Global Breakthrough Immunotherapy Drug Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

792.00 Million

USD

1,764.00 Million

2025

2033

USD

792.00 Million

USD

1,764.00 Million

2025

2033

| 2026 –2033 | |

| USD 792.00 Million | |

| USD 1,764.00 Million | |

|

|

|

|

Segmentación del mercado global de fármacos de inmunoterapia innovadores, por fármaco (inhibidores de puntos de control inmunitario, anticuerpos monoclonales, anticuerpos biespecíficos, conjugados anticuerpo-fármaco (ADC), terapias con células CAR-T, TCR y otras terapias celulares adoptivas, vacunas contra el cáncer, citocinas y moduladores inmunitarios, terapias con virus oncolíticos y otras inmunoterapias novedosas), vía de administración (intravenosa, subcutánea, intramuscular, intratumoral y otras), usuario final (hospitales, clínicas especializadas y oncológicas, institutos de investigación y académicos, y centros de infusión ambulatoria), canal de distribución (farmacias hospitalarias, farmacias especializadas y en línea): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de fármacos de inmunoterapia innovadores

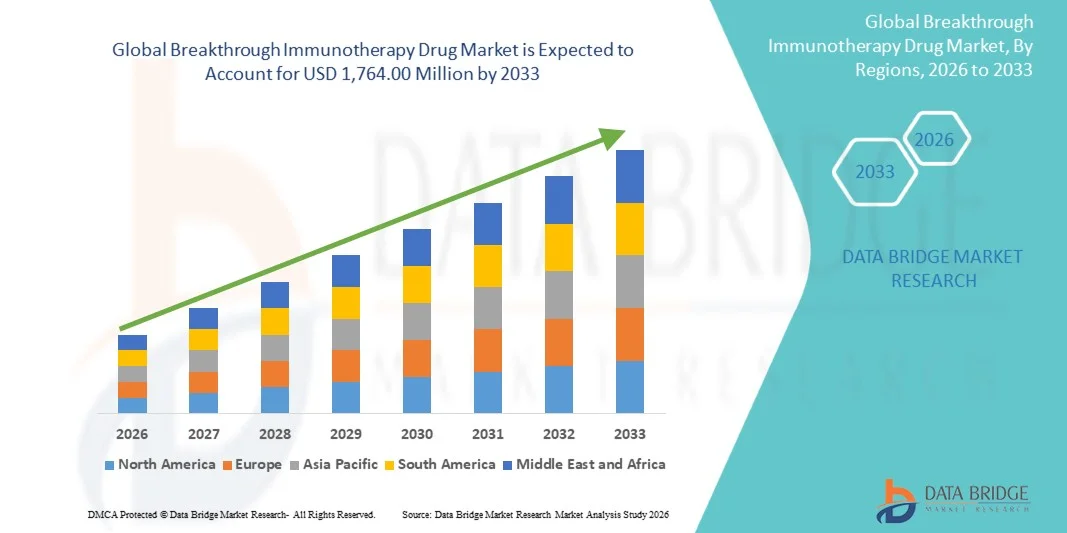

- El tamaño del mercado mundial de fármacos de inmunoterapia innovadores se valoró en mil millones de dólares en 2025 y se espera que alcance los 1.764,00 millones de dólares en 2033 , con una CAGR del 10,50 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por los rápidos avances en inmunooncología, las crecientes aprobaciones de terapias innovadoras y las fuertes inversiones en I+D centradas en productos biológicos de próxima generación, terapias celulares e inmunoterapias de precisión.

- Además, la creciente prevalencia del cáncer y las enfermedades autoinmunes complejas , junto con la creciente demanda de opciones de tratamiento específicas, altamente efectivas y duraderas, está posicionando a los medicamentos de inmunoterapia innovadores como una piedra angular de las estrategias terapéuticas modernas, acelerando así significativamente el crecimiento general del mercado.

