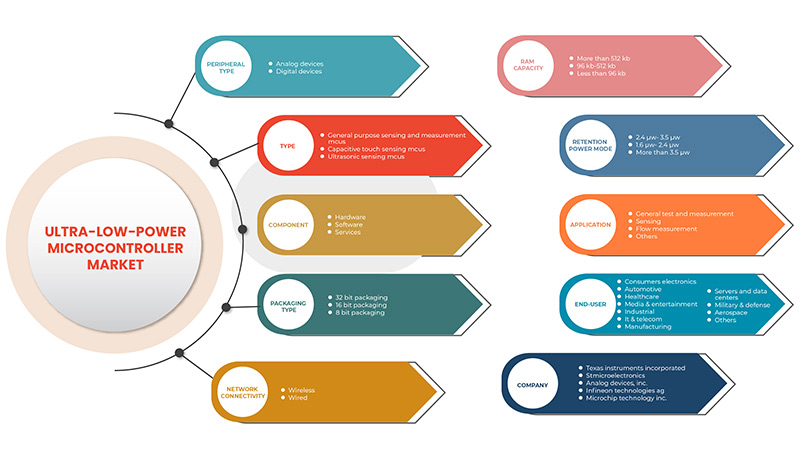

North America Ultra-Low-Power Microcontroller Market, By Peripheral Type (Analog Devices, Digital Devices), Type (General Purpose Sensing and Measurement MCUs, Capacitive Touch Sensing MCUs, Ultrasonic Sensing MCUs), Component (Hardware, Software, Services), Packaging Type (32 Bit Packaging, 16 Bit Packaging, 8 Bit Packaging), Network Connectivity (Wireless, Wired), RAM Capacity (More than 512 Kb, 96 Kb-512 Kb, Less than 96 Kb), Retention Power Mode (2.4 μW- 3.5 μW, 1.6 μW- 2.4 μW, More than 3.5 μW), Application (General Test and Measurement, Sensing, Flow Measurement, Others)– Industry Trends and Forecast to 2029.

North America Ultra-Low-Power Microcontroller Market Analysis and Size

Ultra-low-power microcontroller is the type of semiconductor manufactured to have computing power with the lowest energy consumption for applications such as smart devices, autonomous vehicles, robots, industrial processes, edge AI devices, and others. With increasing digitalization, the demand for power electronics worldwide is increasing, thus driving the demand for these ultra-low-power microcontrollers. MCUs have wide applications and are utilized in almost all the industrial, commercial or residential sectors. Growing emphasis on energy conservation in electronic devices is driving the world towards using more efficient and power-conserving equipment, this has been driving the demand of ultra-low-power microcontrollers in the market.

