La citometría de flujo es una técnica para detectar y cuantificar las propiedades físicas y químicas de una población de células o partículas. Una muestra que contiene células o partículas se suspende en un fluido y se inyecta en el citómetro de flujo. La citometría de flujo es una tecnología consolidada para la identificación de células en una solución, que se utiliza habitualmente para evaluar sangre periférica, médula ósea y otros fluidos corporales. Las células inmunitarias se identifican y cuantifican mediante citometría de flujo, que también se utiliza para describir neoplasias hematológicas. La evaluación de células mediante esta técnica desempeña un papel fundamental en el diagnóstico de numerosas enfermedades crónicas. Analiza las actividades biológicas intracelulares, la apoptosis, la necrosis, el ciclo celular, la membrana celular, la proliferación celular y la medición del ADN por célula.

Las principales aplicaciones diagnósticas incluyen procesos hematológicos benignos, cáncer, SIDA, inmunodeficiencias, enfermedades hematológicas benignas y la detección de estas enfermedades mediante fluorescencia. En este proceso, las células se tiñen con fluoróforos para detectar la luz emitida y producir la intensidad mediante el marcaje de proteínas específicas (inmunofenotipado) para el diagnóstico de leucemias y linfomas.

La creciente prevalencia de enfermedades crónicas ha creado una creciente demanda de técnicas de citometría de flujo que puedan ayudar a los investigadores y médicos a comprender mejor los mecanismos subyacentes de estas enfermedades y desarrollar tratamientos más efectivos.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/north-america-flow-cytometry-market

Data Bridge Market Research analiza que se espera que el mercado de citometría de flujo de América del Norte alcance los USD 7,77 mil millones para 2032 desde USD 3,40 mil millones en 2024, creciendo a una CAGR del 10,8% en el período de pronóstico de 2025 a 2032.

Principales hallazgos del estudio

Aumento de la aplicación de instrumentos de citometría

Los instrumentos de citometría de flujo se han convertido en parte integral del descubrimiento y desarrollo de fármacos en las industrias farmacéutica y biotecnológica. El desarrollo de nuevos equipos de citometría de flujo ha ayudado a los investigadores a analizar y clasificar células con mayor rapidez, precisión y eficiencia, lo que ha contribuido a acelerar el desarrollo de fármacos. Por ejemplo, Beckman Coulter, fabricante líder de equipos de citometría de flujo, ha desarrollado el citómetro de flujo CytoFLEX LX, con detección rápida, sensibilidad mejorada y un tamaño compacto. CytoFLEX LX está diseñado para ayudar a los investigadores a analizar poblaciones de células raras con mayor rapidez y eficiencia.

En general, el desarrollo de nuevos dispositivos de citometría de flujo está ayudando a las empresas farmacéuticas y biotecnológicas a acelerar los plazos de desarrollo de fármacos al permitir un análisis más rápido y preciso de poblaciones celulares complejas. Con el aumento de la población geriátrica y de los casos de enfermedades crónicas, el crecimiento de las empresas biotecnológicas y farmacéuticas también se está expandiendo. A nivel mundial, las actividades de investigación y desarrollo están en aumento debido al gasto público en salud y al rendimiento económico.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2025 a 2032

|

Año base

|

2024

|

Año histórico

|

2023 (Personalizable 2013-2017)

|

Unidades cuantitativas

|

Ingresos en miles de millones de dólares

|

Segmentos cubiertos

|

Producto (reactivos y consumibles, instrumentos de citometría de flujo, accesorios, servicios y software), Tecnología (citometría de flujo celular y microesferas ) , Aplicación (aplicaciones de investigación, aplicaciones clínicas y aplicaciones industriales), Usuario final (empresas farmacéuticas y biotecnológicas, institutos académicos y de investigación, hospitales, laboratorios de análisis clínicos, organizaciones de investigación por contrato (CRO), bancos de sangre, CMO y CDMO, laboratorios forenses, entre otros), Canal de distribución (venta minorista y licitaciones directas)

