North America White Fused Alumina Market

市场规模(十亿美元)

CAGR :

%

USD

158.83 Million

USD

209.14 Million

2025

2033

USD

158.83 Million

USD

209.14 Million

2025

2033

| 2026 –2033 | |

| USD 158.83 Million | |

| USD 209.14 Million | |

|

|

|

|

北美白熔融氧化鋁市場細分,按產品類型(宏觀顆粒、微觀顆粒和粉末、特殊等級、其他)、製造流程(電弧爐、破碎、分級和篩選、後處理、其他)、功能(切割和研磨(磨料)、耐火功能(耐熱/耐磨)、陶瓷添加劑/填料、拋光和研磨、噴砂和表面處理、防滑/陶瓷添加劑/填料、防滑和研磨、噴砂和表面處理、防滑/陶瓷添加劑/填料、防滑和研磨、噴砂和表面處理、防滑/陶瓷添加劑/填充骨料應用(磨料、耐火材料、陶瓷和先進材料、拋光、研磨和精加工、其他)、最終用途(金屬和冶金、汽車和運輸、機械和重型設備、建築和基礎設施、能源(石油和天然氣、發電)、航空航天和國防、電子和半導體、其他)、分銷渠道(直接和間接)劃分——行業趨勢和至2033年的預測

北美白熔融氧化鋁市場規模

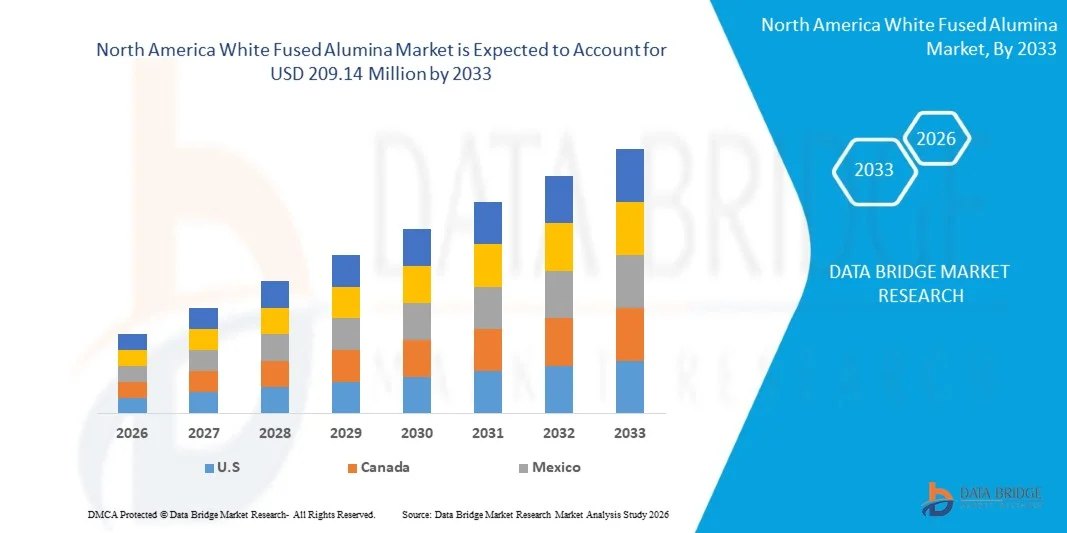

- 2025年北美白熔融氧化鋁市場規模為1.5883億美元 ,預計 2033年將達到2.0914億美元,預測期內 複合年增長率為3.71%。

- 北美白熔氧化鋁市場指的是高純度合成氧化鋁的市場,這種氧化鋁是透過在電弧爐中以極高溫度熔化優質氧化鋁製成的。白熔氧化鋁具有硬度高、熱穩定性好、化學惰性強等特點,適用於磨料、耐火材料、陶瓷、拋光及表面處理等領域。它廣泛應用於金屬冶金、汽車、建築、電子和航空航天等行業,用於切割、研磨、拋光以及增強材料的耐熱性和耐磨性。

- 北美白熔融氧化鋁市場的成長主要得益於建築、汽車和工業製造等關鍵行業需求的不斷增長,這些行業對高品質的磨料、耐火材料和拋光劑的需求至關重要。這些產業依賴耐用且高效的氧化鋁基解決方案,用於切割、研磨、表面處理以及耐熱或耐磨等應用,推動了北美地區白熔融氧化鋁的廣泛應用和市場擴張。

北美白熔氧化鋁市場分析

- 節能型電弧爐、改良的煅燒和熔融製程、先進的雜質去除技術以及更嚴格的粒度控制等技術進步,正在提升產品的純度、白度和一致性。這些改進正在促進其在磨料、耐火材料、陶瓷和精密拋光應用領域的廣泛應用。

- 挑戰依然存在,包括氧化鋁和能源價格波動、熔融過程中高能耗以及日益嚴格的環境和排放法規導致營運成本上升。對可靠電力基礎設施的依賴以及來自棕色熔融氧化鋁和合成替代品等替代磨料的競爭也限制著成長。

- 由於製造業強勁成長、磨料和耐火材料需求量大、建築和冶金行業不斷擴張、生產成本具有競爭力、原材料豐富以及產能快速增長,預計美國將佔據 83.07% 的市場份額,並在 2026 年至 2033 年的預測期內以 3.86% 的複合年增長率實現最高增長。

