北美財務軟體市場,按作業系統(Windows、Linux、IOS、Android、MAC)、應用程式(流動性和現金管理、投資管理、債務管理、金融風險管理、合規管理、稅務規劃等)、部署模式(本地、雲端)、組織規模(大型企業和中小型企業)、垂直行業(銀行、金融服務和保險、政府、製造業、化學品保健、消費品、醫療行業和醫療行業。

北美財務軟體市場分析與規模

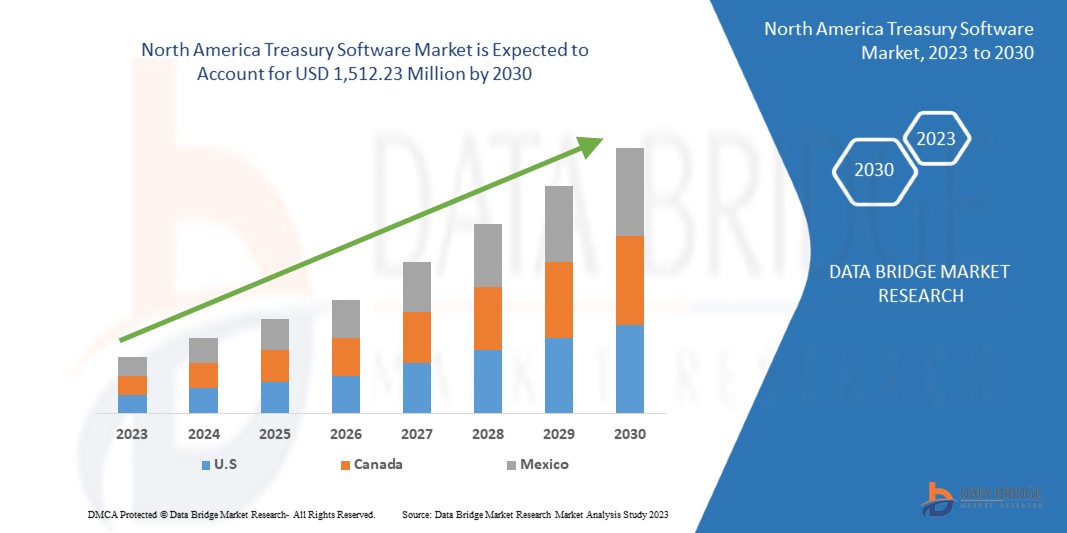

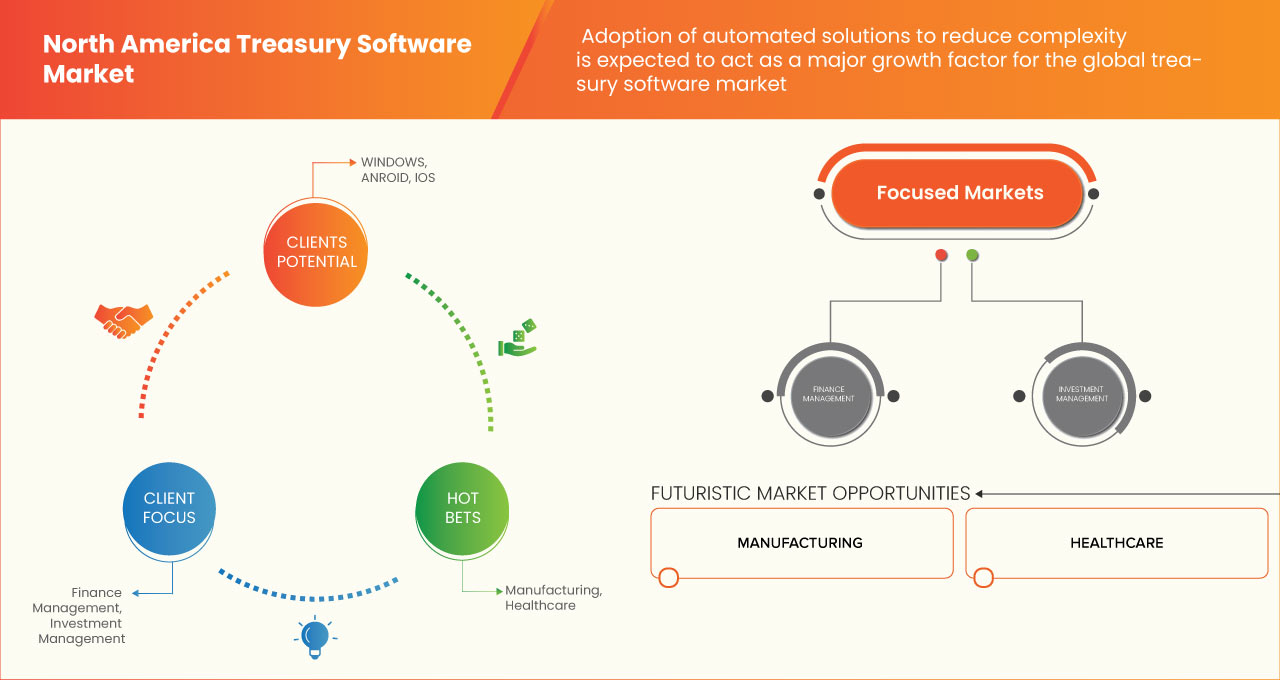

北美財務軟體市場預計將在 2023 年至 2030 年的預測期內實現市場成長。 Data Bridge Market Research 分析,在 2023 年至 2030 年的預測期內,該市場將以 3.3% 的複合年增長率增長,預計到 2030 年將達到 15.1223 億美元。生物技術對快速決策過程的需求增加預計將顯著推動市場成長。

北美財務軟體市場報告提供了市場份額、新發展和產品線分析的詳細資訊、國內和本地化市場參與者的影響,分析了新興收入來源、市場法規變化、產品審批、策略決策、產品發布、地理擴展和市場技術創新方面的機會。要了解分析和市場情景,請聯絡 Data Bridge Market Research 以取得分析師簡報,我們的團隊將協助您建立收入影響解決方案,以實現您的期望目標。

|

報告指標 |

細節 |

|

預測期 |

2023年至2030年 |

|

基準年 |

2022 |

|

歷史歲月 |

2021(可自訂至2020-2016) |

|

定量單位 |

收入(千美元),定價(美元) |

|

涵蓋的領域 |

作業系統(Windows、Linux、IOS、Android、MAC)、應用程式(流動性和現金管理、投資管理、債務管理、金融風險管理、合規管理、稅務規劃等)、部署模式(本地、雲端)、組織規模(大型企業和中小型企業)、垂直產業(銀行、金融服務和保險、政府、製造業、醫療保健、消費品、化學品、能源等) |

|

覆蓋國家 |

美國、加拿大、墨西哥 |

|

涵蓋的市場參與者 |

