North America Sip Trunking Services Market

市场规模(十亿美元)

CAGR :

%

USD

5.95 Billion

USD

19.03 Billion

2024

2032

USD

5.95 Billion

USD

19.03 Billion

2024

2032

| 2025 –2032 | |

| USD 5.95 Billion | |

| USD 19.03 Billion | |

|

|

|

|

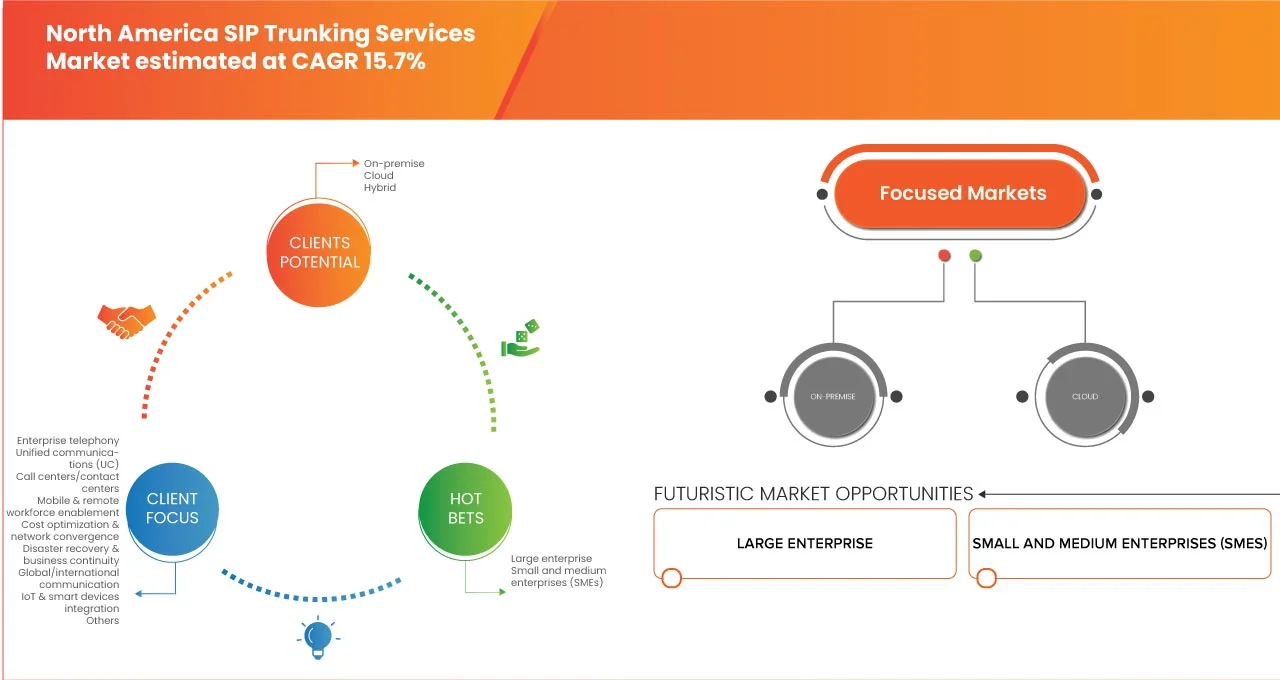

北美SIP中繼服務市場細分,按部署類型(本地部署、雲端部署和混合部署)、組織規模(大型企業、中小企業 (SME))、連接方式(專用SIP中繼和共享/互聯網SIP中繼)、服務類型(語音、視訊、網路會議、簡訊、桌面共享、串流媒體及其他)、應用程式通訊領域(企業電話、統一通訊領域(UC)、呼叫中心/聯絡中心、行動和遠端辦公、成本優化和網路整合、災難復原和業務連續性、全球/國際通訊、物聯網和智慧型裝置整合及其他)、定價模式(通道化SIP中繼和按流量計費的SIP中繼)、作業系統(Windows、iOS、Android、macOS和Linux)、最終用戶(銀行、科學和金融服務和金融服務和金融服務、電子商務、製造業、媒體與娛樂、教育與研究、旅館與餐飲、物流與運輸等產業-2032 年產業趨勢及預測

