North America Veterinary Ivf Market

市场规模(十亿美元)

CAGR :

%

USD

738.09 Million

USD

1,107.22 Million

2024

2032

USD

738.09 Million

USD

1,107.22 Million

2024

2032

| 2025 –2032 | |

| USD 738.09 Million | |

| USD 1,107.22 Million | |

|

|

|

|

亞太地區 獸醫體外受精 (IVF) 市場細分,按產品與服務(設備、 試劑與試劑盒及服務)、動物類型(牲畜和伴侶動物)、技術(人工授精、胚胎移植、卵子採集和體外成熟)、分銷渠道(醫院、 透析 中心、家庭護理機構等)、最終用戶(獸醫生育診所、獸醫醫院、外科中心、研究實驗室、精子庫預測

北美獸醫體外受精(IVF)市場規模

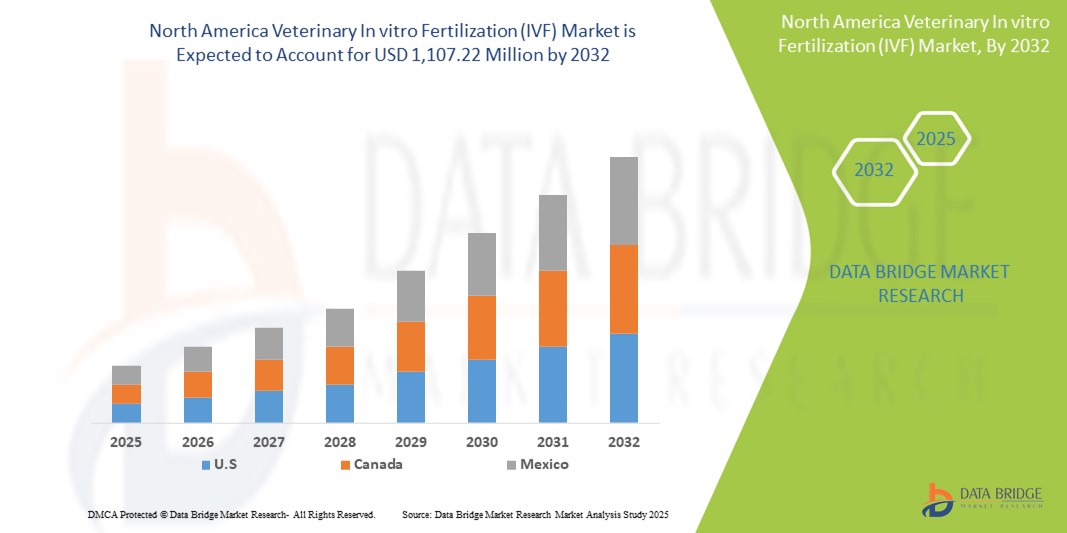

- 2024 年北美獸醫體外受精 (IVF) 市場規模為7.3809 億美元 ,預計 到 2032 年將達到 11.0722 億美元,預測期內 複合年增長率為 5.20% 。

- 市場成長主要得益於北美已開發經濟體越來越多地採用先進的生殖技術來提高牲畜的生育能力和遺傳結果。完善的獸醫基礎設施、強大的學術研究網絡以及對動物生育管理的高度重視是美國和加拿大等國家市場擴張的關鍵驅動力。

- 此外,牲畜生育障礙盛行率的上升,加上對私人獸醫生育診所和動物生物技術研究的投資不斷增加,正在推動體外受精 (IVF) 程序的普及。這些因素共同加速了獸醫 IVF 服務的利用,從而顯著推動了北美獸醫 IVF 市場的成長。

北美獸醫體外受精(IVF)市場分析

- 獸醫體外受精 (IVF) 正在成為北美地區提高動物繁殖效率的重要工具,特別是對於牲畜和伴侶動物,因為它在改善遺傳品質、提高生育率和促進農業部門生產力方面發揮作用