Análisis del mercado de fármacos innovadores de inmunoterapia

- Los medicamentos de inmunoterapia innovadores, diseñados para aprovechar y modular el sistema inmunológico del cuerpo para tratar enfermedades complejas y potencialmente mortales, se están volviendo centrales en las estrategias terapéuticas modernas, particularmente en oncología y trastornos autoinmunes, debido a sus mecanismos específicos, respuestas clínicas duraderas y potencial para mejorar significativamente los resultados del paciente.

- La creciente demanda de medicamentos de inmunoterapia innovadores se debe principalmente a la creciente carga mundial de cáncer y enfermedades inmunomediadas, el creciente apoyo regulatorio para las designaciones de terapias innovadoras y las inversiones sustanciales en productos biológicos avanzados, terapias celulares y enfoques de medicina de precisión.

- América del Norte dominó el mercado de fármacos de inmunoterapia innovadores con la mayor participación en los ingresos del 48,6 % en 2025, respaldada por un sólido ecosistema de I+D biofarmacéutico , la adopción temprana de terapias innovadoras, marcos de reembolso favorables y una alta concentración de empresas farmacéuticas y biotecnológicas líderes , con EE. UU. representando la mayoría de las aprobaciones y la actividad de ensayos clínicos.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de medicamentos de inmunoterapia innovadores durante el período de pronóstico debido a la expansión de la infraestructura de atención médica, el aumento del gasto en atención médica, la creciente incidencia del cáncer y la creciente participación de China, Japón y Corea del Sur en la investigación y comercialización de inmunoterapia.

- El segmento de inhibidores de puntos de control inmunitario dominó el mercado de fármacos de inmunoterapia innovadores con una participación de mercado del 52,9 % en 2025, impulsado por su eficacia clínica demostrada en múltiples indicaciones de cáncer, la expansión de las aprobaciones de etiquetas y la fuerte adopción como monoterapia y terapia combinada en regímenes de tratamiento oncológico estándar.

Alcance del informe y segmentación del mercado de fármacos de inmunoterapia innovadores

|

Atributos |

Análisis clave del mercado de fármacos de inmunoterapia innovadores |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias innovadoras del mercado de fármacos de inmunoterapia

“Expansión de objetivos de próxima generación e inmunoterapia de precisión”

- Una tendencia significativa y en aceleración en el mercado global de fármacos de inmunoterapia innovadores es el cambio hacia objetivos inmunes de próxima generación y enfoques basados en la precisión, que incluyen nuevas vías de puntos de control, anticuerpos biespecíficos y terapias celulares personalizadas, destinadas a mejorar la eficacia y reducir la resistencia al tratamiento.

- Por ejemplo, varios inhibidores de puntos de control de próxima generación dirigidos a LAG-3, TIGIT y otras vías emergentes han ingresado a ensayos clínicos de etapa avanzada, demostrando mejores resultados cuando se usan solos o en combinación con terapias PD-1/PD-L1 establecidas.

- Los avances en la selección de pacientes basada en biomarcadores y la elaboración de perfiles genómicos permiten un despliegue más preciso de inmunoterapias innovadoras, mejorando las tasas de respuesta y minimizando la exposición innecesaria. Por ejemplo , el uso de inhibidores de puntos de control basado en biomarcadores influye cada vez más en las decisiones de tratamiento en múltiples tipos de cáncer.

- La integración de inteligencia artificial y análisis avanzados en la investigación de inmunoterapia está agilizando el descubrimiento de fármacos, optimizando el diseño de ensayos clínicos y acelerando las aprobaciones regulatorias, lo que respalda una comercialización más rápida de terapias innovadoras.

- Esta tendencia hacia el desarrollo de inmunoterapias más específicas, basadas en datos y personalizadas está transformando los paradigmas terapéuticos. En consecuencia, las principales compañías biofarmacéuticas están invirtiendo fuertemente en plataformas de inmunooncología de precisión, regímenes combinados y ensayos clínicos adaptativos.

