Global Animal Antibiotics Antimicrobials Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5.08 Billion

USD

7.00 Billion

2024

2032

USD

5.08 Billion

USD

7.00 Billion

2024

2032

| 2025 –2032 | |

| USD 5.08 Billion | |

| USD 7.00 Billion | |

|

|

|

|

Segmentación del mercado global de antibióticos para animales (antimicrobianos), por producto ( tetraciclina , penicilina, sulfonamida, macrólido, cefalosporina , fluoroquinolona, lincosamidas y cefalosporinas ), tipo (antimicrobianos y antibióticos), modo de administración (premezclas, polvo oral, inyección y otros), tipo de animal (ganado vacuno, cerdo, aves de corral, acuicultura y otros animales) - Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de antibióticos para uso animal

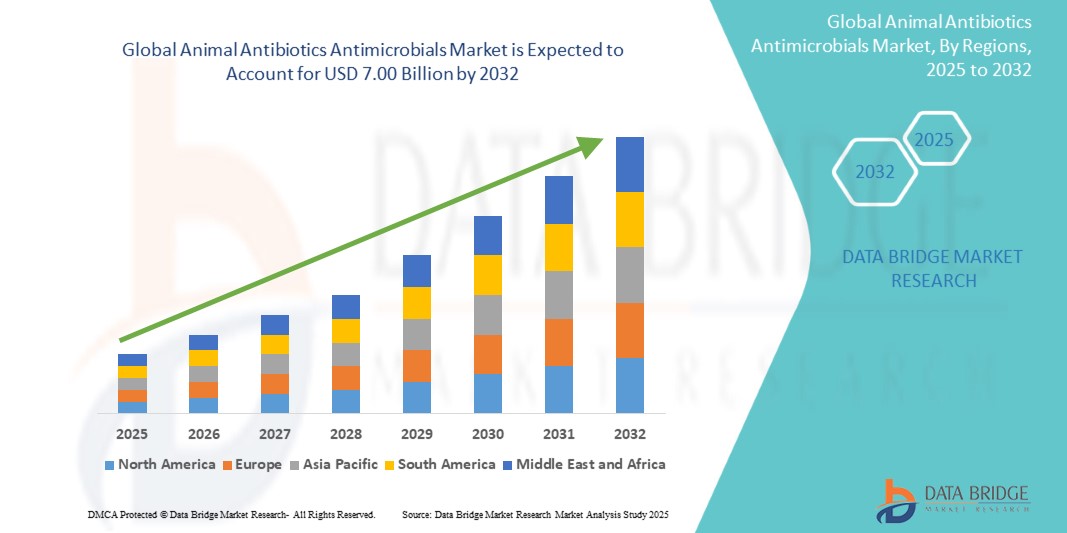

- El tamaño del mercado global de antibióticos antimicrobianos para animales se valoró en USD 5.08 mil millones en 2024 y se espera que alcance los USD 7.00 mil millones para 2032, con una CAGR del 4,10% durante el período de pronóstico.

- Este crecimiento está impulsado por la creciente preocupación por la salud animal.

Análisis del mercado de antibióticos para uso animal

- Los antibióticos y antimicrobianos animales desempeñan un papel crucial en el mantenimiento de la salud animal al tratar y prevenir infecciones bacterianas en el ganado, las aves de corral y los animales de compañía, mejorando así la productividad general y la seguridad alimentaria.

- La demanda de estos productos está aumentando debido al creciente consumo mundial de carne, la intensificación de la ganadería y la necesidad de prevenir brotes de enfermedades en las poblaciones animales para garantizar cadenas de suministro de alimentos sostenibles.

- Se espera que América del Norte domine el mercado de antibióticos antimicrobianos para animales con la mayor participación de mercado del 37,37%, debido a la infraestructura de atención médica veterinaria bien establecida, la alta conciencia entre los ganaderos y la presencia de compañías farmacéuticas líderes en la región.

- Se proyecta que Asia-Pacífico registre la tasa de crecimiento más alta en el mercado de antibióticos antimicrobianos para animales durante el período de pronóstico, debido al crecimiento de las poblaciones de ganado, el aumento de las inversiones en salud veterinaria y la creciente demanda de proteína animal en naciones en rápida urbanización como China, India y Vietnam.

- Se espera que el segmento de antibióticos domine el segmento de tipos con la mayor participación de mercado del 45,44% en 2025, debido a su uso para la prevención y el tratamiento de enfermedades infecciosas en animales, estos medicamentos son aplicables en varias especies, incluido el ganado, las aves de corral y los animales de compañía.

Alcance del informe y segmentación del mercado de antibióticos para uso veterinario

|

Atributos |

Antibióticos para animales Antimicrobianos Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de antibióticos para uso animal

“Cambio hacia alternativas antibióticas y gestión de antimicrobianos”

- Una tendencia destacada en el mercado de antibióticos y antimicrobianos para animales es el cambio creciente hacia alternativas como probióticos , prebióticos, fitogénicos y aceites esenciales para reducir la dependencia de los antibióticos tradicionales.