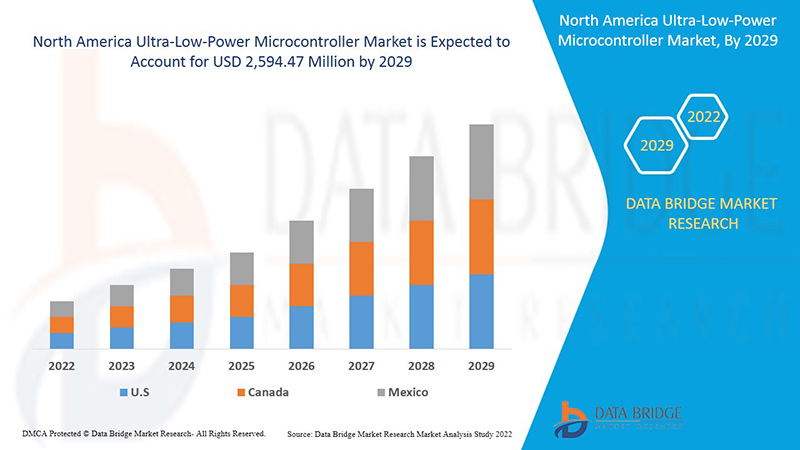

Data Bridge Market Research analyses that the ultra-low-power microcontroller market is expected to reach the value of USD 2,594.47 million by the year 2029, at a CAGR of 10.7% during the forecast period. "Analog Devices" accounts for the most prominent peripheral type segment in the respective market owing to rise in need of detection of signals and converting into digital form. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Tipo de periférico (dispositivos analógicos, dispositivos digitales), tipo (MCU de detección y medición de propósito general, MCU de detección táctil capacitiva, MCU de detección ultrasónica), componente (hardware, software, servicios), tipo de empaque (empaquetado de 32 bits, empaquetado de 16 bits, empaquetado de 8 bits), conectividad de red (inalámbrica, cableada), capacidad de RAM (más de 512 Kb, 96 Kb-512 Kb, menos de 96 Kb), modo de energía de retención (2,4 μW- 3,5 μW, 1,6 μW- 2,4 μW, más de 3,5 μW), aplicación (prueba y medición general, detección, medición de flujo, otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México en América del Norte |

|

Actores del mercado cubiertos |

Texas Instruments Incorporated (EE. UU.), STMicroelectronics (Suiza), Analog Devices, Inc. (EE. UU.), NXP Semiconductors (Países Bajos), EM Microelectronic (Suiza), Nuvoton Technology Corporation (China), Seiko Epson Corporation (Japón), Microchip Technology Inc. (EE. UU.), Broadcom (EE. UU.), Semiconductor Components Industries, LLC (EE. UU.), Holtek Semiconductor Inc. (China), Zilog, Inc. (EE. UU.), Silicon Laboratories (EE. UU.), Infineon Technologies AG (Alemania), Renesas Electronics Corporation (Japón), Profichip USA (EE. UU.), e-peas (Bélgica), Ambiq Micro, Inc. (EE. UU.), TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japón) |

Definición de mercado

Los microcontroladores de consumo ultrabajo (ULP) permiten que los nodos de borde procesen de manera inteligente datos localizados con la menor cantidad de energía del sistema. Esto permite a los clientes extender la vida útil de la batería y el tiempo entre cargas, lo que permite un uso más prolongado. Los tamaños de batería más pequeños y un mayor tiempo entre reemplazos de productos en el campo brindan ahorros de costos para los usuarios finales. El consumo de energía ultrabajo es un requisito muy importante para operar con pequeñas fuentes de energía (para reducir el tamaño) y no generar problemas de calentamiento local. Los microcontroladores de consumo ultrabajo ofrecen a los diseñadores de sistemas y aplicaciones integrados energéticamente eficientes un equilibrio entre rendimiento, potencia, seguridad y rentabilidad. Estos dispositivos semiconductores encuentran aplicaciones en vehículos, robots, máquinas de oficina, dispositivos médicos, transceptores de radio móviles, máquinas expendedoras y electrodomésticos, entre otros dispositivos. Básicamente, son computadoras personales (PC) en miniatura simples diseñadas para controlar pequeñas características de un componente más grande sin un sistema operativo (OS) frontend complejo. Con la modernización de la tecnología y la creciente demanda de dispositivos informáticos de borde con características de ahorro de energía, los microcontroladores de consumo ultrabajo están aumentando.

Impacto de COVID-19 en el mercado de microcontroladores de consumo ultrabajo

La COVID-19 afectó a varias industrias manufactureras en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y restricciones al transporte. La industria de semiconductores se vio gravemente afectada por la pandemia. La industria de semiconductores fue testigo de una enorme escasez de chips que provocó interrupciones en la cadena de suministro.