|

Países cubiertos

|

Estados Unidos, Canadá y México

|

Actores del mercado cubiertos

|

BD (EE. UU.), Agilent Technologies, Inc. (EE. UU.), Thermo Fisher Scientific Inc. (EE. UU.), Bio-Rad Laboratories, Inc. (EE. UU.), Sartorius AG (Alemania), BennuBio Inc. (EE. UU.), Enzo Biochem Inc. (EE. UU.), Beckman Coulter, Inc. (una subsidiaria de Danaher Corporation) (EE. UU.), BIOMÉRIEUX (Francia), Coherent Corp. (EE. UU.), BioLegend, Inc. (EE. UU.), Cell Signaling Technology, Inc. (EE. UU.), Cytek Biosciences (EE. UU.), Diasorin SpA (Italia), Elabscience Bionovation Inc. (EE. UU.), Miltenyi Biotec (Japón), Merck KGaA (Alemania), NanoCellect Biomedical (EE. UU.), NeoGenomics Laboratories (EE. UU.), On-chip Biotechnologies Co., Ltd. Corporation (Japón), ORLFO Technologies (EE. UU.), Stratedigm, Inc (EE. UU.), Sony Biotechnology Inc. (EE. UU.), Sysmex Asia Pacific Pte Ltd (Parte de Sysmex Corporation) (EE. UU.), Union Biometrica, Inc. (EE. UU.), Apogee Flow Systems Ltd. (Reino Unido) y Cytonome/ST LLC (EE. UU.), entre otros

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio.

|

Análisis de segmentos

Los mercados de citometría de flujo de América del Norte se segmentan en cinco segmentos notables según el producto, la tecnología, la aplicación, el usuario final y el canal de distribución.

- Sobre la base del producto, el mercado de citometría de flujo de América del Norte está segmentado en reactivos y consumibles, instrumentos de citometría de flujo, accesorios, servicios y software.

Se espera que en 2025, el segmento de reactivos y consumibles domine el mercado de citometría de flujo de América del Norte.

En 2025, se prevé que el segmento de reactivos y consumibles domine el mercado con una cuota de mercado del 53,34%, debido a su papel esencial en aplicaciones médicas y de investigación. El uso frecuente, las compras recurrentes y la necesidad de suministros consistentes y de alta calidad para procedimientos y diagnósticos impulsan la demanda, lo que contribuye a su elevada cuota de mercado.

- Sobre la base de la tecnología, el mercado de citometría de flujo de América del Norte está segmentado en citometría de flujo basada en células y citometría de flujo basada en perlas.

En 2025, se espera que el segmento de citometría de flujo basada en células domine el mercado de citometría de flujo de América del Norte.

En 2025, se prevé que el segmento de la citometría de flujo celular domine el mercado con una cuota de mercado del 62,75%, debido a su papel crucial en el análisis de las características celulares, lo que facilita el diagnóstico preciso y los tratamientos personalizados. Su amplio uso en inmunología, investigación oncológica y desarrollo de fármacos contribuye significativamente a su elevada cuota de mercado, impulsada por la creciente demanda de herramientas de investigación avanzadas.

- En cuanto a su aplicación, el mercado norteamericano de citometría de flujo se segmenta en aplicaciones de investigación, aplicaciones clínicas y aplicaciones industriales. En 2025, se prevé que el segmento de aplicaciones de investigación domine el mercado con una cuota de mercado del 53,86 %.

- En función del usuario final, el mercado norteamericano de citometría de flujo se segmenta en empresas farmacéuticas y biotecnológicas, institutos académicos y de investigación, hospitales, laboratorios de análisis clínicos, CRO, bancos de sangre, CMO y CDMO, laboratorios forenses, entre otros. En 2025, se prevé que el segmento de empresas farmacéuticas y biotecnológicas domine el mercado con una cuota de mercado del 30,98 %.

- Según el canal de distribución, el mercado norteamericano de citometría de flujo se segmenta en ventas minoristas y licitaciones directas. En 2025, se prevé que el segmento de ventas minoristas domine el mercado con una cuota de mercado del 55,39 %.

Actores principales

Data Bridge Market Research analiza a BD (EE. UU.), Agilent Technologies, Inc. (EE. UU.), Thermo Fisher Scientific Inc. (EE. UU.), Bio-Rad Laboratories, Inc. (EE. UU.) y Sartorius AG (Alemania) como los principales actores del mercado de citometría de flujo de América del Norte.

