North America Long Chain Polyamide Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

798.55 Million

USD

1,107.78 Million

2024

2032

USD

798.55 Million

USD

1,107.78 Million

2024

2032

| 2025 –2032 | |

| USD 798.55 Million | |

| USD 1,107.78 Million | |

|

|

|

North America Long Chain Polyamide Market Segmentation, By Type (PA 11, PA 12, PA 610, PA 612, PA 410, PA 1010, PA 1012, and Others), Source (Artificially Made and Naturally Occuring), Form (Chips, Powder, and Others), Application (Engineering Plastics, Polyamide Fibers & Fabrics, Polyamide Films, Polyamide Adhesives, Coatings, and Others), End-Use (Electrical & Electronics, Healthcare, Industrial, Automotive, Consumer Goods, Packaging, Aerospace & Defense, Oil & Gas, Energy, and Others) - Industry Trends and Forecast to 2032

North America Long Chain Polyamide Market Analysis

The long chain polyamide (LCPA) market is experiencing steady growth due to its widespread use in automotive, electrical, electronics, and industrial applications. These high-performance materials, characterized by superior thermal stability, chemical resistance, and mechanical properties, are increasingly replacing traditional metals and polymers. The automotive sector drives demand, with LCPA being used in fuel systems, connectors, and under-the-hood applications. In addition, growing electric vehicle production and the trend toward lightweight components further boost market prospects. Asia-Pacific leads in market share, driven by industrial expansion, while North America and Europe also contribute significantly due to technological advancements and sustainable material innovations.

Long Chain Polyamide Market Size

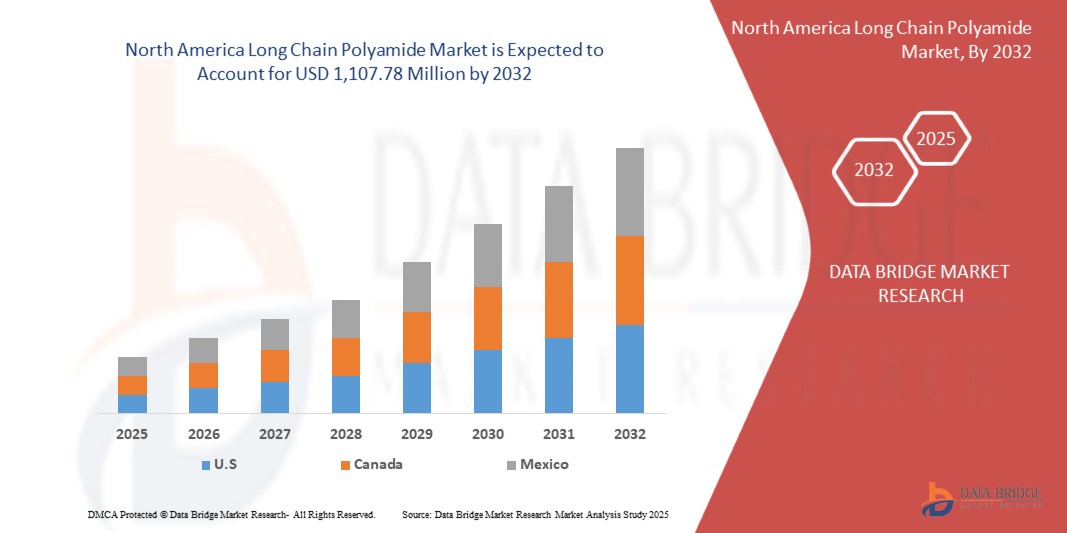

North America long chain polyamide market size was valued at USD 798.55 million in 2024 and is projected to reach USD 1,107.78 million by 2032, with a CAGR of 4.28% during the forecast period of 2024 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Long Chain Polyamide Market

“Widespread Use in Automotive, Electrical, Electronics, And Industrial Applications”

Long Chain Polyamide (LCPA) is increasingly popular in automotive, electrical, electronics, and industrial applications due to its excellent thermal stability, mechanical strength, and chemical resistance. In the automotive industry, LCPA is used for lightweight components, fuel systems, connectors, and under-the-hood parts, contributing to improved fuel efficiency and vehicle performance. In electrical and electronics, LCPA’s insulating properties make it ideal for connectors, wires, and circuit boards. Its durability also benefits industrial applications, where LCPA is used in gears, bearings, and machinery parts. These attributes enable LCPA to replace traditional materials, driving efficiency and sustainability across diverse sectors.

