Global Antimycotic Drugs Market

Taille du marché en milliards USD

TCAC :

%

USD

16.54 Billion

USD

22.64 Billion

2024

2032

USD

16.54 Billion

USD

22.64 Billion

2024

2032

| 2025 –2032 | |

| USD 16.54 Billion | |

| USD 22.64 Billion | |

|

|

|

|

Global Antimycotic Drugs Market Segmentation, By Drug Type (Azoles, Polyenes, Allylamines, and Quinazoles), Treatment (Amphotericin B, Antifungal Therapy for Invasive, and Serious Mycoses), Route of Administration (Oral, Parenteral, and Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy) - Industry Trends and Forecast to 2032

Antimycotic Drugs Market Size

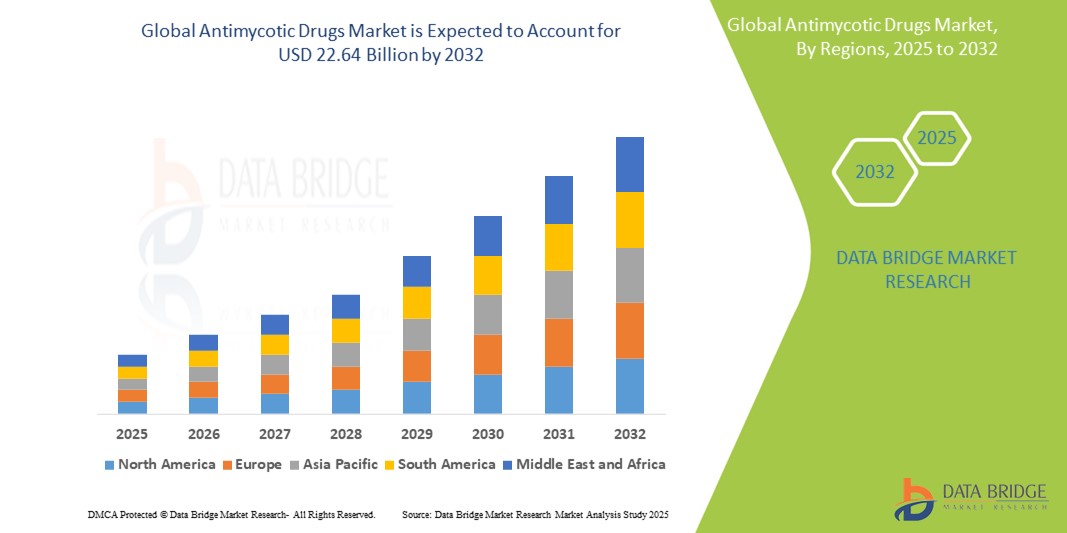

- The global antimycotic drugs market size was valued at USD 16.54 billion in 2024 and is expected to reach USD 22.64 billion by 2032, at a CAGR of 4.00% during the forecast period

- The market growth is largely fueled by the increasing incidence of fungal infections worldwide and ongoing technological progress in antifungal drug development, including novel formulations and targeted delivery mechanisms. Advancements in healthcare infrastructure and diagnostics are also enabling earlier and more accurate identification of fungal diseases, thus driving demand for effective antimycotic treatments across both developed and emerging regions

- Furthermore, rising patient awareness, the growing number of immunocompromised individuals (due to conditions like HIV/AIDS, cancer therapies, and organ transplants), and the increasing prevalence of hospital-acquired fungal infections are establishing antimycotic drugs as a crucial component of infectious disease management. These converging factors are accelerating the uptake of antifungal therapeutic solutions, thereby significantly boosting the industry's growth

Antimycotic Drugs Market Analysis

- Antimycotic drugs, used to treat fungal infections, are becoming increasingly vital components of modern healthcare systems due to the rising prevalence of fungal diseases, especially among immunocompromised patients. These drugs offer broad-spectrum antifungal activity, improved patient outcomes, and are available in various formulations including oral, topical, and intravenous, ensuring accessibility across diverse clinical settings

- The escalating demand for antimycotic therapies is primarily fueled by the growing number of patients undergoing chemotherapy, organ transplants, or living with HIV/AIDS, as well as the increase in hospital-acquired fungal infections. The development of novel antifungal agents and advancements in drug delivery systems are further propelling market growth

- North America dominated the antimycotic drugs market with the largest revenue share of 38.6% in 2024, attributed to the region’s high awareness levels, strong healthcare infrastructure, early adoption of novel antifungal agents, and the presence of key pharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the antimycotic drugs market with a projected CAGR of 9.4% from 2025 to 2032, driven by rising healthcare expenditure, expanding access to antifungal medications, and increasing awareness about fungal infections. Emerging economies like India and China are witnessing a surge in fungal disease diagnoses and treatment rate

- The azole segment dominated the antimycotic drugs market with a market share of 42.1% in 2024, due to its broad-spectrum activity, cost-effectiveness, and widespread use in both superficial and systemic infections. Azoles remain the first-line treatment for conditions such as candidiasis, aspergillosis, and dermatophytosis, contributing significantly to overall market revenue

Report Scope and Antimycotic Drugs Market Segmentation

|

Attributes |

Antimycotic Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antimycotic Drugs Market Trends

“Growing Burden of Fungal Infections and Advancements in Drug Formulations”

- A significant and accelerating trend in the global antimycotic drugs market is the rising burden of fungal infections, particularly among immunocompromised populations, such as individuals with HIV/AIDS, cancer patients undergoing chemotherapy, and organ transplant recipients. This has driven the urgent need for more effective and targeted antifungal therapies across healthcare systems worldwide

- For instance, the growing incidence of invasive fungal infections like candidiasis, aspergillosis, and cryptococcosis in hospital settings has created a surge in demand for broad-spectrum and systemic antimycotic drugs, including azoles and echinocandins. These drugs are increasingly being included in standard treatment protocols in both critical care and outpatient settings

- Continuous advancements in drug formulations, such as liposomal amphotericin B and extended-release antifungal tablets, are improving treatment efficacy while reducing side effects. These innovations are enabling longer-lasting therapeutic effects and improved patient adherence, especially in long-term or prophylactic antifungal therapies

- The availability of combination antifungal therapies is also growing, offering clinicians more flexibility to treat resistant or complicated infections. In addition, enhanced diagnostic tools are enabling early detection of fungal pathogens, leading to more timely and effective treatment interventions

- As pharmaceutical companies continue to invest in R&D for novel antimycotic agents, including those targeting drug-resistant strains, the market is witnessing the emergence of next-generation antifungals that address unmet medical needs and improve clinical outcomes

- The demand for antimycotic drugs is also expanding across both developed and developing regions, supported by greater awareness, expanding access to healthcare, and government-led initiatives to combat infectious diseases. These converging trends are reshaping the antimycotic landscape, making it a dynamic and fast-evolving segment within the broader anti-infective therapeutics market

Antimycotic Drugs Market Dynamics

Driver

“Growing Need Due to Rising Fungal Infections and Immunocompromised Populations”

- The increasing prevalence of fungal infections, particularly among immunocompromised individuals such as cancer patients, organ transplant recipients, and people with HIV/AIDS, is a significant driver contributing to the heightened demand for antimycotic drugs

- For instance, in April 2024, Pfizer Inc. announced the expansion of its antifungal pipeline, with a focus on next-generation treatments for invasive fungal infections in hospitalized patients. Such initiatives by major pharmaceutical players are expected to drive the Antimycotic Drugs industry forward during the forecast period

- As healthcare systems place greater emphasis on managing life-threatening fungal infections, especially in intensive care and oncology units, antimycotic therapies offer a critical solution. These treatments provide broad-spectrum protection and are often used prophylactically in high-risk patients, making them an essential part of modern infection control strategies

- Furthermore, the growing incidence of hospital-acquired infections, increasing use of immunosuppressive drugs, and the expansion of diagnostic technologies are encouraging more aggressive identification and treatment of fungal diseases, thus boosting the adoption of antimycotic drugs in both inpatient and outpatient settings

- The convenience of oral and intravenous formulations, the availability of combination therapies, and ongoing innovations in drug delivery systems are key factors propelling market growth. In addition, the trend toward self-administered treatment options and expanding access in emerging markets further contribute to the increasing demand for antifungal medications

Restraint/Challenge

“Rising Antifungal Resistance and High Treatment Costs”

- The emergence of antifungal resistance is a growing concern and poses a significant challenge to the long-term effectiveness of current antimycotic therapies. Overuse and misuse of antifungal drugs in both clinical and agricultural settings have contributed to resistance in pathogens like Candida auris and Aspergillus fumigatus, reducing the efficacy of standard treatments

- For instance, the World Health Organization recently classified antifungal resistance as a major public health threat, prompting regulatory agencies and pharmaceutical companies to prioritize research into novel mechanisms of action and drug classes

- Tackling resistance requires continuous investment in R&D, surveillance programs, and updated treatment guidelines, which can be resource-intensive and time-consuming. Furthermore, the availability of few new antifungal agents in the development pipeline makes it difficult to replace older, less effective drugs

- In addition to resistance, the high cost of advanced antifungal therapies—such as liposomal amphotericin B and echinocandins—can be a barrier to treatment, particularly in low- and middle-income countries. These premium formulations, while effective, may be out of reach for budget-constrained healthcare systems or uninsured patients

- While generic antifungal drugs help address affordability, they may not offer the same effectiveness against resistant strains or in severe infections. Therefore, overcoming these challenges through global stewardship programs, pricing reforms, and expanded access initiatives will be critical for sustaining growth in the antimycotic drugs market

Antimycotic Drugs Market Scope

The market is segmented on the basis of drug type, treatment, route of administration, and distribution channel.

• By Drug Type

On the basis of drug type, the antimycotic drugs market is segmented into azoles, polyenes, allylamines, and quinazoles. The azoles segment dominated the market with the largest revenue share of 42.1% in 2024, attributed to their broad-spectrum antifungal activity, oral availability, and affordability. Azoles are widely used for both superficial and systemic fungal infections and are often prescribed as first-line therapy in outpatient and hospital settings.

The allylamines segment is projected to witness the fastest CAGR of 8.6% from 2025 to 2032, driven by their increased use in treating dermatophytosis and onychomycosis, particularly in tropical regions with higher skin infection prevalence. Their ability to provide effective treatment with fewer systemic side effects is expanding their adoption.

• By Treatment

Based on treatment, the antimycotic drugs market is segmented into Amphotericin B, Antifungal Therapy for Invasive Mycoses, and Antifungal Therapy for Serious Mycoses. The Amphotericin B segment held a market share of 37.3% in 2024, owing to its potent efficacy against life-threatening fungal infections in immunocompromised patients. Despite its nephrotoxicity, liposomal formulations have improved its safety profile, making it the gold standard for systemic fungal infections.

The antifungal therapy for invasive mycoses segment is anticipated to grow at the highest CAGR of 9.1% during the forecast period, supported by the rising incidence of invasive infections such as candidiasis and aspergillosis, especially in ICU settings and among cancer patients.

• By Route of Administration

On the basis of route of administration, the antimycotic drugs market is segmented into oral, parenteral, and others. The oral segment captured the largest revenue share of 55.8% in 2024, due to the convenience of administration, higher patient compliance, and widespread use for mild to moderate fungal infections including candidiasis, athlete’s foot, and ringworm.

The parenteral segment is expected to witness the fastest CAGR of 9.4% from 2025 to 2032, driven by its application in severe, systemic infections, particularly in hospitalized and immunocompromised patients where rapid drug action and bioavailability are critical.

• By Distribution Channel

On the basis of distribution channel, the antimycotic drugs market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment held the largest market share of 47.6% in 2024, due to the higher prevalence of severe fungal infections among inpatients and the preference for intravenous formulations, especially in tertiary care centers and specialty hospitals.

The online pharmacy segment is expected to register the fastest CAGR of 10.2% during the forecast period, driven by the growing trend of e-pharmacy adoption, increased digital literacy, and the convenience of home delivery, especially in urban and semi-urban areas.

Antimycotic Drugs Market Regional Analysis

- North America dominated the antimycotic drugs market with the largest revenue share of 38.6% in 2024, driven by the high prevalence of fungal infections, increased usage of immunosuppressive therapies, and a well-established healthcare infrastructure supporting early diagnosis and treatment

- Consumers in the region benefit from broad access to prescription and over-the-counter antifungal medications, including advanced therapies for invasive fungal infections. The growing aging population, rising incidence of hospital-acquired infections, and increasing awareness about hygiene are further boosting market demand

- This widespread usage is also supported by the presence of leading pharmaceutical companies, robust clinical research activities, and favorable reimbursement scenarios. Moreover, the rise in immunocompromised patients due to cancer therapies and organ transplants continues to drive demand for effective antimycotic drugs in both inpatient and outpatient settings

U.S. Antimycotic Drugs Market Insight

The U.S. antimycotic drugs market captured the largest revenue share of 71.05% within North America in 2024, owing to its highly developed healthcare system, greater access to prescription medications, and higher awareness of fungal diseases. Strong R&D investments by companies like Pfizer, AbbVie, and Novartis further boost the availability of novel antifungal therapies.

Europe Antimycotic Drugs Market Insight

The Europe antimycotic drugs market accounted for a 28.7% share of the global market in 2024, with significant growth driven by aging populations, high prevalence of chronic illnesses, and widespread use of immunosuppressive therapies. The region's stringent quality and safety regulations ensure the adoption of effective and approved antifungal products.

U.K. Antimycotic Drugs Market Insight

The U.K. antimycotic drugs market is projected to grow at a CAGR of 6.8% during the forecast period, propelled by increasing awareness of fungal infections, government-supported healthcare access, and demand for over-the-counter antifungal medications. The National Health Service (NHS) plays a pivotal role in antifungal drug access and affordability.

Germany Antimycotic Drugs Market Insight

The Germany antimycotic drugs market is forecasted to expand at a CAGR of 6.5% from 2025 to 2032, supported by a strong pharmaceutical industry, rising healthcare spending, and increased use of antifungal therapies in clinical and hospital settings. The country’s focus on antimicrobial resistance also drives the adoption of safer and more effective antifungal agents.

Asia-Pacific Antimycotic Drugs Market Insight

The Asia-Pacific antimycotic drugs market is expected to grow at the fastest CAGR of 9.4% from 2025 to 2032, due to rising urbanization, increasing incidences of fungal infections, and growing awareness of hygiene and preventive care. Countries like India, China, and Japan are witnessing expanding pharmaceutical production and increasing demand for cost-effective antifungal medications.

Japan Antimycotic Drugs Market Insight

The Japan antimycotic drugs market is experiencing significant momentum, accounting for 19.2% of the Asia-Pacific share in 2024, owing to the country’s advanced healthcare infrastructure, aging population, and high demand for topical and oral antifungal treatments. Innovations in drug formulations and patient-focused therapies support market growth.

China Antimycotic Drugs Market Insight

The China antimycotic drugs market captured the largest share within Asia-Pacific at 42.5% in 2024, fueled by rapid healthcare infrastructure expansion, a growing middle-class population, and increased healthcare access in rural and urban areas. Domestic pharmaceutical companies and government initiatives supporting generic antifungal production are contributing to robust market expansion.

Antimycotic Drugs Market Share

The antimycotic drugs industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Endo Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd (Israel)

- Glenmark Pharmaceuticals Ltd. (India)

- Cipla (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Pfizer Inc (U.S.)

- Lupin (India)

- Vintage Labs (India)

- AbbVie Inc. (U.S.)

- Zydus Group (India)

- Wockhardt (India)

- Lannett (U.S.)

Latest Developments in Global Antimycotic Drugs Market

- In January 2024, Vanda Pharmaceuticals received FDA approval for an Investigational New Drug (IND) application to evaluate VTR‑297, a novel topical antifungal candidate for treating onychomycosis. This approval supports early-stage clinical testing of a potentially innovative treatment option for nail fungus infection

- In December 2023, Aurobindo Pharma (via Eugia Pharma Specialities Ltd.) secured USFDA final approval for a 300 mg/16.7 mL Posaconazole injection, a generic equivalent of Merck’s Noxafil. The product, aimed at preventing serious invasive Aspergillus and Candida infections in immunocompromised patients, targets an estimated market size of USD 25.4 million

- In September 2022, BDR Pharmaceuticals launched Zisavel (isavuconazole) capsules—a generic antifungal for treating invasive aspergillosis and mucormycosis—priced at approximately one-third the cost of existing therapies, improving accessibility in fungal infection management

- In March 2024, Akanocure Pharmaceuticals received Bayer’s “Grants4Ag” Award to support the development of novel antifungal agents intended for crop protection. The backing includes funding, mentoring, and testing resources to drive agricultural fungicide innovation

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.