Finastra、ZenTreasury Ltd、Emphasys Software、SS&C Technologies, Inc.、CAPIX、Adenza、Coupa Software Inc.、DataLog Finance、FIS、Access Systems (UK) Limited、Treasury Software Corp.、MUREX SAS、EdgeVerve Systems Limited(Infosys 的全資子公司)、Fi休Inc、ION、SAP、Solomon Software、ABM CLOUD 等 |

市場定義

財務軟體是一種自動化公司財務活動(如現金流量、資產和投資)的應用程式。它提供了一個財務管理系統,用於追蹤企業將資產轉換為現金以履行財務義務的能力。財務經理和會計使用財務管理軟體來監控流動性以及將資產轉換為現金以履行財務義務的能力。該軟體可自動化和簡化財務管理功能,降低財務和聲譽風險,節省成本,並提高營運效率和效力。財務管理系統提供的更強的可視性、分析能力和預測能力可改善決策並有助於制定組織財務策略。

北美財務軟體市場動態

本節涉及了解市場驅動因素、優勢、機會、限制和挑戰。所有這些都將在下面詳細討論:

驅動程式

- 對先進財務管理系統的需求不斷增長,以提升客戶體驗

財務管理系統 (TMS) 是一種有助於實現手動財務流程自動化的軟體。在控制銀行帳戶、維持合規性和管理金融交易的同時,提供對現金和流動性的更高可視性,提高了客戶滿意度。財務管理系統基本上為組織提供了七項核心優勢,可以增強組織的能力,包括:

- 提高生產力

- 即時、精確的數據可用性

- 減少手動輸入和計算錯誤

- 限制冗餘銀行和外匯成本

- 詳細的活動監控

- 銀行和連接靈活性

- 監理合規和風險緩解

據Coupa Software Inc.稱,採用TMS解決方案會受到各種因素的影響,例如外匯波動性下降52%,現金流和財務風險敞口下降43%,現金匯回下降40%,財務基礎設施不足下降30%,北美稅收改革影響下降24%,傳統方法導致的運營和欺詐風險下降20%,財務運營成本下降12%,以及其他因素下降12%。

