COVID-19 Impact on AUV (Autonomous Underwater Vehicle) in the Information, Communications and Technology (ICT) Industry

As the COVID-19 issue rages, many countries' public life had come to a halt. The human toll is immense, with the number of patients and fatalities growing at an exponential rate throughout the world. On the business side, the coronavirus has caused many companies to shut down or scale back operations. Over the short to mid-term, the COVID-19 crisis could delay the development of advanced technologies, such as autonomous technology, as OEMs and investors scale back innovation funding to concentrate on day-to-day cash-management issues.

COVID 19 limitations and lockdowns in many countries have affected the AUV supply chain. Lower customer and supplier activities, travel bans, and a higher risk of project delays due to temporary shutdown and a shortage of inputs are projected to have an impact on sales, earnings, and order intake. Furthermore, as a result of major portions of the customer base being affected, there is a larger risk of cancellation of customer contracts and late or non-payments, which might lead to an increase in the risk of losses on accounts receivable, products, project assets, and currency futures.

The AUV industry's OEMs and players have been affected exceptionally hard. COVID-19 may have a long-term influence on the AUV industry by driving changes in the macroeconomic climate, regulatory tendencies, and technology. Due to uncertainties regarding the duration of the shutdown and supply-chain disruptions, manufacturers found it more difficult to forecast the industry's recovery. The pandemic crisis resulted in structural modifications generally for the supply chain that had far-reaching market consequences. The temporary halt of production at factories during the first half of 2020 resulted in production limitations, together with restricted activities throughout the year, which had a severe impact on 2020 supplies and deployments.

Over the forecast period, the worldwide AUV market is likely to be driven by an increase in the number of research activities in the oil and gas industry, as well as increased government expenditure on sea water monitoring to preserve aquatic life balance.

Furthermore, rapid growth in fish farming is paving the reason for the expansion of the AUV market, since these vehicles can provide aqua farmers with a reliable and affordable platform for monitoring water quality such as turbidity, temp, and conductivity, as well as observing fish behavior during feeding processes in fish farming.

Additionally, the oceanography sector's substantial R&D efforts are driving product demand for real-time data transfer and high-quality hydrographic surveys. The market is also being fueled by the increasing integration of AUV with connectivity temperature-depth and biogeochemical sensors. AUV is also being increasingly used in the aquaculture industry to monitor water turbidity, conductivity, and temperature, as well as study fish movement during feeding procedures, which is propelling the market upward.

The recent development of important markets in both commercial and military sectors has resulted in increased activity in areas ranging from research to AUV manufacturing and operation. As a result, component vendors are putting in substantial effort to adapt their product line to better accommodate AUVs. As a result, AUV capabilities are rapidly expanding, and this trend is expected to continue for some years.

Manufacturers of autonomous underwater vehicles, for example, are investing in R&D to bring new revolutionary AUV models to market. For example, in February 2021, Kongsberg Maritime debuted HUGIN Endurance, the next version of its HUGIN AUV. Kongsberg's newest AUV has an operational endurance of up to 15 days, allowing it to power long-term survey and inspection missions away from the coast.

Impact on supply chain

COVID-19's influence on the AUV market and customer demand is presently unknown. However, it is expected that there will be a short-term drop in AUV production since the oil and gas sector, which is the major customer of AUVs, is experiencing a scarcity of oil and gas. Travel restrictions imposed in several countries are causing a shortage in demand for oil and gas.

Industry dynamics have been predominantly influenced by interruptions in the oil and gas industry in the middle of the global COVID-19 outbreak. Exploration and production activity levels fell significantly in 2020 as the pandemic impacted E&P firms' capacity to operate as expected for the year. Furthermore, the pandemic's supply-demand oscillations and subsequent oil price drop have prompted the bulk of corporations to lower their 2020 projected spending budgets by 10-15% on average, resulting in a multi-year low for exploration and production operations.

However, demand in the military sector is progressively growing as several nations, including the United States, increase their military spending. In 2021, China and India have upped their defense spending. In the case of military and defense applications, the pandemic's impact is less severe. This is mostly due to consistent demand, which is supported by scheduled government expenditure and a supply chain that is less vulnerable to disturbances (as countries are mainly dependent on local manufacturers for defense equipment).

As defense investment and maritime exploration initiatives pick up steam, the corporations are always seeing fresh prospects. For example, recently, maritime surveying and inspection business, Argeo AS purchased 2 Sea Raptor 6,000 m AUVs from Teledyne Gavia to extend its AUV fleet.

