Global Precision Fermentation Derived Biomaterials Market

Taille du marché en milliards USD

TCAC :

%

USD

803.68 Million

USD

2,032.92 Million

2025

2033

USD

803.68 Million

USD

2,032.92 Million

2025

2033

| 2026 –2033 | |

| USD 803.68 Million | |

| USD 2,032.92 Million | |

|

|

|

|

Global Precision Fermentation-Derived Biomaterials Market Segmentation, By Product Type (Proteins, Enzymes, Lipids, Polysaccharides, Peptides & Growth Factors, and Other Biomolecules), Microbial Host (Yeast, Bacteria, Fungi, and Algae), Technology (Strain Engineering, Upstream Fermentation, Downstream Processing, Formulation & Material Conversion, and Contract Manufacturing), Application (Medical & Healthcare, Food & Beverage, Cosmetics & Personal Care, Industrial & Specialty Materials, and Agriculture & Animal Feed)- Industry Trends and Forecast to 2033

Precision Fermentation-Derived Biomaterials Market Size

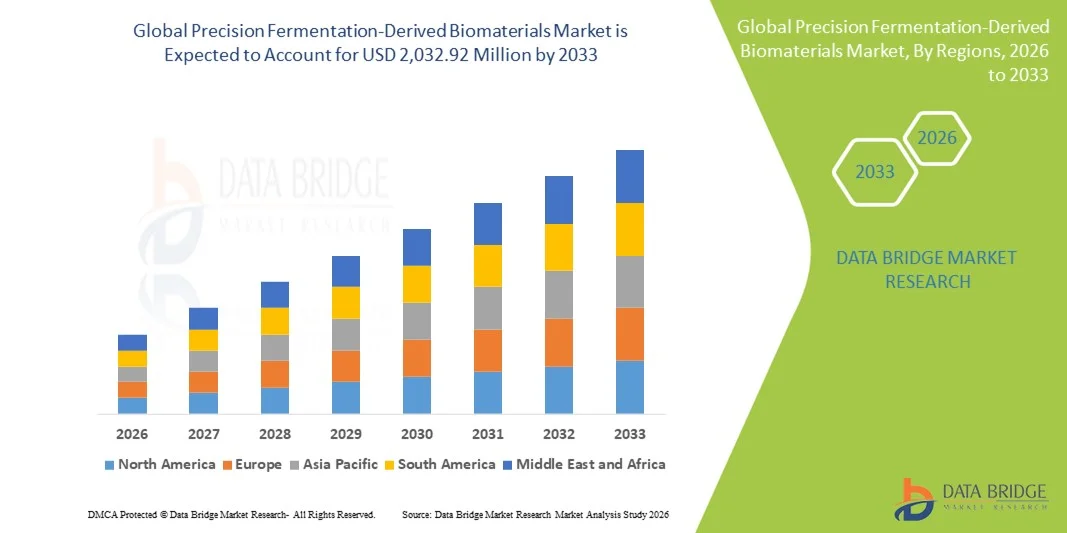

- The global precision fermentation-derived biomaterials market size was valued at USD 803.68 million in 2025 and is expected to reach USD 2,032.92 million by 2033, at a CAGR of 12.30% during the forecast period

- The market growth is primarily driven by rapid advancements in synthetic biology, strain engineering, and bioprocessing technologies, which are enabling scalable, cost-efficient, and sustainable production of high-performance biomaterials

- In addition, rising demand for bio-based, animal-free, and environmentally sustainable materials across food, healthcare, cosmetics, and industrial applications is positioning precision fermentation as a preferred manufacturing approach, thereby significantly accelerating overall market growth

Precision Fermentation-Derived Biomaterials Market Analysis

- Precision fermentation-derived biomaterials, produced through engineered microorganisms to create proteins, polymers, and other functional biomolecules, are becoming increasingly critical across food, healthcare, cosmetics, and industrial applications due to their sustainability advantages, consistent quality, and ability to replace animal- or petrochemical-derived materials