Report Scope and Market Segmentation

|

Attributes |

Long Chain Polyamide Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

LG Chem (South Korea), BASF (Germany), Arkema (France), Evonik Industries AG (Germany), DuPont (U.S.), Asahi Kasei Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), MITSUI CHEMICALS AMERICA, INC. (Japan), KURARAY CO., LTD (Japan), Huntsman International LLC. (U.S.), Ascend Performance Materials (U.S.) Envalior (Germany) Domo Chemicals (Belgium), NYCOA (New York Chemicals) (U.S.), and Radici Partecipazioni SpA (Italy) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Long Chain Polyamide Market Definition

長鎖ポリアミド (LCPA) 市場とは、通常 12 個以上の炭素原子を含む、より長い分子鎖を持つポリアミド ポリマーの生産、流通、消費に重点を置く北米の産業を指します。これらの高性能材料は、優れた熱安定性、耐薬品性、機械的強度、耐久性で知られています。LCPA は、自動車、電気、電子機器、工業、消費財など、過酷な環境での強度と耐久性が不可欠な幅広い用途で使用されています。この市場は、従来のポリマーや金属に比べて優れた性能を発揮する軽量で耐久性があり持続可能な材料の需要によって推進されています。

バイオ炭市場の動向

ドライバー

- 自動車業界からの軽量・高性能素材の需要急増

自動車業界からの軽量で高性能な材料に対する需要の急増は、北米の長鎖ポリアミド市場の大きな原動力となっています。自動車メーカーが燃費の向上、排出量の削減、車両性能の向上にますます注力するにつれて、軽量で耐久性のある材料に対するニーズが高まっています。長鎖ポリアミドは、その優れた強度対重量比により、これらの目的に最適であり、さまざまな自動車用途で好まれる選択肢となっています。

長鎖ポリアミドは、エンジン部品、燃料ライン、コネクタ、電気部品などの部品の製造に使用されます。これらの材料は、車両全体の重量を軽減するだけでなく、必要な強度と耐熱性、耐薬品性、耐摩耗性も備えているため、現代の自動車製造には欠かせないものとなっています。たとえば、部品が高温とストレスに耐える必要があるエンジン コンパートメントでは、長鎖ポリアミドは従来の材料に比べて優れた熱安定性と機械的強度を備えています。

さらに、自動車業界の電気自動車(EV)への移行により、高性能ポリマーの需要も高まっています。EVでは、バッテリーの効率と走行距離を向上させるために軽量素材が必要であり、電気絶縁性と堅牢性を備えた長鎖ポリアミドが、バッテリーハウジング、コネクタ、その他の重要なコンポーネントの設計にますます取り入れられています。

- 急速に拡大する電気・電子機器部門

急速に拡大している電気・電子部門は、北米の長鎖ポリアミド市場の主要な推進力となっています。技術が進歩し、電子機器やシステムの需要が高まるにつれて、優れた熱安定性、電気絶縁性、機械的強度を備えた材料に対するニーズが高まっています。高性能特性で知られる長鎖ポリアミドは、これらの要件を満たし、電気・電子用途で広く使用されています。

長鎖ポリアミドは、コネクタ、スイッチ、回路基板、絶縁体、ケーブルなどの部品の製造で特に重宝されています。これらの材料は、電子機器の安全で効率的な動作を保証するために不可欠な、優れた電気絶縁性を備えています。耐熱性と耐薬品性があるため、部品が高温で動作したり、過酷な条件にさらされたりすることが多い高性能電子機器に最適です。

スマートフォン、ウェアラブル、スマートホームデバイスなどの消費者向け電子機器の増加により、長鎖ポリアミドの需要が高まっています。さらに、ヘルスケア、自動車、通信などの業界におけるモノのインターネット (IoT) とスマートテクノロジーの成長により、先進材料の必要性がさらに高まっています。長鎖ポリアミドは、スペースの制約と性能の要求が重要な小型電子部品の製造でますます使用されています。

機会

- バイオベースポリアミドの進歩

バイオベース ポリアミドの進歩は、北米の長鎖ポリアミド (LCPA) 市場の成長にとって大きなチャンスとなります。持続可能性はさまざまな業界でますます重要な焦点となり、従来の石油ベースのポリマーに代わる環境に優しい代替品の需要が高まっています。植物由来の糖、油、その他のバイオマス源などの再生可能な資源から得られるバイオベース ポリアミドは、LCPA が得意とする高性能特性を維持しながら、化石燃料への依存を減らす魅力的なソリューションを提供します。

バイオベース ポリアミドの主な利点の 1 つは、生産時の炭素排出量とエネルギー消費量を削減できることです。再生可能な原材料を使用することで、バイオベース ポリアミドは、長鎖ポリアミドの主要消費者である自動車、電子機器、繊維などの業界の環境フットプリントを削減するのに役立ちます。これは、特にヨーロッパや北米などの地域で、循環型経済に移行し、より厳しい環境規制を満たすという北米の取り組みと一致しています。

さらに、バイオベースのポリアミドは、持続可能な製品を求める消費者の嗜好の高まりにもアピールできます。環境に優しいソリューションを優先する消費者や企業が増えるにつれて、従来のプラスチックに代わるバイオベースの製品に対する需要が高まっています。たとえば、バイオベースのポリアミドは自動車用途で注目を集めており、業界では燃費を向上させて排出量を削減するために、より軽量で持続可能な素材を求めています。さらに、バイオベースのポリアミドは電子機器での使用が検討されており、その高い熱安定性と電気絶縁特性はグリーンテクノロジーに有益です。

- 高性能繊維の需要増加

高性能繊維の需要の高まりは、北米の長鎖ポリアミド (LCPA) 市場の成長にとって大きなチャンスとなります。耐久性、強度、汎用性で知られる高性能繊維は、自動車、スポーツウェア、医療、工業用途など、さまざまな業界でますます求められています。長鎖ポリアミドは、機械的強度、耐摩耗性、熱安定性のユニークな組み合わせにより、これらの高性能生地に最適な素材です。

たとえば自動車分野では、LCPA はシートカバー、室内装飾品、エアバッグなど、軽量で耐久性のある自動車内装用繊維の製造に使用されています。これらの材料は、高温や紫外線暴露などの過酷な条件に必要な強靭性と耐性を提供し、自動車部品の安全性と寿命を向上させます。自動車メーカーは、先進的な機能を備えた燃費効率の高い自動車の製造に注力し続けているため、長鎖ポリアミドから作られた高性能繊維の需要は増加すると予想されます。

スポーツウェアやアクティブウェア市場も、高性能繊維の需要が高まっている分野です。LCPA は優れた強度と弾力性を備えているため、スポーツユニフォーム、靴、防具など、耐久性と快適性の両方が求められる衣類や用具の製造に適しています。消費者が高品質でパフォーマンスを向上させる製品にますます注目するようになるにつれ、長鎖ポリアミドベースの繊維はアクティブウェア業界のメーカーに競争上の優位性をもたらします。

制約/課題

- 複雑な製造プロセスとカプロラクタムや特殊添加剤などの原材料の高コスト

複雑な製造プロセスと、カプロラクタムや特殊添加剤などの原材料の高コストは、北米の長鎖ポリアミド (LCPA) 市場の成長にとって大きな制約となっています。LCPA の製造には、特殊な装置と技術を必要とする複雑なプロセスが伴います。重合、凝縮、押し出しなどのこれらのプロセスには、大量のエネルギー入力と技術的な専門知識が必要であり、製造コストが増加する可能性があります。製造の複雑さにより、生産の拡大も困難になり、供給が制限され、コストがさらに上昇する可能性があります。

長鎖ポリアミドの製造に使用される主な原材料の 1 つは、ナイロン合成の重要な前駆物質であるカプロラクタムです。カプロラクタムは石油由来で、原油価格の変動は直接そのコストに影響します。北米の原油価格が上昇すると、カプロラクタムの価格も上昇し、その結果、LCPA 製造の総コストが増加します。この価格変動は、競争力を維持するために製造コストと市場価格のバランスを取らなければならないメーカーにとって課題となります。

さらに、長鎖ポリアミドの特性を高めるために、可塑剤、安定剤、難燃剤などの特殊添加剤がよく使用されます。これらの添加剤も高価であり、LCPA 製造の全体的なコスト高につながる可能性があります。これらの高価な材料への依存は、特にコストを抑えながら高性能基準を維持しようとしている業界にとって、製造の経済性をさらに圧迫します。

