Middle East and Africa Fleet Management Market, By Offering (Solution and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engines and Electric Vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags ,Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles), and Large and Enterprise Fleets (20-50+ Vehicles), Communication Range (Short-Range Communication and Long-Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Methods and Decision-Making, RFID, and Others), Function (Monitoring Driver Behaviour, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real-Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Businesses and Large Businesses), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) – Industry Trends and Forecast to 2030.

Middle East and Africa Fleet Management Market Analysis and Size

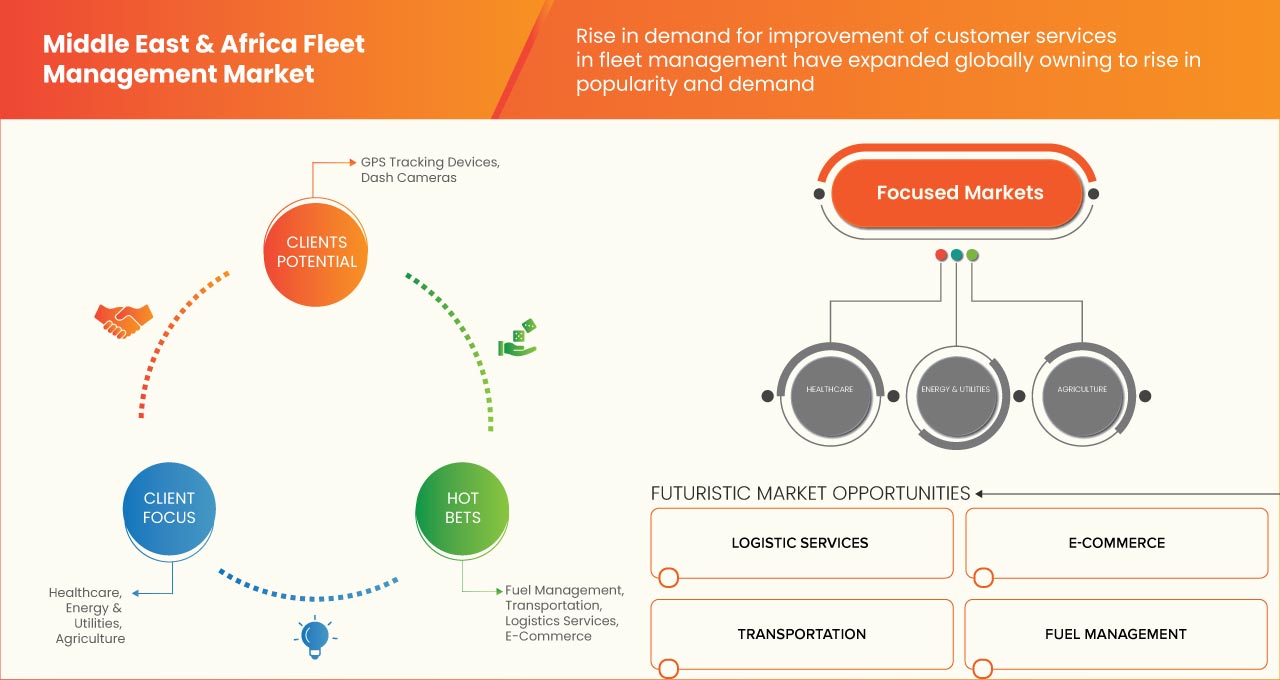

Major factors expected to boost the growth of the fleet management market in the forecast period are the rise in several industrial applications, including aerospace, steel, power, chemical, and others. Furthermore, the increased resistance to load variations is the benefit of fleet management, which is further anticipated to propel the growth of the fleet management market.

Data Bridge Market Research analyses that the Middle East and Africa fleet management market is expected to reach the value of USD 3,773,529.91 thousand by 2030, at a CAGR of 8.6% during the forecast period. The fleet management market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 – 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Offering (Solution and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engines and Electric Vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags ,Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles), and Large and Enterprise Fleets (20-50+ Vehicles), Communication Range (Short-Range Communication and Long-Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Methods and Decision-Making, RFID, and Others), Function (Monitoring Driver Behaviour, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real-Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Businesses and Large Businesses), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) |

|

Countries Covered |

Saudi Arabia, U.A.E., Israel, Egypt, South Africa, and the Rest of the Middle East and Africa |

|

Market Players Covered |

TRAXALL, Donlen LeasePlan, Enterprise Holdings, Emkay, Chevin Fleet Solutions, Deutsche Leasing AG, BERGSTROM AUTOMOTIVE, TÜV SÜD, Motive Technologies, Inc., ALD Automotive, VEL’CO, Avrios, Element Fleet Management Corp., Rarestep, Inc., OviDrive B.V., FleetCompany GmbH, Sixt Leasing (Acquired by Hyundai Capital Bank Europe GmbH) , Fleetcare Pty Ltd., Capital Lease Group, Wilmar Inc., Wheels, NEXTRAQ, LLC, Avis Budget Group, and Zeemac Vehicle Acquisition & Fleet Services among others |

Market Definition

Fleet management is the processes and practices involved in managing a company's fleet of vehicles. Fleet management includes cars, trucks, vans, and other vehicles used for business purposes. It also involves many practices, such as vehicle acquisition, maintenance, fuel management, driver management, and safety and compliance. The goal of fleet management is to optimize the use of company vehicles to improve efficiency, reduce costs, and enhance safety. Effective fleet management can help companies to increase productivity, reduce downtime, and extend the useful life of their vehicles. It can also help to improve driver behavior, reduce accidents, and ensure compliance with regulations and policies. Fleet management is used in various industries, including transportation, logistics, delivery services, and construction. Advanced technologies, such as GPS tracking and telematics, have made fleet management more effective and efficient in recent years.