- 人工智慧在財務管理的廣泛應用

近年來,人工智慧在加強和轉變全球各行業方面發揮了至關重要的作用。從政府機構、大型組織到小型線上企業,全球多個平台上的多個實體都在使用人工智慧 (AI)。

2020年,根據NewVantage的調查,91.5%的頂級企業正大力投資人工智慧。儘管在人工智慧方面進行投資的公司使用人工智慧技術的比例不高,但只有 14.6% 的公司在其組織內廣泛使用人工智慧技術。其中,超過一半(51.2%)的企業已將人工智慧應用於有限的生產,26.8%的企業正在試驗應用。這顯示人工智慧技術的重要性日益提升,企業採用人工智慧技術的熱潮也日益高漲。

人工智慧(AI)已經在財務管理的現金管理和預測方面展現出其巨大潛力。人工智慧試圖解決以前被認為只能透過人工幹預才能解決的問題。

機會

- 高階分析解決方案在銀行業的滲透

如今,銀行越來越多地使用分析來獲得競爭優勢,並根據資訊和數據收集得出結論和見解。進階分析可用於預測客戶行為和偏好並改善風險評估。有時銀行和金融業產生的資料規模龐大,銀行無法使用傳統資料庫來處理這些資料。因此,分析為金融業一次處理大量數據鋪平了道路。

此外,數位世界為銀行業帶來了一場革命。大多數銀行高階分析解決方案由四個不同的部分組成:報告、描述分析、預測分析和規範分析。金融機構現在可以持續地瞄準並吸引客戶,而不僅僅是當客戶進入分行時。他們的覆蓋範圍現在包括使用行動應用程式、ATM 和網路銀行應用程式的客戶。銀行還可以利用分析技術,根據客戶的個人資料和歷史記錄,為他們提供客製化的產品、服務和交易。此外,銀行業的分析也有助於識別和防止詐欺。銀行使用進階分析技術將客戶使用模式與自己的詐欺指標進行比較,並在偵測到潛在詐欺活動時立即採取行動。與其他行業相比,分析在銀行業的整體滲透率仍然相對較低。然而,分析技術在銀行業的滲透為財務軟體市場的成長創造了許多機會。

限制/挑戰

- 網路威脅和資料外洩日益增多

由於 COVID-19,2020 年網路犯罪和網路安全問題增加了 600%。駭客利用網路安全漏洞在系統內執行未經授權的操作。

根據 Purple Sec LLC 統計,2018 年針對行動裝置的行動惡意軟體變種增加了 54%,其中 98% 的行動惡意軟體針對各種智慧安卓裝置。據估計,25% 的企業曾遭受加密劫持。業務涵蓋銀行、各企業/產業的金融管理團隊。

近年來,企業/產業正在大力採用數位化。銀行、購物、旅遊等行業正在向數位化模式轉變,以增強消費者體驗。數位化產生了大量客戶數據和資訊。這引發了安全擔憂,這些資料始終面臨較高的網路攻擊和資料外洩風險。透過這些資訊和數據,詐騙者和網路攻擊者可以輕鬆模仿或竊取個人身份,並將其用於各種犯罪。

根據標普北美公司對2016年至2021年過去五年北美各行業網路攻擊事件佔比的研究,金融機構以26%的網路安全事件佔比位居榜首,其次是醫療保健產業佔11%,軟體和科技服務業佔7%,零售業佔6%。

COVID-19 疫情對北美財務軟體市場的影響

COVID-19 疫情對北美財務軟體市場產生了重大影響。疫情對北美供應鏈、金融市場和經濟活動造成了重大破壞,導致全球財政部門的優先事項和策略轉變。

疫情對財務軟體市場最顯著的影響之一是對基於雲端的解決方案的需求增加。疫情迫使許多組織迅速轉向遠端工作,這凸顯了擁有安全、可存取且可擴展的基於雲端的財務解決方案的重要性。因此,對基於雲端的財務軟體解決方案的需求顯著增加。

疫情對財務軟體市場的另一個影響是更關注現金預測和流動性管理。疫情為企業帶來了巨大的不確定性和風險,準確的現金預測和流動性管理對於企業生存至關重要。能夠提供準確、即時現金預測、流動性管理和風險評估的財務軟體解決方案變得越來越重要。

