America Polyester Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

32.78 Billion

USD

56.10 Billion

2024

2032

USD

32.78 Billion

USD

56.10 Billion

2024

2032

| 2025 –2032 | |

| USD 32.78 Billion | |

| USD 56.10 Billion | |

|

|

|

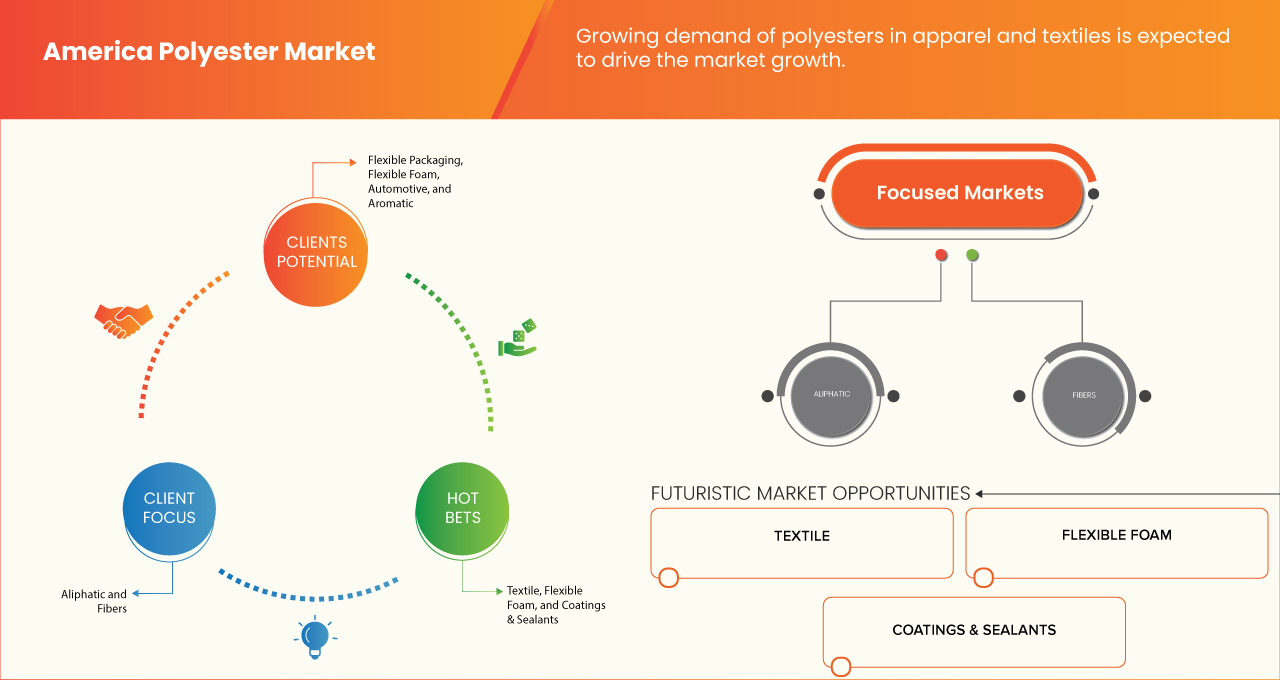

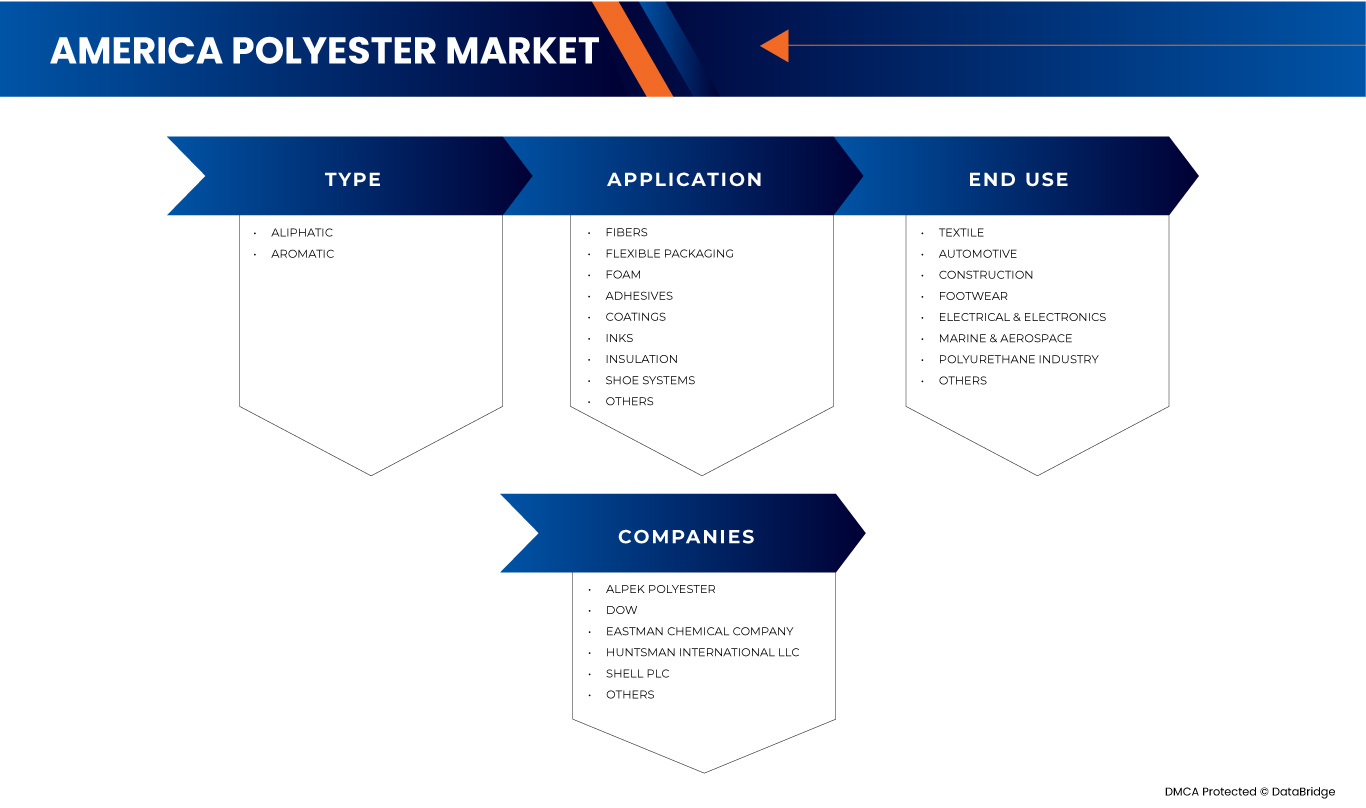

America Polyester Market Segmentation, By Type (Aliphatic and Aromatic), Application (Fibers, Flexible Packaging, Foam, Adhesives, Coatings, Inks, Insulation, Shoe Systems, and Others), End-Use (Textile, Automotive, Construction, Footwear, Electrical & Electronics, Marine & Aerospace, Polyurethane Industry, and Others) – Industry Trends and Forecast to 2032

Polyester Market Analysis

The America polyester market is driven by rising demand in textiles, packaging, and automotive sectors. Polyester, valued for durability, affordability, and versatility, dominates the synthetic fiber industry. The U.S. leads consumption due to its strong apparel and home furnishing industries, while Latin America sees steady growth in PET bottles and films. Sustainability concerns are pushing bio-based and recycled polyester adoption. Market challenges include raw material price volatility and environmental regulations. Key players such as Indorama Ventures, Eastman, and DuPont focus on innovation and circular economy initiatives. Overall, the market is expected to grow steadily, driven by industrial and consumer applications.

Polyester Market Size

America polyester market size was valued at USD 32.78 billion in 2024 and is projected to reach USD 56.10 billion by 2032, with a CAGR of 7.0% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework

Polyester Market Trends

“Growing Demand of Polyesters in Apparel and Textiles”

Polyester has become a preferred material due to its versatility, durability, and affordability, making it an essential component in various clothing and fabric applications. Its ability to blend seamlessly with other fibers, such as cotton and wool, further enhances its appeal, allowing manufacturers to create textiles with unique properties, such as wrinkle resistance, moisture-wicking, and quick-drying capabilities. The American apparel industry’s focus on performance wear and activewear has amplified the demand for polyester. The material’s lightweight nature and high tensile strength make it ideal for sportswear, where durability and flexibility are paramount.