La dinámica del mercado de microcontroladores de consumo ultrabajo incluye:

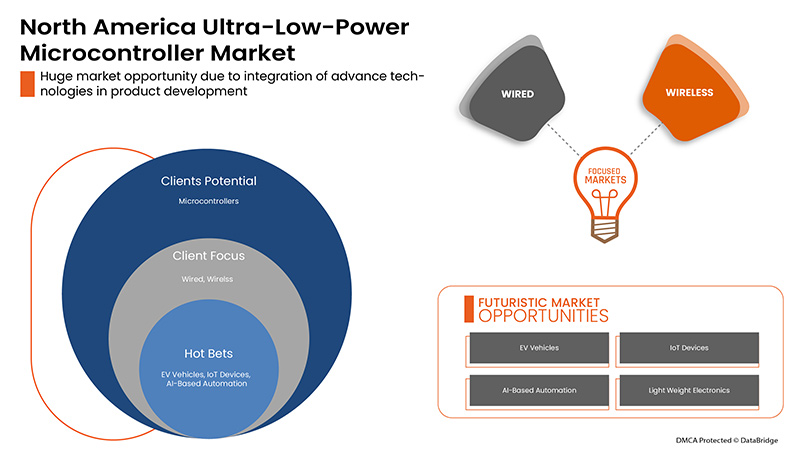

- Aumento de las inversiones gubernamentales para apoyar el crecimiento de la IoT en todo el mundo

En todo el mundo, los gobiernos han aumentado sus inversiones en el sector de la IoT para apoyar proyectos de ciudades inteligentes y aumentar la conectividad rural. Esto ha creado enormes oportunidades para que los fabricantes de semiconductores proporcionen soluciones MCU de consumo ultrabajo y eficientes que satisfagan el aumento de la demanda.

- Creciente popularidad de los dispositivos IoT que consumen poca batería

Las industrias y las empresas están aprovechando la oportunidad de adoptar la IoT a medida que las tecnologías subyacentes maduran rápidamente. La Internet de las cosas parece estar a punto de convertirse en un uso comercial generalizado.

- Creciente demanda de MCU de bajo consumo en dispositivos inteligentes

El mercado de dispositivos médicos y de bienestar personal está creciendo rápidamente. Los nuevos avances tecnológicos y los cambios en el estilo de vida han llevado a una mayor adopción de dispositivos inteligentes en todo el mundo.

- Creciente demanda de microcontroladores en la IA de borde

Los avances en electrónica de potencia han dejado atrás la idea de que se necesita hardware de alta gama para realizar tareas de aprendizaje automático y aprendizaje profundo, con entrenamiento e inferencia en el borde ejecutados por puertas de enlace, servidores de borde o centros de datos. En un número cada vez mayor de casos, los últimos microcontroladores, algunos con aceleradores de aprendizaje automático integrados, pudieron llevar el aprendizaje automático a los dispositivos de borde.

- Creciente demanda de aplicaciones de gestión de edificios y hogares inteligentes

El mundo está cada vez más conectado y la Internet de las cosas (IoT) ha permitido que los electrodomésticos formen parte de redes de automatización de hogares inteligentes. Esto da como resultado diseños de electrodomésticos más silenciosos y con mayor eficiencia energética impulsados por un funcionamiento intuitivo basado en sensores. Los productos ahora se pueden vincular sin problemas, formando redes digitales generalizadas con inteligencia y comunicación integradas. Esta tendencia ofrece mayores niveles de funcionalidad y comodidad para los consumidores expertos en tecnología.

- Adopción creciente de electrónica de potencia en tecnologías automotrices

Las tecnologías automotrices han evolucionado a un ritmo mayor con el aumento de los avances en vehículos autónomos y eléctricos. En todo el mundo se ha puesto cada vez más énfasis en aumentar la producción y la adopción de vehículos eléctricos para reducir la carga de combustibles fósiles y controlar el impacto ambiental.

Restricciones y desafíos que enfrenta el mercado de microcontroladores de consumo ultrabajo

- Menor adopción de microcontroladores de consumo ultrabajo que de microcontroladores de bajo y alto consumo

Los microcontroladores de alta y baja potencia llevan más tiempo en el mercado y han madurado como tecnología en el mercado de semiconductores en comparación con los microcontroladores de potencia ultrabaja. Esto plantea un desafío para los fabricantes de microcontroladores de potencia ultrabaja para aumentar con éxito la adopción de estos MCU en competencia con los MCU de baja y alta potencia.