- 預計到 2026 年,大顆粒磨料細分市場將以 50.51% 的市場份額佔據主導地位,這得益於其在重型研磨、切割、噴砂和耐火材料應用中的廣泛應用,在這些應用中,高強度、熱穩定性和一致的粒徑對於工業性能至關重要。

報告範圍及北美白熔氧化鋁市場細分

|

屬性 |

白色熔融氧化鋁關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、按地域劃分的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和最新的價格趨勢分析以及供應鏈和需求的缺口分析。 |

北美白熔氧化鋁市場趨勢

“採用先進的製程自動化和高純度生產技術”

- 製造商們正日益整合自動化電弧爐控制系統、即時製程監控和人工智慧輔助品質分析,以實現一致的熔融溫度、更緊密的晶粒尺寸分佈和更高的氧化鋁純度,從而減少批次差異和缺陷。

- 這一趨勢是由磨料、耐火材料、陶瓷和電子行業對符合更嚴格技術和監管規範的均一、高性能白色熔融氧化鋁的需求不斷增長所驅動的。人工智慧驅動的重建演算法顯著降低了輻射劑量,同時提高了影像質量,使PET-CT服務更安全,也更易於惠及更廣泛的患者群體。

- 先進的冷卻、破碎和分級技術正在提高產量效率,並能夠生產特定應用的大顆粒和小顆粒,從而提高整體產品性能。

- 此外,數位化生產計劃、自動化物料搬運和預測性維護系統正在幫助生產商管理能源密集型營運、最大限度地減少停機時間並控制營運成本。

北美白熔融氧化鋁市場動態

司機

“鋼鐵業需求不斷增長”

- 鋼鐵業日益增長的需求被認為是北美白熔氧化鋁市場最重要的驅動因素之一。白熔氧化鋁廣泛應用於煉鋼製程中不可或缺的耐火材料,包括鋼包襯裡、閘門耐火材料、中間包噴嘴和高溫耐磨零件。隨著主要製造經濟體粗鋼產量持續成長,以及新興地區新增產能的不斷湧現,對高性能耐火原料的需求也日益增長。對更高品質鋼材、更長爐齡和更少停機時間的需求,進一步強化了對優質氧化鋁基耐火材料的依賴。

- 結論認為,北美粗鋼產量的成長對白熔氧化鋁的消費起到了決定性作用。隨著鋼鐵產量的增加,耐火材料的損耗率也相應上升,導致爐窯、鋼包和中間包等生產過程中必不可少的氧化鋁基耐火材料的更換週期延長。政策驅動的產能擴張、老舊鋼廠的現代化改造以及更高的生產強度共同強化了對白熔氧化鋁的拉動需求。

- 主要鋼鐵生產經濟體產量的持續成長表明,耐火材料的需求將繼續與鋼鐵業的擴張路徑緊密相連。因此,預計鋼鐵產量的成長將繼續支撐北美冶金應用領域對白色熔融氧化鋁的強勁且可預測的長期需求。

機會

“有色金屬和玻璃產業的成長”

- 北美有色金屬和玻璃產業的強勁成長為北美白熔氧化鋁市場帶來了巨大的機遇,因為白熔氧化鋁是這些新興產業在耐火材料、磨料和工業加工應用領域的重要原料。工業化、電動車生產、再生能源基礎設施建設和建築活動推動了鋁、銅和鋅等有色金屬需求的激增,進而帶動了下游對拋光、研磨和耐火材料的需求,而這些需求都依賴白熔氧化鋁基產品。

- 同樣,玻璃產業的擴張,得益於建築、汽車、消費品和包裝等產業的蓬勃發展,也帶動了玻璃熔煉和精加工過程中對高品質磨料和耐火材料的需求成長。這些趨勢共同推動了白色熔融氧化鋁的需求,將原材料成長與終端用戶行業的需求聯繫起來,從而提升了市場前景,並為整個價值鏈上的產能和技術創新投資提供了依據。

- 有色金屬和玻璃產業的持續擴張為北美白熔氧化鋁市場帶來了重要的發展機遇,因為對利用白熔氧化鋁特性的關鍵終端應用的需求不斷增長。隨著基礎設施建設、電氣化和製造業多元化推動有色金屬產量的成長,對與金屬加工相關的高性能耐火材料和磨料的需求也日益增強。

克制/挑戰

“環境法規及合規成本”

- 環境法規及其相關的合規成本是限制北美白熔融氧化鋁市場成長的主要因素,尤其考慮到該材料的生產需要高能耗的高溫工藝,並且與鋁土礦和氧化鋁原料的開採密切相關。各國政府都在收緊排放控制、水資源管理標準、廢棄物處理規則和環境影響評估要求,這增加了生產商的營運支出,延長了專案審批時間,並提高了市場准入門檻。合規要求包括安裝先進的排放控制系統、持續監測技術以及遵守嚴格的環境許可,所有這些都會增加固定成本和持續營運成本。

- 例如,2025 年 9 月,《商業標準報》報道稱,森林和氣候變遷部修改了森林保護規則,簡化了關鍵礦產的採礦審批流程,要求加強對影響採礦和礦產供應作業的環境監測和審計框架。

- 環境法規和合規成本透過增加營運支出、延長審批時間以及引入監管不確定性,對北美白熔融氧化鋁市場產生了顯著的限製作用。世界各國政府正在加強環境保護措施,強制執行補救義務和處罰措施,這些措施都直接影響與熔融氧化鋁生產相關的精煉廠、冶煉廠和採礦作業。

