Saudi Arabia And Egypt Float Glass Market

市场规模(十亿美元)

CAGR :

%

USD

608.40 Million

USD

815.45 Million

2025

2033

USD

608.40 Million

USD

815.45 Million

2025

2033

| 2026 –2033 | |

| USD 608.40 Million | |

| USD 815.45 Million | |

|

|

|

|

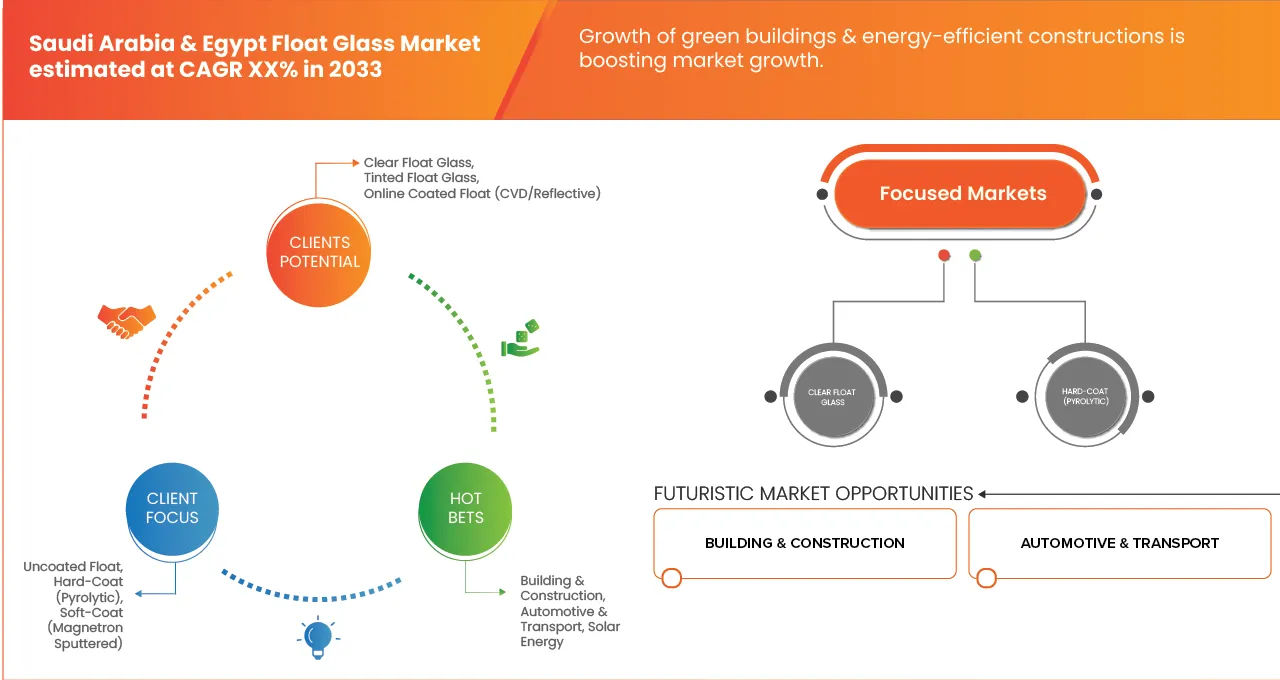

沙烏地阿拉伯和埃及浮法玻璃市場細分,依產品類型(透明浮法玻璃、著色浮法玻璃、低鐵(超白)浮法玻璃、鏡面級浮法玻璃(鍍銀基材)、線上鍍膜浮法玻璃(CVD/反射))、鍍膜類型(未鍍膜浮法玻璃、硬質鍍膜(熱濺解)、軟性鍍膜(磁濺鍍膜)、其他功能性鍍膜)、應用領域(建築與施工、汽車與交通運輸、太陽能、家具與家電、其他)、最終用戶(原始設備製造商和加工商、分銷商和批發商、零售商和小加工商、其他)、分銷渠道(直接、間接)劃分——行業趨勢及至2033年的預測

沙烏地阿拉伯和埃及浮法玻璃市場規模

- 2025年沙烏地阿拉伯和埃及浮法玻璃市場規模為6.084億美元 ,預計 2033年將達到8.1545億美元,預測期內複合年增長率為3.8%。

- 由於建築業的強勁成長、工業的擴張以及對高性能玻璃材料需求的不斷攀升,沙烏地阿拉伯和埃及的浮法玻璃市場正在迅速發展。在豐富的原材料、不斷擴大的基礎設施項目以及旨在提升本地製造能力的政府舉措的支持下,這兩個國家已成為中東和北非地區重要的浮法玻璃生產國。浮法玻璃廣泛應用於建築外觀、窗戶、天窗、太陽能板和汽車等領域,使其成為國家發展計畫的關鍵材料。

- 在沙烏地阿拉伯,需求主要受「2030願景」大型項目(如NEOM新城、The Line購物中心、紅海項目、吉迪亞以及大型住宅和商業開發項目)的推動。這些項目需要先進的玻璃產品,包括低輻射玻璃、反射玻璃、太陽能控制玻璃以及強化和夾層建築玻璃。沙烏地阿拉伯也在大力投資再生能源,這增加了對光伏組件所用低鐵太陽能玻璃的需求。政府的大力支持、充足的能源供應以及產業多元化政策進一步促進了浮法玻璃產能的擴張和現代化。

- 埃及已成為非洲領先的浮法玻璃生產國之一,也是中東、歐洲和非洲的主要出口國。其毗鄰蘇伊士運河的戰略位置、具有競爭力的生產成本以及蓬勃發展的國內建築業,都鞏固了其市場地位。新行政首都的建設、國家住房計劃、旅遊基礎設施和工業園區的建設,持續推動對透明和鍍膜浮法玻璃的需求。發達的製造業群聚和不斷完善的物流網絡也增強了埃及的出口競爭力。

