Global Feeding Tubes Market

Taille du marché en milliards USD

TCAC :

%

USD

4.45 Billion

USD

6.83 Billion

2024

2032

USD

4.45 Billion

USD

6.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.45 Billion | |

| USD 6.83 Billion | |

|

|

|

|

Global Feeding Tubes Market Segmentation, By Product Type (Nasogastric Feeding Tubes, Orogastric Feeding Tubes, Percutaneous Endoscopic Gastrostomy Feeding Tubes, Jejunal Tubes, Enterostomy Tube, Oroenteric Feeding Tube, and Others), Patient Type (Adult and Pediatric), End User (Hospitals, Ambulatory Surgery Centers, Neonatal Care Centers, and Others), Application (Oncology, Gastroenterology, Metabolic Disorders, Hepatology, Diabetes, and Others) - Industry Trends and Forecast to 2032

Feeding Tubes Market Size

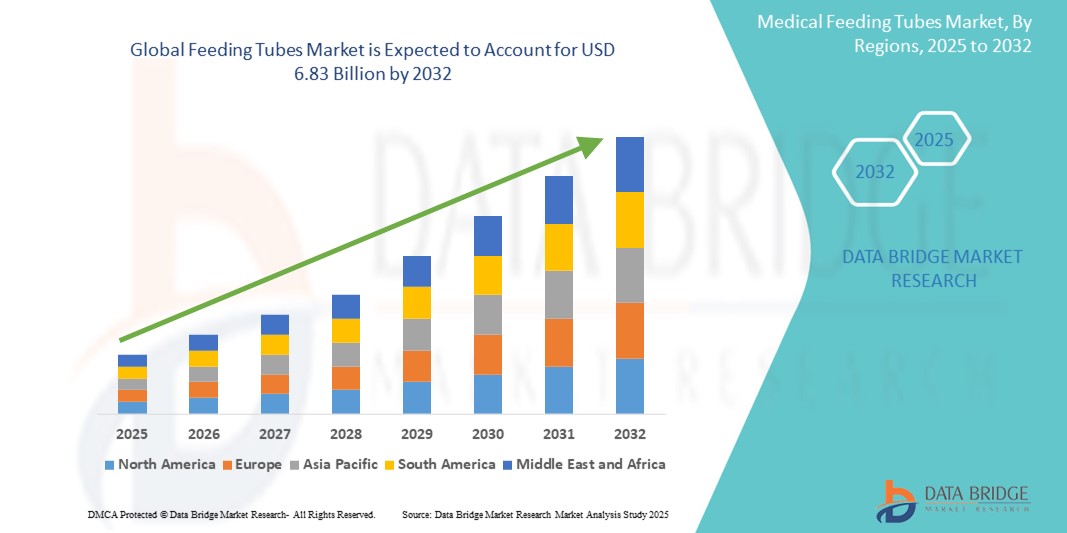

- The global feeding tubes market size was valued at USD 4.45 billion in 2024 and is expected to reach USD 6.83 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases such as cancer, neurological disorders, and gastrointestinal conditions, which often require long-term nutritional support via enteral feeding

- Moreover, the growing geriatric population and rising cases of premature births are contributing to a higher demand for feeding tubes in both hospital and homecare settings. These demographic and clinical trends, alongside improvements in tube materials and placement techniques, are fueling market expansion and making feeding tubes an integral component of modern clinical nutrition and patient care strategies

Feeding Tubes Market Analysis

- Feeding tubes, which provide vital nutritional support to patients unable to eat or swallow, have become indispensable medical devices in both acute care and long-term healthcare settings, owing to their critical role in maintaining adequate nutrition and hydration in patients with chronic illnesses, neurological conditions, or post-surgical complications

- The growing demand for feeding tubes is primarily fueled by the increasing incidence of gastrointestinal disorders, cancer, and neurological diseases, coupled with a surge in the aging population requiring assisted feeding solutions. In addition, the rising preference for enteral over parenteral nutrition due to its lower risk of infection and cost-effectiveness is further propelling market growth

- North America dominated the feeding tubes market with the largest revenue share of 38.7% in 2024, supported by advanced healthcare infrastructure, high awareness levels, and the strong presence of leading market players. The U.S., in particular, sees a high volume of feeding tube procedures in hospitals and home care settings, driven by a robust elderly population and growing chronic disease burden

- Asia-Pacific is expected to be the fastest-growing region in the feeding tubes market during the forecast period, owing to rising healthcare expenditure, improving medical facilities, and increasing awareness about enteral nutrition in emerging economies such as China and India.