北美白熔氧化鋁市場範圍

北美白熔融氧化鋁市場根據產品類型、製造流程、功能、應用最終用途、分銷管道分為六個部分。

- 依產品類型

根據產品類型,北美白熔融氧化鋁市場可分為大顆粒、微顆粒及粉末、特殊等級及其他類型。預計到2026年,大顆粒產品將佔據主導地位,市場份額達50.51%,這主要得益於其在耐火材料、粘結磨料以及對硬度和熱穩定性要求較高的冶金工藝等重載應用中的廣泛應用。

由於精密加工、拋光、研磨和先進陶瓷應用領域對顆粒尺寸細小、均勻性和優異的表面品質的要求不斷提高,預計微粉和粉末細分市場將以 3.3% 的複合年增長率增長。

- 透過製造工藝

根據生產工藝,北美白熔融氧化鋁市場可細分為電弧爐法、破碎法、分級法、後處理法和其他工藝。預計到2026年,電弧爐法將佔據主導地位,市佔率達到50.83%,主要得益於其能夠生產高純度、品位穩定的白熔融氧化鋁,並具有優異的機械和熱性能。

由於人們越來越關注顆粒尺寸優化、表面處理、雜質去除以及高端磨料、陶瓷和電子應用所需的定製材料規格,後處理領域預計將以 4.4% 的複合年增長率增長。

- 按功能

根據功能,北美白熔融氧化鋁市場可細分為切割和研磨(磨料)、拋光和研磨、噴砂和表面處理、耐火材料(耐熱/耐磨)、陶瓷添加劑/填料、防滑/防滑骨料以及其他用途。預計到2026年,切割和研磨領域將佔據主導地位,市場份額達37.04%,這主要得益於其在金屬加工、汽車製造和精密工程應用中的廣泛應用。

由於電子、光學、汽車零件和精密機械行業對超精細表面處理的需求不斷增長,拋光和研磨行業預計將以 4.6% 的複合年增長率增長,因為這些行業對嚴格的公差和光滑的表面質量要求很高。

- 透過申請

根據應用領域,北美白熔融氧化鋁市場可細分為磨料、耐火材料、陶瓷及先進材料、拋光、研磨及精加工等領域。預計到2026年,磨料領域將佔據主導地位,市場份額達到51.14%,這主要得益於其在多個行業的研磨、切割和表面精加工等工序中的廣泛應用。

由於鋼鐵、水泥、玻璃和有色金屬行業對用於熔爐、窯爐和熱處理裝置的耐高溫材料的需求不斷增長,耐火材料行業預計將以 4.0% 的複合年增長率增長。

- 最終用戶

根據最終用戶劃分,北美白熔氧化鋁市場可細分為金屬冶金、汽車運輸、航空航太與國防、電子半導體、機械與重型設備、建築與基礎設施、能源(石油天然氣、發電)以及其他產業。預計到2026年,金屬冶金產業將佔據主導地位,市佔率達23.63%,這主要得益於其在煉鋼、鋁加工和鑄造作業中的廣泛應用。

由於晶圓拋光、電子基板、絕緣元件和精密製造工藝中對高純度白色熔融氧化鋁的需求不斷增長,電子和半導體行業預計將以 5.2% 的複合年增長率增長,這些工藝對污染的最小化和材料一致性的要求也越來越高。

- 按分銷管道

根據分銷管道,北美白熔融氧化鋁市場可分為直接分銷和間接分銷。預計到2026年,直接分銷管道將佔據主導地位,市場份額達65.54%,這主要歸因於大型工業買家傾向於直接從製造商採購,以確保產品品質、享受批量價格優勢並可根據客戶需求定制產品規格。

由於長期供應合約的增加、製造商與終端用戶之間更緊密的合作以及對支持大規模工業生產的穩定供應鏈的需求不斷增長,預計直接供應業務將以 3.8% 的最高複合年增長率增長。

北美白熔融氧化鋁市場洞察

北美白熔氧化鋁市場正經歷著穩定強勁的成長,這主要得益於其完善的工業基礎、先進的製造能力以及關鍵終端用戶產業對高性能材料的早期應用。該地區受益於白熔氧化鋁在磨料、耐火材料和冶金領域的廣泛應用,而鋼鐵、航空航太、汽車和精密加工行業的強勁需求也為其發展提供了有力支撐。電弧爐製程的持續技術進步、嚴格的品質標準以及對高純度材料的重視進一步推動了市場發展。此外,基礎設施的持續現代化、對節能生產的投資、對先進陶瓷日益增長的需求以及主要製造商的積極參與,都將在預測期內鞏固北美市場穩定且具有競爭力的地位。

美國北美白熔融氧化鋁市場洞察

美國是北美白熔氧化鋁市場的主導國家,預計到2026年將佔據該地區83.07%的市場份額,並預計在2026年至2033年間以3.86%的複合年增長率保持強勁增長。這主要得益於美國強大的鋼鐵和製造業、先進的磨料和耐火材料生產能力,以及航空航太、汽車和建築業的高需求。此外,美國的基礎設施投資、技術領先地位以及主要生產商的存在也進一步鞏固了其市場領導地位。

加拿大北美白熔融氧化鋁市場洞察

2026年,加拿大佔據北美白熔氧化鋁市場10.72%的份額,預計2026年至2033年將以3.19%的複合年增長率成長。這主要得益於加拿大強大的冶金和採礦基礎、可靠的高品質氧化鋁和能源資源以及完善的工業基礎設施。受金屬加工、建築和製造業等行業需求的驅動,加拿大持續生產用於磨料和耐火材料的高純度白熔氧化鋁。

