Mercado de insectos comestibles de América del Norte, por tipo de insecto (grillos, gusanos de la harina, moscas soldado negras, búfalos, saltamontes, hormigas, gusanos de seda, cigarras y otros), categoría de insecto (insectos regulares e insectos alimentados con dieta premium), aplicación (productos de consumo humano, nutrición animal , aceite de insectos, productos farmacéuticos, cosméticos, cuidado personal y otros), canal de distribución (directo, indirecto): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de insectos comestibles de América del Norte

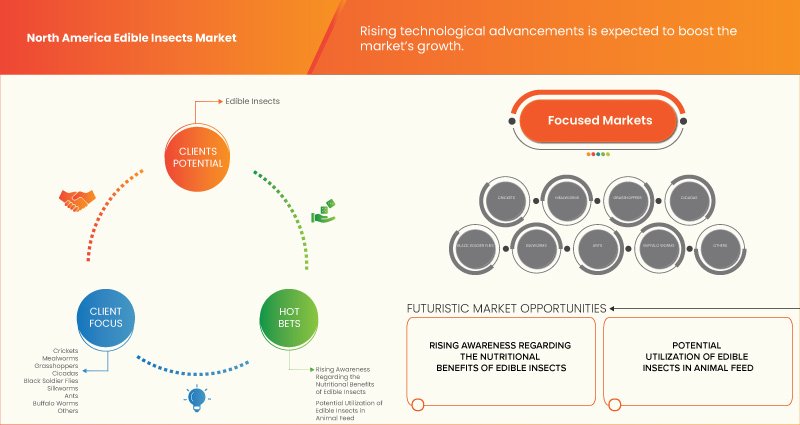

El mercado de insectos comestibles de América del Norte está impulsado por factores como la creciente inclinación hacia el consumo de alimentos ricos en proteínas y el beneficio comercial de la cría de insectos que conduce al crecimiento del mercado.

Uno de los principales factores que impulsan el crecimiento del mercado de insectos comestibles es la creciente inclinación hacia el consumo de alimentos ricos en proteínas. La continua investigación de ensayos clínicos realizada por varias empresas de seguridad alimentaria para mejorar las opciones de carne comestible y el potencial de los insectos comestibles como una nueva fuente de compuestos bioactivos está llevando a la expansión del mercado. El mercado también se ve influenciado por el aumento de la prevalencia de patógenos transmitidos por los alimentos humanos en los insectos. Sin embargo, las barreras éticas asociadas con la tradición y la cultura, la falta de conciencia entre la población, especialmente en los países en desarrollo, y un tiempo prolongado para el marco regulatorio pueden actuar como factores restrictivos para el mercado de insectos comestibles de América del Norte en el período de pronóstico.

Se espera que la demanda de insectos comestibles aumente en América del Norte debido al aumento de la población con desnutrición.

