Middle East And Africa Cereals Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

11.01 Billion

USD

19.89 Billion

2024

2032

USD

11.01 Billion

USD

19.89 Billion

2024

2032

| 2025 –2032 | |

| USD 11.01 Billion | |

| USD 19.89 Billion | |

|

|

|

|

Segmentación del mercado de cereales en Oriente Medio y África, por tipo de producto (trigo, arroz, maíz, cebada, avena, centeno, sorgo, mijo, quinua, trigo sarraceno, triticale, fonio, teff, amaranto, kamut y otros), presentación del producto (granos integrales, harina, copos, laminados, inflados, molidos, triturados, almidón, salvado, germen y otros), nivel de procesamiento (fortificado, descascarillado, pulido, precocido, mezclado, instantáneo, germinado, tostado, extruido, parcialmente cocido, micronizado, crudo, completamente cocido, al vapor, sazonado, endulzado, recubierto y otros), formato de consumo (con leche o yogur, barritas para llevar, gachas, snack seco, snack packs, listo para cocinar, listo para calentar, para mezclar Ingrediente, con infusión de bebidas y otros), Categoría de producto (Ingredientes de panadería (mezclas de harina/grano), Cereales para el desayuno, Materia prima/alimento animal, Snacks de cereales, Mezclas de cereales instantáneos, Cereales para bebés, Kits de comida a base de cereales, Insumos para elaboración de cerveza/destilación y otros), Naturaleza (Convencional y orgánico), Categoría (A BASE DE OMG y con certificación SIN OMG), Beneficios funcionales (Fortificado con vitaminas, Alto en fibra, Bajo en azúcar/sin azúcar, Alto en proteínas, Sin gluten, Saludable para el corazón, Mejorado con probióticos/prebióticos, Reductor de colesterol, Bajo índice glucémico, Enriquecido con omega-3, Bajo en grasa, Sin alérgenos, Alto en hierro, Bajo en sal/sin sal, Apto para paleo, Apto para keto, Certificado vegano y otros) Vida útil (Largo plazo (Estable en almacenamiento a temperatura ambiente), Mediano plazo y Corto plazo (Perecedero)), Empaque (Caja, bolsa, sobre, sobre/paquete, saco (a granel), frasco, tetrapack/cartón aséptico, bidón, tambor, embalaje ecológico y otros), tamaño del embalaje (envases pequeños (51 g–250 g), envases medianos (251 g–500 g), envases grandes (501 g–1 kg), envases individuales (menos de 50 g), envases extra grandes (1,1 kg–2,5 kg) y envases a granel (más de 2,5 kg)), rango de precios (económico (hasta USD 2,49), gama media (USD 2,50–6,99) y premium (USD 7,00 y más)), canal de distribución (B2B y B2C): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de cereales

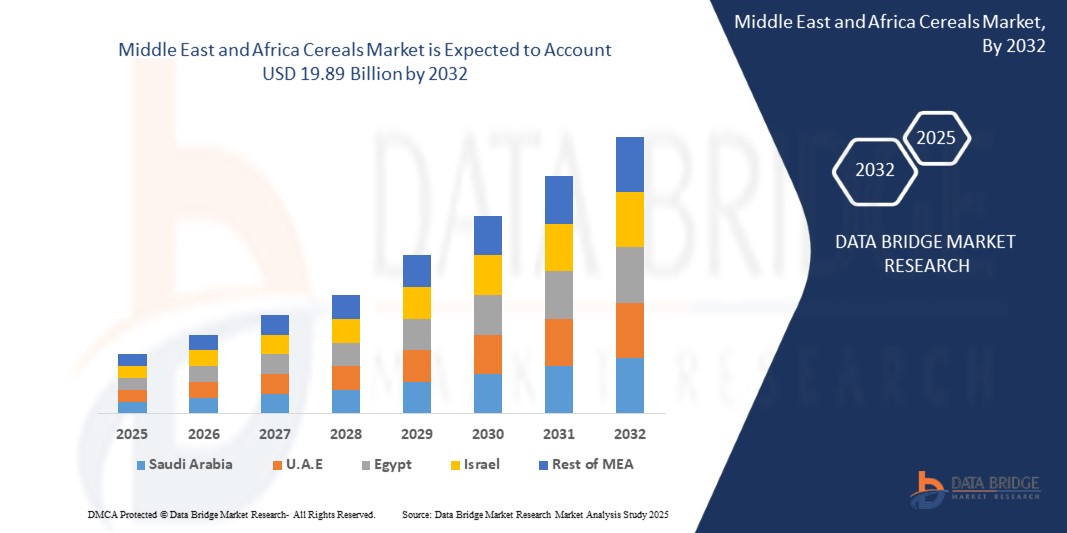

- El tamaño del mercado de cereales de Oriente Medio y África se valoró en 11.010 millones de dólares en 2024 y se espera que alcance los 19.890 millones de dólares en 2032 , con una CAGR del 7,8 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado por factores como la creciente demanda de opciones de desayuno convenientes y nutritivas, la creciente conciencia de la salud entre los consumidores, la innovación en las formulaciones de cereales y la expansión de la disponibilidad a través de canales minoristas en línea.

- Además, la evolución de las preferencias de los consumidores por alimentos nutritivos y funcionales, junto con la expansión de la urbanización y la creciente penetración del comercio minorista en línea, están acelerando la adopción de productos de cereales, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de cereales

- El mercado de cereales representa un segmento clave dentro de la industria agroalimentaria de Oriente Medio y África, que abarca productos de cereales listos para consumir y calientes. Estos productos se consumen ampliamente como opciones de desayuno prácticas y nutritivas que se adaptan a los estilos de vida modernos y ajetreados. El mercado incluye una amplia gama de productos elaborados con trigo, avena, maíz, arroz y cebada, adaptados a las diversas necesidades de los consumidores, incluyendo preferencias saludables, orgánicas y sin gluten.

- Los fabricantes de cereales innovan cada vez más con variantes ricas en proteínas, fortificadas y de origen vegetal para adaptarse a las tendencias de salud y los cambios en la alimentación en Oriente Medio y África. Estos avances están ampliando el alcance del mercado de cereales hacia categorías de alimentos funcionales, especialmente en las regiones desarrolladas, donde los consumidores priorizan las etiquetas limpias y el valor nutricional. La creciente tendencia de los sustitutos de comidas y los snacks para llevar impulsa aún más el crecimiento del mercado.

- Sudáfrica dominó el mercado de cereales durante el período de pronóstico y se prevé que sea el país con mayor crecimiento en el mercado gracias a sus sólidos patrones de consumo, la fidelidad a las marcas y la presencia de empresas consolidadas como Kellogg's, General Mills y Post Holdings. La región también se beneficia de una infraestructura minorista consolidada y una alta concienciación de los consumidores sobre la salud y el bienestar.

- El segmento de trigo dominó el mercado de cereales con la mayor participación en 2024, gracias a su conveniencia, estabilidad en el almacenamiento y amplia disponibilidad. Este segmento desempeña un papel crucial en la formación de los hábitos de desayuno del consumidor y ofrece valor a través de opciones fortificadas, ricas en sabor y específicas para cada dieta, que satisfacen diversas necesidades nutricionales.

Alcance del informe y segmentación del mercado de cereales

|

Atributos |

Mercado de cereales: Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de cereales

“Innovación en Cereales Funcionales y Nutrición Personalizada”

- El mercado de cereales de Oriente Medio y África está experimentando un cambio fundamental con la creciente demanda de cereales funcionales y nutrición personalizada adaptada a los objetivos de salud y las preferencias dietéticas del consumidor.

- Esta tendencia está impulsando a los fabricantes a reformular los cereales tradicionales incorporando ingredientes con beneficios específicos para la salud, como alto contenido de fibra, apoyo inmunológico, salud cardíaca y mejor digestión.

- Por ejemplo, las principales marcas de cereales están introduciendo productos enriquecidos con superalimentos (semillas de chía, semillas de lino), probióticos, prebióticos y adaptógenos como ashwagandha y maca para atraer a los consumidores centrados en el bienestar.

- Este cambio refleja la creciente conciencia en torno a la salud preventiva y la preferencia por alimentos de etiqueta limpia y ricos en nutrientes, posicionando a los cereales funcionales como componentes esenciales de las dietas modernas.

Dinámica del mercado de cereales

Conductor

Creciente demanda de opciones alimentarias convenientes y nutritivas

- Los estilos de vida urbanos se están volviendo cada vez más agitados, lo que provoca un aumento en la demanda de soluciones de desayuno rápidas, nutritivas y fáciles de preparar.

- Los productos de cereales satisfacen eficazmente esta necesidad debido a su conveniencia, larga vida útil, diversos perfiles nutricionales y amplia disponibilidad en los canales minoristas modernos y tradicionales.

- Las opciones de cereales listos para comer e instantáneos permiten a los consumidores ahorrar tiempo y al mismo tiempo garantizar una ingesta equilibrada de nutrientes esenciales como fibra, vitaminas y minerales.

- Esta creciente preferencia por opciones de alimentos convenientes y saludables está impulsando una demanda sostenida de cereales en varios grupos demográficos, especialmente profesionales que trabajan, estudiantes y familias preocupadas por la salud.

- En abril de 2024, según un informe de FoodNavigator, Kellogg's se asoció con una empresa líder en ciencia nutricional para aprovechar los datos de salud del consumidor y las herramientas de inteligencia artificial para desarrollar mezclas de cereales personalizadas. Mediante el análisis de millones de datos relacionados con hábitos alimenticios, preferencias y condiciones de salud, Kellogg's presentó una línea de cereales personalizados diseñados para apoyar la salud intestinal, el bienestar cardiovascular y los niveles de energía. Esta iniciativa refleja la creciente demanda de soluciones de cereales funcionales basadas en datos, diseñadas para una nutrición personalizada.

- Estas innovaciones subrayan cómo las marcas están adoptando la transformación digital y el análisis de salud para impulsar la innovación de productos y mejorar la participación del consumidor, lo que en última instancia impulsa un crecimiento sostenido del mercado en las categorías de cereales de Medio Oriente y África.

Restricción/Desafío

Preocupaciones de salud sobre el contenido de azúcar en los cereales para el desayuno

- El alto coste de obtener materias primas de primera calidad y desarrollar cereales funcionales, orgánicos o personalizados plantea desafíos importantes, especialmente para los pequeños y medianos fabricantes (PYME).

- Estos costos incluyen la adquisición de ingredientes especializados (p. ej., superalimentos, probióticos), tecnologías de procesamiento avanzadas, el cumplimiento de estándares de etiquetado limpio o certificación sanitaria, y la comercialización para nichos de mercado de la salud. Muchos pequeños productores de cereales carecen de los recursos financieros o la capacidad de I+D para competir con marcas consolidadas de Oriente Medio y África, lo que ralentiza la innovación y limita su alcance en el mercado.

- En octubre de 2023, un informe de AgriBusiness Review destacó que el costo de lanzar líneas de productos de cereales funcionales u orgánicos va mucho más allá del abastecimiento de materias primas. Incluye inversión en maquinaria especializada, I+D para la mejora nutricional, innovación en envases, certificación (como la de productos orgánicos o sin gluten) y educación del consumidor. Estos gastos acumulados suelen ser inmanejables para las pequeñas marcas que buscan entrar en el segmento de cereales saludables.

- La limitada capacidad financiera y la infraestructura tecnológica obligan a muchos pequeños y medianos productores de cereales a retrasar o renunciar al desarrollo de estos productos, lo que limita su capacidad para competir en categorías premium y funcionales. Este obstáculo financiero frena significativamente la diversificación del mercado y la innovación en toda la industria cerealera.

Alcance del mercado de cereales

El mercado está segmentado en trece segmentos notables según el tipo de producto, forma del producto, nivel de procesamiento, formato de consumo, categoría del producto, naturaleza, categoría, beneficios funcionales, vida útil, empaque, tamaño del empaque, rango de precios y canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado de cereales se segmenta en trigo, arroz, maíz, cebada, avena, centeno, sorgo, mijo, quinua, trigo sarraceno, triticale, fonio, teff, amaranto, kamut, entre otros. Se prevé que el trigo y el maíz dominen la cuota de mercado en 2025 y sean el segmento de mayor crecimiento gracias a su disponibilidad en Oriente Medio y África, su asequibilidad y su amplio uso en las industrias alimentaria y de piensos. Se prevé que la creciente demanda de granos antiguos como la quinua y el amaranto impulse el crecimiento de los segmentos de cereales especiales y saludables durante el período de pronóstico.

- Por forma de producto

Según la presentación del producto, el mercado de cereales se segmenta en granos integrales, harina, copos, laminados, inflados, molidos, partidos, almidón, salvado, germen y otros. Se prevé que los granos integrales dominen la cuota de mercado en 2025 y sean el segmento de mayor crecimiento, impulsado por la creciente concienciación sobre las dietas ricas en fibra y la preferencia por las etiquetas limpias. Se prevé un crecimiento constante de la harina y el salvado gracias a su uso en panadería y alimentos saludables.

- Por nivel de procesamiento

Según el nivel de procesamiento, el mercado de cereales se segmenta en fortificados, descascarillados, pulidos, precocidos, mezclados, instantáneos, germinados, tostados, extruidos, parcialmente cocidos, micronizados, crudos, totalmente cocidos, al vapor, sazonados, endulzados, recubiertos, entre otros. Se espera que los cereales fortificados dominen la cuota de mercado en 2025 y se prevé que sean el segmento de mayor crecimiento gracias a sus beneficios nutricionales adicionales. Por otro lado, los formatos instantáneos y precocidos impulsan la demanda de soluciones de alimentación rápida entre las poblaciones urbanas.

- Por formato de consumo

Según el formato de consumo, el mercado de cereales se segmenta en: cereales para comer con cuchara con leche/yogur, barritas para llevar, gachas, snacks secos, snacks en envases, listos para cocinar, listos para calentar, con ingredientes para mezclar, con infusión para bebidas, entre otros. Se espera que los cereales para comer con cuchara dominen la cuota de mercado en 2025 y se prevé que sean el segmento de mayor crecimiento debido a su uso convencional, mientras que se proyecta que los cereales listos para cocinar y los snacks en envases experimenten un rápido crecimiento gracias a su portabilidad y comodidad.

- Por categoría de producto

Según la categoría de producto, el mercado de cereales se segmenta en ingredientes de panadería (mezclas de harina y granos), cereales para el desayuno, piensos para animales, snacks de cereales, mezclas de cereales instantáneos, cereales infantiles, kits de comida a base de cereales, insumos para la elaboración de cerveza y destilación, entre otros. Se prevé que los cereales para el desayuno dominen la cuota de mercado en 2025 y se prevé que sean el segmento de mayor crecimiento gracias a su consumo generalizado. Por otro lado, se prevé que los snacks de cereales y los cereales infantiles crezcan rápidamente debido a los cambios en los hábitos alimentarios y a una crianza centrada en la salud.

- Por naturaleza

El mercado de cereales se segmenta en convencional y orgánico, basándose en su naturaleza. Los cereales convencionales predominan en volumen debido a su asequibilidad y a las cadenas de suministro consolidadas.

Se proyecta que los cereales orgánicos exhibirán el crecimiento más rápido durante 2025-2032, impulsado por la creciente demanda de los consumidores de productos libres de pesticidas y de etiqueta limpia.

- Por categoría

Según la categoría, el mercado de cereales se segmenta en cereales con certificación OGM y cereales sin certificación OGM. Se espera que los cereales sin certificación OGM dominen la cuota de mercado en 2025 y se prevé que sean el segmento de mayor crecimiento debido a la creciente concienciación y preferencia de los consumidores por los cereales de origen natural, especialmente en Oriente Medio y África.

- Por beneficios funcionales

En función de sus beneficios funcionales, el mercado de cereales se segmenta en: fortificados con vitaminas, ricos en fibra, bajos en azúcar o sin azúcar, ricos en proteínas, sin gluten, cardiosaludables, enriquecidos con probióticos/prebióticos, reductores de colesterol, de bajo índice glucémico, enriquecidos con omega-3, bajos en grasa, sin alérgenos, ricos en hierro, bajos en sal o sin sal, aptos para dietas paleo, aptos para dietas keto, con certificación vegana, entre otros. Se espera que los cereales ricos en fibra y cardiosaludables dominen la cuota de mercado en 2025 y se prevé que sean el segmento de mayor crecimiento gracias a la mayor atención a la salud preventiva y al control de peso.

- Por vida útil

Según su vida útil, el mercado de cereales se segmenta en largo plazo (perecederos), mediano plazo y corto plazo. Se espera que los cereales perecederos dominen la cuota de mercado en 2025 y se prevé que sean el segmento de mayor crecimiento gracias a su durabilidad y ventajas logísticas, especialmente en los mercados minoristas y de exportación.

- Por embalaje

En cuanto al envasado, el mercado de cereales se segmenta en cajas, bolsas, sobres, sacos (a granel), tarros, envases Tetra Pack/cartón aséptico, bidones, bidones, envases ecológicos y otros. Las cajas y bolsas predominan en el comercio minorista, mientras que se prevé que los envases ecológicos dominen la cuota de mercado en 2025 y se prevé que sean el segmento de mayor crecimiento gracias a las iniciativas de sostenibilidad.

- Por tamaño de embalaje

Según el tamaño del envase, el mercado de cereales se segmenta en paquetes pequeños (51 g–250 g), paquetes medianos (251 g–500 g), paquetes grandes (501 g–1 kg), paquetes individuales (menos de 50 g), paquetes extragrandes (1,1 kg–2,5 kg) y paquetes a granel (más de 2,5 kg). Se prevé que los paquetes pequeños y medianos dominen la cuota de mercado en 2025 y se prevé que sean el segmento de mayor crecimiento gracias a su asequibilidad y a su idoneidad para hogares unifamiliares. Los paquetes a granel son comunes en las ventas B2B e institucionales.

- Por rango de precio

Según el rango de precios, el mercado de cereales se segmenta en económico (hasta USD 2,49), gama media (USD 2,50-6,99) y premium (USD 7,00 y más). Se espera que el segmento de gama media domine la cuota de mercado en 2025 y sea el de mayor crecimiento gracias a su equilibrio entre asequibilidad y calidad, mientras que los cereales premium están ganando terreno en los mercados urbanos con el aumento de la renta disponible.

- Por canal de distribución

Según el canal de distribución, el mercado de cereales se segmenta en B2B y B2C. Se prevé que el B2C domine la cuota de mercado en 2025 y sea el segmento de mayor crecimiento gracias a las ventas a través de supermercados, tiendas de conveniencia y plataformas en línea. El segmento B2B está impulsado por los servicios de alimentación, el suministro institucional y el uso industrial.

Análisis regional del mercado de cereales

- Sudáfrica tuvo una participación de mercado con la mayor participación en ingresos, 19,90% en 2025, impulsada por un alto consumo de cereales listos para comer, una fuerte presencia de marca y una amplia disponibilidad en formatos minoristas modernos.

- La región se beneficia de una industria de procesamiento de alimentos consolidada, una creciente demanda de cereales orgánicos y fortificados, y la innovación continua de empresas clave como Kellogg's, General Mills y Post Holdings. Además, la creciente preferencia de los consumidores por opciones de desayuno prácticas y saludables consolida aún más su liderazgo en el mercado de Oriente Medio y África.

Cuota de mercado de los cereales

El mercado de cereales está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- KWALITY (India)

- Cereal Bio (Italia)

- CEREALES DE DESAYUNO MULDER (Bélgica)

Últimos avances en el mercado de cereales en Oriente Medio y África

- En marzo de 2025 , General Mills lanzó una nueva línea de cereales de desayuno ricos en proteínas bajo su marca "Nature Valley", dirigida a consumidores preocupados por su salud y entusiastas del fitness. El producto incluye variantes fortificadas con proteína de suero, fibra y cero azúcares añadidos, en línea con la creciente demanda de alimentos funcionales.

- En enero de 2025 , Kellogg's anunció su expansión estratégica al Sudeste Asiático con una nueva planta de producción en Vietnam para satisfacer la creciente demanda regional de soluciones de desayuno convenientes. La planta producirá una variedad de cereales adaptados a los gustos locales, incluyendo opciones bajas en azúcar y de origen vegetal.

- En octubre de 2024 , Nestlé se asoció con Danone y una startup de tecnología de la salud para desarrollar conjuntamente una plataforma de nutrición personalizada. Esta plataforma utiliza datos dietéticos de los consumidores para recomendar productos de cereales ricos en nutrientes específicos como omega-3, fibra y hierro, marcando el comienzo de una nueva era de nutrición de precisión en el desayuno.

- En abril de 2025 , Post Holdings presentó un embalaje sostenible para su línea de cereales "Honey Bunches of Oats". Los nuevos envases reciclables y biodegradables respaldan el compromiso de la empresa de reducir el uso de plástico en un 50 % para 2030 y atienden a los consumidores con conciencia ecológica.

- En febrero de 2025 , la marca "Saffola" de Marico introdujo cereales a base de mijo en India, bajo su línea "Healthy Crunch". El lanzamiento se alinea con la iniciativa del Año Internacional del Mijo y responde a la creciente popularidad de los cereales ancestrales en las fórmulas modernas para el desayuno.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES:-

4.1.1 INTENSITY OF COMPETITIVE RIVALRY (HIGH)

4.1.2 BARGAINING POWER OF BUYERS/CONSUMERS (HIGH)

4.1.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.1.4 THREAT OF SUBSTITUTE PRODUCTS (MODERATE TO HIGH)

4.1.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.2 BRAND OUTLOOK

4.2.1 COMPARATIVE BRAND ANALYSIS

4.2.2 PRODUCT AND BRAND OVERVIEW

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS:

4.4 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.5 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.5.1 IMPACT ON PRICE

4.5.2 IMPACT ON SUPPLY CHAIN

4.5.3 IMPACT ON SHIPMENT

4.5.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.6 REGULATORY FRAMEWORK AND GUIDELINES

4.7 VALUE CHAIN

4.7.1 MIDDLE EAST AND AFRICA CEREALS MARKET VALUE CHAIN

4.7.2 PRODUCTION:

4.7.3 PROCESSING:

4.7.4 MARKETING/DISTRIBUTION:

4.7.5 BUYERS:

4.8 SUPPLY CHAIN ANALYSIS

4.9 COST ANALYSIS BREAKDOWN

4.1 PROFIT MARGINS SCENARIO

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 JOINT VENTURES

4.11.1.2 MERGERS AND ACQUISITIONS

4.11.1.3 LICENSING AND PARTNERSHIP

4.11.1.4 TECHNOLOGY COLLABORATIONS

4.11.1.5 STRATEGIC DIVESTMENTS

4.12 PRICING ANALYSIS

4.13 PATENT ANALYSIS

4.13.1 PATENT QUALITY AND STRENGTH

4.13.2 PATENT FAMILIES

4.13.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.13.4 LICENSING AND COLLABORATIONS

4.13.5 COMPANY PATENT LANDSCAPE

4.13.6 REGION PATENT LANDSCAPE

4.14 IP STRATEGY AND MANAGEMENT

4.14.1 PATENT ANALYSIS

4.14.2 PROFIT MARGINS SCENARIO

4.15 IMPACT OF ECONOMIC SLOWDOWN ON THE MIDDLE EAST AND AFRICA CEREALS MARKET

4.15.1 IMPACT ON PRICES

4.15.2 IMPACT ON SUPPLY CHAIN

4.15.3 IMPACT ON SHIPMENT

4.15.4 IMPACT ON DEMAND

4.15.5 IMPACT ON STRATEGIC DECISIONS

4.16 SUPPLY CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 TYPES OF LOGISTICS COSTS INVOLVED

4.16.3 FACTORS INFLUENCING EACH COST TYPE

4.16.4 STRATEGIES TO MINIMIZE LOGISTIC COSTS

4.16.5 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.17 INDUSTRY ECOSYSTEM ANALYSIS

4.17.1 PROMINENT COMPANIES

4.17.2 SMALL & MEDIUM SIZE COMPANIES

4.17.3 END USERS

4.18 PRODUCTION CONSUMPTION ANALYSIS

4.19 RAW MATERIAL SOURCING ANALYSIS (MIDDLE EAST AND AFRICA CEREALS MARKET)

4.2 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.20.1 OVERVIEW:

4.21 TARIFFS & IMPACT ON THE MARKET

4.21.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.21.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.21.3 VENDOR SELECTION CRITERIA DYNAMICS

4.21.4 IMPACT ON SUPPLY CHAIN

4.21.4.1 RAW MATERIAL PROCUREMENT

4.21.4.2 MANUFACTURING AND PRODUCTION

4.21.4.3 LOGISTICS AND DISTRIBUTION

4.21.4.4 PRICE PITCHING AND POSITION OF MARKET

4.21.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.21.5.1 SUPPLY CHAIN OPTIMIZATION

4.21.5.2 JOINT VENTURE ESTABLISHMENTS

4.21.6 IMPACT ON PRICES

4.21.7 REGULATORY INCLINATION

4.21.7.1 GEOPOLITICAL SITUATION

4.21.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.21.8 FREE TRADE AGREEMENTS

4.21.9 ALLIANCES ESTABLISHMENTS

4.21.10 STATUS ACCREDITATION (INCLUDING MFTN)

4.21.11 DOMESTIC COURSE OF CORRECTION

4.21.12 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.21.13 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR NUTRITIONAL AND FUNCTIONAL FOODS

5.1.2 URBANIZATION AND CHANGING LIFESTYLES BOOSTING READY-TO-EAT CEREALS

5.1.3 SURGE OF PLANT‑BASED AND FUNCTIONAL INGREDIENTS DRIVEN BY HEALTH & ENVIRONMENTAL CONCERNS

5.2 RESTRAINTS

5.2.1 FLUCTUATING RAW MATERIAL PRICES AND CLIMATE RISKS

5.2.2 GROWING CRITICISM OVER ADDED SUGAR AND PROCESSING

5.3 OPPORTUNITIES

5.3.1 CONSUMERS ARE INCREASINGLY CHOOSING HIGH-FIBER, LOW-SUGAR, AND ORGANIC CEREALS

5.3.2 THE RISING SHIFT TOWARD PLANT-BASED DIETARY PATTERNS INFLUENCING CONSUMER PREFERENCES.

5.3.3 ONLINE GROCERY ENABLING CEREAL BRANDS TO SELL DIRECTLY, GATHER CONSUMER DATA, AND OFFER SUBSCRIPTIONS

5.4 CHALLENGES

5.4.1 SIGNIFICANT HURDLES FOR SUPPLY CHAINS DUE TO LOGISTICS DISRUPTIONS, COMPLEX REGULATIONS, AND INEFFICIENT DISTRIBUTION NETWORKS

5.4.2 INCREASED COMPETITION FROM ALTERNATIVES LIKE GRANOLA, PROTEIN BARS, SMOOTHIES, YOGURT, AND ETHNIC BREAKFASTS

6 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CEREAL TYPE

6.1 OVERVIEW

6.2 WHEAT

6.2.1 WHEAT, BY TYPE

6.3 RICE

6.3.1 RICE, BY TYPE

6.4 MAIZE(CORN)

6.4.1 MAIZE(CORN), BY TYPE

6.5 BARLEY

6.5.1 BARLEY, BY TYPE

6.6 OATS

6.6.1 OATS, BY TYPE

6.7 RYE

6.7.1 RYE, BY TYPE

6.8 SORGHUM

6.8.1 SORGHUM, BY TYPE

6.9 MILLET

6.9.1 MILLET, BY TYPE

6.1 QUINOA

6.10.1 QUINOA, BY TYPE

6.11 BUCKWHEAT

6.12 TRITICALE

6.13 FONIO

6.14 TEFF

6.15 AMARANTH

6.16 KAMUT

6.17 OTHERS

7 MIDDLE EAST AND AFRICA CEREALS MARKET, PRODUCT FORM

7.1 OVERVIEW

7.2 WHOLE GRAINS

7.3 FLOUR

7.4 FLAKED GRAINS

7.5 ROLLED GRAINS

7.6 PUFFED GRAINS

7.7 GROUND MEAL

7.8 CRACKED GRAINS

7.9 STARCH

7.1 BRAN

7.11 GERM

7.12 OTHERS

8 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PROCESSING LEVEL

8.1 OVERVIEW

8.2 FORTIFIED

8.3 DEHUSKED

8.4 POLISHED

8.5 PRE-COOKED

8.6 BLENDED

8.7 INSTANT

8.8 SPROUTED

8.9 ROASTED

8.1 EXTRUDED

8.11 PARTIALLY COOKED

8.12 MICRONIZED

8.13 RAW

8.14 FULLY COOKED

8.15 STEAMED

8.16 SEASONED

8.17 SWEETENED

8.18 COATED

8.19 OTHERS

9 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CONSUMPTION FORMAT

9.1 OVERVIEW

9.2 SPOON-EATEN WITH MILK/YOGURT

9.3 ON-THE-GO BARS

9.4 PORRIDGE

9.5 DRY SNACK

9.6 SNACK PACKS

9.7 READY-TO-COOK

9.8 READY-TO-HEAT

9.9 MIX-IN INGREDIENT

9.1 BEVERAGE-INFUSED

9.11 OTHERS

10 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PRODUCT CATEGORY

10.1 OVERVIEW

10.2 BAKERY INGREDIENTS (FLOUR/GRAIN BLENDS)

10.3 BREAKFAST CEREALS

10.3.1 BREAKFAST CEREALS, BY TYPE

10.3.1.1 Ready-To-Eat (RTE), By Type

10.3.1.2 Hot Cereals, By Type

10.4 FEEDSTOCK/ANIMAL FEED

10.5 CEREAL SNACKS

10.5.1 CEREAL SNACKS, BY TYPE

10.6 INSTANT CEREAL MIXES

10.7 INFANT CEREALS

10.7.1 INFANT CEREALS, BY TYPE

10.8 CEREAL-BASED MEAL KITS

10.9 BREWING/DISTILLING INPUTS

10.1 OTHERS

11 MIDDLE EAST AND AFRICA CEREALS MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 GMO-BASED

12.3 NON-GMO CERTIFIED

13 MIDDLE EAST AND AFRICA CEREALS MARKET, BY FUNCTIONAL BENEFITS

13.1 OVERVIEW

13.2 VITAMIN-FORTIFIED

13.3 HIGH-FIBER

13.4 LOW/NO SUGAR

13.5 HIGH-PROTEIN

13.6 GLUTEN-FREE

13.7 HEART-HEALTHY

13.8 PROBIOTIC/PREBIOTIC ENHANCED

13.9 CHOLESTEROL-LOWERING

13.1 LOW GLYCEMIC INDEX

13.11 OMEGA-3 ENRICHED

13.12 LOW FAT

13.13 ALLERGEN-FREE

13.14 HIGH-IRON

13.15 LOW/NO SALT

13.16 PALEO-FRIENDLY

13.17 KETO-FRIENDLY

13.18 VEGAN-CERTIFIED

13.19 OTHERS

14 MIDDLE EAST AND AFRICA CEREALS MARKET, BY SHELF LIFE

14.1 OVERVIEW

14.2 LONG-TERM (AMBIENT SHELF-STABLE)

14.3 MEDIUM-TERM

14.4 SHORT-TERM (PERISHABLE)

15 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PACKAGING

15.1 OVERVIEW

15.2 BOX

15.2.1 BOX, BY TYPE

15.3 POUCH

15.3.1 POUCH, BY TYPE

15.4 BAG

15.4.1 BAG, BY TYPE

15.5 SACHET/STICK PACK

15.6 SACK (BULK)

15.7 JAR

15.7.1 JAR, BY TYPE

15.8 TETRA PACK / ASEPTIC CARTON

15.9 CANISTER

15.1 DRUM

15.11 ECO-PACKAGING

15.11.1 ECO-PACKAGING, BY TYPE

15.12 OTHERS

16 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 SMALL PACKS (51G–250G)

16.3 MEDIUM PACKS (251G–500G)

16.4 LARGE PACKS (501G–1KG)

16.5 SINGLE SERVE PACKS (BELOW 50G)

16.6 EXTRA LARGE PACKS (1.1KG–2.5KG)

16.7 BULK PACKS (ABOVE 2.5KG)

17 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 ECONOMY (UPTO USD 2.49)

17.3 MID-RANGE (USD 2.50-6.99)

17.4 PREMIUM (USD 7.00 AND ABOVE)

18 MIDDLE EAST AND AFRICA CEREALS MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 B2B

18.3 B2C

18.3.1 B2C, BY TYPE

18.3.2 ONLINE, BY TYPE

18.3.3 OFFLINE, BY TYPE

19 MIDDLE EAST AND AFRICA CEREALS MARKET, BY REGION

19.1 MIDDLE EAST AND AFRICA

19.1.1 SOUTH AFRICA

19.1.2 SAUDI ARABIA

19.1.3 EGYPT

19.1.4 U.A.E

19.1.5 ISRAEL

19.1.6 KUWAIT

19.1.7 OMAN

19.1.8 BAHRAIN

19.1.9 QATAR

19.1.10 REST OF MIDDLE EAST AND AFRICA

20 MIDDLE EAST AND AFRICA CEREALS MARKET

20.1 COMPANY SHARE ANALYSIS: GLOBAL

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 NESTLÉ

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 BRAND PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 ASSOCIATED BRITISH FOODS PLC

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 BUSINESS PORTFOLIO

22.2.5 RECENT NEWS

22.3 GENERAL MILLS INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 BRAND PORTFOLIO

22.3.5 RECENT DEVELOPMENT

22.4 POST HOLDINGS, INC.

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 BRAND PORTFOLIO

22.4.5 RECENT DEVELOPMENT

22.5 WK KELLOGG CO

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 BRAND PORTFOLIO

22.5.5 RECENT DEVELOPMENT

22.6 BAGRRY'S

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS/NEWS

22.7 B&G FOODS, INC.

22.7.1 COMPANY SNAPSHOT

22.7.2 REVENUE ANALYSIS

22.7.3 PRODUCT PORTFOLIO

22.7.4 RECENT DEVELOPMENT

22.8 BARBARA'S BAKERY

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 BIO-FAMILIA EN

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS/NEWS

22.1 BOB’S RED MILL NATURAL FOODS

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS/NEWS

22.11 CÉRÉAL BIO

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 CLEXTRAL

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENT

22.13 DR. OETKER

22.13.1 COMPANY SNAPSHOT

22.13.2 REVENUE ANALYSIS

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT DEVELOPMENTS/NEWS

22.14 HERO GROUP

22.14.1 COMPANY SNAPSHOT

22.14.2 REVENUE ANALYSIS

22.14.3 PRODUCT PORTFOLIO

22.14.4 RECENT DEVELOPMENTS/NEWS

22.15 KASHI LLC

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENT

22.16 KWALITY

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 LIMAGRAIN - INGRÉDIENTS

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENT

22.18 MARICO

22.18.1 COMPANY SNAPSHOT

22.18.2 REVENUE ANALYSIS

22.18.3 BRAND PORTFOLIO

22.18.4 RECENT DEVELOPMENTS/NEWS

22.19 MULDER BREAKFAST CEREALS

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 NATURE'S PATH

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENT

22.21 PEPSICO

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT DEVELOPMENT

22.22 RUDE HEALTH

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS/NEWS

22.23 SANITARIUM

22.23.1 COMPANY SNAPSHOT

22.23.2 PRODUCT PORTFOLIO

22.23.3 RECENT DEVELOPMENT

22.24 SEITENBACHER

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS/NEWS

22.25 SEVEN SUNDAYS

22.25.1 COMPANY SNAPSHOT

22.25.2 PRODUCT PORTFOLIO

22.25.3 RECENT DEVELOPMENTS/NEWS

22.26 SURREAL UK

22.26.1 COMPANY SNAPSHOT

22.26.2 PRODUCT PORTFOLIO

22.26.3 RECENT DEVELOPMENTS/NEWS

22.27 THE HAIN CELESTIAL GROUP, INC.

22.27.1 COMPANY SNAPSHOT

22.27.2 REVENUE ANALYSIS

22.27.3 BRAND PORTFOLIO

22.27.4 RECENT DEVELOPMENTS/NEWS

22.28 THE QUAKER OATS COMPANY

22.28.1 COMPANY SNAPSHOT

22.28.2 PRODUCT PORTFOLIO

22.28.3 RECENT DEVELOPMENTS/NEWS

22.29 THE SILVER PALATE

22.29.1 COMPANY SNAPSHOT

22.29.2 PRODUCT PORTFOLIO

22.29.3 RECENT DEVELOPMENT

22.3 WEETABIX

22.30.1 COMPANY SNAPSHOT

22.30.2 PRODUCT PORTFOLIO

22.30.3 RECENT DEVELOPMENTS/NEWS

23 QUESTIONNAIRE

24 RELATED REPORTS

Lista de Tablas

TABLE 1 SUMMARY OF COMPETITIVE POSITIONING:

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 EXPORT

TABLE 4 IMPORT

TABLE 5 COST FOR KEY EQUIPMENT AND THE OVERALL CEREALS PROCESSING PLANTS

TABLE 6 PROFIT MARGIN SCENARIOS

TABLE 7 CONSUMER BUYING BEHAVIOUR

TABLE 8 PRODUCTION

TABLE 9 CONSUMPTION

TABLE 10 CONSUMER BUYING BEHAVIOUR

TABLE 11 CEREAL IMPORT TARIFF RATES IN TOP 5 MARKETS (2024)

TABLE 12 LOCAL PRODUCTION V/S IMPORT RELIANCE

TABLE 13 REGULATORY INCLINATION

TABLE 14 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

TABLE 15 ALLIANCES ESTABLISHMENTS

TABLE 16 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES (SEZS) AND INDUSTRIAL PARKS

TABLE 17 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 19 MIDDLE EAST AND AFRICA WHEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA RICE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA MAIZE(CORN) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA BARLEY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OATS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA RYE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SORGHUM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA MILLET IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA QUINOA IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BUCKWHEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA TRITICALE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA FONIO IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA TEFF IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA AMARANTH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA WHOLE GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA FLOUR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA FLAKED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA ROLLED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PUFFED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA GROUND MEAL IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CRACKED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA STARCH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA BRAN IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA GERM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA FORTIFIED CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA DEHUSKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA POLISHED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA PRE-COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA BLENDED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA INSTANT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA SPROUTED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA ROASTED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA EXTRUDED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA PARTIALLY COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA MICRONIZED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA RAW IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA FULLY COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA STEAMED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA SEASONED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA SWEETENED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA COATED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA SPOON-EATEN WITH MILK/YOGURT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA ON-THE-GO BARS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA PORRIDGE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA DRY SNACK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA SNACK PACKS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA READY-TO-COOK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA READY-TO-HEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA MIX-IN INGREDIENT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA BEVERAGE-INFUSED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA BAKERY INGREDIENTS (FLOUR/GRAIN BLENDS) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA BREAKFAST CEREALS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA FEEDSTOCK/ANIMAL FEED CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA CEREAL SNACKS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA INSTANT CEREAL MIXES IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA INFANT CEREALS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA CEREAL-BASED MEAL KITS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA BREWING/DISTILLING INPUTS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA CONVENTIONAL IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA ORGANIC IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA GMO-BASED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA NON-GMO CERTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA VITAMIN-FORTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA HIGH-FIBER IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA LOW/NO SUGAR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA HIGH-PROTEIN IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA GLUTEN-FREE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA HEART-HEALTHY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA PROBIOTIC/PREBIOTIC ENHANCED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA CHOLESTEROL-LOWERING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA LOW GLYCEMIC INDEX IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA OMEGA-3 ENRICHED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA LOW FAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA ALLERGEN-FREE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA HIGH-IRON IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA LOW/NO SALT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA PALEO-FRIENDLY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA KETO-FRIENDLY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA VEGAN-CERTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA LONG-TERM (AMBIENT SHELF-STABLE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA MEDIUM-TERM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA SHORT-TERM (PERISHABLE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA BOX IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA BOX IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA POUCH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA POUCH IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA BAG IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA BAG IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA SACHET/STICK PACK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA SACK (BULK) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA JAR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA JAR IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA TETRA PACK / ASEPTIC CARTON IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA CANISTER IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA DRUM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA ECO-PACKAGING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA ECO-PACKAGING IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MIDDLE EAST AND AFRICA ECO-PACKAGING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PACKAGING-SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 MIDDLE EAST AND AFRICA SMALL PACKS (51G–250G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 149 MIDDLE EAST AND AFRICA MEDIUM PACKS (251G–500G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA LARGE PACKS (501G–1KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 151 MIDDLE EAST AND AFRICA SINGLE SERVE PACKS (BELOW 50G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 152 MIDDLE EAST AND AFRICA EXTRA LARGE PACKS (1.1KG–2.5KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA BULK PACKS (ABOVE 2.5KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 154 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 155 MIDDLE EAST AND AFRICA ECONOMY (UPTO USD 2.49) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA MID-RANGE (USD 2.50-6.99) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 157 MIDDLE EAST AND AFRICA PREMIUM (USD 7.00 AND ABOVE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 158 MIDDLE EAST AND AFRICA CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA B2B IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 160 MIDDLE EAST AND AFRICA B2C IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 161 MIDDLE EAST AND AFRICA B2C IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA ONLINE IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MIDDLE EAST AND AFRICA OFFLINE IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MIDDLE EAST AND AFRICA CEREALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 167 MIDDLE EAST AND AFRICA WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 MIDDLE EAST AND AFRICA RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MIDDLE EAST AND AFRICA MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 MIDDLE EAST AND AFRICA OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 MIDDLE EAST AND AFRICA RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 MIDDLE EAST AND AFRICA MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MIDDLE EAST AND AFRICA QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 177 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 178 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 180 MIDDLE EAST AND AFRICA BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 MIDDLE EAST AND AFRICA READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 MIDDLE EAST AND AFRICA CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MIDDLE EAST AND AFRICA INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 186 MIDDLE EAST AND AFRICA CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 187 MIDDLE EAST AND AFRICA CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 189 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 190 MIDDLE EAST AND AFRICA BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MIDDLE EAST AND AFRICA POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MIDDLE EAST AND AFRICA BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MIDDLE EAST AND AFRICA JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MIDDLE EAST AND AFRICA ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 196 MIDDLE EAST AND AFRICA CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 197 MIDDLE EAST AND AFRICA CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 198 MIDDLE EAST AND AFRICA B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 MIDDLE EAST AND AFRICA ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MIDDLE EAST AND AFRICA OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SOUTH AFRICA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SOUTH AFRICA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 203 SOUTH AFRICA WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SOUTH AFRICA RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SOUTH AFRICA MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SOUTH AFRICA BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SOUTH AFRICA OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SOUTH AFRICA RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SOUTH AFRICA SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SOUTH AFRICA MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SOUTH AFRICA QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SOUTH AFRICA CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 213 SOUTH AFRICA CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 214 SOUTH AFRICA CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 215 SOUTH AFRICA CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 216 SOUTH AFRICA BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SOUTH AFRICA READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SOUTH AFRICA HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SOUTH AFRICA CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SOUTH AFRICA INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SOUTH AFRICA CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 222 SOUTH AFRICA CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 223 SOUTH AFRICA CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 224 SOUTH AFRICA CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 225 SOUTH AFRICA CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 226 SOUTH AFRICA BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SOUTH AFRICA POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SOUTH AFRICA BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SOUTH AFRICA JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SOUTH AFRICA ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SOUTH AFRICA CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 232 SOUTH AFRICA CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 233 SOUTH AFRICA CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 234 SOUTH AFRICA B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH AFRICA ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH AFRICA OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SAUDI ARABIA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SAUDI ARABIA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 239 SAUDI ARABIA WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 SAUDI ARABIA RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SAUDI ARABIA MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SAUDI ARABIA BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 SAUDI ARABIA OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SAUDI ARABIA RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SAUDI ARABIA SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SAUDI ARABIA MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 SAUDI ARABIA QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 SAUDI ARABIA CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 249 SAUDI ARABIA CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 250 SAUDI ARABIA CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 251 SAUDI ARABIA CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 252 SAUDI ARABIA BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 SAUDI ARABIA READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 SAUDI ARABIA HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SAUDI ARABIA CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SAUDI ARABIA INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 SAUDI ARABIA CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 258 SAUDI ARABIA CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 259 SAUDI ARABIA CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 260 SAUDI ARABIA CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 261 SAUDI ARABIA CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 262 SAUDI ARABIA BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SAUDI ARABIA POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 SAUDI ARABIA BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SAUDI ARABIA JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SAUDI ARABIA ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SAUDI ARABIA CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 268 SAUDI ARABIA CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 269 SAUDI ARABIA CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 270 SAUDI ARABIA B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SAUDI ARABIA ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 SAUDI ARABIA OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 EGYPT CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 EGYPT CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 275 EGYPT WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 EGYPT RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 EGYPT MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 EGYPT BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 EGYPT OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 EGYPT RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 EGYPT SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 EGYPT MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 EGYPT QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 EGYPT CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 285 EGYPT CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 286 EGYPT CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 287 EGYPT CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 288 EGYPT BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 EGYPT READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 EGYPT HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 EGYPT CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 EGYPT INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 EGYPT CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 294 EGYPT CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 295 EGYPT CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 296 EGYPT CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 297 EGYPT CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 298 EGYPT BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 EGYPT POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 EGYPT BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 EGYPT JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 EGYPT ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 EGYPT CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 304 EGYPT CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 305 EGYPT CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 306 EGYPT B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 EGYPT ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 EGYPT OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 U.A.E CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 U.A.E CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 311 U.A.E WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 U.A.E RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 U.A.E MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 U.A.E BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 U.A.E OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 U.A.E RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 U.A.E SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 U.A.E MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 U.A.E QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 U.A.E CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 321 U.A.E CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 322 U.A.E CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 323 U.A.E CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 324 U.A.E BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 U.A.E READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 U.A.E HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 U.A.E CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 U.A.E INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 U.A.E CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 330 U.A.E CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 331 U.A.E CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 332 U.A.E CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 333 U.A.E CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 334 U.A.E BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 U.A.E POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 U.A.E BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 U.A.E JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 U.A.E ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 U.A.E CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 340 U.A.E CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 341 U.A.E CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 342 U.A.E B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 U.A.E ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 U.A.E OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 ISRAEL CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 ISRAEL CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 347 ISRAEL WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 ISRAEL RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 ISRAEL MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 ISRAEL BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 ISRAEL OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 ISRAEL RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 ISRAEL SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 ISRAEL MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 ISRAEL QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 ISRAEL CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 357 ISRAEL CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 358 ISRAEL CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 359 ISRAEL CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 360 ISRAEL BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 ISRAEL READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 ISRAEL HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 ISRAEL CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 ISRAEL INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 ISRAEL CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 366 ISRAEL CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 367 ISRAEL CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 368 ISRAEL CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 369 ISRAEL CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 370 ISRAEL BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 ISRAEL POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 ISRAEL BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 ISRAEL JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 ISRAEL ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 ISRAEL CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 376 ISRAEL CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 377 ISRAEL CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 378 ISRAEL B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 ISRAEL ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 ISRAEL OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 KUWAIT CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 KUWAIT CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 383 KUWAIT WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 KUWAIT RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 KUWAIT MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 KUWAIT BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 KUWAIT OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 KUWAIT RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 KUWAIT SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 KUWAIT MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 KUWAIT QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 KUWAIT CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 393 KUWAIT CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 394 KUWAIT CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 395 KUWAIT CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 396 KUWAIT BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 KUWAIT READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 KUWAIT HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 KUWAIT CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 KUWAIT INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 KUWAIT CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 402 KUWAIT CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 403 KUWAIT CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 404 KUWAIT CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 405 KUWAIT CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 406 KUWAIT BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 KUWAIT POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 KUWAIT BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 KUWAIT JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 KUWAIT ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 KUWAIT CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 412 KUWAIT CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 413 KUWAIT CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 414 KUWAIT B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 KUWAIT ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 KUWAIT OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 OMAN CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 OMAN CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 419 OMAN WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 OMAN RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 OMAN MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 422 OMAN BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 OMAN OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 OMAN RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 OMAN SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 426 OMAN MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 OMAN QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 OMAN CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 429 OMAN CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 430 OMAN CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 431 OMAN CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 432 OMAN BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 433 OMAN READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 OMAN HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 OMAN CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 OMAN INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 OMAN CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 438 OMAN CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 439 OMAN CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 440 OMAN CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 441 OMAN CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 442 OMAN BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 443 OMAN POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 OMAN BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 OMAN JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 446 OMAN ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 447 OMAN CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 448 OMAN CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 449 OMAN CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 450 OMAN B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 451 OMAN ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 452 OMAN OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 453 BAHRAIN CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 454 BAHRAIN CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 455 BAHRAIN WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 456 BAHRAIN RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 457 BAHRAIN MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 458 BAHRAIN BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 459 BAHRAIN OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 460 BAHRAIN RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 461 BAHRAIN SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 462 BAHRAIN MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 463 BAHRAIN QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 464 BAHRAIN CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 465 BAHRAIN CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 466 BAHRAIN CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 467 BAHRAIN CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 468 BAHRAIN BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 469 BAHRAIN READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 BAHRAIN HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 471 BAHRAIN CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 BAHRAIN INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 473 BAHRAIN CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)