- Enormes problemas de huella de carbono en el sector de fabricación de semiconductores

La demanda de semiconductores, como los microcontroladores de consumo ultrabajo, está aumentando a medida que la vida se vuelve cada vez más digital, y los chips son el componente clave de aplicaciones que van desde las lavadoras hasta la inteligencia artificial. La fabricación en la industria de semiconductores es un negocio que consume muchos recursos y tiene un enorme impacto ambiental en el proceso.

Este informe de mercado de microcontroladores de potencia ultrabaja proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de microcontroladores de potencia ultrabaja, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Acontecimientos recientes

- En junio de 2021, Texas Instruments Incorporated anunció sus planes de adquirir la fábrica de semiconductores de 300 mm de Micron Technology (o "fab") en Lehi, Utah, por 900 millones de dólares. Con ello, la empresa pretendía reforzar su ventaja competitiva en fabricación y tecnología, lo que le permitió ejercer un mayor control sobre su cadena de suministro.

- En mayo, Ambiq Micro, Inc. y Winbond Electronics Corporation, un proveedor global de soluciones de memoria de semiconductores, colaboraron para combinar HyperRAM y Apollo4 con el fin de ofrecer soluciones de sistemas de consumo ultrabajo para terminales y dispositivos portátiles de IoT. El objetivo era ayudar a los terminales y dispositivos portátiles de IoT a prolongar la vida útil de la batería.

Alcance del mercado de microcontroladores de consumo ultrabajo en América del Norte

El mercado de microcontroladores de consumo ultrabajo está segmentado en función del tipo de periférico, tipo, componente, tipo de empaque, conectividad de red, capacidad de RAM, modo de retención de energía, aplicación y usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo periférico

- Dispositivos analógicos

- Dispositivos digitales

Sobre la base del tipo de periférico, el mercado de microcontroladores de consumo ultra bajo se segmenta en dispositivos analógicos y dispositivos digitales.

Tipo

- MCU de detección y medición de propósito general

- MCU con detección táctil capacitiva

- Detección ultrasónica MCUS

Según el tipo, el mercado de microcontroladores de consumo ultrabaja se segmenta en MCUS de detección y medición de propósito general, MCUS de detección táctil capacitiva y MCUS de detección ultrasónica.

Componente

- Hardware

- Software

- Servicios

Según el componente, el mercado de microcontroladores de consumo ultrabajo se segmenta en hardware, software y servicios.

Tipo de embalaje

- Empaquetado de 8 bits

- Empaquetado de 16 bits

- Empaquetado de 32 bits

Según el tipo de empaque, el mercado de microcontroladores de consumo ultrabaja se segmenta en empaques de 8 bits, empaques de 16 bits y empaques de 32 bits.

Conectividad de red

- Cableado

- Inalámbrico

Sobre la base de la conectividad de red, el mercado de microcontroladores de consumo ultrabajo se segmenta en inalámbricos y cableados.

Capacidad de RAM

- Menos de 96 kb,

- 96 kb-512 kb

- Más de 512 kb

En función de la capacidad de RAM, el mercado de microcontroladores de consumo ultrabajo se segmenta en menos de 96 kb, 96 kb-512 kb y más de 512 kb.

Modo de retención de potencia

- 1,6 μW - 2,4 μW,

- 2,4 μW - 3,5 μW

- Más de 3,5 μW

Sobre la base del modo de potencia de retención, el mercado de microcontroladores de potencia ultrabaja se segmenta en 1,6 μW - 2,4 μW, 2,4 μW - 3,5 μW y más de 3,5 μW.

Solicitud

- Pruebas y mediciones generales

- Detección

- Medición de caudal

- Otros

Sobre la base de la aplicación, el mercado de microcontroladores de potencia ultrabaja se segmenta en pruebas y mediciones generales, detección, medición de flujo y otros.