Overall, the growing demand for polyester in the American apparel and textile industries is driven by its versatility, affordability, and ability to adapt to changing consumer preferences. This trend positions polyester as a critical material in supporting innovation and growth within the America polyester market.

Report Scope and Polyester Market Segmentation

|

Attributes |

Polyester Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Brazil, Argentina, Mexico, Colombia, Chile, Peru, Venezuela, and Rest of America |

|

Key Market Players |

Alpek Polyester (U.S.), Dow (U.S.), Eastman Chemical Company (U.S.), Huntsman International LLC (U.S.), Shell plc (England), Arkema (France), Coim Group (Italy), DIC CORPORATION (Japan), Repsol (Spain), and Stepan Company (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyester Market Definition

Polyester is a synthetic polymer derived primarily from petroleum-based chemicals, commonly known as Polyethylene Terephthalate (PET). It is widely used in textiles, packaging, and industrial applications due to its durability, wrinkle resistance, and moisture-wicking properties. Polyester fabrics are favored in fashion, home furnishings, and sportswear, while industrial-grade polyester is utilized in automotive, construction, and packaging sectors.

Polyester Market Dynamics

Drivers

- Increasing Adoption of PET Bottles and Films in Packaging Industry

PET, a type of polyester, has gained significant popularity due to its excellent properties, including lightweight, durability, transparency, and recyclability. These attributes make it an ideal choice for a wide range of packaging applications, particularly in the beverage, food, personal care, and pharmaceutical sectors.

One of the key factors driving the adoption of PET bottles is the rising demand for sustainable and environmentally friendly packaging solutions. As governments, industries, and consumers increasingly focus on reducing plastic waste and promoting recycling, PET bottles stand out as a sustainable option. They are 100% recyclable and can be converted into new PET products or other materials, such as polyester fibers, reducing environmental impact and supporting circular economy initiatives. This has led to a surge in demand for PET-based packaging, boosting the polyester market. The growth of the beverage industry, particularly bottled water and carbonated soft drinks, is another factor contributing to the widespread use of PET bottles. These bottles are preferred over traditional materials like glass due to their lightweight nature, which lowers transportation costs and enhances convenience for consumers. Similarly, PET films are extensively used in flexible packaging applications due to their excellent barrier properties, which protect products from moisture, oxygen, and contaminants, ensuring longer shelf life.

For instance,

In September 2024, according to an article published by Plastics Engineering, the article highlights advancements in flexible film packaging, focusing on sustainability trends. Monomaterial films, such as Amcor’s AmPrima and Berry Global’s Omni Xtra PE, promote recyclability by replacing multilayer structures. Innovations include PCR integration, downgauging, and aluminum foil alternatives, supporting the circular economy while maintaining performance and reducing environmental impact.

- Rising Use of Polyester Fibers and Composites in Automotive and Industrial Applications

Polyester's unique properties, including high tensile strength, durability, lightweight, and cost-effectiveness, make it an essential material in these sectors. As industries increasingly seek innovative materials to improve performance, efficiency, and sustainability, polyester fibers and composites are becoming indispensable in manufacturing processes.

In the automotive sector, polyester fibers are widely used in seat upholstery, carpets, headliners, and safety belts due to their strength, stain resistance, and ease of maintenance. In addition, composites made with polyester resins are utilized in structural components such as panels, bumpers, and underbody shields, offering excellent impact resistance and reduced vehicle weight. The lightweight nature of polyester-based materials contributes significantly to fuel efficiency and emissions reduction, aligning with the industry's sustainability goals and regulatory requirements. With the growing production of Electric Vehicles (EVs) in America, the demand for polyester composites is further escalating, as they support lightweight while maintaining structural integrity.

For instance,

- In February 2024, according to an article published by AZoNetwork, The automotive industry is adopting fiber-reinforced polymer composites (FRPCs) to enhance performance, efficiency, and sustainability. FRPCs, made of glass, carbon, or natural fibers in a polymer matrix, offer weight reduction, cost savings, and recyclability.

Opportunities

- Rising Adoption of Sustainable Polyester in Various Industries

With increasing consumer awareness of environmental issues and the global push toward sustainability, the demand for eco-friendly materials has surged. Sustainable polyester, often produced from recycled PET bottles or bio-based feedstocks, has emerged as a viable solution, offering the same performance characteristics as conventional polyester while significantly reducing environmental impact.