- La demanda de inmunoterapias innovadoras altamente efectivas, duraderas y personalizadas continúa aumentando en oncología y en determinadas indicaciones autoinmunes, lo que refuerza esta tendencia como un impulsor central de la evolución del mercado a largo plazo.

Dinámica del mercado de fármacos de inmunoterapia innovadores

Conductor

Aumento de la carga de cáncer y fuerte apoyo regulatorio a las terapias innovadoras

- La creciente incidencia mundial del cáncer y de los trastornos inmunomediados, combinada con fuertes incentivos regulatorios para la designación de terapias innovadoras, es un factor importante que acelera la demanda de medicamentos de inmunoterapia innovadores.

- Por ejemplo, las agencias reguladoras como la FDA de EE. UU. y la EMA continúan otorgando designaciones innovadoras y de vía rápida a los candidatos a inmunoterapia que demuestran una mejora sustancial con respecto a los tratamientos existentes, lo que reduce significativamente los plazos de desarrollo.

- Como las terapias convencionales a menudo muestran una durabilidad limitada o una alta toxicidad, las inmunoterapias innovadoras ofrecen mecanismos específicos, respuestas duraderas y mejores resultados de supervivencia, lo que impulsa una rápida adopción entre los médicos y los proveedores de atención médica.

- Además, el aumento de la inversión pública y privada en I+D biofarmacéutica, junto con la expansión de la actividad de ensayos clínicos, está fortaleciendo la línea de desarrollo de medicamentos de inmunoterapia avanzada en todo el mundo.

- La creciente aceptación de la inmunoterapia como una opción de tratamiento de primera línea o combinado, respaldada por políticas de reembolso favorables en los mercados desarrollados, está impulsando aún más el crecimiento del mercado en hospitales y centros oncológicos especializados.

Restricción/Desafío

“Altos costos de tratamiento y requisitos de fabricación complejos”

- El alto costo de los medicamentos de inmunoterapia innovadores, en particular las terapias basadas en células y personalizadas, presenta un desafío importante para su adopción generalizada, especialmente en los mercados de atención médica emergentes y sensibles a los costos.

- Por ejemplo, las terapias con células CAR-T y los productos biológicos avanzados requieren una fabricación compleja, una logística de cadena de frío y una infraestructura clínica especializada, lo que genera precios de tratamiento elevados y una accesibilidad limitada.

- La complejidad de la producción y la administración también aumenta la carga sobre los sistemas de salud, requiriendo personal altamente capacitado, instalaciones avanzadas y estrictos controles de calidad, lo que puede retardar la penetración en el mercado.

- Además, la variabilidad en la respuesta del paciente, los eventos adversos relacionados con el sistema inmunitario y las preocupaciones de seguridad a largo plazo requieren una amplia vigilancia posterior a la comercialización y una evaluación clínica continua, lo que aumenta los costos generales de desarrollo.

- Superar estos desafíos mediante la innovación en la fabricación, estrategias de optimización de costos, una cobertura de reembolso ampliada y tecnologías de producción escalables será fundamental para permitir una adopción global más amplia y un crecimiento sostenido del mercado de fármacos de inmunoterapia innovadores.

Análisis del mercado de fármacos innovadores de inmunoterapia

El mercado está segmentado según el tipo de medicamento, la vía de administración, el usuario final y el canal de distribución.