- 體外受精(IVF)需求的不斷增長,主要源自於人們對先進育種技術的認識不斷提高、牲畜數量的不斷增加,以及透過輔助生殖技術保護瀕危物種的力度不斷加大

- 美國在北美獸醫體外受精 (IVF) 市場佔據主導地位,2024 年其收入份額高達 81.2%,這得益於其高度發達的獸醫醫療基礎設施、動物生育服務的廣泛應用以及大型生物技術公司的強大影響力。此外,動物研究資金的增加以及專業獸醫診所的擴張也支持了市場的持續成長。

- 預計在預測期內,加拿大將成為北美獸醫體外受精 (IVF) 市場成長最快的國家,這得益於農業生物技術投資的增加、乳牛和肉牛生產力日益增長的重要性以及政府促進動物健康和生育能力的支持性舉措

- 試劑和試劑盒領域在北美獸醫體外受精 (IVF) 市場佔據主導地位,2024 年市場份額達 48.6%,這得益於其在胚胎移植、取卵和人工授精等 IVF 程序中不可或缺的作用。它們在臨床和研究環境中的頻繁使用推動了該領域的成長。

報告範圍和北美獸醫體外受精(IVF)市場細分

|

屬性 |

獸醫體外受精(IVF)關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

亞太

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

北美獸醫體外受精(IVF)市場趨勢

“獸醫應用對先進生殖技術的需求不斷增長”

- 北美獸醫體外受精 (IVF) 市場的一個重要且正在加速發展的趨勢是,對先進生殖技術的需求日益增長,以提升牲畜和伴侶動物的育種成果。在中國、印度、日本和澳洲等國家,IVF 技術的應用日益廣泛,旨在提高遺傳品質、繁殖效率和牲畜整體生產力。

- 例如,農民和育種者對體外受精益處的認識不斷提高,包括控制繁殖週期和提高受孕率,這正在推動市場擴張。此外,政府支持的畜牧業計畫以及旨在提高乳製品和肉類產量的舉措,也進一步促進了農業經濟體中體外受精程序的使用。

- 亞太地區城市中心可支配收入的提高和寵物擁有量的增加也推動了伴侶動物生育解決方案的需求。大都會地區的獸醫診所越來越多地為貓狗等寵物提供體外受精(IVF)及相關的輔助生殖技術(ART)服務,反映出人們對動物照護和生育的文化態度正在轉變。

- 此外,胚胎移植、人工授精和卵子採集技術的持續進步正在提高成功率,鼓勵公立和私人獸醫機構更廣泛地採用這些技術。獸醫體外受精培訓和教育的普及也在不斷擴大,使該地區的專業人員能夠有效地實施這些解決方案。

- 隨著亞太地區獸醫基礎設施建設的持續推進以及生物技術和研究的投資,該地區有望成為獸醫IVF服務的重要樞紐。獸醫院、農業大學和生物技術公司之間的合作有望提升農村和城市市場IVF治療的可近性和可負擔性。

- 持續的創新、有利的政府政策以及對基因優良牲畜不斷增長的商業需求,市場前景仍然強勁,使亞太地區成為全球獸醫體外受精 (IVF) 市場增長最快的地區

北美獸醫體外受精(IVF)市場動態

司機

“畜牧業生產力的提高和生殖技術的進步導致需求不斷增長”

- 對提高牲畜生產力和遺傳品質的日益重視是亞太地區採用獸醫 IVF 技術的關鍵驅動力,尤其是在印度、中國和澳洲等農業部門實力雄厚的國家

- 例如,政府推動牛和其他牲畜的人工授精和胚胎移植計劃,增加了公立和私人獸醫機構對 IVF 程序、試劑和設備的需求

- 此外,體外胚胎生產、卵子萃取和胚胎冷凍等生殖技術的進步正在提高動物體外受精的成功率。這些創新使得體外受精程序更加可行、更具成本效益,從而能夠廣泛應用。

- 城市地區伴侶動物數量的不斷增長以及寵物人性化趨勢的不斷上升,也導致獸醫診所和專科中心的 IVF 相關生育治療激增,特別是針對高價值或瀕危品種

- 此外,專業獸醫 IVF 實驗室的建立以及與研究機構的合作日益增多,預計將為該地區的設備供應商、試劑製造商和 IVF 服務公司創造強勁的成長機會。

克制/挑戰

“手術費用高昂,獸醫專業人員的意識有限”