整體而言,COVID-19 疫情加速了數位財務解決方案的採用,從而推動北美財務軟體市場顯著成長。隨著各組織尋求提高其敏捷性、彈性和效率,對基於雲端的解決方案、現金預測和流動性管理以及先進的自動化和整合功能的需求預計在後疫情時代將持續存在。

最新動態

- 2022 年 3 月,ZenTreasury 及其當地合作夥伴 MCA 向 Redington Gulf 提供了符合 IFRS-16 的租賃會計軟體。現在客戶不需要從多個來源匯入資料並將其儲存在各種平台上。一個軟體即可完成所有操作

- 2022年9月,TIS與Delega合作,為客戶提供下一代自動化多銀行簽署人權限管理。 TIS 和 Delega 的客戶可以透過該協議 (eBAM) 享受 NextGen 電子銀行帳戶管理服務

北美財務軟體市場範圍

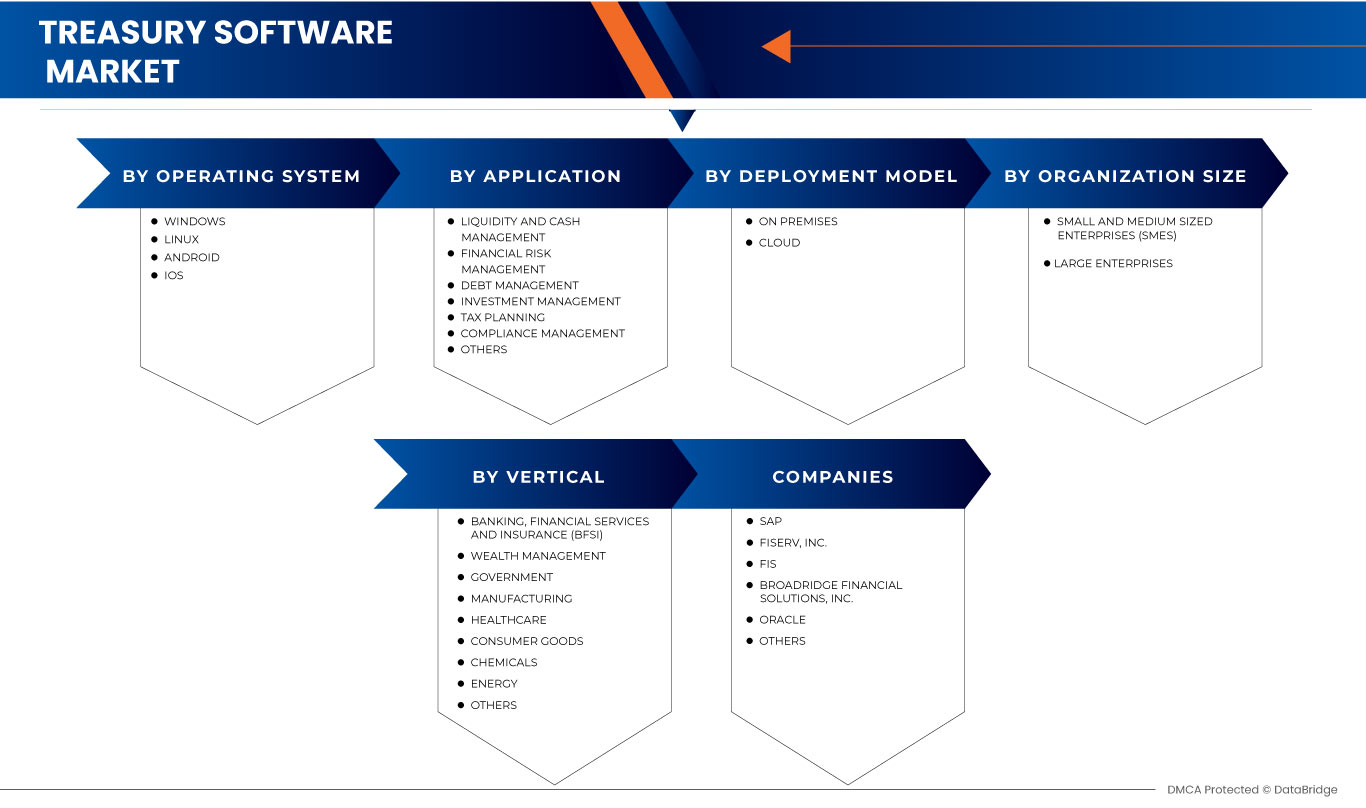

北美財務軟體市場根據作業系統、應用程式、部署模型、組織規模和垂直度進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

