North America Whole Exome Sequencing Market

市场规模(十亿美元)

CAGR :

%

USD

435.97 Million

USD

2,192.73 Million

2022

2030

USD

435.97 Million

USD

2,192.73 Million

2022

2030

| 2023 –2030 | |

| USD 435.97 Million | |

| USD 2,192.73 Million | |

|

|

|

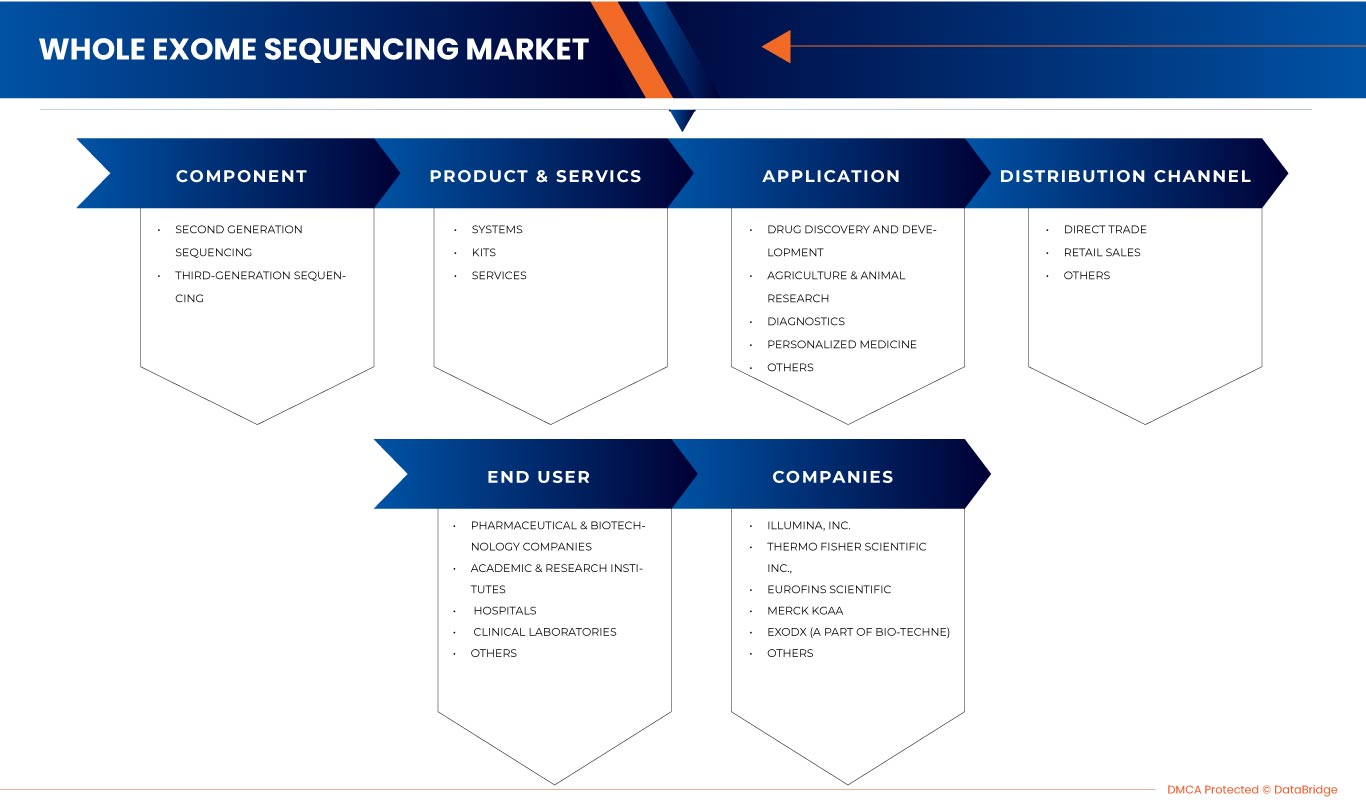

北美全外显子组测序市场,按组成部分(全外显子组测序、第二代测序和第三代测序)、产品和服务(系统、试剂盒和服务)、应用(诊断、药物发现和开发、个性化医疗、农业和动物研究等)、最终用户(医院和诊所、制药和生物技术公司、学术和研究机构、临床实验室等)、分销渠道(直接贸易、零售销售等)划分 - 行业趋势和预测到 2030 年。