- The rising demand for these biomaterials is primarily driven by advances in synthetic biology and fermentation technologies, increasing emphasis on sustainable and animal-free production methods, and growing regulatory and consumer support for bio-based materials

- North America dominated the precision fermentation-derived biomaterials market with the largest revenue share of 38.9% in 2025, supported by strong R&D infrastructure, early adoption of synthetic biology, significant venture capital investments, and the presence of leading biotechnology companies and startups focused on scalable biomaterial production

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, projected to expand at the highest CAGR due to expanding biotechnology manufacturing capabilities, increasing government support for bioeconomy initiatives, and rising demand for sustainable materials across food, healthcare, and industrial sectors

- The protein segment dominated the market with a share of 42.7% in 2025, owing to their widespread use in food ingredients, medical applications, and cosmetic formulations, along with proven scalability and commercial viability through precision fermentation processes

Report Scope and Precision Fermentation-Derived Biomaterials Market Segmentation

|

Attributes |

Precision Fermentation-Derived Biomaterials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Precision Fermentation-Derived Biomaterials Market Trends

Advancement in Synthetic Biology and Scalable Fermentation Technologies

- A significant and accelerating trend in the global precision fermentation-derived biomaterials market is the rapid advancement in synthetic biology, strain engineering, and scalable fermentation platforms, which are enabling the efficient production of high-performance biomaterials with consistent quality and reduced environmental impact

- For instance, companies such as Ginkgo Bioworks and Perfect Day are leveraging advanced genetic programming and precision fermentation to optimize microbial strains for higher yield, purity, and functionality of proteins and biomaterials

- Technological innovations are enabling the production of complex biomaterials such as animal-free collagen, silk proteins, and specialty polymers that were previously difficult or costly to manufacture using traditional methods, thereby expanding commercial viability

- The integration of automated bioprocessing, AI-driven strain optimization, and advanced downstream purification technologies is improving production efficiency and reducing cost barriers across industrial-scale fermentation facilities

- This increasing focus on technological sophistication and process optimization is reshaping industry standards, as biomaterial producers seek scalable, cost-effective, and sustainable alternatives to petrochemical- and animal-derived material

- As a result, demand for precision fermentation-derived biomaterials is rising across food, healthcare, cosmetics, and industrial sectors, as manufacturers prioritize innovation, sustainability, and long-term supply chain resilience

Precision Fermentation-Derived Biomaterials Market Dynamics

Driver

Growing Demand for Sustainable and Animal-Free Biomaterials

- The increasing global emphasis on sustainability, ethical sourcing, and reduced environmental impact is a major driver fueling demand for precision fermentation-derived biomaterials across multiple end-use industries

- For instance, leading food and cosmetic brands are increasingly adopting fermentation-derived proteins and polymers to replace animal-based ingredients, supporting clean-label, vegan, and cruelty-free product positioning

- Precision fermentation enables controlled, scalable, and resource-efficient production processes, offering significant advantages over traditional agriculture- or petrochemical-based biomaterial manufacturing

- Furthermore, growing regulatory and consumer support for bio-based materials, particularly in Europe and North America, is accelerating adoption of fermentation-derived biomaterials in commercial applications

- The ability to ensure consistent quality, traceability, and year-round production is further strengthening the appeal of precision fermentation-derived biomaterials among manufacturers seeking reliable and sustainable supply chains

- Rising investment from venture capital and strategic corporate partners is accelerating innovation and capacity expansion in the precision fermentation ecosystem

- Increasing demand for high-performance biomaterials in medical and pharmaceutical applications is further driving market growth

Restraint/Challenge

High Production Costs and Regulatory Approval Complexity

- The high production and scale-up costs associated with advanced fermentation infrastructure, downstream purification, and strain development remain a key challenge limiting broader market penetration

- For instance, achieving commercial-scale production of high-purity biomaterials often requires significant capital investment in bioreactors, purification systems, and specialized expertise, increasing overall cost structures

- Regulatory approval processes for novel fermentation-derived biomaterials, particularly in food and medical applications, can be lengthy and complex, delaying commercialization timelines