沙烏地阿拉伯和埃及浮法玻璃市場分析

- 沙烏地阿拉伯和埃及的浮法玻璃市場正穩步擴張,這主要得益於強勁的建築活動、快速的城市化進程以及工業和基礎設施項目投資的成長。在沙烏地阿拉伯,「2030願景」計畫持續推動住宅、商業和智慧城市開發計畫(包括NEOM新城、紅海計畫和吉迪亞)對高品質建築玻璃的需求。該國向在地化生產、節能建築和再生能源轉型,進一步促進了鋼化玻璃、夾層玻璃、鍍膜玻璃和太陽能控制玻璃等高附加價值浮法玻璃產品的消費。

- 另一方面,埃及正崛起為具有競爭力的生產中心,這得益於政府的工業化政策、充足的原材料供應、出口激勵措施以及不斷擴大的房地產項目。諸如新行政首都和大型住房計劃等項目正在提升國內需求,而埃及的戰略位置也使其擁有對非洲、南歐和中東的巨大出口潛力。

- 沙烏地阿拉伯和埃及都受益於汽車產量成長、再生能源裝置容量增加以及政府支持的促進國內製造業發展的措施。然而,市場也面臨許多挑戰,包括能源價格波動、來自低成本進口產品的競爭以及影響貿易流動的地緣政治不確定性。總體而言,在建設熱潮、多元化發展策略以及對現代化玻璃製造能力投資增加的支撐下,沙烏地阿拉伯和埃及的浮法玻璃市場有望實現長期健康成長。

- 沙烏地阿拉伯和埃及的浮法玻璃市場預計將以3.9%的複合年增長率成長,這主要得益於沙烏地阿拉伯相比埃及更大的產能、強大的工業基礎以及在建築和大型項目方面的巨額投資。沙烏地阿拉伯的「2030願景」計畫、快速的城市發展以及汽車和建築業的擴張,持續推動對浮法玻璃的高需求。此外,沙烏地阿拉伯豐富的原材料、先進的製造設施以及政府的支持政策也增強了其競爭力,鞏固了沙烏地阿拉伯在沙烏地阿拉伯和埃及區域浮法玻璃市場的主導地位。

- 透明浮法玻璃以41.57%的市場份額在產品類型細分市場中佔據主導地位,因為它具有高透明度、多功能性和成本效益,廣泛應用於建築和汽車領域。其廣泛的供應和易於進行後續加工(例如鋼化、夾層或塗層)的特性,使其成為製造商和終端用戶的首選。

報告範圍及沙烏地阿拉伯和埃及浮法玻璃市場細分

|

屬性 |

沙烏地阿拉伯和埃及浮法玻璃市場關鍵洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

埃及 沙烏地阿拉伯 |

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括進出口分析、產能概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗標準概覽、供應商選擇、PESTLE 分析、五力分析和監管框架。 |

沙烏地阿拉伯和埃及浮法玻璃市場趨勢

“汽車及多元化應用領域的成長”

- 沙烏地阿拉伯在「2030願景」框架下推動產業多元化,特別是發展本土汽車製造業生態系統,顯著提升了浮法玻璃在傳統建築用途之外的需求。隨著沙烏地王國擴大本地汽車和電動車的生產,用於擋風玻璃、車窗和天窗的夾層玻璃、強化玻璃和安全玻璃的需求持續增長。

- 政府激勵措施、外商投資合作以及專用汽車組裝區的設立,增強了本地汽車產量。汽車保有量的成長、車隊現代化以及交通網絡的擴展,也增加了售後市場對擋風玻璃和安全玻璃的需求,從而確保了浮法玻璃全年穩定的消費量。

- 除了汽車產業的成長,沙烏地阿拉伯王國正在擴大浮法玻璃在裝飾、家具、智慧玻璃系統和交通基礎設施等領域的應用。這種多元化發展促使製造商投資於先進的夾層、鋼化和精密切割技術,從而提高產能利用率並增強產業競爭力。

- 近期發展,例如計劃到2030年將產量擴大到40萬輛,Stellantis-Petromin的製造合作項目,不斷增長的售後市場需求,以及PIF-現代在韓國高雄經濟走廊(KAEC)的工廠建設,都凸顯了生態系統的不斷增強。這些因素共同作用,透過擴大需求、提升加工能力和減少對單一產業的依賴,為浮法玻璃生產商的長期穩定發展奠定了基礎。

沙烏地阿拉伯和埃及浮法玻璃市場動態

司機

“建築、汽車和家電行業對MDI基聚氨酯的需求不斷增長”

- 在「2030願景」的推動下,沙烏地阿拉伯的建築業正經歷變革性成長,這得益於一系列大型專案和城市發展計畫的湧現。諸如NEOM、The Line、吉迪亞、紅海環球城、AMAALA和迪里耶門等標誌性建築,以及利雅德和吉達的大規模擴建,都持續推動著外立面、天窗、幕牆、隔間、窗戶和室內應用領域對浮法玻璃的需求。

- 這些專案的規模和雄心壯志需要兼顧能源效率、太陽能控制、美觀性和結構強度的先進玻璃解決方案。因此,市場需求正從基礎浮法玻璃轉向包括低輻射玻璃、反射玻璃、夾層玻璃、隔熱玻璃和高耐久性鍍膜玻璃在內的特殊產品。對智慧城市、氣候適應建築和低碳建築的重視加速了創新玻璃技術的應用,促使本地和區域生產商擴大產能併升級生產線。