- 原材料価格の変動

原材料価格の変動は、北米の長鎖ポリアミド (LCPA) 市場にとって大きな課題です。LCPA の生産は、石油由来の主要前駆体であるカプロラクタムや特殊添加剤などの主要原材料に大きく依存しています。これらの原材料の価格は、北米の石油価格の変動、サプライ チェーンの混乱、地政学的不安定性など、さまざまな要因により変動します。その結果、メーカーは不確実性とコスト圧力に直面し、収益性と市場の安定性に影響を与える可能性があります。

カプロラクタムはポリアミドの製造に不可欠な原料であり、原油価格の変動に非常に敏感です。石油から得られるため、石油市場の変動はカプロラクタムのコストの大幅な上昇につながり、LCPA の全体的な製造コストを上昇させます。さらに、主要な石油生産地域で地政学的イベントや自然災害が発生すると、サプライ チェーンが混乱し、不足やさらなる価格上昇につながる可能性があります。

LCPA の特性を強化するために使用される難燃剤、安定剤、可塑剤などの特殊添加剤の価格も変動しやすい傾向があります。これらの添加剤は、多くの場合、特定の化学プロセスから生成されたり、限られたサプライヤーから調達されたりするため、サプライ チェーンの混乱の影響を受けやすくなります。これらの材料のコストが上昇すると、特に価格に敏感な業界やすでに激しい競争に直面している業界では、製造業者の経済的負担が増大する可能性があります。

原材料不足と出荷遅延の影響と現在の市場シナリオ

Data Bridge Market Research は、市場の高水準な分析を提供し、原材料不足や出荷遅延の影響と現在の市場環境を考慮した情報を提供します。これは、戦略的な可能性を評価し、効果的な行動計画を作成し、企業が重要な決定を下すのを支援することにつながります。

標準レポートの他に、予測される出荷遅延からの調達レベルの詳細な分析、地域別の販売代理店マッピング、商品分析、生産分析、価格マッピングの傾向、調達、カテゴリパフォーマンス分析、サプライチェーンリスク管理ソリューション、高度なベンチマーク、その他の調達および戦略サポートのサービスも提供しています。

経済減速が製品の価格と入手可能性に及ぼす予想される影響

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

North America Long Chain Polyamide Market Scope

The North America long-chain polyamide market is segmented into five notable segments based on type, source, form, application, and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- PA 12

- PA 11

- PA 610

- PA 612

- PA 1010

- PA 1012

- PA 410

- Others

Source

- Artificially Made

- Naturally Occurring

Form

- Chips

- Powder

- Others

Application

- Engineering Plastics

- Polyamide Fibers & Fabrics

- Polyamide Films

- Polyamide Adhesives

- Coatings

- Others

End Use

- Electrical & Electronics

- Healthcare, Industrial

- Automotive, Consumer Goods

- Packaging

- Aerospace & Defense

- Oil & Gas

- Energy

- Others

North America Long Chain Polyamide Market Regional Analysis

The market is analyzed and market size insights and trends are provided on the basis of country, type, source, form, application, and end-use as referenced above

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate the long chain polyamide market due to advanced technological innovation, strong automotive and electronics industries, a focus on sustainability, and high demand for high-performance materials in various applications.

Canada is expected to be fastest growing region in the long chain polyamide market due to its focus on automotive innovation, sustainable manufacturing practices, increasing demand for high-performance materials, and strong presence in industrial and electronic sectors.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Long Chain Polyamide Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Long Chain Polyamide Market Leaders Operating in the Market Are:

- LG Chem (South Korea)

- BASF (Germany)

- Arkema (France)

- Evonik Industries AG (Germany)

- DuPont (U.S.)

- Asahi Kasei Corporation (Japan)

- TORAY INDUSTRIES INC. (Japan)

- MITSUI CHEMICALS AMERICA INC. (Japan)

- KURARAY CO. LTD (Japan)

- Huntsman International LLC. (U.S.)

- Ascend Performance Materials (U.S.)

- Envalior (Germany)

- Domo Chemicals (Belgium)

- NYCOA (New York Chemicals) (U.S.)