北美全外显子组测序市场分析与洞察

由于 WES 具有低成本测序能力,因此其相对于全基因组测序的偏好增加是预测期内推动市场增长的主要因素。然而,高昂的仪器成本、对熟练专业人员的需求以及对补助金和资金的高度依赖可能会阻碍全外显子组测序市场未来的增长。主要市场参与者建立合作伙伴关系和收购等战略联盟为全外显子组测序市场的增长提供了机会。

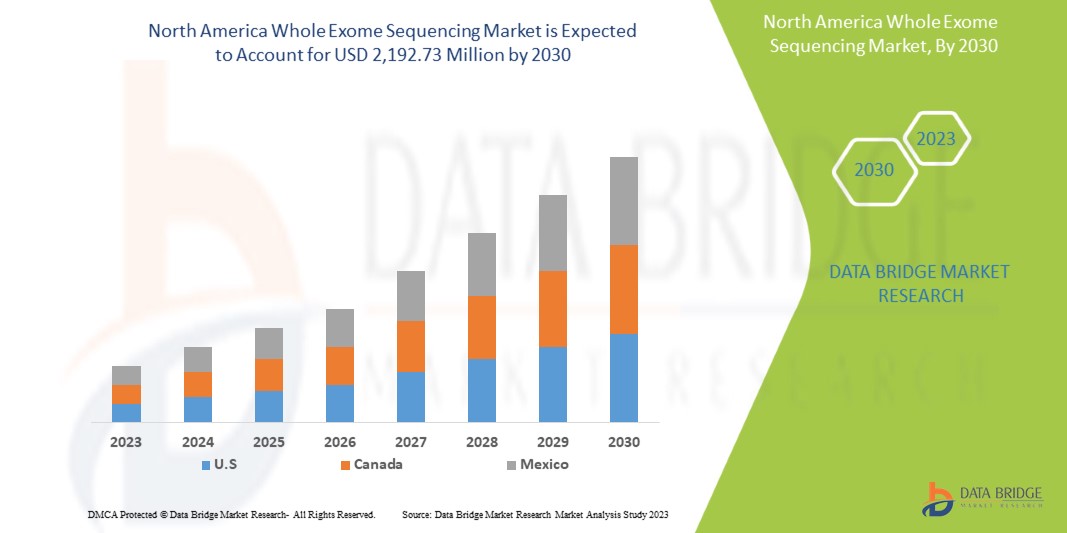

全外显子组测序市场预计将在 2023 年至 2030 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2023 年至 2030 年的预测期内,该市场将以 22.0% 的复合年增长率增长,预计到 2030 年将从 2022 年的 4.3597 亿美元达到 21.9273 亿美元。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021年(根据2015-2020年定制) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

组件(全外显子组测序、第二代测序和第三代测序)、产品和服务(系统、试剂盒和服务)、应用(诊断、药物发现和开发、个性化医疗、农业和动物研究等)、最终用户(医院和诊所、制药和生物技术公司、学术和研究机构、临床实验室等)、分销渠道(直接贸易、零售等) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Thermo Fisher Scientific Inc.、QIAGEN、Illumina, Inc.、Beckman Coulter, Inc.、Eurofins Scientific、BIONEER CORPORATION、ExoDx(Bio-Techne 的一部分)、FOUNDATION MEDICINE, INC.(F. Hoffmann-La Roche Ltd 的子公司)、GeneFirst Limited、Meridian、Merck KGaA、SOPHiA GENETICS、Azenta US Inc.、CD Genomics、Twist Bioscience、PerkinElmer Genomics(PerkinElmer Inc. 的子公司)、GeneDx, LLC、Psomagen 和 Integrated DNA Technologies, Inc. |

市场定义

全外显子组是一种基因组技术,用于对基因组中所有基因的蛋白质编码区进行测序。全外显子组测序 (WES) 适用于寻求多种疾病统一诊断的患者。这是一种实验室过程,主要用于确定个体基因组外显子(或蛋白质编码)区域和相关序列的核苷酸序列,约占完整 DNA 序列的 1%,称为 WES。全外显子组测序是一种广泛使用的全外显子组测序 (WES) 方法,涉及对基因组的蛋白质编码区域进行测序。人类外显子组占基因组的不到 2%,但包含约 85% 的已知疾病相关变异,1 使该方法成为全基因组测序的经济高效的替代方案