- 人口增長、快速的城市化進程以及不斷增長的住宅需求為沙烏地阿拉伯王國的建築活動提供了穩定的基礎。政府住房計劃、公私合營項目以及大型住宅總體規劃持續推動對標準玻璃和高性能玻璃的需求。商業房地產領域——包括辦公大樓、酒店、零售綜合體和綜合用途開發項目——也做出了顯著貢獻,因為現代建築越來越重視大面積玻璃帷幕牆和先進的立面解決方案。

- 2024-2025年的報告顯示,NEOM及其他大型專案仍在積極開發中,數十億美元的投資將用於住宅、辦公室、零售和酒店等領域,從而推動建築玻璃的大規模需求。這場建設熱潮是沙烏地阿拉伯經濟多元化的核心,也為高品質、技術先進的浮法玻璃創造了持續的需求。加之快速的城市化進程和不斷發展的建築標準,這已成為沙烏地阿拉伯浮法玻璃市場最具影響力和最持久的成長驅動力之一。

克制/挑戰

“原材料和能源成本波動”

- 原料和能源價格的波動對沙烏地阿拉伯和埃及浮法玻璃市場的成長和穩定構成重大挑戰。玻璃生產的關鍵投入品,如矽砂、純鹼、石灰石和白雲石,對價格波動高度敏感。許多高純度原料依賴進口,這使得製造商容易受到國際市場趨勢、匯率波動和運費變化的影響,從而壓縮利潤空間並擾亂生產計劃。

- 能源成本是另一個關鍵因素,因為浮法玻璃生產需要高溫熔爐連續運轉,這佔生產成本的很大一部分。沙烏地阿拉伯歷來受益於穩定的燃料價格,但近年來國內能源價格上漲、全球油氣市場波動以及更嚴格的燃油效率法規加劇了營運成本的不確定性。製造商要么自行承擔這些成本,要么將其轉嫁給客戶,從而影響建築和汽車行業的定價。

- 全球航運中斷和商品市場波動——由地緣政治緊張局勢、供應鏈問題和國際需求波動所驅動——進一步加劇了原材料採購的複雜性。對於生產計畫嚴格的資本密集浮法玻璃企業而言,這種不確定性增加了庫存風險,並使長期投資決策更加複雜。原材料依賴性、能源波動性和外部市場壓力三者疊加,造成了財務壓力,尤其對於那些旨在擴大產能或開發高附加價值產品的公司更是如此。

- 近期報告凸顯了這些挑戰:2025年12月工業能源關稅上漲增加了能源密集產業的營運成本;2025年10月,由於供應短缺和出口成本增加,純鹼價格出現顯著波動;2024年2月紅海航運中斷推高了進口原材料的運費。這些成本波動降低了獲利能力,限制了生產的靈活性,並加劇了財務風險,使得有效管理能源和原材料成本成為限製沙烏地阿拉伯和埃及浮法玻璃市場長期競爭力的持續因素。

沙烏地阿拉伯和埃及浮法玻璃市場範圍

沙烏地阿拉伯和埃及浮法玻璃市場根據產品類型、塗層類型、應用、最終用途和分銷管道,可分為五個主要細分市場。

- 依產品類型

根據產品類型,市場可細分為透明浮法玻璃、著色浮法玻璃、低鐵(超白)浮法玻璃、鏡面級浮法玻璃(鍍銀基材)和線上鍍膜浮法玻璃(CVD/反射)。預計到2026年,透明浮法玻璃將以41.48%的市場份額主導沙烏地阿拉伯和埃及的浮法玻璃市場,並預計在2033年達到3.3236億美元,在2026年至2033年的預測期內,其複合年增長率(CAGR)將達到3.5%,成為增長最快的細分市場。這一趨勢主要歸因於市場對美觀且節能的建築應用的高需求。此外,透明浮法玻璃在住宅和商業建築中的廣泛應用也推動了市場的持續成長。

- 按塗層類型

根據塗層類型,浮法玻璃市場可分為無塗層浮法玻璃、硬塗層(熱解)、軟塗層(磁控濺鍍)和其他功能塗層。預計到2026年,無塗層浮法玻璃將佔據沙烏地阿拉伯和埃及浮法玻璃市場的主導地位,市佔率達62.43%,到2033年市場規模將達到4.974億美元,在2026年至2033年的預測期內,複合年增長率(CAGR)將達到3.5%,成為成長最快的細分市場。這一增長主要得益於該細分市場的成本效益和在標準建築項目中的廣泛應用。此外,其高可用性和易於安裝的特性也持續推動市場對其的強勁需求。

- 透過申請

根據應用領域,市場可細分為建築與施工、汽車與交通、太陽能、家具與家電等領域。預計到2026年,建築與施工領域將以76.13%的市場份額主導沙烏地阿拉伯和埃及的浮法玻璃市場,並預計在2033年達到6.185億美元,在2026年至2033年的預測期內,複合年增長率(CAGR)將達到3.8%,成為成長最快的領域。這一增長主要得益於兩國快速的城市化進程和不斷增加的基礎設施項目。此外,對節能耐用建築材料日益增長的需求也推動了浮法玻璃的應用。

- 最終用戶

根據最終用途,市場可細分為原始設備製造商 (OEM) 和加工商、分銷商和批發商、零售商和小型加工商以及其他。預計到 2026 年,OEM 和加工商將以 49.35% 的市場份額主導沙烏地阿拉伯和埃及浮法玻璃市場,並預計到 2033 年市場規模將達到 4.091 億美元,在 2026 年至 2033 年的預測期內,複合年增長率 (CAGR) 將達到 4.0% 的市場增長最快市場增長率。這一主導地位主要得益於汽車和工業領域對客製化玻璃解決方案日益增長的需求。此外,製造商和加工商之間的緊密合作也提高了供應鏈效率,並促進了市場成長。

- 透過分銷管道

根據分銷管道,市場可分為直接銷售和間接銷售。預計到2026年,直接銷售管道將以66.43%的市場份額主導沙烏地阿拉伯和埃及的浮法玻璃市場,並預計在2033年達到5.4633億美元,在2026年至2033年的預測期內,複合年增長率(CAGR)將達到3.9%,成為增長最快的管道。這一成長主要得益於製造商傾向於採用直接銷售模式以降低成本並提高分銷效率。此外,更緊密的客戶關係和更精簡的供應鏈也推動了該地區浮法玻璃市場的普及。

沙烏地阿拉伯和埃及浮法玻璃市場區域分析

- 沙烏地阿拉伯在沙烏地阿拉伯和埃及浮法玻璃市場佔據主導地位,預計到2026年將佔據74.22%的市場份額,這主要得益於該國強勁的建築活動和大規模基礎設施項目。此外,不斷加快的城市化進程以及對住宅和商業開發的投資也推動了市場需求。該地區也展現出3.9%的強勁複合年增長率,顯示在對現代建築材料需求不斷增長和工業應用日益廣泛的情況下,市場正保持強勁且持續的增長。這反映了該地區基礎設施和城市發展投資的不斷增加。

- 此外,政府推行的智慧城市和節能建築工程預計將進一步加速浮法玻璃的需求。加之玻璃製造技術的進步,預計該市場在預測期內將穩定擴張。

沙烏地阿拉伯和埃及浮法玻璃市場洞察

沙烏地阿拉伯和埃及浮法玻璃市場預計將強勁成長,這主要得益於蓬勃發展的建築業和對高品質建築材料日益增長的需求。不斷完善的標準和法規進一步提升了對優質玻璃產品的需求,而區域和全球市場出口機會的不斷擴大也持續支撐著市場擴張。

沙烏地阿拉伯和埃及浮法玻璃市場份額

浮法玻璃產業主要由一些老牌企業主導,其中包括:

- 穆罕默德·曼納玻璃公司(沙烏地阿拉伯)

- 中國玻璃控股有限公司(中國)

- 埃及玻璃公司(埃及)

- 格雷什·格拉斯博士(埃及)

- Guardian Industries Holdings(美國)

- 阿拉伯聯合玻璃有限公司(埃及)

- 聖戈班玻璃埃及公司(埃及)

- 歐貝坎玻璃公司(沙烏地阿拉伯)

- 安達盧斯玻璃公司(沙烏地阿拉伯)

- 聯合浮法玻璃(沙烏地阿拉伯)

- 信義玻璃控股有限公司(中國)

- Düzce Cam Sanayi ve Tic。作為。 (火雞)

- 希謝卡姆(土耳其)

- 獅身人面像(埃及)

- Al-Shams建築玻璃(孟加拉)

沙烏地阿拉伯和埃及浮法玻璃市場的最新發展

- 2024年11月,Guardian Glass在其網站上推出了CLARIA,這是一款全球人工智慧助手,旨在幫助客戶了解玻璃的技術細節、推薦玻璃解決方案、尋找本地供應商並獲取相關資源。 CLARIA支援所有支援語言的對話式、上下文感知交互,使用戶能夠快速解決複雜問題、探索技術主題並獲得個人化指導,這標誌著Guardian Glass在數位互動和客戶支援策略方面邁出了重要一步。

- 2022年9月,Guardian Glass推出了Guardian Clarity™ Neutral,這是一款專為建築和特殊用途設計的高級防反射鍍膜玻璃。其反射率僅0.6%,是Guardian所有產品中透明度最高的,即使在低光源或漫射光下也能有效減少眩光、藍光反射、霧霾和色差。此玻璃適用於Guardian ExtraClear或UltraClear浮法玻璃,厚度範圍為3毫米至15毫米,最大尺寸可達6,000毫米×3,210毫米。 Guardian Clarity™ Neutral可進行退火或熱處理,以滿足安全、安防或隔音等應用需求,帶來幾乎無遮蔽的清晰視野。

- 2023 年 12 月,Sphinx Glass 與 Diamon‑Fusion International (DFI) 簽署了獨家經銷協議,將 Diamon‑Fusion® 玻璃塗層技術引入埃及和地中海北非地區,使塗層玻璃表面具有更好的衛生、防水和防污性能。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA & EGYPT FLOAT GLASS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 PRODUCT TYPE TIMELINE CURVE

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.2 THREAT OF SUBSTITUTE PRODUCTS

4.2.1 INDUSTRY RIVALRY

4.2.2 CONCLUSION

4.3 BRAND OUTLOOK

4.3.1 PRODUCT COMPARISON

4.3.2 BRAND DEVELOPMENT ACROSS APPLICATION

4.4 VALUE CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 GLASS MELTING AND FLOATING

4.4.3 GLASS PROCESSING AND FINISHING

4.4.4 DISTRIBUTION AND LOGISTICS

4.4.5 END-USE MANUFACTURING AND INSTALLATION

4.4.6 RETAIL AND DISTRIBUTION TO CONSUMERS

4.4.7 CONCLUSION

4.5 CONSUMER BUYING BEHAVIOUR

4.5.1 GROUP 1 PREMIUM CHEMICAL PRODUCERS

4.5.2 GROUP 2 PRICE-SENSITIVE MID-SIZED FORMULATORS

4.5.3 GROUP 3 INDUSTRIAL USERS WITH LOGISTICS FOCUS

4.5.4 GROUP 4 COST-FOCUSED SMALL PROCESSORS / TRADERS

4.5.5 GROUP 5 SPECIALTY APPLICATION MANUFACTURERS

4.5.6 GROUP 6 EMERGING MARKET LARGE BUYERS

4.6 RAW MATERIAL COVERAGE

4.6.1 SILICA SAND

4.6.2 SODA ASH

4.6.3 LIMESTONE AND DOLOMITE

4.6.4 CULLET (RECYCLED GLASS)

4.6.5 CHEMICALS AND ADDITIVES

4.6.6 POLICY AND ENVIRONMENTAL FRAMEWORK

4.6.7 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS – SAUDI ARABIA & EGYPT FLOAT GLASS MARKET

