Europe Medical Device Warehouse And Logistics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

9.74 Billion

USD

13.86 Billion

2024

2032

USD

9.74 Billion

USD

13.86 Billion

2024

2032

| 2025 –2032 | |

| USD 9.74 Billion | |

| USD 13.86 Billion | |

|

|

|

|

Segmentación del mercado europeo de almacenamiento y logística de dispositivos médicos, por oferta (servicios, hardware y software), temperatura (ambiente, refrigerado, congelado y otros), modo de transporte (transporte marítimo, aéreo y terrestre), aplicación (dispositivos de diagnóstico, terapéuticos, de monitorización, quirúrgicos y otros), uso final (hospitales y clínicas, empresas de dispositivos médicos, instituciones académicas y de investigación, laboratorios de referencia y diagnóstico, empresas de servicios médicos de emergencia y otros), canal de distribución (logística convencional y de terceros): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado europeo de almacenamiento y logística de dispositivos médicos

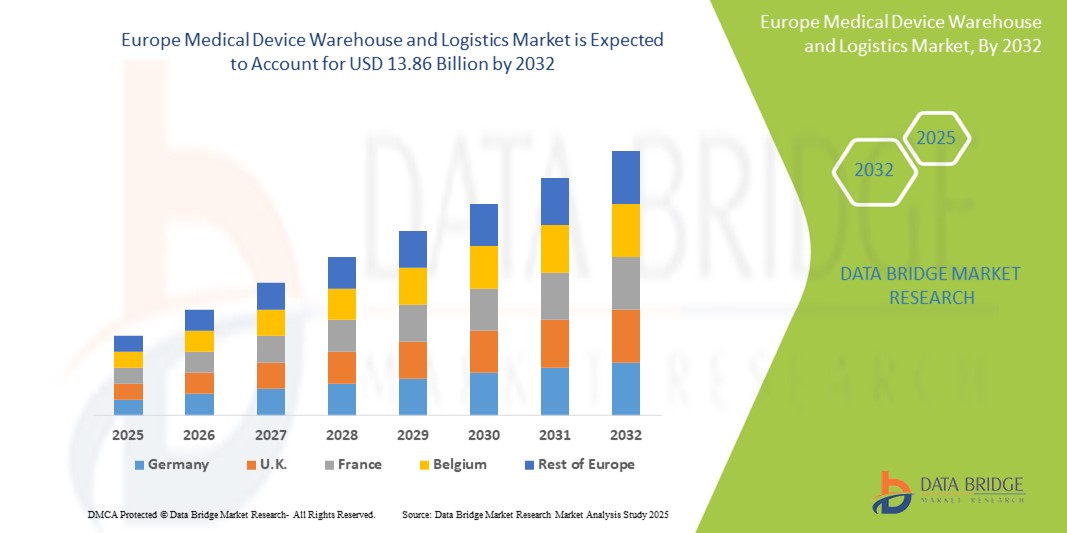

- El tamaño del mercado de almacenamiento y logística de dispositivos médicos de Europa se valoró en USD 9,74 mil millones en 2024 y se espera que alcance los USD 13,86 mil millones para 2032 , con una CAGR del 4,50% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente adopción de tecnologías avanzadas de la cadena de suministro y a la transformación digital de la logística sanitaria, lo que conduce a una mayor eficiencia en el almacenamiento y la distribución de dispositivos médicos en toda Europa.

- Además, la creciente demanda de equipos médicos sensibles a la temperatura y de alto valor, sumada al estricto cumplimiento normativo en materia de trazabilidad y seguridad de los dispositivos médicos, está impulsando la adopción de soluciones europeas de almacenamiento y logística para dispositivos médicos. Estos factores convergentes están acelerando la adopción de plataformas logísticas tecnológicamente avanzadas, impulsando así significativamente el crecimiento del sector.

Análisis del mercado europeo de almacenamiento y logística de dispositivos médicos

- Los servicios de almacenamiento y logística de dispositivos médicos son componentes cada vez más vitales de la infraestructura sanitaria europea, especialmente en entornos hospitalarios, ambulatorios y de atención domiciliaria, debido a la creciente demanda de entregas puntuales, conformes y sensibles a la temperatura de tecnologías médicas complejas. Estos servicios desempeñan un papel crucial para garantizar la disponibilidad, la trazabilidad y la conformidad normativa de los dispositivos en toda la región.