北美白熔融氧化鋁市場份額

北美白熔融氧化鋁市場主要由一些成熟企業主導,其中包括:

- 華盛頓米爾斯(美國)

- 莫蒂姆(斯洛伐克)

- CUMI(印度)

- 河南瑞石再生資源集團股份有限公司(中國)

- 美國電熔礦物公司(美國)

- 秦奈新材料(中國)

- 鄭州豫發磨料集團有限公司 (中國)

- 熔融礦物工業有限責任合夥公司(印度)

- 哈比森沃克國際公司(HWI)(美國)

- 河南宏泰窯爐耐火材料股份有限公司(中國)

- Algrain Products Private Limited(印度)

- 伊梅里斯(法國)

- LP Impex(印度)

- 山東中基金屬製品有限公司(中國)

- Alteo Alumina(法國)

- 東方磨料有限公司(印度)

- 山東博盛新材料有限公司(中國)

- JSR International (India) Pvt. Ltd. (印度)

- 洛陽宏豐磨料磨俱有限公司 (中國)

- 鄭州新力耐磨材料有限公司(中國)

- 南平億澤磨料工具科技有限公司 (中國)

- 俄羅斯鋁業集團(俄羅斯)

- 山東宏瑞爾有限公司(中國)

- 聖戈班(法國)

- Cerablast(德國)

- 日昇耐火材料(營口)有限公司(中國)

- Quarzwerke GmbH(德國)

- 庫米歇爾磨料有限公司(德國)

- Wedge India(印度)

- 淄博聚科斯有限公司(中國)

北美白熔融氧化鋁市場最新動態

- 2025年12月,卡爾德里斯集團旗下的HWI公司在密蘇裡州富爾頓的旋轉窯廠區完成了其新的輕質整體式材料生產設施的建設。這座先進的工廠使輕質整體式材料的產能提高了近60%,採用了先進的自動化技術(包括新型熔爐、機器人包裝和物料搬運系統),預計將提高產品供應能力,並縮短美洲各地客戶的交貨週期。

- 2025年7月,HWI與Electrified Thermal Solutions公司達成策略性製造夥伴關係,共同開發和生產用於Electrified Thermal公司Joule Hive熱電池的導電耐火磚(E磚)。此次合作將Electrified Thermal公司的高溫儲熱技術與HWI公司的耐火材料專長相結合,旨在支持脫碳工業供熱應用;首個商業規模示範項目預計將於2025年完成,其長期目標是到2030年部署2吉瓦的電氣化熱發電。

- 2024年10月,在尚貝裡商業法庭批准Alteo的收購要約後,Niche Fused Alumina被Alteo收購並整合到集團旗下,更名為「Alteo Fused Alumina」。此次收購被視為Alteo特種氧化鋁業務的策略性擴張,旨在鞏固其在北美市場的領先地位,並透過持續關注創新和環境責任,支持永續的工業成長。

- 2024年2月,Alteo正式加入位於法國利摩日的歐洲陶瓷集群。此次合作旨在透過利用該集群在特種氧化鋁和技術陶瓷市場的創新和產業發展網絡,加強Alteo在關鍵高科技和工業領域(包括航空航太、國防、電子、能源、奢侈品和醫療保健)的影響力。

- 2024年9月,CUMI完成了美國先進陶瓷和碳化矽材料公司Silicon Carbide Products LLC (SCP) 100%股權的收購。此舉將增強CUMI在北美高性能陶瓷和磨料市場的地位,提升其技術實力並拓展北美客戶群。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE ANALYSIS

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.4 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 JOINT VENTURES

4.4.1.2 MERGERS AND ACQUISITIONS

4.4.1.3 LICENSING AND PARTNERSHIP

4.4.1.4 TECHNOLOGY COLLABORATIONS

4.4.1.5 STRATEGIC DIVESTMENTS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES AND MILESTONES

4.4.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.4.6 RISK ASSESSMENT AND MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PRICING ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7.4 CONCLUSION

4.8 TECHNOLOGICAL ADVANCEMENTS

4.9 VALUE CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 RAW MATERIAL PROCUREMENT

4.9.3 PRODUCTION / FUSION

4.9.4 PROCESSING & SURFACE TREATMENT

4.9.5 PACKAGING

4.9.6 LOGISTICS & DISTRIBUTION

4.9.7 INDUSTRIAL APPLICATIONS/ END USER DEMAND

4.9.8 CONCLUSION

4.1 VENDOR SELECTION CRITERIA

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEMAND FROM IRON & STEEL INDUSTRY

