IMPACT ANALYSIS OF COVID-19 ON THE MARKET

The World Health Organization declared the new coronavirus epidemic (COVID-19) outbreak a pandemic on March 11, 2020. The virus was originally identified in December 2019 in Wuhan, China. The epidemic has raised economic and demand uncertainties substantially. In addition, policies and initiatives in the public and private sectors to minimize COVID-19 transmissions, such as travel restrictions and the implementation of remote working, impacted worldwide operations. Furthermore, national government’s trade barriers, export restrictions, and other such policies had a detrimental influence on the availability of several products in the market. COVID-19 also had an impact on suppliers and vendors capacity to supply goods and services. A few of these COVID-related factors have boosted the demand for particular products, while other product demand has lowered in specific end markets. COVID-19 also had an impact on the broader economy of affected nations. It may continue to have negative impact on economic growth, capital markets and foreign exchange rates among others. COVID-19, for instance, has caused disruption and volatility in global financial markets, raising capital costs and potentially limiting access to capital.

The sudden shutdown of the manufacturing industry in China and the subsequent domino effect that caused widespread instability among global automobile manufacturers were felt gradually in Europe, the U.S., India, and South America. Many automobile OEMs (Original Equipment Manufacturers) and suppliers are striving to build shorter or localized regional supply chains after offshoring their manufacturing activities to low manufacturing cost nations. The same applies to brake system manufacturers.

For instance,

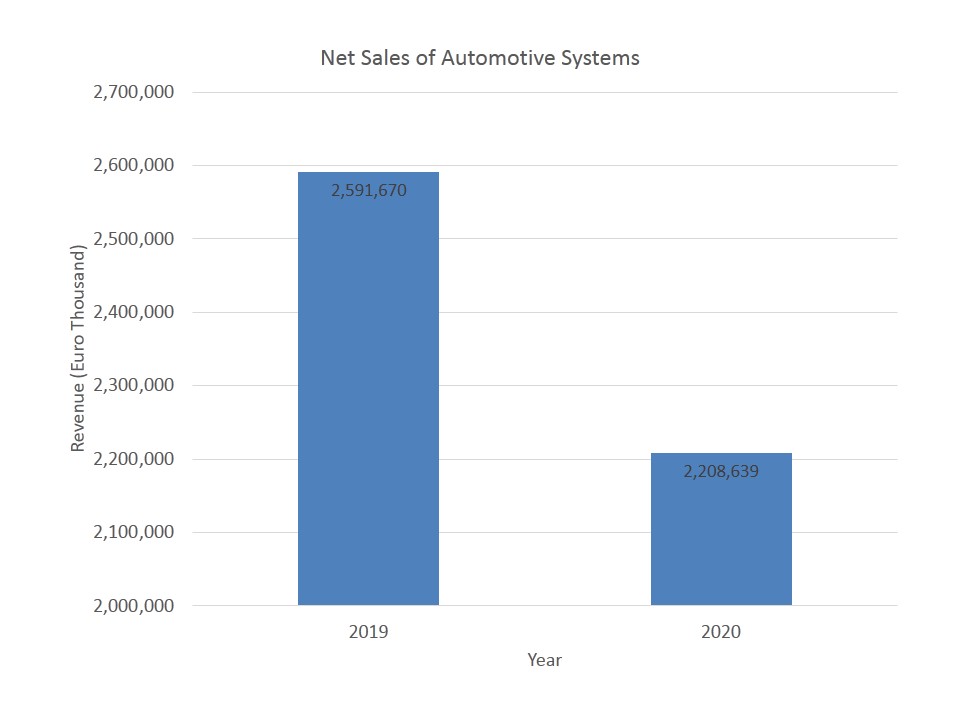

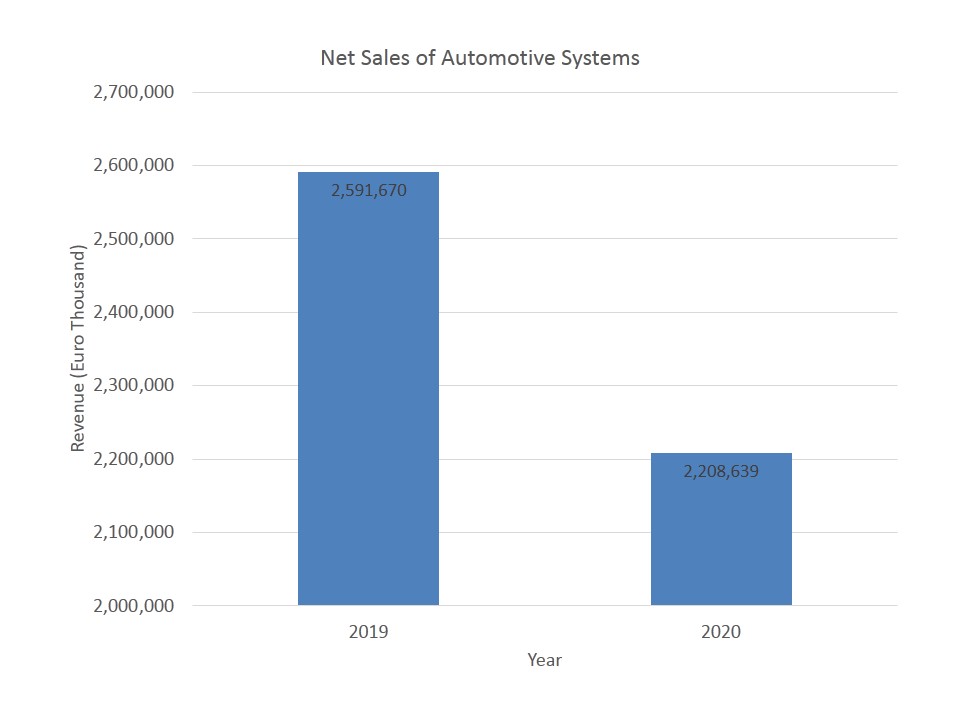

- Brembo S.p.A., one of the major players in automotive systems, suffered a negative impact on their net sales of automotive systems during the financial year 2020 compared with previous years. The financials of the company are represented in a graphical format below