- La creciente demanda de una logística eficiente de dispositivos médicos en Europa está impulsada principalmente por la creciente base de fabricación de dispositivos médicos, los avances en las tecnologías de la cadena de frío, la expansión del comercio electrónico de suministros médicos y las estrictas regulaciones europeas, como las directrices MDR y GDP.

- Alemania dominó el mercado europeo de almacenamiento y logística de dispositivos médicos, con la mayor cuota de ingresos, un 28,3 %, en 2024, gracias a su avanzada infraestructura sanitaria, centros de distribución centralizados y liderazgo en la producción y exportación de dispositivos médicos. La inversión del país en automatización, rastreo RFID y almacenamiento a temperatura controlada está acelerando la madurez del mercado, especialmente entre los grandes proveedores de logística.

- Se espera que Francia sea la región de más rápido crecimiento en el mercado de almacenamiento y logística de dispositivos médicos durante el período de pronóstico, con una CAGR del 5,8%, respaldada por reformas de atención médica respaldadas por el gobierno, la presencia de proveedores de servicios logísticos líderes, la integración de soluciones de cadena de frío y la creciente demanda de dispositivos de atención crónica.

- El segmento de temperatura ambiente dominó el mercado europeo de almacenamiento y logística de dispositivos médicos, con una cuota de mercado del 52,3 % en 2024, gracias a la amplia gama de dispositivos médicos que no requieren control de temperatura. Su rentabilidad, facilidad de manejo y compatibilidad con las condiciones estándar de almacenamiento y transporte lo convierten en la opción preferida para el almacenamiento y la distribución de productos como instrumental quirúrgico, kits de diagnóstico y equipos médicos duraderos en toda Europa.

Alcance del informe y segmentación del mercado europeo de almacenamiento y logística de dispositivos médicos

|

Atributos |

Información clave sobre el mercado de almacenamiento y logística de dispositivos médicos en Europa |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado europeo de almacenamiento y logística de dispositivos médicos

“ Operaciones optimizadas mediante la automatización y el seguimiento digital ”

- Una tendencia significativa y en auge en el mercado europeo de almacenamiento y logística de dispositivos médicos es la adopción de tecnologías avanzadas de automatización y seguimiento digital. Estas innovaciones están mejorando la eficiencia operativa, reduciendo los errores manuales y permitiendo la visibilidad del inventario en tiempo real en toda la cadena de suministro.

- Por ejemplo, muchos proveedores de logística externa (3PL) están integrando sistemas digitales de gestión de almacenes (WMS) con tecnologías RFID y de escaneo de códigos de barras para optimizar el almacenamiento, la recuperación y la distribución de dispositivos médicos. Esto garantiza el cumplimiento normativo, minimiza las discrepancias de inventario y acelera el procesamiento de pedidos.

- Además, la implementación de plataformas logísticas basadas en la nube permite a las partes interesadas monitorear el estado de los envíos en tiempo real, recibir alertas automatizadas y agilizar la documentación aduanera y regulatoria, reduciendo demoras y mejorando la satisfacción del cliente.

- La automatización de los sistemas de monitorización de temperatura y control de humedad en almacenes es especialmente crucial para dispositivos médicos sensibles a la temperatura y de alto valor, como kits de diagnóstico, dispositivos implantables e instrumental quirúrgico. Estos sistemas garantizan condiciones ambientales constantes para preservar la integridad del producto.

- La creciente preferencia por el inventario justo a tiempo (JIT) y la logística impulsada por la demanda está alentando a los fabricantes y distribuidores a colaborar estrechamente con socios logísticos que puedan ofrecer soluciones de almacenamiento escalables y flexibles.

- En consecuencia, actores clave como DB Schenker, CEVA Logistics y Kuehne+Nagel están invirtiendo en almacenes de dispositivos médicos especialmente diseñados y que cumplen con las normas GDP, con una infraestructura especializada para satisfacer las necesidades cambiantes de los fabricantes y proveedores de atención médica en toda Europa.

Dinámica del mercado europeo de almacenamiento y logística de dispositivos médicos

Conductor

Creciente necesidad debido a la creciente demanda de una cadena de frío eficiente y el cumplimiento normativo.