- Esta transición está impulsada por las crecientes preocupaciones sobre la resistencia a los antimicrobianos (RAM), el aumento de las restricciones regulatorias sobre el uso de antibióticos en los alimentos para animales y la presión de los consumidores que exigen carne y productos lácteos sin antibióticos.

- Estas alternativas favorecen la salud intestinal y la inmunidad en los animales, sirviendo como estrategias preventivas para reducir las tasas de infección sin contribuir a la resistencia.

- Por ejemplo, en 2024, DSM Animal Nutrition & Health amplió su gama de alternativas a los antibióticos con el lanzamiento de Symphiome, un nuevo aditivo alimentario que promueve la salud intestinal dirigido a productores avícolas y porcinos.

- Se espera que esta tendencia transforme las prácticas de gestión de la salud animal, impulsando la innovación y la reformulación de los alimentos para el ganado para alinearse con los esfuerzos mundiales de reducción de la RAM.

Dinámica del mercado de antibióticos para uso animal

Conductor

Aumento de la prevalencia de enfermedades zoonóticas y de la carga de enfermedades en el ganado

- El aumento mundial de enfermedades zoonóticas y endémicas del ganado está impulsando la demanda de antibióticos y antimicrobianos eficaces para prevenir brotes a gran escala y salvaguardar la salud pública.

- Las enfermedades animales como la influenza aviar, la peste porcina y la enfermedad respiratoria bovina siguen afectando a las poblaciones animales y a la cadena de suministro de alimentos, lo que crea la urgencia de tratamientos preventivos.

- Los gobiernos y las organizaciones internacionales están promoviendo el uso responsable de antibióticos para controlar los brotes y garantizar la seguridad alimentaria.

- Por ejemplo, en 2023, Zoetis informó un aumento en la demanda de sus antibióticos basados en lincomicina luego de brotes de enfermedades respiratorias en granjas avícolas en el sudeste asiático.

- Se espera que esta creciente carga de enfermedades mantenga el uso de antibióticos en la vanguardia de las estrategias de salud animal, en particular en los sistemas de producción intensiva.

Oportunidad

Creciente demanda en acuicultura y nuevos segmentos de la ganadería

- La acuicultura, uno de los sectores alimentarios de más rápido crecimiento a nivel mundial, presenta una nueva oportunidad para el uso de antibióticos y antimicrobianos específicos para combatir los patógenos transmitidos por el agua y mantener la salud de los peces.

- De manera similar, el uso de antibióticos se está expandiendo en segmentos animales emergentes como conejos, codornices y mascotas exóticas debido a la creciente comercialización y al aumento de la propiedad de mascotas.

- Los actores del mercado ahora están invirtiendo en formulaciones personalizadas y sistemas de administración adecuados para especies acuáticas y no tradicionales.

- Por ejemplo, en 2024, Phibro Animal Health introdujo un antibiótico soluble en agua a base de oxitetraciclina diseñado específicamente para granjas de camarones y tilapia en América Latina.

- Se espera que esta diversificación en sectores agrícolas especializados abra nuevas fuentes de ingresos y fomente la innovación de productos específicos.

Restricción/Desafío

Marco regulatorio estricto y prohibición del uso de antibióticos

- Un desafío importante en el mercado de antibióticos y antimicrobianos para animales es el endurecimiento de las regulaciones globales sobre el uso de antibióticos, especialmente en animales destinados a la producción de alimentos, para combatir la resistencia a los antimicrobianos.

- Muchos países han prohibido el uso de antibióticos como promotores del crecimiento y están implementando estándares de monitoreo de residuos más estrictos, lo que hace que el cumplimiento sea más exigente para los productores.

- Esta presión regulatoria a menudo conduce a mayores costos de producción, reformulación de productos y disponibilidad restringida de productos en ciertos mercados.

- Por ejemplo, en 2023, la Unión Europea impuso una prohibición total de los antibióticos de importancia médica para uso profiláctico en el ganado, lo que impulsó la reformulación en toda la cadena de suministro.

- Si bien estas medidas tienen como objetivo proteger la salud humana y animal, plantean obstáculos a corto plazo para las empresas que deben abordar el cumplimiento regional y reformular sus carteras de productos.

Alcance del mercado de antibióticos antimicrobianos para uso animal

El mercado está segmentado en función del producto, tipo, modo de entrega y tipo de animal.

|

Segmentación |

Subsegmentación |

|

Por producto |

|

|

Por tipo |

|

|

Por modo de entrega |

|

|

Por tipo de animal |

|

Se proyecta que en 2025, el antimicrobiano dominará el mercado con la mayor participación en el segmento tipo.

Se espera que el segmento antimicrobiano domine el mercado de antibióticos para animales con la mayor participación de mercado del 45,44% en 2025, debido a su uso para la prevención y el tratamiento de enfermedades infecciosas en animales, estos medicamentos son aplicables en varias especies, incluido el ganado, las aves de corral y los animales de compañía.