Usuario final

- Cuidado de la salud

- Industrial

- Fabricación

- Informática y telecomunicaciones

- Militar y defensa

- Aeroespacial

- Medios y entretenimiento

- Automotor

- Servidores y centros de datos

- Electrónica de consumo

- Otros

Sobre la base del usuario final, el mercado de microcontroladores de consumo ultra bajo se segmenta en atención médica, industria, fabricación, TI y telecomunicaciones, militar y defensa, aeroespacial, medios y entretenimiento, automotriz, servidores y centros de datos, electrónica de consumo y otros.

Análisis y perspectivas regionales del mercado de microcontroladores de consumo ultrabajo

Se analiza el mercado de microcontroladores de consumo ultrabaja y se proporcionan información y tendencias del tamaño del mercado por país, tipo de periférico, tipo, componente, tipo de empaque, conectividad de red, capacidad de RAM, modo de energía de retención, aplicación y usuario final como se menciona anteriormente.

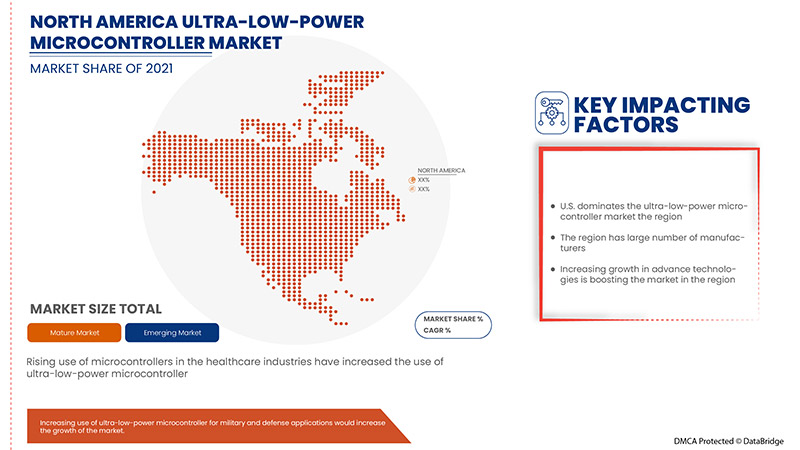

Los países cubiertos en el informe del mercado de microcontroladores de consumo ultrabaja son EE. UU., Canadá y México en América del Norte.

Estados Unidos domina el mercado de microcontroladores de consumo ultrabajo, ya que la región cuenta con una gran cantidad de actores locales. Estados Unidos ha sido el centro de algunas de las empresas más importantes de la industria de semiconductores.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los microcontroladores de consumo ultrabajo

El panorama competitivo del mercado de microcontroladores de consumo ultrabajo proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de microcontroladores de consumo ultrabajo.

Algunos de los principales actores que operan en el mercado de microcontroladores de potencia ultrabaja son Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., NXP Semiconductors, EM Microelectronic, Nuvoton Technology Corporation, Seiko Epson Corporation, Microchip Technology Inc., Broadcom, Semiconductor Components Industries, LLC, Holtek Semiconductor Inc., Zilog, Inc., Silicon Laboratories, LAPIS Semiconductor, Co., Ltd., Infineon Technologies AG, Renesas Electronics Corporation, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Profichip USA, e-peas, Ambiq Micro, Inc., TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 CHALLENGE MATRIX