- La creciente demanda de dispositivos médicos sensibles a la temperatura, junto con las estrictas regulaciones para el manejo y la distribución de dispositivos médicos en toda Europa, es un impulsor importante para la expansión del mercado europeo de almacenamiento y logística de dispositivos médicos.

- Por ejemplo, en abril de 2024, UPS Healthcare anunció la expansión de sus capacidades logísticas de cadena de frío en Europa para satisfacer la creciente demanda de transporte de dispositivos médicos y productos biológicos conforme a las normativas y con temperatura regulada. Se espera que estas inversiones de actores clave impulsen el crecimiento del mercado durante el período de pronóstico.

- A medida que los proveedores de atención médica priorizan la entrega oportuna y segura de dispositivos de diagnóstico y terapéuticos, los socios logísticos están mejorando las capacidades en torno a la trazabilidad, la serialización y el monitoreo de condiciones, lo que garantiza el cumplimiento de las pautas MDR y GDP de la UE.

- Además, el cambio hacia dispositivos mínimamente invasivos y soluciones de atención médica domiciliaria está aumentando la necesidad de entregas de última milla, gestión eficiente del inventario y embalaje especializado, lo que hace que los servicios de almacenamiento y logística sean un eslabón fundamental en la cadena de suministro de dispositivos médicos.

- La creciente prevalencia de enfermedades crónicas y procedimientos quirúrgicos, junto con el creciente número de ensayos clínicos y servicios de diagnóstico, acelera aún más la necesidad de soluciones de almacenamiento ágiles y escalables adaptadas a las condiciones de almacenamiento específicas y los tiempos de respuesta que requieren las tecnologías médicas.

Restricción/Desafío

“ Altos costos operativos y un panorama regulatorio complejo ”

- El mercado europeo de almacenamiento y logística de dispositivos médicos se enfrenta a retos debido a los altos costos asociados a la infraestructura de la cadena de frío, la capacitación especializada del personal y el cumplimiento normativo. La construcción y el mantenimiento de instalaciones y redes de transporte que cumplan con las normas de calidad del producto (GDP), especialmente para los segmentos refrigerados y congelados, exigen una inversión significativa.

- Además, navegar por los complejos y cambiantes marcos regulatorios de múltiples países europeos presenta obstáculos operativos. Los fabricantes y proveedores de logística deben adaptarse a los diversos requisitos nacionales, garantizando al mismo tiempo una visibilidad y un cumplimiento normativo centralizados.

- Por ejemplo, los retrasos en el transporte transfronterizo debido a errores de documentación o diferencias en los protocolos aduaneros pueden afectar los plazos de entrega y la integridad del producto, en particular en el caso de los dispositivos sensibles a la temperatura.

- Además, los fabricantes de dispositivos médicos pequeños y medianos suelen tener dificultades para cumplir con estas exigencias de costos y cumplimiento, lo que los lleva a depender en gran medida de proveedores de logística externos (3PL). Si bien esto mejora el alcance, también puede reducir el control directo sobre la calidad y los plazos.

- Para superar estas limitaciones, los actores del sector deben invertir en automatización, sistemas de seguimiento digital y capacitación del personal, a la vez que fomentan una colaboración más estrecha con los organismos reguladores. La expansión de los centros regionales de almacenamiento y la adopción de plataformas digitales estandarizadas también serán vitales para optimizar las operaciones e impulsar el crecimiento a largo plazo.

Alcance del mercado europeo de almacenamiento y logística de dispositivos médicos

El mercado está segmentado en función de las ofertas, la temperatura, el modo de transporte, la aplicación, el uso final y el canal de distribución.

• Por Ofrendas

En función de la oferta, el mercado europeo de almacenamiento y logística de dispositivos médicos se segmenta en servicios, hardware y software. El segmento de servicios dominó la mayor participación en los ingresos, con un 48,6 % en 2024, impulsado por la creciente externalización de las funciones logísticas y la demanda de manipulación especializada.

Se espera que el segmento de software sea testigo de la CAGR más rápida del 23,5% durante el período de pronóstico, atribuido al creciente uso de herramientas de logística digital como las plataformas WMS y TMS.

• Por temperatura

En función de la temperatura, el mercado europeo de almacenamiento y logística de dispositivos médicos se segmenta en ambiente, refrigerado, congelado y otros. El segmento ambiente tuvo la mayor participación, con un 52,3 %, en 2024, debido a la amplia gama de dispositivos que no requieren control de temperatura.

Se proyecta que el segmento refrigerado/refrigerado crecerá a la CAGR más rápida del 21,1 % entre 2025 y 2032, impulsado por la creciente demanda de logística de cadena de frío para dispositivos médicos sensibles.

• Por modo de transporte

Según el modo de transporte, el mercado europeo de almacenamiento y logística de dispositivos médicos se segmenta en logística de transporte marítimo, aéreo y terrestre. El segmento de logística terrestre dominó el mercado con una cuota de mercado del 45,7 % en 2024, gracias a las consolidadas redes de carreteras y ferrocarriles en toda Europa.

Se prevé que el segmento de logística de transporte aéreo crezca a la CAGR más alta del 19,4 % durante el período de pronóstico, respaldado por la creciente demanda de envíos médicos rápidos y de alto valor.

• Por aplicación

Según la aplicación, el mercado europeo de almacenamiento y logística de dispositivos médicos se segmenta en dispositivos de diagnóstico, dispositivos terapéuticos, dispositivos de monitorización, dispositivos quirúrgicos y otros dispositivos. El segmento de dispositivos de diagnóstico representó la mayor participación, con un 34,2 %, en 2024, impulsado por un alto volumen de uso y ciclos de reabastecimiento recurrentes.

Se proyecta que el segmento de dispositivos quirúrgicos se expandirá a la CAGR más rápida del 20,2 % durante el período de pronóstico, respaldado por el aumento de los volúmenes de procedimientos y los requisitos de manejo de dispositivos de precisión.

• Por uso final

En función del uso final, el mercado europeo de almacenamiento y logística de dispositivos médicos se segmenta en hospitales y clínicas, empresas de dispositivos médicos, institutos académicos y de investigación, laboratorios de referencia y diagnóstico, empresas de servicios médicos de emergencia, entre otros. El segmento de hospitales y clínicas registró la mayor participación en los ingresos, con un 39,6 %, en 2024, gracias al alto consumo de dispositivos y a la adquisición centralizada.

Se pronostica que el segmento de empresas de dispositivos médicos crecerá a la CAGR más rápida del 22,8 % durante el período de pronóstico, a medida que subcontratan cada vez más la logística a proveedores externos especializados.

• Por canal de distribución

Según el canal de distribución, el mercado europeo de almacenamiento y logística de dispositivos médicos se segmenta en logística convencional y logística de terceros. El segmento de logística de terceros captó la mayor participación, con un 61,2 %, en 2024, a medida que los fabricantes de dispositivos adoptan modelos de distribución rentables y flexibles.

Se espera que el segmento de logística convencional crezca a una CAGR más rápida del 13,9% durante el período de pronóstico, manteniendo la relevancia en regiones con sistemas de distribución internos o con regulaciones específicas.

Análisis regional del mercado europeo de almacenamiento y logística de dispositivos médicos

- Europa dominó el mercado de almacenamiento y logística de dispositivos médicos con la mayor participación en los ingresos del 38,7 % en 2024, impulsada por la infraestructura de atención médica bien establecida de la región, la sólida red de centros logísticos y los estrictos estándares regulatorios que respaldan el almacenamiento y la distribución seguros y compatibles de dispositivos médicos.

- El enfoque de la región en la integridad de la cadena de frío, los sistemas de seguimiento digital y la sostenibilidad en la logística ha contribuido significativamente a la demanda de soluciones avanzadas de almacenamiento y distribución médica.

- La presencia de empresas farmacéuticas y de tecnología médica líderes, combinada con la creciente adopción de automatización, robótica y monitoreo de inventario en tiempo real en las operaciones logísticas, está impulsando aún más el crecimiento del mercado.

Análisis del mercado alemán de almacenamiento y logística de dispositivos médicos

El mercado alemán de almacenamiento y logística de dispositivos médicos dominó el mercado europeo con la mayor cuota de ingresos, un 28,3 %, en 2024, gracias a su avanzada infraestructura sanitaria, su sólida red logística y la adopción generalizada de la automatización en la gestión de dispositivos médicos. La ubicación estratégica del país en Europa y su enfoque en el cumplimiento normativo lo convierten en un centro de referencia para el almacenamiento y la distribución.

