La creciente demanda de una gestión eficiente del agua en India es un factor clave para la creciente adopción de medidores de agua inteligentes. La escasez de agua, el crecimiento demográfico y la urbanización han ejercido una enorme presión sobre los recursos hídricos de la India, lo que ha impulsado la necesidad de mejores prácticas de gestión y conservación. Los medidores de agua tradicionales suelen ser imprecisos, ineficientes y propensos a la pérdida de datos, lo que genera problemas como un alto nivel de Agua No Registrada (ANR), facturación incorrecta y desperdicio. Los medidores de agua inteligentes ofrecen una solución al proporcionar datos en tiempo real sobre el uso del agua, lo que ayuda a municipios e industrias a optimizar su distribución y consumo.

Con medidores inteligentes, las empresas de servicios públicos pueden detectar fugas e ineficiencias rápidamente, reduciendo la pérdida de agua y garantizando un uso más sostenible de los recursos. Estos medidores también pueden rastrear patrones de consumo, lo que permite a los proveedores de agua tomar decisiones informadas sobre la asignación y el precio del agua, incentivando así a los consumidores a ahorrar agua. Además, los datos recopilados a través de medidores de agua inteligentes facilitan una facturación precisa, eliminando discrepancias y disputas comunes con los sistemas de medición tradicionales.

El creciente enfoque en la conservación del agua en la India, impulsado tanto por las políticas gubernamentales como por la concienciación pública, está impulsando la demanda de tecnologías eficientes para la gestión del agua. Varias ciudades indias ya han comenzado a implementar sistemas de medidores de agua inteligentes como parte de sus esfuerzos de modernización de la infraestructura hídrica. Además, iniciativas gubernamentales como la Misión de Ciudades Inteligentes buscan integrar soluciones innovadoras, como los medidores de agua inteligentes, en la planificación urbana para abordar los desafíos relacionados con el suministro, la distribución y la calidad del agua.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/india-smart-water-meters-market

Data Bridge Market Research analiza que se espera que el mercado de medidores de agua inteligentes de la India alcance los USD 279,91 millones para 2032 desde USD 191,04 millones en 2024, creciendo con una CAGR sustancial del 5,2% en el período de pronóstico de 2025 a 2032.

Principales hallazgos del estudio

Aumento de la urbanización y el crecimiento de la población

La creciente urbanización y el crecimiento demográfico en la India son factores clave que contribuyen a la creciente demanda de medidores de agua inteligentes. A medida que más personas migran a las zonas urbanas en busca de mejores oportunidades, se prevé que la población urbana en la India supere los 600 millones para 2031. Esta rápida urbanización sobrecarga la infraestructura existente, incluidos los sistemas de suministro de agua, lo que genera ineficiencias en la distribución del agua y una mayor demanda de recursos hídricos. Dado que cada vez más personas dependen de fuentes de agua limitadas, la necesidad de soluciones eficientes para la gestión del agua se ha vuelto crucial.

El crecimiento poblacional agrava el problema al incrementar el consumo de agua y ejercer mayor presión sobre las empresas de agua para gestionar y distribuir los recursos eficazmente. Los sistemas tradicionales de medición de agua a menudo no logran adaptarse al aumento de la demanda y la expansión urbana, lo que resulta en desperdicio de agua, facturación inexacta e ineficiencias del sistema. Los medidores de agua inteligentes, con su capacidad para proporcionar datos en tiempo real y rastrear los patrones de uso, ayudan a abordar estos desafíos al permitir a las empresas de agua monitorear el consumo de agua, detectar fugas y optimizar las redes de distribución.

Los medidores inteligentes también ayudan a reducir el agua no facturada (ANR), que incluye el agua producida pero no facturada, a menudo debido a fugas o consumo no autorizado. Con el crecimiento de las zonas urbanas, la gestión del ANR se convierte en un problema crítico, y los medidores de agua inteligentes pueden reducir significativamente esta pérdida al proporcionar información detallada sobre el consumo de agua, lo que permite intervenciones proactivas.

