Middle East And Africa Ready To Eat Food Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

22.59 Billion

USD

43.82 Billion

2024

2032

USD

22.59 Billion

USD

43.82 Billion

2024

2032

| 2025 –2032 | |

| USD 22.59 Billion | |

| USD 43.82 Billion | |

|

|

|

|

Segmentación del mercado de alimentos listos para comer en Oriente Medio y África, por tipo de producto (productos cárnicos, productos a base de cereales, productos lácteos, productos de panadería, dulces salados, productos de confitería, productos a base de verduras, sopas instantáneas, aperitivos salados, alimentos refrigerados, aperitivos de carne a base de plantas y comidas listas para comer), categoría (convencional y especial), tipo de envase (bolsas/sobres, latas, tarros y contenedores, botellas, cajas y otros), tamaño del envase (menos de 250 gramos, 251-500 gramos, 501-750 gramos, 751-1000 gramos y más de 1000 gramos), tecnología de envasado (capturadores de oxígeno, control de humedad, antimicrobianos, indicadores de tiempo y temperatura y películas comestibles), tipo de almacenamiento (congelado/refrigerado, estable en almacenamiento, enlatado y otros), canal de distribución (canal basado en tienda y canal fuera de tienda), usuario final (Servicios de la industria alimentaria, hogares y otros): Tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de alimentos listos para consumir en Oriente Medio y África

El mercado de alimentos listos para consumir (RTE) en Oriente Medio y África está en constante crecimiento, impulsado por la creciente demanda de opciones de comida prácticas y que ahorran tiempo. La urbanización, los estilos de vida ajetreados y los cambios en los hábitos alimenticios son factores clave que influyen en este cambio. Las comidas congeladas, los snacks instantáneos y los productos envasados listos para consumir están ganando popularidad entre diversos grupos demográficos. Si bien América del Norte y Europa lideran el mercado, Asia-Pacífico se perfila como un fuerte competidor debido al aumento de la renta disponible y la evolución de las preferencias alimentarias. Los consumidores preocupados por su salud buscan opciones orgánicas, sin conservantes y nutritivas. La innovación en envasado, sostenibilidad y calidad de los ingredientes está moldeando el futuro del mercado, a pesar de los desafíos de la cadena de suministro.

Tamaño del mercado de alimentos listos para consumir en Oriente Medio y África

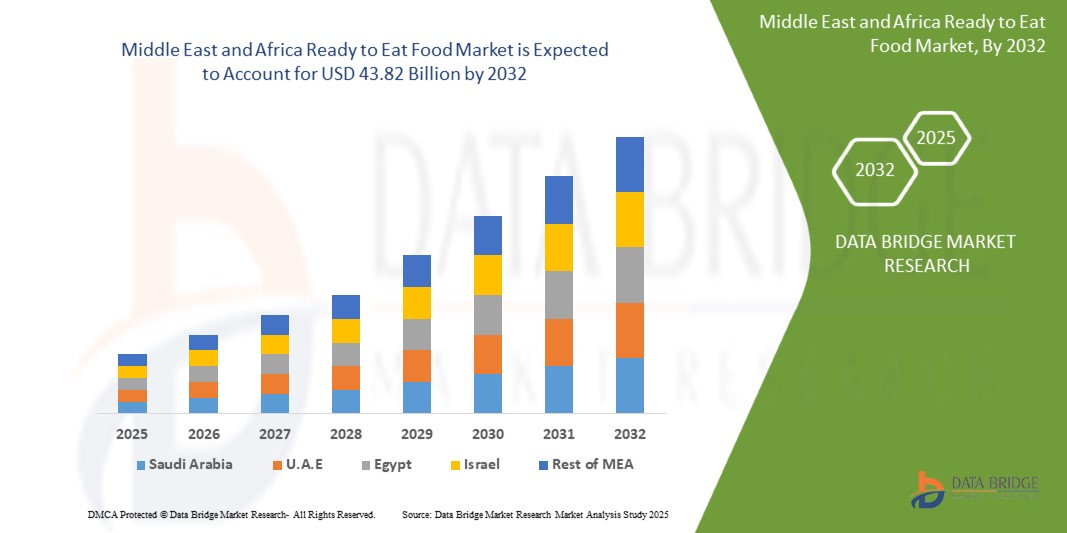

El tamaño del mercado de alimentos listos para comer de Oriente Medio y África se valoró en 22.590 millones de dólares en 2024 y se proyecta que alcance los 43.820 millones de dólares en 2032, con una CAGR del 9,48 % durante el período de pronóstico de 2025 a 2032. Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Tendencias del mercado de alimentos listos para consumir en Oriente Medio y África

“Aumento de las horas de trabajo y estilos de vida acelerados”

A medida que las personas se esfuerzan por conciliar sus compromisos profesionales y personales, la demanda de opciones de comida convenientes ha aumentado. Según un informe de la Organización Internacional del Trabajo (OIT), la jornada laboral promedio en Oriente Medio y África ha aumentado aproximadamente un 8 % en la última década, lo que pone de manifiesto la creciente presión sobre la gestión del tiempo. En consecuencia, los consumidores optan por opciones de comida rápidas y sencillas que requieren una preparación mínima y ofrecen un ahorro de tiempo considerable.

El mercado de alimentos listos para comer se ha beneficiado enormemente de este cambio, ya que estos productos satisfacen las necesidades de las personas ocupadas que buscan comidas prácticas, nutritivas y de consumo inmediato. El ritmo de vida acelerado es particularmente frecuente en las poblaciones urbanas, donde las agendas apretadas limitan el tiempo para la preparación de comidas tradicionales. Esto ha impulsado a los fabricantes a innovar y a introducir una amplia gama de productos listos para comer que satisfacen diversas preferencias de sabor y necesidades dietéticas.

Además, el creciente número de hogares con doble ingreso ha contribuido a la expansión del mercado. En países como Estados Unidos y el Reino Unido, más del 60 % de los hogares tienen ahora a ambos miembros de la pareja trabajando, lo que deja menos tiempo para preparar comidas elaboradas. Este cambio demográfico ha provocado un aumento de la demanda de productos listos para consumir que se pueden consumir cómodamente en el trabajo, durante los desplazamientos o en casa después de largas jornadas laborales.

Por ejemplo,

- En marzo de 2023, la Organización Internacional del Trabajo (OIT) informó que Camboya trabajó un promedio de aproximadamente 2456 horas al año en 2017, lo que equivale a casi 47 horas semanales, la cifra más alta entre los 66 países estudiados. Esto indica una importante limitación de tiempo para la preparación de comidas, lo que impulsa la demanda de productos alimenticios listos para el consumo.