Análisis del mercado francés de almacenamiento y logística de dispositivos médicos

Se proyecta que Francia será testigo de un crecimiento constante en el mercado de almacenamiento y logística de dispositivos médicos durante el período de pronóstico, con una CAGR del 5,8 % entre 2025 y 2032, respaldada por reformas de atención médica respaldadas por el gobierno, la presencia de proveedores de servicios logísticos líderes, la integración de soluciones de cadena de frío y la creciente demanda de dispositivos de atención crónica.

Análisis del mercado de almacenamiento y logística de dispositivos médicos del Reino Unido

Se prevé una expansión significativa del mercado británico de almacenamiento y logística de dispositivos médicos, impulsado por las innovaciones en la entrega de última milla, la reestructuración de la cadena de suministro tras el Brexit y la creciente demanda de dispositivos de diagnóstico. El país está apostando por el almacenamiento digitalizado y las soluciones logísticas sostenibles.

Información sobre el mercado de almacenamiento y logística de dispositivos médicos en los Países Bajos y Europa

El mercado neerlandés de almacenamiento y logística de dispositivos médicos se perfila como un centro logístico clave gracias a su excelente conectividad portuaria y aeroportuaria. El mercado europeo de almacenamiento y logística de dispositivos médicos se sustenta en sólidas colaboraciones público-privadas, una gestión aduanera eficiente y una alta concentración de proveedores 3PL.

Cuota de mercado de almacenamiento y logística de dispositivos médicos en Europa

La industria de almacenamiento y logística de dispositivos médicos en Europa está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Deutsche Post AG (Alemania)

- FedEx (EE. UU.)

- United Parcel Service of America, Inc. (EE. UU.)

- Kuehne+Nagel (Reino Unido)

- DB SCHENKER (Alemania)

- Alloga (Reino Unido)

- CH Robinson Worldwide, Inc. (EE. UU.)

- CEVA (Francia)

- Dimerco (Taiwán)

- DSV (Dinamarca)

- FM Logística (Francia)

- Hellmann Worldwide Logistics SE & Co. KG (Alemania)

- Imperial (Sudáfrica)

- Movianto (Países Bajos)

- OIA Global (EE. UU.)

- Omni Logistics, LLC (EE. UU.)

- puracon GmbH (Alemania)

- Grupo Rhenus (Alemania)

- SEKO (EE. UU.)

- TIBA (España)

- Toll Holdings Limited (Australia)

- XPO, Inc. (EE. UU.)

Últimos avances en el mercado europeo de almacenamiento y logística de dispositivos médicos

- En noviembre de 2023, DHL Express inauguró oficialmente su Hub de Asia Central ampliado en Hong Kong, con una inversión de 562 millones de euros para mejorar sus capacidades en un contexto de crecimiento del comercio mundial. Este centro, crucial para conectar Asia con el mundo, incrementó su capacidad de gestión de envíos en horas punta en casi un 70 % y ahora puede gestionar seis veces el volumen desde su creación en 2004. Esta expansión subraya el compromiso de DHL de apoyar el crecimiento de sus clientes y consolidar la posición de Hong Kong como un centro clave de aviación internacional.

- En diciembre de 2022, DHL Supply Chain anunció una inversión de 10,93 millones de dólares para ampliar su capacidad de almacenamiento en el norte de Taiwán, con especial atención a los sectores de semiconductores, ciencias de la vida y salud. El recién inaugurado Centro de Distribución de Taoyuan-Jian Guo añade 10.000 metros cuadrados al espacio total de almacenamiento de DHL en Taoyuan, aumentando la superficie a 37.000 metros cuadrados. Estas instalaciones mejoran la conectividad para unas operaciones logísticas eficientes y contribuyen al objetivo de la compañía de alcanzar una superficie total de 200.000 metros cuadrados en Taiwán para 2027.

- En septiembre de 2024, FedEx lanzó la plataforma fdx, una solución de comercio basada en datos, ahora disponible para empresas estadounidenses. La plataforma aprovecha la red de FedEx para optimizar la experiencia del cliente, optimizando el crecimiento de la demanda, las tasas de conversión y el cumplimiento. Entre sus características destacadas se incluyen estimaciones predictivas de entrega, información sobre sostenibilidad, seguimiento de pedidos con la marca y procesos de devolución simplificados. Raj Subramaniam, director ejecutivo de FedEx, destacó el papel de la plataforma en cadenas de suministro más inteligentes durante el evento Dreamforce 2024.

