North America Textured Butter Market

市场规模(十亿美元)

CAGR :

%

USD

170.60 Million

USD

208.89 Million

2024

2032

USD

170.60 Million

USD

208.89 Million

2024

2032

| 2025 –2032 | |

| USD 170.60 Million | |

| USD 208.89 Million | |

|

|

|

全球紋理奶油市場細分,按類型(無鹽紋理黃油和含鹽紋理黃油)、產品類型(動物基(牛奶)黃油和植物基黃油)、類別(有機和傳統)、應用(烘焙、冰淇淋、醬料和調味品、糖果等)– 行業趨勢和預測到 2032 年

組織奶油市場規模

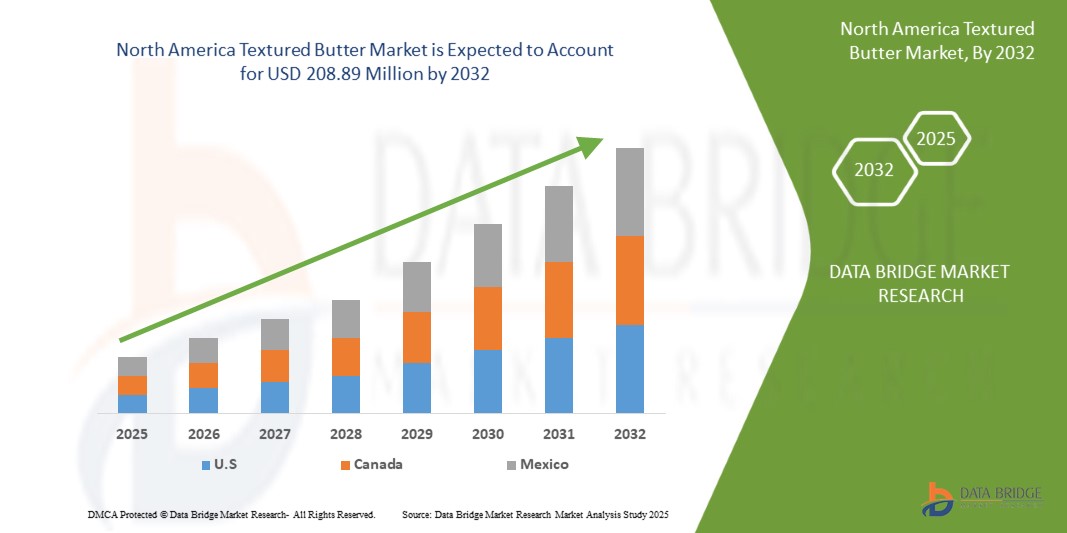

- 2024 年北美組織奶油市場價值為1.706 億美元,預計到 2032 年將達到 2.0889 億美元

- 在 2025 年至 2032 年的預測期內,市場可能會以2.62% 的複合年增長率增長,主要原因是消費者對增強感官食品體驗的需求不斷增長、清潔標籤趨勢以及零售和餐飲服務行業對優質可塗抹黃油的偏好日益增長

- 這一增長受到多種因素的推動,例如對優質乳製品的需求不斷增長、消費者對清潔標籤和天然成分的偏好增加,以及食品加工和黃油質地的創新

北美組織奶油市場分析

- 消費者對手工和優質乳製品的興趣日益濃厚,推動了對組織黃油的需求。這一趨勢受到不斷變化的口味偏好、健康意識以及美食和家常烹飪應用中濃鬱奶油質地的吸引力的推動,尤其是在已開發市場和城市市場

- 食品加工技術的進步使得製造商能夠提供質地、塗抹性和口感更佳的奶油。這些創新迎合了特定的烹飪用途,包括烘焙和糖果,增強了它們對商業食品生產商和家庭消費者的吸引力

- 隨著消費者越來越多地尋求具有清潔標籤、有機認證和最低限度加工的產品,組織黃油市場正在經歷成長。黃油,尤其是來自草飼或有機來源的黃油,被認為是一種更健康的脂肪選擇,這提高了它在傳統和植物基領域的受歡迎程度

- 例如,英國全脂乳製品的復興。瑪莎百貨和 Yeo Valley 等零售商報告稱,全脂牛奶和黃油的銷售正在上升,這是由於消費者偏愛奶油質地,並對低脂加工替代品持懷疑態度

- 紋理奶油在烘焙食品、糖果、醬料和即食食品等各種食品領域中越來越受歡迎。它的多功能性和增強風味和稠度的能力使其成為家庭和工業廚房的必備原料,擴大了其市場佔有率

報告範圍和市場細分

|

屬性 |

北美紋理黃油關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

北美組織奶油市場趨勢

“優質手工乳製品需求不斷增長”

- 北美組織黃油市場正受到消費者對美食和手工產品日益增長的需求的影響。隨著人們轉向高端食品體驗,紋理黃油以其濃鬱的口感和視覺吸引力,在家庭廚房和高端烹飪場所都廣受歡迎,尤其是在城市和發達市場,品質和美觀度影響著人們的購買決策

- 注重健康的消費者正在推動組織黃油市場的成長,他們明顯偏好有機和清潔標籤產品。紋理黃油富含天然脂肪,且通常經過最低限度的加工,符合當前的營養趨勢,即更傾向於食用全食而非低脂替代品,這進一步增強了其在均衡、高品質飲食中的應用。

- 疫情後生活方式的改變加速了家庭烘焙和烹飪的興起,也刺激了對紋理黃油等特殊原料的需求。其增強的風味和稠度使其成為烘焙產品、醬料和塗抹醬的首選,有助於實現食品類別用途的多樣化

- 例如,消費者對手工製作的本地產品的偏好日益增長,這表明消費者越來越傾向於選擇美食,包括紋理黃油

製造商正在組織黃油市場進行創新,推出植物性和無乳糖替代品,以滿足素食主義者和乳糖不耐症消費者的需求。這些產品創新,加上永續包裝和採購舉措,正在擴大消費者群體並支持長期市場成長

北美組織奶油市場動態

驅動程式

“優質乳製品需求不斷增長”

- 如今,消費者更加重視食品的成分和加工方法,對具有卓越口感、質地和營養價值的優質乳製品的需求激增

- 紋理黃油以其增強的可塗抹性、光滑度和稠度而聞名,正在成為家庭廚師和專業廚師的首選。高級餐飲、烘焙和糖果行業的興起進一步推動了這一趨勢,因為紋理黃油提高了糕點、甜點和優質食品的品質。此外,注重健康的消費者正在選擇高品質的奶油替代品,這些替代品含有較少的添加劑和防腐劑,同時保留了天然的豐富性

- 例如,2024年10月,達能宣布投資2,160萬美元擴大在旁遮普邦的業務,以滿足印度對優質乳製品日益增長的需求。隨著消費者越來越追求更健康、更高品質的乳製品選擇,達能的目標是擴大其市場份額,與 Amul 等老牌企業競爭

- 2024年8月,edairynews發表了一篇文章,指出由於注重健康的消費者優先考慮品質而不是成本,印度對優質乳製品的需求激增。隨著人們對天然成分、有機、草飼和無激素選擇的認識不斷提高,市場越來越青睞具有卓越口味和健康益處的產品,從而重塑了乳製品行業

- 有機和草飼乳製品的成長促進了對優質奶油品種的需求增加。消費者願意為符合道德標準、環保且不含人工成分的產品支付溢價。因此,乳製品製造商正在透過不同的質地、口味和有機認證進行創新,以滿足這一不斷擴大的細分市場的需求,從而進一步推動組織黃油市場的成長

機會

“消費者傾向轉向可持續和符合道德的產品”

- 消費者越來越多地轉向可持續和符合道德標準的質地黃油,為市場創造了巨大的機會。隨著人們對環境影響和道德農業的認識不斷提高,買家更喜歡用負責任的乳製品製成的黃油。他們尋求有機、公平貿易和草飼等認證,確保產品符合他們的價值觀

- 永續採購涉及保護自然資源、減少碳足跡和支持生物多樣性的生態友善農業實踐。道德採購確保農民獲得公平的工資並人道地對待動物。許多品牌現在正在採用透明的供應鏈來滿足消費者的這些期望

- 對此類產品日益增長的需求促使製造商投資於負責任的採購和可持續的生產方法。專注於環保包裝、減少浪費和道德原料採購的公司可以在北美組織黃油市場中獲得競爭優勢。隨著消費者偏好的不斷發展,符合永續性和道德標準的企業可能會提高品牌忠誠度並實現市場成長。這一趨勢為製造商提供了一個有利可圖的機會,使他們能夠擴大產品範圍,同時滿足對負責任食品選擇的需求。

例如,

- 2023 年 1 月發表的一項關於永續生產奶油:產品知識、對永續性的興趣和消費者特徵對購買頻率的影響的研究強調,消費者知識、對永續性的興趣以及有機和公平貿易等產品認證顯著影響購買頻率和對符合道德採購奶油的偏好。這一趨勢凸顯了對負責任生產的乳製品日益增長的需求

- 2024 年 8 月,道德消費者研究協會有限公司發表的一篇文章強調,消費者越來越多地選擇獲得公平貿易和有機等道德認證的黃油和塗抹醬,並在購買決策中優先考慮可持續性和負責任的採購

- 世界野生動物基金會發表的一篇文章指出,永續農業實踐,包括生態友善的乳牛養殖方法和負責任的採購,對於保護自然資源、減少碳足跡和促進生物多樣性至關重要

消費者對可持續且符合道德標準的質地黃油的需求日益增長,這推動了市場機會。隨著人們對環境影響和道德農業的認識不斷提高,專注於負責任的採購、環保包裝和透明供應鏈的品牌獲得了競爭優勢。這一趨勢促進了市場成長,鼓勵製造商遵守永續性和道德標準。

限制/挑戰

“組織化黃油生產成本高”

- 紋理黃油由於其特殊的生產工藝,需要更先進的技術和更高品質的原材料,例如有機或草飼奶油。這些因素導致其成本比普通黃油更高。為了達到所需的一致性和質地,需要精確的製造技術,這進一步推高了生產成本

- 對於製造商而言,採購優質原料、維持品質控制和投資專用設備所帶來的較高成本可能會限制組織黃油的可擴展性和可負擔性,尤其是在價格敏感的市場中。這反過來會限制其廣泛採用,特別是對於食品業的中小型企業來說,它們可能難以吸收增加的成本

例如,

- 2024 年 12 月,《Fast Company》的一份報告強調,由於供應鏈中斷、勞動力短缺和生產成本增加,奶油價格飆升。這些因素,尤其是對於紋理黃油而言,給廚師和消費者帶來了壓力,進一步提高了優質黃油和原材料的價格

- 2024 年 4 月,William Reed Ltd 強調,奶油價格上漲歸因於極端天氣、政治不穩定和能源成本上漲等因素,這些因素推高了乳製品價格,進而推高了奶油生產成本。由於持續的需求,預計這種激增將持續下去

消費者的價格敏感性,尤其是在發展中市場,可能會阻礙對組織黃油的需求,因為消費者可能會選擇更實惠的替代品。因此,組織黃油市場的成長面臨挑戰,特別是在與更廣泛的食品行業中較便宜的脂肪和油競爭時。

北美組織奶油市場範圍

市場根據類型、產品類型、類別和應用進行細分。

|

分割 |

細分 |

|

按類型 |

|

|

依產品類型 |

|

|

按類別 |

|

|

按應用 |

|

北美紋理黃油市場區域分析

“美國是北美組織黃油市場的主導國家”

- 由於消費者對天然和有機黃油產品的需求不斷增加,且受到健康意識和對低度加工食品的偏好的推動,美國預計將在組織黃油市場佔據主導地位。此外,蓬勃發展的烘焙和糖果產業也為這一成長做出了巨大貢獻。

“美國 預計將實現最高成長率”

- 由於對優質乳製品的需求不斷增長、消費者對清潔標籤和有機成分的偏好日益增加、手工黃油品牌的強大影響力以及支持性監管框架促進天然和高品質食品供應,美國 預計將實現最高的增長率。

組織黃油市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

北美組織奶油市場的最新發展

- 今年 1 月,Lactalis Ingredients 為其黃油系列的包裝推出了新的圖形標誌。此次更新是該公司為提高品牌知名度和實現產品展示現代化而不斷做出的努力的一部分。新設計旨在體現 Lactalis 對品質、創新和永續性的承諾,同時使包裝對消費者更具吸引力。這項發展有助於 Lactalis Ingredients 加強品牌知名度、提高消費者吸引力,並加強其對品質、創新和永續性的承諾。

- 今年3月,Lakeland Dairies完成了對比利時乳脂企業De Brandt Dairy International NV的收購,旨在提升其增值能力並擴大其在歐洲市場的份額。並鞏固了在歐洲黃油市場的地位,開拓了新的市場和產品類別。這項策略性舉措預計將為農場主帶來更豐厚的回報,並進一步為現有和未來的客戶開發世界一流的產品。

- 今年 2 月,菲仕蘭坎皮納宣布,計劃將黃油生產遷至荷蘭洛赫姆,以提高效率和永續性。此舉包括計劃於 2025 年初關閉 Den Bosch 工廠,影響約 90 名員工,公司將為他們提供支援和其他就業機會。此次搬遷旨在優化生產流程,同時確保長期營運的改善。菲仕蘭強調,該決定在最終實施前仍需經過員工協商和監管部門批准

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO AND ITS IMPACT ON THE NORTH AMERICA TEXTURED BUTTER MARKET

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 RISING TEMPERATURES AND DAIRY PRODUCTIVITY

4.7.1.2 WATER SCARCITY AND RESOURCE USE

4.7.1.3 GREENHOUSE GAS (GHG) EMISSIONS FROM DAIRY FARMING

4.7.1.4 DEFORESTATION AND LAND USE

4.7.2 INDUSTRY RESPONSE

4.7.2.1 SUSTAINABLE DAIRY FARMING PRACTICES

4.7.2.2 RENEWABLE ENERGY INTEGRATION

4.7.2.3 SUSTAINABLE PACKAGING AND WASTE REDUCTION

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 CLIMATE REGULATIONS AND CARBON TAXES

4.7.3.2 RESEARCH AND DEVELOPMENT (R&D) SUPPORT

4.7.3.3 TRADE POLICIES AND SUSTAINABILITY STANDARDS

4.7.4 ANALYST RECOMMENDATIONS

4.7.4.1 INVEST IN CLIMATE-RESILIENT SUPPLY CHAINS

4.7.4.2 PARTNER WITH SUSTAINABLE DAIRY FARMS

4.7.4.3 DIVERSIFY PRODUCT OFFERINGS

4.7.4.4 STRENGTHEN GOVERNMENT AND INDUSTRY COLLABORATION

4.7.5 CONCLUSION

4.8 CLIENT’S DATASET

4.8.1 LINDT & SPRÜNGLI

4.8.2 FERRERO GROUP

4.8.3 LANTMÄNNEN UNIBAKE

4.8.4 BRIDOR:

4.8.5 VANDEMOORTELE

4.8.6 MONDELEZ INTERNATIONAL

4.8.7 FRONERI

4.8.8 DÉLIFRANCE

4.8.9 WEWALKA

4.8.10 CÉRÉLIA

4.8.11 GRUPO BIMBO

4.8.12 LA LORRAINE BAKERY GROUP

4.8.13 ARYZTA AG

4.8.14 PHOON HUAT PTE LTD

4.8.15 CHEESE AND FOOD CO., LTD

4.8.16 AL-AHLAM COMPANY

4.8.17 UNILEVER

4.8.18 DEK SRL

4.8.19 NESTLÉ MEXICO S.A. DE C.V

4.8.20 PT TIRTA ALAM SEGAR

4.8.21 HAJI RAZAK HAJI HABIB JANOO

4.8.22 KELLAS INC.

4.8.23 WS WARMSENER SPEZIALITÄTEN GMBH

4.9 FACTORS INFLUENCING THE PURCHASING DECISION OF END-USERS FOR THE NORTH AMERICA TEXTURED BUTTER MARKET

4.9.1 QUALITY AND TEXTURE

4.9.2 HEALTH AND NUTRITIONAL BENEFITS

4.9.3 INGREDIENT TRANSPARENCY AND CLEAN LABELING

4.9.4 SUSTAINABILITY AND ETHICAL SOURCING

4.9.5 FLAVOR AND PRODUCT VARIETY

4.9.6 PRICE SENSITIVITY AND AFFORDABILITY

4.9.7 BRAND REPUTATION AND TRUST

4.9.8 CONVENIENCE AND ACCESSIBILITY

4.9.9 REGULATORY COMPLIANCE AND SAFETY STANDARDS

4.9.10 MARKETING AND PROMOTIONAL STRATEGIES

4.9.11 CONCLUSION

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS FOR THE NORTH AMERICA TEXTURED BUTTER MARKET

4.10.1 PRODUCT INNOVATION AND DIFFERENTIATION

4.10.2 EXPANSION INTO EMERGING MARKETS

4.10.3 SUSTAINABLE AND CLEAN LABEL PRODUCTS

4.10.4 STRENGTHENING DISTRIBUTION CHANNEL

4.10.5 STRATEGIC MERGERS AND ACQUISITIONS (M&A)

4.10.6 INVESTMENTS IN ADVANCED PROCESSING TECHNOLOGIES

4.10.7 MARKETING AND BRANDING STRATEGIES

4.10.8 FOCUS ON HEALTH AND WELLNESS TRENDS

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN ON THE NORTH AMERICA TEXTURED BUTTER MARKET

4.11.1 IMPACT ON PRICE

4.11.2 IMPACT ON SUPPLY CHAIN

4.11.3 IMPACT ON SHIPMENT

4.11.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.11.5 CONCLUSION

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE NORTH AMERICA TEXTURED BUTTER MARKET

4.12.1 RISING DEMAND FOR PREMIUM AND ARTISANAL BUTTER

4.12.2 GROWING POPULARITY OF FUNCTIONAL AND FORTIFIED BUTTER

4.12.3 EXPANSION OF PLANT-BASED AND DAIRY-FREE ALTERNATIVES

4.12.4 TECHNOLOGICAL INNOVATIONS IN BUTTER PROCESSING

4.12.5 CLEAN LABEL AND TRANSPARENCY TRENDS

4.12.6 SUSTAINABILITY AND ETHICAL SOURCING

4.12.7 E-COMMERCE AND DIRECT-TO-CONSUMER GROWTH

4.12.8 EXPANDING APPLICATIONS IN THE FOOD INDUSTRY

4.12.9 CONCLUSION

4.13 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13.1 ADVANCED PROCESSING TECHNIQUES

4.13.1.1 MICROENCAPSULATION FOR IMPROVED STABILITY

4.13.1.2 CONTROLLED CRYSTALLIZATION FOR OPTIMAL TEXTURE

4.13.1.3 HIGH-PRESSURE PROCESSING (HPP)

4.13.2 AUTOMATION AND ARTIFICIAL INTELLIGENCE (AI) IN BUTTER PRODUCTION

4.13.2.1 AI-POWERED QUALITY CONTROL

4.13.2.2 ROBOTICS AND SMART MANUFACTURING

4.13.2.3 PREDICTIVE MAINTENANCE IN DAIRY PROCESSING

4.13.3 INGREDIENT INNOVATIONS AND FUNCTIONAL ENHANCEMENTS

4.13.3.1 FORTIFIED AND FUNCTIONAL BUTTER

4.13.3.2 HYBRID BUTTER PRODUCTS

4.13.3.3 CLEAN-LABEL AND NATURAL INGREDIENTS

4.13.4 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.13.4.1 CARBON-NEUTRAL DAIRY PRODUCTION

4.13.4.2 BIODEGRADABLE AND RECYCLABLE PACKAGING

4.13.5 INNOVATIONS IN DISTRIBUTION AND CONSUMER ENGAGEMENT

4.13.5.1 BLOCKCHAIN FOR SUPPLY CHAIN TRANSPARENCY

4.13.5.2 DIRECT-TO-CONSUMER (DTC) SALES AND SUBSCRIPTION MODELS

4.13.5.3 SMART LABELING AND AUGMENTED REALITY (AR)

4.13.6 CONCLUSION

4.14 RAW MATERIAL SOURCING ANALYSIS

4.14.1 INTRODUCTION

4.14.2 DAIRY-BASED RAW MATERIAL SOURCING

4.14.3 PLANT-BASED FAT SOURCING FOR ALTERNATIVE BUTTER VARIETIES

4.14.4 ADDITIVES AND FUNCTIONAL INGREDIENTS SOURCING

4.14.5 SUPPLY CHAIN CHALLENGES AND RISKS

4.14.6 SUSTAINABILITY AND ETHICAL SOURCING INITIATIVES

4.14.7 FUTURE TRENDS IN RAW MATERIAL SOURCING

4.14.8 CONCLUSION

4.15 SUPPLY CHAIN ANALYSIS OF THE NORTH AMERICA TEXTURED BUTTER MARKET

4.15.1 LOGISTICS COST SCENARIO

4.15.1.1 RISING TRANSPORTATION COSTS

4.15.1.2 WAREHOUSING AND STORAGE EXPENSES

4.15.1.3 CUSTOMS AND TARIFFS IMPACTING COSTS

4.15.1.4 LAST-MILE DELIVERY CHALLENGES

4.15.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS IN THE TEXTURED BUTTER MARKET

4.15.2.1 ENSURING COLD CHAIN MANAGEMENT

4.15.3 ENHANCING SUPPLY CHAIN EFFICIENCY

4.15.3.1 MANAGING INTERNATIONAL TRADE COMPLIANCE

4.15.3.2 COST OPTIMIZATION STRATEGIES

4.15.3.3 ADAPTING TO MARKET CHANGES

4.15.4 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS

6.1.2 RAPIDLY EXPANDING BAKERY AND CONFECTIONERY INDUSTRY

6.1.3 INCREASED DEMAND FOR NATURAL AND ORGANIC PRODUCTS

6.1.4 INCREASED USAGE OF BUTTER IN FOOD PROCESSING AND FOOD SERVICE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF TEXTURED BUTTER

6.2.2 COMPLIANCE WITH FOOD SAFETY AND DAIRY PRODUCT REGULATIONS LIMITING MARKET EXPANSION

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER INCLINATION TOWARDS SUSTAINABLE AND ETHICAL SOURCED PRODUCTS

6.3.2 RISING URBANIZATION AND CHANGING DIETARY HABITS

6.3.3 DEVELOPMENT OF FLAVORED, ORGANIC, AND FUNCTIONAL BUTTER VARIANTS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION FROM CONVENTIONAL BUTTER

6.4.2 STORAGE AND SHELF-LIFE CONSTRAINTS

7 NORTH AMERICA TEXTURED BUTTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 UNSALTED TEXTURED BUTTER

7.3 SALTED TEXTURED BUTTER

8 NORTH AMERICA TEXTURED BUTTER MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ANIMAL BASED (MILK) BUTTER

8.3 PLANT-BASED BUTTER

9 NORTH AMERICA TEXTURED BUTTER MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 ORGANIC

9.3 CONVENTIONAL

10 NORTH AMERICA TEXTURED BUTTER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BAKERY

10.3 ICE CREAMS

10.4 SAUCES AND CONDIMENTS

10.5 CONFECTIONERY

10.6 OTHERS

11 NORTH AMERICA TEXTURED BUTTER MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U S

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA TEXTURED BUTTER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LACTALIS

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 LAKELAND DAIRIES

14.2.1 COMPANY SNAPSHOTS

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT/NEWS

14.3 UELZENA INGREDIENTS

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 FRIESLANDCAMPINA PROFESSIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 FLECHARD SAS

14.5.1. COMPANY SNAPSHOT

14.5.2. COMPANY SHARE ANALYSIS

14.5.3. PRODUCT PORTFOLIO

14.5.4. RECENT DEVELOPMENT

14.6. CORMAN

14.6.1. COMPANY SNAPSHOT

14.6.2. PRODUCT PORTFOLIO

14.6.3. RECENT DEVELOPMENT

14.7. NUMIDIA BV

14.7.1. COMPANY SNAPSHOTS

14.7.2. PRODUCT PORTFOLIO

14.7.3. RECENT DEVELOPMENT/NEWS

14.8. ROYAL VIVBUISMAN

14.8.1. COMPANY SNAPSHOT

14.8.2. PRODUCT PORTFOLIO

14.8.3. RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 NORTH AMERICA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 NORTH AMERICA UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 8 NORTH AMERICA SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 NORTH AMERICA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 12 NORTH AMERICA ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 14 NORTH AMERICA PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 NORTH AMERICA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 18 NORTH AMERICA ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 20 NORTH AMERICA CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 22 NORTH AMERICA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 24 NORTH AMERICA BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 26 NORTH AMERICA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 NORTH AMERICA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 NORTH AMERICA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 NORTH AMERICA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 NORTH AMERICA UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 47 NORTH AMERICA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 49 NORTH AMERICA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 51 NORTH AMERICA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 53 NORTH AMERICA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 NORTH AMERICA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 68 U.S. TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 70 U.S. TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 72 U.S. TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 74 U.S. BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 87 CANADA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CANADA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 89 CANADA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 CANADA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 91 CANADA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 CANADA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 93 CANADA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CANADA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CANADA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 CANADA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CANADA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MEXICO TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 MEXICO TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 106 MEXICO TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MEXICO TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 108 MEXICO TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 109 MEXICO TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 110 MEXICO TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 MEXICO TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 112 MEXICO BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MEXICO BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 MEXICO ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MEXICO SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MEXICO SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MEXICO CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MEXICO CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA TEXTURED BUTTER MARKET

FIGURE 2 NORTH AMERICA TEXTURED BUTTER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TEXTURED BUTTER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TEXTURED BUTTER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TEXTURED BUTTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TEXTURED BUTTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA TEXTURED BUTTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TEXTURED BUTTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET APPLICATION COVERAGE GRID: NORTH AMERICA TEXTURED BUTTER MARKET

FIGURE 10 NORTH AMERICA TEXTURED BUTTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA TEXTURED BUTTER MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA TEXTURED BUTTER MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA TEXTURED BUTTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE UNSALTED TEXTURED BUTTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TEXTURED BUTTER MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 NORTH AMERICA TEXTURED BUTTER MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA TEXTURED BUTTER MARKET

FIGURE 21 NORTH AMERICA TEXTURED BUTTER MARKET: BY TYPE, 2024

FIGURE 22 NORTH AMERICA TEXTURED BUTTER MARKET: BY PRODUCT TYPE, 2024

FIGURE 23 NORTH AMERICA TEXTURED BUTTER MARKET: BY CATEGORY, 2024

FIGURE 24 NORTH AMERICA TEXTURED BUTTER MARKET: BY APPLICATION, 2024

FIGURE 25 NORTH AMERICA TEXTURED BUTTER MARKET: SNAPSHOT, 2024

FIGURE 26 NORTH AMERICA TEXTURED BUTTER MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。