北美全外显子组测序市场动态

驱动程序

- 全外显子组测序的诊断应用日益增多

目前已发现超过 7,000 种罕见疾病,其中约 80% 与遗传原因有关,诊断罕见病患者通常很困难,导致诊断过程漫长、昂贵且充满情绪。

因此,WES 的诊断应用有望推动市场规模的增长,并有望在预测期内成为全球全外显子组测序市场的驱动力。

- 靶向测序方法的使用日益广泛

随着以基因组学为重点的药理学在各种慢性疾病尤其是癌症的治疗中发挥着越来越重要的作用,下一代测序 (NGS) 正在发展成为一种强有力的工具,可以更深入、更精确地了解单个肿瘤和特定受体的分子基础。

与传统方法相比,NGS 在准确性、灵敏度和速度方面具有优势,有望对肿瘤学领域产生重大影响。NGS 可以在一次检测中评估多个基因,因此无需进行多项检测来确定致病突变。

机会

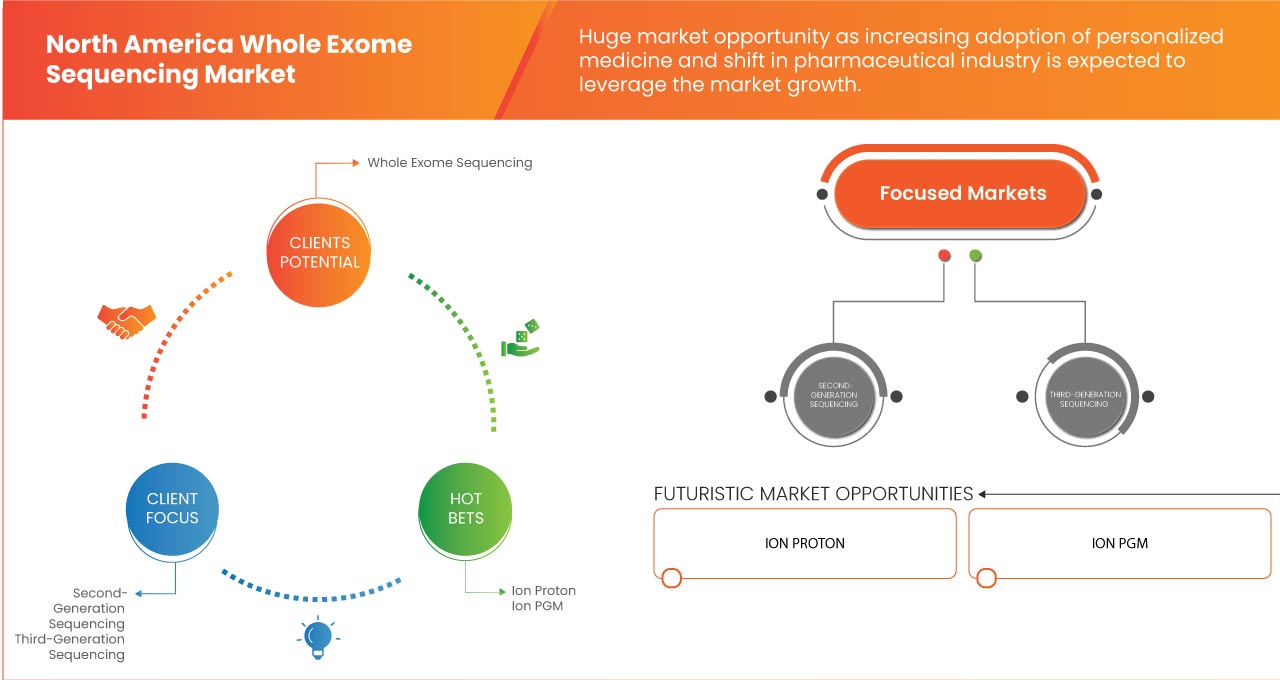

- 近年来产品发布不断增加

由于对全外显子组测序技术的需求不断增加,市场参与者正专注于推出全外显子组测序新产品。技术的进步正在帮助市场参与者推出多种产品。

近年来推出的产品显示了该项技术的潜力,从事该市场的公司正试图在市场上推出更先进的产品,这将为市场带来机遇,并将在预测期内推动市场发展。

挑战/限制

- 基因组学中的网络安全问题

众所周知,软件存在由不完善的代码、错误配置等引起的漏洞,用于操作测序和实验室设备或进行生物信息学分析的 NGS 相关软件也不例外。软件漏洞被用来未经授权访问计算机系统或网络、泄露数据、导致崩溃或以其他方式破坏各种服务。