One of the key drivers behind this opportunity is the growing focus on circular economy initiatives. Governments, organizations, and industries are encouraging the use of recycled materials to minimize waste and reduce reliance on virgin petrochemicals. Sustainable polyester fits seamlessly into these initiatives, as it enables industries to align with environmental regulations and corporate sustainability goals. This shift has opened doors for polyester manufacturers to cater to industries such as apparel, automotive, packaging, and construction that are increasingly prioritizing environmentally conscious materials. In the apparel industry, sustainable polyester has gained substantial traction, particularly among fast-fashion and sportswear brands aiming to appeal to eco-conscious consumers. Many global fashion brands are incorporating recycled polyester into their collections, replacing traditional fibers to meet sustainability targets. This trend not only strengthens polyester’s relevance in the market but also enhances its image as an environmentally friendly choice.

For instance,

In January 2025, according to an article published by Xometry, The rising adoption of sustainable polyester is transforming industries such as fashion, automotive, and packaging. With advancements in recycling and bio-based alternatives, companies are reducing environmental impact while maintaining durability and performance. As demand for eco-friendly materials grows, sustainable polyester is emerging as a key solution for a greener future.

- Advancements in Bio-Based and Recycled Polyester

As industries and consumers increasingly prioritize sustainability, the development of innovative polyester solutions derived from renewable resources or recycled materials has gained significant momentum. These advancements align with global environmental goals, offering a pathway to reduce reliance on fossil fuels and minimize the ecological footprint of polyester production. Bio-based polyester, produced from renewable feedstocks such as corn, sugarcane, or other plant-based materials, is emerging as an environmentally friendly alternative to conventional polyester. This innovation enables manufacturers to decrease greenhouse gas emissions during production while catering to the rising demand for sustainable materials. With growing investments in bio-based technology and research, the potential for large-scale production of bio-based polyester is expanding, creating lucrative opportunities for the market.

Similarly, the development of recycled polyester, particularly made from post-consumer PET bottles and industrial waste, has revolutionized the polyester industry. Recycled polyester offers the same durability, versatility, and performance as virgin polyester while significantly reducing waste and energy consumption during production. These qualities make it a preferred choice for industries such as apparel, automotive, and packaging, where sustainability and functionality are equally valued.

For instance,

- In November 2024, according to an article published by American Chemical Society, The push for sustainability has driven interest in biobased polyesters as alternatives to petroleum-based polymers. Derived from renewable sources, they offer biodegradability and strong mechanical properties but face challenges like low stability and slow crystallization. Advances in synthesis, copolymerization, and green catalysts are improving their industrial viability and performance.

Restraints/Challenges

- Stiff Competition from Alternative Fibers

These fibers often appeal to consumers and industries for their unique characteristics and suitability for specific applications, creating challenges for polyester to maintain its market share across diverse sectors. Cotton, for instance, remains a preferred choice in the apparel and textile industries due to its natural origin, breathability, and softness. With the increasing consumer preference for eco-friendly and biodegradable materials, cotton is often viewed as a sustainable alternative to polyester, which is petroleum-based and takes longer to degrade. Wool, another natural fiber, holds a strong position in premium clothing segments due to its superior insulation properties and luxurious appeal, making it a tough competitor for polyester in specific markets.

Similarly, fibers such as nylon and polypropylene are preferred in technical and industrial applications due to their higher performance attributes, such as greater strength, durability, and thermal resistance. These alternatives can outperform polyester in specific use cases, particularly where high-performance materials are required. The rise of sustainable and innovative fiber alternatives, including lyocell, hemp, and bio-based materials, further intensifies competition. These fibers are gaining traction due to their minimal environmental impact and alignment with growing sustainability trends. This shift poses an additional challenge for the polyester market as manufacturers and consumers increasingly adopt environmentally conscious options.

For instance,

In December 2023, according to an article published by Lyfcycle Ltd., Polyester dominates textiles but has environmental concerns. Sustainable alternatives include recycled polyester, biodegradable polyester, and natural fibers such as lyocell. Brands adopt eco-friendly options, but challenges remain, including microplastic pollution and production costs. A mix of solutions is needed for different applications to drive sustainability in the fashion industry.