En países como México y la República Checa, los empleados suelen trabajar más de 2.000 horas al año, lo que genera una fuerte preferencia por opciones de comidas rápidas y sin complicaciones, incluidos productos listos para comer.

A medida que los estilos de vida ocupados se vuelven más frecuentes en todo el mundo, el mercado de alimentos listos para comer está preparado para un crecimiento sólido, impulsado por la necesidad inquebrantable de soluciones de comidas rápidas, accesibles y satisfactorias.

Alcance del informe y segmentación del mercado

|

Atributos |

Perspectivas clave del mercado de alimentos listos para consumir en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Kuwait, Omán, Qatar, Baréin y el resto de Oriente Medio y África. |

|

Actores clave del mercado |

Mondelēz International, Inc. (EE. UU.), The Kraft Heinz Company (EE. UU.), General Mills Inc (EE. UU.), Nestlé (Suiza), Kellanova (EE. UU.), McCain Foods Limited (Canadá), Hormel Foods, LLC (EE. UU.), Unilever (Reino Unido), Lamb Weston, Inc. (EE. UU.), Simplot (EE. UU.), Tyson Foods, Inc. (EE. UU.), Nomad Foods (Inglaterra), Greencore Group plc (Irlanda), 2 Sisters Food Group (Inglaterra), ITC Limited (India), Agristo (Bélgica), Premier Foods plc (Reino Unido), Bakkavor Group plc (Reino Unido), The Hain Celestial Group, Inc. (EE. UU.), Orkla (Noruega), Farm Frites (Países Bajos), Haldiram's (India), Greenyard (Bélgica), Agrarfrost GmbH (Alemania), Regal Kitchen Foods (India), GODREJ AGROVET LTD. (India), Gitsfood.com (India), LIGHT MASS (Brasil), Koyara Food (India), Genie Food Group (India), Himalaya Food International Ltd. (India), Vimal Agro Products Pvt Ltd (India), Vechem Organics (P) Limited (India), Eateasy New (India), Sankalpfoods.com (India), CSC Brands LP (Canadá) y Priya Foods (Ushodaya Enterprises Pvt Ltd) (India). |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de alimentos listos para consumir en Oriente Medio y África

Los alimentos listos para consumir (RTE) se refieren a productos alimenticios precocinados, preenvasados y que requieren mínima o ninguna preparación adicional antes de su consumo. Estos alimentos están diseñados para la comodidad y se adaptan a estilos de vida ajetreados, ofreciendo soluciones de comidas rápidas y fáciles sin comprometer el sabor ni la calidad. Los alimentos RTE incluyen una amplia variedad de productos, como comidas congeladas, alimentos enlatados, productos refrigerados y refrigerados, y refrigerios envasados no perecederos. Se encuentran comúnmente en supermercados, hipermercados, tiendas de conveniencia y plataformas de venta minorista en línea. Los alimentos RTE son particularmente populares entre profesionales, estudiantes y consumidores urbanos que buscan opciones de comida que les ahorren tiempo.

Dinámica del mercado de alimentos listos para consumir en Oriente Medio y África

Conductores

- Aumento del ingreso disponible del consumidor y mayor poder adquisitivo

A medida que las economías continúan expandiéndose, los consumidores experimentan una mayor estabilidad financiera, lo que les permite gastar más en productos alimenticios prácticos y de alta calidad. Según el Banco Mundial, la renta disponible per cápita en Oriente Medio y África ha experimentado un crecimiento constante durante la última década, lo que permite a los consumidores explorar una mayor variedad de opciones alimentarias que ofrecen comodidad y calidad.

Este aumento de la renta disponible ha provocado un cambio en las preferencias de los consumidores hacia soluciones de comida rápida y sin complicaciones. A medida que más personas pueden permitirse comprar productos listos para comer premium y de mayor precio, los fabricantes están aprovechando esta tendencia ofreciendo opciones de comida diversas e innovadoras que satisfacen diversas preferencias dietéticas, incluyendo variedades orgánicas, sin gluten y de origen vegetal. El aumento de la renta disponible es particularmente evidente en economías emergentes como China, India y Brasil, donde la creciente clase media se inclina cada vez más por opciones de comida convenientes en medio de los ajetreados estilos de vida urbanos. Solo en China, la renta disponible promedio por hogar aumentó alrededor de un 5,3 % en 2024, en comparación con el 5,1 % del año anterior, lo que impulsó significativamente la demanda de productos listos para comer.

Por ejemplo,

- En febrero de 2025, un artículo de The Economic Times destacó que Adani Wilmar, conocida por marcas como el arroz Kohinoor y los aceites de cocina Fortune, anticipa un crecimiento del 10 % en el volumen de ventas para el próximo año fiscal. El director ejecutivo, Angshu Mallick, atribuye este crecimiento previsto al aumento del gasto urbano, impulsado por las reducciones del impuesto sobre la renta personal y la creciente demanda de aplicaciones de entrega rápida de comestibles.

- En 2023, el ingreso personal disponible en China aumentó a 7,2 mil dólares, frente a los 6,9 mil dólares de 2022. Durante el período de 1978 a 2023, el ingreso personal disponible en China promedió 1,97 mil dólares, alcanzando un máximo de 7,2 mil dólares en 2023 y un mínimo histórico de 0,048 mil dólares en 1978.

Además, el mayor poder adquisitivo ha animado a los consumidores a priorizar la calidad, el sabor y la nutrición, impulsando a los fabricantes a desarrollar ofertas de alimentos listos para consumir con valor añadido. A medida que la renta disponible continúa aumentando en Oriente Medio y África, se prevé que el mercado de alimentos listos para consumir prospere, impulsado por la disposición de los consumidores a invertir en soluciones de comida premium y prácticas.

- Canales de comercio minorista y electrónico en rápida expansión

Los fabricantes están aprovechando los formatos minoristas modernos y las soluciones de compra digital para aumentar la visibilidad y la accesibilidad de sus productos a medida que los consumidores los siguen adoptando. La creciente presencia de supermercados, hipermercados, tiendas de conveniencia y plataformas de alimentación en línea ha hecho que los productos alimenticios listos para consumir sean más accesibles, adaptándose al ritmo de vida acelerado de los consumidores urbanos.

El comercio electrónico, en particular, ha transformado el panorama del comercio minorista de alimentos al ofrecer la comodidad de comprar comidas listas para comer desde la comodidad del hogar. Actualmente, alrededor de 2.770 millones de personas en todo el mundo realizan compras en línea a través de plataformas de comercio electrónico especializadas o tiendas en redes sociales, lo que refleja una creciente preferencia por las compras en línea. Esta tendencia se ve impulsada por la creciente penetración de los teléfonos inteligentes y la mejora de la conectividad a internet, especialmente en las economías emergentes. Los gigantes del comercio minorista y las plataformas digitales están aprovechando esta oportunidad ampliando sus carteras de productos listos para comer, incluyendo comidas congeladas, refrigerios instantáneos y kits de comidas saludables. Las colaboraciones estratégicas entre fabricantes de alimentos y plataformas de comercio electrónico como Amazon, Walmart y actores regionales como BigBasket en India y JD.com en China han facilitado a los consumidores el acceso a una amplia variedad de opciones listas para comer con solo unos clics, lo que ha agilizado la distribución, reducido los plazos de entrega y mejorado la satisfacción del cliente. Además, la adopción de la venta minorista omnicanal (que integra las ventas físicas y digitales) ha demostrado ser muy eficaz para satisfacer las diversas demandas de los consumidores modernos.

Por ejemplo,

- Los resultados de SellersCommerce indican que, con más del 33 % de la población mundial comprando en línea, el comercio electrónico se ha convertido en una industria de 6,8 billones de dólares y se proyecta que alcance los 8 billones de dólares para 2027. Alrededor de 2770 millones de personas en todo el mundo realizan compras a través de plataformas de comercio electrónico especializadas o tiendas en redes sociales. China y Estados Unidos lideran las compras en línea, lo que genera grandes oportunidades para las marcas de alimentos listos para comer (RTE). Dado que los consumidores prefieren cada vez más las compras sin complicaciones, los productos listos para comer (RTE) están bien posicionados para prosperar.

- BigBasket, la plataforma líder de alimentación en línea de India, ha ampliado su catálogo de productos listos para consumir (RTE) para satisfacer la creciente demanda de opciones de comida práctica. Centrada en ofrecer productos frescos y de alta calidad, la empresa busca aprovechar la creciente preferencia de los consumidores por comidas rápidas y sin complicaciones. Esta estrategia permite a BigBasket capitalizar la creciente popularidad de los alimentos RTE en el mercado indio.

- En China, las tiendas Hema Fresh de Alibaba combinan la venta en línea y fuera de línea, lo que permite a los consumidores pedir comidas preparadas a través de una aplicación y recibirlas en 30 minutos. Hema reportó un aumento del 20% en sus ventas brutas en 2022.

Esta experiencia de compra fluida, sumada a atractivos descuentos y modelos de suscripción, ha convertido el comercio electrónico en el canal predilecto de los consumidores activos. Como resultado, los fabricantes se asocian cada vez más con plataformas en línea para ampliar su alcance, impulsando así el crecimiento y la innovación del mercado.

Oportunidades

- Creciente demanda de alimentos listos para consumir, de origen vegetal y veganos

La creciente conciencia sobre los beneficios para la salud, la sostenibilidad ambiental y las consideraciones éticas asociadas con las dietas basadas en plantas es una tendencia actual. A medida que más consumidores adoptan estilos de vida veganos o flexitarianos, la demanda de comidas prácticas y listas para comer que se ajusten a estas opciones continúa en aumento.

Los actores del mercado están capitalizando esta tendencia con el lanzamiento de productos listos para comer (RTE) innovadores, sabrosos y ricos en nutrientes, derivados de ingredientes vegetales. Según un informe del Good Food Institute, el sector de alimentos de origen vegetal ha experimentado un crecimiento de dos dígitos en los últimos años, impulsado por el creciente interés de los consumidores y la mayor disponibilidad de productos. Los principales fabricantes de alimentos y startups, por ejemplo, invierten cada vez más en soluciones de comidas veganas, desde curris y pastas vegetales hasta postres sin lácteos y ensaladas ricas en proteínas. Las redes sociales y las tendencias alimentarias impulsadas por influencers también han desempeñado un papel fundamental en la promoción de comidas veganas RTE, haciéndolas más populares y accesibles. Además, la expansión de los canales minoristas y de comercio electrónico ha impulsado aún más la visibilidad y el alcance de las ofertas de origen vegetal.

Por ejemplo,

- En noviembre de 2021, un estudio de NielsenIQ reveló que 2,7 millones de hogares en el Reino Unido tenían al menos un residente vegano o vegetariano. Además, 10,5 millones de hogares optaban por alternativas veganas o vegetarianas al menos una vez a la semana en lugar de comidas a base de carne. Entre los encuestados, el 40 % citó los beneficios para la salud como su motivación, mientras que el 31 % creía que era mejor para el planeta.

- En 2022, un estudio de Ipsos reveló que la creciente demanda de alimentos listos para consumir (LTE) de origen vegetal y veganos es evidente, ya que los consumidores buscan cada vez más opciones más saludables y sostenibles. Según un estudio de Ipsos, casi la mitad (46%) de los británicos de entre 16 y 75 años se plantea reducir el consumo de productos animales, y el 48% ya utiliza alternativas a la leche vegetal, como la de almendras, avena y coco. El mercado de LTE puede aprovechar esta tendencia ofreciendo soluciones de comidas prácticas, nutritivas y de origen vegetal.

- En la Encuesta Europea de Consumidores sobre Alimentos de Origen Vegetal de 2021, realizada por ProVeg International, se destacó que el Reino Unido lidera la compra y el consumo de productos de origen vegetal en Europa, incluyendo platos veganos preparados y comida para llevar. Dado que los consumidores priorizan cada vez más la salud y la sostenibilidad, el mercado de alimentos listos para comer (RTE) puede aprovechar esta tendencia ofreciendo opciones de comidas vegetales prácticas y variadas.

Dado que los consumidores preocupados por su salud buscan opciones alimentarias nutritivas y éticas, existe un amplio margen para que los fabricantes innoven y diversifiquen sus carteras de productos. La colaboración con proveedores de ingredientes de origen vegetal y la inversión en investigación y desarrollo pueden aumentar aún más el atractivo de los alimentos veganos listos para consumir (RTE). A medida que el mercado evoluciona, la adopción del movimiento de origen vegetal presenta una prometedora oportunidad de crecimiento sostenido y rentabilidad.

- Avances tecnológicos en el procesamiento y envasado de alimentos

Las innovaciones en los métodos de procesamiento, como el procesamiento a alta presión (HPP) y la esterilización térmica asistida por microondas (MATS), han permitido a los fabricantes prolongar la vida útil de los productos, preservando al mismo tiempo la frescura, el sabor y el valor nutricional. Estas técnicas de vanguardia satisfacen la demanda de los consumidores de productos mínimamente procesados y sin aditivos, sin comprometer la seguridad ni la calidad.

En el ámbito del envasado, la adopción de soluciones inteligentes y sostenibles está cobrando impulso. Las tecnologías de envasado activas e inteligentes, como los captadores de oxígeno y los indicadores de tiempo y temperatura, mejoran la seguridad del producto y mantienen la calidad a lo largo de la cadena de suministro. Además, la transición hacia materiales ecológicos, como los envases biodegradables y reciclables, atrae a consumidores con conciencia ambiental, a la vez que se alinea con los objetivos de sostenibilidad de Oriente Medio y África. La automatización y la digitalización en el procesamiento de alimentos también están revolucionando la eficiencia de la producción. Los sistemas automatizados de clasificación, porcionado y control de calidad reducen los costes laborales y garantizan la consistencia, lo que permite a los fabricantes aumentar la producción manteniendo altos estándares. Asimismo, la maquinaria de envasado avanzada, con capacidades como el sellado al vacío y el envasado en atmósfera modificada (MAP), aumenta aún más el atractivo del producto al conservar la textura y el sabor durante más tiempo.

La integración de soluciones de trazabilidad, como la tecnología blockchain y los códigos QR en los envases, proporciona a los consumidores información en tiempo real sobre el origen del producto y el control de calidad. Esta transparencia genera confianza y mejora la fidelidad a la marca, haciendo que los productos listos para consumir sean más atractivos para los consumidores más exigentes.

Por ejemplo,

- Tetra Pak revolucionó el envasado de alimentos con su tecnología aséptica, que permite almacenar los productos sin refrigeración durante largos periodos, conservando su valor nutricional y sabor. Esta innovación ha sido fundamental para ampliar la distribución y la vida útil de los productos listos para consumir, especialmente en regiones con escasez de infraestructura para la cadena de frío.

- La esterilización térmica asistida por microondas (MATS) es una tecnología de vanguardia que combina agua caliente a presión y energía de microondas de onda larga para esterilizar productos alimenticios. A diferencia de la esterilización convencional en autoclave, MATS reduce significativamente el tiempo de procesamiento, minimizando la pérdida de nutrientes y preservando la calidad de los alimentos. Empresas líderes en Oriente Medio y África, como Eka Middle East and Africa, están aprovechando esta innovación para mejorar sus soluciones de envasado, satisfaciendo así las necesidades cambiantes de la industria alimentaria.

- La tecnología de sensores inteligentes está revolucionando el control de calidad en el procesamiento de alimentos al proporcionar monitoreo en tiempo real de la temperatura, la humedad y los niveles de contaminación. Estos sensores detectan desviaciones al instante, lo que permite ajustes rápidos para mantener la calidad y seguridad del producto. El registro automatizado de datos garantiza la trazabilidad y el cumplimiento de las normas de seguridad alimentaria, lo que aumenta la fiabilidad y eficiencia de la producción.

Estos avances no solo mejoran el atractivo de los productos, sino que también abren nuevos mercados al abordar los desafíos logísticos, especialmente en zonas remotas. Como resultado, las innovaciones tecnológicas impulsan el crecimiento, permitiendo a los fabricantes satisfacer las cambiantes demandas de los consumidores y, al mismo tiempo, mantener la rentabilidad.

Restricciones/Desafíos

- Alto costo de los alimentos listos para comer (RTE) en comparación con las comidas caseras

Los consumidores, especialmente en regiones con precios sensibles, suelen encontrar los alimentos listos para comer considerablemente más caros que preparar comidas caseras. Esta disparidad de costos se puede atribuir a varios factores, como el uso de ingredientes de primera calidad, el envasado, el procesamiento y los gastos logísticos.

Según la Oficina de Estadísticas Laborales, el costo promedio de una comida casera en EE. UU. es de aproximadamente USD4 por porción, mientras que el costo de una sola comida lista para comer puede variar entre USD7 y USD15, dependiendo de la marca y los ingredientes utilizados. Esta brecha de precios dificulta que muchos consumidores, especialmente aquellos de ingresos medios y bajos, justifiquen la compra frecuente de productos listos para comer. Además, la percepción de que las comidas listas para comer ofrecen una menor relación calidad-precio en comparación con las comidas caseras recién preparadas limita aún más la penetración en el mercado. A medida que los consumidores se vuelven más conscientes de sus gastos, especialmente en medio de las incertidumbres económicas, tienden a preferir opciones de comida casera y económica. Además, las preferencias culturales por las comidas recién cocinadas en muchos países continúan influyendo en las decisiones de los consumidores, ya que las familias priorizan los platos caseros sobre las alternativas preenvasadas. Esta tendencia a optar por métodos de cocción tradicionales plantea un desafío para los fabricantes que buscan capturar una mayor participación en el mercado.

Por ejemplo,

- Un artículo del New York Times de enero de 2025 destacó cómo las personas ahorraron cantidades sustanciales anualmente al reducir su dependencia de la comida rápida y optar por comidas caseras. Una persona ahorró casi 11 000 dólares al año al optar por preparar comidas en casa en lugar de comprar opciones preparadas.

- En agosto de 2023, un estudio destacado por Real Plans indica que los kits de entrega de comidas pueden ser hasta tres veces más caros que comprar ingredientes en supermercados locales y preparar comidas en casa.

Advance Financial informó que el alto costo de los alimentos listos para consumir (RTE) en comparación con las comidas caseras sigue siendo una preocupación para muchos consumidores. En promedio, una comida casera cuesta entre USD 4 y USD 6 por persona, mientras que una comida de restaurante o RTE puede costar entre USD 15 y USD 20 o más. Esta significativa diferencia de precio, de al menos USD 10 por comida, puede acumularse rápidamente, especialmente para quienes compran con frecuencia.

El alto costo de los productos alimenticios listos para consumir (RTE) en comparación con las comidas caseras sigue siendo un obstáculo importante para el crecimiento del mercado. A medida que los consumidores priorizan cada vez más las opciones económicas y recién preparadas, el mercado enfrenta constantes limitaciones para lograr una aceptación generalizada, especialmente en regiones con precios sensibles.

- Intensa competencia en el mercado entre las principales marcas de alimentos y los actores regionales

Las grandes marcas multinacionales están aprovechando sus sólidas redes de distribución y su prestigio consolidado para mantener su dominio, mientras que los actores regionales aprovechan las preferencias locales y las ventajas de costes. Esta competencia obliga a los fabricantes a innovar y diferenciar sus ofertas de productos para captar la atención del consumidor. Las marcas invierten cada vez más en estrategias de marketing y diversificación de productos para destacar, introduciendo a menudo sabores únicos, ingredientes fortificados y fórmulas saludables. Sin embargo, mantener la competitividad en medio de estrategias de precios agresivas y campañas promocionales sigue siendo un reto importante. Los fabricantes más pequeños y regionales a menudo tienen dificultades para igualar las economías de escala de los gigantes del sector, lo que se traduce en márgenes de beneficio más reducidos. Además, la aparición de productos de marca blanca en las grandes cadenas minoristas está ejerciendo mayor presión sobre los productos de marca, ya que los consumidores optan cada vez más por alternativas asequibles sin comprometer la calidad.

Además, la evolución de las preferencias de los consumidores y la creciente popularidad de productos dietéticos de nicho, como las opciones vegetales y sin gluten, obligan a las marcas a adaptar y ampliar continuamente sus portafolios. Equilibrar la innovación de productos con la rentabilidad sigue siendo una tarea abrumadora, especialmente para las empresas pequeñas con recursos limitados.

Por ejemplo,

- En marzo de 2025, Reuters publicó un artículo que afirmaba que los consumidores se inclinaban cada vez más por marcas de alimentos más pequeñas e independientes, a menudo percibidas como productoras menos procesadas y más asequibles. Este cambio ha afectado a grandes conglomerados como Unilever y Procter & Gamble, cuya cuota de mercado ha disminuido a medida que los consumidores optan por alternativas como la mayonesa Duke's y la mayonesa Mike's Amazing en lugar de marcas tradicionales como Hellmann's.

- Un artículo de noviembre de 2022 de Dow Jones & Company, Inc. (WALL STREET JOURNAL) destacó que los minoristas están desarrollando cada vez más sus propios productos alimenticios listos para consumir (RTE) de marca blanca, ofreciendo a los consumidores alternativas rentables a las marcas establecidas. Esta estrategia no solo ofrece a los consumidores más opciones, sino que también intensifica la competencia, obligando a las grandes marcas a reevaluar sus precios y propuestas de valor.

En medio de esta intensa competencia, mantener la lealtad a la marca y sostener la rentabilidad se ha vuelto cada vez más difícil, ya que tanto los actores establecidos como los emergentes navegan en un panorama en rápida evolución con mayores expectativas de los consumidores.

Impacto y escenario actual del mercado ante la escasez de materias primas y los retrasos en los envíos

Data Bridge Market Research ofrece un análisis exhaustivo del mercado y proporciona información considerando el impacto y el entorno actual del mercado en la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción eficaces y la asistencia a las empresas en la toma de decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias empiezan a verse afectadas. Los efectos previstos de la recesión económica en los precios y la accesibilidad de los productos se tienen en cuenta en los informes de análisis de mercado y los servicios de inteligencia que ofrece DBMR. Gracias a esto, nuestros clientes pueden, por lo general, adelantarse a sus competidores, proyectar sus ventas e ingresos, y estimar sus gastos de resultados.

Alcance del mercado de alimentos listos para consumir en Oriente Medio y África

El mercado está segmentado según el tipo de producto, la categoría, el tipo de empaque, el tamaño del empaque, la tecnología de empaque, el tipo de almacenamiento, el canal de distribución y el usuario final. El crecimiento de estos segmentos le permitirá analizar los segmentos con menor crecimiento en las industrias y brindar a los usuarios una valiosa visión general del mercado y perspectivas que les ayudarán a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Productos cárnicos

- Productos a base de cereales

- Productos lácteos

- Productos de panadería

- Dulces Salados

- Productos de confitería

- Productos a base de vegetales

- Sopas instantáneas, bocadillos salados

- Alimentos refrigerados

- Snacks de carne a base de plantas

- Comidas listas para comer

Categoría

- Convencional

- Especialidad

Tipo de embalaje

- Bolsas/sobres

- Latas

- Frascos y contenedores

- Botellas

- Cajas

- Otros

Tamaño del embalaje

- Menos de 250 gramos

- 251-500 gramos

- 501-750 gramos

- 751-1000 gramos

- Más de 1000 gramos

Tecnología de embalaje

- Absorbedores de oxígeno

- Control de humedad

- Antimicrobianos

- Indicadores de temperatura y tiempo

- Películas comestibles

Tipo de fuente

- Congelado/Refrigerado

- Estable en almacenamiento

- Enlatado

- Otros

Canal de distribución

- Basado en la tienda

- Canal no basado en tienda

Usuario final

- Servicios de la industria alimentaria

- Hogares

- Otros

Análisis regional del mercado de alimentos listos para consumir en Oriente Medio y África

Se analiza el mercado y se proporcionan información sobre el tamaño del mercado y las tendencias por país, tipo de producto, categoría, tipo de embalaje, tamaño del embalaje, tecnología de embalaje, tipo de almacenamiento, canal de distribución y usuario final como se mencionó anteriormente.

Los países cubiertos en el mercado son Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Kuwait, Omán, Qatar, Bahréin y el resto de Medio Oriente y África.

Se espera que Arabia Saudita domine el mercado de alimentos listos para consumir (RTE) debido al rápido crecimiento de su población urbana, el aumento de los ingresos disponibles y la creciente demanda de opciones de comida convenientes. Un estilo de vida acelerado, la expansión de la infraestructura minorista y el auge del comercio electrónico impulsan aún más el crecimiento del mercado. Además, la presencia de importantes fabricantes de alimentos, una fuerte preferencia por los alimentos halal envasados y las crecientes tendencias saludables contribuyen al liderazgo del país en el sector de alimentos listos para consumir.

Se prevé que Arabia Saudita sea el mercado de alimentos listos para consumir (RTE) con mayor crecimiento debido a la creciente urbanización, el aumento de los ingresos disponibles y la tendencia hacia la comida preparada. La expansión de supermercados, hipermercados y plataformas de comercio electrónico mejora la accesibilidad de los productos. Un estilo de vida ajetreado y la demanda de comidas envasadas con certificación halal impulsan aún más la expansión del mercado. Además, la creciente concienciación sobre la salud impulsa la demanda de opciones orgánicas y sin conservantes, mientras que la innovación continua de las marcas de alimentos fortalece el sector de alimentos listos para consumir del país.

La sección de países del informe también presenta los factores que impactan el mercado individual y los cambios en la regulación del mercado nacional, los cuales impactan las tendencias actuales y futuras. Datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de caso son algunos de los indicadores utilizados para pronosticar el escenario del mercado en cada país. Asimismo, se considera la presencia y disponibilidad de marcas de Oriente Medio y África, así como los desafíos que enfrentan debido a la alta o escasa competencia de marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales, al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de alimentos listos para consumir en Oriente Medio y África

El panorama competitivo del mercado proporciona detalles por competidores. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Oriente Medio y África, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los líderes del mercado de alimentos listos para comer de Oriente Medio y África que operan en el mercado son:

- Lamb Weston (Estados Unidos)

- Simplot (EE. UU.)

- Haldiram (India)

- Patatas fritas de granja (Países Bajos)

- Greenyard (Bélgica)

- Agrarfrost GmbH (Alemania)

- Agristo (Bélgica)

- CSC Brands LP (Canadá)

- El Grupo Celestial Hain, Inc. (EE. UU.)

- Bakkavor Group plc (Reino Unido)

- McCain Foods Limited (Canadá)

- Premier Foods plc (Reino Unido)

- gitsfood.com (India)

- Nomad Foods (Reino Unido)

- General Mills (EE. UU.)

- Greencore Group plc (Irlanda)

- Orkla (Noruega)

- ITC Limited (India)

- Himalaya Food International Ltd. (India)

- Grupo Internacional Mondelēz (EE. UU.)

- Kraft Heinz (EE. UU.)

- Tyson Foods, Inc. (EE. UU.)

- Soluciones alimentarias de Unilever (Reino Unido)

- Nestlé (Suiza)

- Misa ligera (Brasil)

- Kellanova (EE. UU.)

- Hormel Foods, LLC. (EE. UU.)

- Comida Koyara (India)

- Priya Foods (India)

- Grupo de alimentos Genie (India)

- Vechem Organics (P) Limited (India)

- Vimal Agro Products Pvt Ltd (India)

- sankalpfoods.com (India)

- Alimentos de cocina real (India)

- Eateasy nuevo (India)

- GODREJ AGROVET LTD. (India)

- 2 Sisters Food Group (Reino Unido)

Últimos avances en el mercado de alimentos listos para consumir en Oriente Medio y África

- En enero de 2025, OREO inicia el año con el lanzamiento de seis nuevos y emocionantes sabores, incluyendo ediciones limitadas y productos permanentes. Entre los sabores más destacados se encuentran las galletas OREO Game Day, con relieves inspirados en el fútbol americano, perfectas para los días de partido y las fiestas para ver el partido. Las nuevas galletas OREO Loaded, disponibles permanentemente, ofrecen crema Mega Stuf rellena con trocitos de OREO. Otras novedades permanentes incluyen las OREO Cakesters Doradas, las OREO Irish Creme THINS y las OREO Minis Peanut Butter. Las OREO Cakesters Doradas son pastelitos dorados rellenos de crema, las OREO Irish Creme THINS ofrecen un toque de crema irlandesa, y las OREO Minis Peanut Butter combinan galletas de chocolate con una suave crema de mantequilla de cacahuete. Además, las galletas OREO congeladas completan la nueva y emocionante línea de productos.

- En septiembre de 2024, la alianza entre OREO y Coca-Cola presenta una divertida y emocionante colaboración llamada "Besties", que celebra el vínculo único de la amistad. Las marcas se han unido para ofrecer dos productos por tiempo limitado: la galleta sándwich OREO Coca-Cola y la Coca-Cola OREO Zero Azúcar Edición Limitada. Ambas presentan diseños y empaques distintivos, que combinan los elementos icónicos de ambas marcas. La galleta sándwich OREO Coca-Cola combina una base de chocolate con un sabor inspirado en Coca-Cola y crema blanca con purpurina comestible roja, mientras que la Coca-Cola OREO Zero Azúcar ofrece un refrescante sabor a Coca-Cola con toques de OREO. La colaboración busca unir a los fans, crear nuevas experiencias y celebrar la conexión y la unión de una manera divertida e inesperada.

- En abril de 2024, los traviesos SOUR PATCH KIDS se unieron a OREO para una divertida e inesperada colaboración, presentando las galletas OREO SOUR PATCH KIDS de edición limitada. Estas galletas contienen Golden OREO con sabor a SOUR PATCH KIDS, con inclusiones coloridas y un relleno de crema con azúcar ácida multicolor para una experiencia agridulce. Junto con las galletas, las marcas lanzarán una línea de merchandising exclusiva, que incluye una camiseta de cuello redondo, pantalones deportivos, un sombrero de pescador, una bandolera, pinzas para el pelo y calcetines. La colección celebra el espíritu lúdico de ambas marcas, ofreciendo a los fans la oportunidad de disfrutar de la mejor combinación agridulce con artículos de OREO y SOUR PATCH KIDS de edición limitada.

- En febrero de 2023, Mondelēz International dio un paso significativo hacia su objetivo de cero emisiones netas de gases de efecto invernadero para 2050 al anunciar una importante inversión en energía renovable procedente de plantas fotovoltaicas en Polonia. La compañía firmó un Acuerdo de Compra de Energía Virtual (PPA) de 12 años con GoldenPeaks Capital, que suministrará alrededor de 126 gigavatios hora de electricidad renovable al año, procedente de diversas plantas de energía solar en Polonia. Se espera que este acuerdo ahorre más de un millón de toneladas métricas de CO2 y compense la huella de carbono relacionada con la electricidad de ocho plantas de Mondelēz en Polonia. El inicio de la producción de energía está previsto para marzo de 2023, lo que marca un hito importante en el compromiso de Mondelēz con la sostenibilidad y la reducción de su huella de emisiones. Esta colaboración ejemplifica la dedicación de la compañía a construir un futuro más sostenible, a la vez que continúa ofreciendo sus apreciados productos, como Milka, Prince Polo y Delicje.

- En febrero de 2025, Capri Sun lanzó su primera botella resellable en más de 20 años, ofreciendo una nueva y cómoda forma de disfrutar de sus icónicos sabores para llevar a todos los públicos. Las botellas de 355 ml, disponibles en Fruit Punch, Pacific Cooler y Strawberry Kiwi, contienen el equivalente a dos sobres y están elaboradas con ingredientes totalmente naturales, sin colorantes ni edulcorantes artificiales. Este lanzamiento responde a la demanda de porciones más grandes y está diseñado para satisfacer las necesidades de las familias ocupadas, especialmente en tiendas de conveniencia donde Capri Sun tenía una disponibilidad limitada. Esta iniciativa amplía el portafolio de Capri Sun, basándose en el éxito de innovaciones anteriores como las jarras Capri Sun Multi-Serve, y refuerza el compromiso de la marca de evolucionar con las preferencias del consumidor.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.5 COMPETITIVE RIVALRY

4.2 IMPORT EXPORT SCENARIO

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL SOURCING

4.3.2 FOOD PROCESSING & MANUFACTURING

4.3.3 PACKAGING AND STORAGE

4.3.4 DISTRIBUTION AND LOGISTICS

4.3.5 MARKETING AND RETAILING

4.3.6 CONCLUSION

4.4 KEY FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.4.1 CONVENIENCE AND TIME-SAVING

4.4.2 HEALTH AND NUTRITION AWARENESS

4.4.3 PRICE SENSITIVITY AND ECONOMIC FACTORS

4.4.4 BRAND REPUTATION AND TRUST

4.4.5 PACKAGING AND PRODUCT PRESENTATION

4.4.6 DIGITAL INFLUENCE AND ONLINE RETAILING

4.4.7 CULTURAL AND REGIONAL PREFERENCES

4.4.8 SUSTAINABILITY AND ETHICAL CONSIDERATIONS

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5.1 PRODUCT INNOVATION AND DIVERSIFICATION

4.5.2 STRATEGIC ACQUISITIONS

4.5.3 INTERNATIONAL EXPANSION

4.5.4 TECHNOLOGICAL ADVANCEMENTS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6.1 INDUSTRY TRENDS

4.6.1.1 GROWING CONSUMER DEMAND FOR CONVENIENCE

4.6.1.2 RISING POPULARITY OF HEALTHY AND NUTRITIOUS RTE FOODS

4.6.1.3 INNOVATIONS IN PACKAGING FOR EXTENDED SHELF LIFE

4.6.1.4 EXPANSION OF FROZEN AND CHILLED RTE SEGMENTS

4.6.1.5 RISE OF PLANT-BASED AND ALTERNATIVE PROTEIN OPTIONS

4.6.1.6 DIGITALIZATION AND E-COMMERCE GROWTH

4.6.1.7 FOCUS ON CLEAN LABEL AND TRANSPARENCY

4.6.2 FUTURE PERSPECTIVE

4.6.2.1 TECHNOLOGICAL ADVANCEMENTS IN FOOD PROCESSING

4.6.2.2 SUSTAINABLE AND ETHICAL FOOD CHOICES

4.6.2.3 PERSONALIZATION IN RTE MEALS

4.6.2.4 REGULATORY AND COMPLIANCE CHALLENGES

4.7 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7.1 ADVANCED FOOD PROCESSING TECHNOLOGIES

4.7.2 SMART PACKAGING AND SUSTAINABLE MATERIALS

4.7.3 AUTOMATION AND ROBOTICS IN FOOD PRODUCTION

4.7.4 NUTRITIONAL ENHANCEMENT AND FUNCTIONAL INGREDIENTS

4.7.5 AI & BIG DATA FOR PERSONALIZATION AND SUPPLY CHAIN OPTIMIZATION

4.7.6 3D FOOD PRINTING AND CUSTOMIZATION

4.7.7 E-COMMERCE, CLOUD KITCHENS, AND LAST-MILE DELIVERY INNOVATIONS

4.7.8 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 PROTEINS (MEAT, POULTRY, AND PLANT-BASED PROTEINS)

4.8.2 GRAINS AND CARBOHYDRATES

4.8.3 VEGETABLES AND FRUITS

4.8.4 PRESERVATIVES AND ADDITIVES

4.8.5 EMERGING TRENDS AND FUTURE SOURCING OPPORTUNITIES

4.8.6 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL SOURCING AND PROCUREMENT

4.9.2 PROCESSING AND MANUFACTURING

4.9.3 STORAGE AND INVENTORY MANAGEMENT

4.9.4 DISTRIBUTION AND LOGISTICS

4.9.5 RETAIL AND CONSUMER ACCESS

4.9.6 CHALLENGES IN THE RTE FOOD SUPPLY CHAIN

4.9.7 FUTURE TRENDS AND INNOVATIONS

4.9.8 CONCLUSION

4.1 PRICING ANALYSIS

4.11 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.12 BRAND OUTLOOK

4.12.1 BRAND COMPARATIVE ANALYSIS

4.12.2 PRODUCT VS BRAND OVERVIEW

4.12.2.1 PRODUCT OVERVIEW

4.12.2.2 BRAND OVERVIEW

4.12.2.3 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING WORK HOURS AND FAST-PACED LIFESTYLES

6.1.2 RISING CONSUMER DISPOSABLE INCOME AND HIGHER PURCHASING POWER

6.1.3 RAPIDLY EXPANDING RETAIL AND E-COMMERCE CHANNELS

6.1.4 RISING DEMAND FOR HEALTHY, ORGANIC AND FORTIFIED READY-TO-EAT FOODS

6.2 RESTRAINTS

6.2.1 HEALTH CONCERNS RELATED TO PROCESSED FOODS

6.2.2 HIGH COST OF READY-TO-EAT (RTE) COMPARED TO HOME-COOKED MEALS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR PLANT-BASED AND VEGAN READY-TO-EAT FOODS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN FOOD PROCESSING AND PACKAGING

6.3.3 CUSTOMIZATION AND PERSONALIZATION OF READY-TO-EAT FOODS

6.4 CHALLENGES

6.4.1 INTENSE MARKET COMPETITION AMONGST MAJOR FOOD BRANDS AND REGIONAL PLAYERS

6.4.2 CONSUMER PERCEPTION OF ARTIFICIAL INGREDIENTS AND FLAVORS IN READY-TO-EAT FOODS

7 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 MEAT PRODUCTS

7.3 CEREAL BASED PRODUCTS

7.4 DAIRY PRODUCTS

7.5 BAKERY PRODUCTS

7.6 SAVORY SWEETS

7.7 CONFECTIONERY PRODUCTS

7.8 VEGETABLES BASED PRODUCTS

7.9 INSTANT SOUPS

7.1 SAVORY SNACKS

7.11 REFRIGERATED FOODS

7.12 PLANT BASED MEAT SNACKS

7.13 READY TO EAT MEALS

8 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 SPECIALTY

9 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES/SACHETS

9.3 CANS

9.4 JARS & CONTAINERS

9.5 BOTTLES

9.6 BOXES

9.7 OTHERS

10 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE

10.1 OVERVIEW

10.2 LESS THAN 250 GRAMS

10.3 251-500 GRAMS

10.4 501-750 GRAMS

10.5 751-1000 GRAMS

10.6 MORE THAN 1000 GRAMS

11 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY

11.1 OVERVIEW

11.2 OXYGEN SCAVENGERS

11.3 MOISTURE CONTROL

11.4 ANTIMICROBIALS

11.5 TIME TEMPERATURE INDICATORS

11.6 EDIBLE FILMS

12 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE

12.1 OVERVIEW

12.2 FROZEN/REFRIGERATED

12.3 SHELF-STABLE

12.4 CANNED

12.5 OTHERS

13 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE-BASED

13.3 NON-STORE BASED

14 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER

14.1 OVERVIEW

14.2 FOOD INDUSTRY SERVICES

14.3 HOUSEHOLDS

14.4 OTHERS

15 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SAUDI ARABIA

15.1.2 U.A.E.

15.1.3 SOUTH AFRICA

15.1.4 EGYPT

15.1.5 KUWAIT

15.1.6 OMAN

15.1.7 QATAR

15.1.8 BAHRAIN

15.1.9 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 MONDELĒZ INTERNATIONAL, INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 RECENT FINANCIALS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 THE KRAFT HEINZ COMPANY

18.2.1 COMPANY SNAPSHOT

18.2.2 RECENT FINANCIALS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 GENERAL MILLS INC

18.3.1 COMPANY SNAPSHOT

18.3.2 RECENT FINANCIALS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 NESTLÉ

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 KELLANOVA

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 AGRISTO

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 2 SISTERS FOOD GROUP

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT NEWS

18.8 AGRARFROST GMBH

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BAKKAVOR GROUP PLC

18.9.1 COMPANY SNAPSHOT

18.9.2 RECENT FINANCIALS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 CSC BRANDS LP

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 EATEASY NEW.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 FARM FRITES

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GENIE FOOD GROUP

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GITSFOOD.COM

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 GODREJ AGROVET LIMITED

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 GREENCORE GROUP PLC

18.16.1 COMPANY SNAPSHOT

18.16.2 RECENT FINANCIALS

18.16.3 PRODUCT PORTFOLIO

18.16.4 NEWS TYPE

18.17 GREENYARD

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 HALDIRAM’S

18.18.1 COMPANY SNAPSHOTS

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 HIMALAYA FOOD INTERNATIONAL LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 HORMEL FOODS CORPORATION.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENT

18.21 ITC LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 KOYARA FOODS

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 LAMB WESTON, INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 LIGHT MASS

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 MCCAIN FOODS LIMITED

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 NOMAD FOODS

18.26.1 COMPANY SNAPSHOT

18.26.2 RECENT FINANCIALS

18.26.3 PRODUCT PORTFOLIO

18.26.4 RECENT DEVELOPMENT

18.27 ORKLA

18.27.1 COMPANY SNAPSHOT

18.27.2 RECENT FINANCIALS

18.27.3 PRODUCT PORTFOLIO

18.27.4 RECENT DEVELOPMENT

18.28 PREMIER FOODS PLC

18.28.1 COMPANY SNAPSHOT

18.28.2 RECENT FINANCIALS

18.28.3 PRODUCT PORTFOLIO

18.28.4 RECENT DEVELOPMENT

18.29 PRIYA FOODS

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

18.3 REGAL KITCHEN FOODS

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 RECENT DEVELOPMENT

18.31 SANKALPFOODS.COM

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENT/ NEWS TYPE

18.32 J.R. SIMPLOT COMPANY.

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENT

18.33 THE HAIN CELESTIAL GROUP, INC.

18.33.1 COMPANY SNAPSHOT

18.33.2 REVENUE ANALYSIS

18.33.3 PRODUCT PORTFOLIO

18.33.4 RECENT DEVELOPMENTS

18.34 TYSON FOODS, INC.

18.34.1 COMPANY SNAPSHOT

18.34.2 RECENT FINANCIALS

18.34.3 PRODUCT PORTFOLIO

18.34.4 RECENT DEVELOPMENT

18.35 UNILEVER

18.35.1 COMPANY SNAPSHOT

18.35.2 REVENUE ANALYSIS

18.35.3 PRODUCT PORTFOLIO

18.35.4 RECENT DEVELOPMENTS

18.36 VECHEM ORGANICS (P) LIMITED

18.36.1 COMPANY SNAPSHOT

18.36.2 PRODUCT PORTFOLIO

18.36.3 RECENT DEVELOPMENT

18.37 VIMAL AGRO PRODUCTS PVT LTD

18.37.1 COMPANY SNAPSHOT

18.37.2 PRODUCT PORTFOLIO

18.37.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 INCREASING DISPOSABLE INCOMES

TABLE 4 ESTIMATED SAVINGS USING READY TO EAT FOODS

TABLE 5 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 7 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 8 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 13 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION 2018-2032, (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 15 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 18 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, REGION, 2018-2032, (TONS)

TABLE 20 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 22 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 23 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (TONS)

TABLE 25 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 26 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 28 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA ANIMAL BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA PLANT BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 33 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 34 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 37 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 38 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 39 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 40 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 42 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 43 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032, (TONS)

TABLE 45 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 47 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 48 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 52 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 53 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION TYPE, 2018-2032, (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 55 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 57 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 58 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 60 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 62 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 63 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 65 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 67 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 68 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 70 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 73 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 75 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 78 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 79 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 81 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 82 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 84 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 85 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 87 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (TONS)

TABLE 89 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (USD/KG)

TABLE 90 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 92 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 94 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 95 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 97 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 98 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY REGION 2018-2032, (TONS)

TABLE 100 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 102 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 103 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA SPECIALITY IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA SPECIALTY IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA POUCHES/SACHETS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA CANS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA JARS & CONTAINERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA BOTTLES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA BOTTLES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA BOXES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA OTHERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA LESS THAN 250 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA 251-500 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA 501-750 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA 751-1000 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA MORE THAN 1000 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA OXYGEN SCAVENGERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA MOISTURE CONTROL IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ANTIMICROBIALS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA TIME TEMPERATURE INDICATORS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA EDIBLE FILMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FROZEN/REFRIGERATED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA SHELF-STABLE IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA CANNED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA OTHERS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA NON-STORE BASED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA NON-STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA RESTAURANTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA HOUSEHOLDS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA OTHERS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 145 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (USD/ KG)

TABLE 146 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 148 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 149 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 151 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 152 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 154 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 155 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 157 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 158 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (TONS)

TABLE 160 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 161 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 164 MIDDLE EAST AND AFRICA ANIMAL BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA PLANT BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 168 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 169 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 171 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 172 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 174 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 175 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 177 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 178 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 180 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 181 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 183 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 184 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 186 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 187 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 189 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 190 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 192 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 193 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 195 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 196 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 198 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 199 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 202 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 204 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 205 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 207 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 208 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 210 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 211 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 213 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)