Además, la adopción de medidores de agua inteligentes refuerza la necesidad de una planificación urbana sostenible. Los gobiernos y municipios pueden utilizar los datos recopilados para planificar mejor las necesidades futuras de agua, priorizar las inversiones en infraestructura e implementar políticas de conservación eficaces.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2025 a 2032

|

Año base

|

2024

|

Años históricos

|

2018-2023 (personalizable para 2013-2017)

|

Unidades cuantitativas

|

Ingresos en millones de USD

|

Segmentos cubiertos

|

Tipo de medidor (medidores ultrasónicos, medidores electromagnéticos y medidores mecánicos inteligentes), componente (hardware, software y servicios), tecnología (AMR y AMI), fuente de alimentación (baterías y red eléctrica), tipo de implementación (modernización y nueva instalación), aplicación (medición, detección de fugas, conservación de agua y otros), usuario final (residencial, comercial e industrial)

|

Actores del mercado cubiertos

|

Kamstrup A/S (Dinamarca), Honeywell International Inc. (EE. UU.), Xylem (EE. UU.), Itron Inc. (EE. UU.), Genus (India), Flowtech Water Meters and Instruments Pvt. Ltd. (India), Peltek India (India), Konarak Meters (India), Everest Sanitation (India), ADM Meters LLP (India), Innovatec Systems (India) y Asma Industrial Corporation (India).

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos

El mercado de medidores de agua inteligentes de la India está segmentado en siete segmentos notables según el tipo de medidor, componente, tecnología, fuente de energía, tipo de implementación, aplicación y usuario final.

- Según el tipo de medidor, el mercado se segmenta en medidores ultrasónicos, medidores electromagnéticos y medidores mecánicos inteligentes.

Se espera que en 2025, el segmento de medidores ultrasónicos domine el mercado de medidores de agua inteligentes de la India.

Se espera que en 2025, el segmento de medidores ultrasónicos domine el mercado con una participación de mercado del 43,76% debido a su alta precisión, bajo mantenimiento, capacidad de medir tanto el flujo directo como el inverso y su idoneidad para diversas condiciones del agua.

- En función del componente, el mercado se segmenta en hardware, software y servicios.

Se espera que en 2025, el segmento de hardware domine el mercado de medidores de agua inteligentes de la India.

En 2025, se espera que el segmento de hardware domine el mercado con una participación de mercado del 62,85% debido a la mayor demanda de infraestructura de medición avanzada, recopilación precisa de datos y mayor durabilidad, con componentes como sensores, transmisores y módulos de comunicación que impulsan el crecimiento.

- En función de la tecnología, el mercado se segmenta en AMR y AMI. Se espera que en 2025, el segmento AMR domine el mercado con una cuota de mercado del 56,27%.

- Según la fuente de energía, el mercado se segmenta en baterías y red eléctrica. En 2025, se prevé que el segmento de baterías domine el mercado con una cuota de mercado del 65,54%.

- Según el tipo de implementación, el mercado se segmenta en modernización y nueva instalación. En 2025, se prevé que el segmento de modernización domine el mercado con una cuota de mercado del 61,31%.

- Según su aplicación, el mercado se segmenta en medición, detección de fugas, conservación del agua, etc. En 2025, se prevé que el segmento de medición domine el mercado con una cuota de mercado del 65,41%.

- Según el usuario final, el mercado se segmenta en residencial, comercial e industrial. En 2025, se prevé que el segmento residencial domine el mercado con una cuota de mercado del 45,75%.

Actores principales

Data Bridge Market Research analiza a Kamstrup A/S (Dinamarca), Honeywell International Inc. (EE. UU.), Xylem (EE. UU.), Itron Inc. (EE. UU.) y Genus (India) como los principales actores que operan en el mercado.

