North America Surface Analysis Market

市场规模(十亿美元)

CAGR :

%

USD

2.50 Billion

USD

3.80 Billion

2024

2032

USD

2.50 Billion

USD

3.80 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 3.80 Billion | |

|

|

|

|

北美表面分析市場,按技術(顯微鏡、光譜、X 射線衍射 (XRD) 和表面分析儀)、類型(XPS (X 射線光電子能譜)、TOF-SIMS (飛行時間二次離子質譜)、AES (俄歇電子能譜)、拉曼(拉曼光譜)、UPS (紫外光電子顯微鏡)、ISS (ISS) 等研究方法(SPM)/原子力顯微鏡 (AFM)、電子探針微分析儀 (EPMA)、X 射線光電子能譜儀 (XPS)/化學分析電子能譜 (ESCA) 等)、應用(材料組成、表面粗糙度和形貌、薄膜分析、表面污染、故障分析、腐蝕分析和表面改性)、最終用戶(研究機構和學術趨勢

表面分析市場分析

受半導體、製藥和航空航天等行業對精確材料表徵需求日益增長的推動,北美表面分析市場正經歷顯著增長。該市場涵蓋X射線光電子能譜 (XPS)、原子力顯微鏡 (AFM) 和二次離子質譜 (SIMS) 等先進技術,這些技術能夠實現詳細的表面成分和結構分析。人工智慧驅動的數據解讀、混合分析技術和自動化等技術進步正在提高準確性和效率。研發投入的增加、奈米技術應用的不斷拓展以及材料品質和安全監管要求的不斷提高,進一步推動了該市場的發展。

表面分析市場規模

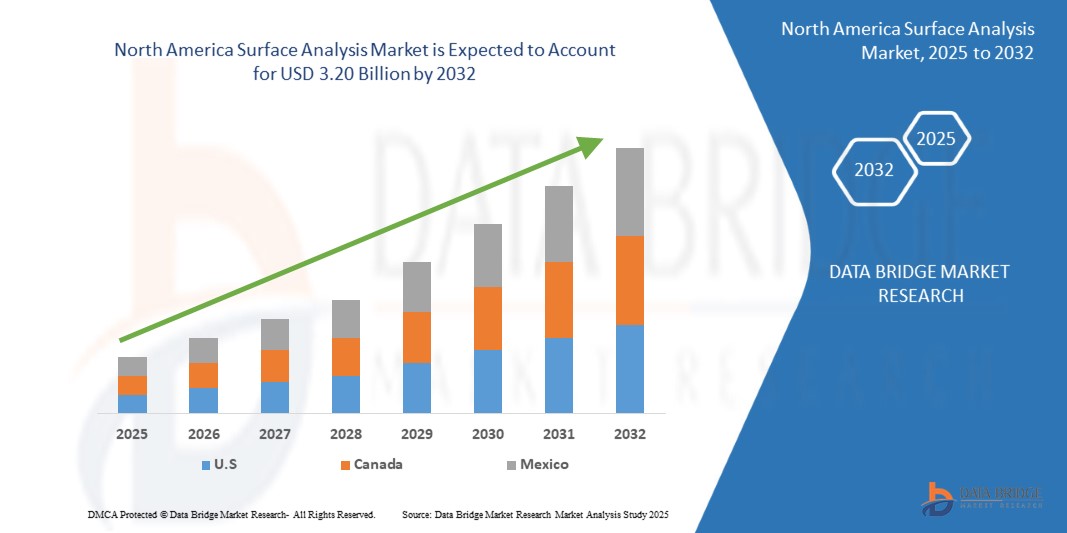

2024 年北美表面分析市場規模為 18.6 億美元,預計到 2032 年將達到 32 億美元,2025 年至 2032 年預測期內的複合年增長率為 7.1%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和杵分析。

表面分析市場趨勢

“對高精度材料表徵的需求不斷增長”

對高精度材料表徵日益增長的需求推動了表面分析市場的進步。半導體、製藥和航空航天等行業需要更精確、更可靠的表面評估技術,以確保產品品質和性能。光譜學、顯微鏡學和質譜學的創新正在增強分析能力,以實現即時、深入的表面評估。此外,自動化和人工智慧驅動的資料處理正在提高效率、減少錯誤並加速研發進程。隨著材料完整性和安全性監管標準的日益嚴格,先進表面分析技術的應用預計將不斷增長,從而鞏固其在各個高科技領域的關鍵作用。

報告範圍和表面分析市場細分

|

屬性 |

表面分析關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

美國、加拿大和墨西哥 |

|

主要市場參與者 |

SERMA GROUP(法國)、島津製作所(日本)、Eurofins Scientific(盧森堡)、賽默飛世爾科技公司(美國)、SAI Ltd(英國)、SPECS GmbH(德國)、Physical Electronics, Inc. (PHI)(美國)、Staib Instruments(德國)、Hiden Ana.(德國) Ltd(日本)、卡爾蔡司股份公司(德國)、TESCAN GROUP, as(捷克共和國)、TSI(美國)和尼康儀器公司(美國) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。 |

表面分析市場定義

表面分析是研究材料最外層,以確定其成分、結構、粗糙度和化學性質的技術。它涉及X射線光電子能譜 (XPS)、原子力顯微鏡 (AFM) 和二次離子質譜 (SIMS) 等先進技術,用於在微觀和原子層面分析表面。表面分析在半導體、製藥、航空航太和奈米技術等行業中至關重要,因為這些行業的材料特性會顯著影響其性能和可靠性。透過提供對錶面特性的詳細洞察,此類分析有助於提高產品品質、優化製造流程並確保符合監管標準。

表面分析市場動態

驅動程式

- 醫藥企業研發支出增加

由於這些行業專注於開發創新藥物和醫療器械,精確的表面表徵對於確保產品品質和法規合規性至關重要。研發支出的激增加速了表面分析的創新,並拓寬了其在關鍵醫療保健領域的應用。此外,資金的增加也促進了分辨率和靈敏度更高的先進分析儀器的開發。這些進步使公司能夠滿足嚴格的監管標準,同時促進產品開發領域的突破性研究。

例如,

- 德勤於2024年4月發表的文章顯示,北美製藥公司的研發投資報酬率在2023年上升至4.1%,從歷史低點回升。受複雜試驗和監管變化的推動,排名前20的製藥公司在研發上的支出達1,450億美元。創新的推動導致對品質控制和製程優化的投資增加。因此,包括表面分析在內的先進分析技術在確保藥物安全性和性能方面的重要性日益凸顯,從而推動了表面分析市場的成長。

表面分析方法的應用日益廣泛

表面分析方法的整合可透過精確檢測表面缺陷並確保一致性來優化製造流程。這種廣泛的應用凸顯了表面分析工具的多功能性,並推動了其在各種工業應用中的市場成長。此外,技術進步降低了營運成本,使這些技術更容易被更廣泛的行業所採用。使用者友善軟體的不斷發展進一步增強了資料解讀和製程控制,從而提升了整體效率。

例如,

根據愛思唯爾公司發表的文章,2025年3月,研究人員利用人工智慧增強型X射線顯微鏡對無定形固體分散體中的結晶咪康唑進行了無損檢測和定量分析。他們將先進的成像技術與人工智慧輔助分割技術相結合,以獲得詳細的粒度分佈並減少人為誤差。這項技術改善了藥品生產的品質控制,並展現出對精確表面分析的顯著優勢,預計將推動北美表面分析市場的成長。

機會

- 新興奈米技術為分析帶來突破性技術

新興奈米技術推動著創新,它實現了原子和分子層面的分析,提供了前所未有的分辨率和精度。這項進步使得檢測和表徵先前傳統方法無法實現的微小表面特徵成為可能。隨著這些基於奈米技術的技術的不斷發展,它們為材料科學和品質控制開闢了新的可能性,推動了各行各業表面分析應用的成長。

例如: -

- 2024年6月,根據施普林格·自然有限公司發表的文章,研究人員利用先進的環境掃描電子顯微鏡(A-ESEM)揭示了濃縮有絲分裂染色體的自然奈米形態。他們應用機器學習最佳化條件,實現了對敏感濕潤樣品的高解析度成像,且不會造成傷害。這項突破使得人們能夠發現染色體表面先前未觀察到的結構細節。該研究表明,奈米技術為推動表面分析市場發展提供了重要機會。

策略合作與合併加速市場擴張

策略夥伴關係與併購將互補的專業知識和資源結合,創造協同效益,推動市場成長。這些合作透過利用共享技術、客戶網路和市場洞察,簡化了先進表面分析技術的開發和部署。因此,企業可以縮短產品上市時間,擴大在北美的商業版圖,並更有效地應對不斷變化的產業挑戰,最終加速表面分析市場的整體擴張。

例如,

In February 2025, according to article published by Cision US Inc., Nanovis announced that Medtronic acquired certain nano surface technology assets, including intellectual property related to OsteoSync titanium pads, for use in its next-generation PEEK interbody fusion devices. The FDA-cleared nanotechnology improved osseointegration, enhancing implant fixation in spine surgery. This strategic acquisition underscored how partnerships and mergers accelerate market expansion in surface analysis by integrating advanced nano-scale innovations with leading medical device designs. The collaboration promised to deliver best-in-class devices to surgeons, further driving innovation and market growth in the medical implant sector.

Restraints/Challenges

- Sensitivity to Surface Contaminants Affecting Accuracy

Techniques such as X-ray Photoelectron Spectroscopy (XPS), Auger Electron Spectroscopy (AES), and Time-of-Flight Secondary Ion Mass Spectrometry (ToF-SIMS) are highly surface-sensitive, meaning contamination from the environment, handling, or sample preparation can introduce errors. This challenge is particularly critical in industries like semiconductors, pharmaceuticals, and advanced materials, where precise surface composition analysis is essential for quality control and regulatory compliance. Addressing these issues requires stringent sample handling protocols, controlled environments, and advanced cleaning techniques to minimize unwanted surface alterations.

Furthermore, the growing demand for high-resolution and quantitative surface analysis in nanotechnology and biomaterials research amplifies the need for improved contamination control measures. Innovative solutions such as ultra-high vacuum (UHV) conditions, in situ cleaning techniques like ion sputtering, and advanced data correction algorithms are being explored to mitigate the impact of contaminants. However, these approaches can add complexity and cost to the analysis process, posing challenges for widespread adoption, particularly for smaller research labs and emerging industries. As surface analysis technologies evolve, advancements in automation, real-time contamination detection, and machine learning-driven correction techniques will be key to enhancing accuracy and reliability in diverse applications.

For instance

According to XPS Metrology, surface contamination impacts material properties, coatings, and adhesion, often leading to corrosion and degradation. Contaminants like oils, salts, and atmospheric pollutants distort surface analysis results, especially in XPS, where even nanometer-thick layers affect accuracy. Handling practices, gloves, and cleaning sprays further compromise measurement reliability in industries like aerospace and semiconductor manufacturing.

- Limited Skilled Workforce for Advanced Surface Analysis Techniques

Techniques like XPS, SIMS, and AFM require specialized knowledge in instrumentation, data interpretation, and sample preparation, which are essential for obtaining precise and reliable results. The shortage of trained professionals can lead to inefficiencies, inconsistent data quality, and prolonged analysis times, ultimately impacting research, quality control, and industrial applications reliant on surface characterization.

For instance:

In January 2020, according to the National Library of Medicine, X-ray photoelectron spectroscopy (XPS) has become the most widely used surface analysis technique, but its rapid adoption has led to frequent misapplications due to a shortage of skilled professionals. Many inexperienced users struggle with accurate measurements and data interpretation, resulting in errors and inconsistencies. Variations in instrument calibration further complicate the process, making the lack of trained specialists a key challenge for the surface analysis market, affecting result reliability and reproducibility

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Surface Analysis Market Scope

The North America Surface Analysis Market is segmented into five notable segments based on the offering, deployment model, organization size, operating system and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Microscopy

- By Method

- Electron Microscopy

- Optical Microscopy

- Confocal Microscopy

- Probe Microscopy

- By Technique

- Scanning Electron Microscopy (Sem)

- Transmission Electron Microscopy (Tem)

- Scanning Probe Microscopy (Spm)

- Image Analysis

- Cryo-Electron Microscopy (Cryo-Em)

- Others

- By Method

- Spectroscopy

- X-Ray Diffraction (Xrd)

- Surface Analyzers

Type

- Xps (X-Ray Photoelectron Spectroscopy)

- Tof-Sims (Time-Of-Flight Secondary Ion Mass Spectrometry)

- Aes (Auger Electron Spectroscopy)

