成本和市場成長波動的可能性就越大。

聚氨酯泡沫生產的主要原料是從原油中提取的多元醇和二異氰酸酯。氣候、供應鏈、需求、可用性、限制以及國家經濟狀況等多種因素決定了這些原料的價格。例如,2024 年 11 月,根據 Polymerupdate 發表的一篇文章,由於煉油利潤率低,石油加工公司在 2024 年第三季度盈利能力大幅下降,2024 年 9 月 GRM 跌至每桶 1.3 美元,為 Covid-19 高峰以來的最低水平。這是由於原油價格低迷、俄羅斯原油供應增加以及需求疲軟(尤其是中國需求)造成的。 2024年北美經濟成長維持穩定在3.1%,但地緣政治緊張局勢和中國房地產行業有下行風險。由於電動車、生物燃料和液化天然氣的普及,亞洲和歐洲對石油燃料的需求減少,它也受到了影響。新的煉油產能進一步擠壓利潤率

原材料短缺和運輸延誤的影響和當前市場情勢

Data Bridge Market Research 提供高水準的市場分析,並透過考慮原材料短缺和運輸延遲的影響和當前市場環境來提供資訊。這意味著評估策略可能性、制定有效的行動計劃並協助企業做出重要決策。

除了標準報告外,我們還提供對採購層面的深入分析,包括預測運輸延遲、按地區劃分的經銷商映射、商品分析、生產分析、價格映射趨勢、採購、類別績效分析、供應鏈風險管理解決方案、高級基準測試以及其他採購和戰略支援服務。

經濟放緩對產品定價和供應的預期影響

當經濟活動放緩時,各行各業就開始受到影響。 DBMR 提供的市場洞察報告和情報服務考慮了經濟衰退對產品定價和可及性的預測影響。透過這種方式,我們的客戶通常可以領先競爭對手一步,預測他們的銷售額和收入,並估算他們的盈虧支出。

聚氨酯泡棉市場範圍

市場根據產品、類別、密度組成、流程和最終用戶進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

產品

- 柔性泡沫

- 硬質泡沫

- 噴塗泡沫

類別

- 開放式電池

- 閉孔

密度組成

- 低密度成分

- 中密度組合物

- 高密度合成

過程

- 模塑泡沫

- 塊狀泡沫

- 噴塗

- 層壓

終端用戶

- 床上用品和家具

- 建築施工

- 汽車

- 電子產品

- 包裝

- 鞋類

- 其他的

聚氨酯泡棉市場區域分析

對市場進行分析,並按上述產品、類別、密度組成、流程和最終用戶提供市場規模洞察和趨勢。

市場涵蓋的國家包括美國、加拿大和墨西哥。

美國憑藉其發達的工業基礎、建築和汽車行業的強勁需求以及聚氨酯技術的先進研究,預計將主導北美聚氨酯市場。大型製造商的存在,加上對基礎設施和節能建築的高投資,推動了聚氨酯的大量消費。此外,促進可持續和高性能材料的嚴格法規導致先進聚氨酯配方的採用率增加。

由於航空航太、家具和電子等行業對輕質耐用材料的需求不斷增長,美國預計將成為成長最快的市場。永續發展趨勢的成長,包括生物基和可回收聚氨酯的開發,以及持續的技術進步,正在進一步加速市場擴張。

報告的國家部分還提供了影響個別市場因素以及影響市場當前和未來趨勢的國內市場監管變化。下游和上游價值鏈分析、技術趨勢和波特五力分析、案例研究等數據點是用於預測各國市場情景的一些指標。此外,在對國家數據進行預測分析時,還考慮了北美品牌的存在和可用性以及由於來自本地和國內品牌的大量或稀缺的競爭而面臨的挑戰、國內關稅和貿易路線的影響。

聚氨酯泡沫市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、北美業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

聚氨酯泡棉市場領導者有:

- 漢高股份公司(德國)

- 聖戈班(法國)

- 亨斯邁國際有限公司(美國)

- 巴斯夫(德國)

- 井上株式會社(日本)

- 陶氏(美國)

- 積水化學工業株式會社(日本)

- Sunpreeth Engineers(印度)

- Recticel NV/SA(比利時)

- Sheela Foam Ltd.(印度)

- Eurofoam Srl(義大利)

- 羅傑斯公司(美國)

- UFP Technologies, Inc.(美國)

- 通用塑膠製造公司(美國)

- Meenakshi Polymers Pvt.有限公司(印度)

- Foamcraft Inc.(美國)

- 阿爾斯通工業私人有限公司有限公司(印度)

- 威斯康辛州泡沫產品公司(美國)

