Southeast Asia Refrigerant Market

市场规模(十亿美元)

CAGR :

%

USD

1.15 Billion

USD

1.78 Billion

2024

2032

USD

1.15 Billion

USD

1.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.15 Billion | |

| USD 1.78 Billion | |

|

|

|

|

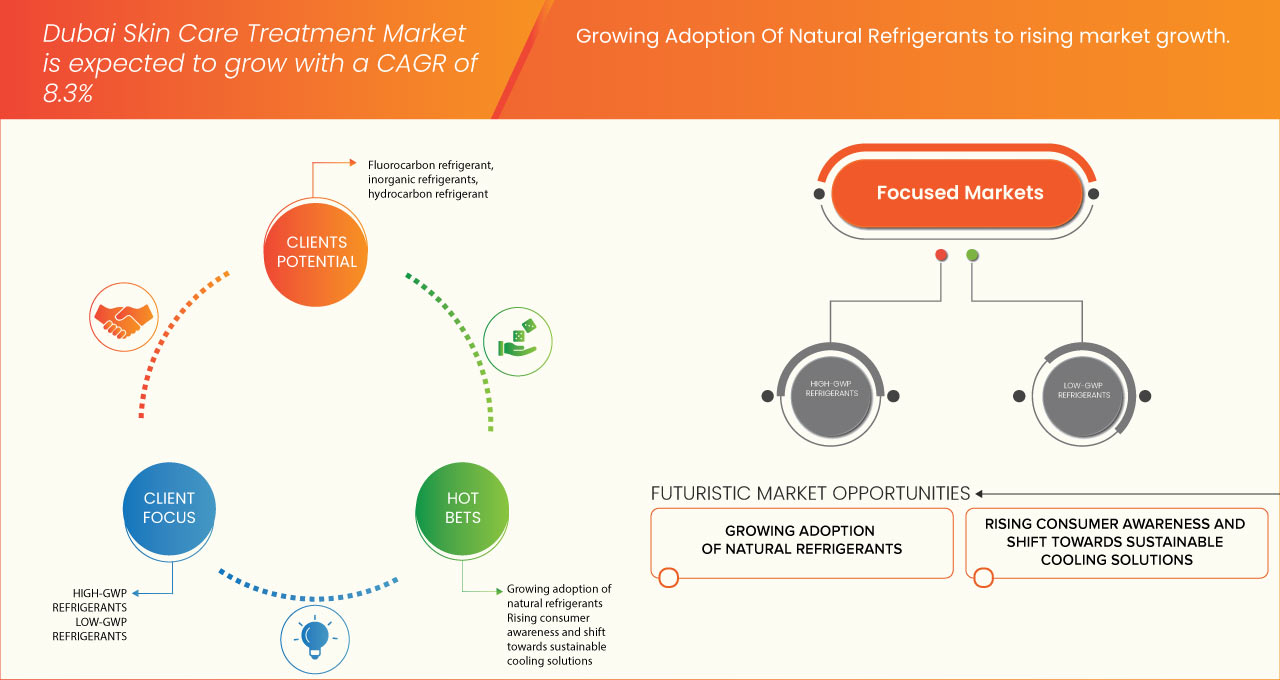

東南亞冷媒市場細分,按產品(氟碳冷媒和無機製冷劑、碳氫冷媒)、GWP 類別(高 GWP 冷媒和低 GWP 冷媒)、應用(空調、冷媒、冷水機組、熱泵等)、最終用途(商用冷媒、工業冷媒)、應用(空調、冷氣、冷水機組、熱泵等)、最終用途(商用冷氣、工業冷氣及咖啡/家庭冷氣/家庭冷度預測

東南亞冷媒市場規模

- 2024 年東南亞冷媒市場規模為11.48 億美元 ,預計 到 2032 年將達到 17.83 億美元,預測期內 複合年增長率為 5.7%。

- 市場成長主要受到冷鏈物流、製藥和食品加工行業的成長以及對節能環保冷氣解決方案的需求不斷增長的推動

- 此外,市場預計將見證冷媒系統的技術進步和嚴格的環境法規,以促進低 GWP 冷媒

東南亞冷媒市場分析

- 隨著東南亞經濟發展加速和城鎮化進程的推進,住宅和商業基礎設施建設的不斷增長、可支配收入的提高以及氣候相關熱應力的不斷加大,對高效製冷系統的需求也日益增長。這推動了對先進環保冷媒解決方案的強勁需求。

