Middle East And Africa Nuts Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.49 Billion

USD

5.11 Billion

2024

2032

USD

3.49 Billion

USD

5.11 Billion

2024

2032

| 2025 –2032 | |

| USD 3.49 Billion | |

| USD 5.11 Billion | |

|

|

|

|

Segmentación del mercado de frutos secos de Oriente Medio y África, por tipo de producto (frutos secos, cacahuetes, frutos secos híbridos/otros y otros), forma (enteros, mantequilla, molidos, mitades, trozos, aceite, leche, pasta, crema, trozos tostados, recubiertos, harina, polvo, picados, rebanados, en cubos, triturados, blanqueados enteros, congelados, secados por aspersión, encapsulados y otros), naturaleza (convencional y orgánico), método de procesamiento (crudos, tostados, salados, blanqueados, aromatizados, sin sal, glaseados, confitados, caramelizados, ahumados, germinados, fermentados, liofilizados, encurtidos, fritos al vacío, deshidratados y otros), grado (grado A (calidad de exportación premium), grado B (uso doméstico de calidad media), grado roto (uso en panadería y confitería), grado de aceite, grado industrial, grado rechazado (alimento animal)), vida útil (

Tamaño del mercado de frutos secos

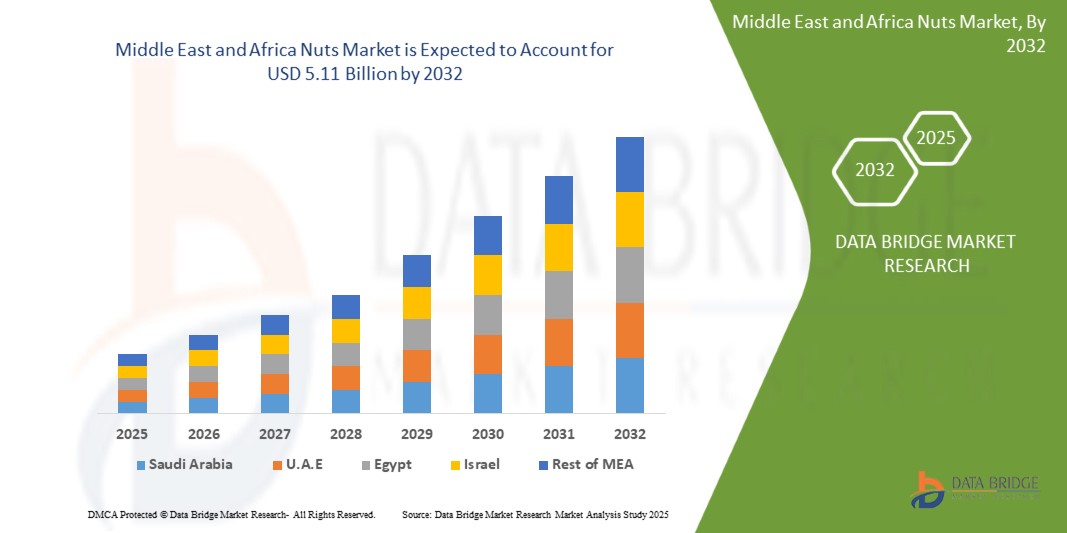

- El tamaño del mercado de nueces de Oriente Medio y África se valoró en 3.490 millones de dólares en 2024 y se espera que alcance los 5.110 millones de dólares en 2032 , con una CAGR del 5,0 % durante el período de pronóstico.

- El mercado de los frutos secos se ve impulsado principalmente por la creciente concienciación sobre sus beneficios para la salud, ya que son una fuente rica de fibra, proteínas, minerales, vitaminas y otros antioxidantes. Son una buena fuente de grasas saturadas y contribuyen a la salud cardiovascular. Los consumidores suelen ser conscientes de las preferencias por los snacks veganos en todo el mundo.

Análisis del mercado de frutos secos

- Un fruto seco es una fruta compuesta por una cáscara dura no comestible y una semilla comestible. Son una buena fuente de grasas saludables, fibra y otros nutrientes beneficiosos. Cada tipo de fruto seco ofrece diferentes beneficios. Los frutos secos se encuentran entre las mejores fuentes de proteínas vegetales. Una dieta rica en frutos secos ayuda a prevenir factores de riesgo como la inflamación o algunas enfermedades crónicas.

- Comer frutos secos con regularidad mejora la salud en muchos sentidos, como reducir el riesgo de diabetes y enfermedades cardíacas, así como los niveles de colesterol y triglicéridos. A pesar de su alto contenido calórico, este nutritivo tratamiento rico en fibra también puede ayudar a perder peso.

- Los Emiratos Árabes Unidos son uno de los principales mercados de frutos secos en Oriente Medio, contribuyendo significativamente a los ingresos regionales. El alto consumo de frutos secos durante el Ramadán y otras festividades culturales impulsa una demanda constante. Los consumidores prefieren variedades de frutos secos de alta calidad y con sabor, como pistachos tostados, almendras y anacardos, que suelen encontrarse en cadenas minoristas, paquetes de regalo de lujo y en el sector de la hostelería.

- Arabia Saudita representa una parte importante del mercado de frutos secos en Oriente Medio, impulsada por su tradición de incluirlos en dietas diarias, eventos festivos y ofertas de hostelería. Los dátiles rellenos de almendras o nueces son especialmente populares.

- Se espera que el segmento de frutos secos domine el mercado debido a su amplia disponibilidad, asequibilidad y extensa variedad de productos.

Alcance del informe y segmentación del mercado de frutos secos

|

Atributos |

Perspectivas clave del mercado de frutos secos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de frutos secos

Tendencia creciente hacia refrigerios más saludables y opciones nutritivas

- El mercado de los frutos secos está en rápido crecimiento, impulsado por las crecientes tendencias de snacks saludables. Los consumidores buscan snacks nutritivos y prácticos, y los frutos secos se adaptan perfectamente a esta demanda gracias a su alto contenido en proteínas, fibra y grasas saludables. A medida que aumenta la concienciación sobre el bienestar, los frutos secos se están convirtiendo en la opción preferida para picar sin remordimientos, impulsando el crecimiento del mercado y fomentando la innovación en la oferta de productos.

- Un factor clave de la popularidad de los frutos secos como refrigerio es la creciente concienciación sobre la salud entre los consumidores. Valorados por su contenido nutricional, los frutos secos se consideran una alternativa saludable a los refrigerios tradicionales. Son ricos en vitaminas, minerales, fibra y proteínas esenciales, y contienen grasas monoinsaturadas y poliinsaturadas cardiosaludables. Su portabilidad y practicidad los hacen ideales para estilos de vida ajetreados, ofreciendo una solución rápida y nutritiva para un refrigerio durante todo el día.

- Por ejemplo, en junio de 2024, según Business Standard Private Ltd., Nutraj anunció el lanzamiento de su nuevo producto, el "NutrajSnackrite Daily Nutrition Pack". Este paquete, cuidadosamente diseñado, contiene prácticas bolsitas llenas de una deliciosa y nutritiva mezcla de frutos secos, que combina una variedad de frutos secos y frutas deshidratadas de primera calidad. Dirigido a consumidores preocupados por su salud, ofrece una opción perfecta para llevar que aporta nutrientes esenciales y energía durante todo el día, satisfaciendo la creciente demanda de opciones de refrigerios saludables y sabrosos.

Dinámica del mercado de frutos secos

Conductor

Aumento del consumo diario de diversos productos derivados de los frutos secos

- El mercado de frutos secos en Oriente Medio y África está experimentando un crecimiento significativo, impulsado principalmente por el aumento del consumo mundial de frutos secos. Uno de los factores clave de este auge es la creciente concienciación de los consumidores sobre sus beneficios para la salud.

- Además, la transición hacia una alimentación basada en plantas y limpia ha popularizado los frutos secos como refrigerio natural y saludable. La comodidad también juega un papel crucial, ya que son fáciles de llevar y consumir en cualquier lugar, adaptándose a la perfección al ajetreado estilo de vida moderno. Asimismo, la innovación en productos, incluyendo nuevos sabores, envases y opciones listas para consumir, ha ampliado su atractivo, animando a más consumidores a incorporar frutos secos en su dieta diaria e impulsando la expansión del mercado en Oriente Medio y África.

- Por ejemplo, en septiembre de 2024, según Forbes Media LLC, Daily Crunch recaudó 4 millones de dólares en una ronda de financiación Serie A para impulsar su expansión en el creciente mercado de snacks de frutos secos. La inversión se centra en ampliar su gama de snacks de frutos secos germinados, como almendras, nueces y anacardos, aumentar la producción y la disponibilidad en tiendas para satisfacer la creciente demanda de productos de frutos secos nutritivos para llevar en Oriente Medio y África.

Restricción/Desafío

La volatilidad de los precios frena el crecimiento del mercado de frutos secos .

- La volatilidad de los precios es un factor importante que frena el crecimiento del mercado de frutos secos en Oriente Medio y África. La fluctuación de los precios, impulsada por fenómenos meteorológicos impredecibles como sequías, inundaciones y heladas, interrumpe las cadenas de suministro y genera incertidumbre tanto para productores como para compradores. Por ejemplo, las condiciones adversas en las principales regiones productoras han provocado una reducción de la producción y un fuerte aumento de los precios, lo que dificulta a los fabricantes mantener la estabilidad de los costes de los productos.

- Además, las tensiones comerciales y los aranceles cambiantes exacerban aún más la inestabilidad de los precios, lo que limita la expansión del mercado. Esta imprevisibilidad desalienta la inversión y dificulta la planificación a largo plazo del sector. Como resultado, los consumidores pueden enfrentarse a precios más altos o a una menor disponibilidad, lo que puede frenar la demanda. Abordar la volatilidad de los precios es crucial para garantizar un crecimiento constante y la sostenibilidad del mercado de frutos secos en Oriente Medio y África.

- Por ejemplo, en junio de 2024, según el SGGP, la Asociación del Anacardo de Vietnam (VINACAS) creó un grupo de trabajo específico para abordar las fluctuaciones de precios de los anacardos crudos. Este grupo colabora con el gobierno y los ministerios para estabilizar los precios, con el objetivo de reducir las interrupciones en la cadena de suministro y promover el crecimiento sostenible de la industria del anacardo en Vietnam.

Alcance del mercado de frutos secos

El mercado de nueces de Medio Oriente y África está segmentado en doce segmentos notables según el tipo de producto, forma, naturaleza, método de procesamiento, grado, vida útil, certificación, empaque, tamaño del empaque, rango de precios, uso final y canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado de frutos secos se segmenta en frutos secos de árbol, cacahuetes, frutos secos híbridos/de otro tipo, entre otros. Se proyecta que este segmento domine el mercado con una cuota de mercado del 52,39 % en 2025, impulsado por la amplia popularidad y disponibilidad de almendras, anacardos, nueces, pistachos y otras variedades. Su consolidado papel en la dieta mundial, sumado a su alto valor nutricional y su creciente uso en refrigerios saludables, convierte a los frutos secos en la categoría preferida.

- Por formulario

Según su presentación, el mercado se segmenta en frutos secos enteros, mantequilla, molidos, mitades, trozos, aceite, leche, pasta, crema, trozos tostados, rebozados, harina, polvo, picados, rebanados, en cubos, triturados, blanqueados, congelados, deshidratados por aspersión, encapsulados, entre otros. En 2025, se prevé que el segmento entero lidere el segmento de frutos secos con una cuota de mercado del 11,99%, impulsado por la creciente concienciación sobre la salud y la preferencia de los consumidores por alimentos sin procesar y de etiqueta limpia. Los frutos secos enteros ofrecen comodidad, atractivo visual y una sensación de frescura, lo que los convierte en una excelente opción tanto para el consumo directo como para aplicaciones culinarias.

- Por naturaleza

Debido a su naturaleza, el mercado de frutos secos se segmenta en convencionales y orgánicos. Se prevé que el segmento convencional domine el mercado con una cuota del 61,71 % en 2025 gracias a su asequibilidad, facilidad de abastecimiento y sólida presencia en los principales canales de venta minorista. En las regiones en desarrollo y sensibles a los precios, los frutos secos convencionales siguen teniendo una cuota importante gracias a su familiaridad, calidad constante y mayor disponibilidad en comparación con las alternativas orgánicas premium.

- Por método de procesamiento

El mercado se segmenta según el método de procesamiento en crudo, tostado, salado, blanqueado, saborizado, sin sal, glaseado, confitado, caramelizado, ahumado, germinado, fermentado, liofilizado, encurtido, frito al vacío, deshidratado, entre otros. Se prevé que el segmento crudo domine el mercado con una cuota de mercado del 12,64 % en 2025, a medida que las tendencias de consumo cambian hacia alimentos mínimamente procesados y ricos en nutrientes. Los frutos secos crudos conservan enzimas y nutrientes naturales, lo que resulta muy atractivo para las comunidades veganas, conscientes de la salud y con una alimentación limpia.

- Por grado

Según la calidad, el mercado se clasifica en: calidad A (calidad premium de exportación), calidad B (calidad media para uso doméstico), calidad quebrada (para panadería y confitería), calidad para aceite, calidad industrial y calidad rechazada (alimento animal). Se proyecta que el segmento de calidad A domine el mercado con una participación del 33,92 % en 2025, debido principalmente a la creciente demanda internacional de frutos secos de alta calidad y apariencia consistente.

- Por vida útil

El mercado se segmenta según la vida útil en <6 meses, 6-12 meses, 13-18 meses, 18 meses y más de 18 meses. Se prevé que el segmento de <6 meses domine el mercado con una cuota del 36,41 % en 2025, lo que refleja la creciente demanda de frutos secos frescos y recién cosechados. Los consumidores premium, especialmente en los sectores minorista y de la salud, asocian una vida útil corta con un mejor sabor, textura y valor nutricional.

- Por certificación

En cuanto a las certificaciones, el mercado incluye ISO 22000/HACCP, USDA Organic, EU Organic, Non-GMO Verified, Gluten Free Certified, Kosher, Halal, Vegan Certified, Fair Trade, Rainforest Alliance, Carbon Neutral Certified, entre otras. Se proyecta que el segmento ISO 22000/HACCP lidere el mercado con una cuota de mercado del 20,43 % en 2025, debido al aumento de las regulaciones mundiales de seguridad alimentaria y a la demanda de productos de frutos secos trazables, higiénicos y de calidad garantizada.

- Por embalaje

Los tipos de envases incluyen bolsas de plástico, envases sellados al vacío, frascos de PET, bolsas de papel, latas compuestas, sacos tejidos a granel, frascos de vidrio, sobres/porciones individuales, cajas de regalo, envases de origen biológico/compostables, latas metálicas, envases ecológicos resellables, barritas envueltas en papel de aluminio, envases de recarga y otros. En 2025, se prevé que el segmento de bolsas de plástico domine el mercado con una cuota del 20,41%, gracias a su comodidad, portabilidad, rentabilidad y durabilidad. Subsegmentos como los envases verticales con cierre hermético también se adaptan bien a los expositores modernos y al uso del consumidor.

- Por tamaño de embalaje

El mercado está segmentado en 101 g–250 g, 251 g–500 g, 51 g–100 g, 25 g–50 g, 501 g–1 kg, 1,1 kg–2,5 kg, 2,6 kg–5 kg, 5,1 kg–10 kg, 10,1 kg–25 kg, 25,1 kg–50 kg, 50 kg y <25 g. En 2025, se prevé que el segmento de 101 g–250 g domine el mercado con una cuota de mercado del 15,49 %, dirigido al consumo para llevar, las compras de prueba y los snacks saludables. Esta gama equilibra comodidad y precio, lo que la hace atractiva tanto en el comercio minorista moderno como en los canales online.

- Por rango de precio

Los rangos de precios incluyen el económico (USD 1,00-6,00 por kg), el medio (USD 6,01-12,00 por kg), el premium (USD 12,01-20,00 por kg) y el super premium/gourmet (más de USD 20,00 por kg). Se proyecta que el segmento económico domine el mercado con una cuota de mercado del 39,08 % en 2025, gracias a la demanda impulsada por la asequibilidad en los mercados emergentes, los compradores institucionales y los canales minoristas de consumo masivo.

- Por uso final

El mercado se segmenta en consumo directo, snacks, mantequillas y untables de frutos secos, panadería, confitería, fabricación de cereales y granola, nutrición funcional, alternativas lácteas, bebidas, carnes vegetales, culinaria, extracción industrial de aceites, repostería sin harina ni gluten, productos de cuidado personal, usos de origen biológico y agroindustrial, aditivos para alimentos para mascotas, piensos, entre otros. En 2025, se prevé que el segmento de consumo directo domine el mercado con una cuota del 13,09%, debido a la creciente demanda de snacks prácticos y nutritivos. El auge de los estilos de vida saludables y las dietas ricas en proteínas impulsa aún más este segmento en los canales minoristas, online y de viajes.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en B2B y B2C. El B2C se divide a su vez en canales offline y online. El offline incluye supermercados/hipermercados, tiendas de conveniencia, tiendas de alimentos saludables, panaderías, tiendas especializadas, hostelería, tiendas libres de impuestos y aerolíneas. El online incluye plataformas de comercio electrónico y sitios web de marcas. Se prevé que el segmento B2B domine el mercado con una cuota de mercado del 53,74% en 2025, gracias a la amplia disponibilidad de productos, la confianza en las tiendas físicas y el comportamiento de compra impulsiva, especialmente en los mercados tradicionales y emergentes.

Análisis regional del mercado de frutos secos

Los Emiratos Árabes Unidos son uno de los principales mercados de frutos secos en Oriente Medio, contribuyendo significativamente a los ingresos regionales. El alto consumo de frutos secos durante el Ramadán y otras festividades culturales impulsa una demanda constante. Los consumidores prefieren variedades de frutos secos de alta calidad y con sabor, como pistachos tostados, almendras y anacardos, que suelen encontrarse en cadenas minoristas, paquetes de regalo de lujo y en el sector de la hostelería. La creciente concienciación sobre la salud y las tendencias dietéticas como las dietas keto y paleo también están impulsando la popularidad de los productos de frutos secos orgánicos y sin sal. La sólida base importadora del país garantiza la disponibilidad de diversas opciones de frutos secos durante todo el año.

Análisis del mercado de frutos secos de Arabia Saudita

Arabia Saudita representa una parte importante del mercado de frutos secos en Oriente Medio, impulsada por su tradición de incluirlos en dietas diarias, eventos festivos y ofertas de hostelería. Los dátiles rellenos de almendras o nueces son especialmente populares. El mercado está experimentando una creciente demanda de productos de frutos secos envasados y con valor añadido, como mezclas de frutos secos, mantequillas de frutos secos y frutos secos recubiertos de chocolate. Los consumidores urbanos muestran un creciente interés en alternativas saludables para picar, lo que se ve reforzado por la expansión de las plataformas modernas de venta minorista y comercio electrónico.

Cuota de mercado de frutos secos

La industria de los frutos secos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Grupo Olam (Singapur)

- ADM (EE. UU.)

- BORGES AGRICULTURAL & INDUSTRIAL NUTS, SA (España)

- Barry Callebaut (Suiza)

- GRUPO INTERSNACK (Alemania)

- COSECHAS SELECTAS (Australia)

- Blue Diamond Growers (EE. UU.)

Últimos avances en el mercado de frutos secos en Oriente Medio y África

- En abril de 2024, el Grupo Olam anunció una importante expansión de su capacidad de procesamiento de nueces en Nigeria, con el objetivo de aumentar el volumen de procesamiento de anacardo tanto para el consumo interno como para la exportación. Esta inversión se alinea con la estrategia de Olam de fortalecer su presencia en el sector de productos agrícolas de valor añadido y apoyar las economías locales mediante la creación de empleo y el desarrollo de capacidades en mercados emergentes.

- En marzo de 2024, Blue Diamond Growers lanzó una nueva línea de snacks proteicos a base de almendras bajo su marca "Nut-Thins", centrada en opciones de snacks ricos en proteínas y sin gluten. Este lanzamiento responde a la creciente demanda de snacks saludables para llevar y consolida la posición de Blue Diamond en el segmento de snacks funcionales de la industria de los frutos secos.

- En febrero de 2024, Select Harvests anunció la adquisición de nuevos huertos de almendras en Victoria para ampliar su capacidad de producción. Se espera que esta estrategia mejore la integración vertical y garantice un suministro estable de almendras de alta calidad, fortaleciendo así la competitividad de la empresa en Oriente Medio y África ante la creciente demanda de los mercados regionales.

- En enero de 2024, Wonderful Pistachios LLC lanzó una campaña de marketing en Oriente Medio y África titulada "El poder del pistacho", que destaca los beneficios para la salud del consumo de pistachos. La campaña se dirige a los principales mercados internacionales, incluido Oriente Medio, y cuenta con el apoyo de marketing de influencers y colaboraciones para fomentar la concienciación nutricional.

- En diciembre de 2023, John B. Sanfilippo & Son, Inc. invirtió en automatización y digitalización en su planta de procesamiento de Illinois para aumentar la eficiencia y garantizar una calidad constante en todas sus líneas de productos de cacahuete y frutos secos. La modernización incluye sistemas de clasificación basados en IA y mejores medidas de sostenibilidad en el envasado y el consumo de agua.

- En noviembre de 2023, Borges Agricultural & Industrial Nuts, SA anunció una alianza con una plataforma blockchain para implementar la trazabilidad completa en sus cadenas de suministro de almendras y nueces. Esta iniciativa busca garantizar la transparencia, la certificación de comercio justo y la confianza del consumidor en los mercados europeos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN

4.1.1 PRODUCTION:

4.1.2 PROCESSING:

4.1.3 MARKETING/DISTRIBUTION:

4.1.4 BUYERS:

4.2 SUPPLY CHAIN ANALYSIS

4.3 PORTER’S FIVE FORCES ANALYSIS

4.4 RAW MATERIAL SOURCING ANALYSIS

4.5 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.6 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.8 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

4.8.1 IMPACT ON PRICE

4.8.2 IMPACT ON SUPPLY CHAIN

4.8.3 IMPACT ON SHIPMENT

4.8.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.9 REGULATORY FRAMEWORK AND GUIDELINES

4.9.1 COST ANALYSIS BREAKDOWN

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS AND ACQUISITIONS

4.10.1.3 LICENSING AND PARTNERSHIP

4.10.1.4 TECHNOLOGY COLLABORATIONS

4.10.1.5 STRATEGIC DIVESTMENTS

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES AND MILESTONES

4.10.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.6 RISK ASSESSMENT AND MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 TARIFFS & IMPACT ON THE MARKET

4.11.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.11.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.11.3 VENDOR SELECTION CRITERIA DYNAMICS

4.11.4 IMPACT ON SUPPLY CHAIN

4.11.4.1 RAW MATERIAL PROCUREMENT

4.11.4.2 MANUFACTURING AND PRODUCTION

4.11.4.3 LOGISTICS AND DISTRIBUTION

4.11.4.4 PRICE PITCHING AND POSITION OF MARKET

4.11.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.11.5.1 SUPPLY CHAIN OPTIMIZATION

4.11.5.2 JOINT VENTURE ESTABLISHMENTS

4.11.6 IMPACT ON PRICES

4.11.7 REGULATORY INCLINATION

4.11.7.1 GEOPOLITICAL SITUATION

4.11.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.11.7.2.1 FREE TRADE AGREEMENTS

4.11.7.2.2 ALLIANCES ESTABLISHMENTS

4.11.7.3 STATUS ACCREDITION (INCLUDING MFTN)

4.11.7.4 DOMESTIC COURSE OF CORRECTION

4.11.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.11.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

4.12 BRAND OUTLOOK

4.12.1 COMPARATIVE BRAND ANALYSIS

4.12.2 PRODUCT AND BRAND OVERVIEW

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 OVERVIEW

4.13.2 LOGISTIC COST SCENARIO

4.13.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.14 PRODUCTION CONSUMPTION ANALYSIS

4.15 IMPORT-EXPORT ANALYSIS

4.16 PATENT ANALYSIS

4.16.1 PATENT QUALITY AND STRENGTH

4.16.2 PATENT FAMILIES

4.16.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.17 LICENSING AND COLLABORATIONS

4.17.1 COMPANY PATENT LANDSCAPE

4.18 REGION PATENT LANDSCAPE

4.19 IP STRATEGY AND MANAGEMENT

4.2 PATENT ANALYSIS

4.21 PROFIT MARGINS SCENARIO

4.22 PRICING ANALYSIS

4.23 INDUSTRY ECOSYSTEM ANALYSIS

4.23.1 PROMINENT COMPANIES

4.23.2 SMALL & MEDIUM SIZE COMPANIES

4.23.3 END USERS

4.24 IMPACT OF ECONOMIC SLOWDOWN ON MIDDLE EAST AND AFRICA NUTS MARKET

4.24.1 IMPACT ON PRICES

4.24.2 IMPACT ON SUPPLY CHAIN

4.24.3 IMPACT ON SHIPMENT

4.24.4 IMPACT ON DEMAND

4.24.5 IMPACT ON STRATEGIC DECISIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MIDDLE EAST AND AFRICA TREND TOWARD HEALTHIER SNACKING AND NUTRITIOUS CHOICES

5.1.2 RISE IN DAILY CONSUMPTION OF VARIOUS NUT PRODUCTS

5.1.3 INCREASING MIDDLE EAST AND AFRICA DEMAND TOWARD PLANT-BASED DIETS

5.1.4 E-COMMERCE GROWTH BOOSTING NUT PRODUCT ACCESSIBILITY

5.2 RESTRAINTS

5.2.1 PRICE VOLATILITY RESTRAINING GROWTH IN THE NUTS MARKET

5.2.2 SUPPLY CHAIN DISRUPTIONS

5.2.3 IMPACT OF CLIMATE CHANGE ON MARKET STABILITY

5.3 OPPORTUNITIES

5.3.1 INNOVATION IN FLAVORED AND READY-TO-EAT NUT PRODUCTS

5.3.2 MODIFICATION IN THE NUT PRODUCTION

5.3.3 INCREASING USE OF NUTS IN BAKERY AND CONFECTIONERY PRODUCTS

5.4 CHALLENGES

5.4.1 RISING DROUGHTS, HEATWAVES, AND UNPREDICTABLE RAINFALL THREATEN CROP YIELDS AND QUALITY

5.4.2 LABOR SHORTAGES IN HARVESTING SEASONS AND RELIANCE ON MANUAL LABOR RAISE BOTH COST AND COMPLIANCE CHALLENGES

6 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 TREE NUTS

6.2.1 TREE NUTS, BY TYPE

6.2.1.1 Almonds

6.2.1.2 Cashews

6.2.1.3 Walnuts

6.2.1.4 Pistachios

6.2.1.5 Hazelnuts

6.2.1.6 Pecans

6.2.1.7 Macadamias

6.2.1.8 Pine Nuts

6.2.1.9 Brazil Nuts

6.2.1.10 Chestnuts

6.2.1.11 Pili Nuts

6.2.1.12 Barukas Nuts

6.2.1.13 Others

6.3 GROUND NUTS

6.3.1 GROUND NUTS, BY PEANUTS

6.3.1.1 Runner

6.3.1.2 Virginia

6.3.1.3 Spanish

6.3.1.4 Valencia

6.3.1.5 Others

6.4 HYBRID/OTHER NUTS

6.4.1 HYBRID/OTHER NUTS, BY TYPE

6.4.1.1 Coconuts

6.4.1.2 Betel Nuts

6.4.1.3 Tiger Nuts

6.4.1.4 Ginkgo Nuts

6.4.1.5 Others

6.5 OTHERS

7 MIDDLE EAST AND AFRICA NUTS MARKET, FORM

7.1 OVERVIEW

7.2 WHOLE

7.3 BUTTER

7.4 GROUND

7.5 HALVES

7.6 PIECES

7.7 OIL

7.8 MILK

7.9 PASTE

7.1 CREAM

7.11 ROASTED PIECES

7.12 COATED

7.13 FLOUR

7.14 POWDER

7.15 CHOPPED

7.16 SLICED

7.17 DICED

7.18 CRUSHED

7.19 BLANCHED WHOLE

7.2 FROZEN

7.21 SPRAY-DRIED

7.22 ENCAPSULATED

7.23 OTHERS

8 MIDDLE EAST AND AFRICA NUTS MARKET, BY NATURE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 ORGANIC

9 MIDDLE EAST AND AFRICA NUTS MARKET, BY PROCESSING METHOD

9.1 OVERVIEW

9.2 RAW

9.3 ROASTED

9.3.1 ROASTED, BY TYPE

9.3.1.1 DRY ROASTED

9.3.1.2 OIL ROASTED

9.4 SALTED

9.5 BLANCHED

9.6 FLAVORED

9.6.1 FLAVORED, BY TYPE

9.6.1.1 Sweetened

9.6.1.2 Spiced

9.6.1.3 Chocolate-Coated

9.6.1.4 Herb-Infused

9.6.1.5 Yogurt-Coated

9.6.1.6 Others

9.7 UNSALTED

9.8 GLAZED

9.9 CANDIED

9.1 CARAMELIZED

9.11 SMOKED

9.12 SPROUTED

9.13 FERMENTED

9.14 FREEZE-DRIED

9.15 PICKLED

9.16 VACUUM-FRIED

9.17 DEHYDRATED

9.18 OTHERS

10 MIDDLE EAST AND AFRICA NUTS MARKET, BY GRADE

10.1 OVERVIEW

10.2 A GRADE (PREMIUM EXPORT QUALITY)

10.3 B GRADE (MID-QUALITY DOMESTIC USE)

10.4 BROKEN GRADE (BAKERY & CONFECTIONERY USE)

10.5 OIL-GRADE

10.6 INDUSTRIAL GRADE

10.7 REJECTED GRADE (ANIMAL FEED)

11 MIDDLE EAST AND AFRICA NUTS MARKET, BY SHELF LIFE

11.1 OVERVIEW

11.2 <6 MONTHS

11.3 6–12 MONTHS

11.4 13–18 MONTHS

11.5 18 MONTHS

11.6 MORE THAN 18 MONTHS

12 MIDDLE EAST AND AFRICA NUTS MARKET, BY CERTIFICATION

12.1 OVERVIEW

12.2 ISO 22000/HACCP

12.3 USDA ORGANIC

12.4 EU ORGANIC

12.5 NON-GMO VERIFIED

12.6 GLUTEN-FREE CERTIFIED

12.7 KOSHER

12.8 HALAL

12.9 VEGAN CERTIFIED

12.1 FAIR TRADE

12.11 RAINFOREST ALLIANCE

12.12 CARBON NEUTRAL CERTIFIED

12.13 OTHERS

13 MIDDLE EAST AND AFRICA NUTS MARKET, PACKAGING

13.1 OVERVIEW

13.2 PLASTIC POUCHES

13.2.1 PLASTIC POUCHES, BY TYPE

13.2.1.1 Stand-Up Zipper Packs

13.2.1.2 Pillow Packs

13.3 VACUUM-SEALED PACKS

13.4 PET JARS

13.5 PAPER BAGS

13.6 COMPOSITE CANS

13.7 BULK WOVEN SACKS

13.8 GLASS JARS

13.9 SACHETS/SINGLE-SERVE

13.1 GIFT BOXES

13.11 BIO-BASED/COMPOSTABLE

13.12 METAL TINS

13.13 RESEALABLE ECO-TUBS

13.14 FOIL-WRAPPED BARS

13.15 REFILL PACKS

13.16 OTHERS

14 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING SIZE

14.1 OVERVIEW

14.2 101G–250G

14.3 251G–500G

14.4 51G–100G

14.5 25G–50G

14.6 501G–1KG

14.7 1.1KG–2.5KG

14.8 2.6KG–5KG

14.9 5.1KG–10KG

14.1 10.1KG–25KG

14.11 25.1KG–50KG

14.12 50KG

14.13 <25G

15 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRICE RANGE

15.1 OVERVIEW

15.2 ECONOMY/BUDGET (USD 1.00-6.00 PER KG)

15.3 MID-RANGE (USD 6.01-12.00 PER KG)

15.4 PREMIUM (USD 12.01-20.00 PER KG)

15.5 SUPER-PREMIUM/GOURMET (ABOVE USD 20.00 PER KG)

16 MIDDLE EAST AND AFRICA NUTS MARKET, BY END-USE

16.1 OVERVIEW

16.2 DIRECT CONSUMPTION

16.3 SNACKS

16.4 NUT BUTTERS & SPREADS

16.5 BAKERY INDUSTRY

16.6 CONFECTIONERY INDUSTRY

16.7 CEREAL & GRANOLA MANUFACTURING

16.8 FUNCTIONAL NUTRITION

16.8.1 FUNCTIONAL NUTRITION, BY TYPE

16.8.1.1 Protein Bars

16.8.1.2 Meal Replacements

16.8.1.3 Supplements

16.8.1.4 Others

16.9 DAIRY ALTERNATIVES

16.1 BEVERAGE INDUSTRY

16.10.1 BEVERAGE INDUSTRY, BY TYPE

16.10.1.1 Nut Milk

16.10.1.2 Nut-Based Protein Drinks

16.10.1.3 Fermented Nut Beverages

16.10.1.4 Others

16.11 PLANT-BASED MEATS

16.12 CULINARY

16.12.1 CULINARY, BY TYPE

16.12.1.1 Garnishing

16.12.1.2 Sauces

16.12.1.3 Condiments

16.12.1.4 Others

16.13 INDUSTRIAL OIL EXTRACTION

16.14 FLOUR & GLUTEN-FREE BAKING

16.15 PERSONAL CARE PRODUCTS

16.15.1 PERSONAL CARE PRODUCTS, BY TYPE

16.15.1.1 Skin Care

16.15.1.2 Hair Oil

16.15.1.3 Exfoliants

16.15.1.4 Others

16.16 BIO-BASED & AGRO-INDUSTRIAL USES

16.16.1 BIO-BASED & AGRO-INDUSTRIAL USES, BY TYPE

16.16.1.1 Activated Carbon

16.16.1.2 Abrasives

16.16.1.3 Biofuel Additives

16.16.1.4 Others

16.17 PET FOOD ADDITIVES

16.18 ANIMAL FEED

16.18.1 ANIMAL FEED, BY TYPE

16.18.1.1 Meal Residue

16.18.1.2 Shells

16.18.1.3 Others

16.19 OTHERS

17 MIDDLE EAST AND AFRICA NUTS MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 B2B

17.3 B2C

17.3.1 B2C, BY TYPE

17.3.1.1 Offline

17.3.1.1.1 Supermarkets/Hypermarkets

17.3.1.1.2 Convenience Stores

17.3.1.1.3 Health Food Stores

17.3.1.1.4 Bakeries

17.3.1.1.5 Specialty Stores

17.3.1.1.6 HoReCa

17.3.1.1.7 Duty-Free Stores

17.3.1.1.8 Airlines

17.3.1.1.9 Others

17.3.1.2 Online

17.3.1.2.1 E-Commerce Marketplaces

17.3.1.2.2 Brand-Owned Websites

18 MIDDLE EAST AND AFRICA NUTS MARKET, BY REGION

18.1 MIDDLE EAST AND AFRICA

18.1.1 U.A.E.

18.1.2 SAUDI ARABIA

18.1.3 EGYPT

18.1.4 SOUTH AFRICA

18.1.5 ISRAEL

18.1.6 KUWAIT

18.1.7 OMAN

18.1.8 BAHRAIN

18.1.9 QATAR

18.1.10 REST OF MIDDLE EAST AND AFRICA

19 MIDDLE EAST AND AFRICA NUTS MARKET COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 ADM

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENT

21.2 OLAM GROUP

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 COMPANY SHARE ANALYSIS

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENT

21.3 BARRY CALLEBAUT

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 COMPANY SHARE ANALYSIS

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENT

21.4 BLUE DIAMOND GROWERS.

21.4.1 COMPANY SNAPSHOT

21.4.2 COMPANY SHARE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS/NEWS

21.5 JOHN B. SANFILIPPO & SON, INC.

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 COMPANY SHARE ANALYSIS

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 BORGES AGRICULTURAL & INDUSTRIAL NUTS, S.A.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS/NEWS

21.7 DEL ALBA.

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT/NEWS

21.8 DIAMOND FOODS

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 RECENT DEVELOPMENTS/NEWS

21.9 GOLDEN PEANUT COMPANY, LLC

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 RECENT DEVELOPMENTS

21.1 GOURMET NUT

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS/NEWS

21.11 HINES NUT COMPANY

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.12 HORMEL FOODS CORPORATION

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS/NEWS

21.13 INTERSNACK GROUP GMBH & CO. KG

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 JINDAL COCOA

21.14.1 COMPANY SNAPSHOT

21.14.2 PRODUCT PORTFOLIO

21.14.3 RECENT DEVELOPMENTS

21.15 MARIANI NUT COMPANY

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENTS

21.16 MOUNT FRANKLIN FOODS

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 NOW FOODS

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS/NEWS

21.18 NUTLAND

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 NUTWORK HANDELSGESELLSCHAFT MBH

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENTS/NEWS

21.2 POINDEXTER NUT COMPANY

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENTS

21.21 ROYAL NUT COMPANY

21.21.1 COMPANY SNAPSHOT

21.21.2 PRODUCT PORTFOLIO

21.21.3 RECENT DEVELOPMENTS

21.22 SAHALE SNACKS

21.22.1 COMPANY SNAPSHOT

21.22.2 PRODUCT PORTFOLIO

21.22.3 RECENT DEVELOPMENTS

21.23 SANTÉ NUTS

21.23.1 COMPANY SNAPSHOT

21.23.2 PRODUCT PORTFOLIO

21.23.3 RECENT DEVELOPMENTS/NEWS

21.24 SELECT HARVESTS LIMITED

21.24.1 COMPANY SNAPSHOT

21.24.2 REVENUE ANALYSIS

21.24.3 PRODUCT PORTFOLIO

21.24.4 RECENT DEVELOPMENTS/NEWS

21.25 SETTON PISTACHIO OF TERRA BELLA, INC.

21.25.1 COMPANY SNAPSHOT

21.25.2 PRODUCT PORTFOLIO

21.25.3 RECENT DEVELOPMENTS

21.26 TERRANUT

21.26.1 COMPANY SNAPSHOT

21.26.2 PRODUCT PORTFOLIO

21.26.3 RECENT DEVELOPMENTS/NEW

21.27 TREEHOUSE CALIFORNIA ALMONDS, LLC

21.27.1 COMPANY SNAPSHOT

21.27.2 PRODUCT PORTFOLIO

21.27.3 RECENT DEVELOPMENT

21.28 THE DAILY NUT CO.

21.28.1 COMPANY SNAPSHOT

21.28.2 PRODUCT PORTFOLIO

21.28.3 RECENT DEVELOPMENTS/NEWS

21.29 WONDERFUL PISTACHIOS LLC

21.29.1 COMPANY SNAPSHOT

21.29.2 PRODUCT PORTFOLIO

21.29.3 RECENT DEVELOPMENTS/NEWS

21.3 WESTERN NUT COMPANY INC.

21.30.1 COMPANY SNAPSHOT

21.30.2 PRODUCT PORTFOLIO

21.30.3 RECENT DEVELOPMENTS/NEWS

22 QUESTIONNAIRE

23 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 COST FOR KEY EQUIPMENT AND THE OVERALL CASHEW NUTS PROCESSING PLANTS

TABLE 3 RECENT DEVELOPMENTS IN THE NUT, HIGHLIGHTING NEW PRODUCT LAUNCHES, INNOVATIONS, AND TRENDS

TABLE 4 TIMELINES AND MILESTONES IN THE NUTS INDUSTRY

TABLE 5 NUT IMPORT TARIFF RATES IN TOP 5 MARKETS (2024)

TABLE 6 LOCAL PRODUCTION V/S IMPORT RELIANCE

TABLE 7 REGULATORY INCLINATION

TABLE 8 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

TABLE 9 ALLIANCES ESTABLISHMENTS

TABLE 10 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES (SEZS) AND INDUSTRIAL PARKS

TABLE 11 COMPARATIVE BRAND ANALYSIS

TABLE 12 PRODUCTION

TABLE 13 CONSUMPTION

TABLE 14 CONSUMER BUYING BEHAVIOUR

TABLE 15 EXPORT DATA SETS

TABLE 16 IMPORT DATA SETS

TABLE 17 CONSUMER BUYING BEHAVIOUR

TABLE 18 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 20 MIDDLE EAST AND AFRICA TREE NUTS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA GROUND NUTS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA GROUND NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA HYBRID/OTHER NUTS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA WHOLE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BUTTER IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA GROUND IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA HALVES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA PIECES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA OIL IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA MILK IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA PASTE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA CREAM IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ROASTED PIECES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA COATED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA FLOUR IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA POWDER IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CHOPPED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA SLICED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA DICED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA CRUSHED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA BLANCHED WHOLE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA FROZEN IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SPRAY-DRIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA ENCAPSULATED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CONVENTIONAL IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ORGANIC IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA RAW IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA ROASTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA SALTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA BLANCHED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA FLAVORED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA UNSALTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA GLAZED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA CANDIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA CARAMELIZED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA SMOKED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA SPROUTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA FERMENTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA FREEZE-DRIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA PICKLED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA VACUUM-FRIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA DEHYDRATED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA A GRADE (PREMIUM EXPORT QUALITY) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA B GRADE (MID-QUALITY DOMESTIC USE) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA BROKEN GRADE (BAKERY & CONFECTIONERY USE) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA OIL-GRADE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA INDUSTRIAL GRADE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA REJECTED GRADE (ANIMAL FEED) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA <6 MONTHS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA 6–12 MONTHS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA I13–18 MONTHS N NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA 18 MONTHS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA MORE THAN 18 MONTHS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA ISO 22000/HACCP IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA USDA ORGANIC IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA EU ORGANIC IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA NON-GMO VERIFIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA GLUTEN-FREE CERTIFIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA KOSHER IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA HALAL IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA VEGAN CERTIFIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA FAIR TRADE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA RAINFOREST ALLIANCE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA CARBON NEUTRAL CERTIFIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA PLASTIC POUCHES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 101 TABLE 14 MIDDLE EAST AND AFRICA PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA VACUUM-SEALED PACKS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA PET JARS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA PAPER BAGS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA COMPOSITE CANS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA BULK WOVEN SACKS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA GLASS JARS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA SACHETS/SINGLE-SERVE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA GIFT BOXES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA BIO-BASED/COMPOSTABLE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA METAL TINS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA RESEALABLE ECO-TUBS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA FOIL-WRAPPED BARS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA REFILL PACKS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA 101G–250G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA 251G–500G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA 51G–100G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA 25G–50G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA 501G–1KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA 1.1KG–2.5KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA 2.6KG–5KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA 5.1KG–10KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA 10.1KG–25KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA 25.1KG–50KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA 50KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA <25G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA ECONOMY/BUDGET (USD 1.00-6.00 PER KG) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA MID-RANGE (USD 6.01-12.00 PER KG) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA PREMIUM (USD 12.01-20.00 PER KG) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA SUPER-PREMIUM/GOURMET (ABOVE USD 20.00 PER KG) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA DIRECT CONSUMPTION IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA SNACKS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA NUT BUTTERS & SPREADS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA BAKERY INDUSTRY IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA CONFECTIONERY INDUSTRY IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA CEREAL & GRANOLA MANUFACTURING IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA FUNCTIONAL NUTRITION IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA DAIRY ALTERNATIVES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA BEVERAGE INDUSTRY IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MIDDLE EAST AND AFRICA PLANT-BASED MEATS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA CULINARY IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 148 MIDDLE EAST AND AFRICA CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 MIDDLE EAST AND AFRICA INDUSTRIAL OIL EXTRACTION IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA FLOUR & GLUTEN-FREE BAKING IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 151 MIDDLE EAST AND AFRICA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 152 MIDDLE EAST AND AFRICA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 154 MIDDLE EAST AND AFRICA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 MIDDLE EAST AND AFRICA PET FOOD ADDITIVES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA ANIMAL FEED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 157 MIDDLE EAST AND AFRICA ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 160 MIDDLE EAST AND AFRICA B2B IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 161 MIDDLE EAST AND AFRICA B2C IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MIDDLE EAST AND AFRICA OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MIDDLE EAST AND AFRICA ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA NUTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 168 MIDDLE EAST AND AFRICA TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MIDDLE EAST AND AFRICA GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 MIDDLE EAST AND AFRICA NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 172 MIDDLE EAST AND AFRICA NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 174 MIDDLE EAST AND AFRICA ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MIDDLE EAST AND AFRICA FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 177 MIDDLE EAST AND AFRICA NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 178 MIDDLE EAST AND AFRICA NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 180 MIDDLE EAST AND AFRICA PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 183 MIDDLE EAST AND AFRICA NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 184 MIDDLE EAST AND AFRICA FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MIDDLE EAST AND AFRICA CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MIDDLE EAST AND AFRICA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MIDDLE EAST AND AFRICA ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 MIDDLE EAST AND AFRICA NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 191 MIDDLE EAST AND AFRICA B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MIDDLE EAST AND AFRICA OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MIDDLE EAST AND AFRICA ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 U.A.E. NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 U.A.E. NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 196 U.A.E. TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 U.A.E. GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 198 U.A.E. HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 U.A.E. NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 200 U.A.E. NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 201 U.A.E. NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 202 U.A.E. ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 U.A.E. FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 U.A.E. NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 205 U.A.E. NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 206 U.A.E. NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 207 U.A.E. NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 208 U.A.E. PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 U.A.E. NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 210 U.A.E. NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 211 U.A.E. NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 212 U.A.E. FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 U.A.E. BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 U.A.E. CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 U.A.E. PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 U.A.E. BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 U.A.E. ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 U.A.E. NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 219 U.A.E. B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 U.A.E. OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 U.A.E. ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SAUDI ARABIA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SAUDI ARABIA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 224 SAUDI ARABIA TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SAUDI ARABIA GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 226 SAUDI ARABIA HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SAUDI ARABIA NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 228 SAUDI ARABIA NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 229 SAUDI ARABIA NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 230 SAUDI ARABIA ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SAUDI ARABIA FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SAUDI ARABIA NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 233 SAUDI ARABIA NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 234 SAUDI ARABIA NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 235 SAUDI ARABIA NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 236 SAUDI ARABIA PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SAUDI ARABIA NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 238 SAUDI ARABIA NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 239 SAUDI ARABIA NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 240 SAUDI ARABIA FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SAUDI ARABIA BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SAUDI ARABIA CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 SAUDI ARABIA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SAUDI ARABIA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SAUDI ARABIA ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SAUDI ARABIA NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 247 SAUDI ARABIA B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 SAUDI ARABIA OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 SAUDI ARABIA ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 EGYPT NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 EGYPT NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 252 EGYPT TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 EGYPT GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 254 EGYPT HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 EGYPT NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 256 EGYPT NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 257 EGYPT NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 258 EGYPT ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 EGYPT FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 EGYPT NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 261 EGYPT NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 262 EGYPT NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 263 EGYPT NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 264 EGYPT PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 EGYPT NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 266 EGYPT NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 267 EGYPT NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 268 EGYPT FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 EGYPT BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 EGYPT CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 EGYPT PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 EGYPT BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 EGYPT ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 EGYPT NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 275 EGYPT B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 EGYPT OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 EGYPT ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 SOUTH AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 SOUTH AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 280 SOUTH AFRICA TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 SOUTH AFRICA GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 282 SOUTH AFRICA HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 SOUTH AFRICA NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 284 SOUTH AFRICA NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 285 SOUTH AFRICA NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 286 SOUTH AFRICA ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 SOUTH AFRICA FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SOUTH AFRICA NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 289 SOUTH AFRICA NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 290 SOUTH AFRICA NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 291 SOUTH AFRICA NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 292 SOUTH AFRICA PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 SOUTH AFRICA NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 294 SOUTH AFRICA NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 295 SOUTH AFRICA NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 296 SOUTH AFRICA FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SOUTH AFRICA BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SOUTH AFRICA CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SOUTH AFRICA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SOUTH AFRICA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SOUTH AFRICA ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SOUTH AFRICA NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 303 SOUTH AFRICA B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SOUTH AFRICA OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SOUTH AFRICA ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 ISRAEL NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 ISRAEL NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 308 ISRAEL TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 ISRAEL GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 310 ISRAEL HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 ISRAEL NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 312 ISRAEL NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 313 ISRAEL NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 314 ISRAEL ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 ISRAEL FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 ISRAEL NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 317 ISRAEL NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 318 ISRAEL NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 319 ISRAEL NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 320 ISRAEL PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 ISRAEL NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 322 ISRAEL NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 323 ISRAEL NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 324 ISRAEL FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 ISRAEL BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 ISRAEL CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 ISRAEL PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 ISRAEL BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 ISRAEL ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 ISRAEL NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 331 ISRAEL B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 ISRAEL OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 ISRAEL ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 KUWAIT NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 KUWAIT NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 336 KUWAIT TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 KUWAIT GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 338 KUWAIT HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 KUWAIT NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 340 KUWAIT NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 341 KUWAIT NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 342 KUWAIT ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 KUWAIT FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 KUWAIT NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 345 KUWAIT NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 346 KUWAIT NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 347 KUWAIT NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 348 KUWAIT PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 KUWAIT NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 350 KUWAIT NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 351 KUWAIT NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 352 KUWAIT FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 KUWAIT BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 KUWAIT CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 KUWAIT PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 KUWAIT BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 KUWAIT ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 KUWAIT NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 359 KUWAIT B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 KUWAIT OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 KUWAIT ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 OMAN NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 OMAN NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 364 OMAN TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 OMAN GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 366 OMAN HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 OMAN NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 368 OMAN NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 369 OMAN NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 370 OMAN ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 OMAN FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 OMAN NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 373 OMAN NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 374 OMAN NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 375 OMAN NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 376 OMAN PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 OMAN NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 378 OMAN NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 379 OMAN NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 380 OMAN FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 OMAN BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 OMAN CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 OMAN PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 OMAN BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 OMAN ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 OMAN NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 387 OMAN B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 OMAN OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 OMAN ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 BAHRAIN NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 BAHRAIN NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 392 BAHRAIN TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 BAHRAIN GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 394 BAHRAIN HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 BAHRAIN NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 396 BAHRAIN NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 397 BAHRAIN NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 398 BAHRAIN ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 BAHRAIN FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 BAHRAIN NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 401 BAHRAIN NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 402 BAHRAIN NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 403 BAHRAIN NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 404 BAHRAIN PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 BAHRAIN NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 406 BAHRAIN NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 407 BAHRAIN NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 408 BAHRAIN FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 BAHRAIN BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 BAHRAIN CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 BAHRAIN PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 BAHRAIN BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 BAHRAIN ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 BAHRAIN NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 415 BAHRAIN B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 BAHRAIN OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 BAHRAIN ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 QATAR NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 QATAR NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 420 QATAR TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 QATAR GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 422 QATAR HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 QATAR NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 424 QATAR NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 425 QATAR NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 426 QATAR ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 QATAR FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 QATAR NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 429 QATAR NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 430 QATAR NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 431 QATAR NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 432 QATAR PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 433 QATAR NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 434 QATAR NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 435 QATAR NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 436 QATAR FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 QATAR BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 438 QATAR CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 439 QATAR PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 QATAR BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 441 QATAR ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 442 QATAR NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 443 QATAR B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 QATAR OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 QATAR ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 446 REST OF MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 447 REST OF MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA NUTS MARKET

FIGURE 2 MIDDLE EAST AND AFRICA NUTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA NUTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA NUTS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA NUTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA NUTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA NUTS MARKET TIME LINE CURVE

FIGURE 8 MIDDLE EAST AND AFRICA NUTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA NUTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA NUTS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA NUTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA NUTS MARKET: SEGMENTATION

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 MIDDLE EAST AND AFRICA NUTS MARKET STRATEGIC DEVELOPMENT

FIGURE 15 FOUR SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE