Global Direct Fed Microbials Market

Taille du marché en milliards USD

TCAC :

%

USD

1.38 Billion

USD

2.49 Billion

2024

2032

USD

1.38 Billion

USD

2.49 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.49 Billion | |

|

|

|

|

Global Direct-Fed Microbials Market Segmentation, By Type (Bacillus subtilis, Lactic Acid Bacteria, Yeast, and Others), Form (Dry and Liquid), Livestock (Aquatic Animals, Poultry, Ruminants, Swine, and Others) - Industry Trends and Forecast to 2032

What is the Global Direct-Fed Microbials Market Size and Growth Rate?

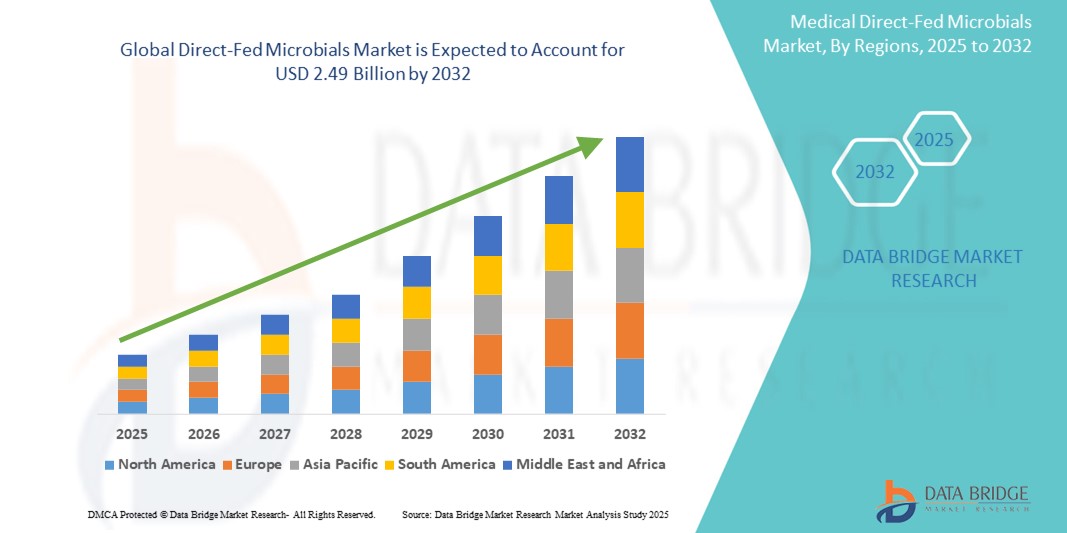

- The global direct-fed microbials market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 2.49 billion by 2032, at a CAGR of 7.60% during the forecast period

- The direct-fed microbials (DFM) market is experiencing significant growth, driven by the increasing demand for natural and sustainable alternatives to traditional antibiotics in animal nutrition. DFMs are gaining popularity as they offer a safe and effective way to improve animal health and performance

- Factors such as the growing concerns over antibiotic resistance, stringent regulations on antibiotic use in animal feed, and the rising consumer preference for antibiotic-free meat products are fueling market expansion

What are the Major Takeaways of Direct-Fed Microbials Market?

- The livestock industry's focus on improving feed efficiency, digestion, and overall gut health to enhance animal productivity is driving the adoption of DFMs. With increasing research and development activities and innovations in DFM formulations, the market is poised for further growth, especially in regions with a strong focus on animal agriculture

- North America dominated the direct-fed microbials market with the largest revenue share of 38.7% in 2024, driven by increasing demand for natural, antibiotic-free feed additives and growing awareness about improving animal gut health and performance

- Asia-Pacific direct-fed microbials market is poised to grow at the fastest CAGR of 12.4% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and the increasing demand for safe, sustainable animal protein

- The Bacillus subtilis segment dominated the direct-fed microbials market with the largest market revenue share of 41.5% in 2024, driven by its proven benefits in enhancing gut health, improving feed conversion, and supporting immunity across multiple livestock species

Report Scope and Direct-Fed Microbials Market Segmentation

|

Attributes |

Direct-Fed Microbials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Direct-Fed Microbials Market?