- Radici Partecipazioni SpA (Italy)

Latest Developments in North America Long Chain Polyamide Market

- In November 2024, BASF’s Polyamide 6 (PA6) plant in Shanghai received the ISCC PLUS certification, enabling it to produce biomass-balanced and Ccycled PA6. This certification supports BASF’s commitment to sustainability, offering lower carbon footprint and circular product alternatives in the PA6 value chain

- In December 2024, Arkema completed the acquisition of Dow’s flexible packaging laminating adhesives business, a leading global producer. This move expanded Arkema's portfolio in flexible packaging, positioning the company as a key player in the market

- In November 2024, Asahi Kasei has announced its decision to absorb its wholly owned subsidiary, Asahi Kasei NS Energy, through a simplified absorption-type merger, effective April 1, 2025. This move aims to streamline operations after Asahi Kasei NS Energy became a fully owned subsidiary in April 2023

- In April 2024, Domo Chemicals has inaugurated a new factory in China with a USD 15.12 million investment, enhancing production capacity. The facility, located south of Shanghai, will double output in the short term and potentially triple it in the future.

- In September 2022, NYCOA announced the launch of NXTamid-L, a new family of specialty performance nylons designed as alternatives to Nylon 12 and 11. NXTamid-L offers comparable or superior properties, including flexibility, lower moisture absorption, higher glass transition temperatures, and enhanced chemical resistance. This innovative nylon family can also be customized to meet specific performance requirements, reinforcing NYCOA’s position as a leader in the nylon industry

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OVERVIEW: NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

4.6 PRODUCTION CONSUMPTION ANALYSIS- NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

4.7 VALUE CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT (MONOMERS & CHEMICALS)

4.7.2 POLYMERIZATION PROCESS (SYNTHESIS OF POLYAMIDE)

4.7.3 COMPOUNDING AND ADDITIVES

4.7.4 FABRICATION (PROCESSING INTO FINAL SHAPES)

4.7.5 DISTRIBUTION AND LOGISTICS

4.7.6 END-USE APPLICATIONS (FINAL PRODUCTS)

4.7.7 CONCLUSION

4.8 VENDOR SELECTION CRITERIA

4.9 CLIMATE CHANGE SCENARIO

4.9.1 ENVIRONMENTAL CONCERNS

4.9.2 INDUSTRY RESPONSE

4.9.3 GOVERNMENT’S ROLE

4.9.4 ANALYST RECOMMENDATIONS

4.1 MARKET SITUATION

4.10.1 PA 1010

4.10.2 PA 1012

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12.1 DEVELOPMENT OF BIO-BASED POLYAMIDES

4.12.2 ADVANCED POLYMERIZATION TECHNIQUES

4.12.3 INTEGRATION OF RECYCLING TECHNOLOGIES

4.12.4 ADOPTION OF SMART MANUFACTURING

4.13 RAW MATERIAL COVERAGE

4.13.1 DICARBOXYLIC ACIDS

4.13.2 DIAMINES

4.13.3 LONG-CHAIN FATTY ACIDS

4.13.4 PETROCHEMICAL FEEDSTOCKS

4.13.5 EMERGING BIO-BASED ALTERNATIVES

4.13.6 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SURGING DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS FROM AUTOMOTIVE INDUSTRY

6.1.2 FAST EXPANDING ELECTRICAL AND ELECTRONICS SECTOR

6.1.3 ADVANCEMENTS AND INNOVATIONS IN SUSTAINABLE PRODUCTION TECHNOLOGIES FOR LONG CHAIN POLYAMIDE

6.2 RESTRAINTS

6.2.1 COMPLEX MANUFACTURING PROCESS AND HIGH COSTS OF RAW MATERIALS

6.2.2 COMPETITION FROM OTHER HIGH-PERFORMANCE POLYMERS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN BIO-BASED POLYAMIDES

6.3.2 RISING DEMAND FOR HIGH-PERFORMANCE TEXTILES

6.3.3 GROWING APPLICATIONS OF LONG CHAIN POLYAMIDE IN MEDICAL DEVICES

6.4 CHALLENGES

6.4.1 VOLATILITY IN RAW MATERIAL PRICES

6.4.2 STRINGENT REGULATIONS ON PLASTIC USE, RECYCLING AND DISPOSAL

7 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE

7.1 OVERVIEW

7.2 PA 11

7.3 PA 12

7.4 PA 610

7.5 PA 612

7.6 PA 410

7.7 PA 1010

7.8 PA 1012

7.9 OTHERS

8 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ARTIFICIALLY MADE

8.3 NATURALLY OCCURRING

9 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM

9.1 OVERVIEW

9.2 CHIPS

9.3 POWDER

9.4 OTHERS

10 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ENGINEERING PLASTICS

10.3 POLYAMIDE FIBERS & FABRICS

10.4 POLYAMIDE FILMS

10.5 POLYAMIDE ADHESIVES

10.6 COATINGS

10.7 OTHERS

11 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE

11.1 OVERVIEW

11.2 ELECTRICAL & ELECTRONICS

11.3 HEALTHCARE

11.4 INDUSTRIAL

11.5 AUTOMOTIVE

11.6 CONSUMER GOODS

11.7 PACKAGING

11.8 AEROSPACE & DEFENSE

11.9 OIL & GAS

11.1 ENERGY

11.11 OTHERS

12 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EVONIK INDUSTRIES AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ARKEMA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASAHI KASEI CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ASCEND PERFORMANCE MATERIALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DOMO CHEMICALS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ENVALIOR

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 HUNTSMAN INTERNATIONAL LLC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 KURARAY CO., LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 LG CHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MITSUI CHEMICALS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 NYCOA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 RADICI PARTECIPAZIONI SPA

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 TORAY INDUSTRIES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF TOP COMPANIES: NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

TABLE 2 REGULATORY COVERAGE

TABLE 3 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 5 NORTH AMERICA PA 11 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA PA 11 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 7 NORTH AMERICA PA 12 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA PA 12 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 9 NORTH AMERICA PA 610 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA PA 610 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 11 NORTH AMERICA PA 612 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA PA 612 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 13 NORTH AMERICA PA 410 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA PA 410 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 15 NORTH AMERICA PA 1010 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA PA 1010 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 17 NORTH AMERICA PA 1012 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PA 1012 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 19 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 21 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2018-2032 (TONS)

TABLE 23 NORTH AMERICA ARTIFICIALLY MADE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA ARTIFICIALLY MADE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 25 NORTH AMERICA NATURALLY OCCURRING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA NATURALLY OCCURRING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 27 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 29 NORTH AMERICA CHIPS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA CHIPS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 NORTH AMERICA POWDER IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA POWDER IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 33 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 37 NORTH AMERICA ENGINEERING PLASTICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA ENGINEERING PLASTICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 NORTH AMERICA POLYAMIDE FIBERS & FABRICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA POLYAMIDE FIBERS & FABRICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 41 NORTH AMERICA POLYAMIDE FILMS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA POLYAMIDE FILMS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 NORTH AMERICA POLYAMIDE ADHESIVES IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA POLYAMIDE ADHESIVES IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 45 NORTH AMERICA COATINGS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COATINGS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 47 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 49 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 51 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 53 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 57 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 61 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 65 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 69 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 73 NORTH AMERICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 76 NORTH AMERICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 79 NORTH AMERICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 82 NORTH AMERICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 85 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 88 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 90 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 92 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 94 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 96 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 98 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 115 U.S. LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 117 U.S. LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 118 U.S. LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 119 U.S. LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 121 U.S. LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 122 U.S. LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 123 U.S. ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 U.S. ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 U.S. INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 CANADA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 CANADA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 140 CANADA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 141 CANADA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 142 CANADA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 143 CANADA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 144 CANADA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 146 CANADA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 148 CANADA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 CANADA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 CANADA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 CANADA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MEXICO LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MEXICO LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 165 MEXICO LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 166 MEXICO LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 167 MEXICO LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 168 MEXICO LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 169 MEXICO LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 MEXICO LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 171 MEXICO LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 172 MEXICO LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 173 MEXICO ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 174 MEXICO ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MEXICO HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 MEXICO HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 MEXICO INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 178 MEXICO INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MEXICO AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 180 MEXICO AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 MEXICO CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 MEXICO CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 MEXICO PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MEXICO AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MEXICO OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MEXICO ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

FIGURE 2 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 EIGHT SEGMENTS COMPRISE THE NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 SURGING DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS FROM AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA LONG CHAIN POLYAMIDE MARKET IN THE FORECAST PERIOD

FIGURE 16 THE PA 11 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LONG CHAIN POLYAMIDE MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 VALUE CHAIN ANALYSIS FOR NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA LONG CHAIN POLYAMIDE MARKET

FIGURE 24 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: BY TYPE, 2024

FIGURE 25 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2024

FIGURE 26 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2024

FIGURE 27 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2024

FIGURE 28 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2024

FIGURE 29 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: SNAPSHOT (2024)

FIGURE 30 NORTH AMERICA LONG CHAIN POLYAMIDE MARKET: COMPANY SHARE 2024 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.