- 獸醫 IVF 程序(包括設備、試劑和服務)的成本相對較高,這在亞太地區的一些地區仍然是一個重大障礙,特別是在獸醫預算有限且成本敏感度高的發展中國家

- 在許多農村或資源有限的地區,由於缺乏基礎設施、訓練有素的人員以及獸醫和動物主人的意識,獲得先進的獸醫生殖技術的機會有限

- 此外,許多小規模農民和動物主人仍然沒有意識到體外受精在提高畜群品質方面的潛在益處,導致儘管一些地區得到了政府的支持,但採用率仍然很低

- 缺乏標準化協議和胚胎處理、冷凍保存和移植方面的技術專業知識不足也影響了 IVF 程序的成功率,阻礙了進一步的投資和實施

- 透過有針對性的宣傳活動、獸醫專業人員培訓計劃、公私合作夥伴關係以及農村地區補貼 IVF 服務來應對這些挑戰,對於充分釋放亞太地區獸醫 IVF 市場的潛力至關重要

北美獸醫體外受精(IVF)市場範圍

市場根據產品和服務、動物類型、技術、分銷管道和最終用戶進行細分。

• 按產品和服務

根據產品和服務,歐洲獸醫體外受精 (IVF) 市場細分為設備、試劑和試劑盒以及服務。試劑和試劑盒細分市場在 2024 年佔據了最大的市場收入份額,達到 48.6%,這得益於它們在所有 IVF 程序中都發揮著重要作用,並且在胚胎移植、卵子採集和人工授精方案中的使用日益增多。這些試劑盒對於成功的結果至關重要,並廣泛應用於研究和臨床領域。

受外包生育服務和專科獸醫診所需求不斷增長的推動,服務業預計將在 2025 年至 2032 年間實現最快的複合年增長率 9.4%。

• 依動物類型

根據動物類型,歐洲獸醫體外受精 (IVF) 市場細分為家畜和伴侶動物。 2024 年,家畜市場收入份額最高,達到 64.1%,這歸因於牛、羊和豬廣泛採用 IVF 技術來提高繁殖能力、遺傳多樣性和生產力。

預計在預測期內,伴侶動物市場將以 8.7% 的最快複合年增長率增長,這得益於寵物擁有量的增加以及高價值品種對生育解決方案的需求不斷增長。

• 依技術

根據技術類型,歐洲獸醫體外受精 (IVF) 市場細分為人工授精、胚胎移植、卵子萃取和體外成熟。人工授精因其普及性、操作簡便和價格實惠,在 2024 年佔據 40.2% 的市場份額。

受胚胎培養技術的進步和獸醫生殖實驗室日益普及的影響,體外成熟領域預計將在 2025 年至 2032 年間以 10.1% 的最快複合年增長率擴張。

•按分銷管道

根據分銷管道,歐洲獸醫體外受精 (IVF) 市場可細分為醫院、透析中心、家庭護理機構和其他。由於較高的手術量和完善的基礎設施,醫院在 2024 年佔據了最大的市場份額,達到 52.8%。

預計家庭護理設置部分將以 7.9% 的最快複合年增長率增長,這得益於便攜式 IVF 工具和家庭生育支持日益普及。

• 按最終用戶

根據最終用戶,歐洲獸醫體外受精 (IVF) 市場細分為獸醫生育診所、獸醫醫院、外科中心、研究實驗室、冷凍庫等。由於伴侶動物和家畜對 IVF 治療的認知度不斷提高,且 IVF 治療的普及性不斷增強,獸醫生育診所市場在 2024 年佔據主導地位,收入份額最高,達到 37.4%。