- Supply Chain Disruptions and Logistics Costs

Supply chain disruptions and rising logistics costs are significant challenges facing the American polyester market. The polyester industry heavily relies on the seamless flow of raw materials, production inputs, and finished products across global supply chains. Any interruptions in these processes can severely impact production schedules, increase costs, and disrupt market operations.

Geopolitical tensions, trade restrictions, and natural disasters have exposed the vulnerabilities of supply chains. These disruptions have led to delays in the procurement of essential raw materials such as ethylene and terephthalic acid, which are critical for polyester production. Port congestion, transportation delays, and restrictions on cross-border trade further exacerbate these issues, creating bottlenecks across the supply chain. Such disruptions increase lead times, hinder inventory management, and ultimately delay product delivery to end-users. In addition, escalating logistics costs contribute to the challenge. Rising fuel prices, shortages of shipping containers, and increased freight charges have significantly raised transportation expenses. For polyester manufacturers operating in cost-sensitive sectors such as apparel, packaging, and automotive, these added costs create pressure on profit margins and reduce competitiveness.

For instance,

According to an article published by QIMA, Recycled polyester (rPET) is a sustainable alternative to virgin polyester, making up over 15% of global polyester fiber use. However, supply chain challenges—such as verifying rPET content, ensuring traceability, and preventing greenwashing-persist. This guide explores authentication methods and compliance solutions. QIMA provides testing and verification to enhance supply chain transparency.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Polyester Market Scope

The market is segmented on the basis of type, application, and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Aliphatic

- Aromatic

Application

- Fibers

- Flexible Packaging

- Foam

- Flexible Foam

- Spray Foam

- Adhesives

- Coatings

- Inks

- Insulation

- Shoe Systems

- Others

End-Use

- Textile

- Automotive

- Flexible & Rigid Foams

- Coatings

- Adhesives & Sealants

- Construction

- Coatings & Sealants

- Adhesives

- Insulation Foams

- Footwear

- Electrical & Electronics

- Marine & Aerospace

- Polyurethane Industry

- Others

Polyester Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, application, and end-use as referenced above.

The countries covered in the market are U.S., Canada, Brazil, Argentina, Mexico, Colombia, Chile, Peru, Venezuela, and Rest of America.

U.S. is projected to lead and growing rapidly in the market, due to high textile demand, advanced manufacturing, strong packaging industry, rising automotive applications, sustainability initiatives, technological innovations, and major players driving market expansion and development.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Polyester Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Polyester Market Leaders Operating in the Market Are:

- Alpek Polyester (U.S.)

- Dow (U.S.)

- Eastman Chemical Company (U.S.)

- Huntsman International LLC (U.S.)

- Shell plc (England)

- Arkema (France)

- Coim Group (Italy)

- DIC CORPORATION (Japan)

- Repsol (Spain)

- Stepan Company (U.S.)

Latest Developments in Polyester Market

- In January 2025, Dow announced a collaboration with Brivaplast and TecnoGi to promote sustainability in the luxury goods sector by reprocessing imperfect perfume caps into high-quality components for luxury footwear and leather goods. Dow supplies SURLYN resin, used in the production of premium perfume caps by Brivaplast, a leading cosmetic packaging manufacturer. While these caps are designed to meet strict quality standards, some pieces are deemed substandard. Rather than discarding them, TecnoGi will repurpose the imperfect caps into components for the luxury fashion industry. This initiative showcases a commitment to circularity and demonstrates how cross-industry collaboration can reduce waste and add value

- In December 2022, Eastman and Krahn Chemie GmbH signed an agreement that states the distribution of Eastman products across central and eastern Europe. This agreement helps in the expansion of their business by distributing their products in different regions with favorable conditions and in original form

- In May 2020, Huntsman Corporation announced the rebranding of its world-leading spray polyurethane foam business as Huntsman Building Solutions. Huntsman Building Solutions is a worldwide platform under Huntsman's Polyurethanes division. This rebranding helped the company to expand its business in the polyurethane foam business

- In November 2023, Shell Chemicals was honored as a winner in BNSF’s 2023 Sustainability Awards program. Alongside nine other recipients, Shell Chemicals received this recognition from BNSF, a prominent North American freight transportation company, for its advancements in sustainable solutions throughout the year

