The Global Maintenance, Repair and Operations (MRO) market is expected to reach USD 3,372,536,588.91 thousand by 2032 from USD 2,138,123,376.71 thousand in 2024, and is expected to grow with a CAGR of 6.2%.

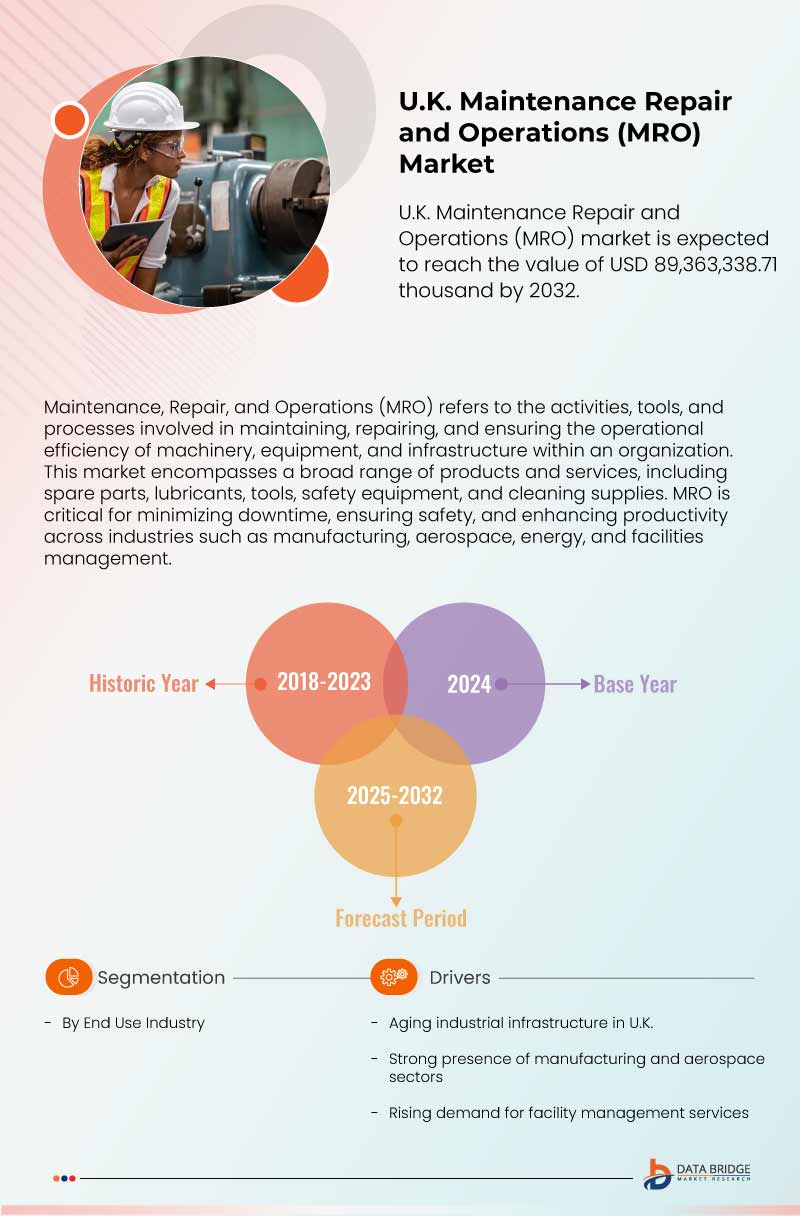

The U.K. Maintenance, Repair and Operations (MRO) market is expected to reach USD 89,363,338.71 thousand by 2032 from USD 56,747,002.84 thousand in 2024, and is expected to grow with a CAGR of 6.2%.

Growing government investments in public infrastructure, coupled with the expansion of the aviation and manufacturing sectors, are significantly boosting the demand for MRO services. Additionally, evolving global regulatory standards and the increasing emphasis on aftermarket services by OEMs are expected to further accelerate market growth.

Global and U.K. Maintenance, Repair and Operations (MRO) Market (By Definition)-

Maintenance, Repair, and Operations (MRO) refers to the activities, tools, and processes involved in maintaining, repairing, and ensuring the operational efficiency of machinery, equipment, and infrastructure within an organization. This market encompasses a broad range of products and services, including spare parts, lubricants, tools, safety equipment, and cleaning supplies. MRO is critical for minimizing downtime, ensuring safety, and enhancing productivity across industries such as manufacturing, aerospace, energy, and facilities management. The MRO market also includes third-party service providers and inventory management solutions, driven by trends in automation, predictive maintenance, and the increasing focus on operational efficiency and cost optimization.

Use: The Maintenance, Repair, and Operations (MRO) market serves a vital role across industries by ensuring the smooth functioning, safety, and longevity of equipment and infrastructure. MRO includes a wide range of activities such as routine maintenance, emergency repairs, and replacement of worn-out components. In manufacturing, it supports machinery uptime and operational efficiency. In the aviation sector, it ensures aircraft safety and regulatory compliance through scheduled inspections and overhauls. In public infrastructure, MRO covers road, bridge, and utility upkeep.

Additionally, MRO is essential for inventory management, facility operations, and the continuous supply of consumables and spare parts. It also enables cost control and risk mitigation by reducing downtime and avoiding major failures. As industries adopt automation and smart systems, MRO is increasingly incorporating predictive maintenance and data-driven service planning.