- 蒂魯帕蒂泡沫有限公司(印度)

聚氨酯泡棉市場的最新發展:

- 2022年9月,聖戈班已獲得相關部門收購GCP Applied Technologies Inc.(北美一家主要的建築化學品公司)的所有必要批准。此次收購有助於公司在建築化學品領域獲得更多認可

- 2020年5月,亨斯邁集團宣布將其全球領先的噴塗聚氨酯泡沫業務更名為亨斯邁建築解決方案。亨斯邁建築解決方案是亨斯邁聚氨酯部門旗下的全球平台。此次品牌重塑幫助該公司擴大了聚氨酯泡沫業務

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.6.1 RAW MATERIAL COVERAGE

4.7 PRICING ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 PRODUCTION CAPACITY ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 POSITIVE OUTLOOK TOWARD THE CONSTRUCTION SECTOR

6.1.2 GROWING ACCEPTANCE IN THE AUTOMOTIVE AND AVIATION SECTOR

6.1.3 RISING DEMAND FOR VARIOUS HOME FURNISHING APPLICATIONS

6.1.4 INCREASING DEMAND FOR PROTECTIVE PACKAGING

6.1.5 RISING ADOPTION OF POLYURETHANE FOAMS IN THE TEXTILE AND FOOTWEAR INDUSTRY

6.2 RESTRAINTS

6.2.1 ENVIRONMENTAL AND HEALTH HAZARDS ASSOCIATED WITH THE USAGE OF POLYURETHANE FOAM

6.2.2 AVAILABILITY OF SUBSTITUTES IN MARKET

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS ENVIRONMENTALLY FRIENDLY FOAMS

6.3.2 SUPPORTIVE GOVERNMENT POLICIES REGARDING INVESTMENT IN DOMESTIC MARKETS, INCLUDING CHINA AND INDIA

6.4 CHALLENGES

6.4.1 HARMFUL CHEMICAL USAGE IN POLYURETHANE FOAM PRODUCTION

6.4.2 VOLATILITY IN RAW MATERIAL PRICES

6.4.3 STRINGENT RULES AND REGULATIONS FOR POLYURETHANE FOAMS

7 NORTH AMERICA POLYURETHANE FOAM MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLEXIBLE FOAM

7.3 RIGID FOAM

7.4 SPRAY FOAM

8 NORTH AMERICA POLYURETHANE FOAM MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 OPEN CELL

8.3 CLOSED CELL

9 NORTH AMERICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION

9.1 OVERVIEW

9.2 LOW-DENSITY COMPOSITION

9.3 MEDIUM-DENSITY COMPOSITION

9.4 HIGH-DENSITY COMPOSITION

10 NORTH AMERICA POLYURETHANE FOAM MARKET, BY PROCESS

10.1 OVERVIEW

10.2 MOLDED FOAM

10.3 SLABSTOCK FOAM

10.4 SPRAYING

10.5 LAMINATION

11 NORTH AMERICA POLYURETHANE FOAM MARKET, BY END-USER

11.1 OVERVIEW

11.2 BEDDING & FURNITURE

11.3 BUILDING & CONSTRUCTION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.6 PACKAGING

11.7 FOOTWEAR

11.8 OTHERS

12 NORTH AMERICA POLYURETHANE FOAM MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA POLYURETHANE FOAM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 COMPANY PROFILES

14.1 HENKEL AG & CO. KGAA

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 COMPANY SHARE ANALYSIS

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 SAINT-GOBAIN

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 SWOT ANALYSIS

14.2.6 RECENT DEVELOPMENT

14.3 HUNTSMAN INTERNATIONAL LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SWOT ANALYSIS

14.3.5 PRODUCT PORTFOLIO

14.3.6 RECENT DEVELOPMENTS

14.4 BASF

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 SWOT ANALYSIS

14.4.6 RECENT DEVELOPMENT

14.5 INOAC CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 SWOT ANALYSIS

14.5.5 RECENT DEVELOPMENT

14.6 ALSTONE INDUSTRIES PVT. LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DOW

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.8 EUROFOAM S.R.L.