- Por droga

En cuanto a fármacos, el mercado global de fármacos innovadores de inmunoterapia se segmenta en inhibidores de puntos de control inmunitario, anticuerpos monoclonales, anticuerpos biespecíficos, conjugados anticuerpo-fármaco (ADC), terapias con células CAR-T, TCR y otras terapias celulares adoptivas, vacunas contra el cáncer, citocinas e inmunomoduladores, terapias con virus oncolíticos y otras inmunoterapias novedosas. El segmento de inhibidores de puntos de control inmunitario dominó el mercado con la mayor participación en ingresos, un 52,9 % en 2025, gracias a su sólida eficacia clínica en múltiples indicaciones oncológicas y a su amplia adopción como terapias de referencia. Estos fármacos han demostrado respuestas duraderas y una mejor supervivencia en cánceres como el cáncer de pulmón, el melanoma y el carcinoma de células renales. Sus numerosas aprobaciones regulatorias, la ampliación de las indicaciones de etiquetado y el creciente uso en regímenes combinados han consolidado aún más su dominio. Además, la sólida familiaridad de los médicos y los marcos de reembolso consolidados en los mercados desarrollados siguen respaldando las altas tasas de utilización. La presencia de fármacos de gran éxito y las estrategias continuas de gestión del ciclo de vida también contribuyen a la generación sostenida de ingresos.

Se espera que el segmento de terapias con células CAR-T experimente el mayor crecimiento durante el período de pronóstico, impulsado por los rápidos avances en ingeniería celular, la escalabilidad de la fabricación y la expansión de indicaciones más allá de las neoplasias hematológicas. El creciente éxito clínico en cánceres difíciles de tratar y los ensayos en curso dirigidos a tumores sólidos están acelerando su adopción. Las crecientes inversiones de las compañías farmacéuticas y las colaboraciones estratégicas están mejorando la accesibilidad y acortando los plazos de producción. Además, el apoyo regulatorio a las terapias celulares innovadoras y la creciente concienciación de los pacientes están impulsando una adopción más rápida. A medida que los costos de fabricación disminuyen gradualmente y la infraestructura clínica se expande, se prevé que las terapias CAR-T experimenten un sólido crecimiento a nivel mundial.

- Por vía de administración

Según la vía de administración, el mercado se segmenta en intravenosa, subcutánea, intramuscular, intratumoral y otras. El segmento intravenoso (IV) dominó el mercado en 2025 debido a su amplio uso para la administración de productos biológicos complejos, anticuerpos monoclonales e inmunoterapias celulares. La administración IV permite un control preciso de la dosis y una rápida distribución sistémica, lo cual es crucial para los fármacos de inmunoterapia innovadores. Los hospitales y centros oncológicos están bien equipados para la infusión IV, lo que respalda su continuo dominio. Además, la mayoría de los fármacos de inmunoterapia aprobados se desarrollaron inicialmente para administración IV, lo que refuerza las prácticas clínicas establecidas. La fiabilidad y la familiaridad de la administración IV entre los profesionales sanitarios refuerzan aún más la posición de liderazgo de este segmento.

Se proyecta que el segmento subcutáneo (SC) crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida durante el período de pronóstico, impulsado por la creciente demanda de opciones de tratamiento fáciles de usar y rápidas. Las formulaciones subcutáneas reducen el tiempo de administración, mejoran la comodidad del paciente y reducen el uso de recursos sanitarios. Los avances en las tecnologías de formulación de fármacos están permitiendo el desarrollo de versiones SC eficaces de las terapias intravenosas existentes. Además, la transición hacia la atención ambulatoria y los modelos de tratamiento domiciliario está acelerando su adopción. Estas ventajas están posicionando la administración subcutánea como un motor clave de crecimiento en el mercado.

- Por el usuario final

En función del usuario final, el mercado se segmenta en hospitales, clínicas especializadas y oncológicas, institutos de investigación y académicos, y centros de infusión ambulatoria. El segmento hospitalario obtuvo la mayor cuota de mercado en 2025, gracias a su infraestructura avanzada y su capacidad para gestionar tratamientos complejos de inmunoterapia. Los hospitales sirven como centros primarios para el diagnóstico del cáncer, la administración de inmunoterapia y el manejo de eventos adversos relacionados con el tratamiento. La disponibilidad de equipos multidisciplinarios de atención e instalaciones de diagnóstico avanzadas facilita un mayor volumen de pacientes. Además, la mayoría de las inmunoterapias innovadoras requieren una estrecha monitorización durante la administración inicial, lo que favorece el tratamiento hospitalario. Los sólidos mecanismos de reembolso en entornos hospitalarios refuerzan aún más el dominio de este segmento.