预计与全外显子组测序相关的数据泄露和网络威胁事件将在预测期内阻碍市场增长。

- 缺乏熟练的专业人员

全外显子组测序 (WES) 数据的解读需要基因组信息学和临床医学方面的专业知识,以确保准确安全地报告结果。WES 的第一步是从生物样本中获取高质量的基因组 DNA (gDNA),最常见的是从外周血白细胞中提取。专业人员应该掌握有关提取 gDNA 的信息。此外,WES 还需要准备外显子组富集文库,但许多医疗专家并不了解这一点。

缺乏技能的专业人员不适合进行全外显子组测序,因为患者的诊断样本至关重要。对熟练医疗保健的需求不断增加。因此,缺乏进行全外显子组测序的熟练专业人员对市场的增长构成了挑战。

近期发展

- 3 月,赛默飞世尔科技推出了 CE-IVD 认证的 Ion Torrent Genexus Dx 集成测序仪,这是一款自动化的新一代测序 (NGS) 平台,可在一天内提供结果。它专为临床实验室设计,经过全面验证的系统使用户能够在一台仪器上进行诊断测试和临床研究。这有助于该公司在其产品组合中取得进步

北美全外显子组测序范围和市场规模

北美全外显子组测序市场根据组件、产品和服务、应用、最终用户和分销渠道进行细分。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

