Middle East And Africa Ready To Eat Food Market

Marktgröße in Milliarden USD

CAGR :

%

USD

22.59 Billion

USD

43.82 Billion

2024

2032

USD

22.59 Billion

USD

43.82 Billion

2024

2032

| 2025 –2032 | |

| USD 22.59 Billion | |

| USD 43.82 Billion | |

|

|

|

|

Marktsegmentierung für verzehrfertige Lebensmittel im Nahen Osten und in Afrika nach Produkttyp (Fleischprodukte, Produkte auf Getreidebasis, Milchprodukte, Backwaren, herzhafte Süßigkeiten, Süßwaren, Produkte auf Gemüsebasis, Instantsuppen, herzhafte Snacks, gekühlte Lebensmittel, pflanzliche Fleischsnacks und verzehrfertige Mahlzeiten), Kategorie (konventionell und Spezial), Verpackungstyp (Beutel/Tütchen, Dosen, Gläser und Behälter, Flaschen, Schachteln und andere), Verpackungsgröße (weniger als 250 Gramm, 251–500 Gramm, 501–750 Gramm, 751–1000 Gramm und mehr als 1000 Gramm), Verpackungstechnologie (Sauerstofffänger, Feuchtigkeitskontrolle, antimikrobielle Mittel, Zeit-Temperatur-Indikatoren und essbare Folien), Lagertyp (gefroren/gekühlt, lagerstabil, in Dosen und andere), Vertriebskanal (Laden- und Nicht-Laden-Kanal), Endbenutzer (Lebensmittelindustrie, Dienstleistungen, Haushalte und andere) – Branchentrends und Prognose bis 2032

Marktanalyse für verzehrfertige Lebensmittel im Nahen Osten und Afrika

Der Markt für verzehrfertige Lebensmittel (RTE) im Nahen Osten und Afrika wächst stetig, angetrieben von der steigenden Nachfrage der Verbraucher nach praktischen und zeitsparenden Mahlzeiten. Urbanisierung, ein geschäftiger Lebensstil und veränderte Ernährungsgewohnheiten sind Schlüsselfaktoren für diesen Wandel. Tiefkühlgerichte, Instant-Snacks und verpackte Fertiggerichte erfreuen sich in verschiedenen Bevölkerungsgruppen zunehmender Beliebtheit. Während Nordamerika und Europa den Markt anführen, entwickelt sich der asiatisch-pazifische Raum aufgrund steigender verfügbarer Einkommen und veränderter Ernährungsvorlieben zu einem starken Konkurrenten. Gesundheitsbewusste Verbraucher suchen nach biologischen, konservierungsmittelfreien und nahrhaften Optionen. Innovationen in den Bereichen Verpackung, Nachhaltigkeit und Zutatenqualität prägen die Zukunft des Marktes trotz Herausforderungen in der Lieferkette.

Marktgröße für verzehrfertige Lebensmittel im Nahen Osten und Afrika

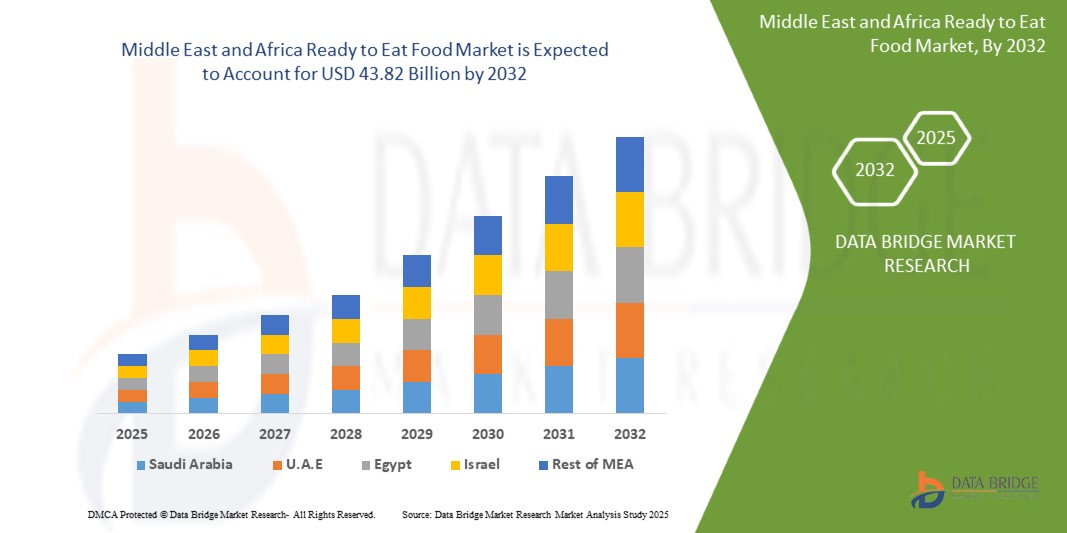

Der Markt für verzehrfertige Lebensmittel im Nahen Osten und in Afrika hatte im Jahr 2024 ein Volumen von 22,59 Milliarden US-Dollar und soll bis 2032 43,82 Milliarden US-Dollar erreichen, mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 9,48 % im Prognosezeitraum 2025 bis 2032. Neben Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen.

Markttrends für verzehrfertige Lebensmittel im Nahen Osten und Afrika

„Steigende Arbeitszeiten und ein schnelllebiger Lebensstil“

Da viele Menschen versuchen, berufliche und private Verpflichtungen in Einklang zu bringen, ist die Nachfrage nach praktischen Mahlzeitenlösungen stark gestiegen. Laut einem Bericht der Internationalen Arbeitsorganisation (ILO) ist die durchschnittliche Arbeitszeit im Nahen Osten und Afrika in den letzten zehn Jahren um rund 8 % gestiegen, was den wachsenden Druck auf das Zeitmanagement verdeutlicht. Daher entscheiden sich Verbraucher für schnelle und unkomplizierte Mahlzeiten, die nur minimale Vorbereitung erfordern und erhebliche Zeitersparnisse bieten.

Der Markt für Fertiggerichte hat von diesem Wandel stark profitiert, da diese Produkte den Bedürfnissen vielbeschäftigter Menschen gerecht werden, die nach praktischen, nahrhaften und sofort verzehrbaren Mahlzeiten suchen. Der Trend zu einem schnelllebigen Lebensstil ist besonders in der Stadtbevölkerung verbreitet, wo der hektische Alltag kaum Zeit für die Zubereitung traditioneller Mahlzeiten lässt. Dies hat die Hersteller dazu veranlasst, Innovationen zu entwickeln und eine breite Palette an Fertiggerichten auf den Markt zu bringen, die unterschiedlichen Geschmacksvorlieben und Ernährungsbedürfnissen gerecht werden.

Darüber hinaus hat die zunehmende Zahl von Doppelverdienerhaushalten zum Marktwachstum beigetragen. In Ländern wie den USA und Großbritannien sind mittlerweile in über 60 % der Haushalte beide Partner berufstätig, sodass weniger Zeit für die Zubereitung aufwendiger Mahlzeiten bleibt. Dieser demografische Wandel hat zu einem Anstieg der Nachfrage nach verzehrfertigen Produkten geführt, die bequem am Arbeitsplatz, auf dem Weg zur Arbeit oder zu Hause nach langen Arbeitszeiten verzehrt werden können.