- 這種市場轉變正在加速零售、酒店、資料中心和製造等行業採用低 GWP(全球暖化潛勢)冷媒、二氧化碳和氨等天然替代品以及節能暖通空調系統

- 2024 年,印尼憑藉其龐大的工業基礎、快速的城市化進程、不斷增長的空調和製冷需求以及對環保冷媒技術的投資不斷增加,佔據東南亞冷媒市場的主導地位

- 預計在預測期內,泰國將成為東南亞冷媒市場中複合年增長率最高的國家,這得益於其不斷擴大的工業部門、對環保製冷劑的強有力的監管支持以及先進製冷技術的日益普及

- 氟碳冷媒在東南亞冷媒市場佔據主導地位,2024 年市場份額為 50.48%,主要受冷鏈物流、製藥和食品加工行業的增長以及對節能環保製冷解決方案的需求不斷增長的推動

報告範圍和東南亞冷媒市場細分

|

屬性 |

東南亞冷媒關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。 |

東南亞冷媒市場趨勢

“日益增長的監管壓力推動向環保冷媒的轉變”

- 隨著該地區各國政府實施更嚴格的環境法規並致力於遵守國際氣候協議,企業和消費者越來越優先考慮低全球暖化潛勢製冷劑,以減少碳足跡,從而推動對永續製冷技術的強勁需求

- 這項監管措施正在鼓勵逐步減少高全球暖化潛勢氫氟碳化物 (HFC),並採用氨和二氧化碳等天然冷媒,以及符合新標準的節能暖通空調系統

- 隨著對永續性的日益關注,製造商和服務提供者正在創新,提供滿足性能和環境要求的更環保的替代品,將冷媒市場定位為區域氣候目標的關鍵參與者

東南亞冷媒市場動態

司機

“皮膚護理服務的創新”

- 智慧感測器、物聯網監控和先進冷媒混合物等尖端技術的融合,正在改變該地區的冷媒系統市場,推動更高的效率、永續性和系統智慧化。這些創新實現了即時效能追蹤、預測性維護和能耗優化,從根本上重塑了冷凍系統的運作和維護方式。

- 智慧技術與環保冷媒之間的協同作用正在提高系統可靠性和環境合規性,滿足商業、工業和住宅領域對更環保、更智慧的製冷解決方案日益增長的需求

- 市場也受惠於氨和二氧化碳等天然冷媒的進步,以及減少洩漏和延長使用壽命的改良系統設計,吸引了許多注重永續性和成本效益的終端用戶。這些技術創新支持向節能環保的冷凍基礎設施轉型,顯著促進了市場擴張。

- 隨著技術進步的加速,智慧環保冷媒系統的不斷發展預計將成為冷媒市場成長的主要驅動力,從而加強該地區對永續發展和氣候目標的承諾

克制/挑戰

“過渡到新冷媒和新設備的初始投資高昂”

- 採用新冷媒和升級設備的高昂初始投資成本嚴重限制了冷媒市場的發展,尤其是在中小企業中。儘管節能和合規性具有長期效益,但改造或安裝現代系統所需的前期資金可能令人望而卻步。

- 該地區經濟格局多元,企業財務能力參差不齊,因此在技術進步與成本效益之間取得平衡至關重要。高昂的轉型成本可能會限制環保冷媒的市場滲透,阻礙那些優先考慮短期營運預算而非長期永續發展目標的企業。這種成本敏感度凸顯了融資解決方案、激勵措施或分階段實施策略的必要性,以減輕最終用戶的負擔。