受配子和胚胎保存需求的不斷增長以及動物遺傳資源庫的擴大推動,預計 2025 年至 2032 年間,冷凍庫領域將以 9.8% 的最快複合年增長率擴張。

北美獸醫體外受精(IVF)市場區域分析

- 受先進獸醫醫療基礎設施的推動,北美在獸醫體外受精 (IVF) 市場佔據主導地位,2024 年的收入份額高達 31.7%

- 廣泛採用輔助生殖技術,高度重視提升牲畜生產力

- 領先的獸醫機構的存在、不斷增長的寵物生育服務以及牛和豬人工授精和胚胎移植計畫的大規模實施進一步推動了該地區的市場擴張

美國獸醫IVF市場洞察

2024年,美國獸醫體外受精 (IVF) 市場佔據北美最大的收入份額,達81.2%,這得益於其高度發達的獸醫服務、廣泛的畜牧養殖實踐以及對動物基因改良日益增長的需求。美國在商業牲畜和伴侶動物育種中應用的體外受精 (IVF) 技術正在快速發展。此外,寵物生育中心和學術研究夥伴關係的增加也將繼續推動市場成長。

加拿大獸醫IVF市場洞察

2024年,加拿大獸醫體外受精 (IVF) 市場佔有13.6%的份額,這得益於日益增多的牛羊基因改良舉措,尤其是在農村地區。加拿大對永續畜牧業實踐的重視,加上政府對農業創新的支持,推動了胚胎移植、體外成熟 (IVM) 和人工授精程序在獸醫診所和養殖場中的應用。

墨西哥獸醫IVF市場洞察

2024年,墨西哥獸醫體外受精 (IVF) 市場佔北美市場份額的4.9%,這得益於墨西哥加大畜牧業現代化力度和減少本土動物品種遺傳疾病的力度。隨著獸醫和育種者對IVF技術的認識不斷提高,尤其是在乳牛和肉牛領域,墨西哥的公立和私立獸醫中心正在逐步且穩定地採用生殖生物技術。

北美獸醫體外受精(IVF)市佔率

北美獸醫體外受精(IVF)產業主要由知名公司主導,包括:

- Hamilton Thorne, Inc(美國)

- Esco Medical(愛沙尼亞)

- Zoetis Services LLC(美國)

- IMV科技公司(法國)

- Minitube(德國)

- Agetech Inc(美國)

- Orgensen Laboratories(美國)

- Bovine Elite LLC(美國)

- 克魯斯(丹麥)

- 馬生育中心(英國)

- 美國獸醫集團

- 州界獸醫服務中心(美國)

- Trans Ova Genetics(美國)

- 三三製藥(日本)

- 生殖服務公司(美國)

- BioTracking LLC(美國)

- Vetoquinol USA(美國)

- 胚胎移植服務公司(美國)

- Agtech, Inc.(美國)

- ABS Global, Inc.(美國)

- Select Sires Inc.(美國)

- 性別鑑定技術(美國)

北美獸醫體外受精(IVF)市場的最新發展

- 2024年1月,ABS Global, Inc.(美國)投資擴大其在北美的牛IVF實驗室基礎設施,並專注於自動化和數位監控系統。這項投資反映了輔助生殖技術在畜牧管理中的日益普及,並滿足了對可擴展、高效IVF服務日益增長的需求。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 CUSTOMIZATION

6 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: REGULATIONS

6.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

6.2 NORTH AMERICA REGULATORY SCENARIO

6.3 EUROPE REGULATORY SCENARIO

7 VALUE CHAIN ANALYSIS OF VETERINARY INTRA-VITRO FERTILIZATION (IVF)

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING LIVESTOCK PRODUCTION & BREEDING PROGRAMS

8.1.2 RISING DEMAND FOR COMPANION ANIMALS

8.1.3 INCREASE IN VETERINARY CLINICS OFFERING IVF SERVICES

8.1.4 INCREASING FOCUS ON ANIMAL WELFARE

8.2 RESTRAINTS

8.2.1 RISKS OF LOW SUCCESS RATES IN IVF

8.2.2 HIGH COST OF IN VITRO FERTILIZATION (IVF)

8.3 OPPORTUNITIES

8.3.1 INCREASE IN RESEARCH AND DEVELOPMENTAL EFFORTS

8.3.2 ADVANCEMENTS IN REPRODUCTIVE TECHNOLOGY

8.3.3 INCREASE IN PET OWNERSHIPS

8.4 CHALLENGES

8.4.1 RISK OF DISEASE TRANSMISSION DURING IVF PROCEDURES

8.4.2 LACK OF AWARENESS IN UNDERDEVELOPED MARKETS

9 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES

9.1 OVERVIEW

9.2 EQUIPMENT

9.2.1 IVF AND EMBRYO CULTURE INSTRUMENTS

9.2.2 LABORATORY EQUIPMENT

9.2.3 CRYOSYSTEMS

9.2.4 MONITORING DEVICES

9.2.5 IMAGING SYSTEMS

9.2.6 OVUM PICK UP SYSTEM

9.2.7 OVUM ASPIRATION PUMPS

9.2.8 CABINETS

9.2.9 OTHERS

9.2.9.1 MICROSCOPES

9.2.9.2 CO2 INCUBATORS

9.2.9.3 EMBRYO TRANSFER CATHETERS

9.2.9.4 LASER SYSTEMS

9.2.9.5 OTHERS

9.2.9.5.1 CENTRIFUGES

9.2.9.5.2 REFRIGERATORS AND FREEZERS

9.2.9.5.3 MICROFUGE TUBES AND PLATES

9.2.9.5.4 OTHERS

9.2.9.5.4.1 ANALYZERS

9.2.9.5.4.2 PH MONITORS

9.2.9.5.4.3 OTHERS

9.2.9.5.4.4 BENCHTOP

9.2.9.5.4.5 STANDALONE

9.3 REAGENTS & KITS

9.3.1 MEDIA

9.3.2 EMBRYO ASSAY

9.3.3 KITS

9.3.3.1 EMBRYO CULTURE MEDIA

9.3.3.2 BOVINE MEDIA

9.3.3.3 SERUM FREE CULTURE MEDIA

9.3.3.4 CRYOPRESERVATION MEDIA

9.3.3.5 EQUINE MEDIA

9.3.3.5.1 DEVITRIFICATION KIT

9.3.3.5.2 VERIFICATION COOLING KIT

9.3.3.5.3 VERIFICATION WARMING KIT

9.3.3.5.4 OTHERS

9.4 SERVICES

9.4.1 OOCYTE RETRIEVAL AND COLLECTION

9.4.2 EMBRYO CULTURE AND DEVELOPMENT

9.4.3 CRYOPRESERVATION

9.4.4 GENETIC SCREENING AND SELECTION

9.4.5 OTHERS

10 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE

10.1 OVERVIEW

10.2 LIVESTOCK ANIMAL

10.2.1 CATTLES

10.2.2 SHEEP

10.2.3 GOAT

10.2.4 OTHERS

10.3 COMPANION ANIMALS

10.3.1 HORSES

10.3.2 DOGS

10.3.3 CATS

10.3.4 OTHERS

10.3.4.1 EQUIPMENT

10.3.4.2 REAGENT

10.3.4.3 SERVICES

11 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE

11.1 OVERVIEW

11.2 ARTIFICIAL INSEMINATION

11.3 EMBRYO TRANSFER

11.4 OVUM PICKUP

11.5 IN VITRO MATURATION

12 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER

12.1 OVERVIEW

12.2 VETERINARY FERTILITY CLINICS

12.3 VETERINARY HOSPITALS

12.4 SURGICAL CENTERS

12.5 RESEARCH LABORATORIES

12.6 CRYOBANKS

12.7 OTHERS

13 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAIL SALES

13.4 ONLINE SALES

13.5 OTHERS

14 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 ZOETIS SERVICES LLC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ESCO MEDICAL

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 MINITÜB GMBH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 IMV TECHNOLOGIES GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 HAMILTON THORNE

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT UPDATES

17.6 AGTECH, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 BOVINE ELITE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 EQUINE FERTILITY CENTRE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATE

17.9 JORGENSEN LABORATORIES

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATES

17.1 KRUUSE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATE

17.11 PARAGON VETERINARY GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 STATELINE VETERINARY SERVICE

17.12.1 COMPANY SNAPSHOT

17.12.2 SERVICE PORTFOLIO

17.12.3 RECENT UPDATE

17.13 TRANS OVA GENETICS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 TRI-MITSU PHARMACEUTICALS

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA OVERVIEW OF BOVINE IN VITRO PRODUCED (IVP) EMBRYO TRANSFER AND EXPORT TRENDS IN 2022 AND PROJECTED GROWTH FOR 2023 COUNTRY WISE