成分

- 全外显子组测序

- 第三代测序

根据组成部分,北美全外显子组测序市场分为全外显子组测序和第三代测序。

產品與服務

- 系统

- 套件

- 服务

根据产品和服务,北美全外显子组测序市场分为系统、试剂盒和服务。

应用

- 诊断

- 药物研发

- 个性化医疗

- 农业与动物研究

- 其他的

根据应用,北美全外显子组测序市场分为药物发现和开发、农业和动物研究、诊断、个性化医疗等。

最终用户

- 医院和诊所

- 制药及生物技术公司

- 学术及研究机构

- 临床实验室

- 其他的

根据最终用户,北美全外显子组测序市场分为制药和生物技术公司、学术和研究机构、医院、临床实验室和其他。

分销渠道

- 直接贸易

- 零售

- 其他的

根据分销渠道,北美全外显子组测序 (WES) 市场分为直接贸易、零售和其他。

北美全外显子组测序市场区域水平分析

对整个外显子组测序市场进行了分析,并按组件、产品和服务、应用、最终用户和分销渠道提供了市场规模信息。

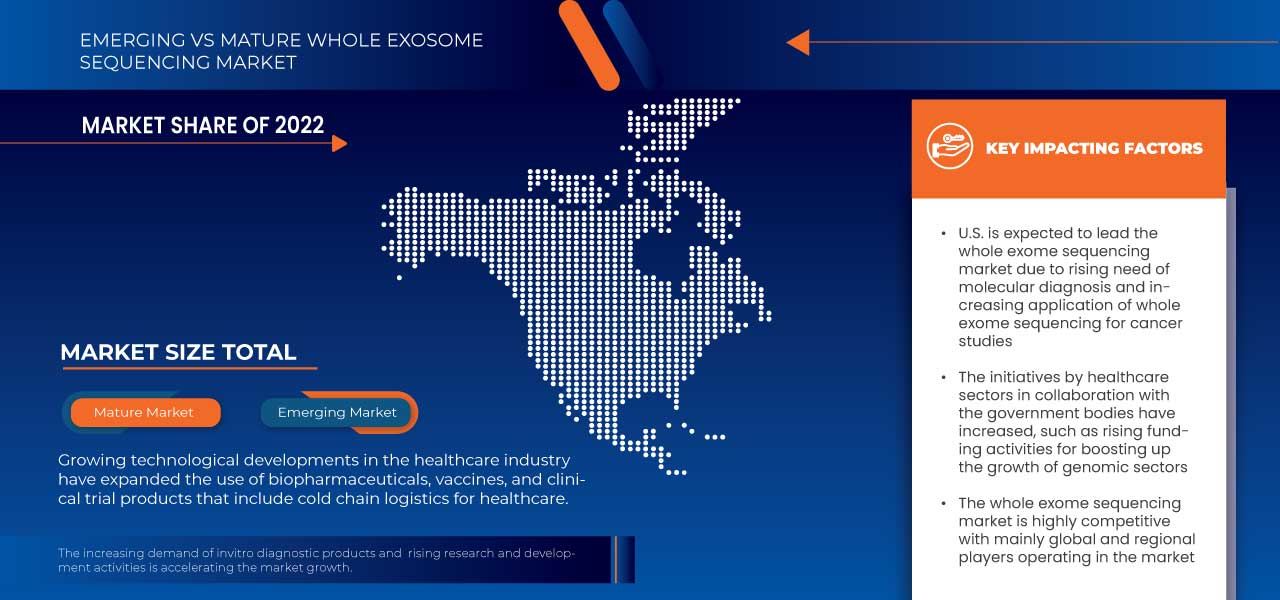

全外显子组测序 (WES) 市场报告涵盖的国家包括美国、加拿大、墨西哥。

由于美国是最大的消费市场,GDP 较高,因此美国有望主导市场,因为美国拥有主要市场参与者。由于技术进步,美国有望实现增长。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了区域品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀少竞争而面临的挑战、销售渠道的影响。

竞争格局和北美全外显子组测序市场份额分析

全外显子组测序市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对市场的关注有关。

在北美全外显子组测序市场开展业务的一些主要公司包括 Thermo Fisher Scientific Inc.、QIAGEN、Illumina, Inc.、Beckman Coulter, Inc.、Eurofins Scientific、BIONEER CORPORATION、ExoDx(Bio-Techne 的一部分)、FOUNDATION MEDICINE, INC.(F. Hoffmann-La Roche Ltd 的子公司)、GeneFirst Limited、CeGaT GmbH、Meridian、Merck KGaA、SOPHiA GENETICS、Azenta US Inc.、CD Genomics、Twist Bioscience、PerkinElmer Genomics(PerkinElmer Inc. 的子公司)、GeneDx, LLC、Psomagen 和 Integrated DNA Technologies, Inc. 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRIAL INSIGHTS:

4.4 CONCLUSION

5 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USAGE OF TARGETED SEQUENCING METHODS

6.1.2 INCREASE IN THE ADOPTION OF NEXT GENERATION SEQUENCING

6.1.3 INCREASING DIAGNOSTICS APPLICATIONS OF WHOLE EXOME SEQUENCING

6.1.4 INCREASE TREND TOWARD PERSONALIZED MEDICATION

6.2 RESTRAINTS

6.2.1 LESS COMPREHENSIVE COVERAGE OF EXONS

6.2.2 CYBER SECURITY CONCERNS IN GENOMICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 INCREASING PRODUCT LAUNCHES IN RECENT YEARS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 ETHICAL AND LEGAL ISSUES RELATED TO WHOLE EXOME SEQUENCING

7 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SECOND-GENERATION SEQUENCING