- In October 2024, DIC Corporation has announced the development of a new specialty polyphenylene sulfide (PPS) film, created in collaboration with Japanese firm Unitika Ltd., designed to reduce transmission loss at high frequencies. With its low dielectric properties, this innovative film is ideal for use in millimeter-wave printed circuit boards, which are essential for next-generation communication devices and millimeter-wave radar. The product has already undergone evaluation by several electronics materials manufacturers, and commercial production preparations are underway

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 BARGAINING POWER OF SUPPLIERS

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 VENDOR SELECTION CRITERIA

4.4.1 COST-BENEFIT ANALYSIS

4.4.2 QUALITY ASSURANCE AND STANDARDS

4.4.3 RELIABILITY AND CONSISTENCY

4.4.4 VENDOR EXPERTISE AND CAPABILITIES

4.4.5 FINANCIAL STABILITY AND LONGEVITY

4.4.6 ETHICAL AND SUSTAINABLE PRACTICES

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.6 POTENTIAL CUSTOMER LIST

4.7 RAW MATERIAL COVERAGE

4.7.1 PURIFIED TEREPHTHALIC ACID (PTA)

4.7.2 MONOETHYLENE GLYCOL (MEG)

4.7.3 PARAXYLENE (PX)

4.7.4 DIMETHYL TEREPHTHALATE (DMT)

4.7.5 ETHYLENE OXIDE (EO)

4.7.6 BIO-BASED AND RECYCLED POLYESTER FEEDSTOCKS

4.7.7 ADDITIVES AND CATALYSTS

4.7.8 CONCLUSION

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9.1 ADVANCED RECYCLING TECHNOLOGIES

4.9.2 BIO-BASED POLYESTER PRODUCTION

4.9.3 WATERLESS DYEING TECHNOLOGY

4.9.4 ENERGY-EFFICIENT PRODUCTION PROCESSES

4.9.5 SMART TEXTILES AND FUNCTIONAL POLYESTER

4.9.6 SUSTAINABLE ADDITIVES AND GREEN CHEMISTRY

4.9.7 CARBON CAPTURE AND STORAGE (CCS) TECHNOLOGIES

4.9.8 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND OF POLYESTERS IN APPAREL AND TEXTILES

6.1.2 INCREASING ADOPTION OF PET BOTTLES AND FILMS IN PACKAGING INDUSTRY

6.1.3 RISING USE OF POLYESTER FIBERS AND COMPOSITES IN AUTOMOTIVE AND INDUSTRIAL APPLICATIONS

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES

6.2.2 STIFF COMPETITION FROM ALTERNATIVE FIBERS

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF SUSTAINABLE POLYESTER IN VARIOUS INDUSTRIES

6.3.2 ADVANCEMENTS IN BIO-BASED AND RECYCLED POLYESTER

6.4 CHALLENGES

6.4.1 SUPPLY CHAIN DISRUPTIONS AND LOGISTICS COSTS

6.4.2 TECHNICAL CHALLENGES IN POLYESTER RECYCLING AND PROCESSING

7 AMERICA POLYESTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 ALIPHATIC

7.3 AROMATIC

8 AMERICA POLYESTER MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 FIBERS

8.3 FLEXIBLE PACKAGING

8.4 FOAM

8.5 ADHESIVES

8.6 COATINGS

8.7 INKS

8.8 INSULATION

8.9 SHOE SYSTEMS

8.1 OTHERS

9 AMERICA POLYESTER MARKET, BY END USE

9.1 OVERVIEW

9.2 TEXTILE

9.3 AUTOMOTIVE

9.4 CONSTRUCTION

9.5 FOOTWEAR

9.6 ELECTRICAL & ELECTRONICS

9.7 MARINE & AEROSPACE

9.8 POLYURETHANE INDUSTRY

9.9 OTHERS

10 AMERICA POLYESTER MARKET, BY COUNTRY

10.1 AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 BRAZIL

10.1.4 ARGENTINA

10.1.5 MEXICO

10.1.6 COLOMBIA

10.1.7 CHILE

10.1.8 PERU

10.1.9 VENEZUELA

10.1.10 REST OF AMERICAS

11 AMERICA POLYESTER MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ALPEK POLYESTER

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 DOW

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATE

13.3 EASTMAN CHEMICAL COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 RECENT FINANCIALS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 HUNTSMAN INTERNATIONAL LLC

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 SHELL PLC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT/NEWS