7.1.2 EXPANDING INDUSTRIAL END USE DEMAND OF WHITE FUSED ALUMINA

7.1.3 RISING INDUSTRIALIZATION AND INFRASTRUCTURE INVESTMENTS IN EMERGING MARKETS

7.1.4 RISING DEMAND FROM THE ELECTRONICS SECTOR

7.2 RESTRAINTS

7.2.1 ENVIRONMENTAL REGULATIONS AND COMPLIANCE COSTS

7.2.2 VOLATILITY IN RAW MATERIAL AND ENERGY COST

7.3 OPPORTUNITIES

7.3.1 GROWTH IN NON-FERROUS METALS AND GLASS INDUSTRIES

7.3.2 TECHNOLOGICAL ADVANCEMENTS IN REFRACTORY MANUFACTURING

7.3.3 DEVELOPMENT OF ADVANCED AND SPECIALIZED GRADES

7.4 CHALLENGES

7.4.1 SUPPLY CHAIN DISRUPTIONS AND LOGISTICS CONSTRAINTS

7.4.2 INTENSE COMPETITION AMONG REGIONAL MANUFACTURERS

8 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

8.2.1 MACROGRITS

8.2.2 MICROGRITS & POWDERS

8.2.3 SPECIALTY GRADES

8.2.4 OTHERS

8.3 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

8.3.1 FEPA F

8.3.2 FEPA P

8.3.3 ANSI

8.4 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

8.4.1 COARSE GRADES (F12–F46)

8.4.2 MEDIUM GRADES (F54–F80)

8.4.3 FINE GRADES (F90–F220)

8.5 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

8.5.1 UNTREATED

8.5.2 SILANE/COATED

8.6 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.6.1 ASIA-PACIFIC

8.6.2 EUROPE

8.6.3 NORTH AMERICA

8.6.4 SOUTH AMERICA

8.6.5 MIDDLE EAST & AFRICA

8.7 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

8.7.1 FEPA F MICRO

8.7.2 JIS

8.8 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

8.8.1 10–60 ΜM

8.8.2 1–10 ΜM

8.8.3 SUB-MICRON (D50 < 1 ΜM)

8.9 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

8.9.1 LAPPING

8.9.2 CMP/POLISHING

8.1 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 EUROPE

8.10.3 NORTH AMERICA

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

8.11.1 ≥ 99.5% AL2O3

8.11.2 99.0%–99.4% AL2O3

8.11.3 98.0%–98.9% AL2O3

8.12 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

8.12.1 LOW-SODA (NA2O ≤ 0.05%)

8.12.2 ULTRA-LOW-SODA (NA2O ≤ 0.02%)

8.13 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

8.13.1 HIGH-WHITENESS

8.13.2 STANDARD-WHITENESS

8.14 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.15.1 ASIA-PACIFIC

8.15.2 EUROPE

8.15.3 NORTH AMERICA

8.15.4 SOUTH AMERICA

8.15.5 MIDDLE EAST & AFRICA

9 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

9.2.1 ELECTRIC ARC FURNACE

9.2.2 CRUSHING, GRADING & CLASSIFICATION

9.2.3 POST-TREATMENT

9.2.4 OTHERS

9.3 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

9.3.1 FIXED/STATIONARY FURNACE

9.3.2 TILTING FURNACE

9.4 NORTH AMERICA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 CONTROLLED COOLING (BLOCKY, DENSE)

9.4.2 RAPID QUENCH (MORE FRIABLE)

9.5 NORTH AMERICA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.5.1 CONTROLLED COOLING (BLOCKY, DENSE)

9.5.2 RAPID QUENCH (MORE FRIABLE)

9.6 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

9.6.1 HIGH-PURITY CALCINED ALUMINA

9.6.2 TABULAR/SEEDING ADDITIVES

9.7 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 SECONDARY PROCESSING

9.8.2 PRIMARY CRUSHING

9.9 NORTH AMERICA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.9.1 AIR CLASSIFICATION

9.9.2 BALL MILLING

9.9.3 MAGNETIC SEPARATION

9.1 NORTH AMERICA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 JAW/IMPACT CRUSHING

9.10.2 ROLLER MILLING

9.11 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

9.12 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.12.1 ACID WASHING/IMPURITY REMOVAL

9.12.2 HEAT TREATMENT/ANNEALING

9.12.3 SURFACE MODIFICATION/COATING

9.13 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.13.1 ASIA-PACIFIC

9.13.2 EUROPE

9.13.3 NORTH AMERICA

9.13.4 SOUTH AMERICA

9.13.5 MIDDLE EAST & AFRICA

9.14 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.14.1 ASIA-PACIFIC

9.14.2 EUROPE

9.14.3 NORTH AMERICA

9.14.4 SOUTH AMERICA

9.14.5 MIDDLE EAST & AFRICA

10 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

10.2.1 CUTTING & GRINDING (ABRASIVE)

10.2.2 REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)

10.2.3 CERAMIC ADDITIVE/FILLER

10.2.4 POLISHING & LAPPING

10.2.5 BLASTING & SURFACE PREPARATION

10.2.6 ANTI-SKID/ANTI-SLIP AGGREGATE

10.2.7 OTHERS

10.3 NORTH AMERICA CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 NORTH AMERICA REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 NORTH AMERICA CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 EUROPE

10.5.3 NORTH AMERICA

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 NORTH AMERICA POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

10.7 NORTH AMERICA BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 EUROPE

10.7.3 NORTH AMERICA

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 NORTH AMERICA ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 EUROPE