- 有效解決這一財務障礙對於加速採用下一代冷媒技術並確保商業和工業領域更廣泛的市場成長至關重要

- 新冷媒和設備所需的大量資本支出仍然是一個關鍵挑戰,特別是對於在價格敏感或資源受限的環境中運營的企業而言,這可能會減緩市場擴張的速度

東南亞冷媒市場範圍

市場根據治療類型、類型、手術類型和性別進行細分

- 按產品

根據產品類型,東南亞冷媒市場細分為氟碳冷媒、無機製冷劑和碳氫化合物。 2024年,氟碳冷媒佔據主導地位,市佔率達50.48%,預測期間(2025年至2032年)的複合年增長率為5.1%,是成長最快的冷媒類別。

預計氟碳冷媒在 2025 年至 2032 年間將實現 9.6% 的最快複合年增長率,這得益於市場預計將見證冷媒系統的技術進步以及嚴格的環境法規推廣低 GWP 冷媒。

- 按 GWP 類別

根據類型,東南亞冷媒市場可分為高GWP冷媒和低GWP冷媒。 2024年,高GWP冷媒佔據主導地位,市佔率達60.43%,預測期內複合年增長率為56.16%,這得益於其卓越的製冷效率、廣泛的工業和商業用途,以及低GWP替代品的採用速度較慢。

預計低 GWP 冷媒在預測期內(2025 年至 2032 年)也將實現最快的複合年增長率 5.1%,這得益於市場預計將見證冷媒系統的技術進步和嚴格的環境法規來促進低 GWP 冷媒的發展。

- 按應用

根據手術類型,東南亞冷媒市場細分為空調、冷氣、冷水機組、熱泵和其他。 2024 年,空調以 45.33% 的市佔率佔據市場主導地位,預計在 2025 年至 2032 年期間將見證 5.2% 的最快複合年增長率,受市場推動,預計將見證冷媒系統的技術進步和嚴格的環境法規推廣低 GWP 冷媒。

- 按最終用途

根據最終用途,東南亞冷媒市場細分為商用冷凍、工業冷凍和家用冷凍。 2024年,商用冷凍佔63.60%的市場份額,預計2025年至2032年期間將以5.0%的複合年增長率保持最快增長勢頭,這主要得益於冷媒系統技術的進步以及嚴格的環境法規對低全球暖化推廣能值冷媒的潛能值冷媒的潛能值。

東南亞冷媒市場區域分析

- 預計到 2032 年,印尼冷媒市場規模將從 2024 年的 3.2002 億美元增至 4.4949 億美元,在 2025 年至 2032 年的預測期內,複合年增長率為 4.5%

- 印尼正在將越來越多的國家預算用於工業發展和環境永續性,其中包括對環保冷媒和先進冷凍技術的投資。人們對氣候變遷、能源效率和環境法規的認識日益增強,推動公共和私營部門加大資金投入,支持向低全球暖化潛勢 (GWP) 冷媒的轉型。這些資金支持在全國範圍內擴大可持續冷媒解決方案的可及性方面發揮著至關重要的作用。

- 在印度尼西亞,受城鎮化、工業擴張以及空調和製冷系統需求成長的推動,冷媒市場正在快速成長。隨著該國暖通空調和冷凍產業日益集中化,並日益向私營部門開放,對先進環保冷媒技術的投資顯著增加。這些趨勢正在推動市場大幅成長,並提升現代冷媒解決方案在全國範圍內的可及性和採用率。

泰國東南亞冷媒市場洞察

預計2025年至2032年泰國冷媒市場在東南亞地區的複合年增長率將達到5.4%,主要得益於市場預計將見證冷媒系統的技術進步以及嚴格的環境法規推廣低GWP冷媒。

越南東南亞冷媒市場洞察

預計越南 冷媒市場在 2025 年至 2032 年期間的複合年增長率將達到 5.3%,這主要得益於市場預計將見證冷媒系統的技術進步以及嚴格的環境法規推廣低 GWP 冷媒。

東南亞冷媒市場份額

東南亞冷媒產業主要由知名公司主導:

- 林德公司(英國)

- 液化空氣集團(法國)

- 科慕公司(美國)

- 大金工業株式會社(日本)

- 阿科瑪(法國)

- 霍尼韋爾國際公司(美國)

- SOL Spa(義大利)