13.6 ARKEMA

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT/NEWS

13.7 COIM GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 DIC CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 RECENT FINANCIALS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 REPSOL

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

13.1 STEPAN COMPAY

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 POTENTIAL CUSTOMER LIST

TABLE 2 REGULATORY COVERAGE

TABLE 3 AMERICA POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 AMERICA POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 5 AMERICA POLYESTER MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 6 AMERICA POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 7 AMERICA POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 8 AMERICA POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD/KG)

TABLE 9 AMERICA FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 AMERICA POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 11 AMERICA POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 12 AMERICA POLYESTER MARKET, BY END USE, 2018-2032 (USD/KG)

TABLE 13 AMERICA AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 AMERICA CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 AMERICA POLYESTER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 16 AMERICA POLYESTER MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 17 U.S. POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 19 U.S. POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 21 U.S. FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 24 U.S. AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 CANADA POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 CANADA POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 28 CANADA POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 CANADA POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 30 CANADA FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 CANADA POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 32 CANADA POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 33 CANADA AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 CANADA CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 BRAZIL POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 BRAZIL POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 37 BRAZIL POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 38 BRAZIL POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 39 BRAZIL FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 BRAZIL POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 41 BRAZIL POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 42 BRAZIL AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 BRAZIL CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ARGENTINA POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ARGENTINA POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 46 ARGENTINA POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 ARGENTINA POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 48 ARGENTINA FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ARGENTINA POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 50 ARGENTINA POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 51 ARGENTINA AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 ARGENTINA CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MEXICO POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MEXICO POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 55 MEXICO POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 MEXICO POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 57 MEXICO FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MEXICO POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 59 MEXICO POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 60 MEXICO AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 COLOMBIA POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 COLOMBIA POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 64 COLOMBIA POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 COLOMBIA POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 66 COLOMBIA FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 COLOMBIA POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 68 COLOMBIA POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 69 COLOMBIA AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 COLOMBIA CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 CHILE POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 CHILE POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 73 CHILE POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 74 CHILE POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 75 CHILE FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CHILE POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 77 CHILE POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 78 CHILE AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHILE CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 PERU POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 PERU POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 82 PERU POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 PERU POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 84 PERU FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 PERU POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 86 PERU POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 87 PERU AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 PERU CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 VENEZUELA POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 VENEZUELA POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 91 VENEZUELA POLYESTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 VENEZUELA POLYESTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 93 VENEZUELA FOAM IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 VENEZUELA POLYESTER MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 95 VENEZUELA POLYESTER MARKET, BY END USE, 2018-2032 (TONS)

TABLE 96 VENEZUELA AUTOMOTIVE IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 VENEZUELA CONSTRUCTION IN POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 REST OF AMERICA POLYESTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 REST OF AMERICA POLYESTER MARKET, BY TYPE, 2018-2032 (TONS)

Lista de figuras

FIGURE 1 AMERICA POLYESTER MARKET

FIGURE 2 AMERICA POLYESTER MARKET: DATA TRIANGULATION

FIGURE 3 AMERICA POLYESTER MARKET: DROC ANALYSIS

FIGURE 4 AMERICA POLYESTER MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 AMERICA POLYESTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AMERICA POLYESTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 AMERICA POLYESTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AMERICA POLYESTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AMERICA POLYESTER MARKET: APPLICATION COVERAGE GRID

FIGURE 10 AMERICA POLYESTER MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 TWO SEGMENTS COMPRISE THE AMERICA POLYESTER MARKET, BY TYPE (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING DEMAND OF POLYESTERS IN APPAREL AND TEXTILES IS EXPECTED TO DRIVE THE AMERICA POLYESTER MARKET IN THE FORECAST PERIOD

FIGURE 15 THE ALIPHATIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AMERICA POLYESTER MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AMERICA POLYESTER MARKET

FIGURE 21 AMERICA POLYESTER MARKET: BY TYPE, 2024

FIGURE 22 AMERICA POLYESTER MARKET, BY APPLICATION, 2024

FIGURE 23 AMERICA POLYESTER MARKET, BY END USE, 2024

FIGURE 24 AMERICA POLYESTER MARKET: SNAPSHOT (2024)

FIGURE 25 AMERICA POLYESTER MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.