10.8.3 NORTH AMERICA

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 EUROPE

10.9.3 NORTH AMERICA

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

11 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 ABRASIVES

11.2.2 REFRACTORIES

11.2.3 CERAMICS & ADVANCED MATERIALS

11.2.4 POLISHING, LAPPING & FINISHING

11.2.5 OTHERS

11.3 NORTH AMERICA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 BONDED ABRASIVES

11.3.2 COATED ABRASIVES

11.3.3 BLASTING MEDIA

11.4 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 VITRIFIED BONDED

11.4.2 RESINOID BONDED

11.5 NORTH AMERICA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 BELTS/DISCS/SHEETS

11.5.2 SANDPAPER

11.6 NORTH AMERICA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 DRY BLASTING

11.6.2 WET/SLURRY BLASTING

11.7 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.7.1 ASIA-PACIFIC

11.7.2 EUROPE

11.7.3 NORTH AMERICA

11.7.4 SOUTH AMERICA

11.7.5 MIDDLE EAST & AFRICA

11.8 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 UN-SHAPED/CASTABLES

11.8.2 SHAPED REFRACTORIES

11.9 NORTH AMERICA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 LOW-CEMENT / ULTRA-LOW CEMENT (LCC/ULCC)

11.9.2 GUNNABLE/RAMMABLE

11.1 NORTH AMERICA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.10.1 BRICKS

11.10.2 PREFORMS

11.11 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 EUROPE

11.11.3 NORTH AMERICA

11.11.4 SOUTH AMERICA

11.11.5 MIDDLE EAST & AFRICA

11.12 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.12.1 TECHNICAL CERAMICS

11.12.2 THERMAL SPRAY/PLASMA SPRAY POWDERS

11.13 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 EUROPE

11.13.3 NORTH AMERICA

11.13.4 SOUTH AMERICA

11.13.5 MIDDLE EAST & AFRICA

11.14 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.14.1 METALS & ALLOYS

11.14.2 GLASS, CRYSTAL, STONE

11.15 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.15.1 ASIA-PACIFIC

11.15.2 EUROPE

11.15.3 NORTH AMERICA

11.15.4 SOUTH AMERICA

11.15.5 MIDDLE EAST & AFRICA

12 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE

12.1 OVERVIEW

12.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

12.2.1 METALS & METALLURGY

12.2.2 AUTOMOTIVE & TRANSPORTATION

12.2.3 MACHINERY & HEAVY EQUIPMENT

12.2.4 CONSTRUCTION & INFRASTRUCTURE

12.2.5 ENERGY (OIL & GAS, POWER GENERATION)

12.2.6 AEROSPACE & DEFENSE

12.2.7 ELECTRONICS & SEMICONDUCTORS

12.2.8 OTHERS

12.3 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.3.1 STEEL & FOUNDRY

12.3.2 NON-FERROUS METALS

12.4 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.5.1 AFTERMARKET/MAINTENANCE

12.5.2 OEM

12.6 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 NORTH AMERICA MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

12.8 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.8.1 ASIA-PACIFIC

12.8.2 EUROPE

12.8.3 NORTH AMERICA

12.8.4 SOUTH AMERICA

12.8.5 MIDDLE EAST & AFRICA

12.9 NORTH AMERICA ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.9.1 ASIA-PACIFIC

12.9.2 EUROPE

12.9.3 NORTH AMERICA

12.9.4 SOUTH AMERICA

12.9.5 MIDDLE EAST & AFRICA

12.1 NORTH AMERICA AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 EUROPE

12.10.3 NORTH AMERICA

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 NORTH AMERICA ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.11.1 ASIA-PACIFIC

12.11.2 EUROPE

12.11.3 NORTH AMERICA

12.11.4 SOUTH AMERICA

12.11.5 MIDDLE EAST & AFRICA

12.12 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 EUROPE

12.12.3 NORTH AMERICA

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

13 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

13.2.1 DIRECT

13.2.2 INDIRECT

13.3 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.3.1 MANUFACTURER TO END-USER

13.3.2 MANUFACTURER TO REFRACTORY INSTALLATION COMPANIES

13.3.3 MANUFACTURER TO EPC / ENGINEERING FIRMS

13.4 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 EUROPE

13.4.3 NORTH AMERICA

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.5.1 DISTRIBUTORS / WHOLESALERS

13.5.2 RETAILERS / DEALERS

13.5.3 ONLINE SALES / E-COMMERCE PLATFORMS

13.6 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 EUROPE

13.6.3 NORTH AMERICA

13.6.4 SOUTH AMERICA

13.6.5 MIDDLE EAST & AFRICA

14 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA WHITE FUSED ALUMINA MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 COMPANY PROFILES

16.1 MANUFACTURER

16.1.1 IMERYS S.A.

16.1.1.1 COMPANY SNAPSHOT

16.1.1.2 REVENUE ANALYSIS

16.1.1.3 COMPANY SHARE ANALYSIS

16.1.1.4 PRODUCT PORTFOLIO

16.1.1.5 RECENT DEVELOPMENT

16.1.2 WASHINGTON MILLS

16.1.2.1 COMPANY SNAPSHOT

16.1.2.2 COMPANY SHARE ANALYSIS

16.1.2.3 PRODUCT PORTFOLIO

16.1.2.4 RECENT DEVELOPMENT

16.1.3 SAINT-GOBAIN

16.1.3.1 COMPANY SNAPSHOT

16.1.3.2 REVENUE ANALYSIS

16.1.3.3 COMPANY SHARE ANALYSIS

16.1.3.4 PRODUCT PORTFOLIO

16.1.3.5 RECENT DEVELOPMENT

16.1.4 RUSAL

16.1.4.1 COMPANY SNAPSHOT

16.1.4.2 REVENUE ANALYSIS

16.1.4.3 PRODUCT PORTFOLIO

16.1.4.4 RECENT DEVELOPMENT

16.1.5 HWI

16.1.5.1 COMPANY SNAPSHOT

16.1.5.2 PRODUCT PORTFOLIO

16.1.5.3 RECENT DEVELOPMENT

16.1.6 ALGRAIN

16.1.6.1 COMPANY SNAPSHOT

16.1.6.2 PRODUCT PORTFOLIO

16.1.6.3 RECENT DEVELOPMENT

16.1.7 ALTEO FUSED ALUMINA

16.1.7.1 COMPANY SNAPSHOT

16.1.7.2 PRODUCT PORTFOLIO

16.1.7.3 RECENT DEVELOPMENT

16.1.8 CERABLAST

16.1.8.1 COMPANY SNAPSHOT

16.1.8.2 PRODUCT PORTFOLIO

16.1.8.3 RECENT DEVELOPMENT

16.1.9 CUMI

16.1.9.1 COMPANY SNAPSHOT

16.1.9.2 REVENUE ANALYSIS

16.1.9.3 PRODUCT PORTFOLIO

16.1.9.4 RECENT DEVELOPMENT

16.1.10 FUSED MINERALS INTERNATIONAL

16.1.10.1 COMPANY SNAPSHOT

16.1.10.2 PRODUCT PORTFOLIO

16.1.10.3 RECENT DEVELOPMENT

16.1.11 HENAN HONGTAI KILN REFRACTORY CO.,LTD.

16.1.11.1 COMPANY SNAPSHOT

16.1.11.2 PRODUCT PORTFOLIO

16.1.11.3 RECENT DEVELOPMENT

16.1.12 HENAN RUISHI RENEWABLE RESOURCES GROUP CO., LTD.

16.1.12.1 COMPANY SNAPSHOT

16.1.12.2 PRODUCT PORTFOLIO

16.1.12.3 RECENT DEVELOPMENT

16.1.13 JSR INTERNATIONAL(INDIA) PRIVATE LIMITED

16.1.13.1 COMPANY SNAPSHOT

16.1.13.2 PRODUCT PORTFOLIO

16.1.13.3 RECENT DEVELOPMENT

16.1.14 KUHMICHEL ABRASIV GMBH

16.1.14.1 COMPANY SNAPSHOT

16.1.14.2 PRODUCT PORTFOLIO

16.1.14.3 RECENT DEVELOPMENT

16.1.15 LP IMPEX

16.1.15.1 COMPANY SNAPSHOT

16.1.15.2 PRODUCT PORTFOLIO

16.1.15.3 RECENT DEVELOPMENT

16.1.16 LUOYANG HONGFENG ABRASIVES CO., LTD

16.1.16.1 COMPANY SNAPSHOT

16.1.16.2 PRODUCT PORTFOLIO

16.1.16.3 RECENT DEVELOPMENT

16.1.17 LUOYANG SUNRISE ABRASIVES CO., LTD.

16.1.17.1 COMPANY SNAPSHOT

16.1.17.2 PRODUCT PORTFOLIO

16.1.17.3 RECENT DEVELOPMENT

16.1.18 MOTIM

16.1.18.1 COMPANY SNAPSHOT

16.1.18.2 PRODUCT PORTFOLIO

16.1.18.3 RECENT DEVELOPMENT

16.1.19 NANPING YI ZE ABRASIVES & TOOLS TECH CO., LTD.

16.1.19.1 COMPANY SNAPSHOT

16.1.19.2 PRODUCT PORTFOLIO

16.1.19.3 RECENT DEVELOPMENT

16.1.20 ORIENT CERATECH LIMITED

16.1.20.1 COMPANY SNAPSHOT

16.1.20.2 REVENUE ANALYSIS

16.1.20.3 PRODUCT PORTFOLIO

16.1.20.4 RECENT DEVELOPMENT

16.1.21 QUARZWERKE GMBH

16.1.21.1 COMPANY SNAPSHOT

16.1.21.2 PRODUCT PORTFOLIO

16.1.21.3 RECENT DEVELOPMENT

16.1.22 QINAI NEW MATERIALS CO. LTD.

16.1.22.1 COMPANY SNAPSHOT

16.1.22.2 PRODUCT PORTFOLIO

16.1.22.3 RECENT DEVELOPMENT

16.1.23 SHANDONG BOSHENG NEW MATERIALS CO., LTD.

16.1.23.1 COMPANY SNAPSHOT

16.1.23.2 PRODUCT PORTFOLIO

16.1.23.3 RECENT DEVELOPMENT

16.1.24 SHANDONG HONREL CO., LTD

16.1.24.1 COMPANY SNAPSHOT

16.1.24.2 PRODUCT PORTFOLIO

16.1.24.3 RECENT DEVELOPMENT

16.1.25 SHANDONG ZHONGJI METAL PRODUCTS CO., LTD

16.1.25.1 COMPANY SNAPSHOT

16.1.25.2 PRODUCT PORTFOLIO

16.1.25.3 RECENT DEVELOPMENT

16.1.26 U.S. ELECTROFUSED MINERALS, INC.

16.1.26.1 COMPANY SNAPSHOT

16.1.26.2 PRODUCT PORTFOLIO

16.1.26.3 RECENT DEVELOPMENT

16.1.27 WEDGE INDIA

16.1.27.1 COMPANY SNAPSHOT

16.1.27.2 PRODUCT PORTFOLIO

16.1.27.3 RECENT DEVELOPMENT

16.1.28 ZHENGZHOU XINLI WEAR-RESISTANT MATERIALS CO. LTD.

16.1.28.1 COMPANY SNAPSHOT

16.1.28.2 PRODUCT PORTFOLIO

16.1.28.3 RECENT DEVELOPMENT

16.1.29 ZHENGZHOU YUFA ABRASIVE GROUP CO., LTD.

16.1.29.1 COMPANY SNAPSHOT

16.1.29.2 PRODUCT PORTFOLIO

16.1.29.3 RECENT DEVELOPMENT

16.1.30 ZIBO JUCOS CO.,LTD.

16.1.30.1 COMPANY SNAPSHOT

16.1.30.2 PRODUCT PORTFOLIO

16.1.30.3 RECENT DEVELOPMENT

16.2 DISTRIBUTOR

16.2.1 CALDERYS DISTRIBUTION.

16.2.1.1 COMPANY SNAPSHOT

16.2.1.2 PRODUCT PORTFOLIO

16.2.1.3 RECENT DEVELOPMENT

16.2.2 HWI DISTRIBUTION GROUP.

16.2.2.1 COMPANY SNAPSHOT

16.2.2.2 PRODUCT PORTFOLIO

16.2.2.3 RECENT DEVELOPMENT

16.2.3 LUOYANG ZHONGSEN REFRACTORY CO., LTD.

16.2.3.1 COMPANY SNAPSHOT

16.2.3.2 PRODUCT PORTFOLIO

16.2.3.3 RECENT DEVELOPMENT

16.2.4 PRATAP CORPORATION

16.2.4.1 COMPANY SNAPSHOT

16.2.4.2 PRODUCT PORTFOLIO

16.2.4.3 RECENT DEVELOPMENT

16.2.5 VESAVIUS

16.2.5.1 COMPANY SNAPSHOT

16.2.5.2 REVENUE ANALYSIS

16.2.5.3 PRODUCT PORTFOLIO

16.2.5.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTSR

表格列表

TABLE 1 PRICING ANALYSIS

TABLE 2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 4 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 5 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 NORTH AMERICA REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 52 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 NORTH AMERICA MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 57 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 NORTH AMERICA ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 NORTH AMERICA AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 NORTH AMERICA ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 61 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 62 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 63 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 68 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 69 NORTH AMERICA

TABLE 70 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 72 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 73 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 74 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 75 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 76 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 77 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 78 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 79 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 80 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 81 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 NORTH AMERICA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 NORTH AMERICA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 85 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 NORTH AMERICA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 NORTH AMERICA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 90 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 91 NORTH AMERICA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 NORTH AMERICA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 NORTH AMERICA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 NORTH AMERICA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 NORTH AMERICA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 101 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 104 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 U.S. WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 108 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 109 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 110 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 111 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 112 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 113 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 114 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 115 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 116 U.S. WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 117 U.S. ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 U.S. FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 U.S. TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 U.S. ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 121 U.S. CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 U.S. SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 U.S. PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 U.S. POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 U.S. WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 126 U.S. WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 127 U.S. ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 U.S. BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 U.S. COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 U.S. BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 U.S. REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 U.S. UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 U.S. SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 U.S. CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 U.S. POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 U.S. WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 137 U.S. METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 U.S. AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 U.S. WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 140 U.S. DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 U.S. INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 CANADA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 144 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 145 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 146 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 147 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 148 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 149 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 150 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 151 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 152 CANADA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 153 CANADA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 CANADA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 CANADA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 CANADA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 157 CANADA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 CANADA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 CANADA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 CANADA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 CANADA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 162 CANADA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 163 CANADA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 CANADA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 CANADA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 CANADA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 CANADA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 CANADA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 CANADA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 CANADA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 CANADA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 CANADA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 173 CANADA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 CANADA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 CANADA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 176 CANADA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 CANADA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 MEXICO WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 180 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 181 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 182 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 183 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 184 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 185 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 186 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 187 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 188 MEXICO WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 189 MEXICO ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 MEXICO FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 MEXICO TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 MEXICO ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 193 MEXICO CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 MEXICO SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 MEXICO PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 MEXICO POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 MEXICO WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 198 MEXICO WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 199 MEXICO ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 MEXICO BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 MEXICO COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 MEXICO BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 MEXICO REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 MEXICO UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 MEXICO SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 MEXICO CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 MEXICO POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 MEXICO WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 209 MEXICO METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 MEXICO AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 MEXICO WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 212 MEXICO DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 MEXICO INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA WHITE FUSED ALUMINA MARKET

FIGURE 2 NORTH AMERICA WHITE FUSED ALUMINA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WHITE FUSED ALUMINA MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WHITE FUSED ALUMINA MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WHITE FUSED ALUMINA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WHITE FUSED ALUMINA MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA WHITE FUSED ALUMINA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA WHITE FUSED ALUMINA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA WHITE FUSED ALUMINA MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA WHITE FUSED ALUMINA MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY: OVERVIEW

FIGURE 12 SIX SEGMENTS COMPRISE THE NORTH AMERICA WHITE FUSED ALUMINA MARKET: BY TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING DEMAND FROM IRON & STEEL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA WHITE FUSED ALUMINA MARKET IN THE FORECAST PERIOD (2026-2033)

FIGURE 15 THE MACROGRITS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WHITE FUSED ALUMINA MARKET IN 2026 AND 2033

FIGURE 16 DROC ANALYSIS

FIGURE 17 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2025

FIGURE 18 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2025

FIGURE 19 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2025

FIGURE 20 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2025

FIGURE 21 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2025

FIGURE 22 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 23 NORTH AMERICA WHITE FUSED ALUMINA MARKET SNAPSHOTS

FIGURE 24 NORTH AMERICA WHITE FUSED ALUMINA MARKET: COMPANY SHARE 2025 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。