Se espera que el segmento de centros de infusión ambulatoria experimente el mayor crecimiento durante el período de pronóstico debido a la creciente transición hacia modelos de atención rentables y centrados en el paciente. Estos centros ofrecen menores costos de tratamiento, tiempos de espera más cortos y mayor comodidad para el paciente en comparación con los hospitales. La creciente disponibilidad de regímenes de infusión subcutáneos y simplificados está impulsando esta transición. Además, los sistemas de salud están fomentando el tratamiento ambulatorio para reducir la carga hospitalaria. Como resultado, los centros de infusión ambulatoria están ganando terreno rápidamente para la administración de inmunoterapia.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en farmacias hospitalarias, farmacias especializadas y farmacias en línea. El segmento de farmacias hospitalarias dominó el mercado en 2025, impulsado por el alto uso de fármacos de inmunoterapia innovadores en entornos hospitalarios. Estas farmacias garantizan el almacenamiento, la manipulación y la preparación adecuados de productos biológicos complejos y terapias celulares. Su estrecha integración con los departamentos de oncología facilita la administración y el seguimiento oportunos de los medicamentos. Además, el estricto cumplimiento normativo y los requisitos de control de calidad favorecen la distribución en farmacias hospitalarias. Los procesos centralizados de adquisición y reembolso refuerzan aún más la posición de liderazgo de este segmento.

Se prevé que el segmento de farmacias especializadas crezca al ritmo más rápido durante el período de pronóstico, impulsado por la creciente complejidad de los medicamentos de inmunoterapia y la necesidad de servicios especializados de manejo y apoyo al paciente. Las farmacias especializadas ofrecen servicios de valor añadido, como la educación del paciente, el seguimiento de la adherencia y la coordinación con los profesionales sanitarios. Participan cada vez más en la distribución de terapias personalizadas y de alto coste. Además, la expansión de los modelos de tratamiento ambulatorio está impulsando la dependencia de las redes de farmacias especializadas. Estos factores, en conjunto, impulsan el rápido crecimiento de este segmento.

Análisis regional del mercado de fármacos innovadores de inmunoterapia

- América del Norte dominó el mercado de fármacos de inmunoterapia innovadores con la mayor participación en los ingresos del 48,6 % en 2025, respaldada por un sólido ecosistema de I+D biofarmacéutico, la adopción temprana de terapias innovadoras, marcos de reembolso favorables y una alta concentración de empresas farmacéuticas y biotecnológicas líderes, con EE. UU. representando la mayoría de las aprobaciones y la actividad de ensayos clínicos.

- Los proveedores de atención médica y los pacientes de la región valoran mucho la eficacia clínica superior, las respuestas duraderas al tratamiento y los mecanismos basados en la precisión que ofrecen los innovadores medicamentos de inmunoterapia en múltiples indicaciones oncológicas y autoinmunes.

- Esta adopción generalizada está respaldada además por un marco regulatorio sólido que favorece las aprobaciones de terapias innovadoras, importantes inversiones en I+D, políticas de reembolso favorables y la fuerte presencia de compañías farmacéuticas y biotecnológicas líderes, estableciendo los medicamentos de inmunoterapia como un componente central de los paradigmas de tratamiento modernos en la región.