- Raman (Raman Spectroscopy)

- Ups (Uv Photoelectron Spectroscopy)

- Iss (Ion Scattering Spectroscopy)

- Others

Method Type

- Spectroscopic Method

- Microscopic Method

- Classical Method

Equipment Type

- Scanning Probe Microscopes (Spm)/Atomic Force Microscopes (Afm)

- By Operation

- Automatic

- Manual

- By Noise Level

- Low

- Extremely Low

- Standard

- By Operation

- Electron Probe Micro-Analyzers (Epma)

- X射線光電子能譜儀(Xps)/化學分析電子能譜儀(Esca)

- 其他的

應用

- 材料成分

- 表面粗糙度和形貌

- 薄膜分析

- 表面污染

- 故障分析

- 腐蝕分析

- 表面改性

最終用戶

- 產業

- 按類型

- 半導體

- 生命科學與製藥

- 聚合物

- 活力

- 冶金礦產

- 汽車

- 食品和飲料

- 紡織品

- 紙張和包裝

- 其他的

- 依技術

- 顯微鏡

- 光譜學

- X射線衍射(Xrd)

- 表面分析儀

- 按類型

- 研究組織

- 顯微鏡

- 光譜學

- X射線衍射(Xrd)

- 表面分析儀

- 學術機構

- 顯微鏡

- 光譜學

- X射線衍射(XRD)

- 表面分析儀

表面分析市場區域分析

對市場進行分析,並按技術、類型、方法類型、設備類型、應用和最終用戶提供市場規模洞察和趨勢。

市場涵蓋的國家包括美國、加拿大和墨西哥。

美國憑藉其先進的技術基礎設施、強大的核心產業參與者以及完善的研究生態系統,預計將在表面分析市場中佔據主導地位。其表面分析設備製造商高度集中,並在電子、醫療保健和航空航天等行業中得到廣泛應用,進一步鞏固了其領先地位。

由於半導體、製藥和材料科學領域的需求不斷增長,美國預計將成為市場成長最快的國家。政府舉措、私人投資的增加以及奈米技術和表面工程的持續進步正在加速市場擴張。

報告的國家部分還提供了各個市場的影響因素以及國內市場監管變化,這些變化會影響市場的當前和未來趨勢。下游和上游價值鏈分析、技術趨勢、波特五力模型分析以及案例研究等數據點是預測各國市場狀況的一些指標。此外,在對國家/地區數據進行預測分析時,還考慮了南美品牌的存在和供應情況,以及它們因本土和國內品牌的激烈競爭或稀缺而面臨的挑戰,以及國內關稅和貿易路線的影響。

表面分析市佔率

市場競爭格局按競爭對手提供詳細資料。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、南美業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據點僅與公司在市場中的重點相關。

在市場上運作的表面分析市場領導者有:

- SERMA集團(法國)

- 島津製作所(日本)

- Eurofins Scientific(盧森堡)

- 賽默飛世爾科技公司(美國)

- SAI有限公司(英國)

- SPECS GmbH(德國)

- Physical Electronics, Inc.(PHI)(美國)

- Staib Instruments (Germany)

- Hiden Analytical (U.K.)

- Bruker (U.S.)

- HORIBA Group (Japan)

- JEOL Ltd (Japan)

- Carl Zeiss AG (Germany)

- TESCAN GROUP, a.s. (Czech Republic)

- TSI (U.S.)

- Nikon Instruments Inc. (U.S.)

Latest Developments in North America Surface Analysis Market

- In January 2025, Eurofins Environment Testing Eaton Analytical has developed a cutting-edge method to detect chloronitramide anion, a newly discovered disinfection byproduct in drinking water, improving water quality analysis and safety. This advancement enhances Eurofins Scientific’s expertise in surface and chemical analysis by refining its ability to identify and evaluate contaminants, further solidifying its leadership in analytical testing for water and environmental safety

- In July 2022, ULVAC-PHI has launched the PHI GENESIS, a fully automated XPS/HAXPES system designed for high-speed, high-sensitivity surface and interface analysis. This advancement strengthens Physical Electronics, Inc.'s position by enhancing automation, sensitivity, and analytical capabilities for metals, semiconductors, ceramics, and organic materials