Se espera que las aves de corral representen la mayor participación durante el período de pronóstico en el segmento de tipo animal.

En 2025, se prevé que el segmento avícola domine el mercado con la mayor cuota de mercado, con un 41,22 %, gracias a su uso en el alimento o el agua para aves. Estas sustancias ayudan a prevenir y tratar infecciones en pollos, patos y otras aves. Favorecen la salud y el bienestar de los animales, a la vez que promueven un mejor crecimiento.

Análisis regional del mercado de antibióticos para uso veterinario

Norteamérica posee la mayor participación en el mercado de antibióticos para uso veterinario.

- Se espera que América del Norte domine el mercado mundial de antibióticos antimicrobianos para animales con la mayor participación de mercado del 37,37%, impulsada por la presencia de fabricantes destacados, infraestructura de investigación avanzada y sólidas inversiones en ciencia agrícola y medicina veterinaria.

- Estados Unidos lidera la región, apoyado por una alta demanda de productos de salud animal, una financiación sustancial para la investigación agrícola y una industria farmacéutica veterinaria bien establecida.

- Se espera que las innovaciones continuas en el diagnóstico veterinario, el enfoque creciente en las prácticas agrícolas sostenibles y las asociaciones estratégicas entre instituciones académicas y líderes de la industria mantengan el dominio de América del Norte durante el período de pronóstico.

Se proyecta que Asia-Pacífico registre la mayor tasa de crecimiento anual compuesta (TCAC) en el mercado de antibióticos para uso animal.

- Se espera que Asia-Pacífico registre la tasa de crecimiento anual compuesta (CAGR) más alta en el mercado de antimicrobianos antibióticos para animales, impulsada por la expansión de la infraestructura de atención médica, la creciente demanda de productos de salud animal y las crecientes inversiones en atención veterinaria.

- Países como China, India y Japón son contribuyentes clave, con iniciativas nacionales como "Hecho en China 2025" y "Ayushman Bharat" de la India que promueven la innovación y la producción local en el cuidado de la salud animal, incluidos los antibióticos y los antimicrobianos.

- La rápida modernización de las prácticas agrícolas en China y la India, combinada con la creciente adopción de tecnologías de diagnóstico avanzadas, está posicionando a Asia-Pacífico como una región de importante crecimiento para los productos de salud animal.

Cuota de mercado de los antimicrobianos para antibióticos animales

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Boehringer Ingelheim International GmbH (Alemania)

- Zoetis Services LLC (EE. UU.)

- Elanco (EE. UU.)

- Merck & Co. Inc. (EE. UU.)

- Corporación de Salud Animal Phibro (EE. UU.)

- Virbac (Francia)

- Vetoquinol (Francia)

- HIPRA (España)

- Ceva (Francia)

- Dechra (Reino Unido)

- Corporación Kyoritsuseiyaku Seiyaku (Japón)

- Grupo de Ganadería de China (China)

- Endovac Salud Animal (EE. UU.)

- Grupo Zydus (India)

- Indian Immunologicals Ltd (India)

- UCBVET - Salud Animal (EE. UU.)

- American Reagent Inc. (EE. UU.)

- Neogen Corporation (EE. UU.)

- Huvepharma (EE. UU.)

- Ashish Life Science (India)

- Inovet (Bélgica)

- Lutim Pharma Private Limited (India)

- ECO - Salud Animal Ltd (EE. UU.)

Últimos avances en el mercado mundial de antibióticos para uso animal

- En mayo de 2023, Bayer AG presentó un nuevo antibiótico, Ceftiofur, una cefalosporina de tercera generación diseñada para tratar diversas infecciones animales, como infecciones respiratorias, urinarias y cutáneas. Se espera que este lanzamiento fortalezca la posición de Bayer en el segmento de antibióticos veterinarios.

- En abril de 2023, Elanco Salud Animal anunció el lanzamiento de Draxxin, un antibiótico inyectable de administración diaria formulado para combatir infecciones bacterianas gramnegativas graves, como E. coli y Klebsiella pneumoniae. Este producto amplía la cartera de productos de Elanco para el tratamiento de infecciones potencialmente mortales en el ganado.

- En marzo de 2023, Virbac lanzó Synulox, un antibiótico de amplio espectro diseñado para el tratamiento de infecciones respiratorias, urinarias y cutáneas en animales. Este producto impulsará el crecimiento de la compañía en los segmentos de tratamiento de animales de compañía y de granja.

- En febrero de 2023, Boehringer Ingelheim GmbH presentó Clavamox, un antibiótico combinado que contiene amoxicilina y ácido clavulánico, diseñado para una amplia gama de infecciones animales. La incorporación de Clavamox amplía las opciones de tratamiento antibiótico de Boehringer Ingelheim para veterinarios.

- En enero de 2023, Ceva Santé Animale lanzó Enrofloxacino, un antibiótico de amplio espectro para infecciones respiratorias, urinarias y cutáneas en animales. Este producto refuerza el compromiso de Ceva de ofrecer soluciones antimicrobianas eficaces para la salud animal.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.