TABLE 2 BOVINE IN VIVO-DERIVED (IVD) EMBRYO COLLECTION BY REGION AND COUNTRY

TABLE 3 TRANSFER OF BOVINE IN VIVO DERIVED (IVD) EMBRYOS BY REGION AND COUNTRY

TABLE 4 VALUE CHAIN ANALYSIS

TABLE 5 DETAILS OF SELECTED COMMUNITY-BASED BREEDING PROGRAMS

TABLE 6 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 7 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 10 NORTH AMERICA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 NORTH AMERICA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 NORTH AMERICA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 14 NORTH AMERICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 NORTH AMERICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 NORTH AMERICA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 NORTH AMERICA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 NORTH AMERICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 NORTH AMERICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 TABLE 1 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2024-2031 (USD THOUSAND)

TABLE 21 NORTH AMERICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 22 NORTH AMERICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 24 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 25 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 26 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 27 NORTH AMERICA ARTIFICIAL INSEMINATION IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 NORTH AMERICA EMBRYO TRANSFER IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 29 NORTH AMERICA OVUM PICKUP IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 NORTH AMERICA IN VITRO MATURATION IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 TABLE 1 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2024-2031 (USD THOUSAND)

TABLE 32 NORTH AMERICA VETERINARY FERTILITY CLINICS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 NORTH AMERICA VETERINARY HOSPITALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 NORTH AMERICA SURGICAL CENTERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 NORTH AMERICA RESEARCH LABORATORIES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 NORTH AMERICA CRYOBANKS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 NORTH AMERICA OTHERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 39 NORTH AMERICA DIRECT TENDERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 NORTH AMERICA RETAIL SALES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 41 NORTH AMERICA ONLINE SALES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 44 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 45 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 47 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 48 NORTH AMERICA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 NORTH AMERICA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 NORTH AMERICA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 52 NORTH AMERICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 NORTH AMERICA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 NORTH AMERICA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 NORTH AMERICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 NORTH AMERICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 60 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 61 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 62 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 63 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 64 U.S. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 U.S. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 66 U.S. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 67 U.S. IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 U.S. LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 U.S. MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 U.S. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 71 U.S. REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 U.S. MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 U.S. KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 U.S. SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 U.S. LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 U.S. COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 U.S. COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 79 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 80 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 81 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 82 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 83 CANADA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 CANADA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 85 CANADA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 86 CANADA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 CANADA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 CANADA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 CANADA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 90 CANADA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 CANADA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 CANADA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 CANADA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 CANADA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 CANADA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 CANADA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 98 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 99 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 100 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 101 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 102 MEXICO EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 MEXICO EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 104 MEXICO EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 105 MEXICO IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 MEXICO LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 MEXICO MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 MEXICO EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 109 MEXICO REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 MEXICO MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 MEXICO KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 MEXICO SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 MEXICO LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 MEXICO COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 MEXICO COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 117 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 118 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 119 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING LIVESTOCK PRODUCTION & BREEDING PROGRAMS IS DRIVING THE GROWTH OF THE NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET FROM 2024 TO 2031

FIGURE 15 THE PRODUCTS & SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET IN 2024 AND 2031

FIGURE 16 DROC ANALYSIS

FIGURE 17 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES, 2023

FIGURE 18 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES 2024-2031 (USD THOUSAND)

FIGURE 19 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES, CAGR (2024-2031)

FIGURE 20 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, 2023

FIGURE 22 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE 2024-2031 (USD THOUSAND)

FIGURE 23 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, CAGR (2024-2031)

FIGURE 24 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, 2023

FIGURE 26 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE 2024-2031 (USD THOUSAND)

FIGURE 27 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, CAGR (2024-2031)

FIGURE 28 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER, 2023

FIGURE 30 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER 2024-2031 (USD THOUSAND)

FIGURE 31 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 32 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 33 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 34 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL 2024-2031 (USD THOUSAND)

FIGURE 35 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 36 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SNAPSHOT (2023)

FIGURE 38 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION MARKET: COMPANY SHARE 2023 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。