Análisis del mercado estadounidense de fármacos de inmunoterapia innovadores

El mercado estadounidense de fármacos innovadores de inmunoterapia captó la mayor participación en los ingresos de Norteamérica en 2025, impulsado por una sólida adopción clínica, un alto volumen de pacientes oncológicos y la rápida adopción de terapias inmunológicas innovadoras. Los profesionales sanitarios priorizan cada vez más las inmunoterapias avanzadas debido a su eficacia superior, respuestas duraderas y capacidad para abordar necesidades médicas no cubiertas. La presencia de compañías biofarmacéuticas líderes, la extensa actividad de ensayos clínicos y las aprobaciones regulatorias tempranas impulsan aún más el crecimiento del mercado. Además, los marcos de reembolso favorables y la sólida concienciación de los pacientes siguen apoyando el uso generalizado de fármacos innovadores de inmunoterapia en los principales centros oncológicos.

Análisis del mercado europeo de fármacos de inmunoterapia innovadores

Se proyecta que el mercado europeo de fármacos innovadores de inmunoterapia se expandirá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por el aumento de la incidencia del cáncer, la solidez de los sistemas de salud pública y el mayor acceso a terapias biológicas avanzadas. El creciente énfasis en la medicina personalizada y el creciente apoyo regulatorio a los fármacos innovadores están impulsando su adopción en toda la región. Los profesionales sanitarios europeos integran cada vez más las inmunoterapias en los protocolos de tratamiento estándar. La región está experimentando un crecimiento constante en sus principales mercados, impulsado por las continuas colaboraciones en investigación clínica y la mejora de la cobertura de reembolso.

Análisis del mercado de fármacos de inmunoterapia innovadores en el Reino Unido

Se prevé que el mercado británico de fármacos innovadores de inmunoterapia crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por el sólido apoyo gubernamental a medicamentos innovadores y la creciente demanda de tratamientos oncológicos avanzados. El enfoque del Servicio Nacional de Salud (NHS) en programas de acceso temprano y evaluaciones de coste-efectividad está facilitando la adopción de terapias innovadoras. La creciente concienciación entre médicos y pacientes sobre los beneficios de la inmunoterapia está impulsando aún más el crecimiento del mercado. Además, la participación activa del Reino Unido en ensayos clínicos globales apoya la expansión continua.

Análisis del mercado alemán de fármacos de inmunoterapia innovadores

Se espera que el mercado alemán de fármacos innovadores de inmunoterapia se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por una infraestructura sanitaria consolidada y un fuerte énfasis en tratamientos innovadores. El sólido sistema de reembolso alemán y su enfoque en la medicina basada en la evidencia fomentan la rápida adopción de inmunoterapias innovadoras. El aumento de la inversión en investigación oncológica y la creciente colaboración entre instituciones académicas y compañías farmacéuticas impulsan el crecimiento del mercado. La integración de inmunoterapias avanzadas en los protocolos oncológicos hospitalarios es cada vez más común en todo el país.

Análisis del mercado de fármacos de inmunoterapia innovadores en Asia-Pacífico

Se prevé que el mercado de fármacos innovadores de inmunoterapia en Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida durante el período de pronóstico, impulsado por el aumento de la prevalencia del cáncer, la expansión de la infraestructura sanitaria y el incremento del gasto sanitario en países como China, Japón e India. Las crecientes iniciativas gubernamentales para mejorar el acceso a terapias avanzadas contra el cáncer están acelerando su adopción. La creciente actividad de ensayos clínicos y la capacidad de fabricación local en la región están mejorando la asequibilidad y la disponibilidad. A medida que aumenta la concienciación sobre los beneficios de la inmunoterapia, Asia-Pacífico se perfila como una región clave para el crecimiento de los fármacos innovadores.

Análisis del mercado japonés de fármacos de inmunoterapia innovadores

El mercado japonés de fármacos de inmunoterapia innovadores está cobrando impulso gracias al avanzado sistema sanitario del país, su fuerte enfoque en la innovación y el rápido envejecimiento de su población. La alta demanda de tratamientos oncológicos eficaces y menos invasivos está impulsando la adopción de fármacos de inmunoterapia. La simplificación de los procesos regulatorios de Japón para medicamentos innovadores facilita una aprobación y comercialización más rápidas. La integración de inmunoterapias innovadoras en la atención oncológica estándar es cada vez más evidente en los principales hospitales y centros de investigación.