- En marzo de 2024, UPS Healthcare presentó UPS Supply Chain Symphony R, una plataforma en la nube diseñada para integrar y gestionar los datos de la cadena de suministro de atención médica desde diversos sistemas operativos. Esta herramienta proporciona a los clientes del sector salud una visibilidad completa de su logística, lo que les permite tomar decisiones informadas, mejorar la planificación y realizar previsiones precisas. Al mejorar el control, la eficiencia y la transparencia, esta plataforma satisface la necesidad crucial de optimizar las cadenas de suministro en el sector salud. Kate Gutmann destacó su potencial transformador para optimizar las operaciones globales y la atención al paciente.

- En septiembre de 2024, Kuehne+Nagel, proveedor líder de logística, inauguró un nuevo centro logístico con control de temperatura para Medtronic en Milton, Ontario, a solo 50 km de Toronto. Con una superficie de 25.000 m², las instalaciones distribuirán dispositivos médicos a hospitales y albergarán los centros de servicio, reparación y mantenimiento preventivo de Medtronic para sus equipos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 COST ANALYSIS BREAKDOWN

4.4 COST BENCHMARK ANALYSIS

4.4.1 COST METRICS OVERVIEW:

4.4.1.1 AVERAGE WAREHOUSE COST PER SQ FT (USD)

4.4.1.2 AVERAGE WAREHOUSE COST PER ORDER:

4.4.1.3 AVERAGE TRANSPORT COST PER SHIPMENT (USD)

4.5 HEALTHCARE ECONOMY

4.6 INDUSTRY INSIGHT

4.6.1 MICRO AND MACRO ECONOMIC FACTORS

4.6.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.6.3 KEY PRICING STRATEGIES

4.6.4 INTERVIEWS WITH SPECIALISTS

4.6.5 ANALYSIS AND RECOMMENDATIONS

4.7 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.7.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.7.1.1 JOINT VENTURES

4.7.1.2 MERGERS AND ACQUISITIONS

4.7.1.3 LICENSING AND PARTNERSHIP

4.7.1.4 TECHNOLOGY COLLABORATIONS

4.7.1.5 STRATEGIC DIVESTMENTS

4.7.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.7.3 STAGE OF DEVELOPMENT

4.7.4 TIMELINES AND MILESTONES

4.7.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.7.6 RISK ASSESSMENT AND MITIGATION

4.7.7 FUTURE OUTLOOK

4.7.8 CONCLUSION

4.8 OPPORTUNITY MAP ANALYSIS

4.9 REIMBURSEMENT FRAMEWORK

4.1 TECHNOLOGICAL ROADMAP

4.11 VALUE CHAIN ANALYSIS

5 REGULATORY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR MEDICAL DEVICES

6.1.2 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN MEDICAL TECHNOLOGY

6.1.3 INCREASED SPENDING ON HEALTHCARE INFRASTRUCTURE BY GOVERNMENTS AND PRIVATE SECTORS

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN DISRUPTIONS

6.2.2 HIGH OPERATIONAL COSTS OF MEDICAL DEVICE LOGISTICS AND WAREHOUSING

6.3 OPPORTUNITIES

6.3.1 ADOPTION OF ADVANCED TECHNOLOGIES IN LOGISTICS MANAGEMENT

6.3.2 STRATEGIC PARTNERSHIPS AND MERGERS BETWEEN MEDICAL DEVICE MANUFACTURERS AND LOGISTICS AND E-COMMERCE COMPANIES

6.4 CHALLENGES

6.4.1 COMPLEX REGULATORY REQUIREMENTS FOR LOGISTICS PROVIDERS TO ENSURE COMPLIANCE

6.4.2 SHORTAGE OF SKILLED LABOR IN LOGISTICS AND WAREHOUSE OPERATIONS CAN CREATE INEFFICIENCIES AND DELAYS

7 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS

7.1 OVERVIEW

7.2 SERVICES

7.3 HARDWARE

7.4 SOFTWARE

8 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION

8.1 OVERVIEW

8.2 SEA FREIGHT LOGISTICS

8.3 AIR FREIGHT LOGISTICS

8.4 OVERLAND LOGISTICS

9 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE

9.1 OVERVIEW

9.2 AMBIENT

9.3 CHILLED/REFRIGERATED

9.4 FROZEN

9.5 OTHERS

10 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DIAGNOSTIC DEVICES

10.3 THERAPEUTIC DEVICES

10.4 MONITORING DEVICES

10.5 SURGICAL DEVICES

10.6 OTHERS DEVICES

11 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 MEDICAL DEVICES COMPANIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 REFERENCE & DIAGNOSTIC LABORATORIES