Middle East and Africa Fleet Management Market Dynamics

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Chancen, Beschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Steigende Nachfrage nach Logistik durch die E-Commerce-Branche

Flottenmanagement ist eine Praxis, die es Unternehmen ermöglicht, Lieferfahrzeuge zu verwalten und zu koordinieren, um optimale Effizienz zu erreichen und Kosten zu senken. Die Praxis des Flottenmanagements wird verwendet, um Kuriere und Lieferpersonal zu überwachen und aufzuzeichnen. Es erfordert ein System von Technologien, die es dem Flottenmanager erleichtern, die Aktivitäten vom Kraftstoffmanagement bis zur Routenplanung zu koordinieren – und die mithilfe von Flottenmanagementsoftware einfach verwaltet werden können. Die Expansion der E-Commerce-Branche hat die Logistikbranche erheblich beeinflusst. Die Logistik gilt als das Rückgrat der E-Commerce-Branche, da sie sich direkt auf geplante Abläufe, Lagerräume und Produktionsnetzwerkorganisationen auswirkt. Sie werden zunehmend auf Neuausrichtung angewiesen sein, um die steigenden Anforderungen im Zusammenhang mit der Entwicklung des E-Commerce-Sektors zu bewältigen. Wenn sie diesen Weg entweder für die Zustellung auf der letzten Meile oder für die Auftragserfüllung einschlagen, können sie eine vorhersehbare, zuverlässige, produktive und störungsfreie Zustellung gewährleisten. Dies kann daher ein wichtiger Faktor bei der Bewältigung und Steigerung des Drucks sein, der durch das erwartete Wachstum der E-Commerce-Branche entsteht.

- Steigende Nachfrage nach Verbesserung des Kundenservice

Kunden sind heutzutage intelligenter und haben höhere Erwartungen als je zuvor. Kundenzufriedenheit und -glück gehören zu den wichtigsten Überlegungen für jedes Unternehmen. Unabhängig vom Geschäftsbereich bleiben unzufriedene Kunden nicht lange Kunden, daher ist es wichtig, sie zufriedenzustellen und ihnen das Gefühl zu geben, geschätzt zu werden. Dies gilt auch für Logistik und Flottenmanagement, wo die Kundenbindung der Schlüssel zum langfristigen Erfolg ist. Die Verbesserung von Kundenservice und -zufriedenheit durch eine verbesserte Flottenmanagementleistung ist ein Schlüsselfaktor, von dem erwartet wird, dass er den Flottenmanagementmarkt im Nahen Osten und in Afrika ankurbelt. Im heutigen wettbewerbsintensiven Markt erkennen Unternehmen die Bedeutung der Kundenzufriedenheit und nutzen fortschrittliche Technologien in Flottenmanagementlösungen, um ihre Abläufe zu optimieren und das Kundenerlebnis zu verbessern

Gelegenheiten

- Steigende Nachfrage nach Nutzfahrzeugen

Nutzfahrzeuge sind Fahrzeuge, die für den Transport von Gütern oder Passagieren konzipiert und verwendet werden. Zu diesen Fahrzeugen gehören Lastwagen, Lieferwagen, Busse und ähnliche Fahrzeuge, die für gewerbliche Zwecke verwendet werden. Der Nutzfahrzeugmarkt ist ein entscheidender Bestandteil der Automobilindustrie im Nahen Osten und in Afrika und hat in den letzten Jahrzehnten ein erhebliches Wachstum erlebt. Der Anstieg der Nachfrage nach Nutzfahrzeugen kann auf mehrere Faktoren zurückgeführt werden, darunter das Wachstum der E-Commerce-Branche, die zunehmende Urbanisierung und der Bedarf an effizienten Transportsystemen. Da immer mehr Unternehmen für ihre Transportbedürfnisse auf Nutzfahrzeuge angewiesen sind, wird auch erwartet, dass die Nachfrage nach Flottenmanagementdiensten und -software steigt. Einer der Gründe für den Anstieg der Nachfrage nach Nutzfahrzeugen ist das Wachstum der E-Commerce-Branche. Die Nachfrage nach Transportdiensten ist mit der zunehmenden Anzahl von Online-Shopping-Plattformen gestiegen. Infolgedessen ist die Verwendung von Nutzfahrzeugen üblicher geworden und das Flottenmanagement ist wichtiger geworden.

Einschränkungen/Herausforderungen

- Geringere Effizienz bei der Konnektivität

Die Logistik- und Transportbranche hat sich in den letzten Jahren erheblich verändert. Konzepte wie Digitalisierung, die Entstehung von Big Data und Konnektivität wurden eingeführt, und viele Flotten nutzen jetzt frühe Versionen dieser neuen Technologien. In vielen Fällen verändern sie die tägliche Arbeitsweise von Flottenmanagern. Konnektivität ist eines der wichtigsten und effektivsten Konzepte. Hier kann ein Flottenmanager einen Überblick über die gesamte Flotte haben und durch automatisierte Prozesse, die verwertbare Daten von Bordgeräten liefern, mit Fahrern, LKWs und Anhängern in Kontakt bleiben. Durch Telematikgeräte und verbundene Softwarelösungen können Flottenprobleme bei Auftreten kleinerer Fahrzeugprobleme gemeldet werden, sodass Probleme früher behoben und behoben werden können, bevor es zu Pannen kommt. Dies bietet die Flexibilität, laufende Reparaturen oder geplante Wartungsarbeiten im Voraus durchzuführen, wodurch die LKWs häufiger auf der Straße bleiben und mehr Zeit für die Lieferung von Waren haben.