北美SIP中繼服務市場規模

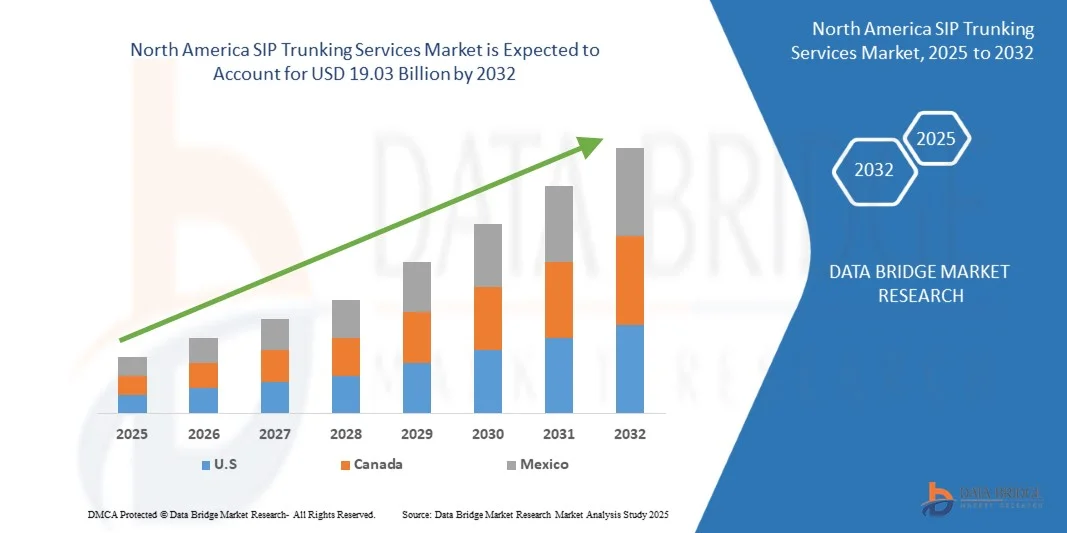

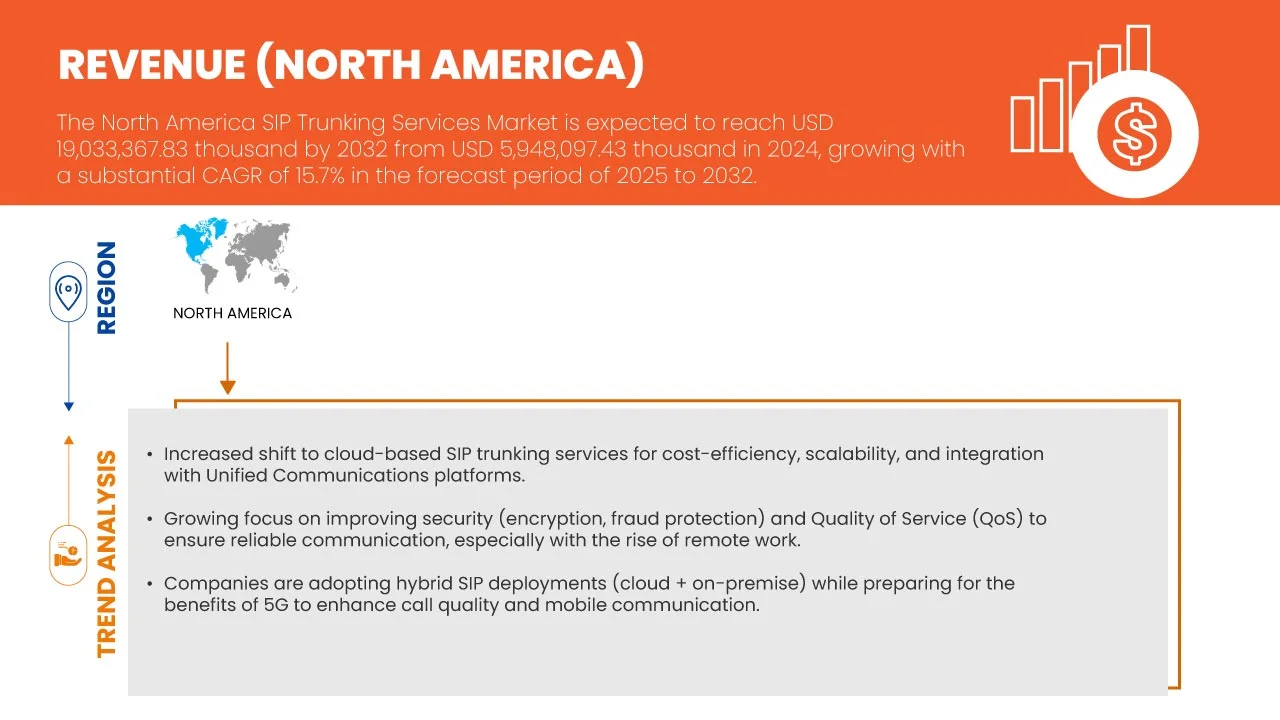

- 2024年北美SIP中繼服務市場規模為59.5億美元 ,預計 到2032年將達到190.3億美元,預測期內複合 年增長率為15.7% 。

- SIP中繼服務是指一種數位通訊技術,它使用會話發起協定 (SIP) 透過互聯網連接而非傳統電話線來提供語音、視訊和訊息服務。

- 與傳統的公共交換電話網路 (PSTN) 系統不同,SIP 中繼允許企業將其專用交換機 (PBX) 直接連接到互聯網,從而實現網路電話 (VoIP) 通話並與統一通訊平台整合。這無需單獨的實體電話線路,為各種規模的組織提供更高的靈活性、可擴展性和成本效益。

北美SIP中繼服務市場分析

- SIP 中繼服務提供“虛擬電話線”,支援並發語音通話,是企業向雲端通訊轉型的重要骨幹網路。服務供應商將呼叫路由、災難復原、免費電話和國際長途等功能捆綁在一起,同時確保符合監管要求和安全標準。

- 數位轉型計畫、監管合規要求以及人工智慧驅動的呼叫路由和雲端PBX系統等先進技術的整合是推動市場發展的關鍵因素。 SIP中繼消除了維護多條電話線路的複雜性和成本,為企業提供可預測的效能、可擴展性和無縫的全球連接。

- 預計到2025年,美國將以81.50%的市佔率主導北美SIP中繼服務市場,並在預測期內維持最快的成長速度,複合年增長率(CAGR)將達到15.9%。這主要得益於先進的電信基礎設施、高雲端採用率、企業數位轉型、成本效益需求、監管支援以及主要供應商的存在。強大的IT生態系統和混合辦公趨勢進一步加速了SIP在全國範圍內從傳統PSTN系統的遷移。

- 由於大型企業和受監管行業持續依賴內部基礎設施以實現更高的控制力、合規性和安全性,預計到2024年,本地伺服器將佔據北美SIP中繼服務市場的主導地位,收入份額高達60.04%。醫療保健、金融和政府等行業的許多機構更傾向於將本地SIP中繼與現有的PBX和UC系統集成,以維護資料主權並降低對外部系統的依賴。

報告範圍及北美SIP中繼服務市場細分

|

屬性 |

北美SIP中繼服務關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特五力分析和監管框架。 |

北美SIP中繼服務市場趨勢

“向雲端整合、統一通訊和人工智慧驅動的呼叫管理轉型”