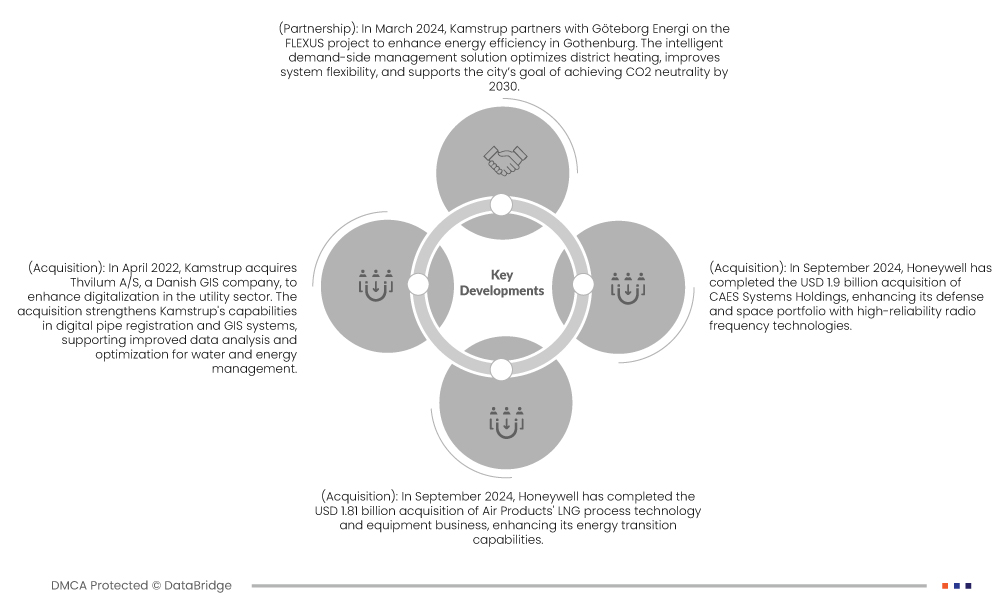

Desarrollos recientes

- En marzo de 2024, Kamstrup se asoció con Göteborg Energi en el proyecto FLEXUS para mejorar la eficiencia energética en Gotemburgo. Esta solución inteligente de gestión de la demanda optimiza la calefacción urbana, mejora la flexibilidad del sistema y contribuye al objetivo de la ciudad de alcanzar la neutralidad en emisiones de CO2 para 2030.

- En abril de 2022, Kamstrup adquirió Thvilum A/S, una empresa danesa de SIG, para impulsar la digitalización en el sector de servicios públicos. Esta adquisición fortalece las capacidades de Kamstrup en el registro digital de tuberías y sistemas SIG, lo que facilita un mejor análisis de datos y la optimización de la gestión del agua y la energía.

- En septiembre de 2024, Honeywell completó la adquisición por USD 1.810 millones del negocio de tecnología y equipos de procesos de GNL de Air Products, lo que fortalece sus capacidades de transición energética. Esta adquisición fortalece el negocio de Soluciones de Energía y Sostenibilidad de Honeywell, incorporando personal cualificado y ampliando su oferta con tecnologías de GNL, incluyendo pretratamiento, licuefacción y automatización digital, lo que impulsa una transformación energética más eficiente para clientes de todo el mundo.

- En septiembre de 2024, Honeywell completó la adquisición de CAES Systems Holdings por USD 1.900 millones, lo que reforzó su cartera de defensa y espacio con tecnologías de radiofrecuencia de alta fiabilidad. Esta adquisición amplía las capacidades de Honeywell en plataformas militares críticas como el F-35, el EA-18G y el AMRAAM, e incorpora 2.200 empleados cualificados. Fortalece la posición de Honeywell en tecnologías de defensa e impulsa el crecimiento a largo plazo en el sector aeroespacial.

Para obtener información más detallada sobre el informe del mercado de medidores de agua inteligentes de la India, haga clic aquí: https://www.databridgemarketresearch.com/reports/india-smart-water-meters-market