Global Multi Target Biosimilar Development Platform Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

148.50 Million

USD

320.64 Million

2025

2033

USD

148.50 Million

USD

320.64 Million

2025

2033

| 2026 –2033 | |

| USD 148.50 Million | |

| USD 320.64 Million | |

|

|

|

|

Global Multi-Target Biosimilar Development Platform Market Segmentation, By Platform (Cell Line Development Platforms, Process Development Platforms, Analytical & Characterization Platforms, Purification & Downstream Processing Platforms, and Regulatory & Data Management Platforms), Molecule (Monoclonal Antibodies (mAbs), Recombinant Proteins, Hormones & Growth Factors, and Peptides & Other Biologics), Deployment Model (On-Premise Platforms, Cloud-Based Platforms, and Hybrid Platforms), Application (Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations, Contract Manufacturing Organizations, and Academic & Research Institutes)- Industry Trends and Forecast to 2033

Multi-Target Biosimilar Development Platform Market Size

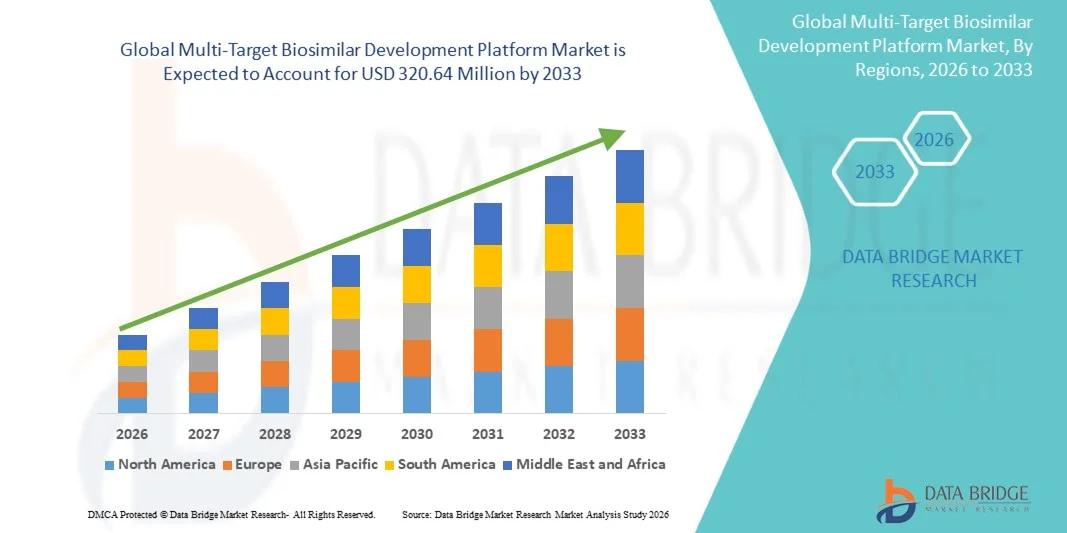

- The global multi-target biosimilar development platform market size was valued at USD 148.50 million in 2025 and is expected to reach USD 320.64 million by 2033, at a CAGR of 10.10% during the forecast period

- The market growth is primarily driven by the increasing emphasis on cost-effective biologics development, rising patent expirations of blockbuster biologics, and the growing need for integrated platforms that can support the simultaneous development of multiple biosimilar targets

- Furthermore, strong demand from pharmaceutical and biotechnology companies for streamlined, scalable, and regulatory-compliant development solutions is positioning multi-target biosimilar development platforms as a critical enabler of efficient biosimilar pipelines, thereby significantly accelerating overall market growth

Multi-Target Biosimilar Development Platform Market Analysis

- Multi-target biosimilar development platforms, which enable the simultaneous design, optimization, and evaluation of multiple biosimilar candidates, are becoming increasingly critical within the biopharmaceutical industry due to their ability to streamline development workflows, reduce costs, and accelerate time-to-market across diverse biologic targets

- The rising demand for these platforms is primarily driven by the growing pressure to develop cost-effective alternatives to high-priced biologics, increasing patent expirations of reference biologics, and the need for integrated analytical, process development, and regulatory support in biosimilar pipelines