北美財務軟體市場(按作業系統)

- 蘋果

- 視窗

- iOS

- 安卓

- Linux

根據作業系統,北美財務軟體市場分為 Windows、Linux、MAC、Android 和 iOS。

北美財務軟體市場(按應用)

- 流動性和現金管理

- 金融風險管理

- 債務管理

- 投資管理

- 稅務規劃

- 合規管理

- 其他的

根據應用,北美財務軟體市場細分為流動性和現金管理、投資管理、債務管理、財務風險管理、合規管理、稅務規劃等

北美財務軟體市場(依部署模式)

- 現場

- 雲

根據部署模式,北美財務軟體市場分為雲端和本地。

北美財務軟體市場(按組織規模)

- 中小企業(SMES)

- 大型企業

根據組織規模,北美財務軟體市場分為大型企業和中小型企業。

北美財務軟體市場(按垂直產業)

- 銀行、金融服務和保險(BFSI)

- 財富管理

- 政府

- 製造業

- 衛生保健

- 消費品

- 化學品

- 活力

- 其他的

在垂直基礎上,北美財務軟體市場細分為銀行、金融服務和保險 (BFSI)、政府、製造業、醫療保健、消費品、化學品、能源等。

北美財務軟體市場區域分析/洞察

對北美財務軟體市場進行了分析,並按國家、作業系統、應用程式、部署模型、組織規模和垂直行業提供了市場規模洞察和趨勢,如上所述。

北美財務軟體市場報告涵蓋的國家包括美國、加拿大和墨西哥。

由於先進技術的廣泛採用和主要參與者在該地區的存在,美國預計將在北美地區佔據主導地位。

報告的國家部分還提供了影響市場當前和未來趨勢的個別市場影響因素和市場監管變化。下游和上游價值鏈分析、技術趨勢和波特五力分析、案例研究等數據點是用於預測各國市場情景的一些指標。此外,在對國家數據進行預測分析時,還考慮了北美品牌的存在和可用性以及由於來自本地和國內品牌的大量或稀缺的競爭而面臨的挑戰、國內關稅和貿易路線的影響。

競爭格局與北美財務軟體市場佔有率分析

北美財務軟體市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、北美業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用主導地位。以上提供的數據點僅與公司對北美財務軟體市場的關注有關。

北美財務軟體市場的一些主要參與者包括 Finastra、ZenTreasury Ltd、Emphasys Software、SS&C Technologies, Inc.、CAPIX、Adenza、Coupa Software Inc.、DataLog Finance、FIS、Access Systems (UK) Limited、Treasury Software Corp.、MUREX road. Inc.、CashAnalytics、Oracle、Fiserv, Inc、ION、SAP、Solomon Software、ABM CLOUD 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TREASURY SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OPERATING SYSTEM TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 KEY PRIMARY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS

5.1.2 GROWING DEMAND FOR ADVANCED TREASURY MANAGEMENT SYSTEM FOR ENHANCING CUSTOMER EXPERIENCE

5.1.3 HEAVING ADOPTION OF ARTIFICIAL INTELLIGENCE IN TREASURY MANAGEMENT

5.1.4 ADOPTION OF CLOUD BASED SOLUTION IN TREASURY MANAGEMENT

5.2 RESTRAINTS

5.2.1 INCREASING CYBER THREATS AND DATA BREACHES

5.2.2 HIGH COST ASSOCIATED WITH TREASURY MANAGEMENT SYSTEMS

5.2.3 CONTINUOUS CHANGES IN REGULATORY FRAMEWORK IN TREASURER MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF ADVANCED ANALYTICS SOLUTIONS IN THE BANKING SECTOR

5.3.2 ADOPTION OF AUTOMATED SOLUTIONS TO REDUCE COMPLEXITY

5.3.3 RISE IN STRATEGIC PARTNERSHIP & COLLABORATION AMONG THE ORGANIZATION

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING THE BENEFITS OF TREASURY SOFTWARE

5.4.2 FACTORS LIKE COMPLEXITIES, INADEQUATE INFRASTRUCTURE, AND FX VOLATILITY HAMPERS TMS EFFICIENCY

6 IMPACT OF COVID-19 ON THE NORTH AMERICA TREASURY SOFTWARE MARKET

7 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 MAC

7.5 ANDROID

7.6 IOS

8 NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 LIQUIDITY AND CASH MANAGEMENT

8.3 INVESTMENT MANAGEMENT

8.4 DEBT MANAGEMENT

8.5 FINANCIAL RISK MANAGEMENT

8.6 COMPLIANCE MANAGEMENT

8.7 TAX PLANNING MANAGEMENT

8.8 OTHERS

9 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

10.1 OVERVIEW

10.2 CLOUD

10.2.1 PUBLIC

10.2.2 HYBRID

10.2.3 PRIVATE

10.3 ON-PREMISES

11 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 WEALTH MANAGEMENT

11.2.2 BANKING

11.2.3 CAPITAL MARKET

11.2.4 OTHERS

11.3 GOVERNMENT

11.4 MANUFACTURING

11.5 HEALTHCARE

11.6 CONSUMER GOODS

11.7 CHEMICALS

11.8 ENERGY

11.9 OTHERS

12 NORTH AMERICA TREASURY SOFTWARE MARKET , BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA TREASURY SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 APPLICATION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 FISERV, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 FIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SOLUTION PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BROADRIDGE FINANCIAL SOLUTIONS, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ORACLE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABM CLOUD

15.6.1 COMPANY SNAPSHOT

15.6.2 SERVICE PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ACCESS SYSTEMS (UK) LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ADENZA

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CAPIX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CASHANALYTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 COUPA SOFTWARE INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 DATALOG FINANCE

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EDGEVERVE SYSTEMS LIMITED (A WHOLLY OWNED SUBSIDIARY OF INFOSYS)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMPHASYS SOFTWARE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ERNST & YOUNG

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FINASTRA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 FINANCIAL SCIENCES CORP.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MUREX S.A.S

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 NOMENTIA

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SOLOMON SOFTWARE

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SS&C TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TREASURY INTELLIGENCE SOLUTIONS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 TREASURY SOFTWARE CORP

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 ZENTREASURY LTD

15.25.1 COMPANY SNAPSHOT

15.25.2 SOLUTION PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA WINDOWS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA LINUX IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA MAC IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ANDROID IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IOS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TREASURY SOFTWARE MARKET, APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA LIQUIDITY AND CASH MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA INVESTMENT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA DEBT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FINANCIAL RISK MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COMPLIANCE MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TAX PLANNING MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA LARGE ENTERPRISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SMALL AND MEDIUM SIZED ENTERPRISES (SMES) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ON-PREMISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CHEMICALS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ENERGY IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TREASURY SOFTWARE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 41 U.S. TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 U.S. TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 43 U.S. CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 45 U.S. TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 46 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CANADA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 CANADA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 CANADA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 50 CANADA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 52 CANADA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 MEXICO TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 55 MEXICO TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 MEXICO TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 57 MEXICO CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MEXICO TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TREASURY SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TREASURY SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TREASURY SOFTWARE MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA TREASURY SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TREASURY SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TREASURY SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA TREASURY SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TREASURY SOFTWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA TREASURY SOFTWARE MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TREASURY SOFTWARE MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA TREASURY SOFTWARE MARKET

FIGURE 14 MOBILE PAYMENTS SHARE (%) BY COUNTRY

FIGURE 15 FACTORS AFFECTING THE TMS AND CUSTOMER EXPERIENCE

FIGURE 16 THREE WAYS ARTIFICIAL INTELLIGENCE IS TRANSFORMING TREASURY

FIGURE 17 CYBER-ATTACKS INCIDENTS ACROSS INDUSTRIES FROM 2016 TO 2021

FIGURE 18 CYBER-ATTACKS INCIDENTS BY COUNTRY AND REGION IN 2020

FIGURE 19 TREASURY DEPARTMENT CURRENTLY USING

FIGURE 20 ANALYTICS ADOPTION BY SECTOR, FROM THE YEAR 2019 TO 2021 AT INDIAN FIRMS

FIGURE 21 NORTH AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM, 2022

FIGURE 22 NORTH AMERICA TREASURY SOFTWARE MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA TREASURY SOFTWARE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 24 NORTH AMERICA TREASURY SOFTWARE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 NORTH AMERICA TREASURY SOFTWARE MARKET: BY VERTICAL, 2022

FIGURE 26 NORTH AMERICA TREASURY SOFTWARE MARKET : SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM (2023 & 2030)

FIGURE 31 NORTH AMERICA TREASURY SOFTWARE MARKET: COMPANY SHARE 2022(%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。