- In July 2024, Shimadzu Corporation has joined forces with TESCAN Group to launch TESCAN's scanning electron microscopes in Japan this autumn, expanding its analytical measurement offerings. This partnership enhances Shimadzu’s surface analysis capabilities by combining TESCAN’s cutting-edge SEM technology with its existing instruments, enabling more precise and comprehensive material characterization

- In July 2024, FOCUS GmbH and SPECS Surface Nano Analysis GmbH, both under LAB14 GmbH, have merged as SPECS Surface Nano Analysis GmbH while maintaining their brand identities. This merger enhances SPECS GmbH’s surface analysis capabilities by integrating FOCUS GmbH’s expertise in momentum microscopes and electron spectroscopy, enabling more precise and comprehensive research solutions

- In February 2025, Thermo Fisher Scientific is acquiring Solventum’s Purification & Filtration business for USD 4.1 billion, reinforcing its presence in the expanding bioprocessing market. This acquisition boosts Thermo Fisher’s filtration and purification capabilities, enhancing sample preparation for surface analysis techniques such as XPS and spectroscopy, resulting in greater precision and efficiency in material characterization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SURFACE ANALYSIS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 THECNOLOGY TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.1.1 SURFACE ANALYSIS IN THE SEMICONDUCTOR INDUSTRY

4.1.2 SURFACE ANALYSIS IN THE ACADEMIC INSTITUTES

4.1.3 SURFACE ANALYSIS IN THE RESEARCH ORGANIZATIONS

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.2.1 GROWTH PROSPECT

4.3 COMPETITOR KEY PRICING STRATEGIES

4.4 KEY TECHNOLOGIES

4.4.1 COMPLEMENTARY TECHNOLOGIES

4.4.2 ADJACENT TECHNOLOGIES

4.4.3 CHALLENGES

4.4.4 TECHNOLOGY SPEND OF COMPANY

4.5 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE R&D EXPENDITURE IN MEDICAL AND PHARMACEUTICAL COMPANIES

5.1.2 GROWING UTILIZATION OF SURFACE ANALYSIS METHODS IS EXPANDING ACROSS SECTORS LIKE ELECTRONICS, AUTOMOTIVE, AEROSPACE, AND ADVANCED MATERIALS