- 東岳集團(中國)

- 英國國家冷媒有限公司

- GTS SPA(義大利)

東南亞冷媒市場最新動態

- 2024年,公司為實驗室和大型科學設備設計和供應冷凍、液化、低溫流體儲存和分配系統。我們採用集諮詢、設計、調試、測試和維護於一體的全球化方案,滿足每位客戶的特定需求。

- 2025年5月,阿科瑪擴展了其低全球暖化潛勢值 (GWP) 冷媒產品組合,現提供一系列 HFO(氫氟烯烴)混合物,包括 Forane 454B (R-454B)、Forane 448A (R-448A)、Forane 449A (R-49495) 4095(Rane 449A (R-49) 513A (R-513A)。此次產品擴展源自阿科瑪與霍尼韋爾國際公司達成的商業協議,旨在加強可持續暖通空調製冷 (HVACR) 解決方案的全球供應鏈,滿足 HFC 逐步淘汰法規帶來的日益增長的需求。

- 2025年4月,A-Gas Singapore成為新加坡唯一獲得國家環境局(NEA)授權,可收集並處理廢棄冷媒(作為有毒工業廢棄物)的公司。這確立了A-Gas作為新加坡領先且唯一一家完全合規的負責任冷媒生命週期管理供應商的地位,以協助環境保護。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 CLIMATE CHANGE SCENARIO

4.4 IMPORT EXPORT SCENARIO

4.5 PRICING ANALYSIS

4.6 PRODUCTION CAPACITY ANALYSIS

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.8 RAW MATERIAL COVERAGE –

4.9 SUPPLY CHAIN ANALYSIS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURER

4.11 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN COLD CHAIN LOGISTICS, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES

6.1.2 INCREASING DEMAND FOR ENERGY-EFFICIENT AND ECO-FRIENDLY REFRIGERATION SOLUTIONS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN REFRIGERANT SYSTEMS

6.1.4 STRINGENT ENVIRONMENTAL REGULATIONS PROMOTING LOW-GWP REFRIGERANTS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT IN TRANSITIONING TO NEW REFRIGERANTS AND EQUIPMENT