11.6 EMERGENCY MEDICAL SERVICES COMPANIES

11.7 OTHERS

12 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 CONVENTIONAL LOGISTICS

12.3 THIRD PARTY

13 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 SPAIN

13.1.5 SWITZERLAND

13.1.6 NETHERLANDS

13.1.7 RUSSIA

13.1.8 BELGIUM

13.1.9 FINLAND

13.1.10 DENMARK

13.1.11 POLAND

13.1.12 NORWAY

13.1.13 HUNGARY

13.1.14 SWEDEN

13.1.15 REST OF EUROPE

14 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 DEUTSCHE POST AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 FEDEX

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 UNITED PARCEL SERVICE OF AMERICA, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 KUEHNE+NAGEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 DB SCHENKER

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALLOGA

16.6.1 COMPANY SNAPSHOT

16.6.2 SERVICE PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AWL INDIA PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 SERVICE PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 C.H. ROBINSON WORLDWIDE, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 CAVALIER LOGISTICS

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CEVA

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CROWN LSP GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 SERVICE PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 DIMERCO

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 DSV

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 FM LOGISTIC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 HANSA INTERNATIONAL

16.15.1 COMPANY SNAPSHOT

16.15.2 SERVICE PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 HELLMANN WORLDWIDE LOGISTICS SE & CO. KG

16.16.1 COMPANY SNAPSHOT

16.16.2 SERVICE PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMPERIAL

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICE PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MERCURY BUSINESS SERVICES

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MOVIANTO

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MURPHY LOGISTICS

16.20.1 COMPANY SNAPSHOT

16.20.2 SERVICE PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 OIA EUROPE

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 OMNI LOGISTICS, LLC

16.22.1 COMPANY SNAPSHOT

16.22.2 SERVICE PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PURACON GMBH

16.23.1 COMPANY SNAPSHOT

16.23.2 SERVICE PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 RHENUS GROUP

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 SEKO

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TIBA

16.26.1 COMPANY SNAPSHOT

16.26.2 SERVICE PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 TOLL HOLDINGS LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 SERVICE PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 WAREHOUSE ANYWHERE

16.28.1 COMPANY SNAPSHOT

16.28.2 SERVICE PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 XPO, INC.

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 SERVICE PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 2 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 3 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 4 EUROPE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 5 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 EUROPE STORAGE AND WAREHOUSE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 EUROPE STORAGE AND WAREHOUSE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 EUROPE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 14 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 18 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 24 EUROPE AMBIENT IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 EUROPE CHILLED/REFRIGERATED IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 EUROPE FROZEN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 29 EUROPE DIAGNOSTIC DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 EUROPE THERAPEUTIC DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 EUROPE MONITORING DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 EUROPE SURGICAL DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 EUROPE OTHERS DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2022-2031 (USD THOUSAND)