7.2.1 SEQUENCING BY SYNTHESIS (SBS)

7.2.2 SEQUENCING BY HYBRIDIZATION (SBH) AND SEQUENCING BY LIGATION (SBL)

7.3 THIRD-GENERATION SEQUENCING

8 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE

8.1 OVERVIEW

8.2 SYSTEMS

8.2.1 HISEQ SERIES

8.2.1.1 HISEQ 2500

8.2.1.2 HISEQ 1500

8.2.2 MISEQ SERIES

8.2.3 ION TORRENT PLATFORMS

8.2.3.1 ION PROTON

8.2.3.2 ION PGM

8.2.4 OTHERS

8.3 KITS

8.3.1 DNA FRAGMENTATION, END REPAIR, A-TAILING, AND SIZE SELECTION KITS

8.3.2 LIBRARY PREPARATION KITS

8.3.3 TARGET ENRICHMENT KITS

8.3.4 OTHERS

8.4 SERVICES

8.4.1 SEQUENCING SERVICES

8.4.2 DATA ANALYSIS (BIOINFORMATICS) SERVICES

8.4.3 OTHERS

9 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DISCOVERY AND DEVELOPMENT

9.3 AGRICULTURE & ANIMAL RESEARCH

9.4 DIAGNOSTICS

9.5 PERSONALIZED MEDICINE

9.6 OTHERS

10 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

10.3 ACADEMIC & RESEARCH INSTITUTES

10.4 HOSPITALS AND CLINICS

10.5 CLINICAL LABORATORIES

10.6 OTHERS

11 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TRADE

11.3 RETAIL SALES

11.4 OTHERS

12 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 COMPANY PROFILE

14.1 PERKINELMER GENOMICS (A SUBSIDIARY OF PERKINELMER INC.)

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 MERCK KGAA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 EXODX (A PART OF BIO-TECHNE)

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 FOUNDATION MEDICINE, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 AZENTA US, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 BECKMAN COULTER, INC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CD GENOMICS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 EUROFINS SCIENTIFIC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 GENEDX, LLC

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 GENEFIRST LIMITED.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 ILLUMINA, INC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 INTEGRATED DNA TECHNOLOGIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 MERIDIAN BIOSCIENCE, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 PSOMAGEN

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 QIAGEN

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 SOPHIA GENETICS

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 TWIST BIOSCIENCE

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 2 NORTH AMERICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 3 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 4 GLOBAL SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 5 GLOBAL HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 6 NORTH AMERICA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 7 NORTH AMERICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 8 NORTH AMERICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 9 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2021- 2030 (USD MILLION)

TABLE 10 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2021- 2030 (USD MILLION)

TABLE 11 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD MILLION)

TABLE 12 U.S. WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 13 U.S. SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 14 U.S. WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 15 U.S. SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 16 U.S. HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 17 U.S. ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 18 U.S. KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 19 U.S. SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 20 U.S. WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2021- 2030 (USD MILLION)

TABLE 21 U.S. WHOLE EXOME SEQUENCING MARKET, BY END USER, 2021- 2030 (USD MILLION)

TABLE 22 U.S. WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD MILLION)

TABLE 23 CANADA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 24 CANADA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 25 CANADA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 26 CANADA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 27 CANADA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 28 CANADA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 29 CANADA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 30 CANADA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 31 CANADA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2021- 2030 (USD MILLION)

TABLE 32 CANADA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2021- 2030 (USD MILLION)

TABLE 33 CANADA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD MILLION)

TABLE 34 MEXICO WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 35 MEXICO SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2021- 2030 (USD MILLION)

TABLE 36 MEXICO WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 37 MEXICO SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 38 MEXICO HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 39 MEXICO ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 40 MEXICO KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 41 MEXICO SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2021- 2030 (USD MILLION)

TABLE 42 MEXICO WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2021- 2030 (USD MILLION)

TABLE 43 MEXICO WHOLE EXOME SEQUENCING MARKET, BY END USER, 2021- 2030 (USD MILLION)

TABLE 44 MEXICO WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET: SEGMENTATION

FIGURE 10 INCREASE IN USE OF WES TECHNOLOGY FOR NEW SCIENTIFIC APPLICATIONS AND INCREASING THE PREFERENCE OF WES OVER WHOLE-GENOME SEQUENCING IS ITS LOW-COST SEQUENCING CAPABILITY IS EXPECTED TO DRIVE THE NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE COMPONENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WHOLE EXOME SEQUENCING (WES) MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA WHOLE EXOME SEQUENCING MARKET

FIGURE 13 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, 2022

FIGURE 14 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 15 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 16 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 17 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, 2022

FIGURE 18 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, 2023-2030 (USD MILLION)

FIGURE 19 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, 2022

FIGURE 22 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 23 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 25 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY END USER, 2022

FIGURE 26 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 27 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 30 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 31 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: SNAPSHOT (2022)

FIGURE 34 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2022)

FIGURE 35 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT (2023-2030)

FIGURE 38 NORTH AMERICA WHOLE EXOME SEQUENCING MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。