- Enterostomy tube, segment dominated the feeding tubes market with a market share of 33.3% in 2024, driven by its widespread use in long-term nutritional support for patients with chronic illnesses and its lower risk of aspiration compared to nasogastric methods

Report Scope and Feeding Tubes Market Segmentation

|

Attributes |

Feeding Tubes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Feeding Tubes Market Trends

“Shift Toward Home Enteral Nutrition and Technological Advancements”

- A prominent and accelerating trend in the global feeding tubes market is the increasing adoption of home enteral nutrition (HEN) due to rising healthcare costs and the growing preference for in-home patient care. This shift is supported by advances in feeding tube design and user-friendly enteral nutrition delivery systems, allowing patients to manage their nutritional needs outside of hospital settings

- For instance, Fresenius Kabi and Nestlé Health Science have developed compact, portable feeding pumps compatible with a variety of feeding tubes, making home-based nutritional care more feasible and convenient

- In addition, innovations such as antimicrobial-coated tubes, low-profile devices, and wireless monitoring systems are improving patient safety, reducing infection risks, and enhancing caregiver efficiency. These technological improvements are particularly important in pediatric and geriatric care, where ease of use and comfort are critical.

- The integration of digital tools to track feeding schedules and tube performance, along with increased emphasis on personalized nutrition plans, is creating a more connected and responsive care environment.

- This trend toward personalized, tech-enabled, and home-based enteral feeding solutions is reshaping the feeding tubes market and raising expectations for both product quality and patient outcomes. As a result, leading companies such as Cardinal Health and Avanos Medical are investing in R&D to launch next-generation feeding tubes that offer improved durability, comfort, and clinical efficiency

Feeding Tubes Market Dynamics

Driver

“Rising Chronic Disease Burden and Aging Population Driving Demand”

- The increasing global burden of chronic illnesses such as cancer, stroke, gastrointestinal disorders, and neurological diseases is a major driver for the growth of the feeding tubes market. These conditions often result in impaired swallowing or inability to consume adequate nutrition orally, making enteral feeding a medical necessity

- For instance, according to WHO, the number of people aged 60 and above is expected to more than double by 2050, significantly boosting demand for long-term nutritional support solutions

- Hospitals, long-term care facilities, and home care providers are witnessing a surge in patients requiring feeding tubes, particularly PEG and jejunal tubes, to maintain proper nutritional intake

- Moreover, increased awareness about enteral nutrition benefits, coupled with a preference for minimally invasive procedures and enhanced patient comfort, is propelling the market forward

- Government and private insurance support for enteral nutrition therapies in developed economies also plays a key role in encouraging the adoption of feeding tube systems

Restraint/Challenge

“Complication Risks and Reimbursement Gap”

- Despite the benefits, feeding tube placement and maintenance carry potential risks such as tube dislodgement, infection, clogging, and aspiration pneumonia, which may deter wider adoption, especially in home settings

- In addition, inconsistent reimbursement policies across regions, particularly in emerging markets, pose challenges for both patients and providers. The high cost of enteral feeding systems and limited insurance coverage for related services can restrict access, especially in low- and middle-income countries.

- For instance, many healthcare systems in developing regions still prioritize acute interventions over long-term nutritional support, creating disparities in care availability.

- Addressing these challenges requires improved training for caregivers, robust aftercare protocols, and policy-level initiatives to ensure equitable access to enteral nutrition. Moreover, enhancing product reliability and simplifying tube maintenance could reduce complication rates and drive market confidence

Feeding Tubes Market Scope

The market is segmented on the basis of product type, patient type, end user, and application.

- By Product Type

On the basis of product type, the feeding tubes market is segmented into nasogastric feeding tubes, orogastric feeding tubes, percutaneous endoscopic gastrostomy (PEG) feeding tubes, jejunal tubes, enterostomy tubes, oroenteric feeding tubes, and others. The enterostomy tube segment dominated the market with the largest market revenue share of 33.3% in 2024, driven by its widespread use in long-term nutritional support for patients with chronic illnesses and its lower risk of aspiration compared to nasogastric methods. Enterostomy tubes are commonly preferred in both hospital and home care settings for patients requiring extended enteral nutrition due to conditions such as cancer, stroke, and neurological disorders.