5.1.3 INCREASING QUALITY CONTROL DEMANDS ARE DRIVING THE EXPANSION OF SURFACE ANALYSIS.

5.1.4 GROWING RESEARCH COLLABORATION AMONG ACADEMIA, INDUSTRY, AND GOVERNMENT BOOST MARKET AWARENESS

5.2 RESTRAINTS

5.2.1 HIGH INSTRUMENT COSTS RESTRICT NORTH AMERICA SURFACE ANALYSIS EXPANSION

5.2.2 REGULATORY COMPLIANCE ISSUES HINDER RAPID TECHNOLOGY DEPLOYMENT

5.3 OPPORTUNITIES

5.3.1 EMERGING NANOTECHNOLOGY OFFERS BREAKTHROUGH TECHNIQUES IN ANALYSIS

5.3.2 STRATEGIC PARTNERSHIPS AND MERGERS ACCELERATE MARKET EXPANSION IN SURFACE ANALYSIS

5.4 CHALLENGES

5.4.1 SENSITIVITY TO SURFACE CONTAMINANTS AFFECTING ACCURACY

5.4.2 LIMITED SKILLED WORKFORCE FOR ADVANCED SURFACE ANALYSIS TECHNIQUES

6 NORTH AMERICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 MICROSCOPY

6.2.1 MICROSCOPY, BY METHOD

6.2.1.1 ELECTRON MICROSCOPY

6.2.1.2 OPTICAL MICROSCOPY

6.2.1.3 CONFOCAL MICROSCOPY

6.2.1.4 PROBE MICROSCOPY

6.2.2 MICROSCOPY, BY TECHNIQUE

6.2.2.1 SCANNING ELECTRON MICROSCOPY (SEM)

6.2.2.2 TRANSMISSION ELECTRON MICROSCOPY (TEM)

6.2.2.3 SCANNING PROBE MICROSCOPY (SPM)

6.2.2.4 IMAGE ANALYSIS

6.2.2.5 CRYO-ELECTRON MICROSCOPY (CRYO-EM)

6.2.2.6 OTHERS

6.3 SPECTROSCOPY

6.4 X-RAY DIFFRACTION (XRD)

6.5 SURFACE ANALYZERS

7 NORTH AMERICA SURFACE ANALYSIS MARKET, BY TYPE

7.1 OVERVIEW

7.2 XPS (X-RAY PHOTOELECTRON SPECTROSCOPY)

7.3 TOF-SIMS (TIME-OF-FLIGHT SECONDARY ION MASS SPECTROMETRY)

7.4 AES (AUGER ELECTRON SPECTROSCOPY)

7.5 RAMAN (RAMAN SPECTROSCOPY)

7.6 UPS (UV PHOTOELECTRON SPECTROSCOPY)

7.7 ISS (ION SCATTERING SPECTROSCOPY)

7.8 OTHERS

8 NORTH AMERICA SURFACE ANALYSIS MARKET, BY METHOD TYPE

8.1 OVERVIEW

8.2 SPECTROSCOPIC METHOD

8.3 MICROSCOPIC METHOD

8.4 CLASSICAL METHOD

9 NORTH AMERICA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE

9.1 OVERVIEW

9.2 SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM)

9.2.1 SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM), BY OPERATION

9.2.1.1 AUTOMATIC

9.2.1.2 MANUAL

9.2.2 SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM), BY NOISE LEVEL

9.2.2.1 LOW

9.2.2.2 EXTREMELY LOW

9.2.2.3 STANDARD

9.3 ELECTRON PROBE MICRO-ANALYZERS (EPMA)

9.4 X-RAY PHOTOELECTRON SPECTROMETERS (XPS)/ELECTRON SPECTROSCOPY FOR CHEMICAL ANALYSIS (ESCA)

9.5 OTHERS

10 NORTH AMERICA SURFACE ANALYSIS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 MATERIAL COMPOSITION

10.3 SURFACE ROUGHNESS AND TOPOGRAPHY

10.4 THIN FILM ANALYSIS

10.5 SURFACE CONTAMINATION

10.6 FAILURE ANALYSIS

10.7 CORROSION ANALYSIS

10.8 SURFACE MODIFICATION

11 NORTH AMERICA SURFACE ANALYSIS MARKET, BY END USER

11.1 OVERVIEW

11.2 INDUSTRIES

11.2.1 INDUSTRIES, BY TYPE

11.2.1.1 LIFE SCIENCES & PHARMACEUTICALS

11.2.1.2 SEMICONDUCTOR

11.2.1.3 METALLURGY AND MINERALS

11.2.1.4 AUTOMOTIVE

11.2.1.5 ENERGY

11.2.1.6 FOOD AND BEVERAGES

11.2.1.7 POLYMERS

11.2.1.8 TEXTILE

11.2.1.9 PAPER AND PACKAGING

11.2.1.10 OTHERS

11.2.2 INDUSTRIES, BY TECHNOLOGY

11.2.2.1 MICROSCOPY

11.2.2.2 SPECTROSCOPY

11.2.2.3 X-RAY DIFFRACTION (XRD)

11.2.2.4 SURFACE ANALYZERS

11.3 RESEARCH ORGANIZATION

11.3.1 RESEARCH ORGANIZATION, BY TECHNOLOGY

11.3.1.1 MICROSCOPY

11.3.1.2 SPECTROSCOPY

11.3.1.3 X-RAY DIFFRACTION (XRD)

11.3.1.4 SURFACE ANALYZERS

11.4 ACADEMIC INSTITUTES

11.4.1 ACADEMIC INSTITUTES, BY TECHNOLOGY

11.4.1.1 MICROSCOPY

11.4.1.2 SPECTROSCOPY

11.4.1.3 X-RAY DIFFRACTION (XRD)

11.4.1.4 SURFACE ANALYZERS

12 NORTH AMERICA SURFACE ANALYSIS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SURFACE ANALYSIS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 THERMO FISHER SCIENTIFIC INC.

15.1.1 COMPANY SNAPSHOTS

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CARL ZEISS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS/NEWS

15.3 BRUKER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT/ NEWS

15.4 HORIBA GROUP

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 EUROFINS SCIENTIFIC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SERVICE PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 HIDDEN ANALYTICAL

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 JEOL LTD.