- North America dominated the market with the largest revenue share of 38.5% in 2025, supported by a strong biopharmaceutical R&D ecosystem, advanced regulatory frameworks for biosimilars, and the presence of leading biotechnology companies and CDMOs actively investing in platform-based development approaches

- Asia-Pacific is expected to be the fastest-growing region during the forecast period as expanding biologics manufacturing capabilities, rising investments in biosimilar R&D across countries such as China, India, and South Korea, and increasing collaborations between local firms and global biopharma players drive adoption

- The analytical and characterization platform segment dominated the market with the largest market share of 41.3% in 2025, owing to the critical role of high-throughput, multi-attribute analytical tools in demonstrating biosimilarity across multiple targets and meeting stringent regulatory requirements

Report Scope and Multi-Target Biosimilar Development Platform Market Segmentation

|

Attributes |

Multi-Target Biosimilar Development Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Multi-Target Biosimilar Development Platform Market Trends

“Platform-Based Integration for Simultaneous Multi-Asset Development”

- A significant and accelerating trend in the global multi-target biosimilar development platform market is the growing adoption of integrated, platform-based approaches that enable the parallel development of multiple biosimilar candidates across different biologic targets

- For instance, leading CDMOs and technology providers are offering standardized cell line, process development, and analytical platforms that can be reused across monoclonal antibodies and recombinant protein biosimilar programs, significantly reducing redundancy

- Platform integration enables features such as shared analytical comparability frameworks, harmonized process development workflows, and reusable regulatory data packages, allowing developers to efficiently demonstrate biosimilarity across multiple reference products

- The consolidation of upstream, downstream, and analytical capabilities within a single development platform facilitates centralized project management, data consistency, and faster decision-making across complex biosimilar pipelines

- The increasing use of digital data management and advanced analytics within these platforms is improving cross-program knowledge reuse and accelerating development learning curves

- This trend toward scalable, modular, and reusable biosimilar development platforms is reshaping how biopharmaceutical companies structure their R&D strategies and allocate development resources

- The growing preference for end-to-end development platforms that integrate development, analytics, and regulatory support is further strengthening long-term platform adoption

Multi-Target Biosimilar Development Platform Market Dynamics

Driver

“Rising Demand for Cost-Effective and Accelerated Biosimilar Development”

- The growing need to reduce biologics development costs and timelines, combined with the rising number of patent expirations of blockbuster biologics, is a major driver for the adoption of multi-target biosimilar development platforms

- For instance, several biosimilar developers are increasingly partnering with platform-based CDMOs to advance multiple biosimilar assets simultaneously rather than pursuing molecule-specific, standalone development models

- As competition intensifies in the biosimilars space, companies are prioritizing platforms that enable faster comparability assessments, streamlined process optimization, and reduced clinical development burden

- Furthermore, increasing regulatory clarity around biosimilar approval pathways is encouraging developers to invest in standardized platforms that support consistent data generation and global submissions

- The ability of multi-target platforms to support portfolio-based biosimilar strategies is a key factor accelerating their adoption across pharmaceutical and biotechnology companies

- Growing pressure from healthcare systems and payers to lower biologic therapy costs is indirectly driving biopharma companies to expand biosimilar pipelines using efficient platform models

- The expansion of biosimilar development activities in emerging markets is also increasing demand for scalable and transferable development platforms

- Strategic collaborations between global biopharma firms and regional CDMOs are further reinforcing platform-driven biosimilar development

Restraint/Challenge

“High Development Complexity and Regulatory Alignment Challenges”

- The inherent complexity of developing multiple biosimilars simultaneously, each with distinct reference products and critical quality attributes, poses a significant challenge to the effective deployment of multi-target development platforms

- For instance, variations in analytical requirements and regulatory expectations across different biologic classes and regions can complicate platform standardization efforts

- Addressing these challenges requires substantial upfront investment in advanced analytical capabilities, skilled scientific expertise, and robust quality systems to ensure platform flexibility without compromising biosimilarity standards

- While platform-based approaches can reduce long-term costs, the initial capital and operational expenditures associated with building or accessing such platforms may deter smaller or resource-constrained developers

- Differences in global regulatory acceptance of platform-based data reuse can slow down multinational biosimilar development programs

- Limited availability of experienced biosimilar development talent can constrain effective platform utilization and scalability

- Ensuring consistent quality control across multiple targets and manufacturing scales adds further operational complexity

- Overcoming these challenges through improved platform modularity, closer regulator engagement, and expanded access to experienced CDMOs will be critical for sustained market growth

Multi-Target Biosimilar Development Platform Market Scope

The market is segmented on the basis of platform, molecule, deployment model, and application.

- By Platform

On the basis of platform, the global multi-target biosimilar development platform market is segmented into cell line development platforms, process development platforms, analytical & characterization platforms, purification & downstream processing platforms, and regulatory & data management platforms. The analytical & characterization platforms segment dominated the market in 2025, accounting for the largest revenue share of 41.3%, driven by the critical importance of demonstrating biosimilarity across multiple targets through robust, high-resolution analytical comparability studies. These platforms support advanced techniques such as multi-attribute methods, mass spectrometry, and structural characterization, which are essential for regulatory submissions. As biosimilar developers increasingly pursue multi-asset pipelines, the reuse of analytical frameworks across multiple molecules significantly reduces development timelines and costs. Regulatory agencies place strong emphasis on analytical similarity, further reinforcing demand for comprehensive analytical platforms. In addition, the integration of digital data management within analytical platforms enhances cross-program data reuse and consistency. These factors collectively position analytical & characterization platforms as the dominant segment.

The regulatory & data management platforms segment is expected to witness the fastest growth during the forecast period, supported by increasing regulatory complexity and the need for harmonized global submissions. As companies pursue simultaneous approvals across multiple geographies, platforms that enable standardized documentation, lifecycle management, and regulatory intelligence are gaining traction. The ability to reuse regulatory strategies and datasets across multiple biosimilar targets is becoming a key competitive advantage. Growing adoption of digital regulatory tools and AI-enabled compliance tracking is further accelerating this segment’s growth. Moreover, regulatory agencies are increasingly encouraging structured, data-driven submissions, boosting platform adoption. These trends are expected to drive strong growth momentum for regulatory & data management platforms.

- By Molecule

On the basis of molecule type, the market is segmented into monoclonal antibodies (mAbs), recombinant proteins, hormones & growth factors, and peptides & other biologics. The monoclonal antibodies (mAbs) segment dominated the market in 2025, owing to the high commercial value and widespread therapeutic use of mAbs in oncology, autoimmune disorders, and inflammatory diseases. A large number of blockbuster mAbs have faced or are approaching patent expiration, driving extensive biosimilar development activity. Multi-target development platforms are particularly well suited for mAbs due to shared structural complexity and comparable analytical requirements across molecules. Developers leverage standardized mAb platforms to reduce duplication in cell line development, process optimization, and analytical testing. Regulatory familiarity with mAb biosimilars further supports their dominance. As a result, mAbs continue to account for the largest share of platform utilization.

The recombinant proteins segment is projected to be the fastest growing, driven by rising demand for cost-effective biosimilars in chronic conditions such as diabetes, anemia, and growth hormone deficiencies. Recombinant proteins often have shorter development timelines compared to mAbs, making them attractive candidates for multi-target platform strategies. Increasing focus on emerging markets, where affordability is a key factor, is accelerating recombinant protein biosimilar development. Platform-based approaches allow developers to rapidly adapt processes across multiple protein targets. In addition, growing payer pressure to reduce biologic therapy costs is boosting recombinant protein biosimilar pipelines. These factors are expected to support strong growth in this segment.

- By Deployment Model

On the basis of deployment model, the market is segmented into on-premise platforms, cloud-based platforms, and hybrid platforms. The on-premise platforms segment held the largest market share in 2025, primarily due to data security concerns, regulatory compliance requirements, and the need for tight control over proprietary development data. Large pharmaceutical and biotechnology companies prefer on-premise solutions to ensure confidentiality of multi-asset pipelines and sensitive analytical data. On-premise platforms also allow customization to specific internal workflows and quality systems. In addition, regulatory audits often favor controlled internal systems, reinforcing adoption. Established biopharma players with substantial IT infrastructure continue to rely on on-premise deployments. These factors collectively contributed to the dominance of this segment.

The cloud-based platforms segment is expected to grow at the fastest rate during the forecast period, driven by increasing adoption of digital R&D, remote collaboration, and scalable data management solutions. Cloud platforms enable real-time data sharing across geographically distributed teams and partners, which is critical for multi-target development programs. Smaller and mid-sized biosimilar developers are increasingly opting for cloud-based solutions to reduce upfront infrastructure costs. Advancements in cloud security and regulatory acceptance are further improving adoption. The flexibility and scalability offered by cloud platforms make them well suited for expanding biosimilar portfolios. Consequently, cloud-based deployment is anticipated to witness rapid growth.

- By Application

On the basis of application, the market is segmented into pharmaceutical companies, biotechnology companies, contract research organizations (CROs), contract manufacturing organizations (CMOs), and academic & research institutes. The pharmaceutical companies segment dominated the market in 2025, driven by their extensive biosimilar pipelines and strategic focus on portfolio-based development. Large pharmaceutical firms leverage multi-target platforms to optimize resource utilization across multiple biosimilar candidates. These companies benefit from economies of scale by standardizing development processes and regulatory strategies. Strong financial capabilities allow them to invest in advanced, end-to-end platforms. In addition, pharmaceutical companies are increasingly shifting from single-asset development to platform-driven biosimilar portfolios. This strategic shift underpins their dominant market position.

The contract manufacturing organizations (CMOs) segment is expected to register the fastest growth, supported by rising outsourcing of biosimilar development and manufacturing activities. Biopharma companies are increasingly partnering with CMOs offering integrated, multi-target development platforms to reduce capital expenditure and accelerate timelines. CMOs are investing heavily in standardized platforms that can be applied across multiple client programs. The growing number of small and mid-sized biosimilar developers relying on external partners is further driving demand. Expansion of biosimilar manufacturing capacity in Asia-Pacific is also benefiting CMOs. These trends are expected to propel rapid growth in this application segment.

Multi-Target Biosimilar Development Platform Market Regional Analysis

- North America dominated the market with the largest revenue share of 38.5% in 2025, supported by a strong biopharmaceutical R&D ecosystem, advanced regulatory frameworks for biosimilars, and the presence of leading biotechnology companies and CDMOs actively investing in platform-based development approaches

- Companies in the region place strong emphasis on integrated, scalable development platforms that support multiple biosimilar assets simultaneously, enabling faster time-to-market and efficient use of R&D resources

- This widespread adoption is further supported by the presence of leading pharmaceutical and biotechnology companies, experienced CDMOs, and increasing focus on cost-effective biologics development, establishing multi-target biosimilar development platforms as a preferred solution across the regional biopharma landscape

U.S. Multi-Target Biosimilar Development Platform Market Insight

The U.S. multi-target biosimilar development platform market captured the largest revenue share within North America in 2025, driven by the country’s advanced biopharmaceutical R&D infrastructure and strong focus on biosimilar portfolio expansion. Biopharma companies are increasingly prioritizing platform-based development models to accelerate multiple biosimilar programs simultaneously. The presence of leading pharmaceutical firms, experienced CDMOs, and well-defined FDA biosimilar pathways further supports market growth. Moreover, rising pressure to reduce biologics development costs and timelines is reinforcing the adoption of integrated, multi-target development platforms across the U.S.

Europe Multi-Target Biosimilar Development Platform Market Insight

The Europe multi-target biosimilar development platform market is projected to expand at a substantial CAGR during the forecast period, primarily driven by the region’s mature biosimilar regulatory environment and high adoption of biosimilars across healthcare systems. Increasing emphasis on cost containment and reimbursement efficiency is encouraging developers to pursue multi-asset biosimilar strategies. European biopharma companies are actively leveraging standardized platforms to streamline development and regulatory submissions. The region continues to witness strong growth across oncology, autoimmune, and chronic disease biosimilar pipelines.

U.K. Multi-Target Biosimilar Development Platform Market Insight

The U.K. multi-target biosimilar development platform market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a strong life sciences ecosystem and increasing biosimilar-focused R&D activities. The U.K.’s regulatory alignment and supportive policies for biosimilars are encouraging the adoption of efficient, platform-based development approaches. Growing collaboration between biotech firms and CDMOs is further accelerating platform utilization. In addition, the focus on expanding biosimilar access within the National Health Service is indirectly driving development platform demand.

Germany Multi-Target Biosimilar Development Platform Market Insight

The Germany multi-target biosimilar development platform market is expected to expand at a considerable CAGR, fueled by the country’s leadership in pharmaceutical manufacturing and biosimilar adoption. German companies place strong emphasis on high-quality analytical and process development platforms to meet stringent regulatory and quality standards. The demand for efficient development solutions supporting multiple biosimilar candidates is increasing as competition intensifies. Integration of advanced analytical technologies and digital data management is further supporting market growth in Germany.

Asia-Pacific Multi-Target Biosimilar Development Platform Market Insight

The Asia-Pacific multi-target biosimilar development platform market is poised to grow at the fastest CAGR during the forecast period, driven by expanding biologics manufacturing capacity and rising investments in biosimilar R&D across countries such as China, India, and South Korea. The region’s growing role as a global biosimilar manufacturing hub is encouraging the adoption of scalable, cost-efficient development platforms. Government initiatives supporting biopharmaceutical innovation and increasing collaboration with global biopharma players are further accelerating market growth. Improved regulatory maturity across APAC is also strengthening platform adoption.

Japan Multi-Target Biosimilar Development Platform Market Insight

The Japan multi-target biosimilar development platform market is gaining momentum due to increasing acceptance of biosimilars and the country’s strong focus on high-quality biologics development. Japanese companies emphasize precision, analytical rigor, and regulatory compliance, driving demand for advanced development platforms. The expansion of biosimilar pipelines in oncology and chronic disease areas is supporting platform adoption. In addition, collaborations between domestic firms and global CDMOs are enhancing access to multi-target development capabilities.

India Multi-Target Biosimilar Development Platform Market Insight

The India multi-target biosimilar development platform market accounted for the largest revenue share in Asia-Pacific in 2025, supported by the country’s strong biosimilar manufacturing base and cost-efficient development capabilities. Indian biopharma companies are increasingly adopting platform-based models to develop multiple biosimilars for both domestic and export markets. The availability of skilled talent, growing CDMO presence, and supportive regulatory environment are key growth drivers. Furthermore, India’s focus on expanding affordable biologic therapies globally is accelerating demand for multi-target biosimilar development platforms.

Multi-Target Biosimilar Development Platform Market Share

The Multi-Target Biosimilar Development Platform industry is primarily led by well-established companies, including:

- Biocon Biologics Limited (India)

- Catalent, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Sandoz Group AG (Switzerland)

- Samsung Biologics Co., Ltd. (South Korea)

- WuXi Biologics (China)

- Polpharma Biologics (Poland)

- Creative Biolabs (U.S.)

- Aragen Bioscience, Inc. (U.S.)

- Celltrion, Inc. (South Korea)

- Coherus BioSciences, Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Fresenius Kabi AG (Germany)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Biogen Inc. (U.S.)

- GSK plc (U.K.)

What are the Recent Developments in Global Multi-Target Biosimilar Development Platform Market?

- In October 2025, reports indicated the U.S. Food and Drug Administration (FDA) intends to streamline and accelerate the biosimilar approval process by potentially reducing required human clinical studies, which could significantly lower development barriers and costs for biosimilars developed via multi-target platforms

- In August 2025, Intas Pharma finalized the acquisition of the UDENYCA biosimilar (pegfilgrastim), strengthening its oncology biosimilar portfolio and expanding its global market reach, showcasing consolidation activity where companies enhance biosimilar platforms via strategic asset acquisitions

- In June 2025, Dr. Reddy’s Laboratories entered into a strategic collaboration with Alvotech to co-develop and commercialize a biosimilar version of the blockbuster cancer immunotherapy Keytruda (pembrolizumab), reflecting growing global partnerships in biosimilar development that leverage combined R&D and platform capabilities to tackle high-value biologics targets

- In May 2023, Just – Evotec Biologics and Sandoz launched a multi-year technology partnership to develop and later manufacture a portfolio of biosimilars using Evotec’s integrated development and continuous manufacturing tech platform, demonstrating early industry moves toward integrated, multi-molecule development platforms

- In February 2023, Similis Bio (business unit of JSR Life Sciences) announced a strategic partnership with Novel351k to co-develop multiple biosimilar programs targeting cancer and autoimmune diseases, combining Similis’s cell line, analytics, process development, and cGMP capabilities with Novel351k’s regulatory and clinical strategy to accelerate multi-asset biosimilar pipelines toward late-stage development

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.