The jejunal tubes segment is anticipated to witness the fastest growth rate of 7.6% from 2025 to 2032, fueled by their growing adoption in critically ill patients who are at high risk of aspiration. Jejunal tubes offer post-pyloric feeding, reducing complications and ensuring more effective nutrient delivery in patients with impaired gastric function or severe reflux.

- By Patient Type

On the basis of patient type, the feeding tubes market is segmented into adult and pediatric. The adult segment held the largest market revenue share of 69.3% in 2024, attributed to the high prevalence of chronic diseases, cancer, and neurological disorders among adults and the elderly. Adults represent the largest user group for feeding tubes, particularly in long-term care and rehabilitation settings, where sustained nutritional support is essential.

The pediatric segment is expected to grow at a steady pace over the forecast period, driven by the increasing incidence of premature births, congenital anomalies, and pediatric gastrointestinal conditions. Specialized pediatric feeding tubes are witnessing demand in neonatal care units and pediatric hospitals

- By End User

On the basis of end user, the feeding tubes market is segmented into hospitals, ambulatory surgery centers, neonatal care centers, and others. The hospitals segment dominated the market with the largest market revenue share of 54.6% in 2024, driven by the availability of skilled healthcare professionals, advanced diagnostic and surgical facilities, and a high volume of enteral feeding procedures. Hospitals remain the primary setting for initial feeding tube placement and post-operative management, especially in critical care units.

The ambulatory surgery centers segment is anticipated to witness the fastest growth rate of 8.2% from 2025 to 2032, owing to the rising number of outpatient procedures for enteral feeding tube placement. These centers offer cost-effective and minimally invasive treatment options, contributing to market expansion in developed healthcare systems.

- By Application

On the basis of application, the feeding tubes market is segmented into oncology, gastroenterology, metabolic disorders, hepatology, diabetes, and others. The oncology segment dominated the market with the largest market revenue share of 28.5% in 2024, driven by the high demand for enteral nutrition in cancer patients undergoing chemotherapy or radiotherapy, particularly those with head, neck, or gastrointestinal malignancies. Feeding tubes play a critical role in maintaining nutritional status, preventing weight loss, and improving treatment outcomes.

The gastroenterology segment is expected to witness the fastest growth rate of 7.9% from 2025 to 2032, supported by the increasing incidence of gastrointestinal disorders such as Crohn’s disease, gastroparesis, and intestinal obstructions. Feeding tubes provide effective nutritional support for patients with compromised digestive function, contributing to improved quality of life and clinical outcomes.

Feeding Tubes Market Regional Analysis

- North America dominated the feeding tubes market with the largest revenue share of 38.7% in 2024, supported by advanced healthcare infrastructure, high awareness levels, and the strong presence of leading market players. The U.S., in particular, sees a high volume of feeding tube procedures in hospitals and home care settings, driven by a robust elderly population and growing chronic disease burden

- The region benefits from high awareness levels regarding clinical nutrition, widespread use of technologically advanced feeding devices, and strong reimbursement frameworks that support long-term enteral feeding therapies

- In addition, the growing aging population and increased incidence of conditions such as cancer, stroke, and neurological disorders contribute to the sustained demand for feeding tubes in both hospital and home care settings

U.S. Feeding Tubes Market Insight

The U.S. feeding tubes market captured the largest revenue share of 83% in 2024 within North America, driven by the country's advanced healthcare infrastructure and high prevalence of chronic diseases such as cancer, neurological conditions, and gastrointestinal disorders. The strong emphasis on clinical nutrition and the widespread use of enteral feeding in both acute care hospitals and home care settings support market growth. In addition, favorable reimbursement policies and the increasing adoption of user-friendly, long-term feeding solutions contribute to the country's leadership position in the regional and global market.

Europe Feeding Tubes Market Insight

The Europe feeding tubes market is projected to grow at a steady CAGR during the forecast period, supported by the region's aging population, increased incidence of dysphagia and cancer, and well-established healthcare systems. Rising demand for minimally invasive and home-based enteral nutrition therapies, along with government initiatives to promote nutritional care in long-term facilities, is fostering market expansion. The adoption of low-profile and antimicrobial-coated feeding tubes is also gaining traction, especially in Western European countries where patient comfort and infection control are priorities.

U.K. Feeding Tubes Market Insight

The U.K. feeding tubes market is expected to grow significantly over the forecast period due to increased awareness about the importance of nutritional support in chronic illness management. The National Health Service (NHS) plays a critical role in ensuring wide access to enteral nutrition therapies, particularly for cancer and stroke patients. The country's push towards community- and home-based care is also contributing to greater adoption of portable and long-term feeding tube solutions.

Germany Feeding Tubes Market Insight

The Germany feeding tubes market is expected to expand at a considerable CAGR during the forecast period, backed by strong investments in healthcare technology and patient-centered care. The country’s focus on preventive healthcare and early intervention, combined with a robust network of long-term care and rehabilitation facilities, supports demand for enteral feeding solutions. Innovations in feeding tube design and growing awareness of clinical nutrition among healthcare professionals further drive growth in both the hospital and home care segments.

Asia-Pacific Feeding Tubes Market Insight

The Asia-Pacific feeding tubes market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising healthcare expenditures, growing aging population, and the increasing prevalence of lifestyle-related diseases such as diabetes and cancer. Countries such as China, India, and Japan are investing heavily in expanding hospital infrastructure and improving access to enteral nutrition, particularly in underserved and rural areas. The shift toward home care and increasing acceptance of nutritional support therapies are creating strong growth opportunities.

Japan Feeding Tubes Market Insight

The Japan feeding tubes market is growing rapidly, propelled by its large geriatric population and high incidence of dysphagia-related conditions. Japan’s technologically advanced medical sector and strong focus on elderly care have led to the adoption of sophisticated enteral feeding systems. The integration of feeding tubes with portable nutrition pumps and advanced materials designed for comfort and durability is gaining momentum, particularly in long-term and home healthcare settings.

India Feeding Tubes Market Insight

The India feeding tubes market accounted for the largest market revenue share in Asia Pacific in 2024, driven by rapid urbanization, growing healthcare awareness, and increased access to enteral nutrition products. The rise in cancer and stroke cases, along with the expansion of private healthcare providers, has significantly boosted the demand for feeding tubes in hospitals and home care. Local manufacturing capabilities and government support for healthcare infrastructure development are further fueling the market’s upward trajectory.

Feeding Tubes Market Share

The feeding tubes industry is primarily led by well-established companies, including:

- Boston Scientific Corporation (U.S.)

- Vygon (France)

- BD (U.S.)

- Cardinal Health (U.S.)

- Amsino International, Inc. (U.S.)

- Fidmi Medical (Israel)

- Vesco Medical (U.S.)

- McKesson Medical-Surgical Inc. (U.S.)

- Medela (Switzerland)

- ALCOR SCIENTIFIC (U.S.)

- Nutricia (Netherlands)

- Medline Industries, Inc. (U.S)

- Mead Johnson & Company, LLC (U.S.)

- Abbott (U.S.)

- Meiji Holdings Co., Ltd. (Japan)

- Fresenius Kabi AG (Germany)

- B. Braun SE (Germany)

- AVNS (U.S.)

- CONMED Corporation (U.S)

- Cook (U.S.)

What are the Recent Developments in Global Feeding Tubes Market?

- In June 2025, NanoVibronix, Inc., a medical technology company focused on therapeutic devices, announced that its subsidiary, ENvue Medical Holdings LLC, had been granted a new U.S. patent for its innovative pediatric feeding tube guidance system. The patented technology is designed to provide real-time navigational assistance during feeding tube placement in pediatric patients, aiming to enhance procedural accuracy and reduce reliance on imaging methods.

- In April 2023, Cardinal Health announced the launch of its next-generation enteral feeding system designed to enhance patient comfort and caregiver usability. The system incorporates anti-clog technology and low-profile connectors, aiming to reduce feeding interruptions and improve patient compliance in both clinical and homecare environments. This innovation reflects Cardinal Health’s commitment to improving enteral nutrition delivery through thoughtful design and technological enhancement

- In March 2023, Fresenius Kabi introduced a new portable enteral feeding pump, the Amika+, equipped with advanced safety features and intuitive digital controls. Targeted for home and hospital use, the device supports flexible feeding schedules and improves mobility for patients on long-term enteral nutrition. This launch aligns with the growing global demand for user-friendly, home-based feeding solutions

- In March 2023, Vygon Group, a France-based medical device manufacturer, announced the expansion of its enteral feeding product line with neonatal-specific feeding tubes designed to minimize trauma and reduce infection risk in premature infants. This development underscores Vygon’s focus on pediatric care and innovation in neonatal nutrition therapy

- In February 2023, Avanos Medical, Inc. partnered with a major U.S. health system to conduct clinical trials evaluating the performance and safety of its anti-reflux feeding tube system in high-risk patients. The system, designed to lower aspiration risk, reflects the company's effort to address critical complications associated with enteral feeding, particularly in ICU and long-term care settings

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FEEDING TUBE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FEEDING TUBE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FEEDING TUBE MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL FEEDING TUBE MARKET , BY TYPE

16.1 OVERVIEW

16.2 NASOGASTRIC FEEDING TUBE

16.2.1 BY TYPE

16.2.1.1. NASOGASTRIC FEEDING TUBES

16.2.1.1.1. BY SIZE

16.2.1.1.1.1 14 FR

16.2.1.1.1.2 18 FR

16.2.1.1.1.3 24 FR

16.2.1.1.1.4 20 FR

16.2.1.1.1.5 16 FR

16.2.1.1.1.6 OTHERS

16.2.1.1.2. BY LENGTH

16.2.1.1.2.1 36 INCH TUBE

16.2.1.1.2.2 48 INCH TUBE

16.2.1.1.2.3 43 INCH TUBE

16.2.1.1.2.4 16 INCH TUBE

16.2.1.1.2.5 22 INCH TUBE

16.2.1.1.2.6 OTHERS

16.2.1.1.3. BY STERILITY

16.2.1.1.3.1 STERILE

16.2.1.1.3.2 NONSTERILE

16.2.1.2. NASOINTESTINAL TUBES

16.2.1.3. NASOENTERIC TUBES

16.2.1.4. SALEM SUMP TUBE

16.2.1.5. OTHERS

16.2.2 BY TYPE

16.2.2.1. SINGLE LUMEN

16.2.2.2. DOUBLE LUMEN

16.2.3 BY SIZE

16.2.3.1. 14 FR

16.2.3.2. 18 FR

16.2.3.3. 24 FR

16.2.3.4. 20 FR

16.2.3.5. 16 FR

16.2.3.6. OTHERS

16.3 OROGASTRIC TUBE

16.3.1 STANDARD TUBES

16.3.2 REPLOGLE TUBE

16.3.3 EWALD TUBE

16.3.4 OTHERS

16.4 PRECUTANEOUS TUBES

16.4.1 STANDARD PEG TUBE

16.4.2 LOW-PROFILE PEG TUBE

16.4.3 PULL-THROUGH PEG TUBE

16.4.4 BALLOON RETENTION PEG TUBE

16.4.5 RADIOLOGICALLY INSERTED GASTROSTOMY (RIG) TUBE

16.4.6 OTHERS

16.5 JEJUNAL TUBES

16.5.1 BY TYPE

16.5.1.1. JEJUNOSTOMY TUBES (J-TUBES)

16.5.1.2. NASOJEJUNAL TUBES

16.5.1.3. JEJUNAL EXTENSION TUBE

16.5.1.4. OTHERS

16.5.2 BY SIZE

16.5.2.1. 14 FR

16.5.2.2. 18 FR

16.5.2.3. 22 FR

16.5.2.4. 20 FR

16.5.2.5. 16 FR

16.5.2.6. OTHERS

16.5.3 BY LENGTH

16.5.3.1. 3.0 CM TUBE

16.5.3.2. 45 CM TUBE

16.5.3.3. 3.5 CM TUBE

16.5.3.4. 30 CM TUBE

16.5.3.5. OTHERS

16.6 ENTEROSTOMY TUBE

16.6.1 ILEOSTOMY

16.6.2 COLOSTOMY

16.6.3 OTHERS

16.7 ORENTERIC FEEDING TUBE

16.7.1 OROINTESTINAL TUBES:

16.7.2 TRANSNASAL ENTERAL TUBES:

16.7.3 ENTERIC-COATED TUBES

16.7.4 OTHERS

16.8 OTHERS

17 GLOBAL FEEDING TUBE MARKET , BY MATERIAL

17.1 OVERVIEW

17.2 POLYVINYL

17.3 SILICONE

17.4 POLYURETHANE

17.5 OTHERS

18 GLOBAL FEEDING TUBE MARKET ,BY FITTING TYPE

18.1 OVERVIEW

18.2 STANDERD TUBES

18.3 LOW PROFILE TUBES

18.4 OTHERS

19 GLOBAL FEEDING TUBE MARKET , BY AGE GROUP

19.1 OVERVIEW

19.2 PEDIATRIC

19.3 NEONATAL

19.4 ADULT

19.5 GERIATRIC

20 GLOBAL FEEDING TUBE MARKET , BY APPLICATION

20.1 OVERVIEW

20.2 ONCOLOGY

20.2.1 GASTRIC CANCER

20.2.2 HEAD AND NECK CANCER

20.2.3 OTHERS

20.3 GASTROENTEROLOGY

20.3.1 SHORT BOWEL SYNDROME

20.3.2 OBSTRUCTED BOWEL SYNDROME

20.3.3 OTHERS

20.4 HEPATOLOGY

20.5 DIABETES

20.6 STROKE

20.7 PARALYSIS

20.8 CROHN’S DISEASE

20.9 OTHERS

21 GLOBAL FEEDING TUBE MARKET , BY END USER

21.1 OVERVIEW

21.2 HOSPITAL

21.3 HOMACARE

21.4 SPECIALTY CLINICS

21.5 AMBULATORY SURGICAL CENTERS

21.6 DIAGNOSTIC CENTERS

21.7 OTHERS

22 GLOBAL FEEDING TUBE MARKET , BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDER

22.3 RETAIL SALE

22.3.1 OFFLINE MODE

22.3.2 ONLINE MODE

22.4 OTHERS

23 GLOBAL FEEDING TUBE MARKET , SWOT AND DBMR ANALYSIS

24 GLOBAL FEEDING TUBE MARKET , COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

24.5 MERGERS & ACQUISITIONS

24.6 NEW PRODUCT DEVELOPMENT & APPROVALS

24.7 EXPANSIONS

24.8 REGULATORY CHANGES

24.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL FEEDING TUBE MARKET , BY REGION

GLOBAL FEEDING TUBE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 NORTH AMERICA

25.1.1 U.S.

25.1.2 CANADA

25.1.3 MEXICO

25.2 EUROPE

25.2.1 GERMANY

25.2.2 FRANCE

25.2.3 U.K.

25.2.4 ITALY

25.2.5 SPAIN

25.2.6 RUSSIA

25.2.7 TURKEY

25.2.8 BELGIUM

25.2.9 NETHERLANDS

25.2.10 SWITZERLAND

25.2.11 DENMARK

25.2.12 NORWAY

25.2.13 SWEDEN

25.2.14 FINLAND

25.2.15 POLAND

25.2.16 REST OF EUROPE

25.3 ASIA-PACIFIC

25.3.1 JAPAN

25.3.2 CHINA

25.3.3 SOUTH KOREA

25.3.4 INDIA

25.3.5 AUSTRALIA

25.3.6 SINGAPORE

25.3.7 THAILAND

25.3.8 MALAYSIA

25.3.9 INDONESIA

25.3.10 PHILIPPINES

25.3.11 VIETNAM

25.3.12 NEW ZEALAND

25.3.13 TAIWAN

25.3.14 REST OF ASIA-PACIFIC

25.4 SOUTH AMERICA

25.4.1 BRAZIL

25.4.2 ARGENTINA

25.4.3 REST OF SOUTH AMERICA

25.5 MIDDLE EAST AND AFRICA

25.5.1 SOUTH AFRICA

25.5.2 SAUDI ARABIA

25.5.3 UAE

25.5.4 EGYPT

25.5.5 ISRAEL

25.5.6 OMAN

25.5.7 QATAR

25.5.8 BAHRAIN

25.5.9 REST OF MIDDLE EAST AND AFRICA

25.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

26 GLOBAL FEEDING TUBE MARKET , COMPANY PROFILE

26.1 CARDINAL HEALTH

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPEMENTS

26.2 BOSTON SCIENTIFIC CORPORATION

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPEMENTS

26.3 VYGON

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPEMENTS

26.4 APPLIED MEDICAL TECHNOLOGY, INC.

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPEMENTS

26.5 NUTRICIA ADVANCED MEDICAL NUTRITION(DANONE)

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPEMENTS

26.6 AVANOS MEDICAL, INC.

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPEMENTS

26.7 DYNAREX CORPORATION

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPEMENTS

26.8 COOK

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPEMENTS

26.9 MEDELA

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPEMENTS

26.1 B. BRAUN SE

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPEMENTS

26.11 QMD

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPEMENTS

26.12 FRESENIUS KABI LIMITED

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPEMENTS

26.13 BD

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPEMENTS

26.14 FUJI SYSTEMS

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPEMENTS

26.15 VICTUS, INC.

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPEMENTS

26.16 MEDLINE INDUSTRIES, LP

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPEMENTS

26.17 FIDMI MEDICAL

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPEMENTS

26.18 VESCO MEDICAL

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPEMENTS

26.19 MOSS TUBES, INC.

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPEMENTS

26.2 ROMSONS

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPEMENTS

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.