- Unzureichende Anleitung zum Aktivieren der Route

Ein Fahrzeugortungssystem kann als Teil eines Flottenmanagementsystems definiert werden, das es dem Flottenbetreiber ermöglicht, den Standort des Fahrzeugs während der Fahrt im Zeitverlauf zu ermitteln. Abgesehen davon, dass die vom Fahrzeugortungssystem generierten Daten zur Einhaltung des Busfahrplans verwendet werden, liefern diese Daten auch wichtige Informationen für die Entscheidungsfindung. Das System erleichtert die Berechnung der genauen zurückgelegten Entfernung in einem bestimmten Zeitraum, die Berechnung der Geschwindigkeit des Busses an einem bestimmten Standort und die Analyse der Zeit, die das Fahrzeug benötigt, um eine bestimmte Entfernung zurückzulegen. Es wird zu einem sehr leistungsfähigen Werkzeug für Betriebsagenturen.

Auswirkungen von COVID-19 auf den Flottenmanagementmarkt im Nahen Osten und in Afrika

COVID-19 hatte aufgrund von Lockdown-Bestimmungen und Vorschriften für Produktionsstätten negative Auswirkungen auf den Flottenmanagementmarkt.

Die COVID-19-Pandemie hat den Flottenmanagementmarkt in gewissem Maße negativ beeinflusst. Die zunehmende Einführung des Flottenmanagements im Luftfahrtsektor hat dem Markt jedoch geholfen, nach der Pandemie zu wachsen. Außerdem war das Wachstum seit der Marktöffnung nach COVID-19 hoch, und es wird erwartet, dass es in diesem Sektor ein beträchtliches Wachstum geben wird.

Die Hersteller treffen verschiedene strategische Entscheidungen, um nach COVID-19 wieder auf die Beine zu kommen. Die Akteure führen zahlreiche Forschungs- und Entwicklungsaktivitäten durch, um die Technologie für das Flottenmanagement zu verbessern. Damit werden die Unternehmen fortschrittliche Technologien auf den Markt bringen. Darüber hinaus haben staatliche Initiativen zur Nutzung von Automatisierungstechnologie zum Wachstum des Marktes geführt.

Jüngste Entwicklung

- Im Oktober 2022 gab Chevin Fleet Solutions bekannt, dass das Unternehmen neue Anwendungen, „FleetWave Technician“ und „FleetWave Driver“, für seine Flottenmanagement-Softwareprodukte auf den Markt gebracht hat.

- Im Februar 2022 gab Element Fleet Management Corp. bekannt, dass das Unternehmen Arc by Element auf den Markt gebracht hat, ein End-to-End-Angebot für Elektrofahrzeugflotten, um Kunden bei der Bewältigung und Vereinfachung des komplexen Umstiegs von Fahrzeugen mit Verbrennungsmotor (ICE) auf Elektrofahrzeuge zu unterstützen.

Marktumfang für Flottenmanagement im Nahen Osten und in Afrika

Der Flottenmanagementmarkt im Nahen Osten und Afrika ist segmentiert auf der Grundlage von Angebot, Leasingart, Transportart, Fahrzeugtyp, Hardware, Flottengröße, Kommunikationsreichweite, Bereitstellungsmodell, Technologie, Funktionen, Betrieb, Geschäftstyp und Endbenutzer. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen dabei helfen, strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Angebot

- Lösung

- Dienstleistungen

Auf der Grundlage des Angebots wird der Markt in Lösungen und Dienstleistungen segmentiert.

Leasingart

- Im Leasing

- Ohne Mietvertrag

Auf Grundlage der Leasingart wird der Markt in „mit Leasing“ und „ohne Leasing“ segmentiert.

Transportmittel

- Automobilindustrie

- Marine

- Fahrzeuge

- Flugzeug

Auf der Grundlage der Transportart ist der Markt in die Bereiche Automobil, Schifffahrt, Schienenfahrzeuge und Flugzeuge segmentiert.

Fahrzeugtyp

- Verbrennungsmotoren (ICE)

- Elektrofahrzeug

Auf der Grundlage des Fahrzeugtyps ist der Markt in Fahrzeuge mit Verbrennungsmotor (ICE) und Elektrofahrzeuge segmentiert.

Hardware

- GPS-Tracking-Geräte

- Armaturenbrettkameras

- Bluetooth-Tracking-Tags (BLE Beacons)

- Datenlogger

- Sonstiges

Auf der Grundlage der Hardware ist der Markt in GPS-Trackinggeräte, Armaturenbrettkameras, Bluetooth-Tracking-Tags (BLE-Beacons), Datenlogger und andere unterteilt.

Flottengröße

- Kleine Flotten (1–5 Fahrzeuge)

- Mittlere Flotten (5–20 Fahrzeuge)

- Große und Unternehmensflotten (20–50+ Fahrzeuge)

Auf der Grundlage der Flottengröße wird der Markt in kleine Flotten (1–5 Fahrzeuge), mittlere Flotten (5–20 Fahrzeuge) und große Flotten und Unternehmensflotten (20–50+ Fahrzeuge) segmentiert.

