Global Anesthesia And Respiratory Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

54.27 Billion

USD

95.72 Billion

2024

2032

USD

54.27 Billion

USD

95.72 Billion

2024

2032

| 2025 –2032 | |

| USD 54.27 Billion | |

| USD 95.72 Billion | |

|

|

|

|

Global Anaesthesia and Respiratory Devices Market Segmentation, By Product Type (Anesthesia Devices and Respiratory Devices), End Users (Hospitals, Ambulatory Service Centres, Homecare, and Clinics) - Industry Trends and Forecast to 2032

Anaesthesia and Respiratory Devices Market Size

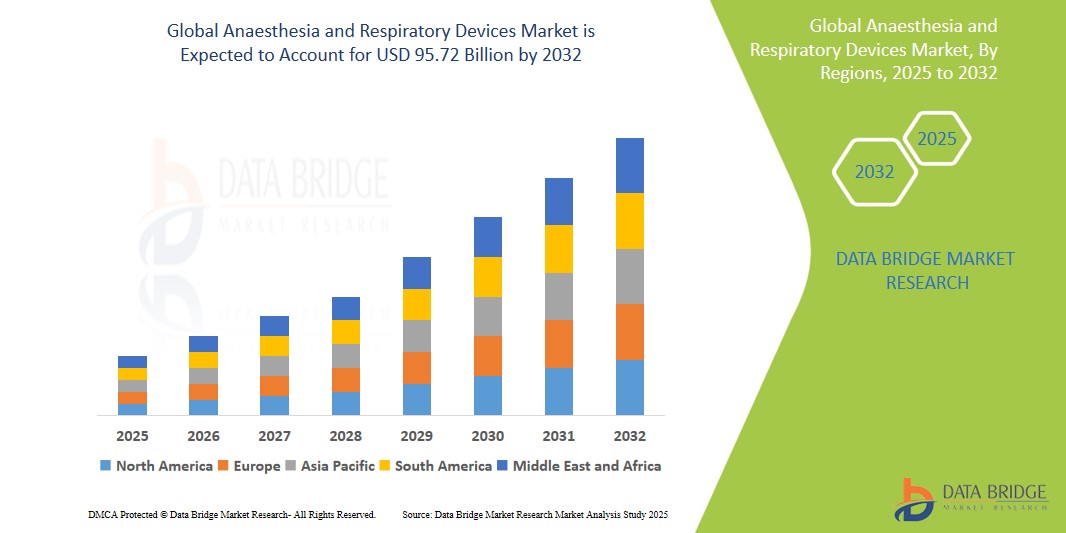

- The global anaesthesia and respiratory devices market size was valued atUSD 54.27 billionin 2024 and is expected to reachUSD 95.72 billionby 2032, at aCAGR of 7.35% during the forecast period

- This growth is driven by increasing number of surgical procedures

Anaesthesia and Respiratory Devices Market Analysis

- Anaesthesia and respiratory devices are essential components in modern healthcare, designed to support or replace spontaneous breathing and ensure effective delivery of anaesthesia during surgeries

- The demand for anaesthesia and respiratory devices is rising due to the increasing prevalence of chronic respiratory diseases such as COPD and asthma, the growing number of surgical procedures globally, and the rising geriatric population that is more susceptible to respiratory complications

- North America is expected to dominate the anaesthesia and respiratory devices market with the largest market share of 27.11%, driven by the strong presence of key industry players, highly developed healthcare infrastructure, widespread adoption of advanced technologies, and supportive reimbursement policies

- Asia-Pacific is expected to witness the highest growth rate in the anaesthesia and respiratory devices market during the forecast period, fueled by rapid healthcare infrastructure improvements, growing investments in surgical care, increasing awareness of image-guided surgeries, and heightened healthcare spending in emerging markets such as China and India

- The respiratory devices segment is expected to dominate the product type segment with the largest market share of 68.69%, due to the high prevalence of chronic respiratory diseases, there is a significant demand for products such asventilators, nebulizers, and oxygen concentrators, as they play a crucial role in managing these conditions

Report Scope and Anaesthesia and Respiratory Devices Market Segmentation

|

Attributes |

Anaesthesia and Respiratory Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anaesthesia and Respiratory Devices Market Trends

“Integration of Artificial Intelligence in Respiratory Monitoring Systems”

- A prominent trend in the anaesthesia and respiratory devices market is the integration ofArtificial Intelligence (AI) into respiratory monitoring devices, enabling real-time data analysis, predictive diagnostics, and enhanced patient care during and post-surgery

- AI-powered respiratory systems can continuously track patients' breathing patterns, alert clinicians of potential respiratory distress, and adjust ventilation parameters accordingly to optimize outcomes

- This trend is being driven by the rising demand for smart ICU and operating room solutions, especially in high-acuity care environments where real-time respiratory monitoring is critical

- For instance, in 2024, Philips introduced its AI-enabled “Respironics V680” ventilator with adaptive support ventilation and predictive analytics to help personalize patient care

- The adoption of AI in respiratory care is revolutionizing how respiratory and anaesthesia devices function, making them more intelligent, responsive, and efficient, thus transforming clinical workflows and patient safety

Anaesthesia and Respiratory Devices Market Dynamics

Driver

“Rising Prevalence of Chronic Respiratory Conditions”

- A key driver for market growth is the global surge in chronic respiratory illnesses such as COPD, asthma, and sleep apnea, leading to increased demand for ventilators, nebulizers, and oxygen therapy systems

- Environmental pollution, tobacco use, and an aging population are major contributing factors to the burden of these conditions, necessitating continuous respiratory support in both hospital and home care settings

- Respiratory diseases now rank among the top causes of mortality worldwide, prompting healthcare systems to invest in advanced respiratory management devices

- For instance, according to the Global Burden of Disease Study (2023), COPD was the third leading cause of death globally, affecting over 390 million people

- The ongoing rise in chronic respiratory cases is significantly boosting the adoption of anaesthesia and respiratory devices for both acute and long-term care

Opportunity

“Expansion of Home Healthcare and Portable Device Solutions”

- A major opportunity in the anaesthesia and respiratory devices market lies in the growing trend toward home-based care, which has accelerated the development of portable, user-friendly respiratory devices

- Patients with chronic conditions increasingly prefer home ventilators,portable oxygen concentrators, andCPAP devices to maintain their respiratory health outside clinical settings

- This shift is further supported by aging populations, increasing healthcare costs, and government initiatives promoting remote patient monitoring and decentralized care models

- For instance, in 2024, ResMed launched the “AirMini 2,” a compact, travel-friendly CPAP machine designed to improve patient adherence in home therapy

- The shift toward homecare solutions represents a substantial opportunity for manufacturers to expand their portfolios and serve a wider patient population with cost-effective solutions

Restraint/Challenge

“Shortage of Skilled Professionals for Device Operation and Maintenance”

- A significant challenge in the anaesthesia and respiratory devices market is the shortage of trained professionals, especially in developing countries, to operate and maintain complex respiratory systems

- Improper usage or failure to interpret respiratory monitoring data can lead to clinical errors, limiting the effectiveness of advanced technologies

- Moreover, many healthcare facilities struggle with understaffing or inadequate training, leading to inefficient utilization of devices and compromised patient outcomes

- For instance, a 2023 WHO report highlighted that 43% of low- and middle-income countries reported critical shortages in respiratory therapy staff and biomedical engineers

- This talent gap poses a major barrier to device adoption, especially for AI-driven and robotic-enabled systems, slowing down implementation despite technological readiness

Anaesthesia and Respiratory Devices Market Scope

The market is segmented on the basis of product type and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By End Users |

|

In 2025, the respiratory devices is projected to dominate the market with a largest share in product type segment

The respiratory devices segment is expected to dominate the anaesthesia and respiratory devices market with the largest market share of 68.69% in 2025 due to the high prevalence of chronic respiratory diseases, there is a significant demand for products such as ventilators, nebulizers, and oxygen concentrators, as they play a crucial role in managing these conditions.

Anaesthesia and Respiratory Devices Market Regional Analysis

“North America Holds the Largest Share in the Anaesthesia and Respiratory Devices Market”

- North America dominates the anaesthesia and respiratory devices market with the largest market share of 27.11%, driven by the strong presence of key industry players, highly developed healthcare infrastructure, widespread adoption of advanced technologies, and supportive reimbursement policies

- The U.S. holds the largest share within the region due to the high demand for sophisticated anaesthesia machines and respiratory devices, alongside continuous innovation in device technologies. The country’s robust healthcare system and significant investment in healthcare research further contribute to its leadership

- Growing investments in healthcare technology, along with favorable regulatory policies and increasing demand for respiratory support devices in critical care units, are expected to reinforce North America's dominance in the global market

“Asia-Pacific is Projected to Register the Highest CAGR in the Anaesthesia and Respiratory Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the anaesthesia and respiratory devices market, fueled by rapid healthcare infrastructure improvements, rising patient volumes, and increased demand for respiratory devices in emerging economies

- Countries such as China, India, and Japan are leading the regional growth, supported by government initiatives to modernize healthcare systems, ongoing investments in hospital facilities, and growing awareness of respiratory care

- China and India are witnessing significant demand due to healthcare reforms, increased access to medical technologies, and training of healthcare professionals in advanced respiratory management

Anaesthesia and Respiratory Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- General Electric Company (U.S.)

- Medtronic (Ireland)

- Teleflex Incorporated (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Drägerwerk AG & Co. KGaA (Germany)

- Getinge (Sweden)

- Smiths Group plc (U.K.)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Masimo (U.S.)

- B. Braun SE (Germany)

- ResMed (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Cardinal Health (U.S.)

- Fisher & Paykel Appliances Ltd (New Zealand)

- VYAIRE (U.S.)

- Metran Co., Ltd. (Japan)

- Siemens (Germany)

- Dixion distribution of medical devices GmbH (Germany)

- SunMed (U.S.)

Latest Developments in Global Anaesthesia and Respiratory Devices Market

- In September 2024, Knack Global announced the acquisition of Merrick Management, Inc., a provider of revenue cycle management solutions for anesthesia practices. This acquisition marks a significant expansion of Knack’s offerings into the anesthesia market, with Merrick’s experienced management team expected to play a pivotal role in leading Knack’s newly formed Anesthesia Services division, which will enhance Knack’s market position

- In June 2024, GHR Healthcare acquired United Anesthesia, a CRNA and Anesthesiologist staffing firm based in North Carolina, U.S. This strategic merger is expected to allow GHR Healthcare to expand its service offerings and provide comprehensive healthcare staffing solutions to clients nationwide, further strengthening its presence in the anesthesia staffing industry

- In January 2024, GlaxoSmithKline (GSK) strategically acquired Aiolos Bio, a biopharmaceutical company focused on innovative asthma treatments. Aiolos Bio's advanced pipeline of therapies for respiratory and inflammatory conditions offered GSK promising opportunities for growth and enhanced patient care, positioning the company for future success in the respiratory treatment market

- In October 2023, AirLife, a leading manufacturer and distributor of medical devices for anesthesia and respiratory care in North America, announced the completion of its acquisition of the respiratory business, including the BALLARD, MICROCUFF, and endOclear product lines, from Avanos Medical, Inc. This acquisition enables AirLife to enhance its product portfolio, offering a wider range of anesthesia and respiratory care solutions to the market

- In June 2023, Avanos Medical, Inc. agreed to sell its Regenerative Medicine (RH) business to SunMed Group Holdings, LLC (SunMed), a leading North American manufacturer and distributor of consumable medical devices for anesthesia and respiratory care. This sale marks a shift in Avanos’ business strategy, allowing SunMed to strengthen its position in the anesthesia and respiratory device market

- In March 2023, SunMed, a leading North American manufacturer and distributor of medical devices for anesthesia and respiratory care, announced a definitive agreement with Vyaire Medical, under which SunMed will acquire Vyaire’s business, which manufactures and sells respiratory and anesthesia supplies for airway management and surgical treatment. This acquisition further enhances SunMed's portfolio and solidifies its leadership in the anesthesia and respiratory care space

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.