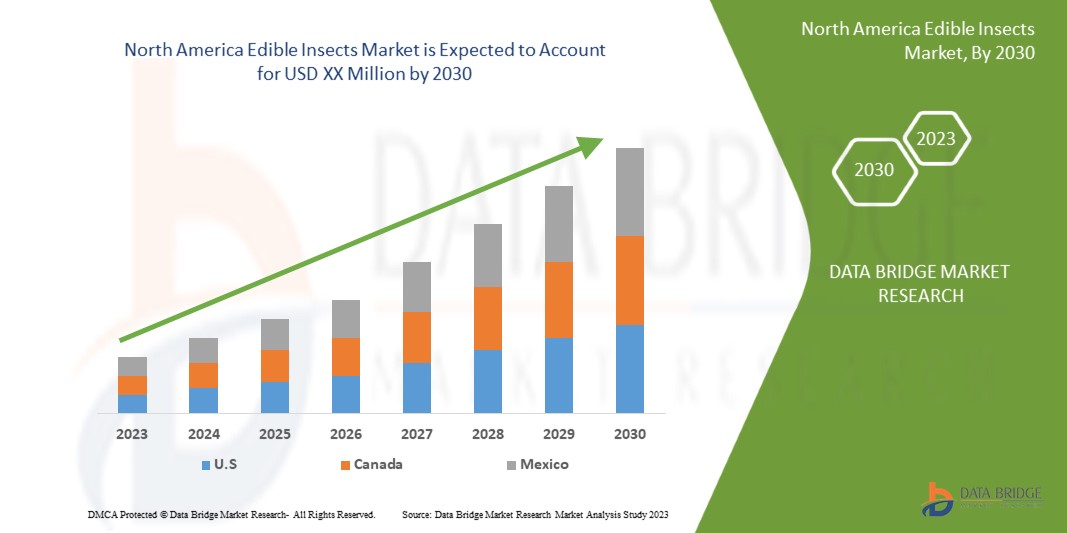

El mercado de insectos comestibles de América del Norte es favorable y tiene como objetivo reducir el riesgo de transmisión de enfermedades zoonóticas con el consumo de insectos comestibles. Data Bridge Market Research analiza que el mercado de insectos comestibles de América del Norte crecerá a una CAGR del 24,6 % durante el período de pronóstico de 2023 a 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones, precios en USD |

|

Segmentos cubiertos |

Tipo de insecto (grillos, gusanos de la harina, moscas soldado negras, búfalos, saltamontes, hormigas, gusanos de seda, cigarras y otros), categoría de insecto (insectos comunes e insectos alimentados con dietas premium), aplicación (productos de consumo humano, nutrición animal, aceite de insectos, productos farmacéuticos, cosméticos, cuidado personal y otros), canal de distribución (directo, indirecto) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Ynsect, Aspire Food Group, BETA HATCH, Fluker's Cricket Farm, Entomo Farms, Enviroflight, Chapul, LLC, Symton Black Soldier Fly y Armstrong Crickets Georgia, entre otros. |

Definición de mercado

Los insectos comestibles constituyen un alimento de alta calidad para los seres humanos, el ganado, las aves de corral y los peces. Como los insectos son animales de sangre fría, tienen una alta tasa de conversión alimenticia. Algunos insectos son una fuente de proteínas completas y proporcionan proteínas esenciales similares a las de la dieta vegetariana.

Se está considerando el uso de insectos comestibles para la alimentación animal, ya que pueden ayudar a paliar rápidamente las deficiencias nutricionales de los animales. Este uso potencial también ayuda a la distribución masiva y la escalabilidad de la alimentación animal en un corto período de tiempo. La alimentación animal a base de insectos comestibles también es sostenible, ya que desempeñan un papel importante en la circularidad de la cadena alimentaria.

Dinámica del mercado de insectos comestibles en América del Norte

Conductores

- Beneficio comercial de la cría de insectos

La mayoría de los insectos comestibles se capturan en estado silvestre, pero algunas especies de insectos han sido domesticadas por sus productos de valor comercial. Los gusanos de seda y las abejas son los ejemplos más conocidos. La sericultura, la práctica de criar gusanos de seda para la producción de seda cruda, tiene su origen en China.

Los insectos también se crían en la agricultura, ya sea para combatir plagas de insectos o para la polinización. En el control biológico, las grandes empresas de cría producen en masa insectos beneficiosos, como depredadores y parasitoides. Estos insectos se suelen vender a los agricultores de frutas, verduras y flores para combatir plagas de insectos y también se utilizan en cultivos de grandes plantaciones, por ejemplo, parasitoides de huevos (Trichogramma spp.) y parasitoides de larvas (Cotesia flavipes) para combatir los barrenadores de la caña de azúcar. Los abejorros (Bombus spp.) y las abejas melíferas (Apis spp.) se crían en todo el mundo para ayudar a los agricultores a polinizar cultivos y huertos frutales.

Por lo tanto, se puede concluir que los beneficios comerciales de la cría de insectos están impulsando el crecimiento del mercado de insectos comestibles en América del Norte.

- Alternativa adecuada a las fuentes de proteínas convencionales de alto costo

Los valores nutricionales de los insectos comestibles son muy variables, sobre todo debido a la gran variedad de especies. Como ocurre con la mayoría de los alimentos, los métodos de preparación y procesamiento (por ejemplo, secado, hervido o frito) aplicados antes del consumo también influyen en la composición nutricional. Sin embargo, debido a su valor nutricional, siguen siendo una fuente de alimentos muy importante para las poblaciones humanas. El contenido de proteínas también depende del alimento (por ejemplo, verduras, cereales o desechos).

Los saltamontes de Nigeria alimentados con salvado, que contiene altos niveles de ácidos grasos esenciales, tienen casi el doble de contenido proteico que los alimentados con maíz. El contenido proteico de los insectos también depende de la etapa de metamorfosis. Los adultos suelen tener un contenido proteico más alto que los estadios anteriores.