TABLE 35 EUROPE HOSPITALS & CLINICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 EUROPE MEDICAL DEVICES COMPANIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 EUROPE ACADEMIC & RESEARCH INSTITUTES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 EUROPE REFERENCE & DIAGNOSTIC LABORATORIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 EUROPE EMERGENCY MEDICAL SERVICES COMPANIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 EUROPE OTHERS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 41 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE CONVENTIONAL LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 EUROPE THIRD PARTY IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 44 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 45 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 46 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 EUROPE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 EUROPE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 EUROPE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 EUROPE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 55 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 56 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 60 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 63 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 64 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 65 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 66 GERMANY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 GERMANY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 GERMANY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 GERMANY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 GERMANY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 GERMANY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 GERMANY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 76 GERMANY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 GERMANY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 GERMANY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 84 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 85 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 86 U.K. SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 U.K. LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 U.K. STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 U.K. STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 U.K. PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 U.K. HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 U.K. SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 95 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 96 U.K. SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 U.K. AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 100 U.K. OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 103 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 104 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 105 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 106 FRANCE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 FRANCE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 FRANCE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 FRANCE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 FRANCE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 FRANCE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 FRANCE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 115 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 116 FRANCE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 FRANCE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 FRANCE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 123 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 124 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 125 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 126 ITALY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 ITALY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 ITALY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 ITALY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 ITALY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 ITALY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 ITALY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 135 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 136 ITALY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 ITALY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 ITALY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 142 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 143 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 144 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 145 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 146 SPAIN SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 SPAIN LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SPAIN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SPAIN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SPAIN PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SPAIN HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 SPAIN SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 155 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 156 SPAIN SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 SPAIN AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 SPAIN OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 163 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 164 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 165 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 166 SWITZERLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 SWITZERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 SWITZERLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 170 SWITZERLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 171 SWITZERLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 SWITZERLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 173 SWITZERLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 174 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 175 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 176 SWITZERLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 SWITZERLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 SWITZERLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 183 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 184 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 185 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 186 NETHERLANDS SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 187 NETHERLANDS LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 189 NETHERLANDS STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 NETHERLANDS STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 NETHERLANDS PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 NETHERLANDS HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 NETHERLANDS SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 195 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 196 NETHERLANDS SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 NETHERLANDS AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 NETHERLANDS OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 203 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 204 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 205 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 206 RUSSIA SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 RUSSIA LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 RUSSIA STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 RUSSIA STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 211 RUSSIA PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 RUSSIA HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 RUSSIA SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 215 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 216 RUSSIA SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 RUSSIA AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 RUSSIA OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 221 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 222 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 223 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 224 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 225 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 226 BELGIUM SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 227 BELGIUM LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 228 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 BELGIUM STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 BELGIUM STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 231 BELGIUM PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 BELGIUM HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 233 BELGIUM SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 234 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 235 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 236 BELGIUM SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 238 BELGIUM AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 BELGIUM OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 243 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 244 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 245 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 246 FINLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 FINLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 249 FINLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 250 FINLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 251 FINLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 252 FINLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 253 FINLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 254 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 255 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 256 FINLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 FINLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 259 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 260 FINLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 262 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 263 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 264 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 265 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 266 DENMARK SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 267 DENMARK LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 268 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 269 DENMARK STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 270 DENMARK STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 271 DENMARK PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 DENMARK HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 273 DENMARK SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 274 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 275 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 276 DENMARK SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 278 DENMARK AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 279 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 280 DENMARK OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 281 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 282 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 283 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 284 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 285 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 286 POLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 287 POLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 288 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 289 POLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 290 POLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 291 POLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 292 POLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 293 POLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 294 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 295 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 296 POLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 297 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 298 POLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 299 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 300 POLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 301 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 302 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 303 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 304 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 305 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 306 NORWAY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 307 NORWAY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 308 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 309 NORWAY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 310 NORWAY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 311 NORWAY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 312 NORWAY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 313 NORWAY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 314 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 315 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 316 NORWAY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 317 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 318 NORWAY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 319 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 320 NORWAY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 321 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 322 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 323 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 324 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 325 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 326 HUNGARY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 327 HUNGARY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 328 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 329 HUNGARY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 330 HUNGARY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 331 HUNGARY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 332 HUNGARY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 333 HUNGARY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 334 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 335 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 336 HUNGARY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 337 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 338 HUNGARY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 339 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 340 HUNGARY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 341 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 342 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 343 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 344 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 345 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 346 SWEDEN SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 347 SWEDEN LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 348 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 349 SWEDEN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 350 SWEDEN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 351 SWEDEN PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 352 SWEDEN HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 353 SWEDEN SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 354 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 355 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 356 SWEDEN SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 357 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 358 SWEDEN AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 359 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 360 SWEDEN OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 361 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 362 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 363 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 364 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 365 REST OF EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

Lista de figuras

FIGURE 1 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET

FIGURE 2 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: SEGMENTATION

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 THREE SEGMENTS COMPRISE THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 RISING DEMAND FOR MEDICAL DEVICES IS EXPECTED TO DRIVE THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES