Global Specialty Feed Additives Market

Taille du marché en milliards USD

TCAC :

%

USD

12.58 Billion

USD

20.67 Billion

2024

2032

USD

12.58 Billion

USD

20.67 Billion

2024

2032

| 2025 –2032 | |

| USD 12.58 Billion | |

| USD 20.67 Billion | |

|

|

|

|

Global Specialty Feed Additives Market Segmentation, By Source (Natural and Synthetic), Type (Vitamins, Antioxidants, Amino Acids, Feed Enzymes, Feed Acidifiers, Phosphates, Carotenoids, Mycotoxin Detoxifiers, Flavors and Sweeteners, Minerals, Non-Protein Nitrogen, Phytogenics, Preservatives, Probiotics, and Other Products), Form (Liquid Feed, Dry Feed, and Others), Function (Palatability Enhancement, Mycotoxin Management, Ingredient Preservation, Digestive Performance Enhancement, and Others), Livestock (Aquatic Animals, Poultry, Swine, Ruminants, and Others) - Industry Trends and Forecast to 2032

Specialty Feed Additives Market Size

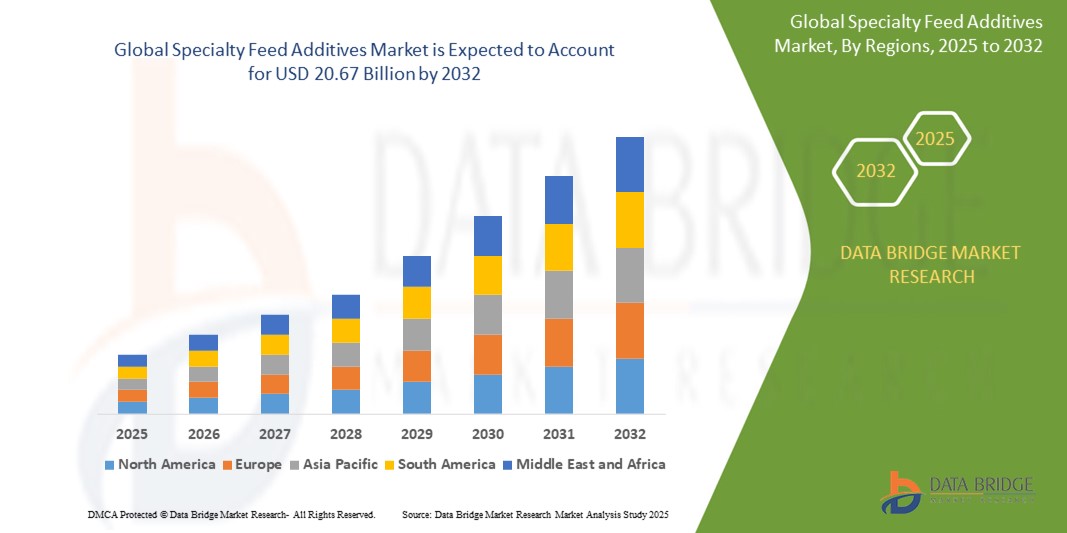

- The global specialty feed additives market size was valued at USD 12.58 billion in 2024 and is expected to reach USD 20.67 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fuelled by the rising demand for high-quality animal protein, growing concerns over animal health and nutrition, and the shift toward more sustainable livestock production systems

- Increasing global population, rising per capita meat consumption, and growing emphasis on enhancing feed efficiency and animal performance are further accelerating market expansion

Specialty Feed Additives Market Analysis

- The market is experiencing robust growth due to the increased awareness of feed quality and its direct impact on animal productivity and health

- Rapid industrialization of livestock production, particularly in developing regions, is further boosting demand for specialty additives such as enzymes, amino acids, vitamins, minerals, and probiotics

- Asia-Pacific dominated the specialty feed additives market with the largest revenue share of 38.2% in 2024, driven by the expansion of the livestock industry, growing demand for high-quality animal protein, and rising awareness about animal nutrition

- North America region is expected to witness the highest growth rate in the global specialty feed additives market, driven by is expected to witness the highest growth rate in the global specialty feed additives market, driven by increased demand for quality meat products, stringent animal health regulations, and the widespread adoption of advanced animal nutrition solutions across the livestock industry

- The natural segment held the largest market revenue share in 2024, driven by increasing consumer demand for clean-label and antibiotic-free meat products. Livestock producers are increasingly opting for natural additives to enhance animal health while meeting stringent regulatory guidelines and consumer expectations. The rising popularity of organic livestock farming also supports the growth of this segment

Report Scope and Specialty Feed Additives Market Segmentation

|

Attributes |

Specialty Feed Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Organic and Natural Feed Additives in Livestock Nutrition • Expansion of Aquaculture and Poultry Farming in Emerging Economies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Specialty Feed Additives Market Trends

“Rising Shift toward Natural and Non-Antibiotic Additives”

- Increasing consumer preference for antibiotic-free meat and dairy products is pushing producers to seek natural feed solutions

- Regulatory bans on antibiotic growth promoters in regions such as the European Union are accelerating the shift toward natural additives

- Probiotics, enzymes, and phytogenics are emerging as favored alternatives to antibiotics due to their gut health and immunity-enhancing properties

- Feed manufacturers are focusing on formulating multifunctional, plant-based additives for sustainable animal nutrition

- For instance, Cargill introduced its phytogenic feed additive “Promote” as a natural growth enhancer, targeting antibiotic-free animal production systems

Specialty Feed Additives Market Dynamics

Driver

“Growing Demand for Enhanced Animal Performance and Feed Efficiency”

- Rising global meat consumption is compelling livestock producers to focus on maximizing feed efficiency and productivity

- Specialty additives such as amino acids, enzymes, and vitamins help improve nutrient absorption and animal health

- Improved feed conversion ratio (FCR) directly reduces feed costs and boosts profitability for farmers

- These additives support better growth rates, disease resistance, and environmental sustainability

- For instance, the inclusion of phytase enzyme in poultry feed has shown to improve phosphorus digestibility, leading to better growth and lower waste output

Restraint/Challenge

“High Cost and Limited Awareness in Developing Regions”

- The higher cost of specialty additives compared to traditional feed ingredients restricts adoption among small and medium farmers

- Lack of awareness and technical knowledge in rural areas limits the use of performance-enhancing additives

- Weak distribution networks in emerging economies make access to quality additives difficult

- Government support and educational initiatives remain limited in key developing markets

- For instance, in rural India, many small-scale livestock farmers avoid amino acid supplements due to limited knowledge and financial constraints

Specialty Feed Additives Market Scope

The market is segmented on the basis of source, type, form, function, and livestock.

• By Source

On the basis of source, the specialty feed additives market is segmented into natural and synthetic. The natural segment held the largest market revenue share in 2024, driven by increasing consumer demand for clean-label and antibiotic-free meat products. Livestock producers are increasingly opting for natural additives to enhance animal health while meeting stringent regulatory guidelines and consumer expectations. The rising popularity of organic livestock farming also supports the growth of this segment.

The synthetic segment is expected to witness fastest growth rate from 2025 to 2032, attributed to its cost-effectiveness and consistent performance. Synthetic additives offer precision in formulation and scalability in mass production, making them appealing for large-scale feed manufacturers, especially in regions with price-sensitive markets.

• By Type

On the basis of type, the market is segmented into vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, phosphates, carotenoids, mycotoxin detoxifiers, flavors and sweeteners, minerals, non-protein nitrogen, phytogenics, preservatives, probiotics, and other products. The amino acids segment dominated the market in 2024, driven by its critical role in improving animal growth and feed efficiency. Amino acids such as lysine and methionine are extensively used in poultry and swine diets to boost muscle development and nutrient absorption.

The probiotics segment is expected to witness fastest growth rate from 2025 to 2032, due to rising concerns about antibiotic resistance. Probiotics support gut health and immunity, serving as effective natural alternatives to antibiotics in livestock production.

• By Form

On the basis of form, the market is segmented into liquid feed, dry feed, and others. The dry feed segment accounted for the largest market share in 2024, owing to its ease of storage, longer shelf life, and compatibility with automated feed mixing systems. Dry additives are also preferred for their cost-efficiency in transportation and reduced spoilage risk.

The liquid feed segment is expected to witness fastest growth rate from 2025 to 2032, supported by its better nutrient absorption and uniform mixing in feed. Liquid forms are increasingly adopted in intensive farming operations where fast digestion and nutrient uptake are essential.

• By Function

On the basis of function, the market is segmented into palatability enhancement, mycotoxin management, ingredient preservation, digestive performance enhancement, and others. The digestive performance enhancement segment led the market in 2024, driven by the need to improve feed utilization, reduce waste, and ensure healthy growth in livestock. Additives such as enzymes and acidifiers enhance nutrient breakdown and absorption, directly impacting animal productivity.

The mycotoxin management segment is expected to witness fastest growth rate from 2025 to 2032, due to rising awareness about the adverse effects of mycotoxins on animal health and food safety. Mycotoxin binders and detoxifiers are increasingly used to mitigate contamination in feed grains, particularly in humid regions.

• By Livestock

On the basis of livestock, the market is segmented into aquatic animals, poultry, swine, ruminants, and others. The poultry segment held the largest share in 2024, owing to the massive scale of poultry farming globally and the high demand for efficient feed solutions to support rapid growth and egg production.

The aquaculture segment is expected to witness fastest growth rate from 2025 to 2032, supported by the global expansion of fish farming and the need for specialized feed additives that cater to the nutritional and health needs of aquatic species.

Specialty Feed Additives Market Regional Analysis

• Asia-Pacific dominated the specialty feed additives market with the largest revenue share of 38.2% in 2024, driven by the expansion of the livestock industry, growing demand for high-quality animal protein, and rising awareness about animal nutrition

• The region benefits from increasing investments in feed production facilities, favorable government initiatives to enhance feed quality, and a shift toward sustainable animal farming practices

• Countries such as China, India, and Vietnam are witnessing significant growth in commercial farming, which is propelling the demand for specialty feed additives aimed at improving animal health, feed efficiency, and overall productivity

China Specialty Feed Additives Market Insight

The China specialty feed additives market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, increased meat consumption, and rising investments in industrial livestock farming. With China's livestock sector being one of the largest globally, there is a growing emphasis on using feed additives to improve animal health and ensure safe food production. Government regulations promoting feed safety and sustainable agriculture, along with the presence of major domestic manufacturers, are further accelerating the market expansion in the country.

Japan Specialty Feed Additives Market Insight

The Japan specialty feed additives market is expected to witness fastest growth rate from 2025 to 2032, driven by the country’s focus on high-quality meat and dairy production and stringent food safety standards. Japan’s livestock industry emphasizes premium-grade outputs, which requires precision in animal nutrition and health management. As a result, there is increasing adoption of specialty additives such as amino acids, enzymes, and probiotics to enhance feed efficiency and improve animal well-being.

North America Specialty Feed Additives Market Insight

The North America is expected to witness fastest growth rate from 2025 to 2032, fuelled by a well-established livestock industry, high adoption of advanced animal nutrition practices, and stringent regulatory frameworks ensuring feed safety. The presence of key market players, coupled with significant investments in research and innovation, supports product development and customization tailored to livestock health requirements. Rising consumer preference for organic and antibiotic-free meat and dairy is also encouraging feed manufacturers to incorporate specialty additives into formulations.

U.S. Specialty Feed Additives Market Insight

The U.S. is expected to witness fastest growth rate from 2025 to 2032, driven by advanced farming practices, a strong focus on productivity enhancement, and increasing demand for traceable, safe, and nutritious animal-derived food products. Feed manufacturers in the U.S. are actively incorporating additives such as probiotics, enzymes, and phytogenics to address health challenges in livestock while meeting the evolving standards of animal welfare and sustainability. In addition, collaboration between research institutions and feed companies is further driving innovation in specialty feed solutions.

Europe Specialty Feed Additives Market Insight

The Europe specialty feed additives market is expected to witness fastest growth rate from 2025 to 2032, attributed to the region's emphasis on sustainable livestock production, animal welfare, and feed safety regulations. The European Union’s ban on antibiotic growth promoters has increased the demand for natural alternatives such as probiotics and organic acids. Moreover, the adoption of precision livestock farming and the rise of organic meat production in countries such as Germany and France are significantly boosting the market for specialty feed additives in Europe.

U.K. Specialty Feed Additives Market Insight

The U.K. specialty feed additives market is expected to witness fastest growth rate from 2025 to 2032, supported by rising concerns over antibiotic resistance, growing demand for natural feed solutions, and stringent regulatory standards. With an increasing consumer preference for ethical and organic meat and dairy products, feed producers in the U.K. are focusing on clean-label and functional additives. The development of novel additives that promote gut health and enhance immunity in livestock is also fostering market growth in the region.

Germany Specialty Feed Additives Market Insight

The Germany is expected to be a significant contributor to the specialty feed additives market in Europe, driven by its advanced livestock management systems and strong focus on feed quality and traceability. The country’s emphasis on sustainability, environmental compliance, and animal health is prompting the adoption of specialty additives that reduce emissions, enhance nutrient absorption, and improve feed conversion ratios. Government support for research into alternative feed ingredients is also promoting innovation in the German market.

Specialty Feed Additives Market Share

The Specialty Feed Additives industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Novus International, Inc. (U.S.)

- Evonik Industries AG (Germany)

- DSM (Netherlands)

- Yara (Norway)

- Mosaic (U.S.)

- K+S Aktiengesellschaft (Germany)

- Compass Minerals (U.S.)

- Akzo Nobel N.V. (Sweden)

- Nutreco (Netherlands)

- Novozymes A/S (Denmark)

- Kemin Industries Inc. (U.S.)

- Brookside Agra (U.S.)

- Pancosma - an ADM brand (France)

- Chr. Hansen Holdings A/S (Denmark)

Latest Developments in Global Specialty Feed Additives Market

- In July 2023, Olmix bolstered its animal care portfolio through the acquisition of Yes Sinergy, signaling a strategic move for international expansion. This transaction positioned Olmix as a key provider of bio-sourced solutions, enhancing its competitiveness in the market

- In June 2023, Alltech introduced Triad, an innovative solution designed to bolster pig livability and optimize farrowing success. Comprising a proprietary blend of premium ingredients, Triad underscores Alltech's commitment to advancing animal health and welfare

- In May 2023, Kemin Food Technologies inaugurated BITEPod, a cutting-edge facility in Asia dedicated to driving food innovation. With a focus on prototyping and formulation enhancement, BITEPod strengthens Kemin's position as a leader in the food and beverage sector

- In December 2022, Adisseo Group finalized the acquisition of Nor-Feed and its subsidiaries, marking a strategic move to develop botanical additives for animal feed. This acquisition expands Adisseo's product portfolio and reinforces its commitment to advancing animal nutrition and welfare

- In October 2022, Evonik secured non-exclusive licensing rights to OpteinicsTM through a partnership with BASF, facilitating the adoption of digital solutions to improve sustainability in the animal protein and feed industries. This collaboration underscores Evonik's dedication to driving technological advancements and reducing environmental impact

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.