Desarrollos del mercado

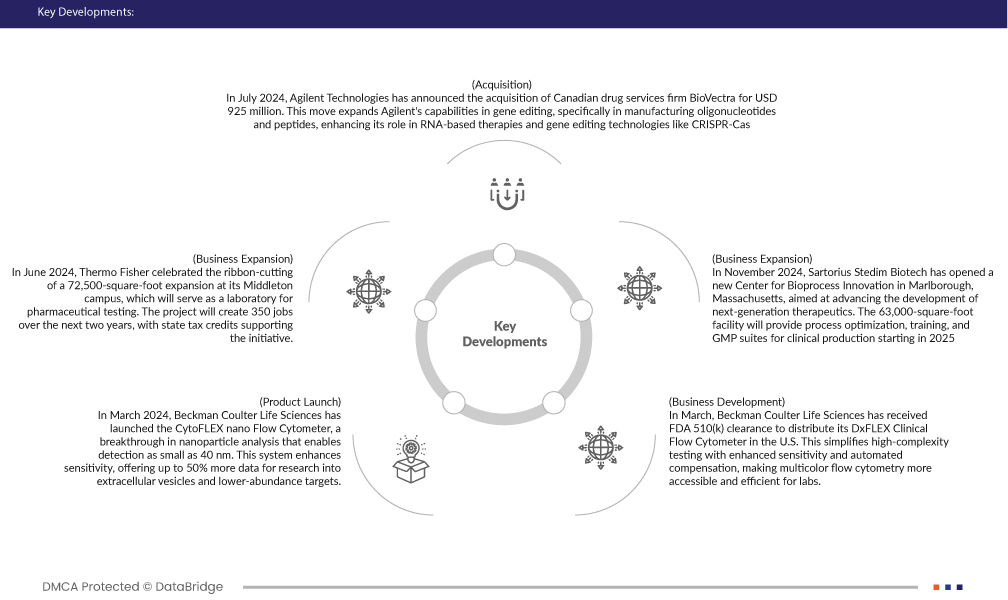

- En julio de 2024, Agilent Technologies anunció la adquisición de la empresa canadiense de servicios farmacéuticos BioVectra por 925 millones de dólares. Esta operación amplía las capacidades de Agilent en edición genética, específicamente en la fabricación de oligonucleótidos y péptidos, y potencia su papel en terapias basadas en ARN y tecnologías de edición genética como CRISPR-Cas.

- En junio de 2024, Thermo Fisher celebró la inauguración de una ampliación de 72,500 pies cuadrados en su campus de Middleton, que servirá como laboratorio para pruebas farmacéuticas. El proyecto creará 350 empleos en los próximos dos años, con créditos fiscales estatales para apoyar la iniciativa.

- En noviembre de 2024, Sartorius Stedim Biotech inauguró un nuevo Centro de Innovación en Bioprocesos en Marlborough, Massachusetts, cuyo objetivo es impulsar el desarrollo de terapias de nueva generación. Las instalaciones de 63.000 pies cuadrados ofrecerán optimización de procesos, capacitación y suites GMP para la producción clínica a partir de 2025.

- En marzo de 2024, Beckman Coulter Life Sciences lanzó el citómetro de flujo CytoFLEX nano, un avance en el análisis de nanopartículas que permite la detección de partículas de hasta 40 nm. Este sistema mejora la sensibilidad y ofrece hasta un 50 % más de datos para la investigación de vesículas extracelulares y dianas de menor abundancia.

- En marzo de 2024, Beckman Coulter Life Sciences recibió la autorización 510(k) de la FDA para distribuir su citómetro de flujo clínico DxFLEX en EE. UU. Esto simplifica las pruebas de alta complejidad con una sensibilidad mejorada y compensación automatizada, lo que hace que la citometría de flujo multicolor sea más accesible y eficiente para los laboratorios.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado de citometría de flujo de América del Norte son EE. UU., Canadá y México.

Según el análisis de investigación de mercado de Data Bridge:

Estados Unidos es el país dominante en el mercado de citometría de flujo de América del Norte.

Estados Unidos es el país líder en el mercado norteamericano de la citometría de flujo gracias a su avanzada infraestructura sanitaria, su importante financiación para la investigación y su alta concentración de empresas biotecnológicas y farmacéuticas líderes. Además, el enfoque del país en la medicina de precisión y las crecientes inversiones en salud impulsan la demanda de tecnologías de citometría de flujo.

Canadá es el país de más rápido crecimiento en el mercado de citometría de flujo de América del Norte

Canadá es el país con mayor crecimiento en el mercado norteamericano de la citometría de flujo, impulsado por el aumento de la inversión en investigación y avances en salud. El creciente enfoque del país en la medicina personalizada, la expansión del sector biotecnológico y la creciente adopción de la citometría de flujo en entornos académicos y clínicos contribuyen a su rápido crecimiento.

Para obtener información más detallada sobre el informe del mercado de citometría de flujo de América del Norte, haga clic aquí: https://www.databridgemarketresearch.com/reports/north-america-flow-cytometry-market