4.7.1 SAUDI ARABIA – FLOAT GLASS TECHNOLOGICAL ADVANCEMENTS

4.7.2 EGYPT – FLOAT GLASS TECHNOLOGICAL ADVANCEMENTS

4.7.3 CONCLUSION

4.8 CHAPTER 1: INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.8.1.1 JOINT VENTURES

4.8.1.2 MERGERS AND ACQUISITIONS

4.8.1.3 LICENSING AND PARTNERSHIP

4.8.1.4 TECHNOLOGY COLLABORATIONS

4.8.1.5 STRATEGIC DIVESTMENTS

4.8.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.8.3 STAGE OF DEVELOPMENT

4.8.4 TIMELINES AND MILESTONES

4.8.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.6 RISK ASSESSMENT AND MITIGATION

4.9 RAW MATERIAL AND ENERGY PRICE VOLATILITY

4.9.1 HIGH CAPITAL EXPENDITURE AND LONG RETURN ON INVESTMENT (ROI) PERIODS

4.9.2 REGULATORY AND ENVIRONMENTAL COMPLIANCE RISKS

4.9.3 TECHNICAL AND SKILLS GAP

4.9.4 MARKET AND DEMAND RISKS

4.9.5 LOGISTICS AND DISTRIBUTION CHALLENGES

4.9.6 CONCLUSION

4.1 FUTURE OUTLOOK

4.11 CHAPTER 2: TARIFFS & IMPACT ON THE MARKET

4.11.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.11.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.11.3 VENDOR SELECTION CRITERIA DYNAMICS

4.11.4 IMPACT ON SUPPLY CHAIN

4.11.5 RAW MATERIAL PROCUREMENT

4.11.6 MANUFACTURING AND PRODUCTION

4.11.6.1 LOGISTICS AND DISTRIBUTION

4.11.6.2 PRICE PITCHING AND POSITION OF MARKET

4.11.7 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.11.7.1 SUPPLY CHAIN OPTIMIZATION

4.11.7.2 JOINT VENTURE ESTABLISHMENTS

4.11.8 IMPACT ON PRICES

4.11.9 REGULATORY INCLINATION

4.11.9.1 GEOPOLITICAL SITUATION

4.11.9.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.11.9.2.1 FREE TRADE AGREEMENTS

4.11.9.2.2 ALLIANCES ESTABLISHMENTS

4.11.9.3 STATUS ACCREDITATION (INCLUDING MFTN)

4.11.9.4 DOMESTIC COURSE OF CORRECTION

4.11.9.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.11.9.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

4.12 SUPPLY CHAIN ANALYSIS – SAUDI ARABIA & EGYPT FLOAT GLASS MARKET

4.12.1 OVERVIEW

4.12.2 LOGISTIC COST SCENARIO

4.12.2.1 INBOUND LOGISTICS FOR RAW MATERIALS

4.12.2.2 DOMESTIC DISTRIBUTION OF FLOAT GLASS SHEETS AND PROCESSED PRODUCTS

4.12.2.3 EXPORT LOGISTICS AND GLOBAL SHIPPING CONDITIONS

4.12.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.12.3.1 SPECIALIZED HANDLING AND DAMAGE PREVENTION

4.12.3.2 NETWORK DESIGN AND ROUTE OPTIMIZATION

4.12.3.3 CUSTOMS COMPLIANCE AND EXPORT FACILITATION

4.12.3.4 RESILIENCE AND RISK MANAGEMENT

4.12.3.5 ENHANCEMENT OF CUSTOMER SERVICE LEVELS

4.12.4 CONCLUSION

5 REGULATION COVERAGE – SAUDI ARABIA & EGYPT FLOAT GLASS MARKET

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.2.1 SAUDI ARABIA – SASO AND GSO/ISO