Análisis del mercado de fármacos de inmunoterapia innovadores en India

El mercado indio de fármacos innovadores de inmunoterapia representó una importante cuota de ingresos en Asia-Pacífico en 2025, debido al aumento de la incidencia del cáncer, la mejora del acceso a la atención médica y la creciente adopción de terapias avanzadas. La creciente infraestructura oncológica de la India y su creciente participación en ensayos clínicos globales impulsan el crecimiento del mercado. Una mayor concienciación entre médicos y pacientes, sumada a las iniciativas gubernamentales para fortalecer la atención oncológica, está acelerando la adopción. Además, la presencia de fabricantes farmacéuticos nacionales y los esfuerzos por mejorar la asequibilidad impulsan aún más el mercado.

Cuota de mercado de fármacos de inmunoterapia innovadores

La industria de fármacos de inmunoterapia innovadores está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Merck & Co., Inc. (EE. UU.)

- Bristol-Myers Squibb Company (EE. UU.)

- F. Hoffmann-La Roche Ltd. (Suiza)

- AstraZeneca (Reino Unido)

- Novartis AG (Suiza)

- Pfizer Inc. (EE. UU.)

- Johnson & Johnson Services, Inc. (EE. UU.)

- Amgen Inc. (EE. UU.)

- GSK plc (Reino Unido)

- Sanofi (Francia)

- Gilead Sciences, Inc. (EE. UU.)

- Moderna, Inc. (EE. UU.)

- BioNTech SE (Alemania)

- Regeneron Pharmaceuticals, Inc. (EE. UU.)

- Adaptimmune Therapeutics PLC (Reino Unido)

- Iovance Biotherapeutics, Inc. (EE. UU.)

- Immutep Ltd (Australia)

- SOTIO Biotech (República Checa)

- Imugene Ltd (Australia)

- BeiGene, Ltd. (China)

¿Cuáles son los desarrollos recientes en el mercado global de fármacos de inmunoterapia innovadores?

- En diciembre de 2025, BioNTech y Bristol Myers Squibb informaron resultados alentadores del ensayo de fase II para el candidato a inmunoterapia de próxima generación BNT327 (pumitamig) en el cáncer de pulmón de células pequeñas, que mostró una reducción sustancial del tumor y avanzó hacia la evaluación de fase III, lo que subraya la innovación continua en terapias basadas en el sistema inmunitario.

- En septiembre de 2025, Keytruda, la exitosa inmunoterapia contra el cáncer de Merck, recibió la aprobación de la FDA para una nueva formulación inyectable subcutánea llamada Keytruda Qlex, que ofrece una administración más rápida (1 a 2 minutos) con una eficacia similar a la infusión intravenosa, lo que mejora la comodidad del paciente y la eficiencia del flujo de trabajo clínico.

- En junio de 2025, el fármaco de inmunoterapia pembrolizumab demostró un avance significativo en el cáncer de cabeza y cuello en un ensayo clínico global, donde los pacientes tratados con el fármaco más la atención estándar experimentaron una remisión notablemente prolongada (hasta cinco años), lo que sugiere nuevos resultados importantes para la inmunoterapia dirigida a PD-1.

- En febrero de 2024, la FDA de EE. UU. aprobó Amtagvi (lifileucel), la primera inmunoterapia de células T derivada de tumores para adultos con melanoma irresecable o metastásico previamente tratado con bloqueadores de PD-1, lo que marca una nueva opción de inmunoterapia celular para tumores sólidos difíciles de tratar.

- En octubre de 2023, el regulador de medicamentos de la India aprobó NexCAR19, la primera terapia de células CAR-T desarrollada localmente en el país para el linfoma y la leucemia avanzados, ampliando la adopción global de CAR-T y haciendo que la inmunoterapia de alto impacto sea más accesible en los mercados emergentes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.