- 北美SIP中繼服務市場正經歷重大變革,企業正從傳統的PBX系統轉向與統一通訊平台整合的基於雲端的SIP中繼解決方案。

- 企業正在利用 SIP 中繼實現語音、視訊和資料的無縫整合,從而支援遠距辦公和混合辦公模式。

- 服務供應商正在擴展其產品組合,利用人工智慧驅動的呼叫路由、詐欺預防和即時分析來提高企業通訊效率。

- 例如,區域電信業者推出了整合協作工具、API 和高階安全協定的 SIP 中繼解決方案,以滿足企業對可擴展、高彈性的通訊基礎架構的需求。

- 這一趨勢反映了向數位轉型的更廣泛轉變,有助於企業降低通訊成本、增強靈活性,並在北美地區實現面向未來的雲端連接。

北美SIP中繼服務市場動態

司機

“對基於雲端的通訊和統一連接的需求日益增長”

- 企業正越來越多地採用SIP中繼來統一語音和數據通信,與協作平台集成,並減少對傳統PRI線路的依賴。

- 遠距辦公和混合辦公模式的興起正在加速SIP中繼的部署,以實現可擴展的、不受位置限制的通訊。

- 將 SIP 中繼與 Microsoft Teams 和 Zoom Phone 等協作套件集成,正在增強企業對 SIP 的採用。

- 電信業者正與雲端服務供應商合作,提供託管的 SIP 解決方案,以確保高可靠性、安全性和與現有企業 IT 基礎架構的互通性。

- 這些進展凸顯了北美各地的企業如何採用 SIP 中繼來實現成本效益、業務連續性和靈活的通訊策略。

克制/挑戰

“安全風險與監管合規的複雜性”

- 儘管SIP中繼技術得到了迅速普及,但它仍然面臨著與網路威脅相關的挑戰,例如電話詐欺、拒絕服務攻擊和資料攔截。

- 企業必須投資於進階加密、防火牆和監控系統來保護 SIP 中繼部署,這增加了實施的複雜性。

- 監管網路電話(VoIP)服務的框架,包括合法監聽要求、緊急服務路由(E911)和跨境通訊合規性,為服務提供者帶來了營運上的障礙。

- 中小企業往往缺乏管理這些合規和安全要求所需的專業知識或資源,因此依賴託管服務提供者。

- 這些障礙可能會減緩SIP中繼解決方案的普及,尤其是在監管嚴格的行業,但同時也為提供安全、合規且完全託管的SIP中繼解決方案的供應商帶來了機會。

北美SIP中繼服務市場範圍

市場按部署類型、組織規模、連接性、服務類型、應用程式、定價、營運模式和最終用戶進行細分。

- 依部署類型

依部署類型,北美SIP中繼服務市場可分為本地部署、雲端部署和混合部署。預計到2025年,本地部署伺服器將佔據市場主導地位,市佔率高達59.67%。這一主導地位源自於大型企業和受監管產業對內部基礎設施的依賴,以確保控制、合規性和安全性。醫療保健、金融和政府機構傾向於將本地SIP中繼與現有的PBX和UC系統集成,以確保資料主權並最大限度地減少對外部系統的依賴。這種與監管和營運重點的高度契合,鞏固了其在該細分市場的領先地位。

預計在預測期內,雲端領域將以17.1%的複合年增長率實現最快成長。企業數位轉型措施的不斷推進以及對雲端通訊模式的廣泛採用,正在推動市場需求。尤其是中小企業,正迅速轉向雲端SIP中繼,以實現成本效益、可擴展性和最低的基礎設施需求。雲端解決方案支援遠端協作、與統一通訊平台無縫集成,並能靈活管理大量通訊工作負載。這一趨勢凸顯了雲端在重塑企業通訊方面的戰略作用。

- 按組織規模

依企業規模,北美SIP中繼服務市場可分為大型企業及中小企業(SME)。預計到2025年,大型企業將佔據市場主導地位,營收份額達65.20%。對可擴展、可靠且安全的通訊解決方案的高需求推動了這一細分市場的發展,尤其是在金融、政府和醫療保健等行業。與現有PBX和UC系統的整合使企業能夠支援複雜的高容量工作負載。大型企業優先採用SIP中繼來提高營運效率、合規性和客戶互動。它們龐大的通訊需求以及先進的基礎設施投資,確保了其在區域SIP中繼領域的持續領先地位。

預計中小企業 (SME) 細分市場將在預測期內實現最快成長,複合年增長率 (CAGR) 將達到 16.7%。中小企業越來越多地採用 SIP 中繼線來取代傳統的電話系統,以獲得更經濟高效、靈活且可擴展的解決方案。基於雲端的 SIP 中繼線路因其前期投資低、部署快速而對中小企業尤其具有吸引力。這些解決方案使企業能夠在保持經濟實惠的同時,簡化通訊、支援遠距辦公並擴大業務範圍。中小企業數位化程度的不斷提高,有力地推動了北美地區該細分市場的快速成長。

- 按連接性

依連接方式,北美SIP中繼服務市場可分為專用SIP中繼與共享/網際網路SIP中繼。預計到2025年,專用SIP中繼將佔據市場主導地位,市佔率達到58.46%,並在預測期內以16.2%的複合年增長率(CAGR)實現最快成長。這主要得益於其更高的可靠性、有保障的頻寬、增強的安全性和穩定的服務質量,這些對於大型企業以及金融、醫療保健和政府等行業的關鍵任務通訊應用至關重要。企業之所以依賴專用SIP中繼,是因為其能夠提供有保障的頻寬、穩定的服務品質和增強的安全性,這對金融、醫療保健和政府等行業至關重要。高可靠性和正常運作時間的保障使專用SIP中繼成為關鍵任務通訊的理想選擇。這種偏好凸顯了企業對安全、高效能解決方案日益增長的需求,以維持營運連續性和客戶信任。

