Middle East And Africa Lithium Ion Battery Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.36 Billion

USD

6.98 Billion

2024

2032

USD

2.36 Billion

USD

6.98 Billion

2024

2032

| 2025 –2032 | |

| USD 2.36 Billion | |

| USD 6.98 Billion | |

|

|

|

|

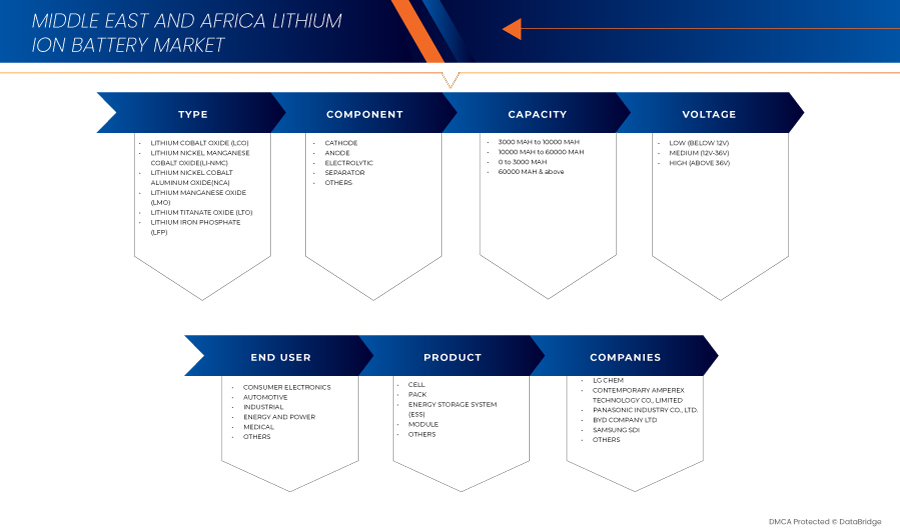

Middle East and Africa Lithium Ion Battery Market Segmentation, By Type (Lithium Cobalt Oxide (LCO), Lithium Nickel Manganese Cobalt Oxide (Li-NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate Oxide (LTO), Lithium Iron Phosphate (LFP)), Components (Cathode, Anode, Electrolyte, Separator, and Others), Capacity (3000 mAh to 10000 mAh, 10000 mAh to 60000 mAh, O to 3000 mAh, and 60000 mAh & above), Voltage (Low (Below 12V), Medium (12V-36V), and High (Above 36V)), Product (Cells, Pack, Energy Storage System (ESS), Module, and Others), End User (Consumer Electronics, Automotive, Industrial, Energy and Power, Medical, and Others) – Industry Trends and Forecast to 2032

Lithium Ion Battery Market Analysis

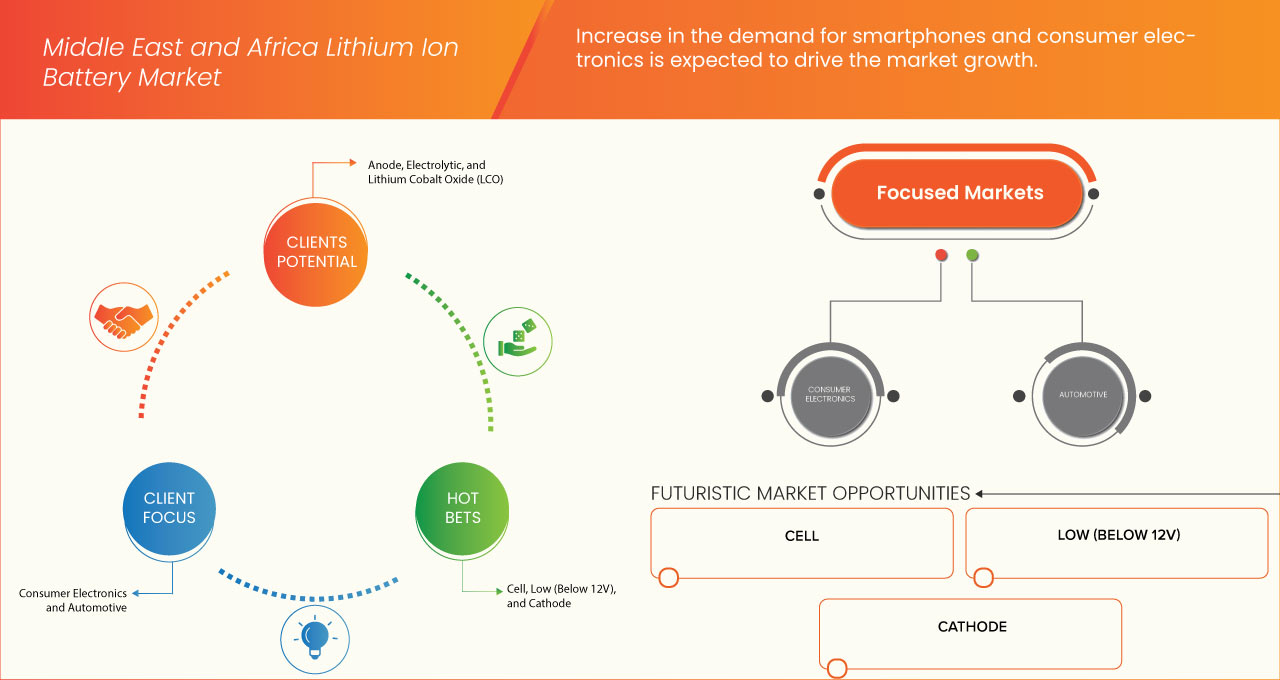

The Middle East and Africa lithium ion battery market is fragmented in nature, as it consists of many global players such as LG Chem, Contemporary Amperex Technology Co., Limited, and BYD Company Limited. among others. The presence of these companies produces competitive prices for lithium-ion battery products across the region. Due to the presence of these players at regional and international levels, suppliers and manufacturers offer products with different specifications and characteristics in all budgets. The increase in demand for smartphones and consumer electronics is driving market growth. In addition, the growing demand for smart devices and wearables is expected to drive market growth.

Safety issue related to lithium ion batteries and the availability of alternatives to lithium-ion batteries is expected to hinder the market growth. Moreover, the rapid aging and degradation of lithium-ion batteries are acting as a challenge to market growth. However, an increase in the number of R&D and manufacturing facilities, growing adoption of renewable energy in the region, and an increase in partnership, acquisitions, and collaboration among market players are estimated to provide opportunities for market growth.

Lithium Ion Battery Market Size

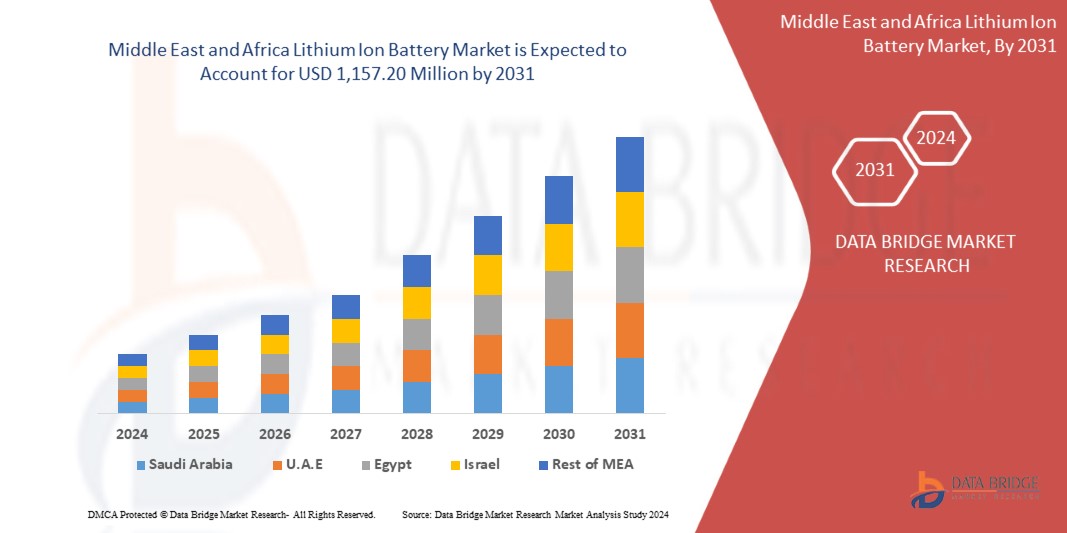

Middle East and Africa lithium ion battery market size was valued at USD 2.36 billion in 2024 and is projected to reach USD 6.98 billion by 2032, with a CAGR of 14.7% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Lithium Ion Battery Market Trends

“Increase in the Demand for Smartphones and Consumer Electronics”

The demands and requirements of consumer electronics have continued to increase at an exponential rate. Lithium ion batteries are common in consumer electronics. They are one of the most popular types of rechargeable batteries for portable electronics, with proper energy-to-weight ratios, high open-circuit voltage, and low self-discharge rate. Advancements in technology have compacted the size of electronic devices, making them slimer and lighter, which is increasing the requirement for lithium ion batteries. These batteries last longer, charge faster, and have a higher power density for more battery life in a lighter package.

Moreover, 1 kg of a lithium ion battery can store up to 150 watt-hours of electricity whereas the lead-acid battery can store only 25 watt-hours per kg. The benefits offered by lithium ion batteries have increased the requirement in consumer electronics. As people are becoming more inclined towards digitalization, more advanced electronics are being developed. This trend increase the demand for smartphones and consumer electronics and expected to boost the market growth.

Report Scope and Lithium Ion Battery Market Segmentation

|

Attributes |

Lithium Ion Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E., South Africa, Saudi Arabia, Egypt, Turkey, Israel, Qatar, Kuwait, Oman, Iraq, Jordan, Lebanon, Georgia, Armenia, Yemen, and Rest of Middle East & Africa |

|

Key Market Players |

LG Chem (South Korea), Contemporary Amperex Technology Co., Limited (China), Panasonic Industry Co., Ltd. (Japan), BYD Company Ltd. (China), SAMSUNG SDI (South Korea), Saft (France), Lithium Energy Japan (Japan), VARTA AG (Germany), Amperex Technology Limited (China), GlobTek, Inc. (U.S.), Leclanché SA (Switzerland), LITHIUMWERKS (Netherlands), TOSHIBA CORPORATION (Japan), Xiamen Tmax Battery Equipments Limited (China), Jiangxi JingJiu Power Science & Technology Co.,LTD. (China), Shenzhen Grepow Battery Co., Ltd. (China), Shuangdeng Group Co,Ltd (China), Codi Energy Ltd. (China), Exide Technologies (U.S.), and SK Inc. (South Korea) among others |

|

Market Opportunities |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Definición del mercado de baterías de iones de litio

Una batería de iones de litio está compuesta por iones de litio que se desplazan desde el electrodo negativo al electrodo positivo a través del electrolito durante la carga y se desplazan hacia atrás en el momento de la carga. Estas baterías son recargables y se utilizan habitualmente en productos electrónicos de consumo y automóviles. Consta de cuatro componentes: cátodo, ánodo, separador y electrolito. El ánodo ayuda a almacenar y liberar iones de litio del cátodo, lo que permite el paso de corriente a través de un circuito externo.

Dinámica del mercado de baterías de iones de litio

Conductores

- Creciente demanda de dispositivos inteligentes y wearables

Los fabricantes de baterías de iones de litio están produciendo baterías más flexibles que se pueden doblar y enrollar. Estas características que ofrecen los fabricantes han aumentado la demanda de dispositivos inteligentes y wearables. El uso de baterías se limitaba hasta ahora a formas voluminosas y rígidas, que han cambiado con tecnologías más avanzadas y mediante I+D. Además, con el crecimiento creciente de IoT y 5G, la adopción de dispositivos inteligentes ha aumentado, lo que ha llevado al crecimiento del mercado. Las empresas están lanzando nuevas baterías que son adecuadas para wearables y otros dispositivos inteligentes, lo que conduce al crecimiento del mercado.

Por ejemplo,

En agosto de 2024, la empresa alemana de baterías de litio y azufre Theion abrió una oficina en Dubái para expandirse en la región del Golfo y promover su tecnología de baterías a base de azufre, de alta densidad energética y rentable. Al utilizar azufre, un subproducto local, Theion redujo los costos en un 99 % en comparación con los materiales convencionales. Esta innovación respaldó el mercado de baterías de iones de litio de Oriente Medio y África, abordando la creciente demanda de teléfonos inteligentes y productos electrónicos de consumo y fomentando al mismo tiempo la transición energética regional.

- Enorme demanda de automóviles en toda la región

Las baterías de iones de litio pueden almacenar mucha más energía y pesan una fracción del peso en comparación con las baterías de plomo-ácido tradicionales, lo que las hace muy adecuadas para automóviles, vehículos híbridos y vehículos eléctricos. Características como el tamaño compacto y la alta potencia que ofrecen las hacen muy adecuadas para varios vehículos eléctricos y bicicletas eléctricas. Las baterías han desempeñado un papel dominante en la industria automotriz, especialmente en el mercado de repuestos; la demanda de baterías eficientes aumenta continuamente con el creciente número de vehículos. La industria automotriz está en expansión y, con el aumento de la población, se requieren más automóviles, lo que impulsa el crecimiento del mercado.

Por ejemplo,

En septiembre de 2022, la Zona Franca de Jebel Ali (Jafza) impulsó el mercado automotriz con una infraestructura logística de clase mundial, facilitando el comercio de más de 1,2 millones de toneladas métricas de vehículos en 2021, por un valor de 12 400 millones de dólares. Conectó los mercados de África, Asia y Oriente Medio con los consumidores globales a través de sistemas multimodales como puertos, aeropuertos y redes ferroviarias. Jafza apoyó las exportaciones de automóviles usados, y se proyecta que el mercado de los EAU alcance los 112 000 millones de AED para 2025. El papel del centro en el comercio automotriz fortaleció la demanda de baterías de iones de litio, que fue impulsada por la creciente adopción de automóviles en toda la región. DP World mejoró la eficiencia de la cadena de suministro a través de la logística y las redes comerciales globales.

Oportunidad

- Aumento del número de instalaciones de I+D y fabricación por parte de los actores del mercado

Las baterías de iones de litio tienen una amplia gama de aplicaciones y, gracias a un mayor esfuerzo en I+D, se están desarrollando características más avanzadas. Las empresas están construyendo nuevas instalaciones de fabricación para satisfacer la creciente demanda de baterías de iones de litio en aplicaciones de vehículos eléctricos, dispositivos médicos y comunicación de datos. Las nuevas instalaciones y el aumento de la I+D están creando nuevas oportunidades para el crecimiento del mercado.

Por ejemplo,

En febrero de 2024, Arabia Saudita y Marruecos avanzaron en su papel en la cadena de suministro de baterías de iones de litio, aprovechando minerales críticos e inversiones respaldadas por el Estado. Arabia Saudita aumentó sus estimaciones de recursos minerales a 2,5 billones de dólares y amplió las capacidades de exploración minera, midstream y downstream, incluida una instalación de ánodos de grafito. Marruecos capitalizó sus reservas de fosfato para atraer inversiones en baterías para vehículos eléctricos. Estos esfuerzos se alinearon con la creciente demanda de teléfonos inteligentes y productos electrónicos de consumo, lo que impulsó el mercado de baterías de iones de litio de Oriente Medio y África.

Restricción/Desafío

- Envejecimiento y degradación rápidos de las baterías de iones de litio

El envejecimiento y la degradación han sido una preocupación importante para los fabricantes de baterías de iones de litio, ya que la vida útil estimada típica de una batería de iones de litio es de aproximadamente dos a tres años o de 300 a 500 ciclos de carga, lo que ocurra primero. Un ciclo de carga es un período de uso desde que está completamente cargada, hasta que está completamente descargada y se vuelve a cargar completamente. La batería ofrece alta potencia y eficiencia energética, pero es muy propensa a degradarse en temperaturas extremas. Además, el envejecimiento está afectando el crecimiento del mercado y actuando como un desafío significativo para el crecimiento del mercado.

Por ejemplo,

Según un informe de la Royal Society of Chemistry, la degradación del rendimiento a lo largo de la vida útil de las baterías de iones de litio es inevitable y, en última instancia, tiene su origen en procesos químicos. Su alcance está determinado principalmente por los componentes del material de la batería y las condiciones de funcionamiento (velocidades de carga/descarga, límites de funcionamiento de voltaje y temperatura) y también puede verse influenciado por el diseño de la batería. Esto puede obligar al consumidor a inclinarse por otras opciones, como las baterías AGM.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de baterías de iones de litio

El mercado está segmentado en seis segmentos notables según el tipo, los componentes, la capacidad, el voltaje, el producto y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Óxido de litio y cobalto (LCO)

- Óxido de litio, níquel, manganeso y cobalto (Li-NMC)

- Óxido de litio, níquel, cobalto y aluminio (NCA)

- Óxido de litio y manganeso (LMO)

- Óxido de titanato de litio (LTO)

- Fosfato de hierro y litio (LFP)

Componentes

- Cátodo

- Ánodo

- Electrolítico

- Separador

- Otro

Capacidad

- 3000 mAh a 10000 mAh

- 10000 a 60000 mAh

- 0 a 3000 mAh

- 60000 mAh y más

Voltaje

- Bajo (por debajo de 12 V)

- Mediano (12 V-36 V)

- Alto (por encima de 36 V)

Producto

- Células

- Celda cilíndrica

- Celda prismática

- Célula de bolsa

- Pila de botón

- Embalar

- Sistema de almacenamiento de energía (ESS)

- Módulo

- Otro

Usuario final

- Electrónica de consumo

- Por el usuario final

- Teléfonos inteligentes

- Computadoras portátiles y tabletas

- Cámaras electrónicas

- Unión Postal Universal

- Otros

- Por el usuario final

- Automotor

- Por tipo de propulsión

- Vehículos eléctricos de batería (VEB)

- Vehículo eléctrico híbrido enchufable (PHEV)

- Vehículos eléctricos híbridos (HEV)

- Por tipo de vehículo

- Automóviles de pasajeros

- Por tipo

- Todoterreno

- Sedán

- Portón trasero

- Otros

- Por tipo

- Bicicletas eléctricas, patinetes eléctricos y ciclomotores

- Vehículos comerciales ligeros

- Por tipo

- Todoterreno

- Sedán

- Portón trasero

- Otros

- Por tipo

- Vehículos comerciales pesados

- Por tipo

- Todoterreno

- Sedán

- Portón trasero

- Otros

- Por tipo

- Patinete eléctrico de 3 ruedas

- Otros

- Automóviles de pasajeros

- Por tipo de propulsión

- Industrial

- Por tipo

- Construcción

- Minería

- Marina

- Aeroespacial y Defensa

- Otros

- Por tipo

- Energía y potencia

- Por tipo

- Red inteligente

- Por tipo

- Almacenamiento de energía renovable

- Almacenamiento de energía no renovable

- Por tipo

- Fuera de la red

- Otros

- Red inteligente

- Por tipo

- Médico

- Otros

Análisis regional del mercado de baterías de iones de litio

El mercado de baterías de iones de litio de Medio Oriente y África está segmentado en seis segmentos notables según el tipo, los componentes, la capacidad, el voltaje, el producto y el usuario final, como se mencionó anteriormente.

Los países cubiertos en el mercado son Emiratos Árabes Unidos, Sudáfrica, Arabia Saudita, Egipto, Turquía, Israel, Qatar, Kuwait, Omán, Irak, Jordania, Líbano, Georgia, Armenia, Yemen y el resto de Medio Oriente y África.

Se prevé que los Emiratos Árabes Unidos lideren el mercado de baterías de iones de litio en Oriente Medio y África. Este crecimiento se puede atribuir a varios factores, entre ellos la rápida industrialización, la creciente adopción de la automatización en varios sectores y un mayor énfasis en la industria.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Lithium Ion Battery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Lithium Ion Battery Market Leaders Operating in the Market Are:

- LG Chem (South Korea)

- Contemporary Amperex Technology Co., Limited (China)

- Panasonic Industry Co., Ltd. (Japan)

- BYD Company Ltd. (China)

- SAMSUNG SDI (South Korea)

- Saft (France)

- Lithium Energy Japan (Japan)

- VARTA AG (Germany)

- Amperex Technology Limited (China)

- GlobTek, Inc. (U.S.)

- Leclanché SA (Switzerland)

- LITHIUMWERKS (Netherlands)

- TOSHIBA CORPORATION (Japan)

- Xiamen Tmax Battery Equipments Limited (China)

- Jiangxi JingJiu Power Science & Technology Co.,LTD. (China)

- Shenzhen Grepow Battery Co., Ltd. (China)

- Shuangdeng Group Co,Ltd (China)

- Codi Energy Ltd. (China)

- Exide Technologies (U.S.)

- SK Inc. (South Korea)

Latest Developments in Lithium Ion Battery Market

- In April 2023, Contemporary Amperex Technology Co., Limited condensed battery, boasting up to 500 Wh/kg energy density, revolutionizes aviation electrification, ensuring safety and efficiency. Leveraging biomimetic electrolytes and innovative materials, it overcomes previous limitations, paving the way for mass production and application in electric passenger aircrafts. This breakthrough marks a pivotal moment in achieving universal electrification across transportation sectors, advancing towards global carbon neutrality goals

- In January 2023, the LG Chem project won the FDI deal of the year award. This recognition made a significant impact on the growth of the company's image as well as the growth of the Middle East and Africa lithium ion battery market

- En octubre de 2021, SAMSUNG SDI y Stellantis crearon una empresa conjunta para la producción de baterías de iones de litio en América del Norte y la región de Oriente Medio. Esta empresa incluye varias plantas de producción de baterías de iones de litio y centros de investigación. Este desarrollo tuvo un impacto positivo en la empresa, así como en el crecimiento del mercado de baterías de iones de litio de Oriente Medio y África.

- En noviembre de 2023, BYD Company Ltd. demostró su expansión estratégica en Oriente Medio, aprovechando las alianzas con empresas automotrices chinas como BeyonCa, Pony.ai y Nio para acceder a los lucrativos mercados de Arabia Saudita y los Emiratos Árabes Unidos. Al mismo tiempo, la colaboración de BYD con entidades financieras de Oriente Medio como Mubadala Investment Company y el Fondo de Inversión Pública Saudí señala un compromiso con la profundización de los lazos económicos y el fomento del crecimiento y la innovación dentro de la industria automotriz.

- En diciembre de 2023, Panasonic Corporation y Sila colaboraron para el suministro de ánodos de silicio, vitales para las baterías de iones de litio que alimentan los vehículos eléctricos. Con el plan de Panasonic de aumentar la producción de baterías a 200 GWh para 2030-31, esta colaboración destaca el papel crucial de las baterías de iones de litio en la industria de los vehículos eléctricos. Como importante proveedor de Tesla, la asociación de Panasonic subraya el impulso de la industria hacia un transporte sostenible

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 END USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY FRAMEWORK

4.2 TECHNOLOGICAL TRENDS

4.3 LIST OF KEY BUYERS IN MIDDLE EAST AND AFRICA REGION

4.4 VALUE CHAIN ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 PESTEL ANALYSIS

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 RAW MATERIAL OUTLOOK

4.9 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS

5.1.2 GROWING DEMAND FOR SMART DEVICES AND WEARABLE

5.1.3 HUGE DEMAND FOR AUTOMOTIVE ACROSS THE REGION

5.1.4 RISE IN REQUIREMENT FOR LITHIUM ION BATTERIES IN INDUSTRIAL AND MEDICAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 SAFETY ISSUES RELATED TO LITHIUM ION BATTERIES

5.2.2 AVAILABILITY OF ALTERNATIVES OF LITHIUM ION BATTERIES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN THE NUMBER OF R&D AND MANUFACTURING FACILITIES BY MARKET PLAYERS

5.3.2 GROWING ADOPTION OF RENEWABLE ENERGY IN THE REGION

5.3.3 INCREASE IN PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 RAPID AGING AND DEGRADATION OF LITHIUM ION BATTERIES

6 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE

6.1 OVERVIEW

6.2 LITHIUM COBALT OXIDE (LCO)

6.3 LITHIUM NICKEL MANGANESE COBALT OXIDE (LI-NMC)

6.4 LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA)

6.5 LITHIUM MANGANESE OXIDE (LMO)

6.6 LITHIUM TITANATE OXIDE (LTO)

6.7 LITHIUM IRON PHOSPHATE (LFP)

7 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 CATHODE

7.3 ANODE

7.4 ELECTROLYTIC

7.5 SEPARATOR

7.6 OTHERS

8 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY,

8.1 OVERVIEW

8.2 3000 MAH TO 10000 MAH

8.3 10000 MAH TO 60000 MAH

8.4 0 TO 3000 MAH

8.5 60000 MAH & ABOVE

9 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE

9.1 OVERVIEW

9.2 LOW (BELOW 12V)

9.3 MEDIUM (12V-36V)

9.4 HIGH (ABOVE 36V)

10 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 CELL

10.2.1 CYLINDRICAL CELL

10.2.2 PRISMATIC CELL

10.2.3 POUCH CELL

10.2.4 BUTTON CELL

10.3 PACK

10.4 ENERGY STORAGE SYSTEM (ESS)

10.5 MODULE

10.6 OTHERS

11 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY END USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 SMARTPHONES

11.2.2 LAPTOPS & TABLETS

11.2.3 ELECTRONIC CAMERAS

11.2.4 UPS

11.2.5 OTHERS

11.3 AUTOMOTIVE

11.3.1 AUTOMOTIVE, PROPULSION TYPE

11.3.1.1 BATTERY ELECTRIC VEHICLES (BEV)

11.3.1.2 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

11.3.1.3 HYBRID ELECTRIC VEHICLES (HEV)

11.3.2 AUTOMOTIVE, VEHICLE TYPE

11.3.2.1 PASSENGER CARS

11.3.2.1.1 PASSENGER CARS,TYPE

11.3.2.1.1.1 SUV

11.3.2.1.1.2 SEDAN

11.3.2.1.1.3 HATCHBACK

11.3.2.1.1.4 OTHERS

11.3.2.2 E-BIKES/ E-SCOOTER/MOPEDS

11.3.2.3 LIGHT COMMERCIAL VEHICLES

11.3.2.3.1 LIGHT COMMERCIAL VEHICLES,TYPE

11.3.2.3.1.1 SUV

11.3.2.3.1.2 SEDAN

11.3.2.3.1.3 HATCHBACK

11.3.2.3.1.4 OTHERS

11.3.2.4 HEAVY COMMERCIAL VEHICLES

11.3.2.4.1 HEAVY COMMERCIAL VEHICLES,TYPE

11.3.2.4.1.1 SUV

11.3.2.4.1.2 SEDAN

11.3.2.4.1.3 HATCHBACK

11.3.2.4.1.4 OTHERS

11.3.2.5 3-WHEELED ELECTRIC SCOOTER

11.3.2.6 OTHERS

11.4 INDUSTRIAL

11.4.1 CONSTRUCTION

11.4.2 MINING

11.4.3 MARINE

11.4.4 AEROSPACE AND DEFENSE

11.4.5 OTHERS

11.5 ENERGY AND POWER

11.5.1 SMART GRID

11.5.1.1 RENEWABLE ENERGY STORAGE

11.5.1.2 NON-RENEWABLE ENERGY STORAGE

11.5.2 OFF GRID

11.5.3 OTHERS

11.6 MEDICAL

11.7 OTHERS

12 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COUNTRY

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E

12.1.2 SOUTH AFRICA

12.1.3 SAUDI ARABIA

12.1.4 EGYPT

12.1.5 TURKEY

12.1.6 ISRAEL

12.1.7 QATAR

12.1.8 KUWAIT

12.1.9 OMAN

12.1.10 IRAQ

12.1.11 JORDAN

12.1.12 LEBANON

12.1.13 GEORGIA

12.1.14 ARMENIA

12.1.15 YEMEN

12.1.16 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 SOLUTION PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 LG CHEM

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 SAMSUNG SDI

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 BYD COMPANY LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 PANASONIC INDUSTRY CO., LTD.

15.5.1 SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 AMPEREX TECHNOLOGY LIMITED

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 CODI ENERGY LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 EXIDE TECHNOLOGIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 GLOBTEK, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 JIANGXI JINGJIU POWER SCIENCE& TECHNOLOGY CO.LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 LECLANCHÉ SA

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 LITHIUM ENERGY JAPAN

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 LITHIUMWERKS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 SAFT

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SHENZHEN GREPOW BATTERY CO., LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SHUANGDENG GROUP CO,LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SK INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TOSHIBA CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 VARTA AG

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 XIAMEN TMAX BATTERY EQUIPMENTS LIMITED

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 CERTIFICATION/RULE/ APPENDIX

TABLE 2 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 4 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND

TABLE 6 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COUNTRY, 2022-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COUNTRY, 2022-2032 (THOUSAND UNITS)

TABLE 21 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 23 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 38 U.A.E LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 39 U.A.E LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 40 U.A.E LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 41 U.A.E LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 42 U.A.E LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 43 U.A.E LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 44 U.A.E CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 45 U.A.E LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 46 U.A.E CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 47 U.A.E AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 48 U.A.E AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 49 U.A.E PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 50 U.A.E LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 51 U.A.E HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 52 U.A.E INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 53 U.A.E ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 54 U.A.E SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 55 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 56 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 57 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 58 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 59 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 60 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 61 SOUTH AFRICA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 62 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 63 SOUTH AFRICA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 64 SOUTH AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 65 SOUTH AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 66 SOUTH AFRICA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 67 SOUTH AFRICA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 68 SOUTH AFRICA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 69 SOUTH AFRICA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 70 SOUTH AFRICA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 71 SOUTH AFRICA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 74 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 75 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 76 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 77 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 78 SAUDI ARABIA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 79 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 80 SAUDI ARABIA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 81 SAUDI ARABIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 82 SAUDI ARABIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 83 SAUDI ARABIA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 84 SAUDI ARABIA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 85 SAUDI ARABIA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 86 SAUDI ARABIA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 87 SAUDI ARABIA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 88 SAUDI ARABIA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 89 EGYPT LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 90 EGYPT LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 91 EGYPT LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 92 EGYPT LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 93 EGYPT LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 94 EGYPT LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 95 EGYPT CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 96 EGYPT LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 97 EGYPT CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 98 EGYPT AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 99 EGYPT AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 100 EGYPT PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 101 EGYPT LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 102 EGYPT HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 103 EGYPT INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 104 EGYPT ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 105 EGYPT SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 106 TURKEY LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 107 TURKEY LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 108 TURKEY LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 109 TURKEY LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 110 TURKEY LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 111 TURKEY LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 112 TURKEY CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 113 TURKEY LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 114 TURKEY CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 115 TURKEY AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 116 TURKEY AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 117 TURKEY PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 118 TURKEY LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 119 TURKEY HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 120 TURKEY INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 121 TURKEY ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 122 TURKEY SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 123 ISRAEL LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 124 ISRAEL LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 125 ISRAEL LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 126 ISRAEL LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 127 ISRAEL LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 128 ISRAEL LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 129 ISRAEL CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 130 ISRAEL LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 131 ISRAEL CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 132 ISRAEL AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 133 ISRAEL AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 134 ISRAEL PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 135 ISRAEL LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 136 ISRAEL HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 137 ISRAEL INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 138 ISRAEL ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 139 ISRAEL SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 140 QATAR LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 141 QATAR LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 142 QATAR LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 143 QATAR LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 144 QATAR LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 145 QATAR LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 146 QATAR CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 147 QATAR LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 148 QATAR CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 149 QATAR AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 150 QATAR AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 151 QATAR PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 152 QATAR LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 153 QATAR HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 154 QATAR INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 155 QATAR ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 156 QATAR SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 157 KUWAIT LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 158 KUWAIT LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 159 KUWAIT LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 160 KUWAIT LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 161 KUWAIT LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 162 KUWAIT LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 163 KUWAIT CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 164 KUWAIT LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 165 KUWAIT CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 166 KUWAIT AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 167 KUWAIT AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 168 KUWAIT PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 169 KUWAIT LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 170 KUWAIT HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 171 KUWAIT INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 172 KUWAIT ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 173 KUWAIT SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 174 OMAN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 175 OMAN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 176 OMAN LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 177 OMAN LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 178 OMAN LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 179 OMAN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 180 OMAN CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 181 OMAN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 182 OMAN CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 183 OMAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 184 OMAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 185 OMAN PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 186 OMAN LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 187 OMAN HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 188 OMAN INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 189 OMAN ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 190 OMAN SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 191 IRAQ LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 192 IRAQ LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 193 IRAQ LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 194 IRAQ LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 195 IRAQ LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 196 IRAQ LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 197 IRAQ CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 198 IRAQ LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 199 IRAQ CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 200 IRAQ AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 201 IRAQ AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 202 IRAQ PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 203 IRAQ LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 204 IRAQ HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 205 IRAQ INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 206 IRAQ ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 207 IRAQ SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 208 JORDAN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 209 JORDAN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 210 JORDAN LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 211 JORDAN LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 212 JORDAN LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 213 JORDAN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 214 JORDAN CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 215 JORDAN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 216 JORDAN CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 217 JORDAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 218 JORDAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 219 JORDAN PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 220 JORDAN LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 221 JORDAN HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 222 JORDAN INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 223 JORDAN ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 224 JORDAN SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 225 LEBANON LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 226 LEBANON LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 227 LEBANON LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 228 LEBANON LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 229 LEBANON LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 230 LEBANON LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 231 LEBANON CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 232 LEBANON LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 233 LEBANON CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 234 LEBANON AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 235 LEBANON AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 236 LEBANON PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 237 LEBANON LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 238 LEBANON HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 239 LEBANON INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 240 LEBANON ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 241 LEBANON SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 242 GEORGIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 243 GEORGIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 244 GEORGIA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 245 GEORGIA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 246 GEORGIA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 247 GEORGIA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 248 GEORGIA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 249 GEORGIA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 250 GEORGIA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 251 GEORGIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 252 GEORGIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 253 GEORGIA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 254 GEORGIA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 255 GEORGIA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 256 GEORGIA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 257 GEORGIA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 258 GEORGIA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 259 ARMENIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 260 ARMENIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 261 ARMENIA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 262 ARMENIA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 263 ARMENIA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 264 ARMENIA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 265 ARMENIA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 266 ARMENIA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 267 ARMENIA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 268 ARMENIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 269 ARMENIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 270 ARMENIA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 271 ARMENIA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 272 ARMENIA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 273 ARMENIA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 274 ARMENIA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 275 ARMENIA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 276 YEMEN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 277 YEMEN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 278 YEMEN LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 279 YEMEN LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 280 YEMEN LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 281 YEMEN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 282 YEMEN CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 283 YEMEN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 284 YEMEN CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 285 YEMEN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 286 YEMEN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 287 YEMEN PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 288 YEMEN LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 289 YEMEN HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 290 YEMEN INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 291 YEMEN ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 292 YEMEN SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 293 REST OF MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: END USER COVERAGE GRID ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: MULTIVARIATE MODELLING

FIGURE 11 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: TYPE TIMELINE CURVE

FIGURE 12 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: SEGMENTATION

FIGURE 13 SIX SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE (2024)

FIGURE 14 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 THE INCREASE IN DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS IS EXPECTED TO BE A KEY DRIVER FOR THE GROWTH OF THE MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET IN THE FORECAST PERIOD OF 2025 AND 2032

FIGURE 17 THE LITHIUM COBALT OXIDE (LCO) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET FROM 2025 TO 2032

FIGURE 18 TECHNOLOGICAL TRENDS IN AUTOMOTIVE BATTERY MANAGEMENT

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET

FIGURE 20 PROJECTION OF STEADY GROWTH IN DEMAND FOR CONSUMER ELECTRONICS (2015-2025)

FIGURE 21 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2024

FIGURE 23 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2024

FIGURE 24 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2024

FIGURE 25 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: BY PRODUCT, 2024

FIGURE 26 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: BY END USER, 2024

FIGURE 27 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: SNAPSHOT (2024)

FIGURE 28 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.