- Variations in regulatory frameworks across regions further complicate global market expansion, as companies must navigate differing safety, labeling, and compliance requirements

- Addressing these challenges through process optimization, cost reduction strategies, and clearer regulatory pathways will be critical for enabling wider adoption and sustained growth of the precision fermentation-derived biomaterials market

- Limited availability of skilled bioprocessing talent can constrain rapid scale-up and operational efficiency

- Dependence on specialized raw materials and fermentation inputs can expose producers to supply chain disruptions

Precision Fermentation-Derived Biomaterials Market Scope

The market is segmented on the basis of product type, microbial host, technology, and application.

- By Product Type

On the basis of product type, the precision fermentation-derived biomaterials market is segmented into proteins, enzymes, lipids, polysaccharides, peptides & growth factors, and other biomolecules. The proteins segment dominated the market with the largest revenue share of 42.7% in 2025, driven by extensive adoption in food, healthcare, and cosmetic applications. Fermentation-derived proteins such as animal-free dairy proteins, collagen, and functional proteins are widely used due to their scalability, consistent quality, and ability to replace animal-based ingredients. The strong demand for sustainable and vegan alternatives in food formulations and personal care products has further reinforced protein dominance. In addition, proteins benefit from relatively mature fermentation pathways and established regulatory familiarity in key markets. Their versatility across multiple end-use industries continues to support sustained revenue leadership.

The peptides & growth factors segment is expected to witness the fastest growth rate during the forecast period, owing to rising applications in regenerative medicine, tissue engineering, and advanced therapeutics. Precision fermentation enables the cost-effective and scalable production of complex peptides and bioactive molecules that are difficult to synthesize chemically. Growing investment in biopharmaceutical research and personalized medicine is accelerating demand for high-purity growth factors. Moreover, increasing clinical research activities and expanding use in wound healing and cosmetic formulations are driving rapid adoption. This segment is also benefiting from technological advancements in strain engineering and downstream purification.

- By Microbial Host

On the basis of microbial host, the market is segmented into yeast, bacteria, fungi, and algae. The yeast segment dominated the market in 2025, supported by its widespread use in precision fermentation due to genetic stability, high protein expression efficiency, and regulatory acceptance. Yeast strains such as Saccharomyces cerevisiae are extensively employed for producing proteins, enzymes, and bio-based materials at commercial scale. Their compatibility with large-scale fermentation infrastructure and lower contamination risk further strengthen market dominance. In addition, yeast-based systems are well-suited for food and pharmaceutical applications, where safety and consistency are critical. These advantages have positioned yeast as the preferred microbial platform across multiple industries.

The algae segment is projected to grow at the fastest CAGR over the forecast period, driven by increasing interest in sustainable lipid and specialty biomolecule production. Algae offer high productivity, carbon capture potential, and the ability to produce unique biomaterials such as omega-rich lipids and pigments. Growing investments in algal biotechnology and advancements in cultivation technologies are improving economic feasibility. Furthermore, rising demand for sustainable materials in food, nutraceuticals, and cosmetics is accelerating algae-based fermentation research. This segment’s growth is also supported by its alignment with global decarbonization and bioeconomy initiatives.

- By Technology

On the basis of technology, the market is segmented into strain engineering, upstream fermentation, downstream processing, formulation & material conversion, and contract manufacturing. The upstream fermentation segment accounted for the largest market share in 2025, as it represents the core production stage in precision fermentation workflows. This segment benefits from increasing deployment of large-scale bioreactors and continuous fermentation systems to improve yields and reduce production costs. Growing investments in fermentation infrastructure by biotech companies and CDMOs are further strengthening its dominance. Upstream fermentation is critical for achieving scalability and consistency, making it central to commercial viability. Continuous process optimization and automation are also enhancing efficiency at this stage.