- 按服務類型

根據服務類型,北美SIP中繼服務市場可細分為語音、視訊、網路會議、簡訊/文字訊息、桌面共享、串流媒體和其他服務。預計到2025年,語音服務將以49.96%的市場份額佔據主導地位,這主要得益於語音通訊在企業通訊中的核心地位,因為語音通話量巨大,且在統一通訊系統中發揮關鍵作用。與傳統的PSTN線路相比,SIP中繼服務能夠節省成本,並為金融、醫療保健和IT等大型企業提供靈活性。企業持續優先考慮建立強大的語音基礎設施,以支援合規性、緊急服務和無縫協作,從而確保語音服務在市場中保持領先地位。

預計在預測期內,網路會議領域將以16.2%的複合年增長率實現最快成長。企業正越來越多地將網路會議作為其SIP中繼解決方案的一部分,以支援混合辦公模式、遠端協作和虛擬活動。對即時通訊、整合視訊和桌面共享的需求不斷增長,推動了網路會議的普及。頻寬的提升和品質的改進也提高了用戶體驗。隨著企業將生產力和無縫連接放在首位,網路會議已成為SIP中繼領域的重要成長驅動力。

- 透過申請

根據應用領域,北美SIP中繼服務市場可細分為企業電話、統一通訊 (UC)、呼叫中心/聯絡中心、行動和遠端辦公、成本優化和網路整合、災難復原和業務連續性、全球/國際通訊、物聯網和智慧型設備整合以及其他領域。預計到2025年,企業電話領域將以29.70%的市佔率佔據主導地位。電話仍然是日常業務運作的支柱,尤其是在大型企業中。金融、政府和醫療保健產業的廣泛應用反映了對安全、合規和可靠的語音解決方案的需求。 SIP中繼可確保符合E911標準,支援國際通信,並與UC平台整合以簡化工作流程。其在實現關鍵企業通訊方面發揮的核心作用,鞏固了該領域在市場中的主導地位。

預計在預測期內,物聯網和智慧型設備整合領域將以16.8%的複合年增長率快速成長。企業中互聯設備的日益普及推動了對SIP中繼的需求,以實現物聯網系統和企業平台之間的無縫通訊。整合能夠提升營運效率、即時監控和自動化能力。隨著各行業在醫療保健、製造和物流等領域採用智慧設備,SIP中繼可確保可擴展、安全且經濟高效的連接,使該領域成為預測期內的主要成長動力。

- 按價格

根據定價策略,北美SIP中繼服務市場可分為通道化SIP中繼和計量SIP中繼。預計到2025年,通道化SIP中繼將佔據市場主導地位,市佔率高達66.97%。這主要得益於企業對通道化中繼的青睞,因為其定價可預測、容量固定且服務品質穩定。此模式確保通訊不間斷,因此非常適合金融、醫療保健等受監管行業中呼叫量大的企業。通道化SIP中繼滿足了企業對穩定、安全且合規的通訊解決方案的需求,鞏固了其在區域SIP中繼服務市場的領先地位。

預計在預測期內,按流量計費的SIP中繼線路細分市場將以16.0%的複合年增長率實現最快成長。按流量計費模式對中小企業和注重成本控制的企業極具吸引力,他們更傾向於根據實際使用量付費。這種模式具有靈活性、可擴展性和經濟性,尤其適合通訊需求波動較大的企業。隨著企業日益尋求成本優化的解決方案,按流量計費的SIP中繼線路使他們能夠在無需投入大量固定成本的情況下擴展通訊基礎設施,從而推動了北美地區在預測期內的強勁增長。

- 按營運模式

根據定價,北美SIP中繼服務市場可細分為Windows、iOS、Android、Mac OS和Linux五大板塊。預計到2025年,Windows板塊將以51.90%的市場份額佔據主導地位,這主要得益於企業廣泛使用基於Windows的系統進行統一通信,因為這些系統具有良好的兼容性、可靠性,並且能夠與PBX和UC平台深度整合。金融、醫療保健和IT產業的廣泛應用也鞏固了該板塊的領先地位。 Windows SIP中繼服務能夠協助企業優化傳統系統、確保合規性並實現無縫通信,從而鞏固其作為市場首選營運模式的地位。

預計在預測期內,Android細分市場將以16.4%的複合年增長率實現最快成長。行動辦公人員的興起和自帶設備辦公室(BYOD)文化的盛行正在推動基於Android的SIP中繼的普及。 Android具有靈活性、經濟性和與各種應用程式的兼容性,因此深受中小企業和遠端團隊的青睞。隨著企業加速推進行動化策略並尋求便攜式通訊解決方案,Android SIP中繼的發展勢頭強勁,預計在預測期內於北美市場實現快速擴張。

- 最終用戶

根據定價,北美SIP中繼服務市場可細分為銀行、金融服務和保險(BFSI)、IT和電信、醫療保健和生命科學、政府和公共部門、零售和電子商務、製造業、媒體和娛樂、教育和研究、酒店和餐飲、物流和運輸以及其他行業。預計到2025年,銀行、金融服務和保險業將以51.90%的市佔率佔據主導地位。 BFSI機構需要安全、可靠且可擴展的通訊系統來處理高交易量、滿足監管合規要求以及處理客戶互動。 SIP中繼有助於優化成本、提高通話品質並確保符合E911等緊急服務要求。鑑於該行業對資料保護、營運效率和客戶信任的重視,SIP中繼解決方案仍然不可或缺,從而確保BFSI在市場應用方面保持領先地位。

預計醫療保健和生命科學領域在預測期內將以16.4%的複合年增長率實現最快成長。醫療保健領域對安全、高品質通訊的需求不斷增長,推動了SIP中繼技術的應用。支援遠距醫療、遠距患者監護以及醫療專業人員之間的協作的需求,正在加速SIP中繼技術的部署。 SIP中繼技術可確保符合醫療保健法規、資料安全和可靠性。醫療保健服務的日益數位化和患者參與度的提高,進一步鞏固了該領域在預測期內的快速成長勢頭。

北美SIP中繼服務市場區域分析

- 預計到2025年,美國將以81.50%的市佔率主導北美SIP中繼服務市場,並在預測期內維持15.9%的複合年增長率,成為成長最快的國家。這主要得益於先進的電信基礎設施、高雲端採用率、企業數位轉型、成本效益需求、監管支援以及主要供應商的存在。強大的IT生態系統和混合辦公趨勢進一步加速了SIP在全國範圍內從傳統PSTN系統向SIP的遷移。

- 美國SIP中繼服務市場的發展動力源自於企業雲端技術的快速普及以及對過時的PRI系統進行現代化改造的需求。企業正在遷移到SIP,以實現統一通訊、與Microsoft Teams和Zoom等協作工具集成,並支援混合辦公模式。

- 對可擴展、安全且經濟高效的連接的強勁需求,加上電信營運商對人工智慧驅動的呼叫管理和網路安全的重視,使美國成為北美SIP中繼的最大成長引擎。

加拿大SIP中繼服務市場洞察

預計到2025年,加拿大SIP中繼市場將佔據市場主導地位,以11.67%的收入份額位居第二,這主要得益於雲端優先業務策略的日益普及以及監管機構對先進VoIP服務的支持。企業正在轉向SIP,以簡化通訊、增強災難復原能力並降低分散營運的電話成本。混合辦公模式和遠距服務在醫療保健、教育和金融服務領域的日益普及加速了SIP的採用。電信營運商正在擴展覆蓋全國的SIP網絡,並提供託管安全和合規功能,從而推動加拿大企業和中端市場強勁成長。

墨西哥SIP中繼服務市場洞察

2024年,墨西哥SIP中繼服務市場份額達到6.85% ,這主要得益於企業數位轉型、近岸製造中心的興起以及通訊基礎設施現代化需求的推動。企業正以SIP中繼取代傳統的PBX系統,以實現經濟高效的擴展、增強跨境連接,並將語音與數據服務融合。電信業者正與雲端服務供應商合作,提供安全合規的SIP產品。此外,銀行、零售和工業等產業對IT基礎設施的投資不斷增長,以及對統一通訊需求的日益增加,也進一步推動了墨西哥SIP技術的普及。

北美SIP中繼服務市場份額

北美SIP中繼服務業主要由一些老牌公司主導,其中包括:

- Lumen Technologies(美國)

- 8x8 公司(美國)

- 羅傑斯通訊(加拿大)

- 美國威瑞森

- Twilio 公司(美國)

- GTT Communications, Inc.(美國)

- net2phone(美國)

- Vonage America, LLC(美國)

- 澳洲電信公司(Telstra)

- Intrado Life & Safety, Inc.(美國)

- Nextiva(美國)

- Sinch AB(瑞典)

- Mitel Networks Corp.(加拿大)

- Colt Technology Services Group Limited(英國)

- Fusion Connect(美國)

- 英國電信(BT)

- 橘子(法國)

- IntelePeer Cloud Communications LLC(美國)

- Wildix 公司(義大利)

- AVOXI公司(美國)

- 3CX(塞浦路斯)

- SIP.US(美國)

- G12 通訊有限責任公司(美國)

北美SIP中繼服務市場最新發展動態

- 2025年6月,AVOXI將人工智慧整合到其雲端語音平台中,推出了主動服務、AVOXI摘要和智慧來電顯示等功能。這些增強功能旨在提供主動、個人化和智慧化的服務,透過預測問題和優化語音基礎設施,變革企業聯絡中心。

- 2025年3月,8x8公司推出了8x8智慧助理和對話智能,增強了其人工智慧驅動的聯絡中心平台,提供即時客服支援、自動化品質保證和情感分析,幫助企業改善客戶互動並降低客戶流失率。

- 2025年7月,Verizon上調了全年調整後EBITDA、調整後每股盈餘和自由現金流的財務預期,原因是其無線和寬頻業務表現強勁,這得益於收入成長、新客戶增加和成功的產品創新。

- 2025年9月,Verizon更新了其寬頻策略,旨在加速光纖和固定無線網路的部署,目標是到2028年將固定無線存取用戶數量翻一番,將光纖網路覆蓋範圍擴大到3500萬至4000萬戶家庭,並擴大其寬頻覆蓋範圍,包括透過計畫收購Frontier來實現。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 USE CASE CATEGORIES WITH APPLICATIONS AND EXAMPLES

6 TARIFFS & IMPACT

6.1 UNITED STATES

6.2 CANADA

6.3 MEXICO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING ADOPTION OF CLOUD SOLUTIONS AND CONTACT CENTERS

7.1.2 THE RISE OF HYBRID WORK MODELS IS CREATING GREATER NEED FOR SCALABLE AND FLEXIBLE SIP TRUNKING

7.1.3 SIGNIFICANT COST ADVANTAGES COMPARED TO TDM ARE ENCOURAGING ENTERPRISES TO SHIFT TOWARD SIP TRUNKING

7.1.4 STRONG BROADBAND/MPLS BACKBONE ENSURES BETTER VOIP QUALITY

7.2 RESTRAINTS

7.2.1 QOS ISSUES DUE TO LAST-MILE CONNECTIVITY GAPS HINDER ADOPTION

7.2.2 LEGACY PBX SYSTEMS SLOW DOWN SIP MIGRATION TIMELINES

7.3 OPPORTUNITIES

7.3.1 SMALL AND MEDIUM SIZED BUSINESSES DEMAND MANAGED SIP SOLUTIONS AS A SERVICE OPPORTUNITY

7.3.2 AI-POWERED ANALYTICS ENHANCE FRAUD DETECTION AND FACILITATE VALUE-ADDED SERVICES

7.3.3 SIP USE IN IOT AND CARRIER WHOLESALE EXPANDS NEW REVENUE STREAMS

7.4 CHALLENGES

7.4.1 COMPLEX MIGRATIONS OF SIP TRUNKING FROM LEGACY COMMUNICATION CHANNELS INCREASE PROJECT DELAYS AND RISKS

7.4.2 SECURITY THREATS REQUIRE CONSTANT INVESTMENT IN SAFEGUARDS

8 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 ON PREMISE

8.3 CLOUD

8.4 HYBRID

9 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISE

9.2.1 LARGE ENTERPRISE, BY TYPE

9.2.1.1 ON PRIMES

9.2.1.2 CLOUD

9.3 SMALL AND MEDIUM ENTERPRISES (SMES)

9.3.1 SMALL AND MEDIUM ENTERPRISES (SMES), BY TYPE

9.3.1.1 ON PRIMES

9.3.1.2 CLOUD

10 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY

10.1 OVERVIEW

10.2 DEDICATED SIP TRUNKS

10.3 SHARED/OVER-THE-INTERNET SIP TRUNKS

11 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY SERVICE TYPE

11.1 OVERVIEW

11.2 VOICE

11.3 VIDEO

11.4 WEB CONFERENCING

11.5 SMS TEXT MESSAGING

11.6 DESKTOP SHARING

11.7 STREAMING MEDIA

11.8 OTHERS

12 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 ENTERPRISE TELEPHONY

12.2.1 ENTERPRISE TELEPHONY, BY TYPE

12.2.1.1 REGULATORY COMPLIANCE / E911 SERVICES

12.2.1.2 OTHERS

12.3 UNIFIED COMMUNICATIONS (UC)

12.4 CALL CENTERS / CONTACT CENTERS

12.5 MOBILE & REMOTE WORKFORCE ENABLEMENT

12.6 COST OPTIMIZATION & NETWORK CONVERGENCE

12.7 DISASTER RECOVERY & BUSINESS CONTINUITY

12.7.1 DISASTER RECOVERY & BUSINESS CONTINUITY, BY TYPE

12.7.1.1 BACKUP TRUNKING

12.7.1.2 BCP PLANS

12.8 GLOBAL/INTERNATIONAL COMMUNICATION

12.8.1 GLOBAL/INTERNATIONAL COMMUNICATION

12.8.1.1 MULTINATIONAL DID ACCESS

12.8.1.2 PSTN COVERAGE

12.9 IOT & SMART DEVICES INTEGRATION

12.1 OTHERS

13 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY PRICING

13.1 OVERVIEW

13.2 CHANNELIZED SIP TRUNKS

13.3 METERED SIP TRUNKS

14 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY OPERATING MODEL

14.1 OVERVIEW

14.2 WINDOWS

14.3 IOS

14.4 ANDROID

14.5 MACOS

14.6 LINUX

15 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY END-USER

15.1 OVERVIEW

15.2 BANKING, FINANCIAL SERVICE & INSURANCE

15.2.1 BY USAGE

15.2.1.1 SECURE VOICE COMMUNICATION

15.2.1.2 CALL CENTER OPERATIONS

15.2.1.3 MULTI-SITE CALL ROUTING

15.2.2 BY CONNECTIVITY

15.2.2.1 DEDICATED SIP TRUNKS

15.2.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.3 IT AND TELECOMMUNICATION

15.3.1 BY USAGE

15.3.1.1 ENTERPRISE VOIP DEPLOYMENTS

15.3.1.2 UNIFIED COMMUNICATIONS (UC) INTEGRATION

15.3.1.3 CLOUD PBX CONNECTIVITY

15.3.2 BY CONNECTIVITY

15.3.2.1 DEDICATED SIP TRUNKS

15.3.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.4 HEALTHCARE AND LIFE SCIENCES

15.4.1 BY USAGE

15.4.1.1 TELEMEDICINE AND VIDEO CONSULTATIONS

15.4.1.2 REMOTE PATIENT MONITORING SYSTEMS

15.4.1.3 INTERNAL COMMUNICATION

15.4.2 BY CONNECTIVITY

15.4.2.1 DEDICATED SIP TRUNKS

15.4.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.5 GOVERNMENT AND PUBLIC SECTOR

15.5.1 BY USAGE

15.5.1.1 PUBLIC SAFETY COMMUNICATION

15.5.1.2 SECURE GOVERNMENT VOIP NETWORKS

15.5.1.3 INTER-DEPARTMENT TELEPHONY

15.5.2 BY CONNECTIVITY

15.5.2.1 DEDICATED SIP TRUNKS

15.5.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.6 RETAIL AND E-COMMERCE

15.6.1 BY USAGE

15.6.1.1 CUSTOMER SERVICE CALL CENTERS

15.6.1.2 ORDER AND SUPPORT HANDLING

15.6.1.3 UNIFIED COMMUNICATIONS

15.6.2 BY CONNECTIVITY

15.6.2.1 DEDICATED SIP TRUNKS

15.6.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.7 MANUFACTURING

15.7.1 BY USAGE

15.7.1.1 PLANT FLOOR-TO-OFFICE COMMUNICATION

15.7.1.2 VIDEO COLLABORATION

15.7.1.3 INTEGRATION WITH IOT

15.7.2 BY CONNECTIVITY

15.7.2.1 DEDICATED SIP TRUNKS

15.7.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.8 MEDIA AND ENTERTAINMENT

15.8.1 BY USAGE

15.8.1.1 REMOTE BROADCASTING

15.8.1.2 VIDEO COLLABORATION IN CREATIVE PRODUCTION

15.8.1.3 STREAMING AND INTERACTIVE CONTENT SUPPORT

15.8.2 BY CONNECTIVITY

15.8.2.1 DEDICATED SIP TRUNKS

15.8.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.9 EDUCATION AND RESEARCH

15.9.1 BY USAGE

15.9.1.1 DISTANCE LEARNING AND VIRTUAL CLASSROOMS

15.9.1.2 VIDEO CONFERENCING FOR COLLABORATION

15.9.1.3 CAMPUS-WIDE COMMUNICATION SYSTEMS

15.9.2 BY CONNECTIVITY

15.9.2.1 DEDICATED SIP TRUNKS

15.9.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.1 HOTELS AND HOSPITALITY

15.10.1 BY USAGE

15.10.1.1 HOTEL PBX SYSTEMS

15.10.1.2 BOOKINGS AND CALL CENTER SUPPORT

15.10.1.3 MOBILE APPS INTEGRATION

15.10.2 BY CONNECTIVITY

15.10.2.1 DEDICATED SIP TRUNKS

15.10.2.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.11 LOGISTICS AND TRANSPORTATION

15.11.1 BY CONNECTIVITY

15.11.1.1 DEDICATED SIP TRUNKS

15.11.1.2 SHARED/OVER-THE-INTERNET SIP TRUNKS

15.12 OTHERS

16 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY COUNTRY

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA SIP TRUNKING SERVICES MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 LUMEN TECHNOLOGIES

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 SERVICE PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 8X8, INC.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 SERVICE PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 ROGERS COMMUNICATIONS

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 VERIZON

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 SERVICE PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 TWILIO INC.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 AVOXI

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 BT

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 SERVICE PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 COIL TECHNOLOGY SERVICES GROUP

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 FUSION CONNECT

19.9.1 COMPANY SNAPSHOT

19.9.2 SERVICE PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 GTT COMMUNICATION, INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 G12 COMMUNICATIONS LLC

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENTS

19.12 INTRADO LIFE & SAFETY, INC.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 INTELE PEER CLOUD COMMUNICATION LLC

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 MITEL NETWORKS CORP.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 NET2PHONE

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 NEXTIVA

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 ORANGE BUSINESS

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 SERVICE PORTFOLIO

19.17.4 RECENT DEVELOPMENT

19.18 SINCH.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 SIP.US

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 TELSTRA

19.20.1 COMPANY SNAPSHOT

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT DEVELOPMENTS

19.21 VONAGE

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENTS

19.22 WILDIX

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENT

19.23 3CX

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

表格列表

TABLE 1 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA LARGE ENTERPRISE IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA SMALL AND MEDIUM ENTERPRISES (SMES) IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ENTERPRISE TELEPHONY IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA DISASTER RECOVERY & BUSINESS CONTINUITY IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA GLOBAL/INTERNATIONAL COMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY PRICING, 2018-2032, (USD THOUSAND)

TABLE 12 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY OPERATING MODEL, 2018-2032, (USD THOUSAND)

TABLE 13 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY END-USER, 2018-2032, (USD THOUSAND)

TABLE 14 NORTH AMERICA BANKING, FINANCIAL SERVICE & INSURANCE IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA BANKING, FINANCIAL SERVICE & INSURANCE IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA IT AND TELECOMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA IT AND TELECOMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA HEALTHCARE AND LIFE SCIENCES IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA HEALTHCARE AND LIFE SCIENCES IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA GOVERNMENT AND PUBLIC SECTOR IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA GOVERNMENT AND PUBLIC SECTOR IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA RETAIL AND E-COMMERCE IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA RETAIL AND E-COMMERCE IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA MANUFACTURING IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA MANUFACTURING IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA MEDIA AND ENTERTAINMENT IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA MEDIA AND ENTERTAINMENT IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA EDUCATION AND RESEARCH IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA EDUCATION AND RESEARCH IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA HOTELS AND HOSPITALITY IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA HOTELS AND HOSPITALITY IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA LOGISTICS AND TRANSPORTATION IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. SIP TRUNKING SERVICES MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. SIP TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. LARGE ENTERPRISE IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. SMALL AND MEDIUM ENTERPRISES (SMES) IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 39 U.S. COMMERCIAL IN SIP TRUNKING SERVICES MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 U.S. SIP TRUNKING SERVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 U.S. ENTERPRISE TELEPHONY IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. DISASTER RECOVERY & BUSINESS CONTINUITY IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. GLOBAL/INTERNATIONAL COMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. SIP TRUNKING SERVICES MARKET, BY PRICING, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. SIP TRUNKING SERVICES MARKET, BY OPERATING MODEL, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. SIP TRUNKING SERVICES MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. BANKING, FINANCIAL SERVICE & INSURANCE IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. BANKING, FINANCIAL SERVICE & INSURANCE IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. IT AND TELECOMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. IT AND TELECOMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. HEALTHCARE AND LIFE SCIENCES IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. HEALTHCARE AND LIFE SCIENCES IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. GOVERNMENT AND PUBLIC SECTOR IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. GOVERNMENT AND PUBLIC SECTOR IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. RETAIL AND E-COMMERCE IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. RETAIL AND E-COMMERCE IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. MANUFACTURING IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. MANUFACTURING IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. MEDIA AND ENTERTAINMENT IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. MEDIA AND ENTERTAINMENT IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. EDUCATION AND RESEARCH IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. EDUCATION AND RESEARCH IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. HOTELS AND HOSPITALITY IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. HOTELS AND HOSPITALITY IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. LOGISTICS AND TRANSPORTATION IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA SIP TRUNKING SERVICES MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA SIP TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA LARGE ENTERPRISE IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA SMALL AND MEDIUM ENTERPRISES (SMES) IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 71 CANADA COMMERCIAL IN SIP TRUNKING SERVICES MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA SIP TRUNKING SERVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA ENTERPRISE TELEPHONY IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 CANADA DISASTER RECOVERY & BUSINESS CONTINUITY IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CANADA GLOBAL/INTERNATIONAL COMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA SIP TRUNKING SERVICES MARKET, BY PRICING, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA SIP TRUNKING SERVICES MARKET, BY OPERATING MODEL, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA SIP TRUNKING SERVICES MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA BANKING, FINANCIAL SERVICE & INSURANCE IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA BANKING, FINANCIAL SERVICE & INSURANCE IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA IT AND TELECOMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA IT AND TELECOMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA HEALTHCARE AND LIFE SCIENCES IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA HEALTHCARE AND LIFE SCIENCES IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA GOVERNMENT AND PUBLIC SECTOR IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA GOVERNMENT AND PUBLIC SECTOR IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 87 CANADA RETAIL AND E-COMMERCE IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 88 CANADA RETAIL AND E-COMMERCE IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 89 CANADA MANUFACTURING IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 90 CANADA MANUFACTURING IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 91 CANADA MEDIA AND ENTERTAINMENT IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 92 CANADA MEDIA AND ENTERTAINMENT IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 93 CANADA EDUCATION AND RESEARCH IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 94 CANADA EDUCATION AND RESEARCH IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 95 CANADA HOTELS AND HOSPITALITY IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA HOTELS AND HOSPITALITY IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA LOGISTICS AND TRANSPORTATION IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO SIP TRUNKING SERVICES MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO SIP TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO LARGE ENTERPRISE IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO SMALL AND MEDIUM ENTERPRISES (SMES) IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MEXICO SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 103 MEXICO COMMERCIAL IN SIP TRUNKING SERVICES MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MEXICO SIP TRUNKING SERVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 MEXICO ENTERPRISE TELEPHONY IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MEXICO DISASTER RECOVERY & BUSINESS CONTINUITY IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MEXICO GLOBAL/INTERNATIONAL COMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MEXICO SIP TRUNKING SERVICES MARKET, BY PRICING, 2018-2032 (USD THOUSAND)

TABLE 109 MEXICO SIP TRUNKING SERVICES MARKET, BY OPERATING MODEL, 2018-2032 (USD THOUSAND)

TABLE 110 MEXICO SIP TRUNKING SERVICES MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 111 MEXICO BANKING, FINANCIAL SERVICE & INSURANCE IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 112 MEXICO BANKING, FINANCIAL SERVICE & INSURANCE IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO IT AND TELECOMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 114 MEXICO IT AND TELECOMMUNICATION IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO HEALTHCARE AND LIFE SCIENCES IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 116 MEXICO HEALTHCARE AND LIFE SCIENCES IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 117 MEXICO GOVERNMENT AND PUBLIC SECTOR IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 118 MEXICO GOVERNMENT AND PUBLIC SECTOR IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 119 MEXICO RETAIL AND E-COMMERCE IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 120 MEXICO RETAIL AND E-COMMERCE IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO MANUFACTURING IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO MANUFACTURING IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 123 MEXICO MEDIA AND ENTERTAINMENT IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 124 MEXICO MEDIA AND ENTERTAINMENT IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO EDUCATION AND RESEARCH IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO EDUCATION AND RESEARCH IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 127 MEXICO HOTELS AND HOSPITALITY IN SIP TRUNKING SERVICES MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO HOTELS AND HOSPITALITY IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO LOGISTICS AND TRANSPORTATION IN SIP TRUNKING SERVICES MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA SIP TRUNKING SERVICES MARKET

FIGURE 2 NORTH AMERICA SIP TRUNKING SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SIP TRUNKING SERVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SIP TRUNKING SERVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SIP TRUNKING SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SIP TRUNKING SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA SIP TRUNKING SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA SIP TRUNKING SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA SIP TRUNKING SERVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 NORTH AMERICA SIP TRUNKING SERVICES MARKET: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE THE NORTH AMERICA SIP TRUNKING SERVICES MARKET, BY DEPLOYMENT TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING ADOPTION OF CLOUD SOLUTIONS AND CONTACT CENTERS IS EXPECTED TO DRIVE THE NORTH AMERICA SIP TRUNKING SERVICES MARKET IN THE FORECAST PERIOD

FIGURE 15 ON-PREMISE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SIP TRUNKING SERVICES MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA SIP TRUNKING SERVICES MARKET

FIGURE 17 NORTH AMERICA SIP TRUNKING SERVICES MARKET: BY DEPLOYMENT MODEL, 2024..

FIGURE 18 NORTH AMERICA SIP TRUNKING SERVICES MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 19 NORTH AMERICA SIP TRUNKING SERVICES MARKET: BY CONNECTIVITY, 2024

FIGURE 20 NORTH AMERICA SIP TRUNKING SERVICES MARKET: BY SERVICE TYPE, 2024

FIGURE 21 NORTH AMERICA SIP TRUNKING SERVICES MARKET: BY APPLICATION, 2024

FIGURE 22 NORTH AMERICA SIP TRUNKING SERVICES MARKET: BY PRICING, 2024

FIGURE 23 NORTH AMERICA SIP TRUNKING SERVICES MARKET: BY OPERATING MODEL, 2024

FIGURE 24 NORTH AMERICA SIP TRUNKING SERVICES MARKET: BY END-USER, 2024

FIGURE 25 NORTH AMERICA SIP TRUNKING SERVICES MARKET: SNAPSHOT (2024)

FIGURE 26 NORTH AMERICA SIP TRUNKING SERVICES MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。