2.1 MULTIVARIATE MODELING

2.11 PERIPHERAL TYPE TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS

5.1.2 GROWING POPULARITY OF LOW-BATTERY-POWERED IOT DEVICES

5.1.3 INCREASING DEMAND FOR LOW POWER CONSUMING MCU IN SMART DEVICES

5.1.4 RISING DEMAND FOR MICROCONTROLLERS IN EDGE AI

5.1.5 INCREASING DEMAND FOR SMART HOME AND BUILDING MANAGEMENT APPLICATIONS

5.2 RESTRAINTS

5.2.1 DESIGN COMPLEXITIES IN ULTRA-LOW-POWER MICROCONTROLLER

5.2.1 HUGE CARBON FOOTPRINT ISSUES IN SEMICONDUCTOR MANUFACTURING SECTOR

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF POWER ELECTRONICS IN AUTOMOTIVE TECHNOLOGIES

5.3.2 SURGE IN GOVERNMENT INVESTMENTS TO SUPPORT IOT GROWTH ACROSS THE GLOBE

5.3.3 INCREASING FOCUS ON ENERGY CONSERVATION AND ENVIRONMENTAL RESPONSIBILITY

5.4 CHALLENGES

5.4.1 CHIP SUPPLY SHORTAGES

5.4.2 LOWER ADOPTION OF ULTRA-LOW-POWER MICROCONTROLLERS THAN LOW AND HIGH-POWER MICROCONTROLLERS

6 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE

6.1 OVERVIEW

6.2 ANALOG DEVICES

6.3 DIGITAL DEVICES

7 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE

7.1 OVERVIEW

7.2 GENERAL PURPOSE SENSING AND MEASUREMENT MCUS

7.3 CAPACITIVE TOUCH SENSING MCUS

7.4 ULTRASONIC SENSING MCUS

8 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 PROCESSORS

8.2.2 MEMORY

8.2.3 POWER SUPPLY UNIT

8.2.4 SENSORS

8.2.5 CONTROLLER

8.2.6 OTHERS

8.3 SOFTWARE

8.4 SERVICES

8.4.1 IMPLEMENTATION & INTEGRATION

8.4.2 TRAINING & CONSULTING

8.4.3 SUPPORT & MAINTENANCE

9 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 32 BIT PACKAGING

9.3 16 BIT PACKAGING

9.4 8 BIT PACKAGING

10 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY

10.1 OVERVIEW

10.2 WIRELESS

10.3 WIRED

11 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY

11.1 OVERVIEW

11.2 MORE THAN 512 KB

11.3 96 KB-512 KB

11.4 LESS THAN 96 KB

12 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE

12.1 OVERVIEW

12.2 2.4 ΜW- 3.5 ΜW

12.3 1.6 ΜW- 2.4 ΜW

12.4 MORE THAN 3.5 ΜW

13 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 GENERAL TEST AND MEASUREMENT

13.3 SENSING

13.4 FLOW MEASUREMENT

13.5 OTHERS

14 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER

14.1 OVERVIEW

14.2 CONSUMERS ELECTRONICS

14.2.1 SMARTPHONES

14.2.2 DESKTOP

14.2.3 TABLETS

14.2.4 LAPTOPS

14.2.5 SMART WATCHES

14.3 AUTOMOTIVE

14.3.1 INFOTAINMENT

14.3.2 ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

14.4 HEALTHCARE

14.4.1 PORTABLE MEDICAL DEVICES

14.4.2 WEARABLE MEDICAL PATCHES

14.5 MEDIA & ENTERTAINMENT

14.6 INDUSTRIAL

14.6.1 BUILDING AUTOMATION

14.6.2 ROBOTICS

14.6.3 MACHINE VISION

14.6.4 AUTOMATED GUIDED VEHICLES

14.6.5 HUMAN–MACHINE INTERFACE (HMI)

14.7 IT & TELECOM

14.8 MANUFACTURING

14.9 SERVERS AND DATA CENTERS

14.1 MILITARY & DEFENSE

14.11 AEROSPACE

14.11.1 AVIONICS AND DEFENSE SYSTEMS

14.11.2 UNMANNED AERIAL VEHICLES

14.12 OTHERS

15 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEXAS INSTRUMENTS INCORPORATED

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 STMICROELECTRONICS

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 ANALOG DEVICES, INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 INFINEON TECHNOLOGIES AG

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MICROCHIP TECHNOLOGY INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 RENESAS ELECTRONICS CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 NXP SEMICONDUCTORS

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 AMBIQ MICRO, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BROADCOM

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EM MICROELECTRONIC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 E-PEAS

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 HOLTEK SEMICONDUCTOR INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 LAPIS SEMICONDUCTOR CO., LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 NUVOTON TECHNOLOGY CORPORATION