The strain engineering segment is anticipated to register the fastest growth during the forecast period, driven by rapid advances in synthetic biology, AI-driven genetic design, and CRISPR-based tools. Improved strain performance directly impacts yield, cost efficiency, and product functionality, making this segment strategically important. Increasing R&D spending by biotechnology firms is accelerating innovation in microbial design. In addition, demand for customized biomaterials with enhanced properties is pushing companies to invest heavily in strain optimization. As competition intensifies, strain engineering is becoming a key differentiator for market players.

- By Application

On the basis of application, the market is segmented into medical & healthcare, food & beverage, cosmetics & personal care, industrial & specialty materials, and agriculture & animal feed. The food & beverage segment dominated the market with the largest revenue share in 2025, driven by strong adoption of fermentation-derived proteins, enzymes, and functional ingredients. Rising consumer demand for animal-free, sustainable, and clean-label products is accelerating use in dairy alternatives and functional foods. Precision fermentation enables consistent supply and quality, addressing limitations of traditional agriculture. Regulatory approvals in major markets have further supported commercialization in this segment. The large volume consumption of food ingredients continues to underpin revenue leadership.

The medical & healthcare segment is expected to be the fastest growing during the forecast period, fueled by increasing use of fermentation-derived biomaterials in regenerative medicine, wound care, and drug delivery systems. High demand for bio-compatible, animal-free materials in medical applications is driving adoption. Precision fermentation offers superior purity and batch consistency, which are critical for clinical use. Expanding investment in biotechnology research and personalized medicine is further supporting growth. This segment also benefits from rising healthcare expenditure and innovation in advanced therapies.

Precision Fermentation-Derived Biomaterials Market Regional Analysis

- North America dominated the precision fermentation-derived biomaterials market with the largest revenue share of 38.9% in 2025, supported by strong R&D infrastructure, early adoption of synthetic biology, significant venture capital investments, and the presence of leading biotechnology companies and startups focused on scalable biomaterial production

- Industry participants in the region place high value on sustainable, animal-free, and high-performance biomaterials, supported by robust R&D ecosystems and the presence of leading biotechnology companies and research institutions

- This widespread adoption is further reinforced by significant venture capital funding, favorable regulatory frameworks for bio-based innovation, and increasing demand from food, healthcare, and industrial sectors, positioning North America as a key hub for precision fermentation-derived biomaterials

U.S. Precision Fermentation-Derived Biomaterials Market Insight

The U.S. precision fermentation-derived biomaterials market captured the largest revenue share within North America in 2025, driven by strong adoption of synthetic biology, advanced biomanufacturing infrastructure, and high investment in biotechnology innovation. Companies in the U.S. are increasingly prioritizing sustainable, animal-free biomaterials across food, healthcare, and industrial applications. The presence of leading biotech startups, research institutions, and contract manufacturing organizations is accelerating commercialization. Moreover, robust venture capital funding and favorable regulatory pathways for novel bio-based products are significantly contributing to market expansion.

Europe Precision Fermentation-Derived Biomaterials Market Insight

The Europe precision fermentation-derived biomaterials market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent sustainability regulations and strong policy support for bio-based and circular economy solutions. Rising demand for environmentally friendly materials in food, cosmetics, and industrial applications is fostering adoption. European manufacturers are increasingly integrating precision fermentation to meet clean-label and carbon reduction targets. The region is witnessing notable growth across food, personal care, and specialty materials, supported by public–private research collaborations and innovation funding.

U.K. Precision Fermentation-Derived Biomaterials Market Insight

The U.K. precision fermentation-derived biomaterials market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a strong synthetic biology ecosystem and government-backed bioeconomy initiatives. Increasing investment in alternative proteins, sustainable materials, and life sciences innovation is driving market momentum. The growing emphasis on ethical sourcing and animal-free ingredients is encouraging adoption across food and cosmetic sectors. In addition, the U.K.’s robust academic research base and startup ecosystem are expected to continue stimulating market growth.

Germany Precision Fermentation-Derived Biomaterials Market Insight

The Germany precision fermentation-derived biomaterials market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on industrial biotechnology, sustainability, and advanced manufacturing. Strong demand for eco-conscious and high-performance biomaterials in industrial, automotive, and healthcare applications is supporting adoption. Germany’s well-developed infrastructure and focus on precision engineering promote scalable fermentation technologies. Furthermore, growing integration of bio-based materials into industrial value chains aligns with national sustainability and climate goals.

Asia-Pacific Precision Fermentation-Derived Biomaterials Market Insight

The Asia-Pacific precision fermentation-derived biomaterials market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid industrialization, expanding biotechnology manufacturing capacity, and rising demand for sustainable materials. Countries such as China, Japan, India, and South Korea are investing heavily in biomanufacturing and bioeconomy development. Government initiatives supporting alternative proteins and green technologies are accelerating adoption. In addition, the region’s role as a global manufacturing hub is improving cost competitiveness and market accessibility.

Japan Precision Fermentation-Derived Biomaterials Market Insight

The Japan precision fermentation-derived biomaterials market is gaining momentum due to the country’s strong focus on advanced biotechnology, precision manufacturing, and innovation. Japanese companies emphasize high-quality, functional biomaterials for food, healthcare, and specialty applications. The integration of fermentation-derived biomaterials into nutraceuticals, medical products, and specialty chemicals is supporting growth. Moreover, Japan’s aging population and demand for health-oriented and sustainable products are further driving market adoption.

India Precision Fermentation-Derived Biomaterials Market Insight

The India precision fermentation-derived biomaterials market accounted for a significant revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding biotechnology capabilities, and growing demand for sustainable and affordable biomaterials. India is emerging as a key hub for fermentation-based manufacturing, supported by strong talent availability and cost advantages. Rising interest in alternative proteins, bio-based ingredients, and healthcare biomaterials is accelerating market growth. Government initiatives promoting biotechnology, startups, and bio-manufacturing infrastructure are further strengthening India’s market position.

Precision Fermentation-Derived Biomaterials Market Share

The Precision Fermentation-Derived Biomaterials industry is primarily led by well-established companies, including:

- Perfect Day, Inc. (U.S.)

- Remilk Ltd. (Israel)

- Imagindairy Ltd. (Israel)

- The EVERY Company (U.S.)

- TurtleTree (Singapore)

- Vivici (Netherlands)

- Change Foods, Inc. (U.S.)

- De Novo Foodlabs (U.S.)

- Eden Brew Pty Ltd. (Australia)

- Evonik Industries AG (Germany)

- Formo Bio GmbH (Germany)

- Fybraworks Foods, Inc. (U.S.)

- Geltor, Inc. (U.S.)

- Helaina Inc. (U.S.)

- Zero Cow Factory (India)

- MeliBio (U.S.)

- Onego Bio Ltd. (Finland)

- Motif FoodWorks, Inc. (U.S.)

- Shiru, Inc. (U.S.)

- Melt & Marble (Sweden)

What are the Recent Developments in Global Precision Fermentation-Derived Biomaterials Market?

- In July 2025, 21st.BIO launched a precision fermentation program for bovine alpha-lactalbumin (α-lac) by licensing a high-yield microbial strain from Novonesis, enabling scalable, animal-free production of this highly functional milk protein for infant nutrition and functional foods, addressing limited traditional supply and high extraction costs

- In April 2025, 21st.BIO published a breakthrough in precision fermentation safety, engineering a fully mycotoxin-free Aspergillus oryzae strain for industrial protein production, establishing a new standard for producing safe novel proteins at scale

- In May 2024, Provenance Bio announced that its hydroxylated type I collagen produced via precision fermentation demonstrated functional cell adhesion comparable to fibronectin, showing potential to replace animal-derived proteins in pharmaceuticals and biomaterials

- In November 2022, New Culture, a precision fermentation food tech company, secured a Series A investment and partnered with CJ CheilJedang to scale animal-free cheese production that melts and stretches such as dairy, pushing commercial adoption of fermentation-derived biomaterials in mainstream food applications

- In February 2022, US-based Modern Kitchen launched the world’s first animal-free cream cheese made using precision fermentation technology, marking an early commercial entry of fermentation-derived dairy alternatives into the market

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.