End Use Industry: The MRO (Maintenance, Repair, and Operations) market spans a diverse range of end-use industries, each relying heavily on timely maintenance and operational efficiency to ensure safety, productivity, and regulatory compliance. Key sectors driving demand include manufacturing, oil & gas/energy, mining & metals, transportation & logistics, construction, utilities and infrastructure, aerospace & defense, among others. Here are some common types:

- Manufacturing:

MRO ensures continuous production by maintaining machinery, reducing downtime, and extending equipment lifespan. It supports quality control, safety standards, and lean operations. Services include equipment calibration, lubrication, parts replacement, and facility upkeep to maintain seamless factory workflows and reduce operational disruptions.

- Oil & Gas/Energy:

MRO is critical for maintaining pipelines, refineries, rigs, and power plants, where operational failures can be costly and hazardous. It involves regular inspections, corrosion control, and parts replacement. Compliance with safety regulations and environmental standards also drives the demand for robust MRO practices in the energy sector.

- Mining & Metals:

In mining and metal processing, MRO services help minimize equipment wear from harsh environments. Activities include heavy machinery servicing, hydraulic system maintenance, and replacement of drilling or crushing tools. Regular MRO prevents unexpected downtime, supports worker safety, and ensures uninterrupted extraction and processing of raw materials.

- Transportation & Logistics:

MRO supports fleets of trucks, trains, and shipping vessels by ensuring timely maintenance of engines, brake systems, and loading equipment. It enhances reliability, reduces delivery delays, and complies with transport safety regulations. Warehouses also require MRO for conveyor systems and storage infrastructure upkeep.

- Construction:

MRO in construction maintains tools, heavy machinery, scaffolding, and safety systems. It ensures project continuity, site safety, and reduces the risk of equipment failure. Regular servicing and timely part replacements optimize resource usage and help meet tight project deadlines without costly breakdowns.

- Utilities and Infrastructure:

Power grids, water systems, and telecom networks depend on MRO for uninterrupted service delivery. This includes inspection of transformers, water pipelines, and fiber cables. MRO activities ensure compliance with government standards and prevent failures that could disrupt essential services to the public or industries.

- Aerospace & Defense:

MRO is vital for aircraft, military vehicles, and defense systems to ensure operational readiness and safety. Services include engine overhauls, structural repairs, avionics testing, and software updates. Strict compliance with aviation regulations and the high cost of downtime make MRO indispensable in this sector.

Market Developments

- GE Aerospace's Investment in MRO Facilities: In July 2024, GE Aerospace announced a USD 1 billion investment over five years to upgrade its engine repair shops globally. The initiative aims to reduce turnaround times by 30%, addressing the surge in demand for aftermarket services

- Pratt & Whitney's Additive Manufacturing Advancements: In April 2025, Pratt & Whitney developed a new additive manufacturing repair process for its Geared Turbofan engine components, aiming to cut repair times by over 60%. This innovation is expected to recover USD 100 million worth of parts over five years

- FTAI Aviation's Growth Amid Engine Shortages: FTAI Aviation has experienced significant growth by integrating leasing with maintenance and repair services, utilizing second-hand or non-original parts to meet the rising demand for engine repairs

- British Army's 3D Printing Initiative: The British Army has deployed advanced 3D printing technology to produce components for aging vehicles, significantly expediting repair processes during conflicts

- Royal Navy's Metal 3D Printers: The UK Ministry of Defence purchased metal 3D printers for the Royal Navy's MRO operations, enabling the production of metal components and reducing reliance on traditional supply chains.

- RAF's AR Training: The Royal Air Force is incorporating AR technology into pilot training programs, allowing trainees to interact with virtual threats and scenarios, enhancing readiness and reducing training costs

Future Opportunities -

Strategic partnerships and collaborations between airlines and OEMs are emerging as key growth opportunities in the MRO market. By integrating advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT), industry players aim to optimize maintenance schedules, reduce operational costs, and enhance overall efficiency, driving innovation and competitiveness across the aviation maintenance landscape.

For instance,

- In February 2024, Safran signed a three-year exclusive maintenance agreement with Malaysia Airlines Berhad (MAB) at the Singapore Air Show. The contract covers repair and maintenance for electrical harnesses on over 40 of MAB’s Boeing 737 aircraft equipped with CFM56-7B engines. This agreement will enhance MAB's operational efficiency and competitiveness by providing OEM repair services, improved turnaround times, extended warranty coverage, and exchange support. Safran's continued support through regional representatives in Singapore underscores their commitment to innovation and long-term service improvement. This partnership will contribute to better reliability and performance of MAB’s fleet, ensuring the safety and satisfaction of their passengers and crew

- In February 2022, according to news published by Collins Aerospace, LLC, Collins Aerospace signed a long-term MRO agreement with Singapore Airlines and Scoot. The agreement, part of Collins' FlightSense program, covers lifecycle support for the airlines' 55 Boeing 787 aircraft. It includes maintenance services and reliability upgrades for various systems. This agreement enhances the airlines' fleet operations by providing comprehensive MRO services, ensuring efficient maintenance and support for their 787s

- In November 2024, according to an article published by Business Wire, SkyDrive Inc., a leading eVTOL aircraft manufacturer, formed a strategic partnership with FEAM Aero, one of the largest MRO companies in North America. This collaboration aimed to combine SkyDrive's air mobility solutions with FEAM Aero's expertise in maintenance, supporting the scalability of electric Vertical Takeoff and Landing (eVTOL) aircraft. The partnership provides both companies with the opportunity to develop operational use cases, enhance the integration of eVTOL services into existing aviation infrastructure, and create eco-friendly, reliable air transport solutions. This collaboration benefits the MRO market by promoting innovation and expanding maintenance support for the emerging eVTOL industry.

Related Reports-

Europe Maintenance Repair and Operations (MRO) Market

Asia-Pacific Maintenance Repair and Operations (MRO) Market