Kommunikationsreichweite

- Nahbereichskommunikation

- Kommunikation über große Entfernungen

Auf der Grundlage der Kommunikationsreichweite wird der Markt in Nahbereichskommunikation und Fernbereichskommunikation segmentiert.

Bereitstellungsmodell

- Vor Ort

- Wolke

- Hybrid

Auf der Grundlage des Bereitstellungsmodells ist der Markt in On-Premise, Cloud und Hybrid segmentiert.

Technologie

- GNSS

- Zelluläre Systeme

- Elektronischer Datenaustausch (EDI)

- Fernerkundung

- Computergestützte Methoden

- Entscheidungsfindung

- RFID

- Sonstiges

Auf der Grundlage der Technologie ist der Markt in GNSS, Mobilfunksysteme, elektronischen Datenaustausch (EDI), Fernerkundung, rechnergestützte Methoden, Entscheidungsfindung, RFID und andere unterteilt.

Funktion

- Überwachung des Fahrerverhaltens

- Kraftstoffverbrauch

- Vermögensverwaltung

- ELD-Beschwerde

- Routenmanagement

- Fahrzeugwartungs-Updates

- Lieferplan

- Unfallverhütung

- Fahrzeugstandort in Echtzeit

- Mobile Apps

- Sonstiges

Auf der Grundlage der Funktion ist der Markt in die Überwachung des Fahrerverhaltens, des Kraftstoffverbrauchs, des Anlagenmanagements, der ELD-Beschwerden, des Routenmanagements, der Fahrzeugwartungsaktualisierungen, des Lieferplans, der Unfallverhütung, der Fahrzeugortung in Echtzeit, der mobilen Apps und anderer Bereiche segmentiert.

Operationen

- Privat

- Kommerziell

Auf der Grundlage der Geschäftstätigkeit wird der Markt in einen privaten und einen gewerblichen Markt segmentiert.

Unternehmenstätigkeit

- Kleine Unternehmen

- Große Unternehmen

Auf der Grundlage der Geschäftsart wird der Markt in kleine und große Unternehmen segmentiert.

Endbenutzer

- Automobilindustrie

- Transport und Logistik

- Einzelhandel

- Herstellung

- Essen & Getränke

- Energie und Versorgung

- Bergbau

- Regierung

- Gesundheitspflege

- Landwirtschaft

- Konstruktion

- Sonstiges

Auf der Grundlage des Endverbrauchers ist der Markt segmentiert in Automobil, Transport und Logistik, Einzelhandel, Fertigung, Lebensmittel und Getränke, Energie und Versorgung, Bergbau, Regierung, Gesundheitswesen, Landwirtschaft, Bauwesen und andere. Alle Automobile, Transport und Logistik, Einzelhandel, Fertigung, Lebensmittel und Getränke, Energie und Versorgung, Bergbau, Regierung, Gesundheitswesen, Landwirtschaft und Bauwesen.

Regionale Analyse/Einblicke zum Flottenmanagementmarkt im Nahen Osten und in Afrika

Der Flottenmanagementmarkt im Nahen Osten und in Afrika wird analysiert und Erkenntnisse und Trends in Bezug auf die Marktgröße werden nach Angebot, Leasingart, Transportart, Fahrzeugtyp, Hardware, Flottengröße, Kommunikationsreichweite, Bereitstellungsmodell, Technologie, Funktionen, Betrieb, Geschäftstyp und Endbenutzer wie oben angegeben bereitgestellt.

Die im Marktbericht zum Flottenmanagement abgedeckten Länder sind Saudi-Arabien, die Vereinigten Arabischen Emirate, Israel, Ägypten, Südafrika und der restliche Nahe Osten und Afrika.

Aufgrund der zunehmenden Automatisierung in der Fertigung und der industriellen Robotik dominiert Saudi-Arabien die Region Naher Osten und Afrika.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Fleet Management Market Share Analysis

Middle East and Africa fleet management market competitive landscape provide details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the fleet management market.

Some of the major players operating in the Middle East and Africa fleet management market are TRAXALL, Donlen LeasePlan, Enterprise Holdings, Emkay, Chevin Fleet Solutions, Deutsche Leasing AG, BERGSTROM AUTOMOTIVE, TÜV SÜD, Motive Technologies, Inc., ALD Automotive, VEL’CO, Avrios, Element Fleet Management Corp., Rarestep, Inc., OviDrive B.V., FleetCompany GmbH, Sixt Leasing (Acquired by Hyundai Capital Bank Europe GmbH) , Fleetcare Pty Ltd., Capital Lease Group, Wilmar Inc., Wheels, NEXTRAQ, LLC, Avis Budget Group, and Zeemac Vehicle Acquisition & Fleet Services among others.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS MODEL

4.2 REGULATORY LANDSCAPE

4.3 TOP WINNING STRATEGIES

4.4 COMPANY CAR POLICY

4.4.1 BENEFITS OF CAR POLICY CENTRALIZATION

4.4.2 CORPORATE POLICIES ON THE USAGE OF COMPANY CARS

4.5 FLEET MANAGEMENT PROFIT ALLOCATION ALONG THE VALUE CHAIN

4.6 BRAND COMPARATIVE ANALYSIS

4.6.1 TRAXALL

4.6.2 LEASEPLAN

4.6.3 ENTERPRISE HOLDINGS

4.6.4 ELEMENT FLEET MANAGEMENT

4.6.5 WHEELS

4.7 DISRUPTIVE TECHNOLOGIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR THE LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASE IN DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 LOWER EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DEMAND FOR UTILITY VEHICLES

5.3.2 RISE IN THE TREND OF MIDDLE EAST & AFRICAIZATION

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 INCREASE IN DATA-DRIVEN MODELS IN MOBILITY

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISE IN CYBER THREATS

6 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE

6.1 OVERVIEW

6.2 SHORT RANGE COMMUNICATION

6.3 LONG RANGE COMMUNICATION

7 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD

7.4 HYBRID

8 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 GNSS

8.3 CELLULAR SYSTEMS

8.4 LECTRONIC DATA INTERCHANGE (EDI)

8.5 REMOTE SENSING

8.6 COMPUTATIONAL METHOD & DECISION MAKING

8.7 RFID

8.8 OTHERS

9 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY FUNCTIONS

9.1 OVERVIEW

9.2 ASSET MANAGEMENT

9.3 ROUTE MANAGEMENT

9.4 FUEL CONSUMPTION

9.5 REAL TIME VEHICLE LOCATION

9.6 DELIVERY SCHEDULE

9.7 ACCIDENT PREVENTION

9.8 MOBILE APPS

9.9 MONITORING DRIVER BEHAVIOR

9.1 VEHICLE MAINTENANCE UPDATES

9.11 ELD COMPLIANCE

9.12 OTHERS

10 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY OPERATIONS

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 PRIVATE

11 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

11.1 OVERVIEW

11.2 LARGE BUSINESS

11.2.1 FLORIST & GIFT DELIVERY BUSINESS

11.2.2 CATERING & FOOD DELIVERING COMPANY

11.2.3 CLEANING SERVICE COMPANY

11.2.4 ELECTRICIAN/PLUMBING/HVAC COMPANY

11.2.5 LANDSCAPING BUSINESS

11.3 SMALL BUSINESS

11.3.1 RENTAL CAR/TRUCK COMPANY

11.3.2 MOVING COMPANY

11.3.3 TAXI COMPANY

11.3.4 DELIVERY COMPANY

11.3.5 LONG HAUL SEMI-TRUCK COMPANY

12 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

12.1 OVERVIEW

12.2 INTERNAL COMBUSTION ENGINE

12.3 ELECTRIC VEHICLE

13 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY OFFERING

13.1 OVERVIEW

13.2 SOLUTIONS

13.2.1 ETA PREDICTIONS

13.2.1.1 STREAMLINED ROUTES

13.2.1.2 DETAILED LOCATION DATA

13.2.1.3 BREAKDOWN NOTIFICATION

13.2.2 OPERATIONS MANAGEMENT

13.2.2.1 FLEET TRACKING & GEO-FENCING

13.2.2.2 ROUTING & SCHEDULING

13.2.2.3 REAL & IDLE TIME MONITORING

13.2.3 PERFORMANCE MANAGEMENT

13.2.3.1 DRIVER MANAGEMENT

13.2.3.1.1 TRACKING

13.2.3.1.2 ROADSIDE/EMERGENCY ASSISTANCE FOR DRIVERS

13.2.3.1.3 MONITORING OF MISUSE (HARD BRAKING)

13.2.3.2 FLEET MANAGEMENT & TRACKING

13.2.3.2.1 REAL TIME ROUTING

13.2.3.2.2 SPEED/IDLING REAL TIME FEEDBACK

13.2.3.2.3 ENGINE DATA VIA ON-BOARD SENSORS

13.2.4 VEHICLE MAINTENANCE & DIAGNOSTICS

13.2.5 SAFETY & COMPLIANCE MANAGEMENT

13.2.6 RISK MANAGEMENT

13.2.7 CONTRACT MANAGEMENT

13.2.7.1 FUEL MANAGEMENT

13.2.7.2 ACCIDENT MANAGEMENT

13.2.7.3 ADMINISTRATIVE COST

13.2.7.4 LONG TERM CONTRACT

13.2.7.5 SHORT TERM CONTRACT

13.3 SERVICES

13.3.1 PROFESSIONAL SERVICES

13.3.1.1 SUPPORT & MAINTENANCE

13.3.1.2 IMPLEMENTATION

13.3.1.3 CONSULTING

13.3.2 MANAGED SERVICES

14 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY LEASE TYPE

14.1 OVERVIEW

14.2 ON-LEASE

14.3 WITHOUT LEASE

14.3.1 OPEN ENDED

14.3.2 CLOSE ENDED

15 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY HARDWARE

15.1 OVERVIEW

15.2 GPS TRACKING DEVICES

15.3 DASH CAMERAS

15.4 BLUETOOTH TRACKING TAGS

15.5 DATA LOGGERS

15.6 OTHERS

16 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY FLEET SIZE

16.1 OVERVIEW

16.2 SMALL FLEETS (1-5 VEHICLES)

16.3 MEDIUM FLEETS (5-20 VEHICLES)

16.4 LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES)

17 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

17.1 OVERVIEW

17.1.1 AUTOMOTIVE

17.1.2 LIGHT DUTY VEHICLE

17.1.2.1 PASSENGER CARS

17.1.2.2 VANS

17.1.3 MEDIUM & HEAVY VEHICLE

17.1.3.1 TRUCKS

17.1.3.2 TRAILERS

17.1.3.3 FORKLIFTS

17.1.3.4 SPECIALIST VEHICLES

17.1.4 MARINE

17.1.5 ROLLING STOCK

17.1.6 AIRCRAFT

18 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY END USER

18.1 OVERVIEW

18.2 AUTOMOTIVE

18.2.1 SOLUTIONS

18.2.1.1 ETA PREDICTIONS

18.2.1.2 OPERATIONS MANAGEMENT

18.2.1.3 PERFORMANCE MANAGEMENT

18.2.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.2.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.2.1.6 RISK MANAGEMENT

18.2.1.7 CONTRACT MANAGEMENT

18.2.2 SERVICES

18.2.2.1 PROFESSIONAL SERVICES

18.2.2.2 MANAGED SERVICES

18.3 TRANSPORTATION & LOGISTICS

18.3.1 SOLUTIONS

18.3.1.1 ETA PREDICTIONS

18.3.1.2 OPERATIONS MANAGEMENT

18.3.1.3 PERFORMANCE MANAGEMENT

18.3.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.3.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.3.1.6 RISK MANAGEMENT

18.3.1.7 CONTRACT MANAGEMENT

18.3.2 SERVICES

18.3.2.1 PROFESSIONAL SERVICES

18.3.2.2 MANAGED SERVICES

18.4 RETAIL

18.4.1 SOLUTIONS

18.4.1.1 ETA PREDICTIONS

18.4.1.2 OPERATIONS MANAGEMENT

18.4.1.3 PERFORMANCE MANAGEMENT

18.4.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.4.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.4.1.6 RISK MANAGEMENT

18.4.1.7 CONTRACT MANAGEMENT

18.4.2 SERVICES

18.4.2.1 PROFESSIONAL SERVICES

18.4.2.2 MANAGED SERVICES

18.5 MANUFACTURING

18.5.1 SOLUTIONS

18.5.1.1 ETA PREDICTIONS

18.5.1.2 OPERATIONS MANAGEMENT

18.5.1.3 PERFORMANCE MANAGEMENT

18.5.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.5.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.5.1.6 RISK MANAGEMENT

18.5.1.7 CONTRACT MANAGEMENT

18.5.2 SERVICES

18.5.2.1 PROFESSIONAL SERVICES

18.5.2.2 MANAGED SERVICES

18.6 FOOD & BEVERAGES

18.6.1 SOLUTIONS

18.6.1.1 ETA PREDICTIONS

18.6.1.2 OPERATIONS MANAGEMENT

18.6.1.3 PERFORMANCE MANAGEMENT

18.6.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.6.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.6.1.6 RISK MANAGEMENT

18.6.1.7 CONTRACT MANAGEMENT

18.6.2 SERVICES

18.6.2.1 PROFESSIONAL SERVICES

18.6.2.2 MANAGED SERVICES

18.7 ENERGY & UTILITIES

18.7.1 SOLUTIONS

18.7.1.1 ETA PREDICTIONS

18.7.1.2 OPERATIONS MANAGEMENT

18.7.1.3 PERFORMANCE MANAGEMENT

18.7.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.7.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.7.1.6 RISK MANAGEMENT

18.7.1.7 CONTRACT MANAGEMENT

18.7.2 SERVICES

18.7.2.1 PROFESSIONAL SERVICES

18.7.2.2 MANAGED SERVICES

18.8 MINING

18.8.1 SOLUTIONS

18.8.1.1 ETA PREDICTIONS

18.8.1.2 OPERATIONS MANAGEMENT

18.8.1.3 PERFORMANCE MANAGEMENT

18.8.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.8.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.8.1.6 RISK MANAGEMENT

18.8.1.7 CONTRACT MANAGEMENT

18.8.2 SERVICES

18.8.2.1 PROFESSIONAL SERVICES

18.8.2.2 MANAGED SERVICES

18.9 GOVERNMENT

18.9.1 SOLUTIONS

18.9.1.1 ETA PREDICTIONS

18.9.1.2 OPERATIONS MANAGEMENT

18.9.1.3 PERFORMANCE MANAGEMENT

18.9.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.9.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.9.1.6 RISK MANAGEMENT

18.9.1.7 CONTRACT MANAGEMENT

18.9.2 SERVICES

18.9.2.1 PROFESSIONAL SERVICES

18.9.2.2 MANAGED SERVICES

18.1 HEALTHCARE

18.10.1 SOLUTIONS

18.10.1.1 ETA PREDICTIONS

18.10.1.2 OPERATIONS MANAGEMENT

18.10.1.3 PERFORMANCE MANAGEMENT

18.10.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.10.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.10.1.6 RISK MANAGEMENT

18.10.1.7 CONTRACT MANAGEMENT

18.10.2 SERVICES

18.10.2.1 PROFESSIONAL SERVICES

18.10.2.2 MANAGED SERVICES

18.11 AGRICULTURE

18.11.1 SOLUTIONS

18.11.1.1 ETA PREDICTIONS

18.11.1.2 OPERATIONS MANAGEMENT

18.11.1.3 PERFORMANCE MANAGEMENT

18.11.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.11.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.11.1.6 RISK MANAGEMENT

18.11.1.7 CONTRACT MANAGEMENT

18.11.2 SERVICES

18.11.2.1 PROFESSIONAL SERVICES

18.11.2.2 MANAGED SERVICES

18.12 CONSTRUCTION

18.12.1 SOLUTIONS

18.12.1.1 ETA PREDICTIONS

18.12.1.2 OPERATIONS MANAGEMENT

18.12.1.3 PERFORMANCE MANAGEMENT

18.12.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.12.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.12.1.6 RISK MANAGEMENT