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PROFICHIP USA

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 SEIKO EPSON CORPORATION

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 SILICON LABORATORIES

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 ZILOG, INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 3 NORTH AMERICA ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 5 NORTH AMERICA DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 7 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 9 NORTH AMERICA GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 11 NORTH AMERICA CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 13 NORTH AMERICA ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 15 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 17 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 19 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 21 NORTH AMERICA SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 23 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 25 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 27 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 29 NORTH AMERICA 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 31 NORTH AMERICA 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 33 NORTH AMERICA 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 35 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 37 NORTH AMERICA WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 39 NORTH AMERICA WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 41 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 43 NORTH AMERICA MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 45 NORTH AMERICA 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 47 NORTH AMERICA LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 49 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 51 NORTH AMERICA 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 53 NORTH AMERICA 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 55 NORTH AMERICA MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 57 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 59 NORTH AMERICA GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 61 NORTH AMERICA SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 63 NORTH AMERICA FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 65 NORTH AMERICA OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 67 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 69 NORTH AMERICA CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 71 NORTH AMERICA CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 73 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 75 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 77 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 79 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 81 NORTH AMERICA MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 83 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 85 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 87 NORTH AMERICA IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 89 NORTH AMERICA MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 91 NORTH AMERICA SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 93 NORTH AMERICA MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 95 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 97 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 99 NORTH AMERICA OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 101 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 103 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 105 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 107 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 109 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NORTH AMERICA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 111 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 NORTH AMERICA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 113 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 115 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 116 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 117 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 118 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 119 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 120 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 121 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 123 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 124 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 125 NORTH AMERICA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 NORTH AMERICA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 127 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 NORTH AMERICA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 129 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 NORTH AMERICA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 131 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 NORTH AMERICA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 133 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 NORTH AMERICA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 135 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 137 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 139 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 140 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 141 U.S. HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.S. HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 143 U.S. SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 U.S. SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 145 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 147 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 148 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 149 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 150 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 151 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 152 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 153 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 155 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 U.S. ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 157 U.S. CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.S. CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 159 U.S. AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.S. AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 161 U.S. HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 U.S. HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 163 U.S. INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 U.S. INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 165 U.S. AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 U.S. AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 167 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 168 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 169 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 171 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 172 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 173 CANADA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 CANADA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 175 CANADA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 CANADA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 177 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 178 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 179 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 180 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 181 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 182 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 183 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 184 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 185 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 187 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 188 CANADA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 189 CANADA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 CANADA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 191 CANADA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 CANADA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 193 CANADA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 CANADA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 195 CANADA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 CANADA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 197 CANADA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 CANADA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 199 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 200 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 201 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 203 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 204 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 205 MEXICO HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 MEXICO HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 207 MEXICO SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 MEXICO SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 209 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 210 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 211 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 212 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 213 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 214 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 215 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 216 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 217 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 219 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 220 MEXICO ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 221 MEXICO CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 MEXICO CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 223 MEXICO AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 MEXICO AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 225 MEXICO HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 MEXICO HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 227 MEXICO INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 MEXICO INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 229 MEXICO AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 MEXICO AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

Lista de figuras

FIGURE 1 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 12 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS IS EXPECTED TO DRIVE THE NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET IN THE FORECAST PERIOD

FIGURE 13 ANALOG DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET IN FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET

FIGURE 16 SHARE OF ELECTRICITY FLOW THROUGH POWER ELECTRONICS IN THE U.S. (2005–2030) (IN %)

FIGURE 17 NUMBER OF WEARABLE DEVICES IN U.S. FROM 2014 TO 2019 (IN MILLIONS)

FIGURE 18 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2021

FIGURE 19 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2021

FIGURE 20 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2021

FIGURE 21 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021

FIGURE 22 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2021

FIGURE 23 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2021

FIGURE 24 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2021

FIGURE 25 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2021

FIGURE 27 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY PERIPHERAL TYPE (2022-2029)

FIGURE 32 NORTH AMERICA ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.