Zum Beispiel,

- Im März 2023 meldete die Internationale Arbeitsorganisation (ILO) in Kambodscha eine durchschnittliche Arbeitszeit von rund 2.456 Stunden pro Jahr im Jahr 2017, was fast 47 Stunden pro Woche entspricht und damit der höchste Wert unter den 66 untersuchten Ländern ist. Dies deutet auf einen erheblichen Zeitmangel bei der Essenszubereitung hin, was die Nachfrage nach verzehrfertigen Lebensmitteln antreibt.

In Ländern wie Mexiko und der Tschechischen Republik arbeiten Arbeitnehmer oft mehr als 2.000 Stunden pro Jahr, was zu einer starken Vorliebe für schnelle und unkomplizierte Mahlzeiten, einschließlich verzehrfertiger Produkte, führt.

Da ein hektischer Lebensstil weltweit immer mehr an Bedeutung gewinnt, steht der Markt für verzehrfertige Lebensmittel vor einem starken Wachstum, das durch den ungebrochenen Bedarf an schnellen, leicht zugänglichen und sättigenden Mahlzeitenlösungen angetrieben wird.

Berichtsumfang und Marktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke in essfertige Lebensmittel im Nahen Osten und Afrika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Kuwait, Oman, Katar, Bahrain und der Rest des Nahen Ostens und Afrikas |

|

Wichtige Marktteilnehmer |

Mondelēz International, Inc. (USA), The Kraft Heinz Company (USA), General Mills Inc (USA), Nestlé (Schweiz), Kellanova (USA), McCain Foods Limited (Kanada), Hormel Foods, LLC (USA), Unilever (Großbritannien), Lamb Weston, Inc. (USA), Simplot (USA), Tyson Foods, Inc. (USA), Nomad Foods (England), Greencore Group plc (Irland), 2 Sisters Food Group (England), ITC Limited (Indien), Agristo (Belgien), Premier Foods plc (Großbritannien), Bakkavor Group plc (Großbritannien), The Hain Celestial Group, Inc. (USA), Orkla (Norwegen), Farm Frites (Niederlande), Haldiram's (Indien), Greenyard (Belgien), Agrarfrost GmbH (Deutschland), Regal Kitchen Foods (Indien), GODREJ AGROVET LTD. (Indien), Gitsfood.com (Indien), LIGHT MASS (Brasilien), Koyara Food (Indien), Genie Food Group (Indien), Himalaya Food International Ltd. (Indien), Vimal Agro Products Pvt Ltd (Indien), Vechem Organics (P) Limited (Indien), Eateasy New (Indien), Sankalpfoods.com (Indien), CSC Brands LP (Kanada) und Priya Foods (Ushodaya Enterprises Pvt Ltd) (Indien) |

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Definition des Marktes für verzehrfertige Lebensmittel im Nahen Osten und Afrika

Ready-to-Eat (RTE)-Lebensmittel sind vorgekochte und vorverpackte Lebensmittel, die vor dem Verzehr nur minimal oder gar nicht weiter zubereitet werden müssen. Diese Lebensmittel sind auf Komfort ausgelegt und passen zu einem geschäftigen Lebensstil. Sie bieten schnelle und einfache Mahlzeiten ohne Kompromisse bei Geschmack oder Qualität. RTE-Lebensmittel umfassen eine breite Produktpalette, darunter Tiefkühlgerichte, Konserven, gekühlte und gekühlte Produkte sowie haltbare, verpackte Snacks. Sie sind häufig in Supermärkten, Verbrauchermärkten, Convenience Stores und im Online-Handel erhältlich. RTE-Lebensmittel sind besonders beliebt bei Berufstätigen, Studenten und städtischen Verbrauchern, die zeitsparende Mahlzeiten suchen.

Marktdynamik für verzehrfertige Lebensmittel im Nahen Osten und Afrika

Treiber

- Steigendes verfügbares Einkommen der Verbraucher und höhere Kaufkraft

Mit dem anhaltenden Wirtschaftswachstum genießen Verbraucher eine größere finanzielle Stabilität und können mehr für praktische und hochwertige Lebensmittel ausgeben. Laut Weltbank ist das verfügbare Pro-Kopf-Einkommen im Nahen Osten und Afrika in den letzten zehn Jahren stetig gestiegen. Dadurch steht den Verbrauchern eine größere Auswahl an Lebensmitteln zur Verfügung, die sowohl praktisch als auch hochwertig sind.

Dieser Anstieg des verfügbaren Einkommens hat zu einer Verschiebung der Verbraucherpräferenzen hin zu zeitsparenden und unkomplizierten Mahlzeitenlösungen geführt. Da sich immer mehr Menschen den Kauf höherpreisiger, hochwertiger Fertiggerichte leisten können, nutzen Hersteller diesen Trend, indem sie vielfältige und innovative Mahlzeitenoptionen anbieten, die verschiedenen Ernährungsgewohnheiten gerecht werden, darunter Bio-, glutenfreie und pflanzliche Varianten. Der Anstieg des verfügbaren Einkommens ist besonders in Schwellenländern wie China, Indien und Brasilien deutlich spürbar, wo die wachsende Mittelschicht im geschäftigen Stadtleben zunehmend auf bequeme Lebensmittel setzt. Allein in China stieg das durchschnittliche verfügbare Haushaltseinkommen im Jahr 2024 um rund 5,3 % gegenüber 5,1 % im Vorjahr, was die Nachfrage nach verzehrfertigen Produkten deutlich steigerte.

Zum Beispiel,

- Ein Artikel der Economic Times vom Februar 2025 hob hervor, dass Adani Wilmar, bekannt für Marken wie „Kohinoor“-Reis und „Fortune“-Speiseöle, im nächsten Geschäftsjahr ein Umsatzwachstum von 10 % erwartet. CEO Angshu Mallick führt dieses erwartete Wachstum auf gestiegene Ausgaben in den Städten zurück, die durch Einkommenssteuersenkungen und die steigende Nachfrage nach Apps für schnelle Lebensmittellieferungen getrieben werden.

- Im Jahr 2023 stieg das verfügbare persönliche Einkommen in China auf 7,2 Tausend USD, gegenüber 6,9 Tausend USD im Jahr 2022. Im Zeitraum von 1978 bis 2023 betrug das verfügbare persönliche Einkommen in China durchschnittlich 1,97 Tausend USD, erreichte 2023 einen Höchststand von 7,2 Tausend USD und erreichte 1978 einen Rekordtiefstand von 0,048 Tausend USD.

Darüber hinaus legt die gestiegene Kaufkraft bei den Verbrauchern zunehmend Wert auf Qualität, Geschmack und Nährwert. Dies veranlasst Hersteller dazu, hochwertige Fertiggerichte zu entwickeln. Da das verfügbare Einkommen im Nahen Osten und in Afrika weiter steigt, dürfte der Markt für verzehrfertige Lebensmittel florieren, da die Verbraucher bereit sind, in hochwertige und praktische Mahlzeiten zu investieren.

- Schnell wachsende Einzelhandels- und E-Commerce-Kanäle

Hersteller nutzen moderne Einzelhandelsformate und digitale Einkaufslösungen, um die Sichtbarkeit und Verfügbarkeit ihrer Produkte zu verbessern, da diese von den Verbrauchern zunehmend angenommen werden. Die zunehmende Präsenz von Supermärkten, Hypermärkten, Convenience Stores und Online-Lebensmittelplattformen hat die Verfügbarkeit von Fertiggerichten erhöht und trägt so zum schnelllebigen Lebensstil urbaner Verbraucher bei.