Por lo tanto, se prevé que el uso de proteínas de origen animal y vegetal como alternativa a las proteínas de alto costo impulsará el crecimiento del mercado en el período de pronóstico.

Oportunidades

- Aumentar la conciencia sobre los beneficios nutricionales

Una dieta nutricionalmente equilibrada es esencial para el crecimiento, el desarrollo y el rendimiento de los animales; por lo tanto, los insectos comestibles están resultando ser una opción nutricional potencial para una dieta equilibrada. Los ingredientes de los insectos actúan como una fuente importante de nutrición para los animales, con numerosos beneficios potenciales para la salud.

Se está considerando el uso de insectos comestibles para la alimentación animal, ya que pueden solucionar rápidamente las deficiencias nutricionales de los animales. Este uso potencial también ayuda a la distribución masiva y la escalabilidad de la alimentación animal en un corto período de tiempo. La alimentación animal a base de insectos comestibles también es sostenible, ya que desempeña un papel importante en la circularidad de la cadena alimentaria.

Sin embargo, los insectos comestibles están regulados de la misma manera que cualquier otro alimento según la política informal de la FDA, ya que los insectos están sujetos a regulaciones de aditivos alimentarios que son administradas por el Reconocimiento General de Seguridad.

Restricciones/Desafíos

- Aumento de los principales peligros y directrices en materia de seguridad alimentaria

Los riesgos para la seguridad alimentaria desempeñan un papel importante en el mercado de los insectos comestibles. Estas normas y reglamentaciones estrictas son necesarias para que el gobierno las apruebe a fin de garantizar la seguridad de los seres humanos y del medio ambiente. Los diversos riesgos para la seguridad alimentaria que plantean los insectos comestibles, o los que están aumentando, pueden ser biológicos, químicos o físicos, como bacterias, virus, hongos, micotoxinas, pesticidas, parásitos y antimicrobianos.

Los principales participantes del subsistema pueden favorecer o ser menos receptivos a las estrictas pautas y regulaciones de la industria cuando los niveles de ganancias disminuyen, ya que una regulación estricta aumentará los costos de inversión y producción y potencialmente reducirá los márgenes para todos los agricultores o cultivadores de insectos y los usuarios finales.

Sin embargo, las cuestiones de seguridad y la necesidad de establecer un nuevo marco legal se resolverán en varios países.

Desarrollo reciente

- En enero de 2023, Yensect amplió su presencia en América del Norte y completó la construcción de Ynfarm, la granja de insectos más grande del mundo, acelerando su entrega a los clientes.

- En junio de 2022, Aspire apoyó el avance de la agricultura de insectos mediante su patrocinio de la Cátedra de Liderazgo Educativo en Producción y Procesamiento Primario de Insectos Comestibles en la Universidad Laval. La empresa cree que esto les ayudará a difundir la conciencia sobre los insectos comestibles.

Segmentación del mercado de insectos comestibles en América del Norte

El mercado de insectos comestibles de América del Norte se clasifica en cuatro segmentos notables según el tipo de insecto, la categoría de insecto, la aplicación y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Tipo de insecto

- Grillos

- Gusanos de la harina

- Saltamontes

- Cigarras

- Moscas soldado negras

- Gusanos de seda

- Hormigas

- De búfalo

- Otros

Según el tipo de insecto, el mercado de insectos comestibles de América del Norte está segmentado en grillos, gusanos de la harina, moscas soldado negras, búfalos, saltamontes, hormigas, gusanos de seda, cigarras y otros.

Categoría de insectos

- Insectos comunes

- Alimentación con insectos de primera calidad

Sobre la base de la categoría de insectos, el mercado de insectos comestibles de América del Norte está segmentado en insectos regulares e insectos alimentados con dieta premium.

Solicitud

- Productos de consumo humano

- Nutrición animal

- Aceite de insectos

- Productos farmacéuticos

- Productos cosméticos

- Cuidado personal

- Otros

Sobre la base de la aplicación, el mercado de insectos comestibles de América del Norte está segmentado en productos de consumo humano, nutrición animal, aceite de insectos, productos farmacéuticos, cosméticos y cuidado personal, entre otros.

Canal de distribución

- Directo

- Indirecto

Sobre la base del canal de distribución, el mercado de insectos comestibles de América del Norte se segmenta en directo e indirecto.

Análisis y perspectivas regionales del mercado de insectos comestibles

Se analiza el mercado de insectos comestibles de América del Norte y se proporcionan información y tendencias del tamaño del mercado por tipo de insecto, categoría de insecto, aplicación y canal de distribución como se menciona anteriormente.

Los países cubiertos en el informe del mercado de insectos comestibles de América del Norte son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado de insectos comestibles de América del Norte debido al creciente avance tecnológico en las áreas en desarrollo.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los insectos comestibles

El panorama competitivo del mercado de insectos comestibles de América del Norte proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de insectos comestibles de América del Norte.

Algunos actores del mercado de insectos comestibles de América del Norte son Ynsect, Aspire Food Group, BETA HATCH, Fluker's Cricket Farm, Entomo Farms, Enviroflight, Chapul, LLC, Symton Black Soldier Fly y Armstrong Crickets Georgia, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA EDIBLE INSECTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA EDIBLE INSECTS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 INSECT TYPE LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 CUSTOMER BARGAINING POWER:

4.3 SUPPLIER BARGAINING POWER:

4.4 THE THREAT OF NEW ENTRANTS

4.5 THE THREAT OF SUBSTITUTES

4.6 INTERNAL COMPETITION (RIVALRY)

4.7 IMPORT-EXPORT ANALYSIS

4.8 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.9 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.1 SUPPLY CHAIN ANALYSIS

4.11 DESIGNING A SUPPLY CHAIN AND ITS IMPORTANCE

4.12 SCENARIO IN ASIAN COUNTRIES

4.13 SCENARIO IN AFRICA AND EUROPEAN UNION

4.14 ADOPTION OF E-COMMERCE

4.15 CONCLUSION

4.16 TECHNOLOGICAL OVERVIEW ON PRODUCTION METHODS

4.17 VALUE CHAIN OF EDIBLE INSECTS MARKET -

4.18 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 REGULATORY SCENARIO IN EUROPEAN UNION

5.2 REGULATORY SCENARIO IN AMERICAS

5.3 REGULATORY SCENARIO IN ASIA-PACIFIC

5.4 REGULATORY SCENARIO IN MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING INCLINATION TOWARDS THE CONSUMPTION OF PROTEIN-RICH FOOD COUPLED WITH CHANGING FOOD HABITS OF MANY INDIVIDUALS

6.1.2 COMMERCIAL BENEFIT OF INSECT FARMING

6.1.3 SUITABLE ALTERNATIVE TO HIGH-COST CONVENTIONAL PROTEIN SOURCES

6.1.4 MINIMAL RISK OF TRANSMITTING ZOONOTIC DISEASES WITH THE CONSUMPTION OF EDIBLE INSECTS

6.2 RESTRAINTS

6.2.1 LACK OF AWARENESS REGARDING THE CONSUMPTION OF EDIBLE INSECTS

6.2.2 NON-STANDARDIZED REGULATORY FRAMEWORK IN SOME REGIONS

6.2.3 INCREASING PSYCHOLOGICAL AND ETHICAL BARRIERS

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS REGARDING NUTRITIONAL BENEFITS

6.3.2 POTENTIAL UTILIZATION OF EDIBLE INSECTS FOR ANIMAL FEED

6.4 CHALLENGES

6.4.1 INCREASING MAJOR FOOD SAFETY HAZARDS AND GUIDELINES

6.4.2 THREAT OF RISING PREVALENCE OF CHRONIC DISEASE

7 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE

7.1 OVERVIEW

7.2 CRICKETS

7.3 MEALWORMS

7.4 GRASSHOPPERS

7.5 CICADAS

7.6 BLACK SOLDIER

7.7 SILKWORMS

7.8 ANTS

7.9 BUFFALO WORMS

7.1 OTHERS

8 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY

8.1 OVERVIEW

8.2 REGULAR INSECTS

8.3 PREMIUM DIET FED INSECTS

9 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HUMAN CONSUMPTION PRODUCTS

9.2.1 HUMAN CONSUMPTION PRODUCTS, BY TYPE

9.2.1.1 WHOLE INSECTS

9.2.1.2 INSECT FLOURS AND POWDER

9.2.1.3 NUTRITION INSECTS BAR

9.2.1.4 INSECT SNACKS

9.2.1.4.1 PROCESSED INSECTS

9.2.1.4.2 CHIPS

9.2.1.4.3 CRACKERS

9.2.1.5 BEVERAGES

9.2.1.5.1 PROTEIN DRINKS

9.2.1.5.2 INSECT DRINKS

9.2.1.5.3 BEER

9.2.1.5.4 SOFT DRINKS

9.2.1.5.5 SPIRITS

9.2.1.6 PROCESSED FOOD

9.2.1.6.1 PASTA

9.2.1.6.2 NOODLES

9.2.1.7 CONFECTIONERY

9.2.1.7.1 CANDIES

9.2.1.7.2 LOLLIES

9.2.1.7.3 CHOCOLATES

9.2.1.8 INSECT BAKERY

9.2.1.8.1 COOKIES

9.2.1.8.2 BREAD

9.2.2 HUMAN CONSUMPTION PRODUCTS, BY INSECT TYPE

9.2.2.1 CRICKETS

9.2.2.2 MEALWORMS

9.2.2.3 GRASSHOPPERS

9.2.2.4 CICADAS

9.2.2.5 BLACK SOLDIER FLIES

9.2.2.6 SILKWORMS

9.2.2.7 ANTS

9.2.2.8 BUFFALO WORMS

9.2.2.9 OTHERS

9.3 ANIMAL NUTRITION

9.3.1 ANIMAL NUTRITION, BY PRODUCT TYPE

9.3.1.1 INSECT MEAL

9.3.1.2 INSECT PROTEIN (AS INGREDIENT)

9.3.2 ANIMAL NUTRITION, BY LIVESTOCK TYPE

9.3.2.1 AQUATIC NUTRITION

9.3.2.1.1 FISH

9.3.2.1.2 CRUSTACEANS

9.3.2.1.3 MOLLUSKS

9.3.2.2 PET NUTRITION

9.3.2.3 SWINE NUTRITION

9.3.2.3.1 SOW

9.3.2.3.2 GROWER

9.3.2.3.3 STARTER

9.3.2.4 POULTRY NUTRITION

9.3.2.4.1 BROILERS

9.3.2.4.2 LAYERS

9.3.2.4.3 BREEDERS

9.3.2.5 RUMINANT NUTRITION

9.3.2.5.1 BEEF CATTLE

9.3.2.5.2 DAIRY CATTLE

9.3.2.5.3 CALVES

9.3.3 ANIMAL NUTRITION, BY INSECT TYPE

9.3.3.1 CRICKETS

9.3.3.2 MEALWORMS

9.3.3.3 GRASSHOPPERS

9.3.3.4 CICADAS

9.3.3.5 BLACK SOLDIER FLIES

9.3.3.6 SILKWORMS

9.3.3.7 ANTS

9.3.3.8 BUFFALO WORMS

9.3.3.9 OTHERS

9.4 INSECT OIL

9.4.1 CRICKETS

9.4.2 MEALWORMS

9.4.3 GRASSHOPPERS

9.4.4 CICADAS

9.4.5 BLACK SOLDIER FLIES

9.4.6 SILKWORMS

9.4.7 ANTS

9.4.8 BUFFALO WORMS

9.4.9 OTHERS

9.5 PHARMACEUTICAL

9.5.1 CRICKETS

9.5.2 MEALWORMS

9.5.3 GRASSHOPPERS

9.5.4 CICADAS

9.5.5 BLACK SOLDIER FLIES

9.5.6 SILKWORMS

9.5.7 ANTS

9.5.8 BUFFALO WORMS

9.5.9 OTHERS

9.6 COSMETICS

9.6.1 CRICKETS

9.6.2 MEALWORMS

9.6.3 GRASSHOPPERS

9.6.4 CICADAS

9.6.5 BLACK SOLDIER FLIES

9.6.6 SILKWORMS

9.6.7 ANTS

9.6.8 BUFFALO WORMS

9.6.9 OTHERS

9.7 PERSONAL CARE

9.7.1 PERSONAL CARE, BY TYPE

9.7.1.1 SKIN CARE

9.7.1.2 HAIR CARE

9.7.2 PERSONAL CARE, BY INSECT TYPE

9.7.2.1 CRICKETS

9.7.2.2 MEALWORMS

9.7.2.3 GRASSHOPPERS

9.7.2.4 CICADAS

9.7.2.5 BLACK SOLDIER FLIES

9.7.2.6 SILKWORMS

9.7.2.7 ANTS

9.7.2.8 BUFFALO WORMS

9.7.2.9 OTHERS

9.8 OTHERS

10 NORTH AMERICA EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 NORTH AMERICA EDIBLE INSECTS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 MEXICO

11.1.2 U.S

11.1.3 CANADA

12 NORTH AMERICA EDIBLE INSECTS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 YNSECT

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 ASPIRE FOOD GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 XIAMEN WATER LIFE IMP. & EXP. CO., LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 BETA HATCH

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 FLUCKER’S CRICKET FARM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ARMSTRONG CRICKETS GEORGIA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 CHAPUL, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 ENTOMO FARMS

14.8.1 COMPANY SNAPSHOT

14.8.2 COMPANY SHARE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 ENVIROFLIGHT

14.9.1 COMPANY SNAPSHOT

14.9.2 COMPANY SHARE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 INSECTÉO

14.10.1 COMPANY SNAPSHOT

14.10.2 COMPANY SHARE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 INVERTAPRO AS

14.11.1 COMPANY SNAPSHOT

14.11.2 COMPANY SHARE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 JIMINI’S

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 KRECA ENTO FEED BV

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SYMTON BLACK SOLDIER FLY.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA CRICKETS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA MEALWORM IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA GRASSHOPPERS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CICADAS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA BLACK SOLDIER IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA SILKWORMS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ANTS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BUFFALO WORMS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OTHERS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA REGULAR INSECTS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA PREMIUM DIET FED INSECTS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA INSECT OIL IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA COSMETICS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA INDIRECT IN EDIBLE INSECTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA EDIBLE INSECTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (UNIT)

TABLE 47 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (ASP)

TABLE 48 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (UNIT)

TABLE 50 NORTH AMERICA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (ASP)

TABLE 51 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 53 NORTH AMERICA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 54 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 56 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 57 NORTH AMERICA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 59 NORTH AMERICA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 60 NORTH AMERICA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 62 NORTH AMERICA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 63 NORTH AMERICA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 65 NORTH AMERICA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 66 NORTH AMERICA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 68 NORTH AMERICA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 69 NORTH AMERICA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 71 NORTH AMERICA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 72 NORTH AMERICA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 75 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 76 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (UNIT)

TABLE 78 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (ASP)

TABLE 79 NORTH AMERICA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 81 NORTH AMERICA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 82 NORTH AMERICA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 84 NORTH AMERICA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 85 NORTH AMERICA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 87 NORTH AMERICA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 88 NORTH AMERICA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 90 NORTH AMERICA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 91 NORTH AMERICA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 97 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 98 NORTH AMERICA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 100 MEXICO EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (UNIT)

TABLE 102 MEXICO EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (ASP)

TABLE 103 MEXICO EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 104 MEXICO EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (UNIT)

TABLE 105 MEXICO EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (ASP)

TABLE 106 MEXICO EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 MEXICO EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 108 MEXICO EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 109 MEXICO HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 MEXICO HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 111 MEXICO HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 112 MEXICO INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 113 MEXICO INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 114 MEXICO INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 115 MEXICO BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 116 MEXICO BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 117 MEXICO BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 118 MEXICO PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 119 MEXICO PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 120 MEXICO PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 121 MEXICO CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 122 MEXICO CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 123 MEXICO CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 124 MEXICO INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 125 MEXICO INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 126 MEXICO INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 127 MEXICO HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 128 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 130 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 131 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 132 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (UNIT)

TABLE 133 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (ASP)

TABLE 134 MEXICO AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 MEXICO AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 136 MEXICO AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 137 MEXICO SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 MEXICO SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 139 MEXICO SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 140 MEXICO POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 MEXICO POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 142 MEXICO POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 143 MEXICO RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 MEXICO RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 145 MEXICO RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 146 MEXICO ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 147 MEXICO INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 148 MEXICO PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 149 MEXICO COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 150 MEXICO PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 MEXICO PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 152 MEXICO PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 153 MEXICO PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 154 MEXICO EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 155 U.S. EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (UNIT)

TABLE 157 U.S. EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (ASP)

TABLE 158 U.S. EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 159 U.S. EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (UNIT)

TABLE 160 U.S. EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (ASP)

TABLE 161 U.S. EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 162 U.S. EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 163 U.S. EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 164 U.S. HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 U.S. HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 166 U.S. HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 167 U.S. INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 168 U.S. INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 169 U.S. INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 170 U.S. BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 U.S. BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 172 U.S. BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 173 U.S. PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 174 U.S. PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 175 U.S. PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 176 U.S. CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 177 U.S. CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 178 U.S. CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 179 U.S. INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 180 U.S. INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 181 U.S. INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 182 U.S. HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 185 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 186 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 187 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (UNIT)

TABLE 188 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (ASP)

TABLE 189 U.S. AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 U.S. AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 191 U.S. AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 192 U.S. SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 U.S. SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 194 U.S. SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 195 U.S. POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 U.S. POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 197 U.S. POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 198 U.S. RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 U.S. RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 200 U.S. RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 201 U.S. ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 202 U.S. INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 203 U.S. PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 204 U.S. COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 205 U.S. PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 U.S. PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 207 U.S. PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 208 U.S. PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 209 U.S. EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 210 CANADA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 211 CANADA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (UNIT)

TABLE 212 CANADA EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (ASP)

TABLE 213 CANADA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (USD MILLION)

TABLE 214 CANADA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (UNIT)

TABLE 215 CANADA EDIBLE INSECTS MARKET, BY INSECT CATEGORY, 2021-2030 (ASP)

TABLE 216 CANADA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 217 CANADA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 218 CANADA EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 219 CANADA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 221 CANADA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 222 CANADA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 223 CANADA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 224 CANADA INSECT SNACKS IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 225 CANADA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 226 CANADA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 227 CANADA BEVERAGES IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 228 CANADA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 229 CANADA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 230 CANADA PROCESSED FOOD IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 231 CANADA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 232 CANADA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 233 CANADA CONFECTIONERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 234 CANADA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 235 CANADA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (UNIT)

TABLE 236 CANADA INSECT BAKERY IN EDIBLE INSECTS MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 237 CANADA HUMAN CONSUMPTION PRODUCTS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 238 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 239 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 240 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 241 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (USD MILLION)

TABLE 242 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (UNIT)

TABLE 243 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY LIVESTOCK TYPE, 2021-2030 (ASP)

TABLE 244 CANADA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 CANADA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 246 CANADA AQUATIC NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 247 CANADA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 CANADA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 249 CANADA SWINE NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 250 CANADA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 251 CANADA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 252 CANADA POULTRY NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 253 CANADA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 CANADA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 255 CANADA RUMINANT NUTRITION IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 256 CANADA ANIMAL NUTRITION IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 257 CANADA INSECT OIL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 258 CANADA PHARMACEUTICAL IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 259 CANADA COSMETICS IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 260 CANADA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 CANADA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (UNIT)

TABLE 262 CANADA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 263 CANADA PERSONAL CARE IN EDIBLE INSECTS MARKET, BY INSECT TYPE, 2021-2030 (USD MILLION)

TABLE 264 CANADA EDIBLE INSECTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA EDIBLE INSECTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA EDIBLE INSECTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA EDIBLE INSECTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA EDIBLE INSECTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA EDIBLE INSECTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA EDIBLE INSECTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA EDIBLE INSECTS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA EDIBLE INSECTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA EDIBLE INSECTS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA EDIBLE INSECTS MARKET: SEGMENTATION

FIGURE 11 RISING INCLINATION TOWARDS THE CONSUMPTION OF PROTEIN-RICH FOOD COUPLED WITH CHANGING EATING HABITS OF MANY INDIVIDUALS IS EXPECTED TO DRIVE THE NORTH AMERICA EDIBLE INSECTS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 CRICKETS IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA EDIBLE INSECTS MARKET IN THE FORECAST PERIOD 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA EDIBLE INSECTS MARKET

FIGURE 14 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT TYPE, 2022

FIGURE 15 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT CATEGORY, 2022

FIGURE 19 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT CATEGORY, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT CATEGORY, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA EDIBLE INSECTS MARKET: BY INSECT CATEGORY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA EDIBLE INSECTS MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA EDIBLE INSECTS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA EDIBLE INSECTS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA EDIBLE INSECTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA EDIBLE INSECTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 NORTH AMERICA EDIBLE INSECTS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA EDIBLE INSECTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA EDIBLE INSECTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 NORTH AMERICA EDIBLE INSECTS MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA EDIBLE INSECTS MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA EDIBLE INSECTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA EDIBLE INSECTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 NORTH AMERICA EDIBLE INSECTS MARKET: INSECT TYPE (2023-2030)

FIGURE 35 NORTH AMERICA EDIBLE INSECTS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.