5.2.2 EGYPT – EOS AND MANDATORY DECREES

5.2.3 MULTI-STANDARD COMPLIANCE

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HAZARD IDENTIFICATION

6 MARKET OVERVIEW OF EGYPT

6.1 DRIVERS

6.1.1 CONSTRUCTION / BUILDING BOOM & RISING DEMAND FOR QUALITY BUILDING MATERIALS

6.1.2 RISING STANDARDS AND REGULATIONS PUSHING DEMAND FOR “GOOD QUALITY GLASS

6.1.3 EXPORT DEMAND — REGIONAL AND GLOBAL MARKETS

6.1.4 PRODUCT DIVERSIFICATION & INNOVATION (COATED, TINTED, ARCHITECTURAL/AUTOMOTIVE GLASS)

6.2 RESTRAINT

6.2.1 CURRENCY VOLATILITY INCREASES RAW MATERIAL IMPORT COSTS

6.2.2 STRONG REGIONAL COMPETITION PRESSURES DOMESTIC PRICE MARGINS

6.3 OPPORTUNITES

6.3.1 GROWING DEMAND FOR ENERGY-EFFICIENT AND “GREEN BUILDING” GLASS PRODUCTS

6.3.2 EXPORT EXPANSION TO UNDERSERVED REGIONAL MARKETS (MENA, AFRICA, GLOBAL)

6.3.3 FURTHER CAPACITY EXPANSION & MODERNIZATION CAN MEET GROWING GLOBAL QUALITY AND VOLUME DEMAND

6.4 CHALLENGES

6.4.1 OVERCAPACITY RISK FROM MULTIPLE NEW FLOAT LINES

6.4.2 DOMESTIC REGULATORY REQUIREMENTS INCREASE QUALITY-COMPLIANCE BURDENS FOR FLOAT-GLASS PRODUCERS

7 MARKET OVERVIEW OF SAUDI ARABIA

7.1 DRIVERS

7.1.1 BOOMING CONSTRUCTION & MEGA-PROJECTS FUEL SUSTAINED DEMAND FOR FLOAT GLASS IN SAUDI ARABIA

7.1.2 GROWTH OF AUTOMOTIVE & DIVERSIFIED APPLICATIONS

7.1.3 RISING DEMAND FOR ENERGY-EFFICIENT AND HIGH-PERFORMANCE GLASS IN SAUDI ARABIA

7.2 RESTRAINTS

7.2.1 VOLATILE RAW MATERIAL AND ENERGY COSTS

7.2.2 REGULATORY & ENVIRONMENTAL COMPLIANCE BURDENS

7.3 OPPORTUNITIES

7.3.1 GROWTH OF GREEN BUILDINGS & ENERGY-EFFICIENT CONSTRUCTIONS

7.3.2 PRODUCT AND TECHNOLOGY INNOVATION

7.3.3 REGIONAL GROWTH BEYOND MAJOR CITIES IN HOUSING AND RURAL DEVELOPMENT

7.4 CHALLENGES

7.4.1 HIGH COMPETITION AND PRICE PRESSURE

7.4.2 NEED FOR INVESTMENT IN ADVANCED MANUFACTURING & ENVIRONMENTAL COMPLIANCE

8 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY PRODUCT TYPE.

8.1 OVERVIEW

8.2 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, 2018-2033 (USD THOUSAND)

8.2.1 SAUDI ARABIA

8.2.2 EGYPT

8.3 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

8.3.1 CLEAR FLOAT GLASS

8.3.2 TINTED FLOAT GLASS

8.3.3 ONLINE COATED FLOAT (CVD/REFLECTIVE)

8.3.4 LOW-IRON (EXTRA CLEAR) FLOAT GLASS

8.3.5 MIRROR-GRADE FLOAT (SILVERING SUBSTRATE)

8.4 SAUDI ARABIA & EGYPT CLEAR FLOAT GLASS IN FLOAT GLASS MARKET, BY THICKNESS, 2018-2033 (USD THOUSAND)

8.4.1 4–6 MM

8.4.2 8–12 MM

8.4.3 2–3 MM

8.4.4 ABOVE 12 MM

8.5 SAUDI ARABIA & EGYPT CLEAR FLOAT GLASS IN FLOAT GLASS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

8.5.1 UNCOATED

8.5.2 HARD-COAT (PYROLYTIC)

8.5.3 SOFT-COAT (MAGNETRON)

8.6 SAUDI ARABIA & EGYPT CLEAR FLOAT GLASS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

8.6.1 SAUDI ARABIA

8.6.2 EGYPT

8.7 SAUDI ARABIA & EGYPT TINTED FLOAT GLASS IN FLOAT GLASS MARKET, BY COLOR, 2018-2033 (USD THOUSAND)

8.7.1 GREY

8.7.2 BRONZE

8.7.3 GREEN

8.7.4 BLUE

8.8 SAUDI ARABIA & EGYPT TINTED FLOAT GLASS IN FLOAT GLASS MARKET, BY THICKNESS, 2018-2033 (USD THOUSAND)

8.8.1 4–6 MM

8.8.2 8–12 MM

8.8.3 ABOVE 12 MM

8.9 SAUDI ARABIA & EGYPT TINTED FLOAT GLASS IN FLOAT GLASS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

8.9.1 UNCOATED

8.9.2 SOLAR CONTROL LOW-E

8.1 SAUDI ARABIA & EGYPT TINTED FLOAT GLASS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

8.10.1 SAUDI ARABIA

8.10.2 EGYPT

8.11 SAUDI ARABIA & EGYPT ONLINE COATED FLOAT (CVD/REFLECTIVE) IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

8.11.1 SAUDI ARABIA

8.11.2 EGYPT

8.12 SAUDI ARABIA & EGYPT LOW-IRON (EXTRA CLEAR) FLOAT GLASS IN FLOAT GLASS MARKET, BY THICKNESS, 2018-2033 (USD THOUSAND)

8.12.1 8–12 MM

8.12.2 4–6 MM

8.12.3 ABOVE 12 MM

8.13 SAUDI ARABIA & EGYPT LOW-IRON (EXTRA CLEAR) FLOAT GLASS IN FLOAT GLASS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

8.13.1 UNCOATED

8.13.2 LOW-E AND ANTI-REFLECTIVE

8.14 SAUDI ARABIA & EGYPT LOW-IRON (EXTRA CLEAR) FLOAT GLASS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

8.14.1 SAUDI ARABIA

8.14.2 EGYPT

8.15 SAUDI ARABIA & EGYPT MIRROR-GRADE FLOAT (SILVERING SUBSTRATE) IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

8.15.1 SAUDI ARABIA

8.15.2 EGYPT

9 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY COATING TYPE

9.1 OVERVIEW

9.2 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY COATING TYPE, 2018-2033 (USD THOUSAND)