“Advancements in Multi-Strain, High-Potency Microbial Formulations”

- A significant and accelerating trend in the global direct-fed microbials market is the development of multi-strain, high-potency blends designed to enhance animal health, productivity, and gut performance across livestock species. These innovative formulations are tailored to improve feed efficiency, immunity, and overall animal well-being

- `For instance, Chr. Hansen Holding A/S expanded its microbial product portfolio in 2024 through the acquisition of UAS Laboratories, significantly enhancing its capabilities in high-potency, multi-species probiotics aimed at improving gut health and performance

- Technological innovations are enabling more targeted microbial combinations that can withstand harsh gastrointestinal environments, optimize nutrient absorption, and deliver consistent benefits across diverse production systems. Companies are investing in strain-specific research to enhance the efficacy of probiotics under different environmental and dietary conditions

- The increased use of advanced encapsulation techniques further boosts product stability and delivery, ensuring the viability of beneficial microbes in animal feed. This supports broader adoption of DFMs, particularly in regions facing regulatory restrictions on antibiotic growth promoters

- Key industry players such as Lallemand Inc. and BASF SE are at the forefront of developing next-generation DFMs that address specific challenges such as heat stress, pathogen control, and gut microbiome optimization

- The demand for scientifically backed, high-performance DFMs is growing rapidly across poultry, ruminants, swine, and aquaculture sectors, as producers increasingly seek sustainable, antibiotic-free solutions to improve animal health and productivity

What are the Key Drivers of Direct-Fed Microbials Market?

- The rising global emphasis on sustainable livestock production, coupled with the growing restrictions on antibiotic growth promoters, is a major driver fueling demand for Direct-Fed Microbials. DFMs are emerging as essential tools to support gut health, immunity, and feed conversion efficiency in livestock

- For instance, in October 2022, Zinpro Corporation launched Zinpro IsoFerm, a next-generation DFM designed to enhance fiber digestion by directly nourishing rumen microbes, offering a significant boost in animal performance

- Heightened consumer demand for antibiotic-free meat, dairy, and aquaculture products is pressuring producers to adopt effective, natural alternatives such as DFMs to maintain animal health and performance standards

- In addition, increasing investments in animal nutrition research and advancements in microbial identification technologies are enabling the development of strain-specific, highly effective DFM solutions tailored to species-specific needs

- Producers are increasingly recognizing the role of DFMs in reducing disease risk, improving growth rates, and enhancing overall productivity, which aligns with broader industry goals for efficiency, profitability, and sustainability

Which Factor is challenging the Growth of the Direct-Fed Microbials Market?

- One of the key challenges limiting the widespread adoption of direct-fed microbials is the inconsistent regulatory framework across regions, particularly concerning product approval processes, strain documentation, and health claims. Variability in national guidelines often delays market entry for innovative products

- For instance, in January 2023, Danisco Animal Nutrition & Health faced regulatory hurdles before obtaining approval for its DFM products Enviva PRO and Syncra SWI from the Canadian Food Inspection Agency (CFIA), highlighting the complexity of global market expansion

- Moreover, the efficacy of DFMs can vary depending on factors such as species, diet composition, environmental conditions, and management practices, which may lead to inconsistent performance results for end-users. This variability sometimes leads to skepticism among producers regarding product reliability

- The relatively higher cost of advanced, research-backed DFM formulations compared to conventional feed additives can also deter adoption, particularly among small-scale producers in developing regions with limited purchasing power

- To overcome these challenges, manufacturers are focusing on comprehensive field trials, robust scientific validation, and collaborative regulatory efforts to standardize approval processes. In addition, efforts to educate producers on proper DFM usage and long-term benefits will be critical for sustained market penetration

How is the Direct-Fed Microbials Market Segmented?

The market is segmented on the basis of type, form, and livestock.

By Type

On the basis of type, the direct-fed microbials market is segmented into Bacillus subtilis, Lactic Acid Bacteria, Yeast, and Others. The Bacillus subtilis segment dominated the Direct-Fed Microbials market with the largest market revenue share of 41.5% in 2024, driven by its proven benefits in enhancing gut health, improving feed conversion, and supporting immunity across multiple livestock species. Bacillus subtilis strains are highly stable, can survive harsh gastrointestinal conditions, and offer consistent performance, making them a preferred choice in poultry, swine, and ruminant nutrition.

The Lactic Acid Bacteria segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for probiotics that modulate gut microbiota, enhance digestion, and reduce pathogenic bacteria. The use of lactic acid bacteria in feed formulations aligns with the global trend of reducing antibiotic use while improving animal health and productivity.

By Form

On the basis of form, the direct-fed microbials market is segmented into Dry and Liquid. The Dry segment accounted for the largest market revenue share in 2024, driven by the ease of storage, extended shelf life, and stability of dry formulations under various environmental conditions. Dry DFMs are widely used in commercial feed manufacturing processes due to their compatibility with pelleted and mash feeds, making them highly convenient for producers.

The Liquid segment is expected to register the fastest CAGR from 2025 to 2032, driven by increased adoption in direct application systems, water-based delivery, and flexibility in on-farm dosing. Liquid DFMs offer rapid absorption and easy integration into livestock water systems, enhancing convenience and precision in supplementation.

By Livestock

On the basis of livestock, the direct-fed microbials market is segmented into Aquatic Animals, Poultry, Ruminants, Swine, and Others. The Poultry segment dominated the market with the largest revenue share of 37.8% in 2024, supported by the growing global demand for antibiotic-free poultry meat and eggs, coupled with increased use of DFMs to improve gut health, feed efficiency, and disease resistance in broilers and layers.

The Aquatic Animals segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the rapid expansion of aquaculture and the growing emphasis on sustainable fish and shrimp production. DFMs in aquaculture enhance water quality, support immune function, and promote growth, aligning with global efforts to reduce antibiotic use in aquatic farming.

Which Region Holds the Largest Share of the Direct-Fed Microbials Maret?

- North America dominated the direct-fed microbials market with the largest revenue share of 38.7% in 2024, driven by increasing demand for natural, antibiotic-free feed additives and growing awareness about improving animal gut health and performance

- Livestock producers in the region are increasingly adopting DFMs to enhance feed efficiency, immunity, and growth rates across poultry, swine, and ruminants, in line with rising consumer preference for sustainable and safe animal products

- The robust animal nutrition sector, technological advancements in microbial formulations, and regulatory support for reducing antibiotic use further strengthen North America's leadership in the DFM market

U.S. Direct-Fed Microbials Market Insight

U.S. direct-fed microbials market accounted for the largest share in 2024 within North America, fueled by strong demand for performance-enhancing probiotics in poultry, cattle, and swine production. Increasing pressure to reduce antibiotic growth promoters (AGPs) has led to wider adoption of DFMs as a proven alternative to support animal health, productivity, and food safety. The U.S. market benefits from advanced research, innovation in microbial strains, and strategic collaborations between feed manufacturers and biotech companies to develop effective, species-specific DFM solutions.

Europe Direct-Fed Microbials Market Insight

The Europe direct-fed microbials market is projected to grow at a steady CAGR throughout the forecast period, supported by stringent regulations on antibiotic use in animal feed and the region's proactive stance on sustainable livestock farming. DFMs are gaining significant traction among European producers seeking to improve feed efficiency, nutrient absorption, and gut health, particularly in ruminants and poultry. In addition, rising consumer demand for high-quality, antibiotic-free animal products and the region's emphasis on food safety are driving market expansion.

U.K. Direct-Fed Microbials Market Insight

The U.K. direct-fed microbials market is anticipated to witness strong growth during the forecast period, driven by increasing focus on sustainable livestock production, animal welfare, and the need to meet evolving food safety standards. British livestock producers are adopting DFMs to enhance gut health, reduce disease prevalence, and align with consumer demand for natural, residue-free meat, dairy, and eggs. The country's innovation-driven animal health sector further accelerates DFM integration into feed formulations.

Germany Direct-Fed Microbials Market Insight

The Germany direct-fed microbials market is expected to expand considerably, supported by the country’s advanced livestock industry and emphasis on reducing antibiotic dependency. German producers are adopting DFMs to promote animal gut health, improve feed conversion, and comply with strict environmental and animal welfare regulations. The growing demand for premium, antibiotic-free animal products and Germany's leadership in agricultural innovation contribute to market growth.

Which Region is the Fastest Growing Region in the Direct-Fed Microbials Market?

Asia-Pacific direct-fed microbials market is poised to grow at the fastest CAGR of 12.4% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and the increasing demand for safe, sustainable animal protein. Governments across countries such as China, India, and Japan are promoting modern livestock practices and reducing antibiotic usage, driving DFM adoption. The region’s expanding livestock population and growing awareness about feed quality and animal health further stimulate market growth.

China Direct-Fed Microbials Market Insight

The China direct-fed microbials market captured the largest revenue share within Asia-Pacific in 2024, driven by the country's massive livestock sector, rising middle class, and efforts to enhance food safety and production efficiency. With stricter regulations limiting antibiotic use, DFMs are being widely adopted in swine, poultry, and aquaculture production. Domestic and international players are investing in localized, high-performance microbial solutions to meet China's growing protein demand sustainably.

Japan Direct-Fed Microbials Market Insight

The Japan direct-fed microbials market is witnessing strong momentum, supported by the country’s high standards for food quality, safety, and animal welfare. Japanese livestock and aquaculture producers are increasingly integrating DFMs to improve animal health, gut function, and disease resistance, particularly in premium poultry, dairy, and seafood production. Innovation in microbial formulations and Japan's commitment to reducing antibiotic reliance are driving market growth.

Which are the Top Companies in Direct-Fed Microbials Market?

The direct-fed microbials industry is primarily led by well-established companies, including:

- Chr. Hansen Holding A/S (Denmark)

- Lallemand Inc. (Canada)

- BASF SE (Germany)

- Bio-Vet (U.S.)

- ADM (U.S.)

- Danisco (Denmark)

- Novozymes A/S (Denmark)

- Dow (U.S.)

- DSM (Netherlands)

- Novus International (U.S.)

- Biomin Holding GmbH (Austria)

- Kemin Industries, Inc. (U.S.)

- Bayer AG (Germany)

- Cargill, Incorporated (U.S.)

- Alltech (U.S.)

- American Biosystems, Inc. (U.S.)

- The Fertrell Company (U.S.)

- Calpis Co., Ltd. (Japan)

- Micron Bio-Systems (U.S.)

What are the Recent Developments in Global Direct-Fed Microbials Market?

- In January 2023, Danisco Animal Nutrition & Health, a division of IFF, announced that its products Enviva® PRO and Syncra® SWI received approval from the Canadian Food Inspection Agency (CFIA). This milestone allows poultry and swine producers in Canada to access advanced feed solutions, ensuring improved and consistent animal performance year-round. The development strengthens Danisco's global footprint in animal nutrition

- In October 2022, Zinpro Corporation, a global leader in high-performance organic trace minerals and animal nutrition, introduced its latest innovation, Zinpro IsoFerm. This vital nutrient enhances rumen function by directly supporting fiber-digesting microbes, thereby improving animal productivity and gut health. The launch further solidifies Zinpro's position as a pioneer in advanced animal nutrition solutions

- In July 2020, Chr. Hansen Holding A/S successfully completed the acquisition of UAS Laboratories LLC after satisfying all regulatory and closing conditions. The acquisition strengthens Chr. Hansen's microbial platform and broadens its Human Health product portfolio, especially in the lucrative multi-species, high-potency probiotic blends segment. This move expands Chr. Hansen’s customer base and enhances its global competitive position

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.