6.2.2 SAFETY CONCERNS RELATED TO FLAMMABLE OR TOXIC REFRIGERANTS

6.3 OPPORTUNITIES

6.3.1 GROWING ADOPTION OF NATURAL REFRIGERANTS

6.3.2 GOVERNMENT INCENTIVES FOR GREEN AND ENERGY-EFFICIENT REFRIGERATION TECHNOLOGIES

6.3.3 RISING CONSUMER AWARENESS AND SHIFT TOWARDS SUSTAINABLE COOLING SOLUTIONS

6.4 CHALLENGES

6.4.1 HIGH COSTS OF R&D IN SUSTAINABLE REFRIGERANT

6.4.2 COMPLEX RETROFITTING REQUIREMENTS FOR EXISTING REFRIGERATION SYSTEMS

7 SOUTHEAST ASIA REFRIGERANT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLUOROCARBON REFRIGERANT

7.2.1 FLUOROCARBON REFRIGERANT, BY PRODUCT

7.2.1.1 HYDROFLUOROCARBONS (HFCS)

7.2.1.2 HYDROCHLOROFLUOROCARBONS HCFCS)

7.2.1.3 HYDROFLUOROOLEFINS (HFOS)

7.2.1.4 OTHERS

7.2.1.5 HYDROFLUOROOLEFINS (HFOS), BY PRODUCT

7.2.1.5.1 R-1234ZE

7.2.1.5.2 R-1234YF

7.3 INORGANIC REFRIGERANTS

7.3.1 INORGANIC REFRIGERANT, BY PRODUCT

7.3.1.1 AMMONIA

7.3.1.2 CARBON DIOXIDE

7.3.1.3 WATER

7.3.1.4 OTHERS

7.4 HYDROCARBON REFRIGERANT

7.4.1 HYDROCARBON REFRIGERANT, BY PRODUCT

7.4.1.1 PROPANE (R-290)

7.4.1.2 ISO-BUTANE (R-600A)

7.4.1.3 PROPYLENE

7.4.1.4 BUTANE (R-600)

7.4.1.5 METHANE

7.4.1.6 ETHANE

7.4.1.7 ETHYLENE

7.4.1.8 OTHERS

8 SOUTHEAST ASIA REFRIGERANT MARKET, BY GWP CATEGORY

8.1 OVERVIEW

8.2 HIGH-GWP REFRIGERANTS

8.3 LOW-GWP REFRIGERANTS

9 SOUTHEAST ASIA REFRIGERANT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AIR CONDITIONING

9.2.1 AIR CONDITIONING, BY TYPE

9.2.1.1 STATIONARY AIR CONDITIONING

9.2.1.2 MOBILE AIR CONDITIONING

9.2.1.3 OTHERS

9.3 REFRIGERATION

9.4 CHILLERS

9.5 HEAT PUMPS

9.6 OTHERS

10 SOUTHEAST ASIA REFRIGERANT MARKET, BY END USE

10.1 OVERVIEW

10.2 COMMERCIAL REFRIGERATION

10.2.1 COMMERCIAL REFRIGERATION, BY TYPE

10.2.1.1 HOTELS & RESTAURANTS

10.2.1.2 OFFICE SPACES

10.2.1.3 SUPERMARKETS/HYPERMARKETS

10.2.1.4 OTHERS

10.3 INDUSTRIAL REFRIGERATION

10.3.1 INDUSTRIAL REFRIGERATION, BY TYPE

10.3.1.1 CHEMICAL & PETROCHEMICAL

10.3.1.2 PHARMACEUTICALS

10.3.1.3 FOOD & BEVERAGE

10.3.1.4 AUTOMOTIVE

10.3.1.5 HEALTHCARE

10.3.1.6 OTHERS

10.3.1.7 AUTOMOTIVE, BY TYPE

10.3.1.7.1 PASSENGER VEHICLES

10.3.1.7.2 COMMERCIAL VEHICLES

10.4 DOMESTIC/HOUSEHOLD REFRIGERATION

11 SOUTHEAST ASIA REFRIGERANT MARKET BY COUNTRIES

11.1 SOUTHEAST ASIA

11.1.1 INDONESIA

11.1.2 THAILAND

11.1.3 VIETNAM

11.1.4 MALAYSIA

11.1.5 PHILIPPINES

11.1.6 SINGAPORE

11.1.7 MYANMAR

11.1.8 REST OF SOUTHEAST ASIA

12 SOUTHEAST ASIA REFRIGERANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LINDE PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 AIR LIQUIDE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 THE CHEMOURS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT/NEWS

14.4 DAIKIN INDUSTRIES, LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ARKEMA

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT/NEWS

14.6 A-GAS INTERNATIONAL LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 DONGYUE GROUP

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 EASTERN WINTER TRADING PTE LTD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ENTALPIA EUROPE

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 GLOBAL GASES GROUP THAILAND CO LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 GTS SPA

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 HONEYWELL INTERNATIONAL INC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 PVCK.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 RHODIA CHEMICALS LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SRF

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 SUMMARY OF PRODUCTION CAPACITY:

TABLE 2 REGIONAL COMPARISON:

TABLE 3 THE REFRIGERANTS USED ACROSS SOUTHEAST ASIA:

TABLE 4 REGIONAL PRODUCTION VS. IMPORT DEPENDENCY

TABLE 5 REGULATORY COVERAGE

TABLE 6 SOUTHEAST ASIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 7 SOUTHEAST ASIA FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 SOUTHEAST ASIA HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 SOUTHEAST ASIA INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 10 SOUTHEAST ASIA HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 11 SOUTHEAST ASIA REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 12 SOUTHEAST ASIA REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 SOUTHEAST ASIA AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 SOUTHEAST ASIA REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 15 SOUTHEAST ASIA COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 SOUTHEAST ASIA INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 SOUTHEAST ASIA AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 SOUTHEAST ASIA REFRIGERANT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 19 INDONESIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 20 INDONESIA FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 INDONESIA HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 22 INDONESIA INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 23 INDONESIA HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 INDONESIA REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 25 INDONESIA REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 INDONESIA AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 INDONESIA REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 28 INDONESIA COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 INDONESIA INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 INDONESIA AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 THAILAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 32 THAILAND FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 33 THAILAND HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 34 THAILAND INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 35 THAILAND HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 36 THAILAND REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 37 THAILAND REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 38 THAILAND AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 THAILAND REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 40 THAILAND COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 THAILAND INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 THAILAND AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 VIETNAM REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 44 VIETNAM FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 45 VIETNAM HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 VIETNAM INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 VIETNAM HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 48 VIETNAM REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 49 VIETNAM REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 VIETNAM AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 VIETNAM REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 52 VIETNAM COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 VIETNAM INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 VIETNAM AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MALAYSIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 56 MALAYSIA FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 57 MALAYSIA HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 MALAYSIA INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 59 MALAYSIA HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 60 MALAYSIA REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 61 MALAYSIA REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 MALAYSIA AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MALAYSIA REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 64 MALAYSIA COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MALAYSIA INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MALAYSIA AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 PHILIPPINES REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 PHILIPPINES FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 69 PHILIPPINES HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 70 PHILIPPINES INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 71 PHILIPPINES HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 72 PHILIPPINES REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 73 PHILIPPINES REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 74 PHILIPPINES AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 PHILIPPINES REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 76 PHILIPPINES COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 PHILIPPINES INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 PHILIPPINES AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 SINGAPORE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 SINGAPORE FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 81 SINGAPORE HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 82 SINGAPORE INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 83 SINGAPORE HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 SINGAPORE REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 85 SINGAPORE REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 86 SINGAPORE AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 SINGAPORE REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 88 SINGAPORE COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SINGAPORE INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 SINGAPORE AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MYANMAR REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 MYANMAR FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 93 MYANMAR HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 94 MYANMAR INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 95 MYANMAR HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 96 MYANMAR REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 97 MYANMAR REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 MYANMAR AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MYANMAR REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 100 MYANMAR COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MYANMAR INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MYANMAR AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 REST OF SOUTHEAST ASIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 SOUTHEAST ASIA REFRIGERANT MARKET

FIGURE 2 SOUTHEAST ASIA REFRIGERANT MARKET: DATA TRIANGULATION

FIGURE 3 SOUTHEAST ASIA REFRIGERANT MARKET: DROC ANALYSIS

FIGURE 4 SOUTHEAST ASIA REFRIGERANT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 SOUTHEAST ASIA REFRIGERANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SOUTHEAST ASIA REFRIGERANT MARKET: MULTIVARIATE MODELLING

FIGURE 7 SOUTHEAST ASIA REFRIGERANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SOUTHEAST ASIA REFRIGERANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SOUTHEAST ASIA REFRIGERANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 SOUTHEAST ASIA REFRIGERANT MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 THREE SEGMENTS COMPRISE THE SOUTHEAST ASIA REFRIGERANT MARKET, BY PRODUCT (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWTH IN COLD CHAIN LOGISTICS, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES IS EXPECTED TO DRIVE THE SOUTHEAST ASIA REFRIGERANT MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE FLUOROCARBON REFRIGERANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SOUTHEAST ASIA REFRIGERANT MARKET IN 2025 AND 2032

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SOUTHEAST ASIA REFRIGERANT MARKET

FIGURE 19 SOUTHEAST ASIA REFRIGERANT MARKET: BY PRODUCT, 2024

FIGURE 20 SOUTHEAST ASIA REFRIGERANT MARKET, BY GWP CATEGORY, 2024

FIGURE 21 SOUTHEAST ASIA REFRIGERANT MARKET: BY APPLICATION, 2024

FIGURE 22 SOUTHEAST ASIA REFRIGERANT MARKET: BY END USE, 2024

FIGURE 23 SOUTHEAST ASIA REFRIGERANT MARKET: SNAPSHOT (2024)

FIGURE 24 SOUTHEAST ASIA REFRIGERANT MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。