9.2.1 UNCOATED FLOAT

9.2.2 HARD-COAT (PYROLYTIC)

9.2.3 SOFT-COAT (MAGNETRON SPUTTERED)

9.2.4 OTHER FUNCTIONAL COATINGS

9.2.5 SAUDI ARABIA & EGYPT UNCOATED FLOAT IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

9.2.6 SAUDI ARABIA

9.2.7 EGYPT

9.3 SAUDI ARABIA & EGYPT HARD-COAT (PYROLYTIC) IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

9.3.1 SAUDI ARABIA

9.3.2 EGYPT

9.4 SAUDI ARABIA & EGYPT SOFT-COAT (MAGNETRON SPUTTERED) IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

9.4.1 SAUDI ARABIA

9.4.2 EGYPT

9.5 SAUDI ARABIA & EGYPT OTHER FUNCTIONAL COATINGS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

9.5.1 SAUDI ARABIA

9.5.2 EGYPT

10 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

10.2.1 BUILDING & CONSTRUCTION

10.2.2 AUTOMOTIVE & TRANSPORT

10.2.3 SOLAR ENERGY

10.2.4 FURNITURE & APPLIANCES

10.2.5 OTHERS

10.3 SAUDI ARABIA & EGYPT BUILDING & CONSTRUCTION IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.3.1 EXTERIOR GLAZING

10.3.2 INTERIOR

10.4 SAUDI ARABIA & EGYPT EXTERIOR GLAZING IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.4.1 CURTAIN WALLS & FACADES

10.4.2 WINDOWS & FENESTRATION

10.4.3 SKYLIGHTS

10.5 SAUDI ARABIA & EGYPT INTERIOR IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.5.1 PARTITIONS & BALUSTRADES

10.5.2 MIRRORS

10.6 SAUDI ARABIA & EGYPT BUILDING & CONSTRUCTION IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

10.6.1 SAUDI ARABIA

10.6.2 EGYPT

10.7 SAUDI ARABIA & EGYPT AUTOMOTIVE & TRANSPORT IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.7.1 WINDSCREENS (LAMINATED)

10.7.2 SIDE & BACKLITES (TEMPERED)

10.7.3 SUNROOFS

10.8 SAUDI ARABIA & EGYPT AUTOMOTIVE & TRANSPORT IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

10.8.1 SAUDI ARABIA

10.8.2 EGYPT

10.9 SAUDI ARABIA & EGYPT SOLAR ENERGY IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.9.1 SOLAR PV MODULE GLASS

10.9.2 SOLAR THERMAL COLLECTOR GLASS

10.1 SAUDI ARABIA & EGYPT SOLAR ENERGY IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

10.10.1 SAUDI ARABIA

10.10.2 EGYPT

10.11 SAUDI ARABIA & EGYPT FURNITURE & APPLIANCES IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 FURNITURE GLASS

10.11.2 HOME APPLIANCE GLASS

10.12 SAUDI ARABIA & EGYPT FURNITURE & APPLIANCES IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

10.12.1 SAUDI ARABIA

10.12.2 EGYPT

10.13 SAUDI ARABIA & EGYPT OTHERS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

10.13.1 SAUDI ARABIA

10.13.2 EGYPT

11 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY END USE.

11.1 OVERVIEW

11.2 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

11.2.1 OEMS AND PROCESSORS

11.2.2 DISTRIBUTORS & WHOLESALE

11.2.3 RETAIL AND SMALL FABRICATORS

11.2.4 OTHERS

11.3 SAUDI ARABIA & EGYPT OEMS AND PROCESSORS IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 ARCHITECTURAL PROCESSORS

11.3.2 AUTOMOTIVE GLASS FABRICATORS

11.4 SAUDI ARABIA & EGYPT OEMS AND PROCESSORS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

11.4.1 SAUDI ARABIA

11.4.2 EGYPT

11.5 SAUDI ARABIA & EGYPT DISTRIBUTORS & WHOLESALE IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

11.5.1 SAUDI ARABIA

11.5.2 EGYPT

11.6 SAUDI ARABIA & EGYPT RETAIL AND SMALL FABRICATORS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

11.6.1 SAUDI ARABIA

11.6.2 EGYPT

11.7 SAUDI ARABIA & EGYPT OTHERS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

11.7.1 SAUDI ARABIA

11.7.2 EGYPT

12 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.2.1 DIRECT

12.2.2 INDIRECT

12.3 SAUDI ARABIA & EGYPT DIRECT IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.3.1 SALES DIRECTLY FROM MANUFACTURER TO CONSTRUCTION/COMMERCIAL PROJECT

12.3.2 MANUFACTURER TO OEM EQUIPMENT

12.3.3 MANUFACTURER TO LARGE REAL-ESTATE DEVELOPER

12.3.4 DIRECT E-COMMERCE

12.4 SAUDI ARABIA & EGYPT DIRECT IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

12.4.1 SAUDI ARABIA

12.4.2 EGYPT

12.5 SAUDI ARABIA & EGYPT INDIRECT IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.5.1 DISTRIBUTOR/WHOLESALER SALES

12.5.2 GLASS & GLAZING FABRICATORS

12.5.3 BUILDING-MATERIAL RETAILERS

12.5.4 STOCKIST/WAREHOUSE CHANNEL

12.6 SAUDI ARABIA & EGYPT INDIRECT IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

12.6.1 SAUDI ARABIA

12.6.2 EGYPT

13 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13.2 COMPANY SHARE ANALYSIS: EGYPT

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 UNITED FLOAT GLASS

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 XINYI GLASS HOLDINGS LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 OBEIKAN GLASS COMPANY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 GUARDIAN INDUSTRIES HOLDINGS

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 SPHINX

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AL JAZEERA GLASS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ARAB UNION GLASS CO., LTD

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AL ANDALUS GLASS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CHINA GLASS HOLDINGS LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 DR. GREICHE GLASS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EGYPTIAN GLASS COMPANY

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 GUARDIAN INDUSTRIES HOLDINGS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MANNA GLASS CO.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MOHAMMED MANNAA GLASS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SISECAM

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 NUMBER OF PRODUCTS IN DEVELOPMENT