- The turnover earned by the automotive industry exceeds 7% of EU GDP, 3 -3.5% of the overall GDP in the U.S., and 10% in China. Although it is currently a difficult time, the OEMs that are able to mobilize their COVID -19 response and take swift actions will be in a better position post-event and more resilient going forward

However, increasing urbanization and the expanding automation sector across the world are expected to drive up the demand for advanced automotive systems, which is also fueling the expansion of the braking system market. Along with that, rising vehicle demand is expected to drive up demand for automotive systems, ultimately driving up demand for braking systems in the automotive sector.

AFTERMATH OF GLOBAL BRAKING SYSTEMS MARKET

COVID-19 pandemic affected a wide range of industries, from small to large manufacturing companies. It hampered the worldwide demand for solutions in the braking systems market up to a certain extent. Limited workforce and operational restrictions negatively affected the product development life cycle. But at later stages, when lockdown restrictions were lifted, demand got stable up to a certain point. Companies developed different strategies and partnerships and new product launches specifically to tackle problems during the COVID-19 pandemic.

For instance,

- In April 2021, brake specialist Haldex joined hands with FAST Group to expand their Air Disc Brakes (ADB) business in the Chinese market. The aim of the new joint venture is to introduce the full range of Haldex ModulT Air Disc Brakes for trucks and buses, using the establishment of Haldex, IP, and technology to develop a strong market position of FAST Group in China

- In April 2021, Brembo S.p.A. signed a 100% stakeholder agreement with J.Juan Group, a Spanish company that specializes in developing and manufacturing motorcycle braking systems. With this transaction, Brembo is moving forward with its approach to becoming a reliable solution provider. The acquisition of J.Juan will enable the Group to complete its range of motorcycle braking program solutions and expand its range of growing motorcycle industry

- In October 2019, Hitachi Automotive Systems, Ltd., a wholly-owned subsidiary of Hitachi, Ltd., announced the acquisition of Chassis Brakes International B.V. The combination of Hitachi Automotive Systems and Chassis Brakes puts them at the forefront of global leadership in automotive safety solutions, capable of shaping the path of advanced safety solutions through our amazingly compact, technological, customer, location and expertise

Likewise, many companies responded to the COVID-19 situation in similar ways to ensure the betterment of the company. Losses that occurred during this period could be overcome in the future by taking this slowdown as an opportunity to redesign and refresh the business processes.

OPPORTUNITIES FOR THE MARKET AFTER COVID-19 PANDEMIC

Market players have an opportunity to upgrade their operations and prospective for the betterment of their companies. Upgradation is the key to success in this unpredictable world. Different crises, labor shortages, natural disasters impact a lot on every industry. So being one step ahead of time and understanding the market well will ensure the success of the market player. Apart from the COVID-19 pandemic, there are hopes for this market to grow at a significant rate in the future. Future opportunities for the market is stated below-

Advancement and automation in braking systems

Given the critical importance of reliable, efficient braking systems and the significant impact any potential error with safety may have, a wide range of items should be carefully considered when constructing critical system components such as seals. With electro-hydraulic braking (EHB), a number of special requirements are set, such as abrasion resistance and the accuracy of sealing solutions in production. Among other things, the elastomer components in modern brake control systems must also be able to withstand high frequency, flexible mechanical loads under high pressure, and at the same time ensure safety throughout the life of the vehicle. Also, demand for automatic braking systems is increasing year by year.

New developments in braking technology bring good opportunities for the braking system market in the future.

IMPACT ON SUPPLY, DEMAND, AND PRICE

In the fiscal year 2021, the automotive braking systems industry experienced significant disruptions due to the shutdown of many automotive manufacturers. Through this epidemic, automotive braking systems players from all areas have learned difficult experiences about their operations. Some firms, for instance, have decided to ride out the storm with as few changes as possible, whereas others have viewed these exceptional times as an opportunity to go ahead and innovate. The automotive sector was already suffering financial challenges prior to the pandemic, and the impact of COVID-19 has further compounded many of those concerns. This impact has indirectly affected the demand of the braking system for the automotive industry.

In the context of manufacturing, it just takes a single missing part to bring a production line to a halt, and the negative ripple effect of a material or parts shortage quickly spreads across the supply chain. Many automotive suppliers and other manufacturers have challenges in acquiring adequate raw materials to match customer demand, including the risk of paying higher costs. The sector is still dealing with the dual impact of falling sales and rising prices, which has resulted in financial difficulties for braking system manufacturers.

Conclusion

While COVID-19 will delay immediate investments in new mobility and its supply chain, market drivers will continue to encourage investments in the long term. Alliances and partnerships will become important tools for automakers to gain a competitive advantage. However, the nature of alliances will vary for each mobility type. Automation and digitalization in cars will get a boost from COVID-19, with people embracing a digital life that promotes social distancing, safety, tracking, and efficiency. Services and features enabling the above will see growing popularity among automobile buyers. Additionally, rising vehicle demand will drive up demand for automotive systems, which will ultimately drive up demand for braking systems in the market.