Conclusion

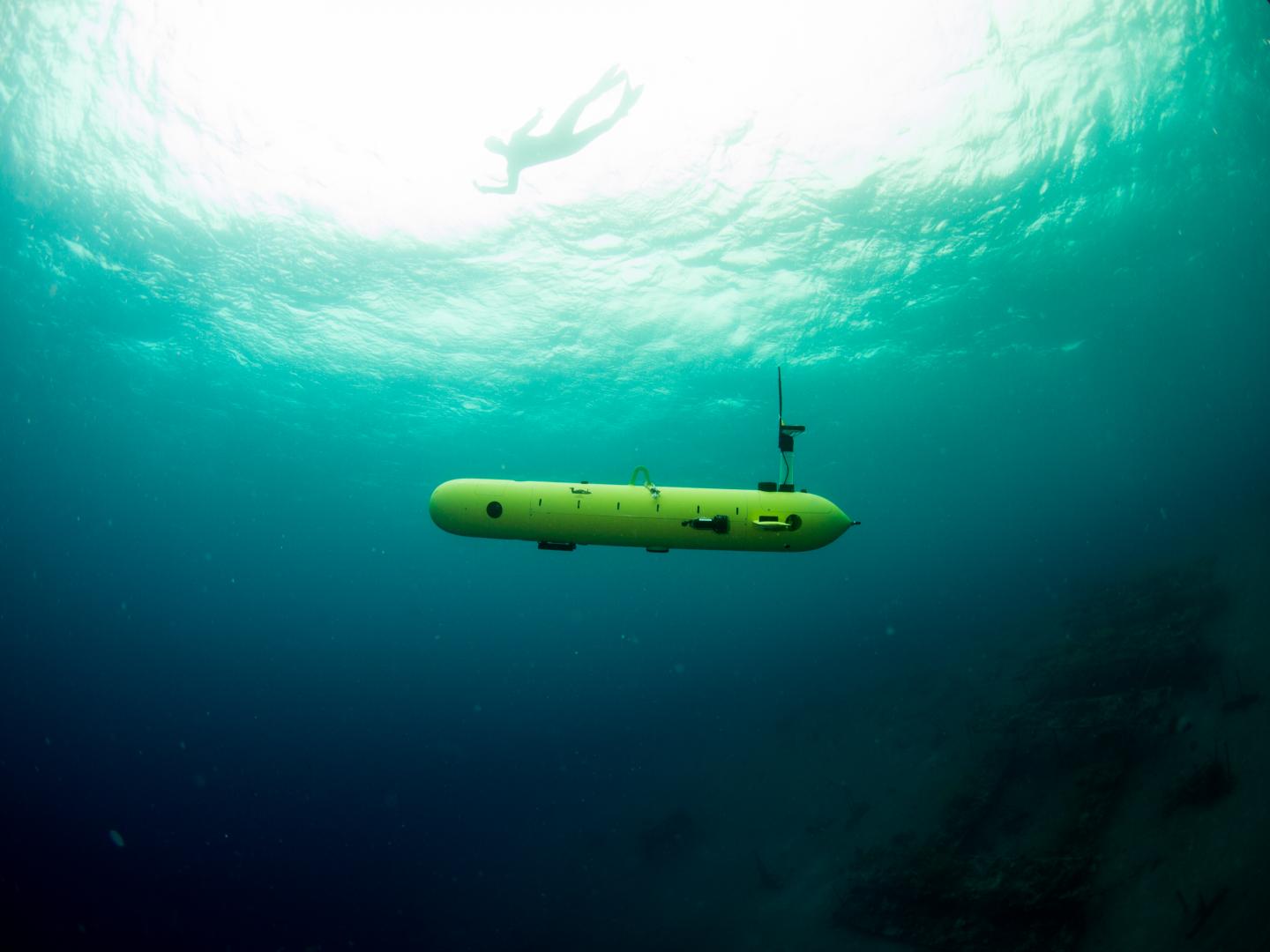

The COVID-19 virus outbreak has changed the entire process of activities across the globe. From lifestyle to the global economy, the pandemic has affected each and every factors related to the world. AUVs is a critical tool for marine geoscientists, particularly those engaged in seafloor monitoring and mapping, over the years. These vehicles' capacity to fly at a low altitude and over seabed allows them to capture spatial data at a much greater resolution than surface vessels, specifically in deep water. When additional drivers like Marine Protected Area surveillance and site inspections for offshore renewable installations are included in, it's apparent that AUVs will continue to play a bigger role in ocean explorations and surveillance.

However, the COVID-19 outbreak has temporarily halted the manufacturing process of AUVs, which will indirectly affect the sales of AUVs in coming years, but increasing government initiatives and huge investments in R&D of AUVs will continue the growth of the industry in the coming years. Also, innovation in IoT in AUV technology will also propel the market in near future.