Insbesondere der E-Commerce hat den Lebensmitteleinzelhandel verändert, indem er den bequemen Einkauf von Fertiggerichten von zu Hause aus ermöglicht. Derzeit tätigen rund 2,77 Milliarden Menschen weltweit Online-Käufe über spezielle E-Commerce-Plattformen oder Social-Media-Shops, was eine wachsende Präferenz für Online-Shopping widerspiegelt. Dieser Trend wird durch die zunehmende Verbreitung von Smartphones und eine verbesserte Internetverbindung, insbesondere in Schwellenländern, weiter unterstützt. Einzelhandelsriesen und digitale Plattformen nutzen diese Chance, indem sie ihr RTE-Produktportfolio um Tiefkühlgerichte, Instant-Snacks und gesunde Kochboxen erweitern. Strategische Kooperationen zwischen Lebensmittelherstellern und E-Commerce-Plattformen wie Amazon, Walmart und regionalen Akteuren wie BigBasket in Indien und JD.com in China haben es Verbrauchern erleichtert, mit nur wenigen Klicks auf eine große Auswahl an verzehrfertigen Optionen zuzugreifen, was den Vertrieb rationalisiert, Lieferzeiten verkürzt und die Kundenzufriedenheit erhöht hat. Darüber hinaus hat sich die Einführung des Omnichannel-Einzelhandels – der Integration von physischem und digitalem Verkauf – als äußerst effektiv erwiesen, um die vielfältigen Bedürfnisse moderner Verbraucher zu erfüllen.

Zum Beispiel,

- Ergebnisse von SellersCommerce zeigen, dass über 33 % der Weltbevölkerung online einkaufen. Der E-Commerce hat sich zu einer 6,8 Billionen US-Dollar schweren Branche entwickelt und soll bis 2027 voraussichtlich 8 Billionen US-Dollar erreichen. Weltweit tätigen rund 2,77 Milliarden Menschen ihre Einkäufe über dedizierte E-Commerce-Plattformen oder Social-Media-Kanäle. China und die USA sind beim Online-Shopping führend und eröffnen damit enorme Chancen für Fertiggerichte. Da Verbraucher zunehmend unkomplizierte Einkäufe bevorzugen, sind Fertiggerichte bestens aufgestellt, um zu wachsen.

- BigBasket, Indiens führender Online-Lebensmittelhändler, hat sein Produktportfolio an Fertiggerichten (RTE) erweitert, um der wachsenden Nachfrage nach praktischen Lebensmitteln gerecht zu werden. Mit dem Fokus auf frische und hochwertige Produkte will das Unternehmen die steigende Verbraucherpräferenz für schnelle und unkomplizierte Mahlzeiten bedienen. Mit diesem strategischen Schritt kann BigBasket von der zunehmenden Beliebtheit von RTE-Lebensmitteln auf dem indischen Markt profitieren.

- In China kombinieren Alibabas Hema Fresh-Läden Online- und Offline-Einzelhandel. Verbraucher können Fertiggerichte über eine App bestellen und innerhalb von 30 Minuten erhalten. Hema meldete 2022 einen Anstieg des Bruttoumsatzes um 20 %.

Dieses nahtlose Einkaufserlebnis, gepaart mit attraktiven Rabatten und Abonnementmodellen, hat den E-Commerce zu einem bevorzugten Kanal für vielbeschäftigte Verbraucher gemacht. Daher kooperieren Hersteller zunehmend mit Online-Plattformen, um ihre Reichweite zu erweitern und so das Marktwachstum und die Innovation voranzutreiben.

Gelegenheiten

- Steigende Nachfrage nach pflanzlichen und veganen Fertiggerichten

Das Bewusstsein für die gesundheitlichen Vorteile, die ökologische Nachhaltigkeit und die ethischen Aspekte pflanzlicher Ernährung wächst in der heutigen Zeit. Da immer mehr Verbraucher einen veganen oder flexitarischen Lebensstil wählen, steigt die Nachfrage nach praktischen Fertiggerichten, die diesen Lebensstilen gerecht werden, weiter an.

Marktteilnehmer nutzen diesen Trend, indem sie innovative, geschmackvolle und nährstoffreiche Fertiggerichte auf pflanzlicher Basis auf den Markt bringen. Laut einem Bericht des Good Food Institute verzeichnete der Sektor für pflanzliche Lebensmittel in den letzten Jahren ein zweistelliges Wachstum, angetrieben vom steigenden Verbraucherinteresse und der verbesserten Produktverfügbarkeit. Große Lebensmittelhersteller und Start-ups investieren zunehmend in vegane Mahlzeitenlösungen, von pflanzlichen Currys und Pasta über milchfreie Desserts bis hin zu proteinreichen Salaten. Auch Social-Media- und Influencer-getriebene Food-Trends spielen eine entscheidende Rolle bei der Förderung veganer Fertiggerichte und machen sie gängiger und zugänglicher. Darüber hinaus hat der Ausbau von Einzelhandels- und E-Commerce-Kanälen die Sichtbarkeit und Reichweite pflanzlicher Angebote weiter erhöht.

Zum Beispiel,

- Im November 2021 ergab eine Studie von NielsenIQ, dass in 2,7 Millionen Haushalten in Großbritannien mindestens ein Veganer oder Vegetarier lebte. Darüber hinaus entschieden sich 10,5 Millionen Haushalte mindestens einmal pro Woche für vegane oder vegetarische Alternativen anstelle von fleischhaltigen Mahlzeiten. 40 % der Befragten gaben gesundheitliche Vorteile als Motivation an, während 31 % glaubten, es sei besser für den Planeten.

- Eine Studie von Ipsos aus dem Jahr 2022 ergab, dass die steigende Nachfrage nach pflanzlichen und veganen Fertiggerichten (RTE) deutlich wird, da Verbraucher zunehmend nach gesünderen und nachhaltigeren Optionen suchen. Laut einer Ipsos-Studie erwägt fast die Hälfte (46 %) der Briten im Alter von 16 bis 75 Jahren, ihren Konsum tierischer Produkte zu reduzieren. 48 % nutzen bereits pflanzliche Milchalternativen wie Mandel-, Hafer- und Kokosmilch. Der RTE-Markt kann von diesem Trend profitieren, indem er praktische, nahrhafte und pflanzliche Mahlzeitenlösungen anbietet.

- Die europäische Verbraucherumfrage zu pflanzlichen Lebensmitteln von ProVeg International aus dem Jahr 2021 zeigte, dass Großbritannien beim Kauf und Konsum pflanzlicher Produkte, einschließlich veganer Fertiggerichte und To-go-Gerichte, in Europa führend ist. Da Verbraucher zunehmend Wert auf Gesundheit und Nachhaltigkeit legen, kann der RTE-Markt von diesem Trend profitieren, indem er praktische und vielfältige pflanzliche Mahlzeiten anbietet.

Da gesundheitsbewusste Verbraucher auf der Suche nach nahrhaften und ethischen Lebensmitteln sind, gibt es für Hersteller viel Raum für Innovationen und die Diversifizierung ihres Produktportfolios. Kooperationen mit Lieferanten pflanzlicher Zutaten und Investitionen in Forschung und Entwicklung können die Attraktivität veganer Fertiggerichte weiter steigern. Angesichts der Marktentwicklung bietet die Akzeptanz der pflanzlichen Ernährung eine vielversprechende Chance für nachhaltiges Wachstum und Profitabilität.

- Technologische Fortschritte in der Lebensmittelverarbeitung und -verpackung

Innovative Verarbeitungsverfahren wie Hochdruckverfahren (HPP) und mikrowellenunterstützte thermische Sterilisation (MATS) ermöglichen es Herstellern, die Haltbarkeit von Produkten zu verlängern und gleichzeitig Frische, Geschmack und Nährwert zu erhalten. Diese hochmodernen Techniken erfüllen die Verbrauchernachfrage nach minimal verarbeiteten, zusatzstofffreien Produkten, ohne Kompromisse bei Sicherheit und Qualität einzugehen.

Im Verpackungsbereich gewinnt die Einführung intelligenter und nachhaltiger Lösungen an Bedeutung. Aktive und intelligente Verpackungstechnologien, darunter Sauerstoffabsorber und Zeit-Temperatur-Indikatoren, erhöhen die Produktsicherheit und gewährleisten die Qualität entlang der gesamten Lieferkette. Der Trend zu umweltfreundlichen Materialien wie biologisch abbaubaren und recycelbaren Verpackungen spricht zudem umweltbewusste Verbraucher an und entspricht den Nachhaltigkeitszielen des Nahen Ostens und Afrikas. Automatisierung und Digitalisierung in der Lebensmittelverarbeitung revolutionieren zudem die Produktionseffizienz. Automatisierte Sortier-, Portionierungs- und Qualitätskontrollsysteme senken die Arbeitskosten und gewährleisten Konsistenz. So können Hersteller ihre Produktion steigern und gleichzeitig hohe Standards einhalten. Darüber hinaus steigern moderne Verpackungsmaschinen mit Funktionen wie Vakuumversiegelung und Schutzatmosphärenverpackung (MAP) die Attraktivität der Produkte, indem sie Textur und Geschmack länger erhalten.

Die Integration von Rückverfolgbarkeitslösungen, einschließlich Blockchain-Technologie und QR-Codes auf Verpackungen, bietet Verbrauchern Echtzeitinformationen über Produktherkunft und Qualitätssicherung. Diese Transparenz schafft Vertrauen und stärkt die Markentreue, wodurch RTE-Produkte für anspruchsvolle Kunden attraktiver werden.

Zum Beispiel,

- Tetra Pak revolutionierte die Lebensmittelverpackung mit seiner aseptischen Technologie. Produkte können dadurch länger ungekühlt gelagert werden, ohne dass Nährwert und Geschmack verloren gehen. Diese Innovation trug maßgeblich zur Erweiterung der Distribution und Haltbarkeit von verzehrfertigen Produkten bei, insbesondere in Regionen ohne Kühlketteninfrastruktur.

- Die mikrowellenunterstützte thermische Sterilisation (MATS) ist eine hochmoderne Technologie, die eine Kombination aus heißem Druckwasser und langwelliger Mikrowellenenergie zur Sterilisation von Lebensmitteln nutzt. Im Gegensatz zur herkömmlichen Autoklavensterilisation verkürzt MATS die Verarbeitungszeit erheblich, minimiert Nährstoffverluste und erhält die Lebensmittelqualität. Führende Unternehmen im Nahen Osten und Afrika wie Eka Middle East and Africa nutzen diese Innovation, um Verpackungslösungen zu verbessern und den wachsenden Anforderungen der Lebensmittelindustrie gerecht zu werden.

- Intelligente Sensortechnologie revolutioniert die Qualitätskontrolle in der Lebensmittelverarbeitung durch Echtzeitüberwachung von Temperatur, Luftfeuchtigkeit und Kontaminationsgrad. Diese Sensoren erkennen Abweichungen sofort und ermöglichen schnelle Anpassungen zur Gewährleistung von Produktqualität und -sicherheit. Die automatisierte Datenerfassung gewährleistet Rückverfolgbarkeit und Einhaltung von Lebensmittelsicherheitsstandards und macht die Produktion zuverlässiger und effizienter.

Diese Fortschritte steigern nicht nur die Attraktivität der Produkte, sondern eröffnen auch neue Märkte, indem sie logistische Herausforderungen, insbesondere in abgelegenen Gebieten, bewältigen. Technologische Innovationen fördern das Wachstum und ermöglichen es Herstellern, den steigenden Verbraucheranforderungen gerecht zu werden und gleichzeitig ihre Rentabilität zu sichern.

Einschränkungen/Herausforderungen

- Hohe Kosten für verzehrfertige Gerichte (RTE) im Vergleich zu selbst gekochten Mahlzeiten

Verbraucher, insbesondere in preissensiblen Regionen, empfinden Fertiggerichte oft als deutlich teurer als selbst zubereitete Mahlzeiten. Dieser Kostenunterschied ist auf verschiedene Faktoren zurückzuführen, darunter die Verwendung hochwertiger Zutaten sowie Verpackungs-, Verarbeitungs- und Logistikkosten.

Laut dem Bureau of Labor Statistics betragen die Kosten für eine selbst gekochte Mahlzeit in den USA durchschnittlich etwa 4 US-Dollar pro Portion, während die Kosten für ein einzelnes verzehrfertiges Gericht je nach Marke und verwendeten Zutaten zwischen 7 und 15 US-Dollar liegen können. Diese Preislücke macht es vielen Verbrauchern, insbesondere denen aus der mittleren und niedrigen Einkommensgruppe, schwer, den häufigen Kauf von verzehrfertigen Produkten zu rechtfertigen. Die Marktdurchdringung wird zudem durch die Wahrnehmung eingeschränkt, dass verzehrfertige Gerichte im Vergleich zu frisch zubereiteten hausgemachten Mahlzeiten ein schlechteres Preis-Leistungs-Verhältnis bieten. Da Verbraucher sich insbesondere in Zeiten wirtschaftlicher Unsicherheiten ihrer Ausgaben bewusster werden, neigen sie dazu, preisgünstige und hausgemachte Speisen zu bevorzugen. Außerdem beeinflussen in vielen Ländern kulturelle Vorlieben für frisch gekochte Mahlzeiten weiterhin die Entscheidungen der Verbraucher, da Familien hausgemachte Gerichte vorverpackten Alternativen vorziehen. Dieser Trend zu traditionellen Kochmethoden stellt für Hersteller, die einen größeren Marktanteil erobern möchten, eine Herausforderung dar.

Zum Beispiel,

- Ein Artikel der New York Times vom Januar 2025 hob hervor, wie viele Menschen jährlich erhebliche Summen sparen, indem sie weniger Fast Food essen und stattdessen lieber selbst kochen. Eine Person sparte in einem Jahr fast 11.000 US-Dollar, indem sie sich für die Zubereitung ihrer Mahlzeiten zu Hause entschied, anstatt Fertiggerichte zu kaufen.

- Eine im August 2023 von Real Plans veröffentlichte Studie zeigt, dass Essenslieferpakete bis zu dreimal teurer sein können als der Kauf von Zutaten im örtlichen Lebensmittelgeschäft und die Zubereitung von Mahlzeiten zu Hause.

Advance Financial berichtete, dass die hohen Kosten von Fertiggerichten im Vergleich zu selbst gekochten Mahlzeiten für viele Verbraucher weiterhin ein Problem darstellen. Im Durchschnitt kostet eine selbst gekochte Mahlzeit etwa 4 bis 6 US-Dollar pro Person, während ein Restaurant- oder Fertiggericht 15 bis 20 US-Dollar oder mehr kosten kann. Dieser erhebliche Preisunterschied von mindestens 10 US-Dollar pro Mahlzeit kann sich schnell summieren, insbesondere für Vielkäufer.

Die hohen Kosten für verzehrfertige Lebensmittel im Vergleich zu selbst gekochten Mahlzeiten stellen weiterhin ein erhebliches Hindernis für das Marktwachstum dar. Da Verbraucher zunehmend kostengünstige und frisch zubereitete Optionen bevorzugen, ist der Markt insbesondere in preissensiblen Regionen weiterhin mit Einschränkungen bei der breiten Akzeptanz konfrontiert.

- Intensiver Marktwettbewerb zwischen großen Lebensmittelmarken und regionalen Akteuren

Große multinationale Marken nutzen ihre robusten Vertriebsnetze und ihren etablierten Markenwert, um ihre marktbeherrschende Stellung zu behaupten, während regionale Akteure lokale Vorlieben und Kostenvorteile ausnutzen. Dieser Wettbewerb zwingt die Hersteller dazu, ihr Produktangebot zu erneuern und zu differenzieren, um die Aufmerksamkeit der Verbraucher zu gewinnen. Marken investieren zunehmend in Marketingstrategien und Produktdiversifizierung, um sich abzuheben, und führen häufig einzigartige Geschmacksrichtungen, angereicherte Zutaten und gesundheitsorientierte Rezepturen ein. Allerdings bleibt es eine enorme Herausforderung, angesichts aggressiver Preisstrategien und Werbekampagnen wettbewerbsfähig zu bleiben. Kleinere und regionale Hersteller haben oft Schwierigkeiten, mit den Skaleneffekten der Branchenriesen mitzuhalten, was zu geringeren Gewinnmargen führt. Außerdem erhöht das Aufkommen von Eigenmarkenprodukten großer Einzelhandelsketten den Druck auf Markenprodukte zusätzlich, da Verbraucher zunehmend erschwingliche Alternativen wählen, ohne Kompromisse bei der Qualität eingehen zu müssen.

Darüber hinaus zwingen veränderte Verbraucherpräferenzen und die steigende Beliebtheit von Nischenprodukten, wie pflanzlichen und glutenfreien Alternativen, Marken dazu, ihr Portfolio kontinuierlich anzupassen und zu erweitern. Die Balance zwischen Produktinnovation und Kosteneffizienz bleibt eine anspruchsvolle Aufgabe, insbesondere für kleinere Unternehmen mit begrenzten Ressourcen.

Zum Beispiel,

- Im März 2025 veröffentlichte Reuters einen Artikel, in dem es hieß, dass Verbraucher zunehmend zu kleineren, unabhängigen Lebensmittelmarken tendieren, die oft als Anbieter weniger verarbeiteter und günstigerer Produkte wahrgenommen werden. Dieser Wandel hat Auswirkungen auf Großkonzerne wie Unilever und Procter & Gamble, deren Marktanteile sinken, da Käufer Alternativen wie Duke's Mayo und Mike's Amazing Mayo gegenüber traditionellen Marken wie Hellmann's bevorzugen.

- Ein Artikel von Dow Jones & Company, Inc. (WALL STREET JOURNAL) vom November 2022 hob hervor, dass Einzelhändler zunehmend eigene Handelsmarken für verzehrfertige Lebensmittel entwickeln und Verbrauchern kostengünstige Alternativen zu etablierten Marken bieten. Diese Strategie bietet Verbrauchern nicht nur mehr Auswahl, sondern verschärft auch den Wettbewerb und zwingt große Marken dazu, ihre Preise und Leistungsversprechen zu überdenken.

Inmitten dieses intensiven Wettbewerbs wird es immer schwieriger, die Markentreue aufrechtzuerhalten und die Rentabilität aufrechtzuerhalten, da sowohl etablierte als auch aufstrebende Akteure in einem sich rasch entwickelnden Umfeld mit gestiegenen Verbrauchererwartungen agieren müssen.

Auswirkungen und aktuelles Marktszenario von Rohstoffknappheit und Lieferverzögerungen

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen unter Berücksichtigung der Auswirkungen von Rohstoffknappheit und Lieferverzögerungen sowie des aktuellen Marktumfelds. Dies ermöglicht die Bewertung strategischer Möglichkeiten, die Erstellung effektiver Aktionspläne und die Unterstützung von Unternehmen bei wichtigen Entscheidungen.

Neben dem Standardbericht bieten wir auch eine detaillierte Analyse des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Warenanalysen, Produktionsanalysen, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalysen, Lösungen zum Lieferkettenrisikomanagement, erweitertes Benchmarking und andere Dienste für Beschaffung und strategische Unterstützung.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Lässt die Konjunktur nach, leiden auch Branchen. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf Preisgestaltung und Produktverfügbarkeit werden in den Marktberichten und Informationsdiensten von DBMR berücksichtigt. So sind unsere Kunden ihren Wettbewerbern in der Regel immer einen Schritt voraus, können Umsatz und Ertrag prognostizieren und ihre Gewinn- und Verlustrechnung abschätzen.

Marktumfang für verzehrfertige Lebensmittel im Nahen Osten und Afrika

Der Markt ist nach Produkttyp, Kategorie, Verpackungsart, Verpackungsgröße, Verpackungstechnologie, Lagerart, Vertriebskanal und Endverbraucher segmentiert. Das Wachstum dieser Segmente hilft Ihnen, schwache Wachstumssegmente in den Branchen zu analysieren und bietet den Nutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen helfen, strategische Entscheidungen zur Identifizierung zentraler Marktanwendungen zu treffen.

Produkttyp

- Fleischprodukte

- Getreidebasierte Produkte

- Milchprodukte

- Backwaren

- Pikante Süßigkeiten

- Süßwaren

- Produkte auf pflanzlicher Basis

- Instantsuppen, herzhafte Snacks

- Gekühlte Lebensmittel

- Pflanzliche Fleischsnacks

- Verzehrfertige Mahlzeiten

Kategorie

- Konventionell

- Spezialität

Verpackungsart

- Beutel/Sachets

- Dosen

- Gläser & Behälter

- Flaschen

- Boxen

- Sonstige

Verpackungsgröße

- Weniger als 250 Gramm

- 251-500 Gramm

- 501-750 Gramm

- 751-1000 Gramm

- Mehr als 1000 Gramm

Verpackungstechnik

- Sauerstofffänger

- Feuchtigkeitskontrolle

- Antimikrobielle Mittel

- Zeit-Temperatur-Indikatoren

- Essbare Folien

Quellentyp

- Gefroren/Gekühlt

- Lagerstabil

- Dosen

- Sonstige

Vertriebskanal

- Ladenbasiert

- Nicht-Store-basierter Kanal

Endbenutzer

- Dienstleistungen für die Lebensmittelindustrie

- Haushalte

- Sonstige

Regionale Analyse des Marktes für verzehrfertige Lebensmittel im Nahen Osten und Afrika

Der Markt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkttyp, Kategorie, Verpackungsart, Verpackungsgröße, Verpackungstechnologie, Lagerart, Vertriebskanal und Endbenutzer wie oben angegeben bereitgestellt.

Die vom Markt abgedeckten Länder sind Saudi-Arabien, die Vereinigten Arabischen Emirate, Südafrika, Ägypten, Kuwait, Oman, Katar, Bahrain und der Rest des Nahen Ostens und Afrikas.

Saudi-Arabien wird voraussichtlich den Markt für verzehrfertige Lebensmittel dominieren. Grund dafür sind die schnell wachsende Stadtbevölkerung, steigende verfügbare Einkommen und die steigende Nachfrage nach praktischen Mahlzeiten. Ein schnelllebiger Lebensstil, die wachsende Einzelhandelsinfrastruktur und der Aufstieg des E-Commerce treiben das Marktwachstum zusätzlich voran. Die Präsenz großer Lebensmittelhersteller, eine starke Vorliebe für verpackte Halal-Lebensmittel und ein wachsender Trend zum Gesundheitsbewusstsein tragen ebenfalls zur Führungsrolle des Landes im Bereich verzehrfertiger Lebensmittel bei.

Saudi-Arabien dürfte aufgrund der zunehmenden Urbanisierung, steigender verfügbarer Einkommen und der Verlagerung hin zu Fertiggerichten der am schnellsten wachsende Markt für verzehrfertige Lebensmittel (RTE) sein. Wachsende Supermärkte, Hypermärkte und E-Commerce-Plattformen verbessern die Produktverfügbarkeit. Ein geschäftiger Lebensstil und die Nachfrage nach halal-zertifizierten Fertiggerichten treiben das Marktwachstum weiter voran. Darüber hinaus treibt das wachsende Gesundheitsbewusstsein die Nachfrage nach Bio- und konservierungsmittelfreien Optionen an, während kontinuierliche Innovationen der Lebensmittelmarken den RTE-Lebensmittelsektor des Landes stärken.

Der Länderteil des Berichts enthält zudem Informationen zu einzelnen marktbeeinflussenden Faktoren und regulatorischen Veränderungen im Inland, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie die Analyse der nachgelagerten und vorgelagerten Wertschöpfungskette, technische Trends, die Fünf-Kräfte-Analyse nach Porter sowie Fallstudien dienen unter anderem der Prognose des Marktszenarios für einzelne Länder. Auch die Präsenz und Verfügbarkeit von Marken aus dem Nahen Osten und Afrika sowie die Herausforderungen, denen sie aufgrund der starken oder schwachen Konkurrenz durch lokale und inländische Marken sowie der Einfluss inländischer Zölle und Handelsrouten gegenüberstehen, werden bei der Prognoseanalyse der Länderdaten berücksichtigt.

Marktanteile verzehrfertiger Lebensmittel im Nahen Osten und Afrika

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz im Nahen Osten und Afrika, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die Marktführer für verzehrfertige Lebensmittel im Nahen Osten und Afrika sind:

- Lamb Weston (USA)

- Simplot (USA)

- Haldiram (Indien)

- Farm Frites (Niederlande)

- Greenyard (Belgien)

- Agrarfrost GmbH (Deutschland)

- Agristo (Belgien)

- CSC Brands LP (Kanada)

- The Hain Celestial Group, Inc. (USA)

- Bakkavor Group plc (Großbritannien)

- McCain Foods Limited (Kanada)

- Premier Foods plc (Großbritannien)

- gitsfood.com (Indien)

- Nomad Foods (Großbritannien)

- General Mills (USA)

- Greencore Group plc (Irland)

- Orkla (Norwegen)

- ITC Limited (Indien)

- Himalaya Food International Ltd. (Indien)

- Mondelēz International Group (USA)

- Kraft Heinz (USA)

- Tyson Foods, Inc. (USA)

- Unilever Food Solutions (Großbritannien)

- Nestlé (Schweiz)

- Leichte Messe (Brasilien)

- Kellanova (USA)

- Hormel Foods, LLC. (USA)

- Koyara Food (Indien)

- Priya Foods (Indien)

- Genie Food Group (Indien)

- Vechem Organics (P) Limited (Indien)

- Vimal Agro Products Pvt Ltd (Indien)

- sankalpfoods.com (Indien)

- Regal Kitchen Foods (Indien)

- eateasy neu (Indien)

- GODREJ AGROVET LTD. (Indien)

- 2 Sisters Food Group (Großbritannien)

Neueste Entwicklungen auf dem Markt für verzehrfertige Lebensmittel im Nahen Osten und Afrika

- Im Januar 2025 startet OREO das Jahr 2025 mit der Einführung von sechs aufregenden neuen Geschmacksrichtungen, darunter sowohl limitierte Editionen als auch Dauerprodukte. Zu den Highlights zählen die OREO Game Day Cookies mit ihren Football-inspirierten Prägungen – perfekt für Spieltage und Fernsehabende. Die neuen Loaded OREO Cookies, die dauerhaft erhältlich sind, bieten Mega Stuf Creme, gefüllt mit OREO-Stückchen. Weitere dauerhafte Neuheiten sind Golden OREO Cakesters, OREO Irish Creme THINS und OREO Minis Peanut Butter. Golden OREO Cakesters sind goldene Snack-Kuchen mit Cremefüllung, OREO Irish Creme THINS bieten eine reichhaltige Irish Creme-Note und OREO Minis Peanut Butter kombiniert Schokoladenkekse mit zarter Erdnussbuttercreme. Darüber hinaus runden gefrorene OREO-Leckereien das aufregende neue Produktsortiment ab.

- Im September 2024 startet die Partnerschaft zwischen OREO und Coca-Cola mit der spielerischen und spannenden Zusammenarbeit „Besties“, die das einzigartige Band der Freundschaft feiert. Die Marken bieten gemeinsam zwei zeitlich begrenzte Produkte an: den OREO Coca-Cola Sandwich Cookie und die Coca-Cola OREO Zero Sugar Limited Edition. Beide zeichnen sich durch unterschiedliche Designs und Verpackungen aus und vereinen die ikonischen Elemente beider Marken. Der OREO Coca-Cola Sandwich Cookie kombiniert Schokoladenboden mit Coca-Cola-inspiriertem Geschmack und weißer Creme mit rotem, essbarem Glitzer, während der Coca-Cola OREO Zero Sugar erfrischenden Coca-Cola-Geschmack mit einem Hauch von OREO bietet. Die Zusammenarbeit zielt darauf ab, Fans zu vereinen, neue Erlebnisse zu schaffen und Verbundenheit und Zusammengehörigkeit auf unterhaltsame und unerwartete Weise zu feiern.

- Im April 2024 haben sich die schelmischen SOUR PATCH KIDS mit OREO für eine lustige und unerwartete Zusammenarbeit zusammengetan und die limitierten OREO SOUR PATCH KIDS Cookies vorgestellt. Diese Kekse enthalten Golden OREOs mit SOUR PATCH KIDS Geschmack, bunte Einschlüsse und eine Cremefüllung mit buntem Sauerzucker für ein süß-saures Erlebnis. Zusammen mit den Keksen bringen die Marken eine exklusive Merchandise-Linie auf den Markt, darunter ein Rundhalsausschnitt, Jogginghosen, ein Bucket Hat, eine Umhängetasche, Haarspangen und Socken. Die Kollektion zelebriert den verspielten Geist beider Marken und bietet Fans die Möglichkeit, die ultimative süß-saure Kombination zu genießen und gleichzeitig limitierte OREO- und SOUR PATCH KIDS-Artikel zu tragen.

- Im Februar 2023 macht Mondelēz International einen wichtigen Schritt in Richtung seines Ziels, bis 2050 Netto-Null-Treibhausgasemissionen zu erreichen, und kündigt eine Großinvestition in erneuerbare Energien aus Photovoltaik-Kraftwerken in Polen an. Das Unternehmen hat einen 12-jährigen virtuellen Stromabnahmevertrag mit GoldenPeaks Capital unterzeichnet, der jährlich rund 126 Gigawattstunden erneuerbaren Strom aus verschiedenen Solarkraftwerken in Polen liefern wird. Diese Vereinbarung soll über eine Million Tonnen CO2 einsparen und den strombezogenen CO2-Fußabdruck von acht Mondelēz-Werken in Polen kompensieren. Die Energieproduktion soll im März 2023 beginnen und markiert einen wichtigen Meilenstein im Engagement von Mondelēz für Nachhaltigkeit und die Reduzierung seines Emissionsfußabdrucks. Diese Zusammenarbeit verdeutlicht das Engagement des Unternehmens für eine nachhaltigere Zukunft und die weitere Bereitstellung beliebter Produkte wie Milka, Prince Polo und Delicje.

- Im Februar 2025 präsentierte Capri Sun seine erste wiederverschließbare Flasche seit über 20 Jahren und bietet damit Fans jeden Alters eine praktische Möglichkeit, die legendären Geschmacksrichtungen auch unterwegs zu genießen. Die 350-ml-Flaschen, erhältlich in den Geschmacksrichtungen Fruit Punch, Pacific Cooler und Strawberry Kiwi, enthalten das Äquivalent von zwei Beuteln und werden aus rein natürlichen Zutaten ohne künstliche Farb- und Süßstoffe hergestellt. Diese Produkteinführung trägt der Nachfrage der Verbraucher nach größeren Portionsgrößen Rechnung und ist auf die Bedürfnisse vielbeschäftigter Familien zugeschnitten, insbesondere in Convenience Stores, in denen Capri Sun bisher weniger erhältlich war. Dieser Schritt erweitert das Portfolio von Capri Sun, baut auf dem Erfolg früherer Innovationen wie den Capri Sun Multi-Serve-Krügen auf und setzt das Engagement der Marke fort, sich an die Bedürfnisse der Verbraucher anzupassen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.5 COMPETITIVE RIVALRY

4.2 IMPORT EXPORT SCENARIO

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL SOURCING

4.3.2 FOOD PROCESSING & MANUFACTURING

4.3.3 PACKAGING AND STORAGE

4.3.4 DISTRIBUTION AND LOGISTICS

4.3.5 MARKETING AND RETAILING

4.3.6 CONCLUSION

4.4 KEY FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.4.1 CONVENIENCE AND TIME-SAVING

4.4.2 HEALTH AND NUTRITION AWARENESS

4.4.3 PRICE SENSITIVITY AND ECONOMIC FACTORS

4.4.4 BRAND REPUTATION AND TRUST

4.4.5 PACKAGING AND PRODUCT PRESENTATION

4.4.6 DIGITAL INFLUENCE AND ONLINE RETAILING

4.4.7 CULTURAL AND REGIONAL PREFERENCES

4.4.8 SUSTAINABILITY AND ETHICAL CONSIDERATIONS

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5.1 PRODUCT INNOVATION AND DIVERSIFICATION

4.5.2 STRATEGIC ACQUISITIONS

4.5.3 INTERNATIONAL EXPANSION

4.5.4 TECHNOLOGICAL ADVANCEMENTS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6.1 INDUSTRY TRENDS

4.6.1.1 GROWING CONSUMER DEMAND FOR CONVENIENCE

4.6.1.2 RISING POPULARITY OF HEALTHY AND NUTRITIOUS RTE FOODS

4.6.1.3 INNOVATIONS IN PACKAGING FOR EXTENDED SHELF LIFE

4.6.1.4 EXPANSION OF FROZEN AND CHILLED RTE SEGMENTS

4.6.1.5 RISE OF PLANT-BASED AND ALTERNATIVE PROTEIN OPTIONS

4.6.1.6 DIGITALIZATION AND E-COMMERCE GROWTH

4.6.1.7 FOCUS ON CLEAN LABEL AND TRANSPARENCY

4.6.2 FUTURE PERSPECTIVE

4.6.2.1 TECHNOLOGICAL ADVANCEMENTS IN FOOD PROCESSING

4.6.2.2 SUSTAINABLE AND ETHICAL FOOD CHOICES

4.6.2.3 PERSONALIZATION IN RTE MEALS

4.6.2.4 REGULATORY AND COMPLIANCE CHALLENGES

4.7 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7.1 ADVANCED FOOD PROCESSING TECHNOLOGIES

4.7.2 SMART PACKAGING AND SUSTAINABLE MATERIALS

4.7.3 AUTOMATION AND ROBOTICS IN FOOD PRODUCTION

4.7.4 NUTRITIONAL ENHANCEMENT AND FUNCTIONAL INGREDIENTS

4.7.5 AI & BIG DATA FOR PERSONALIZATION AND SUPPLY CHAIN OPTIMIZATION

4.7.6 3D FOOD PRINTING AND CUSTOMIZATION

4.7.7 E-COMMERCE, CLOUD KITCHENS, AND LAST-MILE DELIVERY INNOVATIONS

4.7.8 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 PROTEINS (MEAT, POULTRY, AND PLANT-BASED PROTEINS)

4.8.2 GRAINS AND CARBOHYDRATES

4.8.3 VEGETABLES AND FRUITS

4.8.4 PRESERVATIVES AND ADDITIVES

4.8.5 EMERGING TRENDS AND FUTURE SOURCING OPPORTUNITIES

4.8.6 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL SOURCING AND PROCUREMENT

4.9.2 PROCESSING AND MANUFACTURING

4.9.3 STORAGE AND INVENTORY MANAGEMENT

4.9.4 DISTRIBUTION AND LOGISTICS

4.9.5 RETAIL AND CONSUMER ACCESS

4.9.6 CHALLENGES IN THE RTE FOOD SUPPLY CHAIN

4.9.7 FUTURE TRENDS AND INNOVATIONS

4.9.8 CONCLUSION

4.1 PRICING ANALYSIS

4.11 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.12 BRAND OUTLOOK

4.12.1 BRAND COMPARATIVE ANALYSIS

4.12.2 PRODUCT VS BRAND OVERVIEW

4.12.2.1 PRODUCT OVERVIEW

4.12.2.2 BRAND OVERVIEW

4.12.2.3 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING WORK HOURS AND FAST-PACED LIFESTYLES

6.1.2 RISING CONSUMER DISPOSABLE INCOME AND HIGHER PURCHASING POWER

6.1.3 RAPIDLY EXPANDING RETAIL AND E-COMMERCE CHANNELS

6.1.4 RISING DEMAND FOR HEALTHY, ORGANIC AND FORTIFIED READY-TO-EAT FOODS

6.2 RESTRAINTS

6.2.1 HEALTH CONCERNS RELATED TO PROCESSED FOODS

6.2.2 HIGH COST OF READY-TO-EAT (RTE) COMPARED TO HOME-COOKED MEALS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR PLANT-BASED AND VEGAN READY-TO-EAT FOODS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN FOOD PROCESSING AND PACKAGING

6.3.3 CUSTOMIZATION AND PERSONALIZATION OF READY-TO-EAT FOODS

6.4 CHALLENGES

6.4.1 INTENSE MARKET COMPETITION AMONGST MAJOR FOOD BRANDS AND REGIONAL PLAYERS

6.4.2 CONSUMER PERCEPTION OF ARTIFICIAL INGREDIENTS AND FLAVORS IN READY-TO-EAT FOODS

7 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 MEAT PRODUCTS

7.3 CEREAL BASED PRODUCTS

7.4 DAIRY PRODUCTS

7.5 BAKERY PRODUCTS

7.6 SAVORY SWEETS

7.7 CONFECTIONERY PRODUCTS

7.8 VEGETABLES BASED PRODUCTS

7.9 INSTANT SOUPS

7.1 SAVORY SNACKS

7.11 REFRIGERATED FOODS

7.12 PLANT BASED MEAT SNACKS

7.13 READY TO EAT MEALS

8 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 SPECIALTY

9 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES/SACHETS

9.3 CANS

9.4 JARS & CONTAINERS

9.5 BOTTLES

9.6 BOXES

9.7 OTHERS

10 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE

10.1 OVERVIEW

10.2 LESS THAN 250 GRAMS

10.3 251-500 GRAMS

10.4 501-750 GRAMS

10.5 751-1000 GRAMS

10.6 MORE THAN 1000 GRAMS

11 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY

11.1 OVERVIEW

11.2 OXYGEN SCAVENGERS

11.3 MOISTURE CONTROL

11.4 ANTIMICROBIALS

11.5 TIME TEMPERATURE INDICATORS

11.6 EDIBLE FILMS

12 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE

12.1 OVERVIEW

12.2 FROZEN/REFRIGERATED

12.3 SHELF-STABLE

12.4 CANNED

12.5 OTHERS

13 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE-BASED

13.3 NON-STORE BASED

14 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER

14.1 OVERVIEW

14.2 FOOD INDUSTRY SERVICES

14.3 HOUSEHOLDS

14.4 OTHERS

15 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SAUDI ARABIA

15.1.2 U.A.E.

15.1.3 SOUTH AFRICA

15.1.4 EGYPT

15.1.5 KUWAIT

15.1.6 OMAN

15.1.7 QATAR

15.1.8 BAHRAIN

15.1.9 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 MONDELĒZ INTERNATIONAL, INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 RECENT FINANCIALS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 THE KRAFT HEINZ COMPANY

18.2.1 COMPANY SNAPSHOT

18.2.2 RECENT FINANCIALS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 GENERAL MILLS INC

18.3.1 COMPANY SNAPSHOT

18.3.2 RECENT FINANCIALS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 NESTLÉ

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 KELLANOVA

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 AGRISTO

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 2 SISTERS FOOD GROUP

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT NEWS

18.8 AGRARFROST GMBH

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BAKKAVOR GROUP PLC

18.9.1 COMPANY SNAPSHOT

18.9.2 RECENT FINANCIALS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 CSC BRANDS LP

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 EATEASY NEW.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 FARM FRITES

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GENIE FOOD GROUP

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GITSFOOD.COM

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 GODREJ AGROVET LIMITED

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 GREENCORE GROUP PLC

18.16.1 COMPANY SNAPSHOT

18.16.2 RECENT FINANCIALS

18.16.3 PRODUCT PORTFOLIO

18.16.4 NEWS TYPE

18.17 GREENYARD

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 HALDIRAM’S

18.18.1 COMPANY SNAPSHOTS

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 HIMALAYA FOOD INTERNATIONAL LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 HORMEL FOODS CORPORATION.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENT

18.21 ITC LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 KOYARA FOODS

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 LAMB WESTON, INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 LIGHT MASS

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 MCCAIN FOODS LIMITED

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 NOMAD FOODS

18.26.1 COMPANY SNAPSHOT

18.26.2 RECENT FINANCIALS

18.26.3 PRODUCT PORTFOLIO

18.26.4 RECENT DEVELOPMENT

18.27 ORKLA

18.27.1 COMPANY SNAPSHOT

18.27.2 RECENT FINANCIALS

18.27.3 PRODUCT PORTFOLIO

18.27.4 RECENT DEVELOPMENT

18.28 PREMIER FOODS PLC

18.28.1 COMPANY SNAPSHOT

18.28.2 RECENT FINANCIALS

18.28.3 PRODUCT PORTFOLIO

18.28.4 RECENT DEVELOPMENT

18.29 PRIYA FOODS

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

18.3 REGAL KITCHEN FOODS

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 RECENT DEVELOPMENT

18.31 SANKALPFOODS.COM

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENT/ NEWS TYPE

18.32 J.R. SIMPLOT COMPANY.

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENT

18.33 THE HAIN CELESTIAL GROUP, INC.

18.33.1 COMPANY SNAPSHOT

18.33.2 REVENUE ANALYSIS

18.33.3 PRODUCT PORTFOLIO

18.33.4 RECENT DEVELOPMENTS

18.34 TYSON FOODS, INC.

18.34.1 COMPANY SNAPSHOT

18.34.2 RECENT FINANCIALS

18.34.3 PRODUCT PORTFOLIO

18.34.4 RECENT DEVELOPMENT

18.35 UNILEVER

18.35.1 COMPANY SNAPSHOT

18.35.2 REVENUE ANALYSIS

18.35.3 PRODUCT PORTFOLIO

18.35.4 RECENT DEVELOPMENTS

18.36 VECHEM ORGANICS (P) LIMITED

18.36.1 COMPANY SNAPSHOT

18.36.2 PRODUCT PORTFOLIO

18.36.3 RECENT DEVELOPMENT

18.37 VIMAL AGRO PRODUCTS PVT LTD

18.37.1 COMPANY SNAPSHOT

18.37.2 PRODUCT PORTFOLIO

18.37.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 INCREASING DISPOSABLE INCOMES

TABLE 4 ESTIMATED SAVINGS USING READY TO EAT FOODS

TABLE 5 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 7 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 8 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 13 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION 2018-2032, (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 15 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 18 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, REGION, 2018-2032, (TONS)

TABLE 20 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 22 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 23 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (TONS)

TABLE 25 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 26 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 28 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA ANIMAL BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA PLANT BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 33 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 34 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 37 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 38 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 39 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 40 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 42 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 43 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032, (TONS)

TABLE 45 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 47 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 48 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 52 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 53 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION TYPE, 2018-2032, (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 55 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 57 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 58 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 60 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 62 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 63 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 65 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 67 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 68 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 70 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 73 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 75 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 78 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 79 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 81 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 82 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 84 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 85 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 87 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (TONS)

TABLE 89 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (USD/KG)

TABLE 90 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 92 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 94 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 95 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 97 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 98 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY REGION 2018-2032, (TONS)

TABLE 100 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 102 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 103 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA SPECIALITY IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA SPECIALTY IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA POUCHES/SACHETS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA CANS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA JARS & CONTAINERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA BOTTLES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA BOTTLES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA BOXES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA OTHERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA LESS THAN 250 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA 251-500 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA 501-750 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA 751-1000 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA MORE THAN 1000 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA OXYGEN SCAVENGERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA MOISTURE CONTROL IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ANTIMICROBIALS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA TIME TEMPERATURE INDICATORS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA EDIBLE FILMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FROZEN/REFRIGERATED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA SHELF-STABLE IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA CANNED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA OTHERS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA NON-STORE BASED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA NON-STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA RESTAURANTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA HOUSEHOLDS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA OTHERS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 145 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (USD/ KG)

TABLE 146 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 148 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 149 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 151 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 152 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 154 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 155 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 157 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 158 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (TONS)

TABLE 160 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 161 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 164 MIDDLE EAST AND AFRICA ANIMAL BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA PLANT BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 168 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 169 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 171 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 172 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 174 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 175 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 177 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 178 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 180 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 181 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 183 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 184 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 186 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 187 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 189 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 190 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 192 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 193 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 195 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 196 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 198 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 199 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 202 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 204 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 205 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 207 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 208 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 210 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 211 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 213 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 214 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 215 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 216 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 217 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 219 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 220 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 221 MIDDLE EAST AND AFRICA SPECIALTY IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 MIDDLE EAST AND AFRICA BOTTLES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 225 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 226 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 228 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MIDDLE EAST AND AFRICA NON-STORE BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 231 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MIDDLE EAST AND AFRICA RESTAURANTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SAUDI ARABIA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SAUDI ARABIA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)