15.7.1 COMPANY SNAPSHOTS

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS/NEWS

15.8 NIKON INSTRUMENTS INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 PHYSICAL ELECTRONICS, INC. (AS A PART OF ULVAC-PHI)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 S A I LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 SERMA GROUP

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT / NEWS

15.12 SHIMADZU CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SPECS GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 STAIB INSTRUMENTS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 TESCAN

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT/NEWS

15.16 TSI

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT/NEWS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 MARKET PENETRATION ANALYSIS

TABLE 2 PRICING

TABLE 3 COMPANY COMPARATIVE ANALYSIS

TABLE 4 SEVERAL SOURCES OF SUBSTRATE SURFACE CONTAMINATION

TABLE 5 NORTH AMERICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA SPECTROSCOPY IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA X-RAY DIFFRACTION (XRD) IN SURFACE ANALYSIS MARKET, BY RGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SURFACE ANALYZERS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA XPS (X-RAY PHOTOELECTRON SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA TOF-SIMS (TIME-OF-FLIGHT SECONDARY ION MASS SPECTROMETRY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA AES (AUGER ELECTRON SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA RAMAN (RAMAN SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA UPS (UV PHOTOELECTRON SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA ISS (ION SCATTERING SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA SPECTROSCOPIC METHOD IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA MICROSCOPIC METHOD IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA CLASSICAL METHOD IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA ELECTRON PROBE MICRO-ANALYZERS (EPMA) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA X-RAY PHOTOELECTRON SPECTROMETERS (XPS)/ELECTRON SPECTROSCOPY FOR CHEMICAL ANALYSIS (ESCA) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA OTHERS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA MATERIAL COMPOSITION IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA SURFACE ROUGHNESS AND TOPOGRAPHY IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA THIN FILM ANALYSIS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA SURFACE CONTAMINATION IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA FAILURE ANALYSIS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA CORROSION ANALYSIS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA SURFACE MODIFICATION IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA SURFACE ANALYSIS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CANADA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 88 CANADA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 89 CANADA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 90 MEXICO SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 102 MEXICO RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 103 MEXICO ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA SURFACE ANALYSIS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SURFACE ANALYSIS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SURFACE ANALYSIS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SURFACE ANALYSIS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 5 NORTH AMERICA SURFACE ANALYSIS MARKET: DBMR MARKET POSITION GRID

FIGURE 6 NORTH AMERICA SURFACE ANALYSIS MARKET: MULTIVARIATE MODELING

FIGURE 7 NORTH AMERICA SURFACE ANALYSIS MARKET: TECHNOLOGY TIMELINE CURVE

FIGURE 8 NORTH AMERICA SURFACE ANALYSIS MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA SURFACE ANALYSIS MARKET: SEGMENTATION

FIGURE 10 SEMICONDUCTOR: NORTH AMERICA SURFACE ANALYSIS MARKET EXECUTIVE SUMMARY

FIGURE 11 FOUR SEGMENTS COMPRISE THE NORTH AMERICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASE IN THE R&D EXPENDITURE IN MEDICAL AND PHARMACEUTICAL COMPANIES THE NORTH AMERICA SURFACE ANALYSIS MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 TECHNOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SURFACE ANALYSIS MARKET IN 2025 & 2032

FIGURE 15 BIGGEST MANUFACTURING ECONOMIES

FIGURE 16 DROC ANALYSIS

FIGURE 17 R&D INVESTMENTS BY INDIAN PHARMA COMPANIES

FIGURE 18 NORTH AMERICA SURFACE ANALYSIS MARKET: BY TECHNOLOGY, 2024

FIGURE 19 NORTH AMERICA SURFACE ANALYSIS MARKET: BY TYPE, 2024

FIGURE 20 NORTH AMERICA SURFACE ANALYSIS MARKET: BY METHOD TYPE, 2024

FIGURE 21 NORTH AMERICA SURFACE ANALYSIS MARKET: BY EQUIPMENT TYPE, 2024

FIGURE 22 NORTH AMERICA SURFACE ANALYSIS MARKET: BY APPLICATION, 2024

FIGURE 23 NORTH AMERICA SURFACE ANALYSIS MARKET: BY END USER, 2024

FIGURE 24 NORTH AMERICA SURFACE ANALYSIS MARKET: SNAPSHOT (2024)

FIGURE 25 NORTH AMERICA SURFACE ANALYSIS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。