TABLE 2 TIMELINES AND MILESTONES IN THE SAUDI ARABIA & EGYPT FLOAT GLASS INDUSTRY

TABLE 3 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, 2018-2033 (USD THOUSAND)

TABLE 4 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 SAUDI ARABIA & EGYPT CLEAR FLOAT GLASS IN FLOAT GLASS MARKET, BY THICKNESS, 2018-2033 (USD THOUSAND)

TABLE 6 SAUDI ARABIA & EGYPT CLEAR FLOAT GLASS IN FLOAT GLASS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 7 SAUDI ARABIA & EGYPT CLEAR FLOAT GLASS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 8 SAUDI ARABIA & EGYPT TINTED FLOAT GLASS IN FLOAT GLASS MARKET, BY COLOR, 2018-2033 (USD THOUSAND)

TABLE 9 SAUDI ARABIA & EGYPT TINTED FLOAT GLASS IN FLOAT GLASS MARKET, BY THICKNESS, 2018-2033 (USD THOUSAND)

TABLE 10 SAUDI ARABIA & EGYPT TINTED FLOAT GLASS IN FLOAT GLASS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 11 SAUDI ARABIA & EGYPT TINTED FLOAT GLASS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 12 SAUDI ARABIA & EGYPT ONLINE COATED FLOAT (CVD/REFLECTIVE) IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 13 SAUDI ARABIA & EGYPT LOW-IRON (EXTRA CLEAR) FLOAT GLASS IN FLOAT GLASS MARKET, BY THICKNESS, 2018-2033 (USD THOUSAND)

TABLE 14 SAUDI ARABIA & EGYPT LOW-IRON (EXTRA CLEAR) FLOAT GLASS IN FLOAT GLASS MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 15 SAUDI ARABIA & EGYPT LOW-IRON (EXTRA CLEAR) FLOAT GLASS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 16 SAUDI ARABIA & EGYPT MIRROR-GRADE FLOAT (SILVERING SUBSTRATE) IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 17 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY COATING TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 SAUDI ARABIA & EGYPT UNCOATED FLOAT IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 19 SAUDI ARABIA & EGYPT HARD-COAT (PYROLYTIC) IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 20 SAUDI ARABIA & EGYPT SOFT-COAT (MAGNETRON SPUTTERED) IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 21 SAUDI ARABIA & EGYPT OTHER FUNCTIONAL COATINGS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 22 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 23 SAUDI ARABIA & EGYPT BUILDING & CONSTRUCTION IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 SAUDI ARABIA & EGYPT EXTERIOR GLAZING IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 SAUDI ARABIA & EGYPT INTERIOR IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 SAUDI ARABIA & EGYPT BUILDING & CONSTRUCTION IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 27 SAUDI ARABIA & EGYPT AUTOMOTIVE & TRANSPORT IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 SAUDI ARABIA & EGYPT AUTOMOTIVE & TRANSPORT IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 29 SAUDI ARABIA & EGYPT SOLAR ENERGY IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 SAUDI ARABIA & EGYPT SOLAR ENERGY IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 31 SAUDI ARABIA & EGYPT FURNITURE & APPLIANCES IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 SAUDI ARABIA & EGYPT FURNITURE & APPLIANCES IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 33 SAUDI ARABIA & EGYPT OTHERS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 34 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 35 SAUDI ARABIA & EGYPT OEMS AND PROCESSORS IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 SAUDI ARABIA & EGYPT OEMS AND PROCESSORS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 37 SAUDI ARABIA & EGYPT DISTRIBUTORS & WHOLESALE IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 38 SAUDI ARABIA & EGYPT RETAIL AND SMALL FABRICATORS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 39 SAUDI ARABIA & EGYPT OTHERS IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 40 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 41 SAUDI ARABIA & EGYPT DIRECT IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 SAUDI ARABIA & EGYPT DIRECT IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 43 SAUDI ARABIA & EGYPT INDIRECT IN FLOAT GLASS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 SAUDI ARABIA & EGYPT INDIRECT IN FLOAT GLASS MARKET, BY STATE, 2018-2033 (USD THOUSAND)

图片列表

FIGURE 1 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA FLOAT GLASS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EGYPT FLOAT GLASS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA FLOAT GLASS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EGYPT FLOAT GLASS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SAUDI ARABIA FLOAT GLASS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 EGYPT FLOAT GLASS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 13 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: SEGMENTATION

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 BOOMING CONSTRUCTION & MEGA-PROJECTS IS A MAJOR FACTOR BOOSTING THE SAUDI ARABIA & EGYPT FLOAT GLASS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 CLEAR FLOAT GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SAUDI ARABIA & EGYPT FLOAT GLASS MARKET IN 2026 & 2033

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 VALUE CHAIN ANALYSIS FOR SAUDI ARABIA AND EGYPT FLOAT GLASS MARKET

FIGURE 19 TOTAL NUMBER OF DEALS

FIGURE 20 DEALS BY TYPE

FIGURE 21 DEALS BY SEGMENT

FIGURE 22 EGYPT FLOAT GLASS MARKET: COMPANY SHARE 2025 (%)

FIGURE 23 SAUDI ARABIA FLOAT GLASS MARKET: COMPANY SHARE 2025 (%)

FIGURE 24 DROC ANALYSIS

FIGURE 25 DROC ANALYSIS

FIGURE 26 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY PRODUCT TYPE, 2025

FIGURE 27 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY COATING TYPE, 2025

FIGURE 28 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY APPLICATION, 2025

FIGURE 29 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY END USE, 2025

FIGURE 30 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 31 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: COMPANY SHARE 2025 (%)

FIGURE 32 SAUDI ARABIA & EGYPT FLOAT GLASS MARKET: COMPANY SHARE 2025 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。