18.12.1.7 CONTRACT MANAGEMENT

18.12.2 SERVICES

18.12.2.1 PROFESSIONAL SERVICES

18.12.2.2 MANAGED SERVICES

18.13 OTHERS

19 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY REGION

19.1 MIDDLE EAST AND AFRICA

19.1.1 SAUDI ARABIA

19.1.2 SOUTH AFRICA

19.1.3 EGYPT

19.1.4 ISRAEL

19.1.5 REST OF MIDDLE EAST AND AFRICA

20 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 ENTERPRISE HOLDINGS

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 SOLUTION PORTFOLIO

22.1.4 RECENT DEVELOPMENTS

22.2 AVIS BUDGET GROUP

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 SOLUTION PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 DEUTSCHE LEASING AG

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 SOLUTION PORTFOLIO

22.3.5 RECENT DEVELOPMENT

22.4 ALD AUTOMOTIVE

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 SOLUTION PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 LEASEPLAN

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 SOLUTION PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 AVRIOS

22.6.1 COMPANY SNAPSHOT

22.6.2 SOLUTION PORTFOLIO

22.6.3 RECENT DEVELOPMENT

22.7 BERGSTROM AUTOMOTIVE

22.7.1 COMPANY SNAPSHOT

22.7.2 SOLUTION PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CAPITAL LEASE GROUP

22.8.1 COMPANY SNAPSHOT

22.8.2 SOLUTION PORTFOLIO

22.8.3 RECENT DEVELOPMENTS

22.9 CHEVIN FLEET SOLUTIONS

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS

22.1 DONLEN

22.10.1 COMPANY SNAPSHOT

22.10.2 SOLUTION PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 ELEMENT FLEET MANAGEMENT CORP.

22.11.1 COMPANY SNAPSHOT

22.11.2 REVENUE ANALYSIS

22.11.3 SOLUTION PORTFOLIO

22.11.4 RECENT DEVELOPMENT

22.12 EMKAY

22.12.1 COMPANY SNAPSHOT

22.12.2 SOLUTION PORTFOLIO

22.12.3 RECENT DEVELOPMENT

22.13 FLEETCARE PTY LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 SOLUTION PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 FLEETCOMPANY GMBH

22.14.1 COMPANY SNAPSHOT

22.14.2 SOLUTION PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 MOTIVE TECHNOLOGIES, INC.

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 NEXTRAQ, LLC

22.16.1 COMPANY SNAPSHOT

22.16.2 SOLUTION PORTFOLIO

22.16.3 RECENT DEVELOPMENTS

22.17 OVIDRIVE B.V.

22.17.1 COMPANY SNAPSHOT

22.17.2 SOLUTION PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 RARESTEP, INC.

22.18.1 COMPANY SNAPSHOT

22.18.2 SOLUTION PORTFOLIO

22.18.3 RECENT DEVELOPMENTS

22.19 SIXT LEASING

22.19.1 COMPANY SNAPSHOT

22.19.2 REVENUE ANALYSIS

22.19.3 SOLUTION PORTFOLIO

22.19.4 RECENT DEVELOPMENT

22.2 TRAXALL

22.20.1 COMPANY SNAPSHOT

22.20.2 SOLUTION PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 TÜV SÜD

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 SOLUTION PORTFOLIO

22.21.4 RECENT DEVELOPMENT

22.22 VELCO

22.22.1 COMPANY SNAPSHOT

22.22.2 SOLUTION PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 WHEELS

22.23.1 COMPANY SNAPSHOT

22.23.2 SOLUTION PORTFOLIO

22.23.3 RECENT DEVELOPMENTS

22.24 WILMAR INC.

22.24.1 COMPANY SNAPSHOT

22.24.2 SOLUTION PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

22.25 ZEEMAC VEHICLE ACQUISITION & FLEET SERVICES

22.25.1 COMPANY SNAPSHOT

22.25.2 SOLUTION PORTFOLIO

22.25.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 VARIOUS REGULATORY STANDARDS RELATED TO FLEET MANAGEMENT

TABLE 2 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA SHORT RANGE COMMUNICATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA LONG RANGE COMMUNICATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA ON-PREMISE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA CLOUD IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA HYBRID IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA GNSS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA CELLULAR SYSTEMS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA ELECTRONIC DATA INTERCHANGE (EDI) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA REMOTE SENSING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA COMPUTATIONAL METHOD & DECISION MAKING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RFID IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA ASSET MANAGEMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA ROUTE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA FUEL CONSUMPTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA REAL TIME VEHICLE LOCATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA DELIVERY SCHEDULE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ACCIDENT PREVENTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA MOBILE APPS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MONITORING DRIVER BEHAVIOR IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA VEHICLE MAINTENANCE UPDATES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA ELD COMPLIANCE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA COMMERCIAL IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA PRIVATE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA INTERNAL COMBUSTION ENGINE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA ON-LEASE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA GPS TRACKING DEVICES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA DASH CAMERAS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA BLUETOOTH TRACKING TAGS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA DATA LOGGERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA SMALL FLEETS (1-5 VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA MEDIUM FLEETS (5-20 VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA MARINE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA ROLLING STOCK IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA AIRCRAFT STOCK IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 79 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 81 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND)

TABLE 83 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 MIDDLE EAST & AFRICA RETAIL IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 85 MIDDLE EAST & AFRICA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 86 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 MIDDLE EAST & AFRICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 89 MIDDLE EAST & AFRICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 93 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 MIDDLE EAST & AFRICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 97 MIDDLE EAST & AFRICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 98 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MIDDLE EAST & AFRICA MINING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 101 MIDDLE EAST & AFRICA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 102 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 MIDDLE EAST & AFRICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 105 MIDDLE EAST & AFRICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 106 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 MIDDLE EAST & AFRICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 109 MIDDLE EAST & AFRICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 110 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 MIDDLE EAST & AFRICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 113 MIDDLE EAST & AFRICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 114 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 MIDDLE EAST & AFRICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 117 MIDDLE EAST & AFRICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 MIDDLE EAST & AFRICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 146 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 MIDDLE EAST AND AFRICA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 MIDDLE EAST AND AFRICA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 151 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 MIDDLE EAST AND AFRICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 MIDDLE EAST AND AFRICA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 160 MIDDLE EAST AND AFRICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 164 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 MIDDLE EAST AND AFRICA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 171 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 MIDDLE EAST AND AFRICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 MIDDLE EAST AND AFRICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 MIDDLE EAST AND AFRICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 MIDDLE EAST AND AFRICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 185 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 SAUDI ARABIA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 SAUDI ARABIA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 SAUDI ARABIA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 189 SAUDI ARABIA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 SAUDI ARABIA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 SAUDI ARABIA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 192 SAUDI ARABIA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 193 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 SAUDI ARABIA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 196 SAUDI ARABIA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 198 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 199 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 200 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 201 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 202 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 203 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 204 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 SAUDI ARABIA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 SAUDI ARABIA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 209 SAUDI ARABIA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 210 SAUDI ARABIA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 SAUDI ARABIA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 213 SAUDI ARABIA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 214 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 216 SAUDI ARABIA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 217 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 218 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 219 SAUDI ARABIA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 220 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 SAUDI ARABIA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 223 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 225 SAUDI ARABIA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 226 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 227 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 228 SAUDI ARABIA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 229 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 230 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 SAUDI ARABIA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 232 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 234 SAUDI ARABIA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 235 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 236 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 SAUDI ARABIA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 238 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 SAUDI ARABIA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 241 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 243 SAUDI ARABIA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 244 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 245 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 246 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 247 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 SOUTH AFRICA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 SOUTH AFRICA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 250 SOUTH AFRICA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 251 SOUTH AFRICA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 252 SOUTH AFRICA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 SOUTH AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 254 SOUTH AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 255 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 SOUTH AFRICA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 257 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 258 SOUTH AFRICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 260 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 261 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 262 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 263 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 264 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 265 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 266 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 SOUTH AFRICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 SOUTH AFRICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 270 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 271 SOUTH AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 272 SOUTH AFRICA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 273 SOUTH AFRICA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 274 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 275 SOUTH AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 276 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 278 SOUTH AFRICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 279 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 280 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 281 SOUTH AFRICA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 282 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 283 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 SOUTH AFRICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 285 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 286 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 SOUTH AFRICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 288 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 290 SOUTH AFRICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 291 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 292 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 SOUTH AFRICA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 294 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 295 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 SOUTH AFRICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 297 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 299 SOUTH AFRICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 300 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 301 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 SOUTH AFRICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 303 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 304 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 SOUTH AFRICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 306 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 308 EGYPT FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 309 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 310 EGYPT ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 EGYPT OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 312 EGYPT PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 313 EGYPT DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 EGYPT FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 315 EGYPT CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 316 EGYPT CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 317 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 318 EGYPT PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 319 EGYPT FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 320 EGYPT WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 321 EGYPT FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 322 EGYPT FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 323 EGYPT FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 324 EGYPT FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 325 EGYPT FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 326 EGYPT FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 327 EGYPT FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 328 EGYPT FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 329 EGYPT LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 330 EGYPT SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 331 EGYPT FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 332 EGYPT FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 333 EGYPT AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 334 EGYPT LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 335 EGYPT MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 336 EGYPT FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 337 EGYPT AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 338 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 339 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 340 EGYPT TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 341 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 342 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 343 EGYPT RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 344 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 345 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 346 EGYPT MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 347 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 348 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 349 EGYPT FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 350 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 351 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 352 EGYPT ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 353 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 354 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 355 EGYPT MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 356 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 357 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 358 EGYPT GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 359 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 360 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 361 EGYPT HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 362 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 363 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 364 EGYPT AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 365 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 366 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 367 EGYPT CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 368 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 369 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 370 ISRAEL FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 371 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 372 ISRAEL ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 373 ISRAEL OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 374 ISRAEL PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 375 ISRAEL DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 376 ISRAEL FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 377 ISRAEL CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 378 ISRAEL CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 379 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 380 ISRAEL PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 381 ISRAEL FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 382 ISRAEL WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 383 ISRAEL FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 384 ISRAEL FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 385 ISRAEL FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 386 ISRAEL FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 387 ISRAEL FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 388 ISRAEL FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 389 ISRAEL FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 390 ISRAEL FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 391 ISRAEL LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 392 ISRAEL SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 393 ISRAEL FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 394 ISRAEL FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 395 ISRAEL AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 396 ISRAEL LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 397 ISRAEL MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 398 ISRAEL FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 399 ISRAEL AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 400 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 401 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 402 ISRAEL TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 403 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 404 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 405 ISRAEL RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 406 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 407 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 408 ISRAEL MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 409 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 410 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 411 ISRAEL FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 412 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 413 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 414 ISRAEL ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 415 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 416 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 417 ISRAEL MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 418 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 419 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 420 ISRAEL GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 421 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 422 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)