14.8.1 COMPANY SNAPSHOT

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 FOAMCRAFT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT ANALYSIS

14.9.4 RECENT DEVELOPMENTS

14.1 GENERAL PLASTICS MANUFACTURING COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 SWOT ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MEENAKSHI POLYMERS PVT. LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 RECTICEL NV/SA

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SWOT ANALYSIS

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 ROGERS CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE ANALYSIS

14.13.4 SWOT ANALYSIS

14.13.5 RECENT DEVELOPMENTS

14.14 SEKISUI CHEMICAL CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 SWOT ANALYSIS

14.14.5 RECENT DEVELOPMENT

14.15 SHEELA FOAM LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 SWOT ANALYSIS

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 SUNPREETH ENGINEERS

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TIRUPATI FOAM LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT ANALYSIS

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 UFP TECHNOLOGIES, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 SWOT ANALYSIS

14.18.5 RECENT DEVELOPMENT

14.19 WISCONSIN FOAM PRODUCTS

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 SWOT ANALYSIS

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (TONS)

TABLE 4 NORTH AMERICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 NORTH AMERICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 6 NORTH AMERICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 7 NORTH AMERICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 8 NORTH AMERICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 9 NORTH AMERICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 NORTH AMERICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (TONS)

TABLE 12 NORTH AMERICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 NORTH AMERICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 14 NORTH AMERICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 15 NORTH AMERICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 16 NORTH AMERICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 18 NORTH AMERICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 NORTH AMERICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 20 NORTH AMERICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 NORTH AMERICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 22 NORTH AMERICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 23 NORTH AMERICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 24 NORTH AMERICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (TONS)

TABLE 26 NORTH AMERICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 27 NORTH AMERICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 28 NORTH AMERICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 29 NORTH AMERICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 30 NORTH AMERICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 NORTH AMERICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 32 NORTH AMERICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 33 NORTH AMERICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 34 NORTH AMERICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (TONS)

TABLE 36 NORTH AMERICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 37 NORTH AMERICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 38 NORTH AMERICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 41 NORTH AMERICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 42 NORTH AMERICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 45 NORTH AMERICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 46 NORTH AMERICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 NORTH AMERICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 NORTH AMERICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 NORTH AMERICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 53 NORTH AMERICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 56 NORTH AMERICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 57 NORTH AMERICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 60 NORTH AMERICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 61 NORTH AMERICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 64 NORTH AMERICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 66 NORTH AMERICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 68 NORTH AMERICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 70 NORTH AMERICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 72 NORTH AMERICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 74 NORTH AMERICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 88 U.S. POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 90 U.S. POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 92 U.S. POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 94 U.S. POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 96 U.S. BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 U.S. AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 101 U.S. AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 U.S. ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 U.S. PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 104 U.S. PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 110 CANADA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 112 CANADA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 113 CANADA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 114 CANADA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 115 CANADA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 116 CANADA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 118 CANADA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 128 CANADA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 CANADA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 132 MEXICO POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 133 MEXICO POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 134 MEXICO POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 135 MEXICO POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 136 MEXICO POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 137 MEXICO POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 138 MEXICO POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 139 MEXICO POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 140 MEXICO BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 141 MEXICO BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 MEXICO BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 143 MEXICO BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 MEXICO AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 145 MEXICO AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MEXICO ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MEXICO PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 148 MEXICO PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 MEXICO FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 150 MEXICO FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 MEXICO OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA POLYURETHANE FOAM MARKET

FIGURE 2 NORTH AMERICA POLYURETHANE FOAM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA POLYURETHANE FOAM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA POLYURETHANE FOAM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POLYURETHANE FOAM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POLYURETHANE FOAM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA POLYURETHANE FOAM MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA POLYURETHANE FOAM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA POLYURETHANE FOAM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA POLYURETHANE FOAM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA POLYURETHANE FOAM MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA POLYURETHANE FOAM MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA POLYURETHANE FOAM MARKET EXECUTIVE SUMMARY

FIGURE 14 THREE SEGMENTS COMPRISE THE NORTH AMERICA POLYURETHANE FOAM MARKET, BY PRODUCT

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 A POSITIVE OUTLOOK TOWARDS THE BUILDING AND CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA POLYURETHANE FOAM MARKET IN THE FORECAST PERIOD

FIGURE 17 THE FLEXIBLE FOAM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POLYURETHANE FOAM MARKET IN 2025 AND 2032

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA POLYURETHANE FOAM MARKET

FIGURE 21 NORTH AMERICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2024

FIGURE 22 NORTH AMERICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2024

FIGURE 23 NORTH AMERICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2024

FIGURE 24 NORTH AMERICA POLYURETHANE FOAM MARKET: BY PROCESS, 2024

FIGURE 25 NORTH AMERICA POLYURETHANE FOAM MARKET: BY END-USER, 2024

FIGURE 26 NORTH AMERICA POLYURETHANE FOAM MARKET: SNAPSHOT (2024)

FIGURE 27 NORTH AMERICA POLYURETHANE FOAM MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。